Stay Ahead in Fast-Growing Economies.

Browse Reports NowChocolate Market-Global Size & Upcoming Industry Trends By 2032

Chocolate, or cocoa, is a food made from roasted and ground cacao seed bits that’s available as a fluid, strong, or glue, either on its possess or as a flavouring specialist in other foods. Cacao has been consumed in a few shapes for at least 5,300 years beginning with the Mayo-Chinchipe culture in what is present-day Ecuador.

IMR Group

Description

Chocolate Market Synopsis

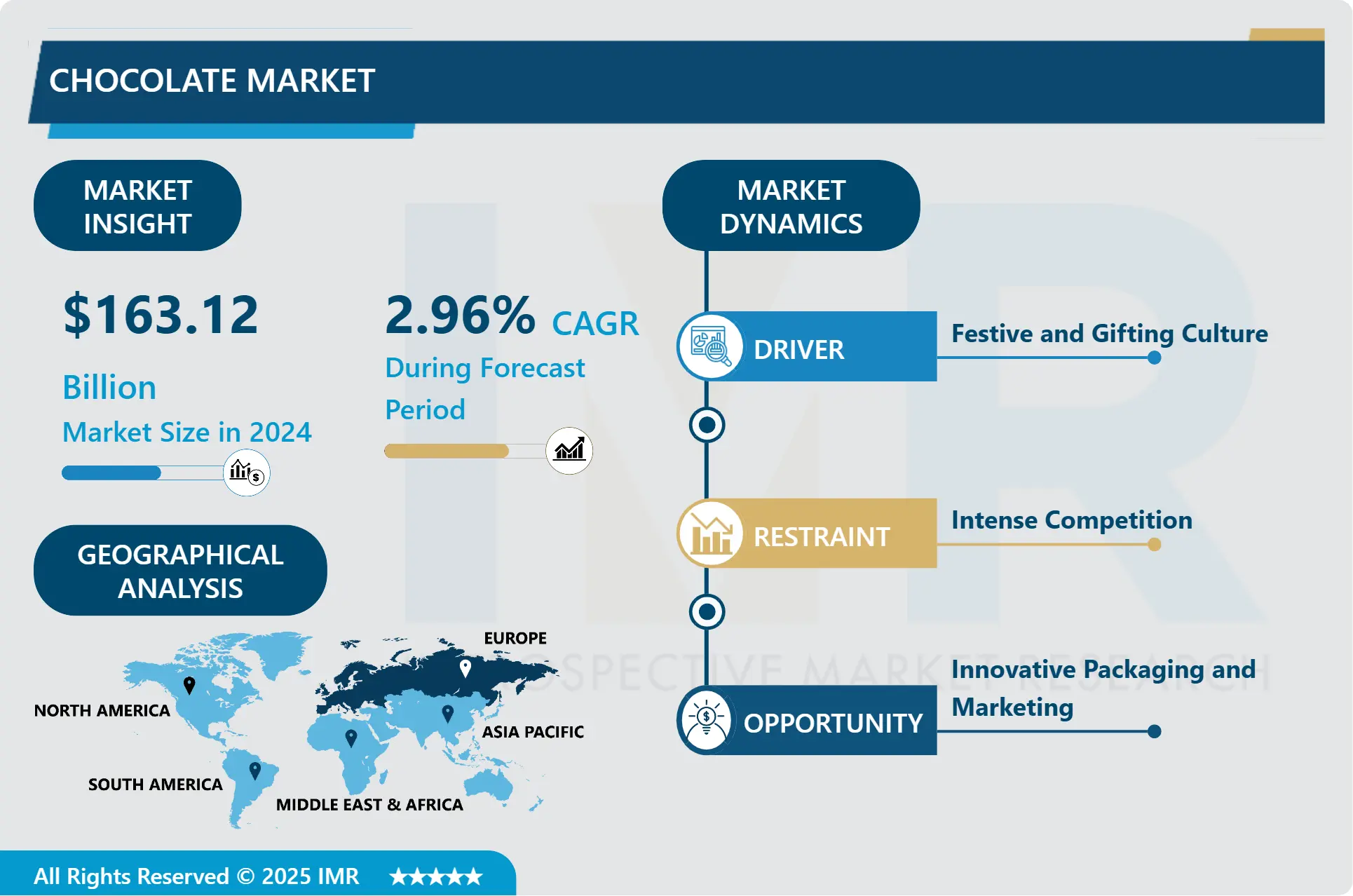

The global Chocolate Market was valued at USD 163.12 billion in 2024 and is likely to reach USD 205.99 billion by 2032, increasing at a CAGR of 2.96 % from 2025 to 2032.

