Stay Ahead in Fast-Growing Economies.

Browse Reports NowBusiness Assurance Market- Global Analysis and Forecast (2024-2032)

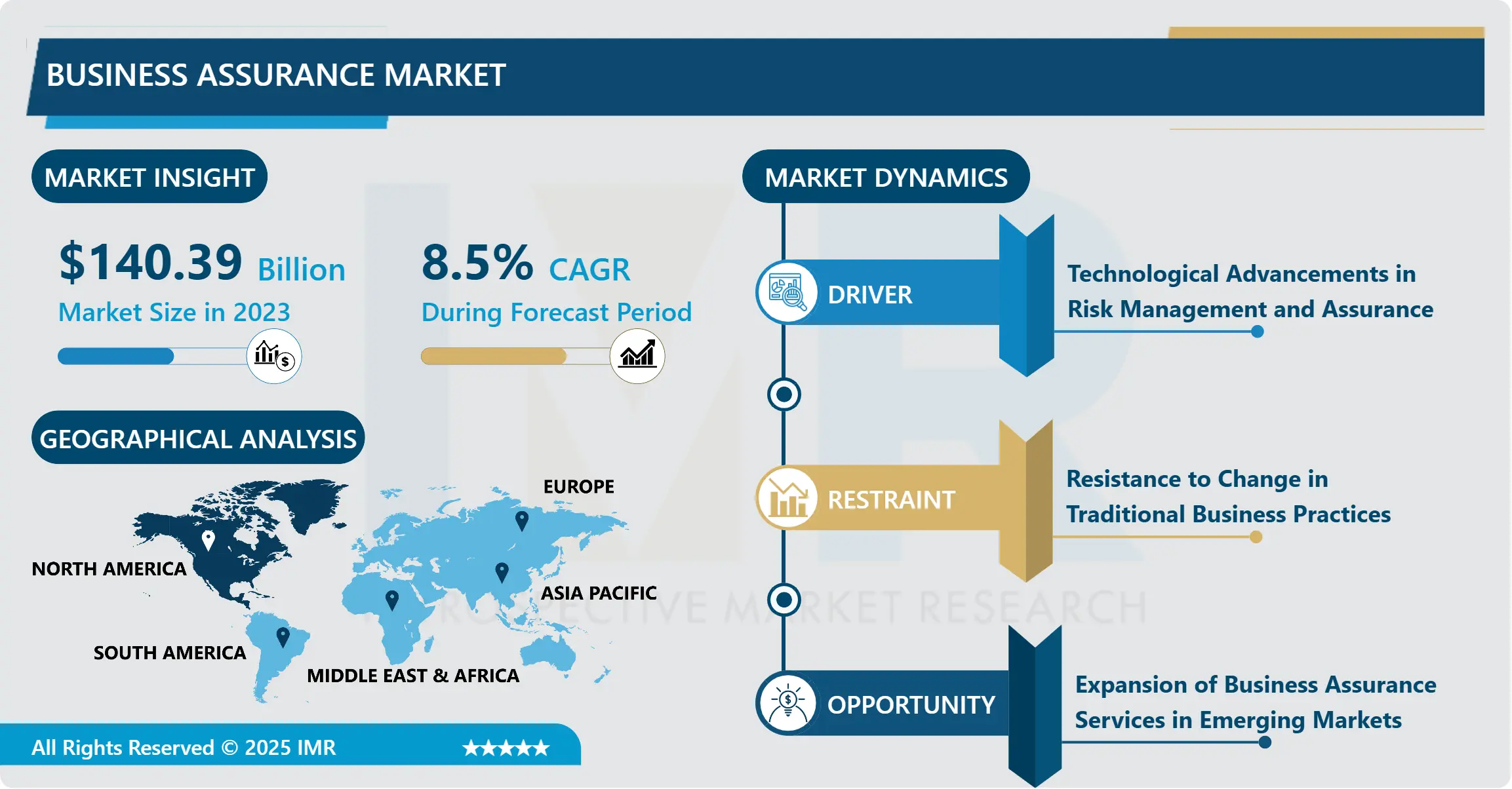

Business Assurance Market Size Was Valued at USD 140.39 Billion in 2023, and is Projected to Reach USD 292.55 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

IMR Group

Description

Business Assurance Market Synopsis

Business Assurance Market Size Was Valued at USD 140.39 Billion in 2023, and is Projected to Reach USD 292.55 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

The Business Assurance market relates to a range of services and products that help an organization enhance its performance, financial situation and legal compliance. It guarantees that organisations mitigate risks, work at optimum productivity and align with internal and external requirements. There are numerous operational assurance services including financial operations assurance, compliance operation, risk operations, and IT operations assurance. The purpose is to safeguard and advance business position, then to achieve consistency with strategic objectives and laws.

