Stay Ahead in Fast-Growing Economies.

Browse Reports NowCat Litter Market Analysis, Share, and Future Forecast (2024-2032)

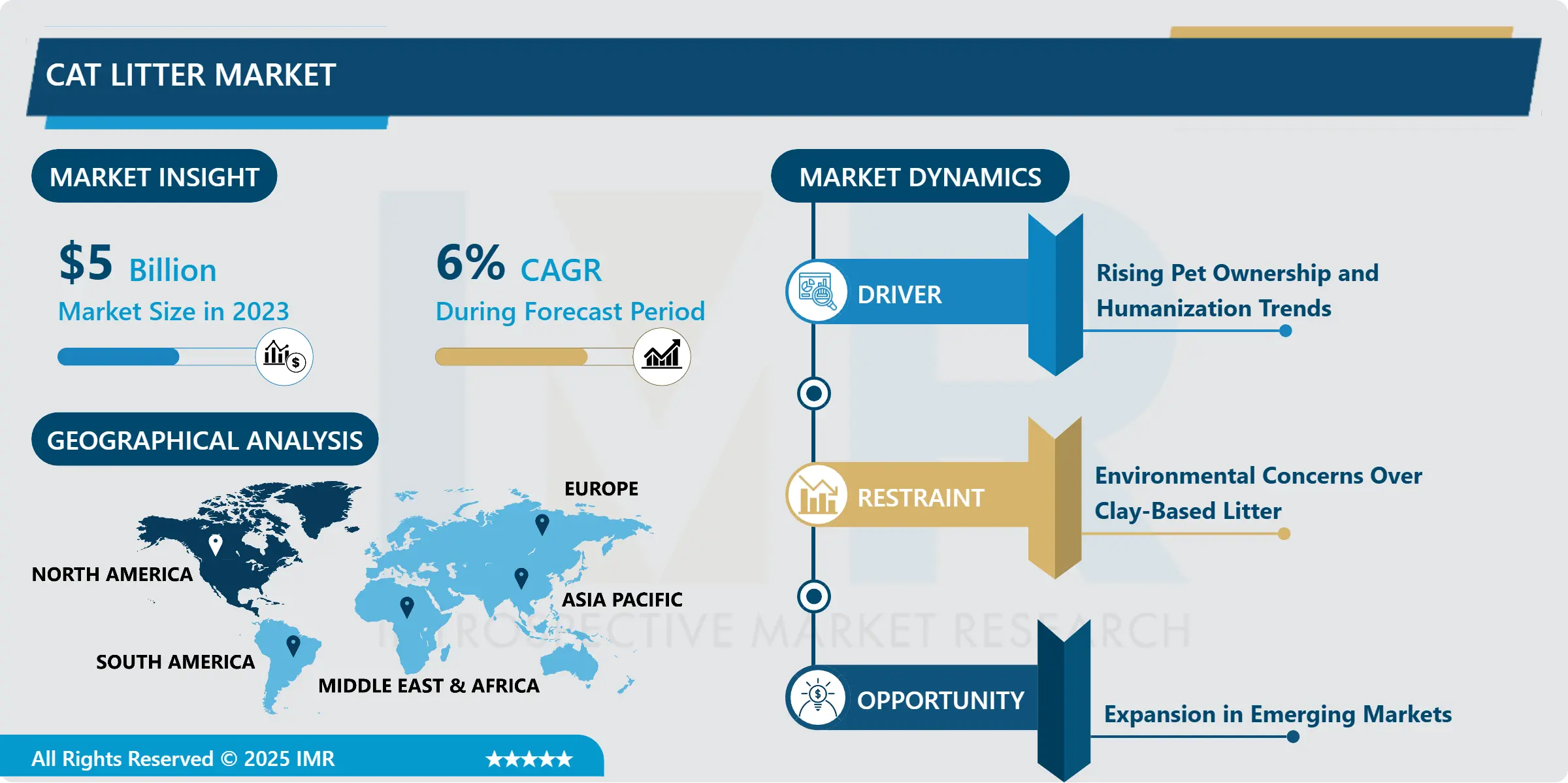

Cat Litter Market Size Was Valued at USD 5.0 Billion in 2023, and is Projected to Reach USD 8.4 Billion by 2032, Growing at a CAGR of 6% From 2024-2032. The cat litter industry consists of goods specifically for domestic cats to have one as a toilet.

IMR Group

Description

Cat Litter Market Synopsis:

Cat Litter Market Size Was Valued at USD 5.0 Billion in 2023, and is Projected to Reach USD 8.4 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

The cat litter industry consists of goods specifically for domestic cats to have one as a toilet. These products come in different types like clay, silica, biodegradable kind, etc., which indeed serve p t as effective odors, n efficient waste disposal and enhanced hygiene for cat owners. Sustained demand in pet adoption and the trends of pet humanization are the main drivers of this market.