Chocolate, or cocoa, is a food made from roasted and ground cacao seed bits that’s available as a fluid, strong, or glue, either on its possess or as a flavouring specialist in other foods. Cacao has been consumed in a few shapes for at least 5,300 years beginning with the Mayo-Chinchipe culture in what is present-day Ecuador. Later Mesoamerican civilizations also devoured chocolate beverages before being presented to Europe within the 16th century. The seeds of the cacao tree have an intense sharp taste and must be matured to create the flavor. After fermentation, the seeds are dried, cleaned, and roasted. The shell is removed to produce cocoa nibs, which are at that point ground to cocoa mass, unadulterated chocolate in rough shape. Once the cocoa mass is liquefied by warming, it is called chocolate alcohol.

The alcohol may moreover be cooled and prepared into its two components: cocoa solids and cocoa butter. Preparing chocolate, moreover called severe chocolate, contains cocoa solids and cocoa butter in shifting extents without any included sugar. Powdered preparing cocoa, which contains more fiber than cocoa butter, can be handled with soluble base to create Dutch cocoa. Much of the chocolate consumed nowadays is in the frame of sweet chocolate, a combination of cocoa solids, cocoa butter, or included vegetable oils and sugar. Milk chocolate is sweet chocolate that also contains milk powder or condensed milk. White chocolate contains cocoa butter, sugar, and milk, but no cocoa solids.

Chocolate is one of the foremost well-known food types and flavors within the world, and numerous foodstuffs involving chocolate exist, especially sweets, counting cakes, pudding, mousse, chocolate brownies, and chocolate chip treats. Numerous candies are filled with or coated with sweetened chocolate. Chocolate bars, either made of strong chocolate or other fixings coated in chocolate, are eaten as snacks. Blessings of chocolate molded into diverse shapes (such as eggs, hearts, and coins) are conventional on certain Western occasions, including Christmas, Easter, Valentine’s Day, and Hanukkah. Chocolate is additionally utilized in cold and hot refreshments, such as chocolate drain and hot chocolate, and in a few alcoholic drinks, such as creme de cacao. In spite of the fact that cocoa started within the Americas, West African nations, especially Côte d’Ivoire and Ghana, are the driving makers of cocoa within the 21st century, bookkeeping for a few 60% of the world cocoa supply. With a few two million children included in the farming of cocoa in West Africa, child subjugation and trafficking related with the cocoa exchange stay major concerns.

A 2018 report contended that universal endeavours to improve conditions for children were destined to disappointment since of diligent destitution, the nonappearance of schools, expanding world cocoa demand, more seriously cultivating of cocoa, and continued exploitation of child labour.

Chocolate Market Trend Analysis

Chocolate Market Growth Driver- Festive and Gifting Culture

Chocolate has a special place in the cultures of celebration and gifts around the world, making it a perennial favourite for various celebrations and special occasions. During festive times like Christmas, Easter, Valentine’s Day and Diwali, the tradition of gifting chocolate is deeply rooted. This cultural practice greatly increases chocolate sales as people buy chocolate as gifts for family, friends and colleagues. Chocolate is often considered a versatile and universally appreciated gift that is suitable for all ages and relationships.

During Christmas, chocolate sales soar as people buys holiday chocolates such as advent calendars, chocolate Christmases and various gift packs. Easter is characterized by the widespread tradition of giving chocolate eggs and bunnies, which creates a significant increase in demand. Sales of heart-shaped chocolates and luxury chocolate boxes increase on Valentine’s Day, as they are seen as romantic gifts that symbolize love and affection. Diwali, India’s festival of lights, also witnesses a significant increase in chocolate purchases as people choose beautifully packaged assortments of chocolates to exchange as gifts during the celebrations.

