Stay Ahead in Fast-Growing Economies.

Browse Reports NowBaggage Scanner Market – Overview & Growth Outlook

Baggage scanners are found at airports worldwide, customs, and government buildings such as courthouses and other security-critical buildings, so they are often readily available and require very little operator training. They work in a similar way to conventional medical X-rays in that an X-ray beam is directed at the object (usually a suitcase, briefcase, parcel, etc.) and those that pass through the object hit a detector and are converted into an image that can be seen by the operator. Unlike medical X-rays, baggage/security scanners create the image by mechanically passing the object through a fan-shaped X-ray beam that is directed onto a linear detector array that builds up the image.

IMR Group

Description

Baggage Scanner Market Synopsis

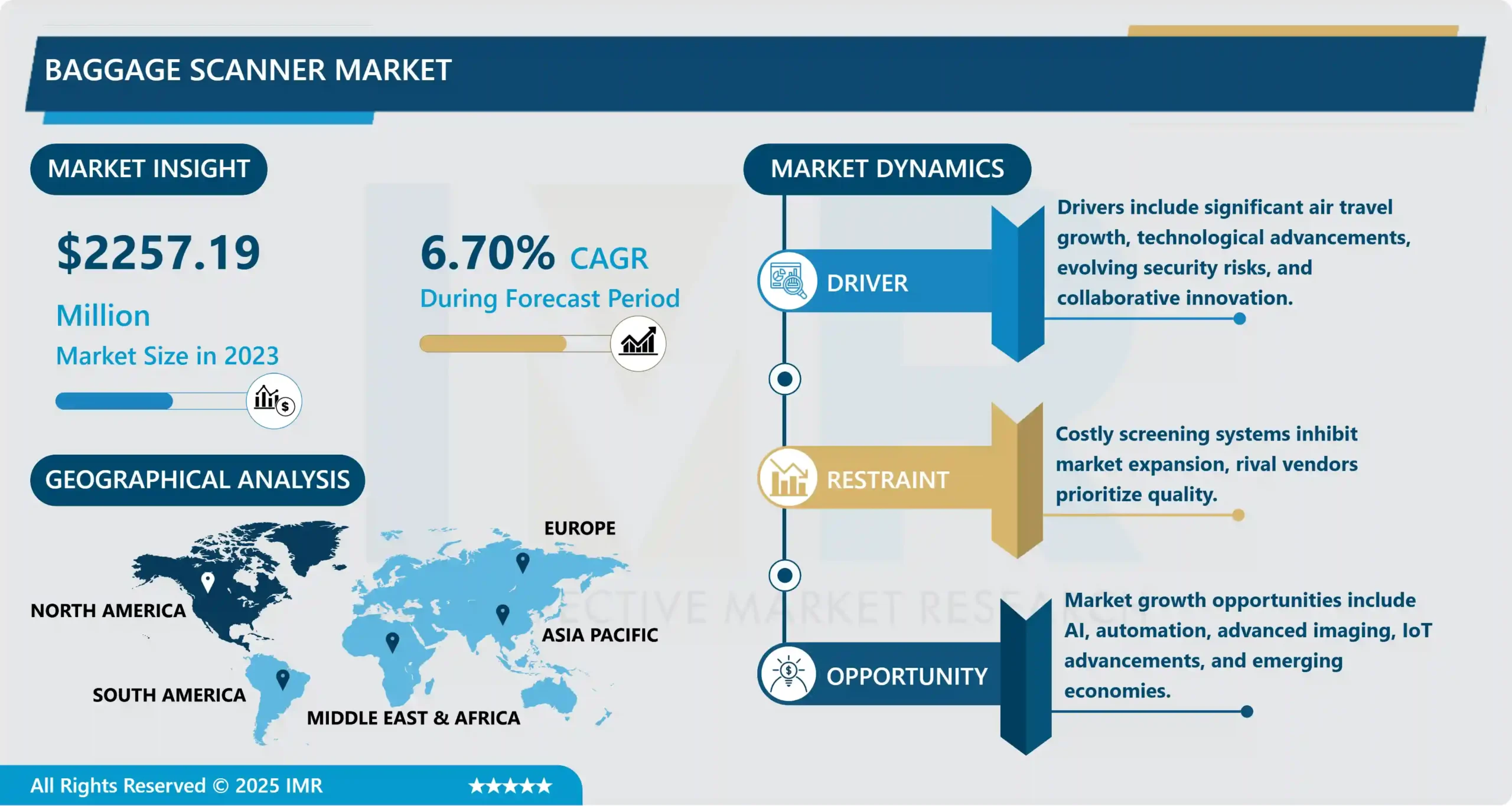

Baggage Scanner Market Size Was Valued at USD 2257.19 Million in 2023 and is Projected to Reach USD 4046.21 Million by 2032, Growing at a CAGR of 6.7% From 2024-2032.

