Stay Ahead in Fast-Growing Economies.

Browse Reports NowBrewing Enzymes Market- Global Size, Share & Industry Trends (2025- 2032)

Enzymes are complex organic substances that act as a catalyst to fasten a chemical reaction while it remains unchanged in the end. The conventional brewing process requires an incredible amount of energy while the use of the brewing enzymes reduces the energy required in the brewing process thus it is an economically preferable process.

IMR Group

Description

Global Brewing Enzymes Market Overview

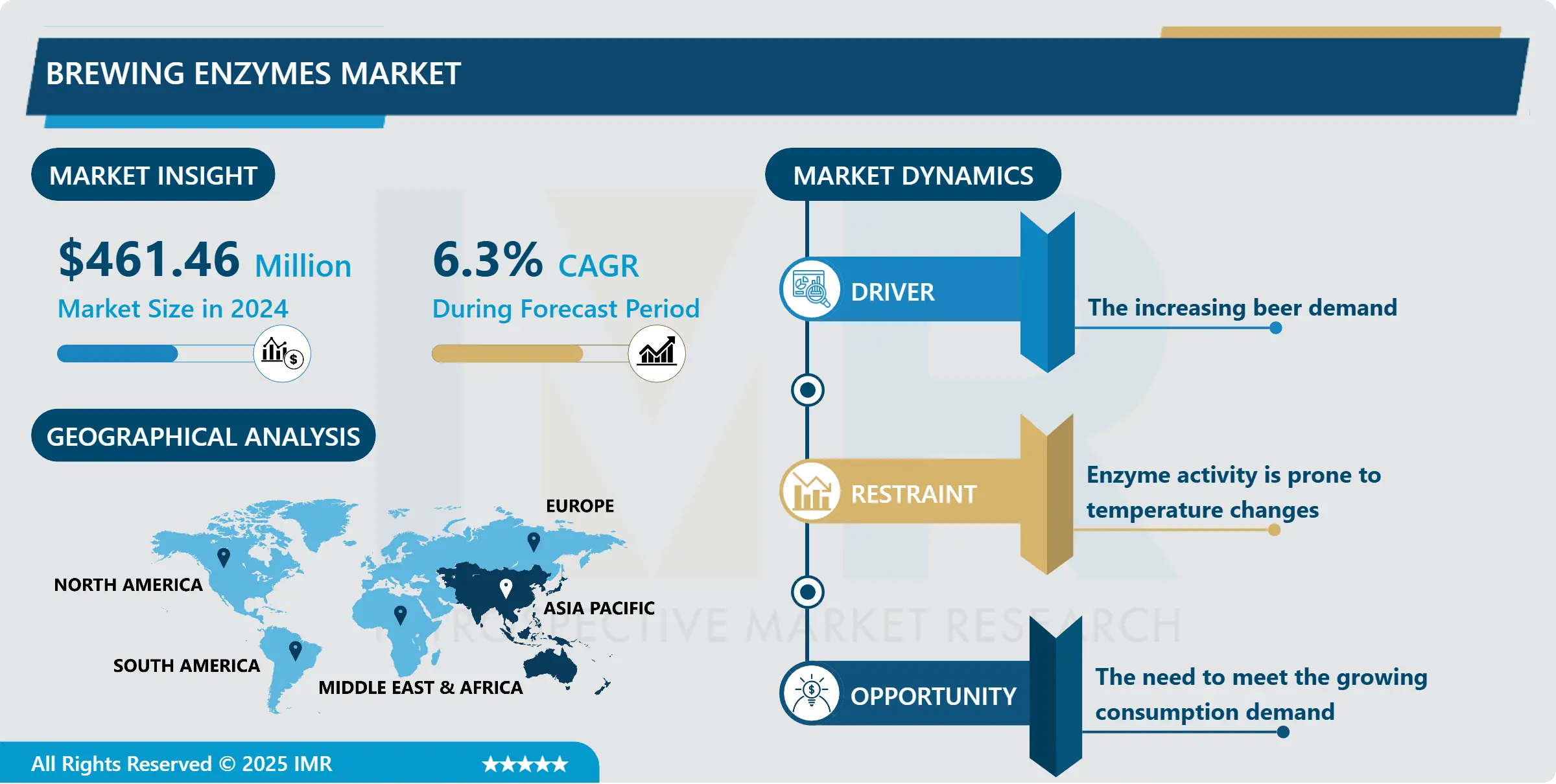

The Global Brewing Enzymes market was estimated at USD 461.46 million in 2024, and is anticipated to reach USD 752.31 million by 2032, Growing at a CAGR of 6.3% From 2025-2032.

The steady growth of the worldwide brewing enzymes market is fueled by various factors, such as the increasing global demand for beer, especially in emerging economies. Enzymes are essential in the brewing process as they help break down complex substances such as starches into simpler sugars, which yeast then ferments to create alcohol. This boosts the effectiveness of the brewing process, minimizes processing duration, and enhances the quality and uniformity of the end product. Moreover, brewers are being motivated to investigate innovative enzyme solutions in order to produce one-of-a-kind flavors and enhance beer qualities due to the growing demand for craft and specialty beers among consumers.

Furthermore, strict rules regarding sustainability and environmental issues are urging breweries to utilize enzyme-based solutions in order to maximize resource efficiency and reduce waste production. Enzymes provide a more environmentally friendly option compared to conventional brewing techniques because they decrease energy consumption, water usage, and greenhouse gas emissions. Consequently, the worldwide brewing enzymes industry is projected to experience growth in response to breweries’ efforts to improve production methods, fulfill diverse beer preferences, and comply with regulations.

Market Dynamics and Factors for the Brewing Enzymes Market

Drivers:

The requirement to improve the production to accomplish the growing beer demand is to accelerate the brewing enzymes market growth. Requirement improved beer quality & better flavor will increase the product demand. The target of beer manufacturers on enhancing the economic feasibility due to the growing count of breweries globally will be triggering the industry growth. Judicious R&D spending on enzyme producers on product development targeting boosting the production efficiency will improve the business revenue over the forecast period.

