Stay Ahead in Fast-Growing Economies.

Browse Reports NowCabin Air Filter Market- In Deep Analysis Focusing on Market Share

A Cabin Air Filter is a vehicular filtration device installed in the ventilation system to enhance interior air quality. It effectively captures and filters airborne particles, dust, pollen, allergens, and pollutants before they enter the vehicle’s passenger compartment. This filter helps create a cleaner and healthier environment for occupants by reducing respiratory irritants and improving overall air circulation within the cabin.

IMR Group

Description

Cabin Air Filter Market Synopsis

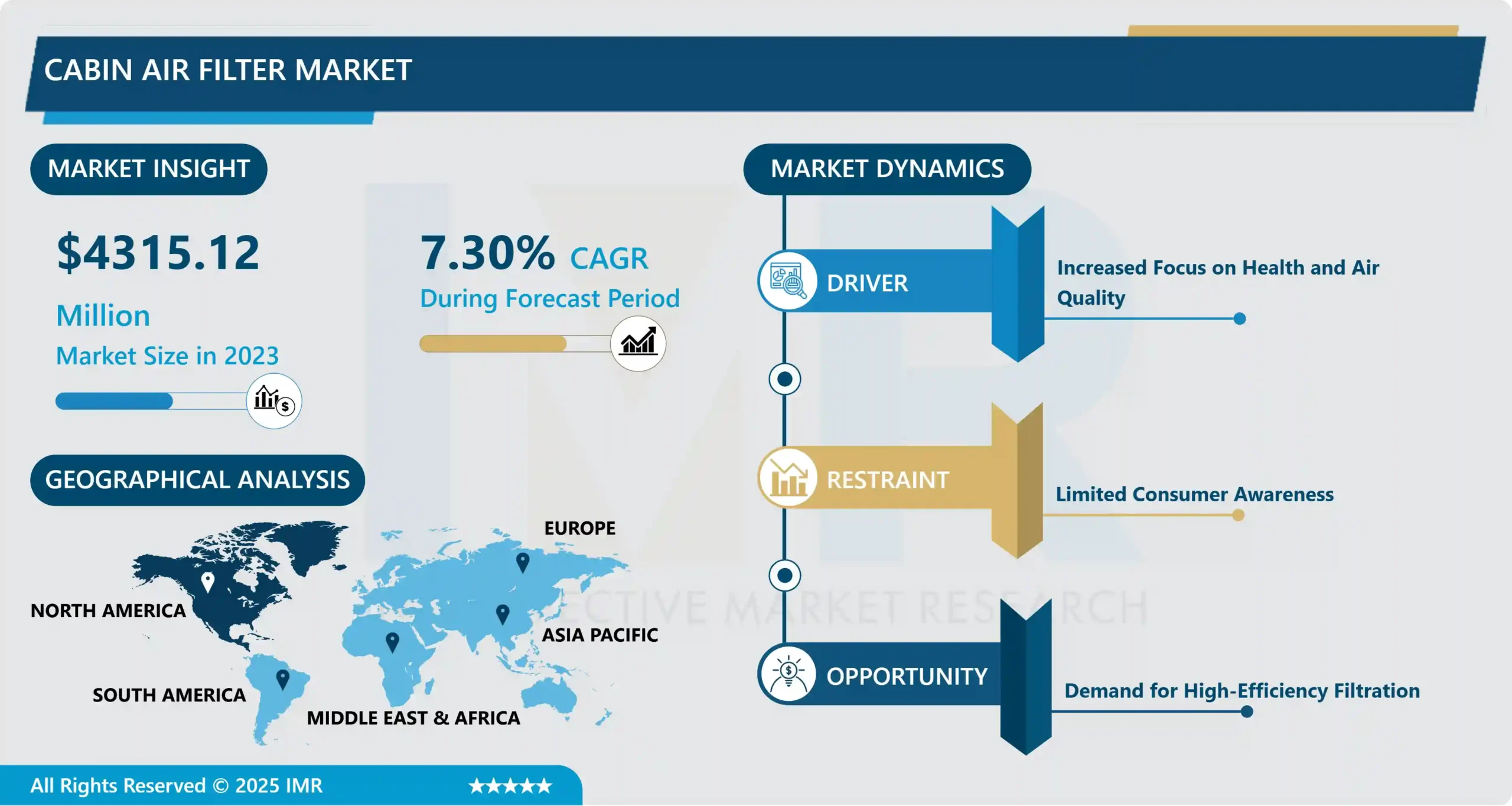

Cabin Air Filter Market Size Was Valued at USD 4315.12 Million in 2023 and is Projected to Reach USD 8135.61 Million by 2032, Growing at a CAGR of 7.30% From 2024-2032.