In addition, chocolatiers take advantage of these opportunities by launching limited edition products, special packaging and promotional offers tailored to the party theme. This not only attracts consumers but also encourages them to spend more on high-quality and personalized chocolate gifts. Chocolate’s association with celebration, joy and indulgence makes it an ideal gift choice, ensuring its popularity continues throughout the holidays. This cultural trend not only promotes seasonal sales, but also strengthens brand loyalty and expands the customer base of chocolatiers.

Chocolate Market Opportunities- Innovative Packaging and Marketing

Innovative packaging and marketing play a crucial part in differentiating chocolate brands in a progressively swarmed and competitive market. Imaginative packaging arrangements not as it were capturing the consumer’s eye but moreover pass on the brand’s character and values. For occasion, aesthetically engaging and mindfully planned packaging can raise the seen esteem of the chocolate, making it an appealing blessing option. One-of-a-kind plans, vibrant colours, and subjects custom-made to particular events or buyer inclinations can upgrade the generally request and desirability of the item.

Sustainable packaging arrangements are especially vital in today’s market, as consumers ended up more eco-conscious and concerned almost natural affect. Brands that utilize recyclable, biodegradable, or reusable bundling can offer to naturally mindful shoppers, building a positive brand picture and cultivating client dependability. Highlighting the supportability of the bundling through clear labeling and messaging can encourage draw in eco-conscious buyers who prioritize reducing their biological footprint. Locks in marketing campaigns are similarly vital in capturing buyer intrigued and driving deals. These campaigns can use various stages, counting social media, influencers, and experiential promoting, to reach a broader group of onlookers and make buzz around the item. Narrating that highlights the special qualities of the chocolate, such as its root, artisanal generation strategies, or wellbeing benefits, can reverberate with shoppers looking for authenticity and quality. Intuitively and immersive promoting encounters, such as virtual chocolate tastings or behind-the-scenes visits of chocolate-making forms, can extend shopper engagement and make important brand intuitive.

By combining inventive packaging with vital promoting, chocolate brands can stand out in a competitive commercial center. This approach not as it were attracting younger customers who esteem imagination and sustainability but too adjusts with the developing request for items that offer both quality and moral contemplations. Eventually, these endeavours can lead to expanded brand acknowledgment, client devotion, and market share.

Market Segment Analysis:

Market Segmented based on Product Type, Product Form, by Application, by Distribution and region.

By Product Type, Milk Chocolate Is Expected to Dominate the Market During the Forecast Period 2024-2032

By Product Type segmented in White Chocolate, Milk Chocolate, Dark Chocolate, Others

The dominance of milk chocolate in the global chocolate market can be attributed to several interrelated factors. Its broad consumer appeal is based on its creamy texture and sweet taste, which are particularly appealing to children and young adults. The balanced sweetness and milder taste of cocoa compared to dark chocolate makes it a better choice for the general population, increasing consumption. Additionally, the versatility of milk chocolate extends beyond traditional chocolate bars; It is widely used in various products such as sweets, desserts, pastries and ice cream, which increases its demand in various segments of the food industry.

Milk chocolate has historically been a consumer favorite and has built a strong brand presence and loyalty over the years. Companies have invested heavily in marketing and product development, creating a wide range of milk chocolate products that continue to appeal to consumers. This historic popularity ensures a stable market presence and continued consumer preference. In addition, milk chocolate is widely available in both developed and developing markets. Its production is established worldwide and it has a significant production capacity for milk chocolate products. Such widespread availability supports its dominance and makes it easily accessible to many consumers.

Affordability also plays a crucial role in controlling milk chocolate. Compared to premium dark chocolate products, milk chocolate is usually more affordable, so it is available to a wider range of consumers. This lower price contributes to its widespread consumption. Major chocolate brands focus their marketing and sales promotion on milk chocolate extracts. Seasonal campaigns, special editions and advertising campaigns often emphasize milk chocolate, maintaining its visibility and popularity among consumers. These promotional strategies ensure that milk chocolate remains the leading choice in the chocolate market and reinforces its dominant position.

