Stay Ahead in Fast-Growing Economies.

Browse Reports NowBiscuits Market – In-Deep Analysis Focusing on Market Share

Biscuits are small pieces of bread manufactured from a mixture of ingredients such as flour, milk, sugar, cream, nuts, spice, and others. There are different kinds of biscuits available in the market such as sweet biscuits, savory biscuits, filled biscuits, and others.

IMR Group

Description

Biscuits Market Synopsis

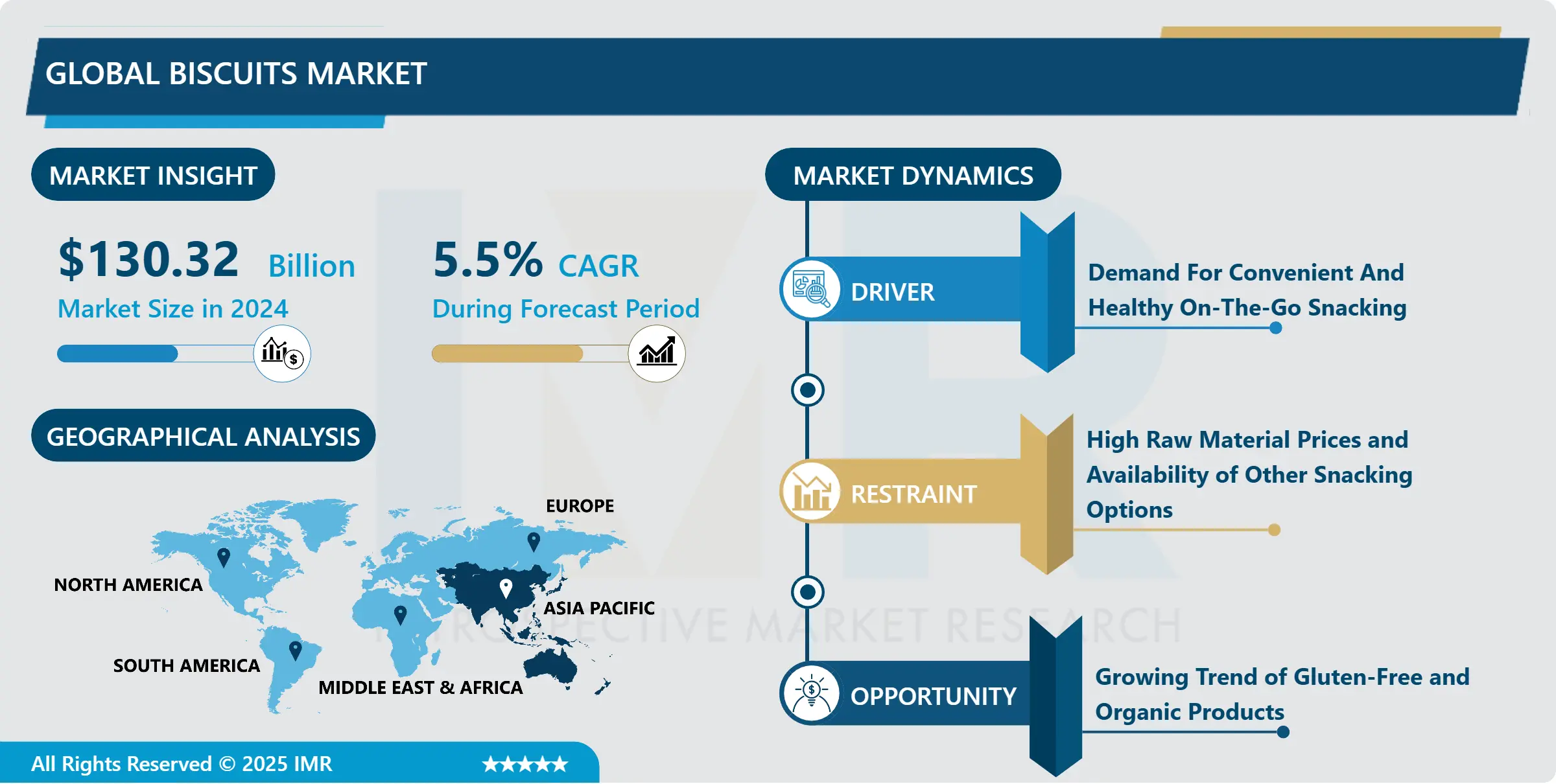

Biscuits Market Size Was Valued at USD 130.32 Billion in 2024, and is Projected to Reach USD 200.01 Billion by 2032, Growing at a CAGR of 5.5% From 2025-2032.

Biscuits are small pieces of bread manufactured from a mixture of ingredients such as flour, milk, sugar, cream, nuts, spice, and others. There are different kinds of biscuits available in the market such as sweet biscuits, savory biscuits, filled biscuits, and others.

In addition, some biscuits are made to aiming to meet the nutritional benefits for the consumer such as fat-free, sugar-free biscuits. Furthermore, with a focus on new product innovation and marketing communications, the players are also engaging in various in-store promotions. Consumers are driven by satisfaction, depending on the type of biscuit and size of the pack, where a different range of new products is continually being designed, including healthy biscuits, ‘thins’, free-from options, and breakfast biscuits.

As part of targeting the premium biscuits segment, players like Mondelez International rolled out a Cadbury branded biscuit with the option of consuming the product warm, out of the microwave. Additionally, significant surge products that are low-sugar, sugarless, whole grain, and products made from artificial and natural sweeteners such as Stevia have been observed globally, owing to the demonization of sugar consumption and calorie-conscious food habits.

Biscuits Market Trend Analysis

Demand For Convenient And Healthy On-The-Go Snacking

An increasing urge for convenience food globally at a faster pace owing to changes in social and economic patterns, growing expenditure on food and beverages as well as an increased concern related to concepts such as portion control. Moreover, a calorie deficit is also driving a more significant number of brands to offer small/ on-the-go consumption packs. The market is driven by the rising demand for convenient snacking paired with healthy ingredients among consumers.