A Cabin Air Filter is a vehicular filtration device installed in the ventilation system to enhance interior air quality. It effectively captures and filters airborne particles, dust, pollen, allergens, and pollutants before they enter the vehicle’s passenger compartment. This filter helps create a cleaner and healthier environment for occupants by reducing respiratory irritants and improving overall air circulation within the cabin.

Regular replacement of cabin air filters is essential for maintaining optimal air quality and ensuring the efficient functioning of the vehicle’s heating, ventilation, and air conditioning (HVAC) system. The Cabin Air Filter Market is growing due to its role in improving interior air quality in vehicles. As health consciousness increases, consumers prioritize cleaner air, leading to a surge in the adoption of cabin air filters. These filters effectively capture and prevent dust, allergens, and pollutants, providing a healthier driving experience. Advanced technologies are being integrated into cabin air filters, such as activated carbon layers for improved odor removal, antimicrobial treatments for microbial inhibition, and high-efficiency particulate air (HEPA) filters for enhanced particle filtration.

The Health trend increased the demand for specialized solutions, particularly in regions with high pollution levels. The global demand for cabin air filters is driven by factors like urbanization, rising pollution levels, and the growing automotive market. As stringent regulations and standards focus on emissions and air quality, the market is expected to grow in the forecasting Period.

Cabin Air Filter Market Trend Analysis

Increased Focus on Health and Air Quality

There is a growing awareness of the impact of air quality on well-being, particularly within confined spaces such as vehicle cabins. Consumers are prioritizing cleaner and healthier environments during their daily travels, leading to a surge in demand for cabin air filters. These filters play a crucial role in modifying the ingress of pollutants, allergens, and particulate matter, creating a healthier experience.

As air quality concerns heighten globally, cabin air filters are becoming essential components in vehicles, reflecting a collective effort to enhance the driving experience and address health-related apprehensions associated with airborne contaminants. The market is expected to grow as health-conscious consumers continue to seek solutions to contribute to a cleaner and safer in-car environment.

Demand for High-Efficiency Filtration

Consumers are increasingly conscious of air quality within vehicle cabins, there is a growing preference for advanced filtration technologies that eliminate finer particles, allergens, and pollutants. This trend is particularly driven by concerns about respiratory health and the desire for a cleaner and healthier driving environment. Automotive manufacturers are responding to this demand by integrating high-efficiency filtration systems, such as HEPA filters, into their cabin air filter offerings. These filters validate superior capabilities in trapping microscopic particles, providing enhanced protection against airborne contaminants. The high-efficiency filtration represents a strategic move for manufacturers, aligning with the market trend towards advanced technologies and contributing to the overall growth and innovation in the Cabin Air Filter Market.

Cabin Air Filter Market Segment Analysis:

Cabin Air Filter Market Segmented based on Type, Application, And End-Users.

By Type, the Regular Cabin Filter segment is expected to dominate the market during the forecast period

Regular cabin filters, are the most commonly used and widely adopted type due to their cost-effectiveness and efficiency in capturing larger particles such as dust, pollen, and debris. The affordability makes them a preferred choice, especially in the aftermarket segment, where price-conscious consumers often seek reliable and economical filtration solutions. The advanced technologies like activated carbon and HEPA filters offer specialized features, the majority of vehicles come equipped with regular cabin filters as a standard component. As a result, the high prevalence of regular cabin filters in both original equipment and aftermarket applications contributes to their dominance in the overall market.

By Application, Passenger Car segment held the largest share of xx% in 2022

The Passenger Car segment has a large number of vehicles on the road, rising air quality and health concerns among consumers, and the standardization of cabin air filters in passenger car models. Automotive manufacturers are integrating advanced filtration technologies to provide a superior driving experience, aligning with the global trend towards cleaner and healthier mobility solutions. This dominance in the market is expected to continue as consumers spend more on advanced Cabin Air filters for a clean and comfortable driving environment.

