Stay Ahead in Fast-Growing Economies.

Browse Reports NowBaby Warmer Device Market – Analysis, Size, Share & Forecast 2025–2032

Babies are protected in both open and enclosed spaces by baby warming devices, which keep them warm while offering basic to essential care services. Since their organs are still developing and prone to problems, these are primarily utilized for particular care of preterm babies.

IMR Group

Description

Baby Warmer Device Market Synopsis:

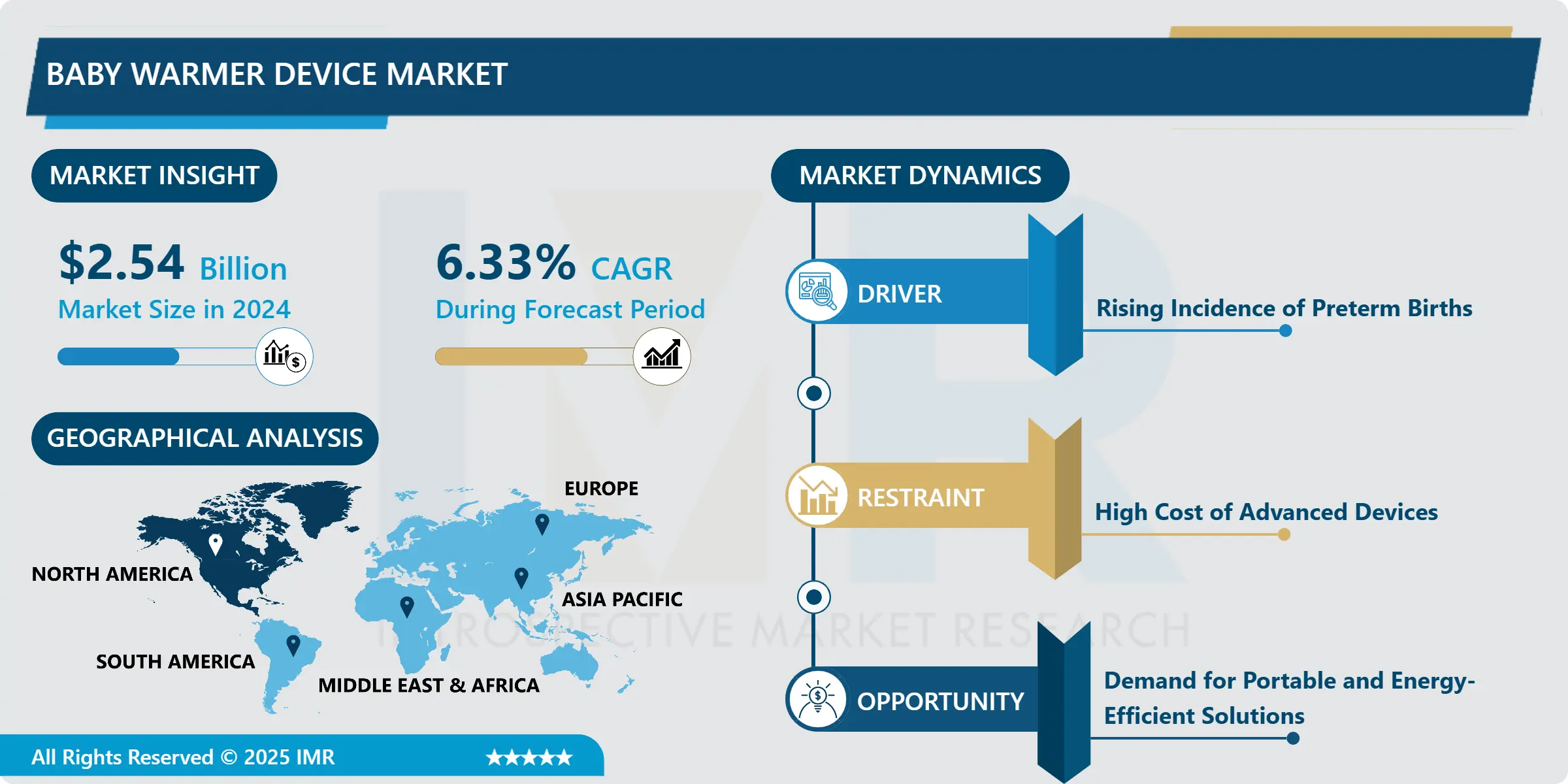

Baby Warmer Device Market Size Was Valued at USD 2.54 Billion in 2024, and is Projected to Reach USD 4.15 Billion by 2032, Growing at a CAGR of 6.33% from 2025-2032.

Babies are protected in both open and enclosed spaces by baby warming devices, which keep them warm while offering basic to essential care services. Since their organs are still developing and prone to problems, these are primarily utilized for particular care of preterm babies.

The global market for baby warming devices is expanding due to increasing rates of preterm births (According to World Bank Group in 2023 Fertility rate per women is 2.2), pregnancy-related complications, and the effectiveness of these devices in reducing neonatal mortality. The growing number of neonatal intensive care units (NICUs) and the rising demand for advanced medical equipment further support market growth.

