Stay Ahead in Fast-Growing Economies.

Browse Reports NowBiocomposites Market- Global Size & Industry Forecast (2024-2032)

Biocomposites are materials composed of two or more distinct constituents—a matrix and reinforcement—where at least one component is derived from renewable, biological sources. These materials are designed to combine the advantages of both constituents, leveraging the natural properties of bio-based materials to create innovative, sustainable alternatives. The matrix can be a polymer derived from plant-based sources such as starch, cellulose, or natural resins, while the reinforcement phase often includes natural fibers such as hemp, flax, or jute.

IMR Group

Description

Biocomposites Market Synopsis

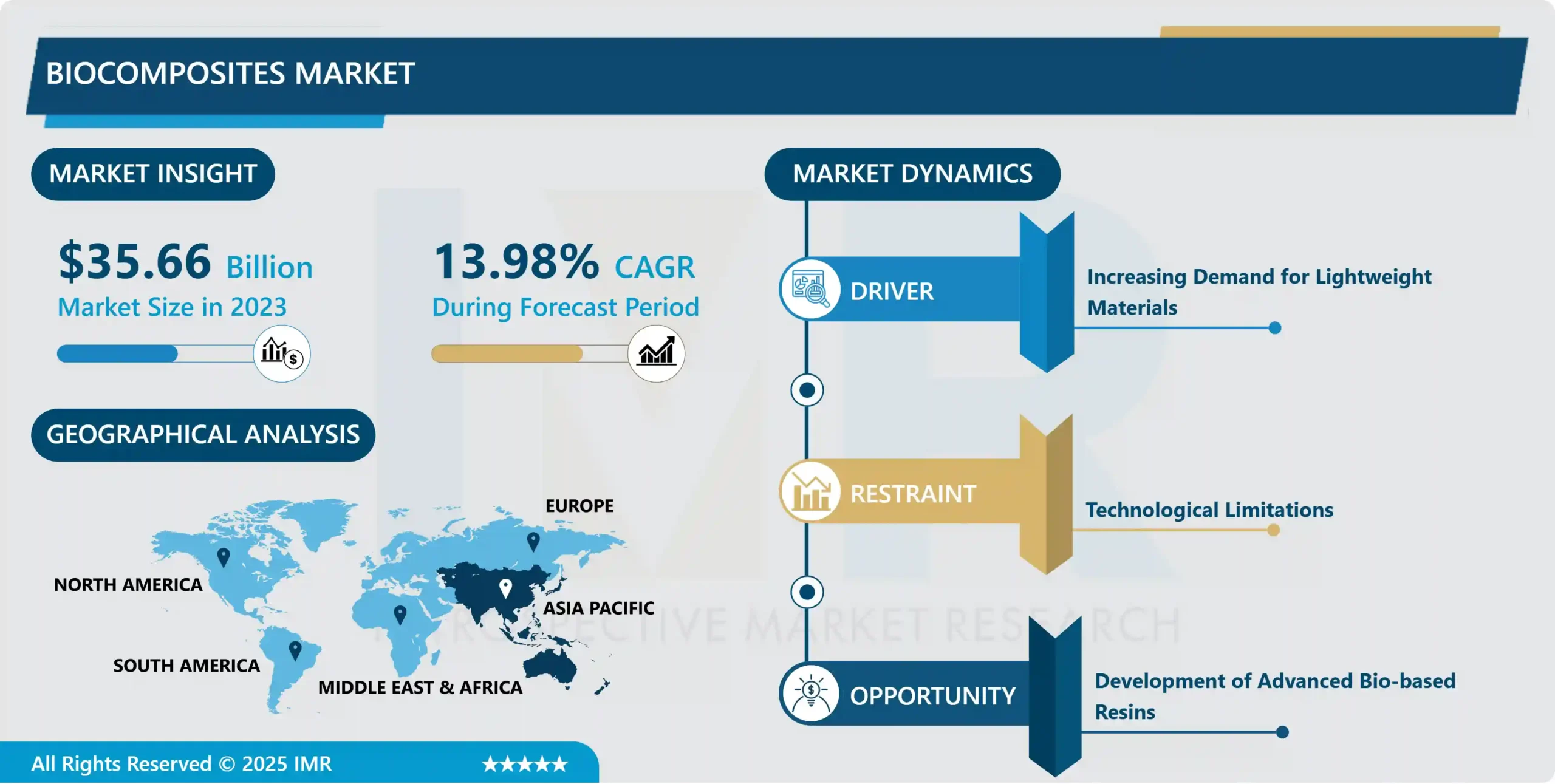

Biocomposites Market Size Was Valued at USD 35.66 Billion in 2023 and is Projected to Reach USD 115.78 Billion by 2032, Growing at a CAGR of 13.98% From 2024-2032.