Growing the number of microbreweries and the necessity to participate with large producers through cost reduction is demanding the brewing enzymes business revenue. Massive product introductions in alcohol-free and low-alcohol categories due to the trend towards a strong lifestyle are hastening the market growth.

Furthermore, accelerating the surge for gluten-free and flavored beer coupled with penetration of worldwide distinguished companies in low-alcohol & alcohol-free segments will propel the demand in the upcoming years. Rising consumer spending on food & beverages especially in emerging countries will aid the beer industry demand. Significant urbanization accompanied by increasing demand for alcoholic beverages through dining restaurants, cafes, bars & pubs will positively affect the market growth.

Restraints:

Brewing enzymes work productively in a lean range near optimum temperature & pH. Additionally, changing raw material prices can restraint the industry revenues. Poor uniformity in regulations may affect the brewing enzymes industry growth.

Opportunities:

Demand for enzymes to raise beer production efficiency. Beer and wine producers constantly look for advanced solutions to accomplish safety standards and improve productivity to meet the changes in consumer demand for beer and wine. Major beer and wine producers are mostly targeted at growing the level of efficiency to raise their level of volumes for the production of beer. Brewers who look for raw material cost savings or use of local raw materials may source under-modified malts or rise the ratio of supplements. Although, the restraining factor is to ensure an adequate complex of enzymatic activities for high-quality wort. Hence, with the intent of growing efficiency and optimize raw material applications, many brewers are now targeted on commercial enzymes to shorten the manufacturing time, rising capacity, and for the usage of raw material substitutes to malt.

The dominance of nuclear double-income families, especially in urban areas in developing nations contributes to the shifting in lifestyles among consumers. Changes in utilization patterns have led to an increase in the demand for alcoholic beverages.

