Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Refinish Market – Outlook & Future Trends

For automotive refinish, auto body shops and repair establishments use polyurethane, acrylic or alkyd coatings. These coatings is used on both the new and the second-hand passengers and commercial cars for shielding the body from damages occasioned by extreme temperatures, accidents and stone chipping. Refinish coatings are primer, filler, topcoat, basecoat, activator or hardener coatings which are widely utilized in cars’ refinerary

IMR Group

Description

Automotive Refinish Market Synopsis:

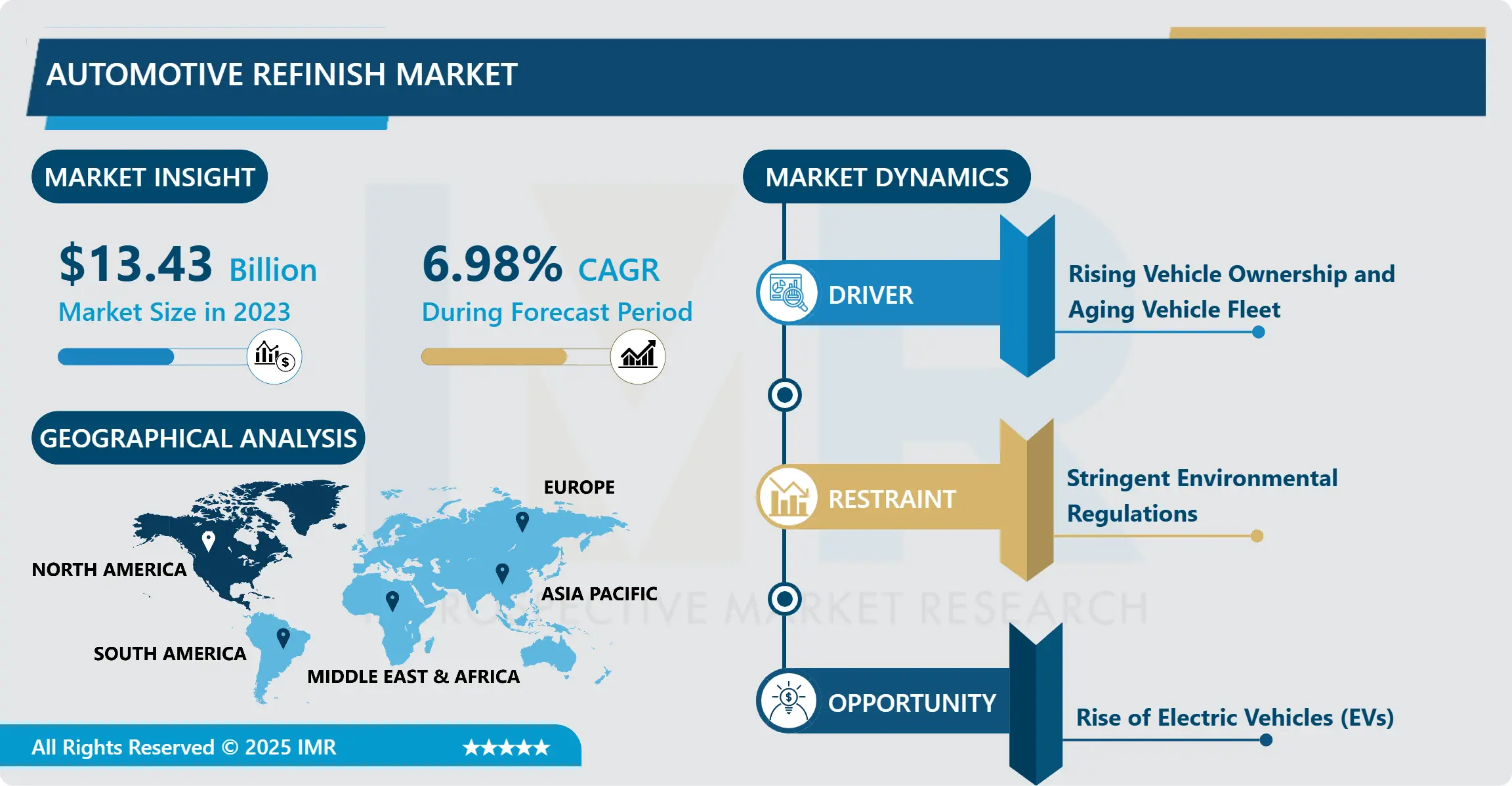

Automotive Refinish Market Was Valued at USD 13.43 Billion in 2023 and is Projected to Reach USD 24.65 Billion by 2032, Growing at a CAGR of 6.98 % from 2024 to 2032.