Biocomposites are materials composed of two or more distinct constituents—a matrix and reinforcement—where at least one component is derived from renewable, biological sources. These materials are designed to combine the advantages of both constituents, leveraging the natural properties of bio-based materials to create innovative, sustainable alternatives. The matrix can be a polymer derived from plant-based sources such as starch, cellulose, or natural resins, while the reinforcement phase often includes natural fibers such as hemp, flax, or jute.

The applications of biocomposites span various industries, including automotive, construction, aerospace, and consumer goods. In automotive manufacturing, biocomposites are used to create interior parts, panels, and structural components, offering reduced weight, improved sustainability, and sometimes enhanced mechanical properties compared to traditional materials. Similarly, in construction, biocomposites find utility in creating durable yet eco-friendly building materials like bioplastic-based insulation or biofiber-reinforced concrete.

Currently, the market for biocomposites is experiencing notable growth due to increased emphasis on sustainability and environmental concerns across industries. The demand for eco-friendly materials, coupled with advancements in research and technology, has driven innovations in biocomposite formulations, enhancing their strength, durability, and versatility. Additionally, stringent regulations and consumer preferences for greener products have spurred manufacturers to explore and adopt biocomposites as viable alternatives to conventional materials, thereby contributing to the expansion of their market share in various sectors. The ongoing research focus involves developing cost-effective production methods, optimizing material properties, and exploring new bio-derived sources to further broaden the applications and commercial viability of biocomposites.

Biocomposites Market Trend Analysis

Increasing Demand for Lightweight Materials

Industries such as automotive, aerospace, and transportation are increasingly seeking materials that offer high strength while significantly reducing overall weight. Biocomposites, derived from natural fibers and bio-based polymers, serve as an attractive solution due to their inherent lightweight nature coupled with notable strength and durability.

In the automotive sector, for instance, reducing vehicle weight is crucial for improving fuel efficiency and reducing emissions. Biocomposites find applications in manufacturing interior components, body panels, and structural parts, offering a viable alternative to traditional materials such as steel or fiberglass. Similarly, in aerospace, where weight is a critical factor impacting fuel consumption and operational efficiency, biocomposites are gaining traction for manufacturing aircraft components, contributing to lighter aircraft designs without compromising on performance or safety standards.

The demand for lightweight materials is not solely driven by the transportation sector but extends to various consumer goods, packaging, and construction materials. Biocomposites’ ability to offer a balance between lightweight properties, eco-friendliness, and structural integrity positions them as a sought-after choice for industries striving to meet stringent weight reduction targets while maintaining product quality and sustainability goals. As industries continue to prioritize lightweight solutions for enhanced efficiency and reduced environmental impact, the demand for biocomposites is expected to witness sustained growth.

Development of Advanced Bio-based Resins

The development of advanced bio-based resins represents a pivotal opportunity within the biocomposites market. These resins, derived from renewable sources like plant-based polymers or bio-waste, present a significant breakthrough in enhancing the performance and applicability of biocomposite materials. Their evolution allows for the creation of biocomposites with improved mechanical properties, durability, and versatility, catering to diverse industry needs.

Advanced bio-based resins offer a compelling solution to challenges previously faced by biocomposites, such as achieving comparable performance to traditional materials. Innovations in resin chemistry enable the customization of properties, allowing manufacturers to tailor biocomposites for specific applications, including automotive parts, structural components, and consumer goods. Moreover, these resins often exhibit characteristics like improved heat resistance, better adhesion, and enhanced biodegradability, aligning with the growing demand for sustainable materials.

This development not only expands the range of potential applications for biocomposites but also contributes significantly to sustainability efforts. The use of bio-based resins reduces dependency on fossil fuels and mitigates environmental impact, positioning biocomposites as an eco-friendlier alternative in various industries. As research and technology further refine these resins, unlocking their full potential, the market for biocomposites is poised to witness substantial growth, meeting the demands of both industries and environmentally conscious consumers.

Biocomposites Market Segment Analysis:

Biocomposites Market Segmented on the basis of fibers, polymer, product, process type, and end-use industry.