By Application, Sugar Confectionery held the largest share

By Application segmented as Food Products: Bakery Products, Sugar Confectionery, Desserts, Beverages, Others

Sugar confectionery’s dominance within the chocolate market can be attributed to its broad popularity, driven by its widespread offer as a liberal treat expended by people of all ages. Items such as chocolate bars, candies, and bonbons are enjoyed as often as possible, distant more than other chocolate applications, due to their status as regular snacks. The section flourishes on an endless variety and continuous innovation, from classic drain chocolate bars to modern flavors and combinations, which keep up tall buyer intrigued and energize rehashed buys.

Comfort and portability are key variables as well; sugar confectionery things are planned to be simple to carry, store, and devour on the go, making them a popular choice for both snacking and gifting. Major chocolate brands encourage boost the request of sugar confectionery through considerable investments in promoting and limited time exercises. Regular promotions amid holidays like Halloween, Christmas, and Easter, together with constrained version discharges and focused on promoting campaigns, guarantee these items stay exceedingly unmistakable and locks in to customers.

In addition, sugar confectionery items appreciate a vigorous worldwide reach, being broadly accessible in grocery stores, comfort stores, vending machines, and online stages. This broad conveyance arrange guarantees that these items are effortlessly open to an endless customer base, strengthening their dominance in the market.

In 2023, the sales of Nestlé’s chocolate segment amounted to about 6.1 billion Swiss francs. The total sales of Nestlé’s confectionery sector amounted to about 8.1 billion Swiss francs in that year. Since 2021, sales started increasing again.

Market Regional Insights:

Europe Region is Expected to Dominate the Market Over the Forecast Period

Europe’s dominance within the global chocolate market is profoundly established in a combination of chronicled centrality, solid fabricating capabilities, social liking, development, premium offerings, send out openings, and customer preferences. The region’s wealthy history and tradition of chocolate utilization, dating back centuries, have established Europe as a center of chocolate craftsmanship and mastery. Nations like Switzerland and Belgium have earned international fame for their dominance in chocolate generation, setting the standard for quality and excellence.

Europe’s strong fabricating foundation gives a strong establishment for chocolate generation, with numerous well-established companies headquartered within the locale. Switzerland, in specific, stands out for its high-quality chocolate fabricating, domestic to notorious brands like Lindt and Sprüngli and Nestlé. Chocolate holds noteworthy social and culinary significance in European social orders, profoundly inserted in traditions and traditions. It is cherished as a adored treat, dessert, or blessing amid different events and celebrations, cultivating a solid emotional association with buyers. European chocolate producers are eminent for their innovation and inventiveness, continuously introducing new flavors, surfaces, and designs to meet advancing shopper inclinations and patterns. This commitment to development keeps European chocolates at the forefront of the worldwide market.

Europe’s reputation for premium and artisanal offerings further sets its dominance within the chocolate industry. European chocolatiers prioritize craftsmanship, quality ingredients, and interesting flavor profiles, captivating observing customers worldwide. Export opportunities proliferate for European chocolate producers, driven by the worldwide request for their items. The notoriety of European chocolate for its unparalleled quality and authenticity opens entryways to profitable markets worldwide, further fueling the region’s dominance. European consumers display a solid partiality for chocolate, willing to contribute in high-quality items. This request not only sustains continuous innovation and investment within the chocolate industry but too strengthens Europe’s position as a global pioneer in chocolate production and utilization.

Market Top Key Players:

The top key companies in the Chocolate Market are:

Mars, Inc. (USA)

Nestlé S.A. (Switzerland)

Mondelez International, Inc. (USA)

Ferrero Group (Italy)

Hershey Company (USA)

Lindt & Sprüngli AG (Switzerland)

Barry Callebaut (Switzerland)

Meiji Holdings Co., Ltd. (Japan)

Arcor (Argentina)

Ezaki Glico Co., Ltd. (Japan)

Pladis Global (UK)

Storck (Germany)

Perfetti Van Melle (Netherlands/Italy)

Grupo Bimbo (Mexico)

Cacau Show (Brazil)

Orion Confectionery (South Korea)

CEMOI Group (France)

August Storck KG (Germany)

Guan Chong Berhad (Malaysia)