Convenient snacking is gaining popularity, especially among working people, school and college children, students living in hostels, and bachelors owing to their busy lifestyles. Furthermore, the on-the-go snacking concept is closely associated with the easy consumption and handling of products, which biscuits and cookies offer. Therefore, the urge for snack products is increasing owing to the linked convenience of consumption, aided by disposable packaging that prevents the necessity to carry large bulk packets. Presently, consumers are allocating less time for traditional grocery shopping due to busier schedules. Due to the same, they are also unable to take out time for proper meals and, therefore, opt for on-the-go snack products, such as multigrain cookies and other biscuit products with high nutritional value to satisfy their hunger.

The biscuit market is experiencing significant growth as players operating in this market are continuously differentiating their offerings in terms of ingredient, flavor, composition, and packaging type to sustain in such a competitive market.

Clean label has moved on from being a trend and is now considered as a standard in the food industry. The interest in identifying the ingredients present in products has triggered the growth of the biscuit market.

Growing Trend of Gluten-Free and Organic Products

The biscuits market is witnessing a significant shift driven by the growing trend of gluten-free and organic products. Consumers are increasingly seeking healthier and more natural alternatives, creating a lucrative opportunity for manufacturers to capitalize on this evolving demand.

One of the key opportunities lies in the development of gluten-free biscuits to cater to individuals with gluten sensitivities or those following gluten-free diets. As awareness of gluten-related issues rises, there is a considerable market segment actively seeking gluten-free snack options. By formulating biscuits with alternative flours such as rice, almond, or coconut, manufacturers can tap into this niche market and offer a broader range of choices to health-conscious consumers.

Moreover, the demand for organic products continues to gain momentum as consumers prioritize clean eating and sustainable practices. Organic biscuits, made from organically grown ingredients without the use of synthetic pesticides or fertilizers, present a compelling opportunity for companies to align with the preferences of environmentally conscious consumers. Emphasizing the use of organic certification in marketing strategies can enhance the appeal of biscuits within this growing market segment.