By Type, Wood Fiber Composites segment is expected to dominate the market during the forecast period

In the biocomposites market, the Wood Fiber Composites segment is anticipated to maintain dominance during the forecast period. This segment’s prominence can be attributed to the widespread availability of wood fibers, coupled with their excellent mechanical properties and cost-effectiveness compared to other natural fibers. Wood fibre composites offer high strength-to-weight ratios, good thermal insulation, and durability, making them highly suitable for various applications across industries.

Industries such as construction, automotive, and consumer goods favour wood fibre composites due to their versatility and performance. These composites find extensive use in manufacturing decking, fencing, furniture, and building materials, among other products. Moreover, advancements in technology and manufacturing processes continually improve the quality and properties of wood fibre composites, further solidifying their market dominance.

The segment’s dominance is also influenced by the growing emphasis on sustainability, as wood fibers are renewable resources, aligning with the market’s increasing demand for eco-friendly materials. As a result, the Wood Fiber Composites segment is projected to maintain its leading position in the biocomposites market owing to its widespread applicability, performance attributes, and eco-friendly nature.

By Product, Hybrid segment held the largest market share of 73% in 2022

In the biocomposites market, the Hybrid segment has secured the largest market share due to its unique combination of different types of fibers and matrices, offering a blend of properties that cater to diverse industry needs. Hybrid biocomposites leverage the strengths of various natural fibers, such as wood, jute, hemp, or flax, in combination with different bio-based matrices or resins. This amalgamation allows for enhanced mechanical strength, improved durability, and tailored functionalities, surpassing the individual characteristics of single-component biocomposites.

Industries ranging from automotive to construction and consumer goods benefit from the versatility and performance advantages of hybrid biocomposites. These materials are utilized in manufacturing various components, including interior parts in automobiles, structural elements in buildings, and packaging solutions. The ability to customize properties like stiffness, impact resistance, and thermal stability to meet specific application requirements positions the Hybrid segment as a preferred choice across multiple industries.

Furthermore, the continual advancements in research and development focusing on optimizing hybrid combinations, along with their sustainable nature, contribute to their dominance in the biocomposites market. The versatility, combined properties, and adaptability of hybrid biocomposites make them a frontrunner, holding the largest market share and continuing to witness sustained growth and adoption.

Biocomposites Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Over the forecast period, the Asia Pacific region is poised to dominate the biocomposites market due to several key factors. The region’s dominance is attributed to its rapid industrialization, increasing infrastructure development, and a burgeoning automotive sector. Countries such as China, India, Japan, and South Korea are experiencing significant demand for sustainable materials, driving the adoption of biocomposites in various industries.

The Asia Pacific region boasts a robust presence of raw materials required for biocomposite production, including abundant sources of natural fibers and a growing focus on utilizing renewable resources. Moreover, supportive government initiatives promoting sustainable practices and stringent environmental regulations are accelerating the adoption of eco-friendly materials, further fueling the market growth.

Additionally, rising consumer awareness regarding environmental conservation and the preference for sustainable products contribute to the escalating demand for biocomposites in applications such as construction, automotive manufacturing, and consumer goods production. With expanding industrial sectors and increasing emphasis on eco-friendly solutions, the Asia Pacific region is positioned to lead the biocomposites market during the forecast period.

Biocomposites Market Top Key Players:

Advanced Environmental Recycling Technologies Inc. (U.S.)

Anhui Guofeng Wood-Plastic Composite Co. Ltd. (China)

B. Composites Pvt.Ltd. (India)

Bcomp (Switzerland)

Colan Australia (Australia)

Composites Pvt.Ltd. (India)

Devold Amt (Norway)

Fiberon (U.S.)

Flexform Spa (U.S.)

G. Angeloni S.R.L (Italy)

Green Dot Corporation (U.S.)

Hualong New Material Lumber Co. Ltd. (China)

Kudoti Pty Ltd (South Africa)

Lingrove Inc, (U.S.)

Mcg Biocomposites Llc (U.S.)

Meshlin Composites Zrt (Hungary)

Nanjing Xuha Sundi New Building Materials Ltd. (China)

Rock West Composites, Inc (U.S.)

Rtp Company (U.S.)

Structeam (U.K.)

Taiyuan Heavy Industry Co., Ltd (China)

Talon Technology Co., Ltd (U.S.)

Tecnaro Gmbh (Germany)

Trex Company, Inc. (U.S.)

Ufp Industries, Inc., (U.S.)

