Stay Ahead in Fast-Growing Economies.

Browse Reports NowBiomarker Testing Service Market Opportunities, Challenges & Strategic Forecast (2024–2032)

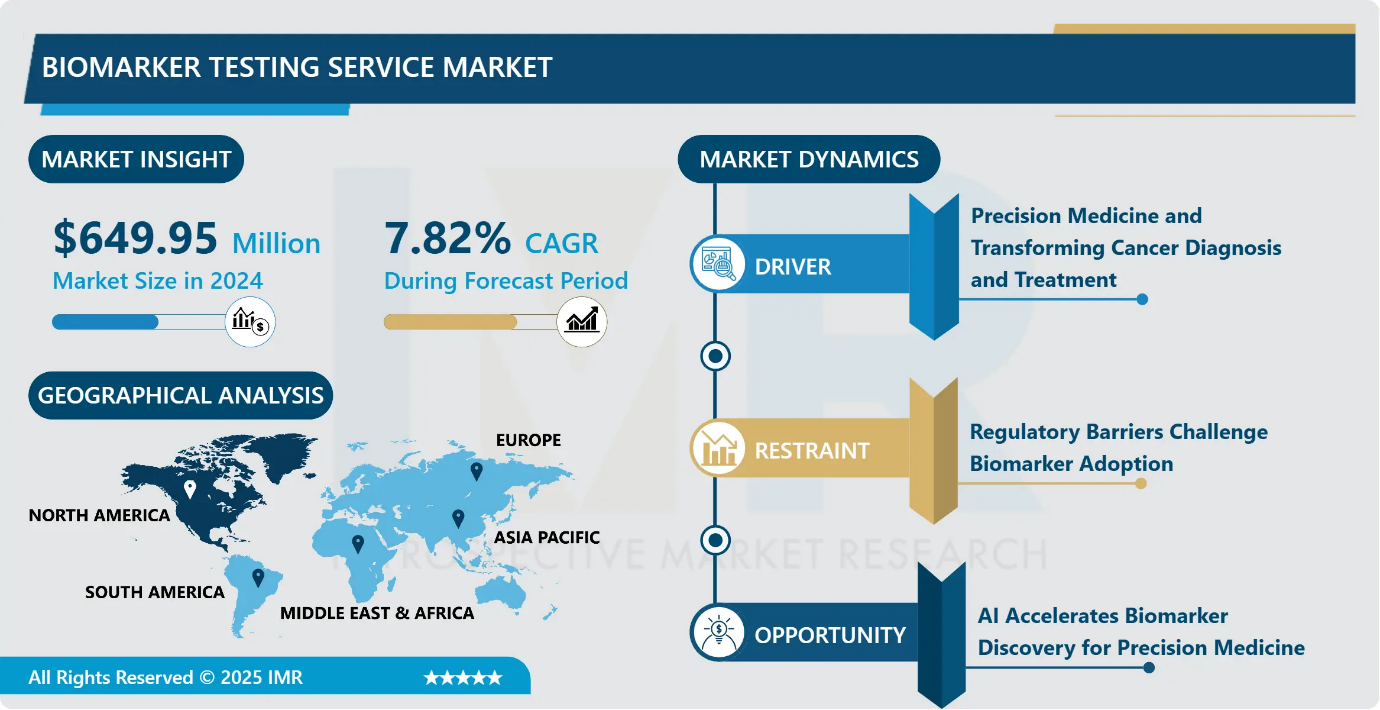

Biomarker Testing Service Market Size Was Valued at USD 649.95 Million in 2024 and is Projected to Reach USD 1,187.07 Million by 2032, Growing at a CAGR of 7.82% From 2024-2032.

IMR Group

Description

Biomarker Testing Service Market Synopsis:

Biomarker Testing Service Market Size Was Valued at USD 649.95 Million in 2024 and is Projected to Reach USD 1,187.07 Million by 2032, Growing at a CAGR of 7.82% From 2024-2032.