The combination of gluten-free and organic attributes in biscuits represents a powerful proposition that resonates with consumers seeking a balance between health, dietary preferences, and environmental consciousness. Manufacturers embracing these trends and incorporating them into their product lines are well-positioned to not only meet current consumer demands but also to stay ahead in an evolving and competitive market landscape.

Biscuits Market Segment Analysis:

Biscuits Market Segmented on the basis of type, Ingredient, Product, Packing and Distribution Channel.

By Type, sweet biscuits segment is expected to dominate the market during the forecast period

Sweet biscuits are often associated with indulgence and provide a delightful taste experience. Consumers often turn to sweet biscuits as a treat or snack to satisfy their sweet cravings.

The sweet biscuits category offers a wide variety of flavors, ranging from classic options like chocolate and vanilla to more innovative and exotic choices. This versatility caters to diverse consumer tastes and preferences.

Sweet biscuits are convenient and portable, making them well-suited for on-the-go snacking. The fast-paced lifestyles of modern consumers contribute to the popularity of easily transportable and individually wrapped sweet biscuit products.

Sweet biscuits are often enjoyed with tea or coffee, contributing to their popularity during snack times or as accompaniments to hot beverages. This pairing enhances the overall snacking experience.

Sweet biscuits are commonly associated with celebrations and festive occasions. The demand for these biscuits tends to increase during holidays and special events, driving overall sales in the segment.

Manufacturers continually introduce new and innovative sweet biscuit products by experimenting with ingredients, textures, and formats. This innovation helps to keep the segment dynamic and capture consumer interest.

By Ingredients, Flour segment held the largest share in 2024

Flour is a fundamental ingredient in the traditional recipes of many biscuits. It serves as the primary structural component, providing the base for the dough and contributing to the texture and consistency of the final product.

Flour is a versatile ingredient that imparts structure, texture, and volume to biscuits. It contributes to the overall sensory experience, ensuring that biscuits have the desired crunch, crumb structure, and mouthfeel.

Wheat flour, in particular, is commonly used in biscuit production due to its gluten content, which helps create the desired texture. Wheat flour is abundant, cost-effective, and widely available, making it a preferred choice for many manufacturers.

Flour, especially wheat flour, tends to be a cost-effective ingredient, contributing to the economic viability of biscuit production. This cost-efficiency aligns with both mass production and affordability for consumers.

Manufacturers can control and standardize the texture of biscuits by using specific types of flour. This allows for the production of biscuits with consistent quality in terms of texture, ensuring a familiar and expected taste for consumers.

Biscuits Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific holds the largest biscuits market share, and is expected to exhibit the fastest growth over the forecast period. This region comprises several emerging countries, including China, India, Japan, and Australia. These nations are experiencing substantial growth in their middle-class population and urbanization, offering numerous opportunities for key players to expand in the region.

India and China are the primary drivers behind the exceptional growth rate witnessed in the Asian market. Increased awareness regarding proper nutrition and a focus on a healthy diet are crucial aspects of today’s busy lifestyle, leading consumers to seek convenient food items that facilitate measuring nutrient intake.

Consequently, companies are progressively launching digestive crackers and developing innovative plain, sugar-free biscuits enriched with grains. Moreover, the growth of retail stores and e-commerce platforms in the region has introduced new distribution channels for biscuit manufacturer.

The increasing popularity of clean-label snacks is expected to drive product innovation in the market. The emerging class of younger consumers and the working population regularly consume bakery products, such as sweet biscuits, thereby supporting the regional product demand. Moreover, international companies are looking to expand into the emerging Asian countries.