Upm (Finland)

Yixing Hualong New Material Lumber Co. Ltd. (China) and Other Major Players

Key Industry Developments in the Biocomposites Market:

In April 2023, in a groundbreaking collaboration, BASF and SWISS KRONO Group are revolutionizing the wood-based panel industry. BASF introduces Kaurit® ZERO and Kauramin® BALANCE, pioneering biomass-balanced amino resins. SWISS KRONO Group becomes the inaugural wood-based material manufacturer to utilize Kauramin® BALANCE in their innovative biocomposite product. BASF empowers its wood-based panel industry customers with the ability to compute their products’ CO2 footprint, marking a significant stride towards sustainability and eco-friendly production practices.

In September 2022, Nippon Paper Industries Co., Ltd. (Tokyo: 3863; President: NOZAWA Toru) and Mitsui Chemicals, Inc. are set to partner in the development of a new biocomposite with a high content of cellulose powder, a woody biomass material.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biocomposites Market by Fibres (2018-2032)

4.1 Biocomposites Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wood Fiber Composites

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Wood Fiber Composites

Chapter 5: Biocomposites Market by Polymer (2018-2032)

5.1 Biocomposites Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Synthetic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Natural

Chapter 6: Biocomposites Market by Product (2018-2032)

6.1 Biocomposites Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hybrid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Green

Chapter 7: Biocomposites Market by Process Type (2018-2032)

7.1 Biocomposites Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Compression Molding

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Injection Molding

7.5 Resin Transfer Molding

7.6 Others

Chapter 8: Biocomposites Market by End Use (2018-2032)

8.1 Biocomposites Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Construction

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Automotive

8.5 Consumer Goods

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Biocomposites Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 MUSIM MAS

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 KLK OLEO

9.4 EMERY OLEOCHEMICALS GROUP

9.5 CAROTINO GROUP

9.6 APICAL GROUP

9.7 ASIAN AGRI

9.8 ECOGREEN OLEOCHEMICALS

9.9 OLEON NV

9.10 VVF LLC

9.11 KAO CORPORATION

9.12 OTHER KEY PLAYERS

Chapter 10: Global Biocomposites Market By Region

10.1 Overview

10.2. North America Biocomposites Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Fibres

10.2.4.1 Wood Fiber Composites

10.2.4.2 Non-Wood Fiber Composites

10.2.5 Historic and Forecasted Market Size by Polymer

10.2.5.1 Synthetic

10.2.5.2 Natural

10.2.6 Historic and Forecasted Market Size by Product

10.2.6.1 Hybrid

10.2.6.2 Green

10.2.7 Historic and Forecasted Market Size by Process Type

10.2.7.1 Compression Molding

10.2.7.2 Injection Molding

10.2.7.3 Resin Transfer Molding

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size by End Use

10.2.8.1 Construction

10.2.8.2 Automotive

10.2.8.3 Consumer Goods

10.2.8.4 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Biocomposites Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Fibres

10.3.4.1 Wood Fiber Composites

10.3.4.2 Non-Wood Fiber Composites

10.3.5 Historic and Forecasted Market Size by Polymer

10.3.5.1 Synthetic

10.3.5.2 Natural

10.3.6 Historic and Forecasted Market Size by Product

10.3.6.1 Hybrid

10.3.6.2 Green

10.3.7 Historic and Forecasted Market Size by Process Type

10.3.7.1 Compression Molding

10.3.7.2 Injection Molding

10.3.7.3 Resin Transfer Molding

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size by End Use

10.3.8.1 Construction

10.3.8.2 Automotive

10.3.8.3 Consumer Goods

10.3.8.4 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Biocomposites Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Fibres

10.4.4.1 Wood Fiber Composites

10.4.4.2 Non-Wood Fiber Composites

10.4.5 Historic and Forecasted Market Size by Polymer

10.4.5.1 Synthetic

10.4.5.2 Natural

10.4.6 Historic and Forecasted Market Size by Product

10.4.6.1 Hybrid

10.4.6.2 Green

10.4.7 Historic and Forecasted Market Size by Process Type

10.4.7.1 Compression Molding

10.4.7.2 Injection Molding

10.4.7.3 Resin Transfer Molding

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size by End Use

10.4.8.1 Construction

10.4.8.2 Automotive

10.4.8.3 Consumer Goods

10.4.8.4 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Biocomposites Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Fibres