Cabin Air Filter Market Regional Insights:

Is Expected to Dominate the Market Over the Forecast Period

The region is home to the world’s largest automotive markets, including China, Japan, and India. The rapid urbanization, increasing disposable income, and growing awareness of air quality issues in these countries contribute significantly to the demand for cabin air filters. As urban areas in Asia Pacific grow with rising pollution levels, consumers are increasingly prioritizing clean and healthy driving environments, boosting the adoption of cabin air filtration systems.

Original Equipment Manufacturers (OEMs) in the region are integrating advanced cabin air filter technologies into their vehicles to meet the evolving preferences of consumers. The implementation of stringent emission norms and regulations further forces the market to meet quality standards. The Asia Pacific region is expected to dominate the Cabin Air Filter Market due to the emerging market demand, automotive industry growth, and the need for cleaner, healthier driving environments.

Cabin Air Filter Market Top Key Players:

FRAM (USA)

WIX Filters (USA)

Cummins (USA)

Donaldson (USA)

Clarcor (USA)

ACDelco (USA)

Sogefi (Italy)

UFI Group (Italy)

Mann+Hummel (Germany)

Mahle (Germany)

Freudenberg (Germany)

BOSCH (Germany)

APEC KOREA (South Korea)

Bengbu Jinwei (China)

Zhejiang Universe Filter (China)

Yonghua Group (China)

Okyia Auto Technology (China)

Guangzhou Yifeng (China)

TORA Group (China)

Bengbu Phoenix (China)

DongGuan Shenglian Filter (China)

Foshan Dong Fan (China)

Kenlee (South Korea)

YBM (South Korea)

DENSO (Japan), and Major Players.

Key Industry Developments in the Cabin Air Filter Market:

In March 2024: Bosch was replacing the proven FILTER+ cabin filter with the enhanced FILTER+pro. Following extensive air-quality tests, the independent certification body OFI CERT, based in Vienna, Austria, had previously confirmed the product’s excellent filtration performance. Among other things, OFI tested and confirmed the product’s ability to filter and reduce allergens. The tests also confirmed that FILTER+pro reduces the risk of germ transmission. With several coordinated filter layers, the enhanced product ensures cleaner, largely pollutant-free air in the vehicle cabin, better protects vehicle occupants’ health, and offers them more comfort. This makes it particularly suitable for people who suffer from allergies.

In January 2023: Panasonic Automotive Systems Company, United States, announced the launch of its nanoe X portable in-vehicle air cleaner designed to enhance and maintain cabin air purity in the North American market.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cabin Air Filter Market by Type (2018-2032)

4.1 Cabin Air Filter Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Regular Cabin Filter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Active Carbon Cabin Filter

4.5 HEPA Cabin Filter

4.6 Combined Filters

Chapter 5: Cabin Air Filter Market by Application (2018-2032)

5.1 Cabin Air Filter Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Original Equipment Manufacturer (OEM)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Aftermarket

5.5 Online Retail

Chapter 6: Cabin Air Filter Market by Distribution Channel (2018-2032)

6.1 Cabin Air Filter Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Car

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Vehicle

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cabin Air Filter Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HALLSTAR (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PARCHEM FINE & SPECIALTY CHEMICALS (UNITED STATES)

7.4 JEDWARDS INTERNATIONAL (UNITED STATES)

7.5 VIGON INTERNATIONAL (UNITED STATES)

7.6 NATURAL SOURCING (UNITED STATES)

7.7 COSMETIC BUTTERS (UNITED STATES)

7.8 CRAFTER’S CHOICE BRANDS (UNITED STATES)

7.9 PARIS FRAGRANCES USA (UNITED STATES)

7.10 CARIBBEAN NATURAL PRODUCTS (JAMAICA)

7.11 AMANACI ROHSTOFFE (GERMANY)

7.12 AROMA ZONE. (FRANCE)

7.13 JARCHEM INDUSTRIES (INDIA)

7.14

Chapter 8: Global Cabin Air Filter Market By Region

8.1 Overview

8.2. North America Cabin Air Filter Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Regular Cabin Filter

8.2.4.2 Active Carbon Cabin Filter

8.2.4.3 HEPA Cabin Filter

8.2.4.4 Combined Filters

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Original Equipment Manufacturer (OEM)