The rising Business Assurance market is growth in the need for more comprehensive reporting due to the complexity of business fields and the global market’s continuously shifting characteristics. Governance is becoming ever more important to organisations as they look for methods of reducing operational costs and minimising the risks they are exposed to and regulatory changes. This demand is compounded by an increased cybersecurity threat, a breakout of financial fraud, and changing regulations, ensuring that businesses adopt assurance services to protect their operations.

The other factor is the increased use of technology in business assurance especially AI and machine learning. These technologies improve the ways in which risk identification and mitigation, compliance issues, and financial statements preparation are accomplished. As companies seek better and faster ways of decision making to avoid human errors especially in sensitive operations, digital solutions are developed to fill the niches hence driving the market further.

Business Assurance Market Trend Analysis:

Increasing shift toward cloud-based solutions

cloud based Business Assurance solutions are one of the current trends within the market in question. Analyzing the development of working in the information age, organizations require cloud-based assurance services due to the relevance of remote work and digitalization strategies. Another advantage of cloud solutions is the better integration because such systems provide organisations with consolidated and real time data.

Another important development is the increasing concern with the issue of integrated risk management. Businesses are adopting integrated assurance solutions that embrace financial, operational, compliance and IT risk assurance services. This trend is caused by the necessity to have systemic approach to the business risks for organizations as for the way of recognizing potential threats in different aspects of their activity.

Rapid industrialization and increasing government regulations

Business assurance services are staggeringly growing in Asia Pacific and Latin America, where potential buyers are spending increased amounts on enhancements strategies for their businesses. With the industrialization process that has rapidly taken place in these areas and the continuously emerging Government regulations, there is a significant need for the overall risks management and compliance assurance. It will therefore be a great opportunity to unlock physical expansion for service providers in these regions as business needs evolve.

With enhanced focus on sustainable business, organization and ESG factors, the area of business assurance services is emerging. Sustainability remediations and ESG compliance have rapidly become high priorities for companies, thus they search for assurance. This increasing emphasis on sustainable business practices presents service providers the opportunity to extend the market for more specific assurance products, to cover ESG threats.

Business Assurance Market Segment Analysis:

Business Assurance Market is Segmented on the basis of Type, Service, End User, and Region

By Type, Financial Assurance segment is expected to dominate the market during the forecast period

The Business Assurance market can be segmented into several types: FA, OA, CA, RA, and ITA. In effect financial assurance deals with ascertaining the genuineness and accuracy of the financial records and or financial statements to ensure that they conform to the recognized financial reporting standards.

Operational assurance concerns itself with the efficiency of service delivery with an objective of minimizing the level of risk in operations. Compliance assurance is the deliberate way of making sure that an organization fully complies with the relevant laws and regulations. Risk assurance presupposes the assessment and management of business risks and IT assurance is related to protection of systems, data, and networks.

By Service, Consulting segment expected to held the largest share

In the Business Assurance Market, the consulting segment is projected to hold the largest share over the forecast period. This dominance is primarily driven by the growing demand for expert advisory services to navigate complex regulatory environments, manage operational risks, and implement robust governance frameworks. Organizations across industries are increasingly seeking specialized consulting support to enhance their compliance, audit, and risk management processes, ensuring business continuity and operational resilience.

The rise in digital transformation initiatives has amplified the need for consulting services to address emerging risks associated with cybersecurity, data privacy, and regulatory changes. Consulting firms offer tailored solutions that help businesses align their operations with industry standards and best practices, strengthening stakeholder confidence. As companies prioritize risk mitigation and strategic assurance to maintain a competitive edge, the consulting segment is expected to continue its leadership position within the Business Assurance Market.

Business Assurance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Business Assurance market of North American has shown immense growth due to the increasing complexity of organizations’ business operations and required regulations. The availability of rich Business services like banking, finance, healthcare, and energy actuates the need for business assurance services in the area exceptionally. International businesses want to increase the effectiveness of their operations and work through crisis situations and the deterioration of the financial standing of enterprises. In addition, the trend for adopting innovative solutions such as artificial intelligence and cloud-based services is changing the perspective of the regional market and its possibilities to obtain more versatile, operative, and integrated risk username.