Biscuits Market Top Key Players:

Mondelez International (US)

Kraft Heinz Company (US)

Kellogg Company (US)

PepsiCo, Inc. (US)

Campbell Soup Company (US)

Murray Biscuit Company (US)

Bacheldre Watermill (UK)

Colussi Group (Italy)

Bahlsen GmbH & Co. KG (Germany)

Burton’s Biscuit Company (UK)

Nestlé S.A.(Switzerland)

Pladis Global (UK)

Danone S.A. (France)

Ferrero Group (Italy)

United Biscuits (McVitie’s) -(UK)

Lotus Bakeries (Belgium)

Mayora Indah Tbk (Indonesia)

Mondel?z Rus LLC – Part of Mondelez International (Russia)

Groupe Poult (France)

Arcor Group (Argentina)

Dali Group (China)

Britannia Industries Limited (India)

Parle Products Pvt. Ltd. (India)

Meiji Holdings Co., Ltd. (Japan)

Other Active Players

Key Industry Developments in the Biscuits Market:

In August 2023, Britannia Industries Limited, an Indian multinational FMCG company specializing in the food industry, launched Jim Jam Pops, an open cream biscuit. It is also known as the ‘Biscuit of the Future,’ and this variant has only one base biscuit, thus eliminating the need to twist it to relish the crème.

In May 2023, Bisk Farm, an Indian biscuit and bakery owned by SAJ Food Products Ltd., introduced two new products, Heylo T-Time Cookies and Half Half Masti, a unique cracker biscuit range. It is a blend of sweet and salty flavors with a hint of enigmatic spices, providing biscuit lovers a unique product to snack on.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biscuits Market by Type (2018-2032)

4.1 Biscuits Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sweet Biscuits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Crackers

4.5 Filled/ Coated

4.6 Savory Biscuits

Chapter 5: Biscuits Market by Ingredients (2018-2032)

5.1 Biscuits Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flour

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sugar

5.5 Butter

5.6 Chocolate

5.7 Milk

5.8 Cream

Chapter 6: Biscuits Market by Product (2018-2032)

6.1 Biscuits Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Rich Tea

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Bourbon

6.5 Plain Biscuits

6.6 Chocolate Coated Biscuits

6.7 Filled Biscuits

Chapter 7: Biscuits Market by Packaging (2018-2032)

7.1 Biscuits Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pouches

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Boxes

7.5 Jars

Chapter 8: Biscuits Market by Distribution Channel (2018-2032)

8.1 Biscuits Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hypermarkets/Supermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retailers

8.5 Convenience Store

8.6 Online

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Biscuits Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ALPHABET INC. (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MICROSOFT CORPORATION (US)