A laboratory method that uses a sample of tissue, blood, or other body fluid to check for certain genes, proteins, or other molecules that might be a sign of a disease or condition, such as cancer. Biomarker testing can also be used to check for certain changes in a gene or chromosome that may increase a person’s risk of developing cancer or other diseases. Biomarker testing be done with other procedures, such as biopsies, to help diagnose some types of cancer. It also be used to help plan treatment, find out how well treatment is working, make a prognosis, or predict whether cancer will come back or spread to other parts of the body. Also called molecular profiling and molecular testing.

The integration of cancer biomarkers into oncology has revolutionized cancer treatment, yielding remarkable advancements in cancer therapeutics and the prognosis of cancer patients. The development of personalized medicine represents a turning point and a new paradigm in cancer management, as biomarkers enable oncologists to tailor treatments based on the unique molecular profile of each patient’s tumor. These Advancements will further fuel the growth of the global Biomarker Testing Service Market.

Biomarker Testing Service Market Growth and Trend Analysis:

Precision Medicine and Transforming Cancer Diagnosis and Treatment

Biomarker-based tests, including genomic and imaging advancements, are increasingly being used to refine prostate cancer diagnosis and treatment. The use of PSA (Prostate-Specific Antigen) tests has led to concerns about overdiagnosis and unnecessary biopsies, prompting a shift toward more advanced biomarker-based assessments to improve accuracy?

Advocacy efforts have been made to ensure comprehensive biomarker testing is covered under state-regulated insurance plans and Medicaid, improving access to precision medicine. This reflects a broader trend toward integrating biomarker testing into routine cancer care for personalized treatment strategies?

In alignment with these trends, organizations like the American Cancer Society are significantly investing in biomarker research. With a portfolio of USD 446.4 million dedicated to cancer research, a substantial portion of funding is directed toward areas such as biomarker discovery, drug development, and molecular epidemiology. The investments in breast, lung, and colorectal cancer research, among others, underscore the growing recognition of biomarkers as a pivotal element in improving cancer care. These trends are contributing to the rapid expansion of the global biomarker testing market, as stakeholders from pharmaceutical companies to healthcare providers are increasingly aware of the potential benefits that advanced biomarker-based diagnostics and treatments offer.

Regulatory Barriers Challenge Biomarker Adoption

Obtaining reimbursement for biomarker tests proves to be complex for healthcare providers since validation through patient benefits and cost-effectiveness outcomes remains essential. The evidence acquisition process proves to be costly and time-consuming thus creating substantial difficulties for recently identified biomarkers to obtain insurance coverage. Investments needed for biomarker discovery span from modest to substantial based on how broad the study is the difficulty of the disease and the resources available. Creating and preserving the essential research facilities requires extensive financial resources which increases the total expenditure. Precise implementation of biomarkers depends heavily on overcoming substantial financial and regulatory barriers to advance precision medical practices.

AI Accelerates Biomarker Discovery for Precision Medicine

Several dimensions of healthcare depend on biomarkers as diagonal tools for medical detection together with prediction methods pharmaceutical creation procedures and therapeutic effectiveness tracking. The existing process to discover biomarkers proves challenging since it requires excessive resources along with long workflows. Pharmaceutical and healthcare industries require efficient methods to discover suitable biomarkers along with validation procedures that measure pre-clinical model results in clinical applications. The analysis of biomarkers is currently undergoing fundamental transformation due to AI/ML models being integrated into their assessment process. Sophisticated algorithms from these systems allow scientists to analyze high-throughput complex data from multi-omics, GWAS, and clinical data for the biomarker revolution.

High Cost of Biomarker Discovery

One of the primary barriers is the high cost of biomarker discovery, validation, and testing infrastructure, which limits accessibility, especially in low- and middle-income regions. Additionally, technical complexities in biomarker identification, standardization, and assay reproducibility often delay clinical adoption and regulatory approvals, making market expansion slower than anticipated.

Biomarker Testing Service Market Segment Analysis:

Biomarker Testing Service Market is segmented based on type, service, application, and region

By Type, biomarker assay development and validation segment is expected to dominate the market during the forecast period

The biomarker assay development and validation segment is leading the global biomarker testing market, driven by advancements in complex technologies that enhance the discovery and clinical application of biomarkers. The ability to accurately identify, quantify, and validate biomarkers is essential for their successful integration into clinical practice, where they can improve diagnosis, prognosis, and disease monitoring.