8.2.5.2 Aftermarket

8.2.5.3 Online Retail

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Passenger Car

8.2.6.2 Commercial Vehicle

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cabin Air Filter Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Regular Cabin Filter

8.3.4.2 Active Carbon Cabin Filter

8.3.4.3 HEPA Cabin Filter

8.3.4.4 Combined Filters

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Original Equipment Manufacturer (OEM)

8.3.5.2 Aftermarket

8.3.5.3 Online Retail

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Passenger Car

8.3.6.2 Commercial Vehicle

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cabin Air Filter Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Regular Cabin Filter

8.4.4.2 Active Carbon Cabin Filter

8.4.4.3 HEPA Cabin Filter

8.4.4.4 Combined Filters

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Original Equipment Manufacturer (OEM)

8.4.5.2 Aftermarket

8.4.5.3 Online Retail

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Passenger Car

8.4.6.2 Commercial Vehicle

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cabin Air Filter Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Regular Cabin Filter

8.5.4.2 Active Carbon Cabin Filter

8.5.4.3 HEPA Cabin Filter

8.5.4.4 Combined Filters

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Original Equipment Manufacturer (OEM)

8.5.5.2 Aftermarket

8.5.5.3 Online Retail

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Passenger Car

8.5.6.2 Commercial Vehicle

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cabin Air Filter Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Regular Cabin Filter

8.6.4.2 Active Carbon Cabin Filter

8.6.4.3 HEPA Cabin Filter

8.6.4.4 Combined Filters

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Original Equipment Manufacturer (OEM)

8.6.5.2 Aftermarket

8.6.5.3 Online Retail

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Passenger Car

8.6.6.2 Commercial Vehicle

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cabin Air Filter Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Regular Cabin Filter

8.7.4.2 Active Carbon Cabin Filter

8.7.4.3 HEPA Cabin Filter

8.7.4.4 Combined Filters

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Original Equipment Manufacturer (OEM)

8.7.5.2 Aftermarket

8.7.5.3 Online Retail

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Passenger Car

8.7.6.2 Commercial Vehicle

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Cabin Air Filter Market research report?

A1: The forecast period in the Cabin Air Filter Market research report is 2024-2032.

Q2: Who are the key players in the Cabin Air Filter Market?

A2: FRAM (USA), WIX Filters (USA), Cummins (USA), Donaldson (USA), Clarcor (USA), ACDelco (USA), Sogefi (Italy), UFI Group (Italy), Mann+Hummel (Germany), Mahle (Germany), Freudenberg (Germany), BOSCH (Germany), APEC KOREA (South Korea), Bengbu Jinwei (China), Zhejiang Universe Filter (China), Yonghua Group (China), Okyia Auto Technology (China), Guangzhou Yifeng (China), TORA Group (China), Bengbu Phoenix (China), DongGuan Shenglian Filter (China), Foshan Dong Fan (China), Kenlee (South Korea), YBM (South Korea), DENSO (Japan), and Other Major Players.

Q3: What are the segments of the Cabin Air Filter Market?

A3: The Cabin Air Filter Market is segmented into Type, Application, Distribution Channel, and region. By Type, the market is categorized into Regular Cabin Filter, Active Carbon Cabin Filter, HEPA Cabin Filters, and Combined Filters. By Application, the market is categorized into Passenger Cars and commercial Vehicles. By Distribution Channel, the market is categorized into Original Equipment Manufacturer (OEM), Aftermarket, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Cabin Air Filter Market?

A4: A Cabin Air Filter is a vehicular filtration device installed in the ventilation system to enhance interior air quality. It effectively captures and filters airborne particles, dust, pollen, allergens, and pollutants before they enter the vehicle's passenger compartment. This filter helps create a cleaner and healthier environment for occupants by reducing respiratory irritants and improving overall air circulation within the cabin. Regular replacement of cabin air filters is essential for maintaining optimal air quality and ensuring the efficient functioning of the vehicle's heating, ventilation, and air conditioning (HVAC) system.

Q5: How big is the Cabin Air Filter Market?

A5: Cabin Air Filter Market Size Was Valued at USD 4315.12 Million in 2023 and is Projected to Reach USD 8135.61 Million by 2032, Growing at a CAGR of 7.30% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!