9.4 IBM CORPORATION (US)

9.5 NVIDIA CORPORATION (US)

9.6 INTEL CORPORATION (US)

9.7 AMAZON.COM INC. (US)

9.8 APPLE INC. (US)

9.9 ADOBE INC. (US)

9.10 CISCO SYSTEMS INC. (US)

9.11 QUALCOMM INCORPORATED (US)

9.12 PALANTIR TECHNOLOGIES INC. (US)

9.13 DELL TECHNOLOGIES INC. (US)

9.14 TWITTER INC. (US)

9.15 SALESFORCE.COM INC. (US)

9.16 ORACLE CORPORATION (US)

9.17 FACEBOOK INC. (US)

9.18 SAP SE (GERMANY)

9.19 SIEMENS AG (GERMANY)

9.20 ATOS SE (FRANCE)

9.21 ACCENTURE PLC (IRELAND)

9.22 TENCENT HOLDINGS LIMITED (CHINA)

9.23 BAIDU INC. (CHINA)

9.24 ALIBABA GROUP HOLDING LIMITED (CHINA)

9.25 INFOSYS LIMITED (INDIA)

9.26 SAMSUNG ELECTRONICS COLTD. (SOUTH KOREA)

9.27

Chapter 10: Global Biscuits Market By Region

10.1 Overview

10.2. North America Biscuits Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Sweet Biscuits

10.2.4.2 Crackers

10.2.4.3 Filled/ Coated

10.2.4.4 Savory Biscuits

10.2.5 Historic and Forecasted Market Size by Ingredients

10.2.5.1 Flour

10.2.5.2 Sugar

10.2.5.3 Butter

10.2.5.4 Chocolate

10.2.5.5 Milk

10.2.5.6 Cream

10.2.6 Historic and Forecasted Market Size by Product

10.2.6.1 Rich Tea

10.2.6.2 Bourbon

10.2.6.3 Plain Biscuits

10.2.6.4 Chocolate Coated Biscuits

10.2.6.5 Filled Biscuits

10.2.7 Historic and Forecasted Market Size by Packaging

10.2.7.1 Pouches

10.2.7.2 Boxes

10.2.7.3 Jars

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Hypermarkets/Supermarkets

10.2.8.2 Retailers

10.2.8.3 Convenience Store

10.2.8.4 Online

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Biscuits Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Sweet Biscuits

10.3.4.2 Crackers

10.3.4.3 Filled/ Coated

10.3.4.4 Savory Biscuits

10.3.5 Historic and Forecasted Market Size by Ingredients

10.3.5.1 Flour

10.3.5.2 Sugar

10.3.5.3 Butter

10.3.5.4 Chocolate

10.3.5.5 Milk

10.3.5.6 Cream

10.3.6 Historic and Forecasted Market Size by Product

10.3.6.1 Rich Tea

10.3.6.2 Bourbon

10.3.6.3 Plain Biscuits

10.3.6.4 Chocolate Coated Biscuits

10.3.6.5 Filled Biscuits

10.3.7 Historic and Forecasted Market Size by Packaging

10.3.7.1 Pouches

10.3.7.2 Boxes

10.3.7.3 Jars

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Hypermarkets/Supermarkets

10.3.8.2 Retailers

10.3.8.3 Convenience Store

10.3.8.4 Online

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Biscuits Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Sweet Biscuits

10.4.4.2 Crackers

10.4.4.3 Filled/ Coated

10.4.4.4 Savory Biscuits

10.4.5 Historic and Forecasted Market Size by Ingredients

10.4.5.1 Flour

10.4.5.2 Sugar

10.4.5.3 Butter

10.4.5.4 Chocolate

10.4.5.5 Milk

10.4.5.6 Cream

10.4.6 Historic and Forecasted Market Size by Product

10.4.6.1 Rich Tea

10.4.6.2 Bourbon

10.4.6.3 Plain Biscuits

10.4.6.4 Chocolate Coated Biscuits

10.4.6.5 Filled Biscuits

10.4.7 Historic and Forecasted Market Size by Packaging

10.4.7.1 Pouches

10.4.7.2 Boxes

10.4.7.3 Jars

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Hypermarkets/Supermarkets

10.4.8.2 Retailers

10.4.8.3 Convenience Store

10.4.8.4 Online

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Biscuits Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Sweet Biscuits

10.5.4.2 Crackers

10.5.4.3 Filled/ Coated

10.5.4.4 Savory Biscuits

10.5.5 Historic and Forecasted Market Size by Ingredients

10.5.5.1 Flour

10.5.5.2 Sugar

10.5.5.3 Butter

10.5.5.4 Chocolate

10.5.5.5 Milk

10.5.5.6 Cream

10.5.6 Historic and Forecasted Market Size by Product

10.5.6.1 Rich Tea

10.5.6.2 Bourbon

10.5.6.3 Plain Biscuits

10.5.6.4 Chocolate Coated Biscuits

10.5.6.5 Filled Biscuits

10.5.7 Historic and Forecasted Market Size by Packaging

10.5.7.1 Pouches

10.5.7.2 Boxes

10.5.7.3 Jars

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Hypermarkets/Supermarkets

10.5.8.2 Retailers

10.5.8.3 Convenience Store

10.5.8.4 Online

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Biscuits Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Sweet Biscuits

