Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Wiring Harness Market – Opportunities & Growth Forecast

The automotive wiring harness is a business of manufacturing and selling wires, connectors, and parts of automobiles that are expected to transmit power and signals between the different units of a vehicle.

IMR Group

Description

Automotive Wiring Harness Market Synopsis:

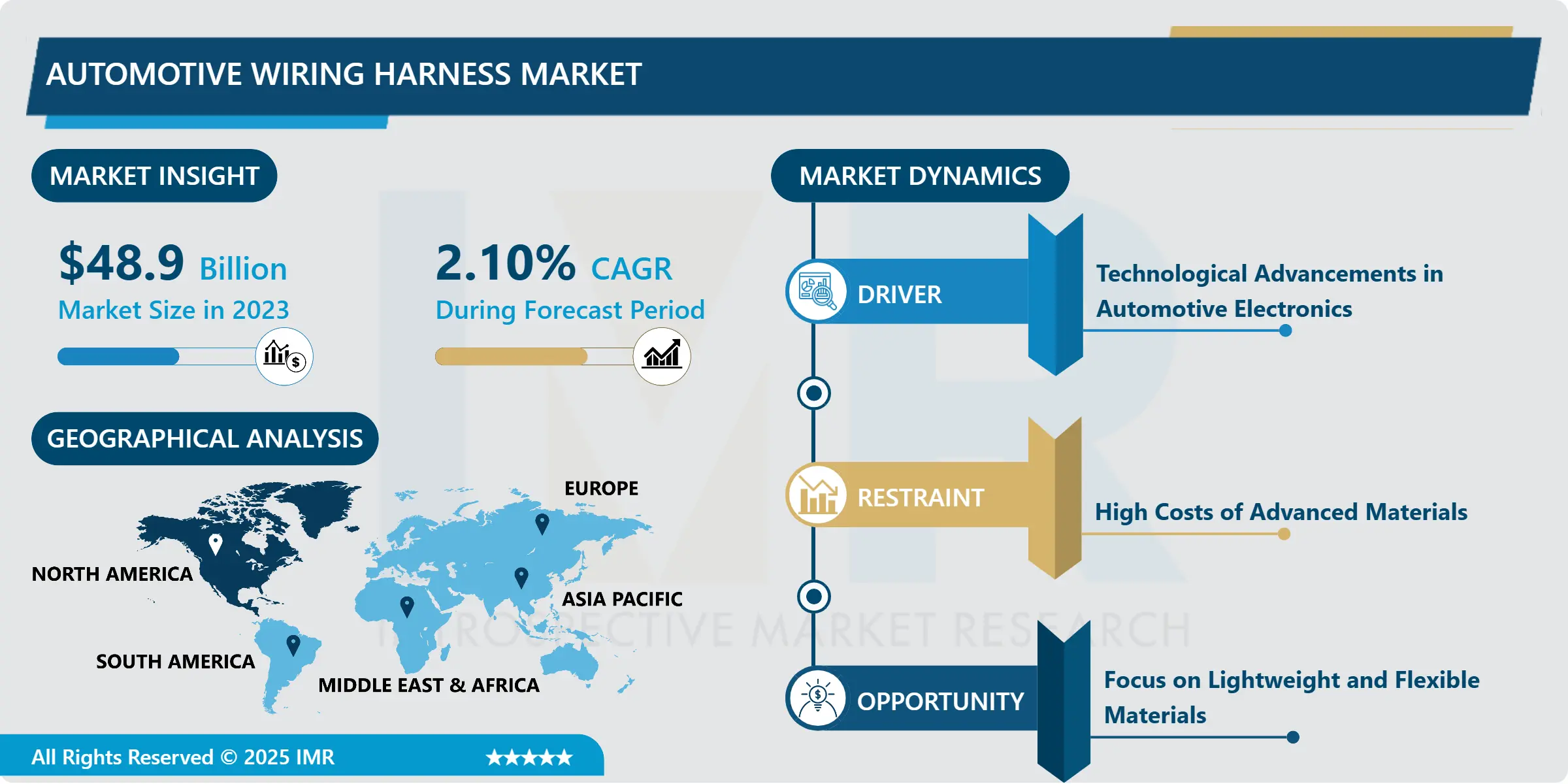

Automotive Wiring Harness Market Size Was Valued at USD 48.9 Billion in 2023, and is Projected to Reach USD 59.0 Billion by 2032, Growing at a CAGR of 2.10 % From 2024-2032.