Blommer Chocolate Company (USA)

Morinaga & Co., Ltd. (Japan)

Tcho Ventures Inc. (USA)

Fujiya Co., Ltd. (Japan)

Cadbury (part of Mondelez International, Inc.) (UK)

Thorntons Ltd. (part of Ferrero Group) (UK) and Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Chocolate Market by Product Type (2018-2032)

4.1 Chocolate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 White Chocolate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Milk Chocolate

4.5 Dark Chocolate

4.6 Others

Chapter 5: Chocolate Market by Product Form (2018-2032)

5.1 Chocolate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Moulded

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Countlines

5.5 Others

Chapter 6: Chocolate Market by Application (2018-2032)

6.1 Chocolate Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Food Products: Bakery Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Sugar Confectionery

6.5 Desserts

6.6 Beverages and Others

Chapter 7: Chocolate Market by Distribution (2018-2032)

7.1 Chocolate Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct Sales (B2B)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Supermarkets and Hypermarkets

7.5 Convenience Stores

7.6 Online Stores and Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Chocolate Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MARS INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NESTLÉ S.A. (SWITZERLAND)

8.4 MONDELEZ INTERNATIONAL INC. (USA)

8.5 FERRERO GROUP (ITALY)

8.6 HERSHEY COMPANY (USA)

8.7 LINDT & SPRÜNGLI AG (SWITZERLAND)

8.8 BARRY CALLEBAUT (SWITZERLAND)

8.9 MEIJI HOLDINGS COLTD. (JAPAN)

8.10 ARCOR (ARGENTINA)

8.11 EZAKI GLICO COLTD. (JAPAN)

8.12 PLADIS GLOBAL (UK)

8.13 STORCK (GERMANY)

8.14 PERFETTI VAN MELLE (NETHERLANDS/ITALY)

8.15 GRUPO BIMBO (MEXICO)

8.16 CACAU SHOW (BRAZIL)

8.17 ORION CONFECTIONERY (SOUTH KOREA)

8.18 CEMOI GROUP (FRANCE)

8.19 AUGUST STORCK KG (GERMANY)

8.20 GUAN CHONG BERHAD (MALAYSIA)

8.21 BLOMMER CHOCOLATE COMPANY (USA)

8.22 MORINAGA & COLTD. (JAPAN)

8.23 TCHO VENTURES INC. (USA)

8.24 FUJIYA COLTD. (JAPAN)

8.25 CADBURY (PART OF MONDELEZ INTERNATIONAL INC.) (UK)

8.26 THORNTONS LTD. (PART OF FERRERO GROUP) (UK)

Chapter 9: Global Chocolate Market By Region

9.1 Overview

9.2. North America Chocolate Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 White Chocolate

9.2.4.2 Milk Chocolate

9.2.4.3 Dark Chocolate

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size by Product Form

9.2.5.1 Moulded

9.2.5.2 Countlines

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Food Products: Bakery Products

9.2.6.2 Sugar Confectionery

9.2.6.3 Desserts

9.2.6.4 Beverages and Others

9.2.7 Historic and Forecasted Market Size by Distribution

9.2.7.1 Direct Sales (B2B)

9.2.7.2 Supermarkets and Hypermarkets

9.2.7.3 Convenience Stores

9.2.7.4 Online Stores and Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Chocolate Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 White Chocolate

9.3.4.2 Milk Chocolate

9.3.4.3 Dark Chocolate

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size by Product Form

9.3.5.1 Moulded

9.3.5.2 Countlines

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Food Products: Bakery Products

9.3.6.2 Sugar Confectionery

9.3.6.3 Desserts

9.3.6.4 Beverages and Others

9.3.7 Historic and Forecasted Market Size by Distribution

9.3.7.1 Direct Sales (B2B)

9.3.7.2 Supermarkets and Hypermarkets

9.3.7.3 Convenience Stores

9.3.7.4 Online Stores and Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Chocolate Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 White Chocolate

9.4.4.2 Milk Chocolate

9.4.4.3 Dark Chocolate

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size by Product Form

9.4.5.1 Moulded

9.4.5.2 Countlines

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Food Products: Bakery Products