The cat litter industry has expanded tremendously throughout the world as people have shifted their perception about pet care. Self shopping is a rapidly expanding niche to which the market aims to sell products to a continuously expanding group of pet owners who are concerned with their pet’s cleanliness and easy carrying around. Changes in the litter technology over the years like the formation of the clumping litter and silica gel crystals have made usability and waste management much better. Other factors include; rising urbanization as more people are taking pets to their apart Montpelier and those that do not leave a bad smell or cause mess since majority of them live in apartments.

Its types include clumping and non-clumping, silica gel crystals, and natural/organic litter, where each offers a market of individual consumer interests. Scooping and odor control earns clumping litter its place as the most popular type of litter to date. As for now, there is a observable increase in further consumption of natural goods andro organic products resulting from the day by day enlarging environmental concern. The largest consumers are homeowners, although the commercial application, such as pet shelters and clinics, is relevant as well. On the regional basis, North America shows the highest market share because of the higher density of pet ownership and increased usage of premium products, the Asia-Pacific market offers the growth prospects because of growing awareness regarding pet care.

Cat Litter Market Trend Analysis:

Growing Popularity of Eco-Friendly and Natural Cat Litters

With the recent focus on environmental consciousness, more and more pet owners choose organic and environment friendly cat litter. These litters are biodegradable made from components such as corn, wheat, recycled paper and wood, ideal to those caring for the environment. The change is harmonious with the global trend towards decreased use of plastics and increased promotion of Sustainable practices.

Manufacturers are therefore working hard to come up with products that are compostable and environmental-friendly. For instance, natural litters are free from chemical by products hence safe for the pets and the humans. It will continue to grow as more younger, environmentally conscious pet owners are making the market for sustainable cat litter possible.

Expansion in Emerging Markets

There is a great potential for new markets in the Asia Pacific region and Latin America for the cat litter products. These region is experiencing growth in pets ownership due to change in demand for pet products such as improvement in disposable income and increased appreciation of pet hygiene. Other factors such as increased urbanization and changing working and home care and lifestyle also factors to increased convenience based demand for pet care solutions.

These markets are being exploited by multinational companies by initiating cheap and regional products. For instance, the packaging sizes which are small and the use of local materials that lower pegged costs are appealing factors for price-sensitive buyer. The demand of hygienic litter products is likely to increase in these evolving markets due to increased awareness of the improved health benefits it brings, providing a larger degree of growth opportunities for the manufacture.

Cat Litter Market Segment Analysis:

Cat Litter Market is Segmented on the basis of Product Type, Raw Material, Distribution Channel, End User, and Region.

By Product Type, Clumping segment is expected to dominate the market during the forecast period

The cat litter products that have been grouped as mentioned above consists of clumping and non-clumping cat litters, silica gel cat litter crystals, and natural and organic cat litter products. Stationary littering is currently holding a massive market share due to its ease of use in waste management and has efficient odor elimination compared to clumping litter. This type is well adopted in developed areas because consumers of products from convenience rather than the price.

The natural and organic types of litters are quickly emerging in the market and steadily picking up popularity especially among people who are environmentally sensitive. These products are made with raw materials such as corn , recycled paper and timber and are marketable to consumers with conservation conscience. However, it is common that silica gel crystals have better odorless and moistureless performance, which is suitable for selling to the first-tier customers instead of focusing on the price.

By End User, Residential segment expected to held the largest share

Housing the largest market share the cat litter is being propelled forward by the rising population of pet owning households globally. Pet owners living in apartments in urban areas require the best quality products to help them care for their pets since litter can be easily stained and used up frequently. The use of litter also remains a key consumer need from the residential users thus driving the demand of some improved features like scented and clumping litters.

The commercial segment, namely rescues and sensitive, namely clinics, hotels, and animal shelters, claims a substantial market share. These institutions focus on cheaper and in large quantities solutions. Higher level of cleanliness in animal care establishments, and the increasing number of animal sanctuaries across the world also argues for the commercial segment.

Cat Litter Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America has the largest share in the cat litter market and; the market in North America has been growing due to increased pet ownership and the use of superior quality products. The pet care industry is already well developed in the region, also customers are savvy making sustainable demand for the new litter system. Furthermore, trends of pets humanization are higher in North America as pet owners are ready to invest in quality products.

Successive manufacturers are also located in the region providing a number of product types/is product diversity. Concerns related to environmental issues have lead to the growth of demand for biodegradable cutlery in the USA and Canada, where the problems of the environment are especially urgent. These all factors combine to further reinforce North America as the market leader for cat litter.