Market Segmentation

Segmentation for the Brewing Enzymes Market:

Based on the Product Type, amylase is projected to account for the maximum share in the market due to the high-ranking functional benefits along with a healthy outlook in several brewery processes including fermentation, mashing, and cereal cooking is positively impacting the amylases business growth. Constant & uniform mashing coupled with enhanced filtration are among the major factors turning the product demand. Higher production of fermentable glucose in beer production particularly in light beer is accelerating the industry development. The necessity to expand the beer production capacity with usages of existing production units is driving the market revenue. The optimal temperature of amylase is higher than other products.

Based on the Source, the microbes segment accounted for the maximum share and dominate the global market, as they are easy to handle, can be produced in massive tanks without light, and have a high growth rate. The ideal microorganism develops instantly and produces a significant amount of the desired enzyme at mild temperatures while consuming cheap nutrients. Microbial sources are also more cost-effective sources than plant sources, which has stimulated the growth of this segment.

Based on the Form, the liquid form is expected to dominate the market over the forecast period. It is preferred in the brewing process as it saves energy, decreases water usage, reduces wastage of beer, and clarifies the filtering process.

Regional Analysis for the Brewing Enzymes Market:

The Asia Pacific region is witnessing a surge in demand for alcoholic beverages, particularly beer and spirits. As economies in the region mature, disposable income is on the rise. This newfound spending power allows individuals to indulge in leisure activities and explore new products, including premium and imported beers and spirits. For instance, China’s economic boom has created a massive middle class with a taste for finer things. This has led to a significant increase in the consumption of imported beers and craft spirits, a trend absent just a decade ago.

The Asia Pacific region boasts a large and growing young population. This demographic is particularly susceptible to influences from Western culture, where social gatherings often revolve around alcohol consumption. With a median age of around 30, Vietnam has a youthful population eager to explore new experiences. This has fueled the popularity of bars and pubs, leading to a rise in beer consumption, by both domestic and international brands.

Globalization and increased exposure to Western media have introduced Asian consumers to new drinking habits and social norms. The association of alcohol with relaxation, celebration, and socializing is gaining traction, particularly in urban areas. South Korea, a country known for its vibrant nightlife, exemplifies this trend. Soju, a traditional Korean spirit, remains popular, but there’s a growing demand for cocktails, craft beers, and wines influenced by Western drinking culture.

Players Covered in Brewing Enzymes market are :

Enzyme Innovation (US)

Eugene Biosciences (India)

Brenntag SE (Germany)

DSM (Netherlands)

Amano Enzyme (Japan)

Novozymes (Denmark)

Kerry Group (Ireland)

Biocatalysts (UK)

Enzyme Development (US)

Associated British Foods Plc (UK)

Dupont De Nemours Inc. (US) and Others Major Players.

Key Industry Development of The Brewing Enzymes Market

In April 2021, Brenntag North America inc. a part of Brenntag SE has won two awards in the best company outlook and best sales team section. The company has been placed in the top 50 companies in North America among the top brands of the globe. Moreover, the company has acquired the matrix chemical to extend its supplies in the North American region.

In October 2020, DSM an active company in nutrition and health announced the launch of Maxadjunct ß L, a high-performance adjunct brewing enzyme. With this novel enzyme brewers around the globe will be able to increase the number of adjuncts in their beers. Moreover, it will also help the brewhouse to increase its capacity by 25% and cut the cost of the raw materials.

In October 2023, Montana State University’s research delves into barley protein distribution, crucial for livestock feed and beer clarity. Led by Professor Andreas Fischer, funded by the USDA, the study targets plant enzymes controlling crop value, aiding new grain variety development. This breakthrough intersects with the Brewing Enzymes market, promising advancements in brewing efficiency.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Brewing Enzymes Market by Type (2018-2032)

4.1 Brewing Enzymes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Amylase {Α-Amylase & Β-Amylase}

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Beta-Glucanase

4.5 Protease Amyloglucosidase

4.6 Xylanase

4.7 Others

Chapter 5: Brewing Enzymes Market by Source (2018-2032)

5.1 Brewing Enzymes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Plants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Microbes

Chapter 6: Brewing Enzymes Market by Form (2018-2032)