However, high costs and limited awareness of pregnancy-related issues, especially in low-income regions, remain significant challenges. Despite these barriers, the market holds strong potential, driven by government initiatives to improve maternal and child health, particularly in developing countries. There is also rising interest in portable and energy-efficient warmers for use in remote areas.

Moreover, the trend toward smart healthcare solutions creates opportunities for innovation. Manufacturers are focusing on integrating features like real-time temperature monitoring, data tracking, and connectivity with hospital systems. These advancements not only improve infant care but also position smart baby warmers as a vital part of the modern neonatal healthcare ecosystem.

Baby Warmer Device Market Growth and Trend Analysis:

Rising Incidence of Preterm Births

Preterm birth remains a leading cause of neonatal mortality globally, as highlighted in numerous pediatric and neonatal health journals. Preterm infants often lack adequate fat stores and have immature thermoregulatory systems, making them highly susceptible to hypothermia.

Baby warmer devices play a crucial role in stabilizing these newborns by maintaining optimal body temperature, a vital factor in survival and recovery. The clinical need for thermal regulation, emphasized in WHO guidelines and neonatal care protocols, has led to a consistent demand for infant warmers, especially in hospitals and NICUs, thus driving steady growth in the baby warmer device market.

High Cost of Advanced Devices

Despite their life-saving potential, the high cost of infant warmer devices restricts their widespread adoption, especially in low- and middle-income countries. Medical journals and healthcare case studies often cite limited hospital budgets and resource constraints as key barriers. Sophisticated devices with features like servo-controlled heating, alarms, and integrated monitors can be prohibitively expensive.

Additional expenses related to staff training, device maintenance, and infrastructure readiness further compound the issue. As a result, some healthcare providers resort to substandard or improvised warming methods, reducing the quality and consistency of neonatal care and slowing the market’s expansion in economically challenged regions.

Baby Warmer Device Market Expansion Opportunity

Demand for Portable and Energy-Efficient Solutions

Global health initiatives and engineering innovation have spurred the development of portable, low-power baby warmers for use in rural or off-grid settings. Academic and non-profit publications highlight the need for compact, affordable devices that can operate on battery or solar power, especially for home births or neonatal transport.

These innovations extend care beyond urban hospitals, aligning with efforts to reduce neonatal mortality in underserved regions. As governments and NGOs invest in maternal and child health, the market sees significant opportunity in scalable, cost-effective technologies that meet the practical challenges of low-resource environments while delivering essential thermal support to newborns.

Baby Warmer Device Market Challenge Barrier

Lack of Trained Healthcare Personnel

A critical challenge in the baby warmer market is the shortage of adequately trained healthcare professionals, particularly in developing regions. Medical literature emphasizes that even when devices are available, improper use or poor maintenance due to training gaps can render them ineffective or even hazardous. Misuse can lead to overheating or underheating, both of which are dangerous for fragile neonates.

Additionally, power instability and insufficient biomedical support services exacerbate operational difficulties. Addressing this issue requires sustained investment in clinical education, training programs, and maintenance infrastructure to ensure that baby warmers are used safely and effectively across all healthcare settings.

Baby Warmer Device Market Segment Analysis:

Baby Warmer Device Market is segmented based on Product Type, Usage Type, Distribution Channel, End-User, and Region

By Product Type, Radiant warmers Segment is Expected to Dominate the Market During the Forecast Period

Radiant warmers are projected to dominate the baby warmer device market because they provide efficient and controlled heat directly to newborns, especially preterm and low-birth-weight infants who require constant thermal support. Unlike incubators, radiant warmers offer easy access to the baby during medical procedures, allowing healthcare providers to perform immediate interventions without disturbing the infant’s warmth.

Their versatility and effectiveness make them the preferred choice in neonatal intensive care units (NICUs) worldwide. Additionally, advancements in radiant warmer technology, such as integrated temperature monitoring and alarm systems, have further increased their adoption in hospitals, driving this segment’s market leadership.

By End-user, Hospitals Segment Held the Largest Share in 2024

Hospitals segment held the largest share of the baby warmer device market. This is because hospitals, especially those with well-equipped neonatal intensive care units (NICUs), are the primary users of baby warming devices to care for preterm and low-birth-weight infants.

The rising number of hospital births worldwide, increasing preterm birth rates, and growing investments in neonatal care infrastructure have all contributed to the dominance of this segment. Hospitals demand reliable and advanced warming solutions, driving significant market share compared to other end-users like home care or nursing homes.

Baby Warmer Device Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the baby warmer device market over the forecast period, driven by its advanced healthcare infrastructure, high awareness of neonatal care, and strong presence of leading medical device manufacturers. The United States, in particular, has a large number of well-equipped neonatal intensive care units (NICUs) that rely on technologically advanced infant warmers with features like temperature sensors, alarms, and integrated monitoring systems. Widespread insurance coverage and government-supported programs such as Medicaid and CHIP make these high-cost devices more accessible to hospitals and healthcare providers.

Continuous research and development efforts, along with strong collaborations between academic institutions and healthcare companies, support innovation in neonatal technology. This results in a steady demand for smart and efficient baby warmers.