10.5.4.1 Wood Fiber Composites

10.5.4.2 Non-Wood Fiber Composites

10.5.5 Historic and Forecasted Market Size by Polymer

10.5.5.1 Synthetic

10.5.5.2 Natural

10.5.6 Historic and Forecasted Market Size by Product

10.5.6.1 Hybrid

10.5.6.2 Green

10.5.7 Historic and Forecasted Market Size by Process Type

10.5.7.1 Compression Molding

10.5.7.2 Injection Molding

10.5.7.3 Resin Transfer Molding

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size by End Use

10.5.8.1 Construction

10.5.8.2 Automotive

10.5.8.3 Consumer Goods

10.5.8.4 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Biocomposites Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Fibres

10.6.4.1 Wood Fiber Composites

10.6.4.2 Non-Wood Fiber Composites

10.6.5 Historic and Forecasted Market Size by Polymer

10.6.5.1 Synthetic

10.6.5.2 Natural

10.6.6 Historic and Forecasted Market Size by Product

10.6.6.1 Hybrid

10.6.6.2 Green

10.6.7 Historic and Forecasted Market Size by Process Type

10.6.7.1 Compression Molding

10.6.7.2 Injection Molding

10.6.7.3 Resin Transfer Molding

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size by End Use

10.6.8.1 Construction

10.6.8.2 Automotive

10.6.8.3 Consumer Goods

10.6.8.4 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Biocomposites Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Fibres

10.7.4.1 Wood Fiber Composites

10.7.4.2 Non-Wood Fiber Composites

10.7.5 Historic and Forecasted Market Size by Polymer

10.7.5.1 Synthetic

10.7.5.2 Natural

10.7.6 Historic and Forecasted Market Size by Product

10.7.6.1 Hybrid

10.7.6.2 Green

10.7.7 Historic and Forecasted Market Size by Process Type

10.7.7.1 Compression Molding

10.7.7.2 Injection Molding

10.7.7.3 Resin Transfer Molding

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size by End Use

10.7.8.1 Construction

10.7.8.2 Automotive

10.7.8.3 Consumer Goods

10.7.8.4 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Biocomposites Market research report?

A1: The forecast period in the Biocomposites Market research report is 2024-2032.

Q2: Who are the key players in the Biocomposites Market?

A2: Advanced Environmental Recycling Technologies Inc. (U.S.), Anhui Guofeng Wood-Plastic Composite Co. Ltd. (China), B. Composites Pvt.Ltd. (India), Bcomp (Switzerland), Colan Australia (Australia), Composites Pvt.Ltd. (India), Devold Amt (Norway), Fiberon (U.S.), Flexform Spa (U.S.), G. Angeloni S.R.L (Italy), Green Dot Corporation (U.S.), Hualong New Material Lumber Co. Ltd. (China), Kudoti Pty Ltd (South Africa), Lingrove Inc, (U.S.), Mcg Biocomposites Llc (U.S.), Meshlin Composites Zrt (Hungary), Nanjing Xuha Sundi New Building Materials Ltd. (China), Rock West Composites, Inc (U.S.), Rtp Company (U.S.), Structeam (U.K.), Taiyuan Heavy Industry Co.,Ltd (China), Talon Technology Co.,Ltd (U.S.), Tecnaro Gmbh (Germany), Trex Company, Inc. (U.S.), Ufp Industries, Inc., (U.S.), Upm (Finland), Yixing Hualong New Material Lumber Co. Ltd. (China) and Other Major Players.

Q3: What are the segments of the Biocomposites Market?

A3: The Biocomposites Market is segmented into Fibers, Polymers, Product, Process Type, End Use Industry, and region. By Fibers, the market is categorized into Wood Fiber Composites and Non-Wood Fiber Composites. By Polymer, the market is categorized into Synthetic and Natural. By Product, the market is categorized into Hybrid and Green. By Process Type, the market is categorized into Compression Molding, Injection Molding, Resin Transfer Molding and Extrusion molding process. By End Use Industry, the market is categorized into Automobile, Military Application, Aerospace, Building Construction and Consumer Goods. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Biocomposites Market?

A4: Biocomposites are materials composed of two or more distinct constituents—a matrix and reinforcement—where at least one component is derived from renewable, biological sources. These materials are designed to combine the advantages of both constituents, leveraging the natural properties of bio-based materials to create innovative, sustainable alternatives. The matrix can be a polymer derived from plant-based sources such as starch, cellulose, or natural resins, while the reinforcement phase often includes natural fibers such as hemp, flax, or jute.

Q5: How big is the Biocomposites Market?

A5: Biocomposites Market Size Was Valued at USD 35.66 Billion in 2023 and is Projected to Reach USD 115.78 Billion by 2032, Growing at a CAGR of 13.98% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!