Automation and standardization in assay development play a critical role in accelerating biomarker validation, ensuring reproducibility, and meeting stringent regulatory requirements set by agencies such as the FDA and EMEA. As biomarker-based diagnostics continue to gain prominence, achieving regulatory approval should remain a primary objective to facilitate their widespread adoption in healthcare.

To bridge the gap between research and clinical application, greater collaboration is needed between scientists, industry leaders, and policymakers. Such partnerships can drive innovation, streamline regulatory pathways, and ultimately ensure that validated biomarker assays reach patients faster, improving personalized medicine and disease management outcomes globally.

By Application, the oncology segment held the largest share in the projected period

According to the 2024 American Cancer Society report on Cancer Statistics over 2 million people will receive cancer diagnoses this year meaning almost 5,500 individuals are diagnosed every day at a rate of one new case occurring every 15 seconds. These statistics mark the first time cancer has reached 2 million new diagnoses per year in the U.S. as an increasing number of people receive early-stage cancer diagnoses at optimal times for positive treatment outcomes. The milestone shows the increasing significance of detecting cancer at its early stages while using advanced diagnostic approaches which include biomarker testing services.

The American Cancer Society’s (ACS) approval of USD 28 million in new Extramural Discovery Science (EDS) research and career development grants plays a significant role in driving the growth of the oncology biomarker testing segment. This funding supports cutting-edge research aimed at advancing early cancer detection, precision medicine, and targeted therapies, all of which rely heavily on biomarker testing. By investing in innovative diagnostic approaches, the ACS helps accelerate the development and adoption of biomarker-driven oncology solutions, further expanding the market.

Biomarker Testing Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America leads the global biomarker services market through combined factors including robust research activities and extensive clinical trials and advanced medical infrastructure. The North American market leads global biomarker services due to NGS technologies combined with AI-driven biomarker testing and liquid biopsy approaches have made personalized medicine possible. Biomarker-driven cancer diagnostics service providers such as Foundation Medicine alongside Guardant Health and Caris Life Sciences deliver enhanced therapeutic results through precision medicine. Government support through Medicare programs coupled with insurance coverage of biomarker testing for lung and breast cancer and colorectal and prostate cancer patients facilitated the rapid increase in biomarker testing adoption.

Source: American Cancer Society

The graph highlights the disparity between new cancer cases and mortality rates for five major cancer types in North America in 2024. Breast and prostate cancer have the highest incidence rates, with approximately 310,720 and 299,010 new cases, respectively. However, their mortality rates remain relatively low (42,250 for breast cancer and 35,250 for prostate cancer), largely due to the widespread use of biomarker-based diagnostics such as HER2, ER/PR, and PSA testing, which enable early detection and targeted treatment.

On the other hand, pancreatic cancer presents a stark contrast, with 66,440 new cases and 51,750 deaths, making it one of the deadliest cancers due to the lack of early detection biomarkers and limited treatment options. Lung and colorectal cancer also exhibit high mortality rates (~50-53%), despite significant advancements in precision medicine, including EGFR, ALK, PD-L1, and MSI testing, which have improved survival rates in recent years. Expanding biomarker testing services, especially in pancreatic and colorectal cancer could further enhance early detection, personalize treatments, and ultimately reduce cancer-related deaths in the region.