10.6.4.2 Crackers

10.6.4.3 Filled/ Coated

10.6.4.4 Savory Biscuits

10.6.5 Historic and Forecasted Market Size by Ingredients

10.6.5.1 Flour

10.6.5.2 Sugar

10.6.5.3 Butter

10.6.5.4 Chocolate

10.6.5.5 Milk

10.6.5.6 Cream

10.6.6 Historic and Forecasted Market Size by Product

10.6.6.1 Rich Tea

10.6.6.2 Bourbon

10.6.6.3 Plain Biscuits

10.6.6.4 Chocolate Coated Biscuits

10.6.6.5 Filled Biscuits

10.6.7 Historic and Forecasted Market Size by Packaging

10.6.7.1 Pouches

10.6.7.2 Boxes

10.6.7.3 Jars

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Hypermarkets/Supermarkets

10.6.8.2 Retailers

10.6.8.3 Convenience Store

10.6.8.4 Online

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Biscuits Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Sweet Biscuits

10.7.4.2 Crackers

10.7.4.3 Filled/ Coated

10.7.4.4 Savory Biscuits

10.7.5 Historic and Forecasted Market Size by Ingredients

10.7.5.1 Flour

10.7.5.2 Sugar

10.7.5.3 Butter

10.7.5.4 Chocolate

10.7.5.5 Milk

10.7.5.6 Cream

10.7.6 Historic and Forecasted Market Size by Product

10.7.6.1 Rich Tea

10.7.6.2 Bourbon

10.7.6.3 Plain Biscuits

10.7.6.4 Chocolate Coated Biscuits

10.7.6.5 Filled Biscuits

10.7.7 Historic and Forecasted Market Size by Packaging

10.7.7.1 Pouches

10.7.7.2 Boxes

10.7.7.3 Jars

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Hypermarkets/Supermarkets

10.7.8.2 Retailers

10.7.8.3 Convenience Store

10.7.8.4 Online

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Biscuits Market research report?

A1: The forecast period in the Biscuits Market research report is 2025-2032.

Q2: Who are the key players in the Biscuits Market?

A2: Mondelez International (US), Kraft Heinz Company (US), Kellogg Company (US), PepsiCo, Inc. (US), Campbell Soup Company (US), Murray Biscuit Company (US), Bacheldre Watermill (UK), Colussi Group (Italy), Bahlsen GmbH & Co. KG (Germany), Burton's Biscuit Company (UK), Nestlé S.A. (Switzerland), Pladis Global (UK), Danone S.A. (France), Ferrero Group (Italy), United Biscuits (McVitie's) – (UK), Lotus Bakeries (Belgium), Mayora Indah Tbk (Indonesia), Mondel?z Rus LLC – Part of Mondelez International (Russia), Groupe Poult (France), Arcor Group (Argentina), Dali Group (China), Britannia Industries Limited (India), Parle Products Pvt. Ltd. (India), Meiji Holdings Co., Ltd. (Japan), Y?ld?z Holding (Turkey).and Other Active Players.

Q3: What are the segments of the Biscuits Market?

A3: The Biscuits Market is segmented into Type, Ingredients, Product, Packaging, Distribution Channel and region. By Type, the market is categorized into Sweet Biscuits, Crackers, Filled/ Coated, Savory Biscuits. By Ingredients, the market is categorized into Flour, Sugar, Butter, Chocolate, Milk, Cream. By Product, the market is categorized into Rich Tea, Bourbon, Plain Biscuits, Chocolate Coated Biscuits, Filled Biscuits. By Packaging, the market is categorized into Pouches, Boxes, Jars. By Distribution Channel, the market is categorized into Hypermarkets/Supermarkets, Retailers, Convenience Store, Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Biscuits Market?

A4: Biscuits are small pieces of bread manufactured from a mixture of ingredients such as flour, milk, sugar, cream, nuts, spice, and others. There are different kinds of biscuits available in the market such as sweet biscuits, savory biscuits, filled biscuits, and others.

Q5: How big is the Biscuits Market?

A5: Biscuits Market Size Was Valued at USD 130.32 Billion in 2024, and is Projected to Reach USD 200.01 Billion by 2032, Growing at a CAGR of 5.5% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!