For automotive refinish, auto body shops and repair establishments use polyurethane, acrylic or alkyd coatings. These coatings is used on both the new and the second-hand passengers and commercial cars for shielding the body from damages occasioned by extreme temperatures, accidents and stone chipping. Refinish coatings are primer, filler, topcoat, basecoat, activator or hardener coatings which are widely utilized in cars’ refinerary.

The automotive refinish market is growing at a fast pace the global level due to factors such as increased car ownership, enhanced consumer prosperity, and changes in consumer preferences with regard to car appearances and maintenance. The main target here is the demand of markets for refinish coatings and paints that are used in the repairing or the changing of the looks of autos. Emerging technologies like use of environment friendly water borne coatings and UV cured finishes are also fueling the market. These innovations discharge regulation related to the volatile organic compound VOC emissions while improving the existence and curing periods. Also, the growing incidence of minor damages and recurrent necessity of car refurbishing generates the constant market demand for automotive refinish goods in the developed and developing countries.

Another feature of this market is the great variety of consumers, who include collision repair centers, automotive workshops and individuals with their vehicles. The Asia-Pacific region remains the largest market, mainly sired by the rising urban prevalence, a growing automobile industry, and improved consumer expenditure on automobile maintenance. Other regions where TE is also focus include Europe and North America because of established automotive industries and legal requirements on environmental standards hence promoting the use of sustainable TE refinishing techniques.’ On the other hand, the American and European markets are experiencing decline in usage because of the growing popularity of caves, while markets in Latin America and Middle East are gradually adopting the product as more vehicles are being produced and tune painting becomes more popular. In due course, we can conclude that the automotive refinish market is set for long-term growth, spurred by progressing enhancements of the formulating of auto refinish products; growth of the pools of motor vehicles both globally and regionally; as well as trend shifts.

Automotive Refinish Market Trend Analysis:

Eco-Friendly Innovations and Rising Vehicle Ownership Driving the Automotive Refinish Market

Automotive refinish market existing and prospective market conditions and trends are progressing largely due to the rising world car population with special emphasis in the developing countries. The demand has grown for maintenance and repair services regarding vehicles available leading to healthy market adoption of refinish products. Besides, with increase in disposable income levels among consumers in these regions,; consumers have been in a position to spend more on exterior appearance of their vehicles, thereby increasing the demand for refinishing services. Customers are becoming more demanding about the kind of finishes and accessories they want in their automobiles thus putting pressure on manufactures.

The third important factor is the use of hi-tech materials including waterborne and UV-curable refinishes as a reaction to today’s environment-oriented approach. These innovations assist manufactures to operate under the enhanced environmental standards especially in the Europe and North American market where low-VOC products are becoming standard. The transition to sustainable practices cuts costs in terms of the negative effects on the environment all while placing companies which implement these technologies at the forefront of a more progressive and forward looking market.

Growing Demand for Refinishing Solutions and Customization Trends in the Automotive Sector

Caps and hoods, Bumpers and wheel flares, fenders, and bumpers for cars have been victims of the increasing road accidents and the normal wear out on the roads resulting to a continuous and healthy growth rate for the automotive refinishing solutions market. Consumers are demanding professional repair and paint works so as to regain the cosmetic and utilitarian qualities of their vehicles hence increasing the demand for refinishing commodities including primers, base coates and clear coates. This trend is however compounded by increasing number of units on the road with old car models that may need periodic refinishing hence a steady stream of business for refinish product manufacturers and service providers.