Baggage scanners are found at airports worldwide, customs, and government buildings such as courthouses and other security-critical buildings, so they are often readily available and require very little operator training. They work in a similar way to conventional medical X-rays in that an X-ray beam is directed at the object (usually a suitcase, briefcase, parcel, etc.) and those that pass through the object hit a detector and are converted into an image that can be seen by the operator. Unlike medical X-rays, baggage/security scanners create the image by mechanically passing the object through a fan-shaped X-ray beam that is directed onto a linear detector array that builds up the image.

This detector is constructed in two layers to distinguish low-energy and high-energy X-rays which are used to determine the average atomic number of the material and differentiate different classes of material. Baggage scanners play a basic role in the protection of airports, customs, and other strategically important buildings and infrastructures. The current technology of baggage scanners is based on X-ray attenuation, meaning that the detection of threat objects relies on how various objects differently attenuate the X-ray beams going through them. This capability is enhanced by the use of dual-energy X-ray scanners, which make the determination of the X-ray attenuation characteristics of a material more precise by taking images with different X-ray spectra, and combining the information appropriately

A study by Goodman and Edelson alluded to a suggestion made that security (baggage) scanners be used in the temporary mortuary for the Primary Survey, but it is unclear whether the suggestion was made by the authors or by the participants of the identification process at the time of the crash. The study used security (baggage) scanners to image body bags containing fragmented human remains and other debris. The contents were identified, and the efficiency of this method was compared with the time taken and accuracy of contents identified in a manual search.

Baggage Scanner Market Trend Analysis

Current trends include remote screening, machine vision, multi-view scanning, predictive maintenance, and biometric integration.

Machine vision and deep learning have enhanced the detection of threats in luggage screening by accurately pinpointing suspicious items. This decreases mistakes made by humans, quickens the screening process, and improves security by reliably identifying irregularities. Continual progress in algorithms enables adaptation to fresh threats, enhancing the security solution’s resilience and growth. Scanning systems that utilize multiple views and energies provide detailed knowledge about the contents of baggage, improving security efforts.

Multi-view technology captures images from various perspectives, decreasing the likelihood of overlooking contraband caused by obstacles. Multi-energy X-ray imaging is able to differentiate materials based on their atomic numbers in order to accurately identify them. These systems enhance the ability to detect threats such as explosives disguised in harmless objects, increasing the effectiveness of baggage screening procedures.

Anticipatory maintenance is crucial for baggage screening, enhancing efficiency and minimizing downtime. Sensors and data analytics continuously monitor scanner parts, foreseeing maintenance requirements proactively to prevent malfunctions. This proactive method guarantees that scanners remain in optimal condition, preventing sudden malfunctions and upholding strict security measures for continuous operation in busy locations such as airports. Remote screening solutions for baggage scanning meet security requirements by enabling staff to review scanned images from a centralized point. This method improves efficiency, flexibility, and safety for security personnel.

Incorporating biometric authentication into scanning systems strengthens security by connecting luggage to passenger identities through fingerprints, facial recognition, or iris scans for identity confirmation. This simplifies passenger screening and decreases the possibility of tampering. Customizable baggage scanner options address specific market demands through flexible security solutions tailored to various airports, transportation centers, and security settings. Manufacturers provide modular scanners designed for particular needs and operational limitations.

Market growth opportunities include AI, automation, advanced imaging, IoT advancements, and emerging economies.

Airlines are making investments in innovative baggage handling technologies such as scanners in order to enhance services for passengers, decrease delays and mistakes, and enhance the overall customer experience. Developing environmentally friendly luggage scanning solutions presents a beneficial chance for airports and airlines to diminish their environmental impact, appeal to eco-conscious travelers, and take advantage of sustainability rewards.