Baby Warmer Device Market Active Players:

Alfamedic (Czechia)

Ardo Medical AG (Switzerland)

Atom Medical Corporation (Japan)

AVI Healthcare Pvt Ltd. (India)

Bluechip Medical (USA)

Datex Ohmeda Ltd (USA)

Drägerwerk AG & Co. KGaA (Germany)

Fisher & Paykel Healthcare (New-Zealand)

GE Healthcare (Germany)

General Electric Company (USA)

Ibis Medical Equipment & Systems Pvt Ltd. (India)

International Biomedical (USA)

Medtronic (USA)

Natus Medical Incorporated (USA)

Phoenix Medical Systems (P) Ltd (India)

Other Active Players

Key Industry Developments in the Baby Warmer Device Market:

In August 2024, Phoenix Medical Systems introduced the NWS 101 radiant warmer, emphasizing comfort and safety for newborns. The device featured adaptable design, reliable battery-backed display, integrated storage, and a space-saving structure. Its user-friendly controls and thoughtful engineering aimed to support healthcare professionals in delivering uninterrupted neonatal care.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Baby Warmer Device Market by Product Type (2018-2032)

4.1 Baby Warmer Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Convection Warmers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Radiant Warmers

4.5 Portable Warmers

4.6 Incubator

Chapter 5: Baby Warmer Device Market by Usage Type (2018-2032)

5.1 Baby Warmer Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Single Use

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multi-Use

Chapter 6: Baby Warmer Device Market by Distribution Channel (2018-2032)

6.1 Baby Warmer Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Sales

6.5 Third Party Distributors

Chapter 7: Baby Warmer Device Market by End-User (2018-2032)

7.1 Baby Warmer Device Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Home Care

7.5 Nursing Homes

7.6 Ambulatory Surgical Centers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Baby Warmer Device Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ALFAMEDIC (CZECHIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ARDO MEDICAL AG (SWITZERLAND)

8.4 ATOM MEDICAL CORPORATION (JAPAN)

8.5 AVI HEALTHCARE PVT LTD. (INDIA)

8.6 BLUECHIP MEDICAL (USA)

8.7 DATEX OHMEDA LTD (USA)

8.8 DRÄGERWERK AG & CO. KGAA (GERMANY)

8.9 FISHER & PAYKEL HEALTHCARE (NEW-ZEALAND)

8.10 GE HEALTHCARE (GERMANY)

8.11 GENERAL ELECTRIC COMPANY (USA)

8.12 IBIS MEDICAL EQUIPMENT & SYSTEMS PVT LTD. (INDIA)

8.13 INTERNATIONAL BIOMEDICAL (USA)

8.14 MEDTRONIC (USA)

8.15 NATUS MEDICAL INCORPORATED (USA)

8.16 PHOENIX MEDICAL SYSTEMS (P) LTD (INDIA)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Baby Warmer Device Market By Region

9.1 Overview

9.2. North America Baby Warmer Device Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Baby Warmer Device Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Baby Warmer Device Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Baby Warmer Device Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Baby Warmer Device Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Baby Warmer Device Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

Q1: What is the Forecast Period Covered in the Baby Warmer Device Market Research Report?

A1: The projected forecast period for the Baby Warmer Device Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Baby Warmer Device Market?

A2: Alfamedic (Czechia), Ardo Medical AG (Switzerland), Atom Medical Corporation (Japan), AVI Healthcare Pvt Ltd. (India), Bluechip Medical (USA), Datex Ohmeda Ltd (USA), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare (New-Zealand), GE Healthcare (Germany), General Electric Company (USA), Ibis Medical Equipment & Systems Pvt Ltd. (India), International Biomedical (USA), Medtronic (USA), Natus Medical Incorporated (USA), Phoenix Medical Systems (P) Ltd (India), and Other Active Players.

Q3: How is the Baby Warmer Device Market segmented?

A3: The Baby Warmer Device Market is segmented into Product Type, Usage Type, Distribution Channel, End-User, and Region. By Product Type, the market is categorized into Convection Warmers, Radiant Warmers, Portable Warmers, Incubator. By Usage Type, the market is categorized into Single Use, Multi-Use. By Distribution Channel, the market is categorized into Direct Sales, Online Sales, Third Party Distributors. By End-User, the market is categorized into Hospitals, Home Care, Nursing Homes, Ambulatory Surgical Centers. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, Rest of SA.).

Q4: What defines the Baby Warmer Device Market?

A4: Babies are protected in both open and enclosed spaces by baby warming devices, which keep them warm while offering basic to essential care services. Since their organs are still developing and prone to problems, these are primarily utilized for particular care of preterm babies. The global market for baby warming devices is expanding due to increasing rates of preterm births, pregnancy-related complications, and the effectiveness of these devices in reducing neonatal mortality. The growing number of neonatal intensive care units (NICUs) and the rising demand for advanced medical equipment further support market growth.

Q5: What is the market size of the Baby Warmer Device Market?

A5: Baby Warmer Device Market Size Was Valued at USD 2.54 Billion in 2024, and is Projected to Reach USD 4.15 Billion by 2032, Growing at a CAGR of 6.33% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!