Active Key Players in the Cat Litter Market:

Nestlé Purina PetCare (Switzerland)

Church & Dwight Co., Inc. (USA)

Clorox Company (USA)

Mars Petcare (USA)

Pettex Ltd (UK)

Oil-Dri Corporation of America (USA)

Healthy Pet (USA)

BLUE Naturally Fresh (USA)

Cat’s Best (J. Rettenmaier & Söhne Group) (Germany)

Dr. Elsey’s Precious Cat Products (USA)

Ökocat (USA)

Sunpet Ltd (UK), and Other Active Players

Key Industry Developments in the Cat Litter Market:

In May 2024, Oil-Dri Corporation of America finalized its USD 46 million acquisition of Ultra Pet, a leading crystal catheter company. Both companies emphasize smooth integration, leveraging expertise and shared values to deliver superior products and grow their combined customer base.

In February 2024, PetSafe introduced PetSafe ScoopFree Premium Natural Litter, designed to manage odor for over 21 days. The litter is 100% natural, made from fossilized algae, and contains no additional fragrances, dyes, or chemicals.

In February 2024, Kent Corporation’s brand, World’s Best Cat Litter, partnered with Little Big Brands to design a new logo, packaging, and a softer color scheme that reflects its natural and sustainable cat litter products.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cat Litter Market by Product Type

4.1 Cat Litter Market Snapshot and Growth Engine

4.2 Cat Litter Market Overview

4.3 Clumping

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Clumping: Geographic Segmentation Analysis

4.4 Non-Clumping

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Non-Clumping: Geographic Segmentation Analysis

4.5 Silica Gel Crystals

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Silica Gel Crystals: Geographic Segmentation Analysis

4.6 Natural/Organic

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Natural/Organic: Geographic Segmentation Analysis

Chapter 5: Cat Litter Market by Raw Material

5.1 Cat Litter Market Snapshot and Growth Engine

5.2 Cat Litter Market Overview

5.3 :Clay

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 :Clay: Geographic Segmentation Analysis

5.4 Silica

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Silica: Geographic Segmentation Analysis

5.5 Corn

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Corn: Geographic Segmentation Analysis

5.6 Wheat

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Wheat: Geographic Segmentation Analysis

5.7 Pine

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Pine: Geographic Segmentation Analysis

5.8 Recycled Paper

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Recycled Paper: Geographic Segmentation Analysis

Chapter 6: Cat Litter Market by Distribution Channel

6.1 Cat Litter Market Snapshot and Growth Engine

6.2 Cat Litter Market Overview

6.3 Online (E-commerce Platforms

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online (E-commerce Platforms: Geographic Segmentation Analysis

6.4 Offline (Supers/Hypers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Offline (Supers/Hypers: Geographic Segmentation Analysis

6.5 Pet Stores

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pet Stores: Geographic Segmentation Analysis

6.6 Convenience Stores)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Convenience Stores): Geographic Segmentation Analysis

Chapter 7: Cat Litter Market by End User

7.1 Cat Litter Market Snapshot and Growth Engine

7.2 Cat Litter Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Residential: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cat Litter Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NESTLÉ PURINA PETCARE (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CHURCH & DWIGHT CO. INC. (USA)

8.4 CLOROX COMPANY (USA)

8.5 MARS PETCARE (USA)

8.6 PETTEX LTD (UK)

8.7 OIL-DRI CORPORATION OF AMERICA (USA)

8.8 HEALTHY PET (USA)

8.9 BLUE NATURALLY FRESH (USA)

8.10 CAT’S BEST (J. RETTENMAIER & SÖHNE GROUP) (GERMANY)

8.11 DR. ELSEY’S PRECIOUS CAT PRODUCTS (USA)

8.12 ÖKOCAT (USA)

8.13 SUNPET LTD (UK)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Cat Litter Market By Region

9.1 Overview

9.2. North America Cat Litter Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Clumping

9.2.4.2 Non-Clumping

9.2.4.3 Silica Gel Crystals

9.2.4.4 Natural/Organic

9.2.5 Historic and Forecasted Market Size By Raw Material

9.2.5.1 :Clay

9.2.5.2 Silica

9.2.5.3 Corn

9.2.5.4 Wheat

9.2.5.5 Pine

9.2.5.6 Recycled Paper

9.2.6 Historic and Forecasted Market Size By Distribution Channel

9.2.6.1 Online (E-commerce Platforms

9.2.6.2 Offline (Supers/Hypers

9.2.6.3 Pet Stores

9.2.6.4 Convenience Stores)

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cat Litter Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Clumping