The automotive wiring harness is a business of manufacturing and selling wires, connectors, and parts of automobiles that are expected to transmit power and signals between the different units of a vehicle. These harnesses are very vital as they provide proper connection between vehicles and their inner functioning such as power train, infotainment, illumination and safety systems.

The automotive wiring harness market plays an essential role for the automotive sector as it shapes the necessary physical topology for electrical/electronics systems in automobiles. These harnesses consist of several cables and connections all intended to transfer electrical power and signals between equipment. With new automotive systems enhancing the functionality of vehicles, wiring harnesses assume even the more crucial part in today’s automobiles. They facilitate connection between different electronics devices including sensors, control units, and actuator required for the proper operation of conventional as well as EVs.

The growth has been having boosts by electrification of vehicles, self driving technologies, and the call for infotainment and connectivity at high levels. Advanced equipment in automobiles today requires increased complexity in wiring harnesses with more concentration being laid on weight and efficiency and more enhanced safety measures. Out of these developing trends and styles, the rising usage of EVs, especially, is affecting market trends as such automobiles demand lots of cabling to support complex electric systems like batteries, electric vehicles, and charging apparatus.

With today’s growth these automobile industries towards electric, there is an increasing demand for the wiring system which is more competent, lightweight as well as durable. Thus, automotive wiring harness production is in for further growth because automotive original equipment manufacturers are in the continuous search for solutions enabling them to meet increased demand for electrically connected automobiles and car models. It said new technologies like the use of fiber optics and other advanced materials that are making their way into the production of automobiles are also driving the expansion, with players seeking to shaving of costs and enhancing of the capabilities of the vehicles.

Automotive Wiring Harness Market Trend Analysis

Increasing Demand for Electric Vehicles (EVs)

The rise of the electric vehicle market is one of the foremost emerging trends in the automotive wiring harness market. These intensified electric and electronic architectures of EVs also entail more intricate and heavier wirings harnesses to support electric power trains, battery and charging systems. Conventional vehicles’ propulsion systems are different from those of EVs since wiring domination of electrical systems is key to their unhampered operations and safety. This necessity for superior wiring harnesses is projected to rise further as car manufacturers progress on their electrification strategy in vehicles on offer.

Manufacturing wiring harness for EVs has also impacted the development of new ideas in the wiring harness market. Producers are to work on making cables more lightweight, that would be more efficient and reliable for an electric drive system. This trend has encouraged the development of new materials, including light weight composite and thermoplastic polymers to enable miniaturization of the wiring harnesses, overall, enhancing the energy efficiency of the wiring harnesses and in turn the Electric Vehicles. They will further develop as demand for EVs arises, presenting chances for companies to give additional focused and ecological wiring arrangements.

Focus on Lightweight and Flexible Materials

One of the emerging opportunities of the automotive wiring harness industry is the shifts in focus on light-weight and flexibility. With automotive manufacturers concentrating on ways to make vehicles more efficient and powerful, there is consequent call for lightweight parts which includes wiring harnesses. Low mass wiring harness also find usage in the over all mass reduction of the automobile which plays a pivotal role in effective fuel consumption and the consequent emission of carbon in to the atmosphere. This is particularly crucial in the case of electric cars because any ounce of weight taken out of these cars factored directly on the car’s ability to run on battery and the range that it will be able to cover.

To address this opportunity, the companies in the Global Automotive Wiring Harness Market are focusing on the R & D of new materials, including aluminum, carbon fiber, high strength and high quality polymer materials. Besides, they help to decrease weight, get increased flexibility, durability and resistance to severe environment, which have a great importance for constant high efficiency of cars. One emerging area of development for the manufacturers is the ability to offer materials with high performance, sustainability and low cost while keeping in mind the growing need for automotive innovation for green mobility technologies.

Automotive Wiring Harness Market Segment Analysis:

Automotive Wiring Harness Market is Segmented on the basis of Vehicle Type, Wire Type, Application, End User, and Region.

By Vehicle Type, Passenger Cars segment is expected to dominate the market during the forecast period

The market for automotive wiring harness can be categorized based on a vehicle type with focus on passenger cars, commercial vehicles and electric vehicles (EVs). Passenger cars are the largest segment owing to the growing automotive industry and advancements in hi-tech automotive technology in the traditional automobile Passenger cars are the largest segment, owing to the rising automotive market and the need for innovative automotive systems in standard automobiles. These vehicles have many electrical connectivity requirements for controls like infotainment systems and lighting, powertrain, and safety systems.