The North American market also has to comply with strict rules and regulations like the Sarbanes-Oxley Act, HIPAA and other regulations of a specific segment. This regulation drive organizations in looking for business assurance services that would assist them in staying compliant and at the same time minimizing probable risks. Furthermore, due to large consulting and IT players such as Deloitte, PwC, and KPMG and centrality of sustainability and ESG (Environmental, Social, and Governance) trends, North America is set to emerge as the leader of the business assurance market. Continued spending on the advancement across numerous markets also enhances the prospects for the growth of the Automotive Cloud Services market.

Active Key Players in the Business Assurance Market

Accenture (Ireland)

BDO (Belgium)

Deloitte (USA)

EY (UK)

Grant Thornton (USA)

IBM (USA)

KPMG (Netherlands)

Protiviti (USA)

PwC (UK)

RSM International (UK)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Assurance Market by Type

4.1 Business Assurance Market Snapshot and Growth Engine

4.2 Business Assurance Market Overview

4.3 Financial Assurance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Financial Assurance: Geographic Segmentation Analysis

4.4 Operational Assurance

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Operational Assurance: Geographic Segmentation Analysis

4.5 Compliance Assurance

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Compliance Assurance: Geographic Segmentation Analysis

4.6 Risk Assurance

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Risk Assurance: Geographic Segmentation Analysis

4.7 IT Assurance

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 IT Assurance: Geographic Segmentation Analysis

Chapter 5: Business Assurance Market by Service

5.1 Business Assurance Market Snapshot and Growth Engine

5.2 Business Assurance Market Overview

5.3 Consulting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Consulting: Geographic Segmentation Analysis

5.4 Implementation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Implementation: Geographic Segmentation Analysis

5.5 Managed Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Managed Services: Geographic Segmentation Analysis

Chapter 6: Business Assurance Market by End User

6.1 Business Assurance Market Snapshot and Growth Engine

6.2 Business Assurance Market Overview

6.3 BFSI (Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BFSI (Banking: Geographic Segmentation Analysis

6.4 Financial Services

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Financial Services: Geographic Segmentation Analysis

6.5 and Insurance

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Insurance: Geographic Segmentation Analysis

6.6 Healthcare

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Healthcare: Geographic Segmentation Analysis

6.7 IT and Telecom

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 IT and Telecom: Geographic Segmentation Analysis

6.8 Manufacturing

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Manufacturing: Geographic Segmentation Analysis

6.9 Retail

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Retail: Geographic Segmentation Analysis

6.10 Government

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Government: Geographic Segmentation Analysis

6.11 Energy and Utilities

6.11.1 Introduction and Market Overview

6.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.11.3 Key Market Trends, Growth Factors and Opportunities

6.11.4 Energy and Utilities: Geographic Segmentation Analysis

6.12 Others

6.12.1 Introduction and Market Overview

6.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.12.3 Key Market Trends, Growth Factors and Opportunities

6.12.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Business Assurance Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DELOITTE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KPMG (NETHERLANDS)

7.4 PWC (UK)

7.5 EY (UK)

7.6 ACCENTURE (IRELAND)

7.7 IBM (USA)

7.8 PROTIVITI (USA)

7.9 BDO (BELGIUM)

7.10 GRANT THORNTON (USA)

7.11 RSM INTERNATIONAL (UK)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Business Assurance Market By Region

8.1 Overview

8.2. North America Business Assurance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Financial Assurance

8.2.4.2 Operational Assurance

8.2.4.3 Compliance Assurance

8.2.4.4 Risk Assurance

8.2.4.5 IT Assurance

8.2.5 Historic and Forecasted Market Size By Service

8.2.5.1 Consulting

8.2.5.2 Implementation

8.2.5.3 Managed Services

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 BFSI (Banking

8.2.6.2 Financial Services

8.2.6.3 and Insurance

8.2.6.4 Healthcare

8.2.6.5 IT and Telecom

8.2.6.6 Manufacturing

8.2.6.7 Retail

8.2.6.8 Government

8.2.6.9 Energy and Utilities

8.2.6.10 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Business Assurance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Financial Assurance

8.3.4.2 Operational Assurance

8.3.4.3 Compliance Assurance

8.3.4.4 Risk Assurance

8.3.4.5 IT Assurance

8.3.5 Historic and Forecasted Market Size By Service

8.3.5.1 Consulting

8.3.5.2 Implementation

8.3.5.3 Managed Services

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 BFSI (Banking

8.3.6.2 Financial Services

8.3.6.3 and Insurance

8.3.6.4 Healthcare

8.3.6.5 IT and Telecom

8.3.6.6 Manufacturing

8.3.6.7 Retail

8.3.6.8 Government

8.3.6.9 Energy and Utilities

8.3.6.10 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Business Assurance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Financial Assurance