6.1 Brewing Enzymes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Dry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

Chapter 7: Brewing Enzymes Market by Process (2018-2032)

7.1 Brewing Enzymes Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Malting

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Mashing & Fermentation

7.5 Wort Separation & Filtration

7.6 Maturation

Chapter 8: Brewing Enzymes Market by Application (2018-2032)

8.1 Brewing Enzymes Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Wine Industry

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Beer Industry

8.5 Fruit Juice Industry

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Brewing Enzymes Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ENZYME INNOVATION (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BASF SE(GERMANY)

9.4 BIORESOURCE INTERNATIONAL INC. (US)

9.5 EUKARYOTIC BIOLOGICALS PVT LTD (INDIA)

9.6 NUTREX BE (CENTRAL FLORIDA)

9.7 AB ENZYMES GMBH (GERMANY)

9.8 KONINKLIJKE DSM (NETHERLANDS)

9.9 DUPONT (US)

9.10 CHR. HANSEN HOLDING A/S (DENMARK)

9.11 NOVOZYMES (DENMARK)

9.12 AUM ENZYMES (INDIA)

9.13 CAPRIENZYMES (INDIA) OTHERS MAJOR PLAYERS

Chapter 10: Global Brewing Enzymes Market By Region

10.1 Overview

10.2. North America Brewing Enzymes Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Amylase {Α-Amylase & Β-Amylase}

10.2.4.2 Beta-Glucanase

10.2.4.3 Protease Amyloglucosidase

10.2.4.4 Xylanase

10.2.4.5 Others

10.2.5 Historic and Forecasted Market Size by Source

10.2.5.1 Plants

10.2.5.2 Microbes

10.2.6 Historic and Forecasted Market Size by Form

10.2.6.1 Dry

10.2.6.2 Liquid

10.2.7 Historic and Forecasted Market Size by Process

10.2.7.1 Malting

10.2.7.2 Mashing & Fermentation

10.2.7.3 Wort Separation & Filtration

10.2.7.4 Maturation

10.2.8 Historic and Forecasted Market Size by Application

10.2.8.1 Wine Industry

10.2.8.2 Beer Industry

10.2.8.3 Fruit Juice Industry

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Brewing Enzymes Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Amylase {Α-Amylase & Β-Amylase}

10.3.4.2 Beta-Glucanase

10.3.4.3 Protease Amyloglucosidase

10.3.4.4 Xylanase

10.3.4.5 Others

10.3.5 Historic and Forecasted Market Size by Source

10.3.5.1 Plants

10.3.5.2 Microbes

10.3.6 Historic and Forecasted Market Size by Form

10.3.6.1 Dry

10.3.6.2 Liquid

10.3.7 Historic and Forecasted Market Size by Process

10.3.7.1 Malting

10.3.7.2 Mashing & Fermentation

10.3.7.3 Wort Separation & Filtration

10.3.7.4 Maturation

10.3.8 Historic and Forecasted Market Size by Application

10.3.8.1 Wine Industry

10.3.8.2 Beer Industry

10.3.8.3 Fruit Juice Industry

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Brewing Enzymes Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Amylase {Α-Amylase & Β-Amylase}

10.4.4.2 Beta-Glucanase

10.4.4.3 Protease Amyloglucosidase

10.4.4.4 Xylanase

10.4.4.5 Others

10.4.5 Historic and Forecasted Market Size by Source

10.4.5.1 Plants

10.4.5.2 Microbes

10.4.6 Historic and Forecasted Market Size by Form

10.4.6.1 Dry

10.4.6.2 Liquid

10.4.7 Historic and Forecasted Market Size by Process

10.4.7.1 Malting

10.4.7.2 Mashing & Fermentation

10.4.7.3 Wort Separation & Filtration

10.4.7.4 Maturation

10.4.8 Historic and Forecasted Market Size by Application

10.4.8.1 Wine Industry

10.4.8.2 Beer Industry

10.4.8.3 Fruit Juice Industry

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Brewing Enzymes Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Amylase {Α-Amylase & Β-Amylase}