The commercial vehicle segment such as trucks, buses, and van is also improving steadily as industries related to e-commerce, logistics, etc., get developed. Commercial vehicles may need large wiring harness that include tall power trains, heating and facility regulating systems as well as many types of specialized equipment. Out of all these categories, the EV segment is nevertheless expected to expand at the highest rate thanks to mounting demand for electric mobility. As electric vehicles possess electric powertrains, battery systems and charging structures more sophisticated than conventional vehicles, the market for automotive wiring harness has a strong prospect for growth.

By Application, Powertrain segment expected to held the largest share

The automotive wiring harness market is also segmented by application: powertrain, body and chassis, HVAC, lighting, infotainment/connectivity, safety and security. The powertrain segment leads the wiring harness market since the wiring harnesses are required behind the scenes to interconnect the enine, transmission and other drive related parts. With theOX automotive powertrains evolving increasingly to meet the requirements of hybrid and electrical systems, the complexity of their wiring harness requirement is also escalating in this segment.

Many other applications that include body and chassis, lighting, and HVAC serve important functions in the proper working of specific vehicle systems. The small wiring harnesses are needed for lighting and climate systems and electronics for stability, to improve the safety and comfort of the car. At the same time, elements such as infotainment and connectivity, and safety and security are becoming more integrated, requiring higher levels of wiring complexity. These applications especially in the field of connected and autonomous vehicles are forecasted to experience future growth tremendously.

Automotive Wiring Harness Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The automotive wiring harness market is dominated by North America due to the increased number of manufacturing companies of automobiles and suppliers across the region. The USA specifically is a key player in manufacturer of both the traditional and electric vehicles with more emphasis on the latter. The demand for Sophisticated wiring harnesses in North America is attributed to the incorporation of sophisticated technology solutions such as auto pilot or auto driving technology, electrification of power train technology, infotainment system, etc., in automobiles produced in the region.

In addition, the increasing spending in the infrastructure needed for EVs, including charging stations and battery manufacturing plants, are also adding further requirements for custom offerings. With these factors in mind, growth in automaker development and implementation of new system technologies and applications, including high-performance wiring harnesses, prove promising within the North American region for steady future market growth. The legal standards that govern the markets in the region are also favorable for the market’s expansion, requiring manufacturers to create new and advanced wiring systems that are light and efficient, not to mention friendly on the environment and fuel efficient as well.

Active Key Players in the Automotive Wiring Harness Market:

Aptiv PLC (Ireland)

Delphi Technologies (United Kingdom)

Furukawa Electric Co. Ltd. (Japan)

Hitachi Automotive Systems (Japan)

Kongsberg Automotive (Norway)

Lear Corporation (United States)

Leoni AG (Germany)

Motherson Sumi Systems Ltd. (India)

Sichuan Hitech Group (China)

Sumitomo Electric Industries, Ltd. (Japan)

TE Connectivity (Switzerland)

Yazaki Corporation (Japan)

Other Active Players

Key Industry Developments in the Automotive Wiring Harness Market:

In April 2024, AVR Global Technologies, Inc., a manufacturer of wire harnesses, custom molded cables, and electronics assemblies, announced its merger with Conner Industrial, a Surface Mount Technology (SMT) PCB and cable manufacturer. The companies would be named AVR Conner Industrial Ltda. The combined proficiency of these companies in SMT, electronics box assembly, and custom wire harness OEM/CM/ODM manufacturing is likely to help manufacturers improve their product efficiency

In May 2023, Sumitomo Electric Industries, Ltd. accelerated the development of an automotive optical harness, with commercial samples slated for release in 2026. Leveraging its extensive experience in wire harness technology and optical communication, the company has been looking forward to facilitating the evolution of Connected, Autonomous, Shared & Services, and Electric (CASE) technologies by enabling high-speed, large-capacity communication

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Wiring Harness Market by Vehicle Type

4.1 Automotive Wiring Harness Market Snapshot and Growth Engine

4.2 Automotive Wiring Harness Market Overview

4.3 Passenger Cars

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Passenger Cars: Geographic Segmentation Analysis

4.4 Commercial Vehicles

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Commercial Vehicles: Geographic Segmentation Analysis

4.5 Electric Vehicles (EVs)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Electric Vehicles (EVs): Geographic Segmentation Analysis