At the same time, growing popularity of car styling and proprietor’s focus on appearance of their cars has dubbed automobile paint industry as a promising niche of premium segment. His metallic, matte, and custom-finish paints are fast becoming popular as people seek to individualize their vehicles and make them more attractive. This is more evident among the younger population and within the high-income earners hence putting pressure on the manufactures to come up with new products varieties. Moreover, the increasing popularity of electric vehicles direction creates new opportunities, because EV producers give importance to the body coatings and pick more eye-catching designs as well as environmentally friendly coatings, relevant to environmentally friendly steps and directives for greener vehicles

Automotive Refinish Market Segment Analysis:

Automotive Refinish Market Segmented on the basis of Material Type, Product Type, Technology, Vehicle Type, End Use, and Region.

By Material Type, Polyurethanes segment is expected to dominate the market during the forecast period

Polyurethane coatings are especially popular in the automotive industry because of their great financial sustainability and protective features. These coatings are admired for their abrasion, chemical, and UV light resistance resulting in their functionality as protective layer to unfavorable exterior conditions of vehicles. Its ability to retain gloss and colour stability to protect automotive finishes looking smart and attractive in ways that can be extremely demanding. Therefore, polyurethane coatings are predominantly applied in external and internal environments due to their efficiency in acting as a shield to the components from severities of the surface, chips, and common use.

Also, the polyurethane produces a smooth and hard surface which gives the vehicle a stylish look and at the same time has a lasting impact on the vehicle. This material is favoured for its endurance to the vagaries of the environment such as oxidation, fading and corrosion, which are important in durability of automotive finishes. Application of polyurethane coated products is not limited to automotive body parts such as panels, bumpers and trims where the durability of the product and its ability to retain its aesthetic appeal and retain the appearance and value of the car is important.

By End Use, OEM segment expected to held the largest share

In the automotive coatings market, the OEM (Original Equipment Manufacturer) class of coatings are those that are applied directly by a car manufacturing company. These coatings are all developed to work within the needs and sometimes the strict requirements of the automotive manufacturers, to guarantee that the quality and standard of every car manufactured is consistent. End-user coatings are very important so that, not only the vehicles are aesthetically appealing but also performs well as to its durability, resistance to the external conditions, and the longevity. These coatings are generally much higher than after market ones because they have to meet OEM requirements and chemical and UV resistance, fluctuating temperatures etc.

In addition, OEM coatings are very important in enhancing the mechanical properties of automobiles in as much as the cars are in use. These compounds are designed to uphold fluctuating conditions from day-to-day usage including exposure to road salts, pollutant and wearing down from the environmental factors. Due to their reliability and high quality of performance OEM coatings offer durable barrier and helps the new constructed vehicles to maintain their optimum condition throughout their life cycle. These types of coatings also assist automotive manufacturers in fulfilling and passing regulatory legal requirements on environmental preservation, making them as well a vital component of the current car industry.

Automotive Refinish Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North American automotive refinish consumption is expected to be primarily influenced by the increasing car population and especially in the United States. A radically large car fleet; A significant and well-developed aftermarket repair segment; Constant demand for automotive refinishing products. Since owners of any car seek to retain or enhance the aesthetic value of the car through painting, there is always an increasing need for refinishing solutions. Besides that, growing number of road accidents and rising popularity of car personalization create a favorable environment for the market and boost demand for enhanced, long-lasting coatings. Certainly, the huge automotive repair and maintenance industry is a major factor contributing to the markets development in the region with refinishing services as an important aspect of vehicles durability and appearance.

Several factors are currently driving the market with the adoption of environment-conscious, environmentally sustainable refinish solutions being one of the main drivers. Environmental issues have increased the demand for eco-friendly and readily washable coatings including low VOC and waterborne coatings. For instance while emission and environmental regulations have been increasingly tightened markets for refinish product are shifting their attention to environmentally friendly products. Furthermore, these high-tech solutions in the sector like better color matching systems, better and improved durability aspects, quick-drying products enhance the attractiveness of automotive refinishing solutions. These innovations not only enhance the value and efficiency of refinish process, but also respond to the shift towards the eco-friendly production, boosting the development of the market in North America for automotive refinish.