Automation and robotics are pushing growth in the baggage scanning market by enhancing precision, productivity, and lowering expenses. In busy airports, luggage tracking is improved by technologies such as robotic arms and RFID tagging. AI improves threat detection in luggage scanners by examining scan images with precision in real time. Machine learning models enhance security standards by improving the identification of prohibited items, reducing false alarms.

Sophisticated imaging techniques such as X-ray and CT in luggage scanners improve threat detection with detailed, multi-dimensional images, enhancing security in high-risk locations such as airports and seaports. IoT sensors and big data analytics enhance baggage scanner functions by offering immediate insights on baggage contents, enhancing security, and allowing for predictive maintenance to decrease downtime. The market for baggage scanning is expanding in developing nations because of rising disposable incomes, urbanization, and air travel. Advanced scanning technologies are being implemented in modern airports in these areas to enhance security and efficiency.

Baggage Scanner Market Segment Analysis:

Baggage Scanner Market Segmented on the basis of Sorting System, Scanner Type, Application, Form, and End-use.

By Scanner Type, Conventional X-ray Scanners Segment Is Expected to Dominate the Market During the Forecast Period

X-ray scanners provide detailed, multi-dimensional images of luggage for extensive security checks, accurately detecting potential threats and ensuring thorough screening procedures. Ongoing advancements in X-ray scanning technology, such as the integration of AI and enhanced resolution, bolster the effectiveness and superiority in threat detection.

X-ray scanners are dependable in detecting threats by spotting hidden dangers, making them crucial for thorough security in transportation hubs and vital infrastructure around the globe. X-ray scanners are commonly utilized in airports, train stations, seaports, and critical infrastructure due to their effectiveness in detecting threats, making them a popular choice.

X-ray scanners utilize radiation to generate images of the contents of luggage, enabling security personnel to identify hidden weapons, explosives, or illicit items. X-ray scanners are the top choice in the baggage scanning market due to their strong presence and track record of success, making them the preferred option for security operators and regulatory authorities. X-ray scanners can be used in various scanning environments and for different security requirements as they are flexible, adjustable, and can be tailored to specific needs. Their dominance in the baggage scanning market is ensured by their capacity to fulfill various operational needs.

By End-use, Airports Segment Held the Largest Share In 2023

Stringent security regulations are implemented by global aviation authorities at airports, which include thorough baggage screening procedures, increasing the need for innovative baggage scanning technologies. Airports are at risk of security threats because of increased passenger volume. Robust baggage scanning systems are crucial for managing large amounts of luggage.

Baggage scanners play a vital role in aviation safety by identifying banned items and potential dangers in baggage to thwart acts of terrorism, illegal smuggling, and breaches in security. Baggage scanning systems are crucial for global airport security, underlining their extensive use and essential function in upholding industry regulations.

The increase in passenger traffic is what leads to market domination in commercial service airports. Improvements and extensions fulfill needs, leading to increased profits in luggage screening. Airports prioritize the use of baggage scanners that utilize real-time and advanced analysis in order to swiftly identify hazardous materials and suspicious baggage, thereby enhancing security measures.

There is a strong need for baggage scanners in airports to guarantee the safety and security of passengers, staff, and infrastructure. It is anticipated that this need will persist, making airports an essential market.

Baggage Scanner Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

The U.S. and other nations in North America prioritize investments in security infrastructure, particularly in advanced technologies such as baggage scanning, to maintain strong security at airports, borders, and entry points. Advanced baggage scanning solutions are needed to comply with stringent aviation security regulations in North America. Advanced technologies are needed to protect travelers and deter security risks. Major market players in baggage scanning have a significant presence in North America, using their expertise and technology to develop innovative security solutions.

The region’s sophisticated tech infrastructure allows for the implementation of smart city initiatives and advanced security technology, such as baggage scanners, to be seamlessly integrated into transportation hubs and critical facilities. Increased need for sophisticated luggage scanning systems in the aviation sector of North America due to high international travel, passenger traffic, regulatory compliance, and improved airport security measures.

The area’s dedication to creativity is demonstrated through substantial funding for research and development in baggage scanning technologies, resulting in advanced solutions for security issues and operational effectiveness. Following the 9/11 tragedy, airport scanners became required in all United States airports, contributing to North America’s leading position in baggage scanning technology thanks to the widespread use of scanning technologies in the area.