Chapter 5: Automotive Wiring Harness Market by Application

5.1 Automotive Wiring Harness Market Snapshot and Growth Engine

5.2 Automotive Wiring Harness Market Overview

5.3 Powertrain

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powertrain: Geographic Segmentation Analysis

5.4 Body and Chassis

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Body and Chassis: Geographic Segmentation Analysis

5.5 HVAC (Heating

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 HVAC (Heating: Geographic Segmentation Analysis

5.6 Ventilation

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Ventilation: Geographic Segmentation Analysis

5.7 and Air Conditioning

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 and Air Conditioning: Geographic Segmentation Analysis

5.8 Lighting

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Lighting: Geographic Segmentation Analysis

5.9 Infotainment and Connectivity

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Infotainment and Connectivity: Geographic Segmentation Analysis

5.10 Safety and Security

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Safety and Security: Geographic Segmentation Analysis

Chapter 6: Automotive Wiring Harness Market by Wire Type

6.1 Automotive Wiring Harness Market Snapshot and Growth Engine

6.2 Automotive Wiring Harness Market Overview

6.3 Copper Wiring Harness

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Copper Wiring Harness: Geographic Segmentation Analysis

6.4 Aluminum Wiring Harness

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aluminum Wiring Harness: Geographic Segmentation Analysis

Chapter 7: Automotive Wiring Harness Market by End User

7.1 Automotive Wiring Harness Market Snapshot and Growth Engine

7.2 Automotive Wiring Harness Market Overview

7.3 OEMs (Original Equipment Manufacturers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 OEMs (Original Equipment Manufacturers: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Wiring Harness Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DELPHI TECHNOLOGIES – (UNITED KINGDOM)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 LEONI AG – (GERMANY)

8.4 YAZAKI CORPORATION – (JAPAN)

8.5 SUMITOMO ELECTRIC INDUSTRIES

8.6 LTD. – (JAPAN)

8.7 APTIV PLC – (IRELAND)

8.8 FURUKAWA ELECTRIC CO. LTD. – (JAPAN)

8.9 KONGSBERG AUTOMOTIVE – (NORWAY)

8.10 HITACHI AUTOMOTIVE SYSTEMS – (JAPAN)

8.11 TE CONNECTIVITY – (SWITZERLAND)

8.12 MOTHERSON SUMI SYSTEMS LTD. – (INDIA)

8.13 LEAR CORPORATION – (UNITED STATES)

8.14 SICHUAN HITECH GROUP – (CHINA)

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Automotive Wiring Harness Market By Region

9.1 Overview

9.2. North America Automotive Wiring Harness Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Vehicle Type

9.2.4.1 Passenger Cars

9.2.4.2 Commercial Vehicles

9.2.4.3 Electric Vehicles (EVs)

9.2.5 Historic and Forecasted Market Size By Application

9.2.5.1 Powertrain

9.2.5.2 Body and Chassis

9.2.5.3 HVAC (Heating

9.2.5.4 Ventilation

9.2.5.5 and Air Conditioning

9.2.5.6 Lighting

9.2.5.7 Infotainment and Connectivity

9.2.5.8 Safety and Security

9.2.6 Historic and Forecasted Market Size By Wire Type

9.2.6.1 Copper Wiring Harness

9.2.6.2 Aluminum Wiring Harness

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 OEMs (Original Equipment Manufacturers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Wiring Harness Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Vehicle Type

9.3.4.1 Passenger Cars

9.3.4.2 Commercial Vehicles

9.3.4.3 Electric Vehicles (EVs)

9.3.5 Historic and Forecasted Market Size By Application

9.3.5.1 Powertrain

9.3.5.2 Body and Chassis

9.3.5.3 HVAC (Heating

9.3.5.4 Ventilation

9.3.5.5 and Air Conditioning

9.3.5.6 Lighting

9.3.5.7 Infotainment and Connectivity

9.3.5.8 Safety and Security

9.3.6 Historic and Forecasted Market Size By Wire Type

9.3.6.1 Copper Wiring Harness

9.3.6.2 Aluminum Wiring Harness

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 OEMs (Original Equipment Manufacturers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Wiring Harness Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Vehicle Type