9.3.4.2 Non-Clumping

9.3.4.3 Silica Gel Crystals

9.3.4.4 Natural/Organic

9.3.5 Historic and Forecasted Market Size By Raw Material

9.3.5.1 :Clay

9.3.5.2 Silica

9.3.5.3 Corn

9.3.5.4 Wheat

9.3.5.5 Pine

9.3.5.6 Recycled Paper

9.3.6 Historic and Forecasted Market Size By Distribution Channel

9.3.6.1 Online (E-commerce Platforms

9.3.6.2 Offline (Supers/Hypers

9.3.6.3 Pet Stores

9.3.6.4 Convenience Stores)

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cat Litter Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Clumping

9.4.4.2 Non-Clumping

9.4.4.3 Silica Gel Crystals

9.4.4.4 Natural/Organic

9.4.5 Historic and Forecasted Market Size By Raw Material

9.4.5.1 :Clay

9.4.5.2 Silica

9.4.5.3 Corn

9.4.5.4 Wheat

9.4.5.5 Pine

9.4.5.6 Recycled Paper

9.4.6 Historic and Forecasted Market Size By Distribution Channel

9.4.6.1 Online (E-commerce Platforms

9.4.6.2 Offline (Supers/Hypers

9.4.6.3 Pet Stores

9.4.6.4 Convenience Stores)

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cat Litter Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Clumping

9.5.4.2 Non-Clumping

9.5.4.3 Silica Gel Crystals

9.5.4.4 Natural/Organic

9.5.5 Historic and Forecasted Market Size By Raw Material

9.5.5.1 :Clay

9.5.5.2 Silica

9.5.5.3 Corn

9.5.5.4 Wheat

9.5.5.5 Pine

9.5.5.6 Recycled Paper

9.5.6 Historic and Forecasted Market Size By Distribution Channel

9.5.6.1 Online (E-commerce Platforms

9.5.6.2 Offline (Supers/Hypers

9.5.6.3 Pet Stores

9.5.6.4 Convenience Stores)

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cat Litter Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Clumping

9.6.4.2 Non-Clumping

9.6.4.3 Silica Gel Crystals

9.6.4.4 Natural/Organic

9.6.5 Historic and Forecasted Market Size By Raw Material

9.6.5.1 :Clay

9.6.5.2 Silica

9.6.5.3 Corn

9.6.5.4 Wheat

9.6.5.5 Pine

9.6.5.6 Recycled Paper

9.6.6 Historic and Forecasted Market Size By Distribution Channel

9.6.6.1 Online (E-commerce Platforms

9.6.6.2 Offline (Supers/Hypers

9.6.6.3 Pet Stores

9.6.6.4 Convenience Stores)

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cat Litter Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Clumping

9.7.4.2 Non-Clumping

9.7.4.3 Silica Gel Crystals

9.7.4.4 Natural/Organic

9.7.5 Historic and Forecasted Market Size By Raw Material

9.7.5.1 :Clay

9.7.5.2 Silica

9.7.5.3 Corn

9.7.5.4 Wheat

9.7.5.5 Pine

9.7.5.6 Recycled Paper

9.7.6 Historic and Forecasted Market Size By Distribution Channel

9.7.6.1 Online (E-commerce Platforms

9.7.6.2 Offline (Supers/Hypers

9.7.6.3 Pet Stores

9.7.6.4 Convenience Stores)

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Researc

Q1: What would be the forecast period in the Cat Litter Market research report?

A1: The forecast period in the Cat Litter Market research report is 2024-2032.

Q2: Who are the key players in the Cat Litter Market?

A2: Nestlé Purina PetCare (Switzerland), Church & Dwight Co., Inc. (USA), Clorox Company (USA), Mars Petcare (USA), Pettex Ltd (UK), Oil-Dri Corporation of America (USA), Healthy Pet (USA), BLUE Naturally Fresh (USA), Cat’s Best (J. Rettenmaier & Söhne Group) (Germany), Dr. Elsey’s Precious Cat Products (USA), Ökocat (USA), Sunpet Ltd (UK), and Other Active Players.

Q3: What are the segments of the Cat Litter Market?

A3: The Cat Litter Market is segmented into Product Type, Raw Material, Distribution Channel, End User and region. By Product Type, the market is categorized into Clumping, Non-Clumping, Silica Gel Crystals, and Natural/Organic. By Raw Material, the market is categorized into Clay, Silica, Corn, Wheat, Pine, and Recycled Paper. By Distribution Channel, the market is categorized into Online, Offline. By End User, the market is categorized into Residential, Commercial. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Cat Litter Market?

A4: The cat litter industry consists of goods specifically for domestic cats to have one as a toilet. These products come in different types like clay, silica, biodegradable kind, etc., which indeed serve pet as effective odors, and efficient waste disposal and enhanced hygiene for cat owners. Sustained demand in pet adoption and the trends of pet humanization are the main drivers of this market.

Q5: How big is the Cat Litter Market?

A5: Cat Litter Market Size Was Valued at USD 5.0 Billion in 2023, and is Projected to Reach USD 8.4 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!