Baggage Scanner Market Active Players

Smiths Detection (United Kingdom)

Rapiscan Systems (United States)

L3Harris Technologies (United States)

Leidos (United States)

Nuctech Company Limited (China)

Astrophysics Inc. (United States)

Analogic Corporation (United States)

Gilardoni S.p.A. (Italy)

Autoclear LLC (United States)

ADANI Systems Inc. (United States)

Morpho Detection (United States)

Vidisco Ltd. (Israel)

VOTI Detection (Canada)

Gilardoni S.p.A. (Italy)

Optosecurity Inc. (Canada)

Ketech Defence (Turkey)

Teledyne Technologies Incorporated (United States)

CEIA S.p.A. (Italy)

Scan-X Security Ltd. (United Kingdom)

VueMetrix Inc. (United States)

ODSecurity (Netherlands)

MinXray Inc. (United States)

L3 Security & Detection Systems (

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Baggage Scanner Market by Sorting System (2018-2032)

4.1 Baggage Scanner Market Snapshot and Growth Engine

4.2 Market Overview

4.3 X-ray Scanners

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vacuum System

4.5 Radiofrequency Identification

Chapter 5: Baggage Scanner Market by Scanner Type (2018-2032)

5.1 Baggage Scanner Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Conventional X-ray Scanners

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Computed Tomography (CT) Scanners

5.5 Millimeter Wave Scanners

5.6 Backscatter X-ray Scanners

Chapter 6: Baggage Scanner Market by Application (2018-2032)

6.1 Baggage Scanner Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Metal Detection

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Explosive Detection

6.5 Drug Detection

Chapter 7: Baggage Scanner Market by Form (2018-2032)

7.1 Baggage Scanner Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Single View

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Multi View

7.5 3D Imaging

Chapter 8: Baggage Scanner Market by End-use (2018-2032)

8.1 Baggage Scanner Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Railway Stations

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Border checkpoints

8.5 Airports

8.6 Public Sectors

8.7 Transit Stations

8.8 Critical Infrastructures

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Baggage Scanner Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SMITHS DETECTION (UNITED KINGDOM)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 RAPISCAN SYSTEMS (UNITED STATES)