8.4.4.2 Operational Assurance

8.4.4.3 Compliance Assurance

8.4.4.4 Risk Assurance

8.4.4.5 IT Assurance

8.4.5 Historic and Forecasted Market Size By Service

8.4.5.1 Consulting

8.4.5.2 Implementation

8.4.5.3 Managed Services

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 BFSI (Banking

8.4.6.2 Financial Services

8.4.6.3 and Insurance

8.4.6.4 Healthcare

8.4.6.5 IT and Telecom

8.4.6.6 Manufacturing

8.4.6.7 Retail

8.4.6.8 Government

8.4.6.9 Energy and Utilities

8.4.6.10 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Business Assurance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Financial Assurance

8.5.4.2 Operational Assurance

8.5.4.3 Compliance Assurance

8.5.4.4 Risk Assurance

8.5.4.5 IT Assurance

8.5.5 Historic and Forecasted Market Size By Service

8.5.5.1 Consulting

8.5.5.2 Implementation

8.5.5.3 Managed Services

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 BFSI (Banking

8.5.6.2 Financial Services

8.5.6.3 and Insurance

8.5.6.4 Healthcare

8.5.6.5 IT and Telecom

8.5.6.6 Manufacturing

8.5.6.7 Retail

8.5.6.8 Government

8.5.6.9 Energy and Utilities

8.5.6.10 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Business Assurance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Financial Assurance

8.6.4.2 Operational Assurance

8.6.4.3 Compliance Assurance

8.6.4.4 Risk Assurance

8.6.4.5 IT Assurance

8.6.5 Historic and Forecasted Market Size By Service

8.6.5.1 Consulting

8.6.5.2 Implementation

8.6.5.3 Managed Services

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 BFSI (Banking

8.6.6.2 Financial Services

8.6.6.3 and Insurance

8.6.6.4 Healthcare

8.6.6.5 IT and Telecom

8.6.6.6 Manufacturing

8.6.6.7 Retail

8.6.6.8 Government

8.6.6.9 Energy and Utilities

8.6.6.10 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Business Assurance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Financial Assurance

8.7.4.2 Operational Assurance

8.7.4.3 Compliance Assurance

8.7.4.4 Risk Assurance

8.7.4.5 IT Assurance

8.7.5 Historic and Forecasted Market Size By Service

8.7.5.1 Consulting

8.7.5.2 Implementation

8.7.5.3 Managed Services

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 BFSI (Banking

8.7.6.2 Financial Services

8.7.6.3 and Insurance

8.7.6.4 Healthcare

8.7.6.5 IT and Telecom

8.7.6.6 Manufacturing

8.7.6.7 Retail

8.7.6.8 Government

8.7.6.9 Energy and Utilities

8.7.6.10 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Business Assurance Market research report?

A1: The forecast period in the Business Assurance Market research report is 2024-2032.

Q2: Who are the key players in the Business Assurance Market?

A2: Accenture (Ireland), BDO (Belgium),Deloitte (USA),EY (UK),Grant Thornton (USA),IBM (USA),KPMG (Netherlands),Protiviti (USA),PwC (UK),RSM International (UK), and Other Active Players.

Q3: What are the segments of the Business Assurance Market?

A3: The Business Assurance Market is segmented into by Type (Financial Assurance, Operational Assurance, Compliance Assurance, Risk Assurance, IT Assurance), By Service (Consulting, Implementation, Managed Services), End User (BFSI (Banking, Financial Services, and Insurance), Healthcare, IT and Telecom, Manufacturing, Retail, Government, Energy and Utilities, Others). By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Business Assurance Market?

A4: The Business Assurance market relates to a range of services and products that help an organization enhance its performance, financial situation and legal compliance. It guarantees that organisations mitigate risks, work at optimum productivity and align with internal and external requirements. There are numerous operational assurance services including financial operations assurance, compliance operation, risk operations, and IT operations assurance. The purpose is to safeguard and advance business position, then to achieve consistency with strategic objectives and laws.

Q5: How big is the Business Assurance Market?

A5: Business Assurance Market Size Was Valued at USD 140.39 Billion in 2023, and is Projected to Reach USD 292.55 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!