9.4.4.1 Passenger Cars

9.4.4.2 Commercial Vehicles

9.4.4.3 Electric Vehicles (EVs)

9.4.5 Historic and Forecasted Market Size By Application

9.4.5.1 Powertrain

9.4.5.2 Body and Chassis

9.4.5.3 HVAC (Heating

9.4.5.4 Ventilation

9.4.5.5 and Air Conditioning

9.4.5.6 Lighting

9.4.5.7 Infotainment and Connectivity

9.4.5.8 Safety and Security

9.4.6 Historic and Forecasted Market Size By Wire Type

9.4.6.1 Copper Wiring Harness

9.4.6.2 Aluminum Wiring Harness

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 OEMs (Original Equipment Manufacturers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Wiring Harness Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Vehicle Type

9.5.4.1 Passenger Cars

9.5.4.2 Commercial Vehicles

9.5.4.3 Electric Vehicles (EVs)

9.5.5 Historic and Forecasted Market Size By Application

9.5.5.1 Powertrain

9.5.5.2 Body and Chassis

9.5.5.3 HVAC (Heating

9.5.5.4 Ventilation

9.5.5.5 and Air Conditioning

9.5.5.6 Lighting

9.5.5.7 Infotainment and Connectivity

9.5.5.8 Safety and Security

9.5.6 Historic and Forecasted Market Size By Wire Type

9.5.6.1 Copper Wiring Harness

9.5.6.2 Aluminum Wiring Harness

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 OEMs (Original Equipment Manufacturers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Wiring Harness Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Vehicle Type

9.6.4.1 Passenger Cars

9.6.4.2 Commercial Vehicles

9.6.4.3 Electric Vehicles (EVs)

9.6.5 Historic and Forecasted Market Size By Application

9.6.5.1 Powertrain

9.6.5.2 Body and Chassis

9.6.5.3 HVAC (Heating

9.6.5.4 Ventilation

9.6.5.5 and Air Conditioning

9.6.5.6 Lighting

9.6.5.7 Infotainment and Connectivity

9.6.5.8 Safety and Security

9.6.6 Historic and Forecasted Market Size By Wire Type

9.6.6.1 Copper Wiring Harness

9.6.6.2 Aluminum Wiring Harness

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 OEMs (Original Equipment Manufacturers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Wiring Harness Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Vehicle Type

9.7.4.1 Passenger Cars

9.7.4.2 Commercial Vehicles

9.7.4.3 Electric Vehicles (EVs)

9.7.5 Historic and Forecasted Market Size By Application

9.7.5.1 Powertrain

9.7.5.2 Body and Chassis

9.7.5.3 HVAC (Heating

9.7.5.4 Ventilation

9.7.5.5 and Air Conditioning

9.7.5.6 Lighting

9.7.5.7 Infotainment and Connectivity

9.7.5.8 Safety and Security

9.7.6 Historic and Forecasted Market Size By Wire Type

9.7.6.1 Copper Wiring Harness

9.7.6.2 Aluminum Wiring Harness

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 OEMs (Original Equipment Manufacturers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Automotive Wiring Harness Market research report?

A1: The forecast period in the Automotive Wiring Harness Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Wiring Harness Market?

A2: Delphi Technologies (United Kingdom), Leoni AG (Germany), Yazaki Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), Aptiv PLC (Ireland), Furukawa Electric Co. Ltd. (Japan), Kongsberg Automotive (Norway), Hitachi Automotive Systems (Japan), TE Connectivity (Switzerland), Motherson Sumi Systems Ltd. (India), Lear Corporation (United States), Sichuan Hitech Group (China), and Other Active Players.

Q3: What are the segments of the Automotive Wiring Harness Market?

A3: The Automotive Wiring Harness Market is segmented into Vehicle Type, Application, Wire Type, End User and region. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs). By Application, the market is categorized into Powertrain, Body and Chassis, HVAC (Heating, Ventilation, and Air Conditioning), Lighting, Infotainment and Connectivity, Safety and Security. By Wire Type, the market is categorized into Copper Wiring Harness, Aluminum Wiring Harness. By End User, the market is categorized into OEMs (Original Equipment Manufacturers), Aftermarket. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Wiring Harness Market?

A4: The automotive wiring harness is a business of manufacturing and selling wires, connectors, and parts of automobiles that are expected to transmit power and signals between the different units of a vehicle. These harnesses are very vital as they provide proper connection between vehicles and their inner functioning such as power train, infotainment, illumination and safety systems.

Q5: How big is the Automotive Wiring Harness Market?

A5: Automotive Wiring Harness Market Size Was Valued at USD 48.9 Billion in 2023, and is Projected to Reach USD 59.0 Billion by 2032, Growing at a CAGR of 2.10% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!