Biomarker Testing Service Market Active Players:

Abbott Laboratories (USA)

Adaptive Biotechnologies Corporation (USA)

Agilent Technologies, Inc. (USA)

Becton, Dickinson and Company (BD) (USA)

Bio-Rad Laboratories, Inc. (USA)

Eurofins Scientific (France)

F. Hoffmann-La Roche Ltd (Switzerland)

Foundation Medicine, Inc. (USA)

Genomic Health, Inc. (USA)

Hologic, Inc. (USA)

Illumina, Inc. (USA)

Merck KGaA (Germany)

Myriad Genetics, Inc. (USA)

Natera, Inc. (USA)

PerkinElmer, Inc. (USA)

QIAGEN N.V. (Netherlands)

Quest Diagnostics Incorporated (USA)

Siemens Healthineers AG (Germany)

SYNLAB Group (Germany)

Thermo Fisher Scientific Inc. (USA)

Other Active Players

Key Industry Developments in the Biomarker Testing Service Market:

In August 2024, Illumina, Inc. (NASDAQ: ILMN), a global leader in DNA sequencing and array-based technologies, announced Food and Drug Administration (FDA) approval of its in vitro diagnostic (IVD) TruSight™ Oncology (TSO) Comprehensive test and its first two companion diagnostic (CDx) indications. This single test interrogates over 500 genes to profile a patient’s solid tumor, helping to increase the likelihood of identifying an immuno-oncology biomarker or clinically actionable biomarkers that enable targeted therapy options or clinical trial enrollment.

In July 2024, Quanterix Corporation, a company fueling scientific discovery and breakthrough diagnostics through ultrasensitive biomarker detection, announced it has launched LucentAD, a test to assist in the evaluation of patients experiencing cognitive symptoms consistent with the early signs of Alzheimer’s disease (AD). The LucentAD test, which will be available to healthcare providers as an aid in conjunction with other diagnostic tools, provides clinicians with a simplified process to quickly assess the likelihood of a patient having amyloid pathology consistent with AD.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biomarker Testing Service Market by Service

4.1 Biomarker Testing Service Market Snapshot and Growth Engine

4.2 Biomarker Testing Service Market Overview

4.3 Biomarker Assay Development & Validation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Biomarker Assay Development & Validation: Geographic Segmentation Analysis

4.4 Flow Cytometry

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Flow Cytometry: Geographic Segmentation Analysis

4.5 and Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Others: Geographic Segmentation Analysis

Chapter 5: Biomarker Testing Service Market by Application

5.1 Biomarker Testing Service Market Snapshot and Growth Engine

5.2 Biomarker Testing Service Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oncology: Geographic Segmentation Analysis

5.4 Drug Discovery & Development

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Drug Discovery & Development: Geographic Segmentation Analysis

5.5 and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Others: Geographic Segmentation Analysis

Chapter 6: Biomarker Testing Service Market by Type

6.1 Biomarker Testing Service Market Snapshot and Growth Engine

6.2 Biomarker Testing Service Market Overview

6.3 Molecular Biomarkers & Cellular Biomarkers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Molecular Biomarkers & Cellular Biomarkers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biomarker Testing Service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MERCK KGAA (GERMANY)

7.4 THERMO FISHER SCIENTIFIC INC. (USA)

7.5 ABBOTT LABORATORIES (USA)

7.6 QIAGEN N.V. (NETHERLANDS)

7.7 NATERA INC. (USA)

7.8 EUROFINS SCIENTIFIC (FRANCE)

7.9 QUEST DIAGNOSTICS INCORPORATED (USA)

7.10 SYNLAB GROUP (GERMANY)

7.11 AGILENT TECHNOLOGIES INC. (USA)

7.12 ILLUMINA INC. (USA)

7.13 BIO-RAD LABORATORIES INC. (USA)

7.14 SIEMENS HEALTHINEERS AG (GERMANY)

7.15 PERKINELMER INC. (USA)

7.16 BECTON

7.17 DICKINSON AND COMPANY (BD) (USA)

7.18 MYRIAD GENETICS INC. (USA)

7.19 HOLOGIC INC. (USA)

7.20 GENOMIC HEALTH INC. (USA)

7.21 FOUNDATION MEDICINE INC. (USA)

7.22 ADAPTIVE BIOTECHNOLOGIES CORPORATION (USA)

7.23 OTHER ACTIVE PLAYERS.

Chapter 8: Global Biomarker Testing Service Market By Region

8.1 Overview

8.2. North America Biomarker Testing Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Service

8.2.4.1 Biomarker Assay Development & Validation

8.2.4.2 Flow Cytometry

8.2.4.3 and Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oncology

8.2.5.2 Drug Discovery & Development

8.2.5.3 and Others

8.2.6 Historic and Forecasted Market Size By Type

8.2.6.1 Molecular Biomarkers & Cellular Biomarkers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biomarker Testing Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Service