9.4 L3HARRIS TECHNOLOGIES (UNITED STATES)

9.5 LEIDOS (UNITED STATES)

9.6 NUCTECH COMPANY LIMITED (CHINA)

9.7 ASTROPHYSICS INC. (UNITED STATES)

9.8 ANALOGIC CORPORATION (UNITED STATES)

9.9 GILARDONI S.P.A. (ITALY)

9.10 AUTOCLEAR LLC (UNITED STATES)

9.11 ADANI SYSTEMS INC. (UNITED STATES)

9.12 MORPHO DETECTION (UNITED STATES)

9.13 VIDISCO LTD. (ISRAEL)

9.14 VOTI DETECTION (CANADA)

9.15 GILARDONI S.P.A. (ITALY)

9.16 OPTOSECURITY INC. (CANADA)

9.17 KETECH DEFENCE (TURKEY)

9.18 TELEDYNE TECHNOLOGIES INCORPORATED (UNITED STATES)

9.19 CEIA S.P.A. (ITALY)

9.20 SCAN-X SECURITY LTD. (UNITED KINGDOM)

9.21 VUEMETRIX INC. (UNITED STATES)

9.22 ODSECURITY (NETHERLANDS)

9.23 MINXRAY INC. (UNITED STATES)

9.24 L3 SECURITY & DETECTION SYSTEMS (UNITED STATES)

9.25 GILARDONI S.P.A. (ITALY)

9.26 KROMEK GROUP PLC (UNITED KINGDOM)

9.27 GILARDONI S.P.A. (ITALY)

9.28 SRI INTERNATIONAL (UNITED STATES)

9.29 PACIFIC AIRPORT GROUP (MEXICO)

9.30 DETECTACHEM (UNITED STATES)

9.31 GILARDONI S.P.A. (ITALY)

9.32 HIKVISION (INDIA)

Chapter 10: Global Baggage Scanner Market By Region

10.1 Overview

10.2. North America Baggage Scanner Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Sorting System

10.2.4.1 X-ray Scanners

10.2.4.2 Vacuum System

10.2.4.3 Radiofrequency Identification

10.2.5 Historic and Forecasted Market Size by Scanner Type

10.2.5.1 Conventional X-ray Scanners

10.2.5.2 Computed Tomography (CT) Scanners

10.2.5.3 Millimeter Wave Scanners

10.2.5.4 Backscatter X-ray Scanners

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Metal Detection

10.2.6.2 Explosive Detection

10.2.6.3 Drug Detection

10.2.7 Historic and Forecasted Market Size by Form

10.2.7.1 Single View

10.2.7.2 Multi View

10.2.7.3 3D Imaging

10.2.8 Historic and Forecasted Market Size by End-use

10.2.8.1 Railway Stations

10.2.8.2 Border checkpoints

10.2.8.3 Airports

10.2.8.4 Public Sectors

10.2.8.5 Transit Stations

10.2.8.6 Critical Infrastructures

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Baggage Scanner Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Sorting System

10.3.4.1 X-ray Scanners

10.3.4.2 Vacuum System

10.3.4.3 Radiofrequency Identification

10.3.5 Historic and Forecasted Market Size by Scanner Type

10.3.5.1 Conventional X-ray Scanners

10.3.5.2 Computed Tomography (CT) Scanners

10.3.5.3 Millimeter Wave Scanners

10.3.5.4 Backscatter X-ray Scanners

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Metal Detection

10.3.6.2 Explosive Detection

10.3.6.3 Drug Detection

10.3.7 Historic and Forecasted Market Size by Form

10.3.7.1 Single View

10.3.7.2 Multi View

10.3.7.3 3D Imaging

10.3.8 Historic and Forecasted Market Size by End-use

10.3.8.1 Railway Stations

10.3.8.2 Border checkpoints

10.3.8.3 Airports

10.3.8.4 Public Sectors

10.3.8.5 Transit Stations

10.3.8.6 Critical Infrastructures

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Baggage Scanner Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Sorting System

10.4.4.1 X-ray Scanners

10.4.4.2 Vacuum System

10.4.4.3 Radiofrequency Identification

10.4.5 Historic and Forecasted Market Size by Scanner Type

10.4.5.1 Conventional X-ray Scanners

10.4.5.2 Computed Tomography (CT) Scanners

10.4.5.3 Millimeter Wave Scanners

10.4.5.4 Backscatter X-ray Scanners

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Metal Detection

10.4.6.2 Explosive Detection

10.4.6.3 Drug Detection

10.4.7 Historic and Forecasted Market Size by Form

10.4.7.1 Single View

10.4.7.2 Multi View

10.4.7.3 3D Imaging

10.4.8 Historic and Forecasted Market Size by End-use

10.4.8.1 Railway Stations

10.4.8.2 Border checkpoints

10.4.8.3 Airports

10.4.8.4 Public Sectors

10.4.8.5 Transit Stations

10.4.8.6 Critical Infrastructures

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Baggage Scanner Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Sorting System

10.5.4.1 X-ray Scanners

10.5.4.2 Vacuum System

10.5.4.3 Radiofrequency Identification

10.5.5 Historic and Forecasted Market Size by Scanner Type

10.5.5.1 Conventional X-ray Scanners

10.5.5.2 Computed Tomography (CT) Scanners

10.5.5.3 Millimeter Wave Scanners

10.5.5.4 Backscatter X-ray Scanners

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Metal Detection

10.5.6.2 Explosive Detection

10.5.6.3 Drug Detection

10.5.7 Historic and Forecasted Market Size by Form

10.5.7.1 Single View

10.5.7.2 Multi View

10.5.7.3 3D Imaging

10.5.8 Historic and Forecasted Market Size by End-use

10.5.8.1 Railway Stations

10.5.8.2 Border checkpoints

10.5.8.3 Airports

10.5.8.4 Public Sectors

10.5.8.5 Transit Stations

10.5.8.6 Critical Infrastructures

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Baggage Scanner Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Sorting System