9.4.6.2 Sugar Confectionery

9.4.6.3 Desserts

9.4.6.4 Beverages and Others

9.4.7 Historic and Forecasted Market Size by Distribution

9.4.7.1 Direct Sales (B2B)

9.4.7.2 Supermarkets and Hypermarkets

9.4.7.3 Convenience Stores

9.4.7.4 Online Stores and Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Chocolate Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 White Chocolate

9.5.4.2 Milk Chocolate

9.5.4.3 Dark Chocolate

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size by Product Form

9.5.5.1 Moulded

9.5.5.2 Countlines

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Food Products: Bakery Products

9.5.6.2 Sugar Confectionery

9.5.6.3 Desserts

9.5.6.4 Beverages and Others

9.5.7 Historic and Forecasted Market Size by Distribution

9.5.7.1 Direct Sales (B2B)

9.5.7.2 Supermarkets and Hypermarkets

9.5.7.3 Convenience Stores

9.5.7.4 Online Stores and Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Chocolate Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 White Chocolate

9.6.4.2 Milk Chocolate

9.6.4.3 Dark Chocolate

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size by Product Form

9.6.5.1 Moulded

9.6.5.2 Countlines

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Food Products: Bakery Products

9.6.6.2 Sugar Confectionery

9.6.6.3 Desserts

9.6.6.4 Beverages and Others

9.6.7 Historic and Forecasted Market Size by Distribution

9.6.7.1 Direct Sales (B2B)

9.6.7.2 Supermarkets and Hypermarkets

9.6.7.3 Convenience Stores

9.6.7.4 Online Stores and Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Chocolate Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 White Chocolate

9.7.4.2 Milk Chocolate

9.7.4.3 Dark Chocolate

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size by Product Form

9.7.5.1 Moulded

9.7.5.2 Countlines

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Food Products: Bakery Products

9.7.6.2 Sugar Confectionery

9.7.6.3 Desserts

9.7.6.4 Beverages and Others

9.7.7 Historic and Forecasted Market Size by Distribution

9.7.7.1 Direct Sales (B2B)

9.7.7.2 Supermarkets and Hypermarkets

9.7.7.3 Convenience Stores

9.7.7.4 Online Stores and Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Chocolate Market research report?

A1: The forecast period in the Chocolate Market research report is 2025-2032.

Q2: Who are the key players in the Chocolate Market?

A2: Mars, Inc. (USA),Nestlé S.A. (Switzerland),Mondelez International, Inc. (USA),Ferrero Group (Italy),Hershey Company (USA),Lindt & Sprüngli AG (Switzerland),Barry Callebaut (Switzerland),Meiji Holdings Co., Ltd. (Japan),Arcor (Argentina),Ezaki Glico Co., Ltd. (Japan),Pladis Global (UK),Storck (Germany),Perfetti Van Melle (Netherlands/Italy),Grupo Bimbo (Mexico),Cacau Show (Brazil),Orion Confectionery (South Korea),CEMOI Group (France),August Storck KG (Germany),Guan Chong Berhad (Malaysia),Blommer Chocolate Company (USA),Morinaga & Co., Ltd. (Japan),Tcho Ventures Inc. (USA),Fujiya Co., Ltd. (Japan),Cadbury (part of Mondelez International, Inc.) (UK),Thorntons Ltd. (part of Ferrero Group) (UK) and Other Active Players.

Q3: What are the segments of the Chocolate Market?

A3: The Chocolate Market is segmented Product Type, Product Form, by Application, by Distribution, by End-Use and region. By Product Type (White Chocolate, Milk Chocolate, Dark Chocolate, Others), By Product Form (Molded, Countlines, Others), By Application (Food Products: Bakery Products, Sugar Confectionery, Desserts, Beverages, Others), By Distribution (Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others), and by region. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Chocolate Market?

A4: Chocolate, or cocoa, is a food made from roasted and ground cacao seed bits that's available as a fluid, strong, or glue, either on its possess or as a flavoring specialist in other foods.

Q5: How big is the Chocolate Market?

A5: The global Chocolate Market was valued at USD 163.12 billion in 2024 and is likely to reach USD 212.09 billion by 2032, increasing at a CAGR of 205.99 % from 2025 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!