10.5.4.2 Beta-Glucanase

10.5.4.3 Protease Amyloglucosidase

10.5.4.4 Xylanase

10.5.4.5 Others

10.5.5 Historic and Forecasted Market Size by Source

10.5.5.1 Plants

10.5.5.2 Microbes

10.5.6 Historic and Forecasted Market Size by Form

10.5.6.1 Dry

10.5.6.2 Liquid

10.5.7 Historic and Forecasted Market Size by Process

10.5.7.1 Malting

10.5.7.2 Mashing & Fermentation

10.5.7.3 Wort Separation & Filtration

10.5.7.4 Maturation

10.5.8 Historic and Forecasted Market Size by Application

10.5.8.1 Wine Industry

10.5.8.2 Beer Industry

10.5.8.3 Fruit Juice Industry

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Brewing Enzymes Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Amylase {Α-Amylase & Β-Amylase}

10.6.4.2 Beta-Glucanase

10.6.4.3 Protease Amyloglucosidase

10.6.4.4 Xylanase

10.6.4.5 Others

10.6.5 Historic and Forecasted Market Size by Source

10.6.5.1 Plants

10.6.5.2 Microbes

10.6.6 Historic and Forecasted Market Size by Form

10.6.6.1 Dry

10.6.6.2 Liquid

10.6.7 Historic and Forecasted Market Size by Process

10.6.7.1 Malting

10.6.7.2 Mashing & Fermentation

10.6.7.3 Wort Separation & Filtration

10.6.7.4 Maturation

10.6.8 Historic and Forecasted Market Size by Application

10.6.8.1 Wine Industry

10.6.8.2 Beer Industry

10.6.8.3 Fruit Juice Industry

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Brewing Enzymes Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Amylase {Α-Amylase & Β-Amylase}

10.7.4.2 Beta-Glucanase

10.7.4.3 Protease Amyloglucosidase

10.7.4.4 Xylanase

10.7.4.5 Others

10.7.5 Historic and Forecasted Market Size by Source

10.7.5.1 Plants

10.7.5.2 Microbes

10.7.6 Historic and Forecasted Market Size by Form

10.7.6.1 Dry

10.7.6.2 Liquid

10.7.7 Historic and Forecasted Market Size by Process

10.7.7.1 Malting

10.7.7.2 Mashing & Fermentation

10.7.7.3 Wort Separation & Filtration

10.7.7.4 Maturation

10.7.8 Historic and Forecasted Market Size by Application

10.7.8.1 Wine Industry

10.7.8.2 Beer Industry

10.7.8.3 Fruit Juice Industry

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Brewing Enzymes Market research report?

A1: The forecast period in the Brewing Enzymes Market research report is 2025-2032.

Q2: Who are the key players in Brewing Enzymes market?

A2: Dupont De Nemours Inc., Novozymes, DSM, Eugene Biosciences, Kerry Group, Brenntag SE, and Other active Players.

Q3: What are the segments of the Brewing Enzymes Market?

A3: The Brewing Enzymes Market is segmented into Type, Source, Form, Application, and Region. By Type, the market is categorized into Amylase, ?-Glucanase, Proteases Amyloglucosidase, Xylanase, and Others. By Source the market is categorized into Plants, and Microbes. By Form, the market is categorized into Powder, and Liquid. By Process, the market is categorized into Malting, Mashing & Fermentation, Wort Separation & Filtration, and Maturation. By Application, the market is categorized into Swine, Poultry, Aquaculture, Sheep's, Goats, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Brewing Enzymes Market?

A4: Enzymes are complex organic substances that act as a catalyst to fasten a chemical reaction while it remains unchanged in the end. The conventional brewing process requires an incredible amount of energy while the use of the brewing enzymes reduces the energy required in the brewing process thus it is an economically preferable process.

Q5: How big is the Brewing Enzymes Market?

A5: The Global Brewing Enzymes market was estimated at USD 461.46 million in 2024, and is anticipated to reach USD 752.31 million by 2032, Growing at a CAGR of 6.3% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!