10.6.4.1 X-ray Scanners

10.6.4.2 Vacuum System

10.6.4.3 Radiofrequency Identification

10.6.5 Historic and Forecasted Market Size by Scanner Type

10.6.5.1 Conventional X-ray Scanners

10.6.5.2 Computed Tomography (CT) Scanners

10.6.5.3 Millimeter Wave Scanners

10.6.5.4 Backscatter X-ray Scanners

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Metal Detection

10.6.6.2 Explosive Detection

10.6.6.3 Drug Detection

10.6.7 Historic and Forecasted Market Size by Form

10.6.7.1 Single View

10.6.7.2 Multi View

10.6.7.3 3D Imaging

10.6.8 Historic and Forecasted Market Size by End-use

10.6.8.1 Railway Stations

10.6.8.2 Border checkpoints

10.6.8.3 Airports

10.6.8.4 Public Sectors

10.6.8.5 Transit Stations

10.6.8.6 Critical Infrastructures

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Baggage Scanner Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Sorting System

10.7.4.1 X-ray Scanners

10.7.4.2 Vacuum System

10.7.4.3 Radiofrequency Identification

10.7.5 Historic and Forecasted Market Size by Scanner Type

10.7.5.1 Conventional X-ray Scanners

10.7.5.2 Computed Tomography (CT) Scanners

10.7.5.3 Millimeter Wave Scanners

10.7.5.4 Backscatter X-ray Scanners

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Metal Detection

10.7.6.2 Explosive Detection

10.7.6.3 Drug Detection

10.7.7 Historic and Forecasted Market Size by Form

10.7.7.1 Single View

10.7.7.2 Multi View

10.7.7.3 3D Imaging

10.7.8 Historic and Forecasted Market Size by End-use

10.7.8.1 Railway Stations

10.7.8.2 Border checkpoints

10.7.8.3 Airports

10.7.8.4 Public Sectors

10.7.8.5 Transit Stations

10.7.8.6 Critical Infrastructures

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Baggage Scanner Market research report?

A1: The forecast period in the Baggage Scanner Market research report is 2024-2032.

Q2: Who are the key players in the Baggage Scanner Market?

A2: Smiths Detection (United Kingdom), Rapiscan Systems (United States), L3Harris Technologies (United States), Leidos (United States), Nuctech Company Limited (China), Astrophysics Inc. (United States), Analogic Corporation (United States), Gilardoni S.p.A. (Italy), Autoclear LLC (United States), ADANI Systems Inc. (United States), Morpho Detection (United States), Vidisco Ltd. (Israel), VOTI Detection (Canada), Gilardoni S.p.A. (Italy), Optosecurity Inc. (Canada), Ketech Defence (Turkey), Teledyne Technologies Incorporated (United States), CEIA S.p.A. (Italy), Scan-X Security Ltd. (United Kingdom), VueMetrix Inc. (United States), ODSecurity (Netherlands), MinXray Inc. (United States), L3 Security & Detection Systems (United States), Gilardoni S.p.A. (Italy), Kromek Group PLC (United Kingdom), Gilardoni S.p.A. (Italy), SRI International (United States), Pacific Airport Group (Mexico), DetectaChem (United States), Gilardoni S.p.A. (Italy), Hikvision (India) Other Active Players.

Q3: What are the segments of the Baggage Scanner Market?

A3: The Baggage Scanner Market is segmented into Sorting System, Scanner Type, Application, Form, End-use, and Region. By Sorting System, the market is categorized into X-ray Scanners, Vacuum Systems, and Radiofrequency Identification. By Scanner Type, the market is categorized into Conventional X-ray Scanners, Computed Tomography (CT) Scanners, Millimeter Wave Scanners, and Backscatter X-ray Scanners. By Application, the market is categorized into Metal Detection, Explosive Detection, and Drug Detection. By Form, the market is categorized into single-view, Multi-View, and 3D Imaging. By End-use, The Market Is Categorized Into Railway Stations, Border checkpoints, Airports, Public Sectors, Transit Stations, And Critical Infrastructures. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Baggage Scanner Market?

A4: Baggage scanners are found at airports worldwide, customs, and government buildings such as courthouses and other security-critical buildings, so they are often readily available and require very little operator training. . Baggage scanners play a basic role in the protection of airports, customs, and other strategically important buildings and infrastructures.

Q5: How big is the Baggage Scanner Market?

A5: Baggage Scanner Market Size Was Valued at USD 2257.19 Million in 2023 and is Projected to Reach USD 4046.21 Million by 2032, Growing at a CAGR of 6.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!