8.3.4.1 Biomarker Assay Development & Validation

8.3.4.2 Flow Cytometry

8.3.4.3 and Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oncology

8.3.5.2 Drug Discovery & Development

8.3.5.3 and Others

8.3.6 Historic and Forecasted Market Size By Type

8.3.6.1 Molecular Biomarkers & Cellular Biomarkers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biomarker Testing Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Service

8.4.4.1 Biomarker Assay Development & Validation

8.4.4.2 Flow Cytometry

8.4.4.3 and Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oncology

8.4.5.2 Drug Discovery & Development

8.4.5.3 and Others

8.4.6 Historic and Forecasted Market Size By Type

8.4.6.1 Molecular Biomarkers & Cellular Biomarkers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biomarker Testing Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Service

8.5.4.1 Biomarker Assay Development & Validation

8.5.4.2 Flow Cytometry

8.5.4.3 and Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oncology

8.5.5.2 Drug Discovery & Development

8.5.5.3 and Others

8.5.6 Historic and Forecasted Market Size By Type

8.5.6.1 Molecular Biomarkers & Cellular Biomarkers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biomarker Testing Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Service

8.6.4.1 Biomarker Assay Development & Validation

8.6.4.2 Flow Cytometry

8.6.4.3 and Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oncology

8.6.5.2 Drug Discovery & Development

8.6.5.3 and Others

8.6.6 Historic and Forecasted Market Size By Type

8.6.6.1 Molecular Biomarkers & Cellular Biomarkers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biomarker Testing Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Service

8.7.4.1 Biomarker Assay Development & Validation

8.7.4.2 Flow Cytometry

8.7.4.3 and Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oncology

8.7.5.2 Drug Discovery & Development

8.7.5.3 and Others

8.7.6 Historic and Forecasted Market Size By Type

8.7.6.1 Molecular Biomarkers & Cellular Biomarkers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Biomarker Testing Service Market research report?

A1: The forecast period in the Biomarker Testing Service Market research report is 2024-2032.

Q2: Who are the key players in the Biomarker Testing Service Market?

A2: F. Hoffmann-La Roche Ltd (Switzerland), Merck KGaA (Germany), Thermo Fisher Scientific Inc. (USA), Abbott Laboratories (USA), QIAGEN N.V. (Netherlands), Natera, Inc. (USA), Eurofins Scientific (France), Quest Diagnostics Incorporated (USA), SYNLAB Group (Germany), Agilent Technologies, Inc. (USA), Illumina, Inc. (USA), Bio-Rad Laboratories, Inc. (USA), Siemens Healthineers AG (Germany), PerkinElmer, Inc. (USA), Becton, Dickinson and Company (BD) (USA), Myriad Genetics, Inc. (USA), Hologic, Inc. (USA), Genomic Health, Inc. (USA), Foundation Medicine, Inc. (USA), Adaptive Biotechnologies Corporation (USA), and Other Active Players.

Q3: What are the segments of the Biomarker Testing Service Market?

A3: The Biomarker Testing Service Market is segmented into Type, Nature, Application, and Region. By Service, it is categorized into Biomarker Assay Development & Validation, Flow Cytometry, and Others. By Application, it is categorized into Oncology, Drug Discovery & Development, and Others. By Type, it is categorized into Molecular Biomarkers and Cellular Biomarkers. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Biomarker Testing Service Market?

A4: A laboratory method that uses a sample of tissue, blood, or other body fluid to check for certain genes, proteins, or other molecules that may be a sign of a disease or condition, such as cancer. Biomarker testing can also be used to check for certain changes in a gene or chromosome that may increase a person’s risk of developing cancer or other diseases.

Q5: How big is the Biomarker Testing Service Market?

A5: Biomarker Testing Service Market Size Was Valued at USD 649.95 Million in 2024 and is Projected to Reach USD 1,187.07 Million by 2032, Growing at a CAGR of 7.82% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!