Active Key Players in the Automotive Refinish Market:

3M (US)

AkzoNobel N.V. (Netherlands)

Allnex Group (Germany)

Alps Coating Sdn. Bhd. (Malaysia)

Axalta Coating Systems, Ltd. (US)

BASF SE (Germany)

Bernardo Ecenarro S.A. (Spain)

Covestro AG (Germany)

Cresta Paint Industries Ltd. (Africa)

Dow (US)

HMG Paints Ltd (UK)

James Briggs Limited (UK)

Kansai Paint Co., Ltd. (Japan)

KAPCI Coatings (India)

KCC Corporation (South Korea)

Koninklijke DSM N.V. (Netherlands)

Nippon Paint Holdings Co., Ltd. (Japan)

NOROO Paint & Coatings Co., Ltd. (South Korea)

NOVOL Sp. Z o.o. (Polan)

PPG Industries, Inc. (US)

Reichhold LLC (US)

Samhwa Paints Industrial Co. Ltd (South Korea)

SEM Products, Inc. (US)

Sheboygan Paint Co (US)

The Lubrizol Corporation (US)

The Sherwin-Williams Company (US)

TOA Performance Coating Corporation CO., Ltd. (Thailand)

U.S. Paint (US)

WEG SA (Brazil)

Yashm Paint & Resin Industries (Iran)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Refinish Market by Material Type

4.1 Automotive Refinish Market Snapshot and Growth Engine

4.2 Automotive Refinish Market Overview

4.3 Polyurethanes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Polyurethanes: Geographic Segmentation Analysis

4.4 Acrylics and Alkyd

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Acrylics and Alkyd: Geographic Segmentation Analysis

Chapter 5: Automotive Refinish Market by Product Type

5.1 Automotive Refinish Market Snapshot and Growth Engine

5.2 Automotive Refinish Market Overview

5.3 Primer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Primer: Geographic Segmentation Analysis

5.4 Base Coat

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Base Coat: Geographic Segmentation Analysis

5.5 Top Coat and Clear Coat

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Top Coat and Clear Coat: Geographic Segmentation Analysis

Chapter 6: Automotive Refinish Market by Technology

6.1 Automotive Refinish Market Snapshot and Growth Engine

6.2 Automotive Refinish Market Overview

6.3 Solvent Borne

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Solvent Borne: Geographic Segmentation Analysis

6.4 Water Borne and UV Cure

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Water Borne and UV Cure: Geographic Segmentation Analysis

Chapter 7: Automotive Refinish Market by Vehicle Type

7.1 Automotive Refinish Market Snapshot and Growth Engine

7.2 Automotive Refinish Market Overview

7.3 Passenger Cars and Commercial Vehicles

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Cars and Commercial Vehicles: Geographic Segmentation Analysis

Chapter 8: Automotive Refinish Market by End Use

8.1 Automotive Refinish Market Snapshot and Growth Engine

8.2 Automotive Refinish Market Overview

8.3 OEM and After

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEM and After: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Refinish Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AXALTA COATING SYSTEMS

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 LTD. (US)

9.4 3M (US)

9.5 AKZONOBEL N.V. (NETHERLANDS)

9.6 PPG INDUSTRIES INC. (US)

9.7 THE SHERWIN-WILLIAMS COMPANY (US)

9.8 DOW (US)

9.9 NIPPON PAINT HOLDINGS CO. LTD. (JAPAN)

9.10 KANSAI PAINT CO. LTD. (JAPAN)

9.11 COVESTRO AG (GERMANY)

9.12 KAPCI COATINGS (INDIA)

9.13 NOVOL SP. Z O.O. (POLAND)

9.14 KCC CORPORATION (SOUTH KOREA)

9.15 BERNARDO ECENARRO S.A. (SPAIN)

9.16 SEM PRODUCTS INC. (US)

9.17 SHEBOYGAN PAINT CO (US)

9.18 CRESTA PAINT INDUSTRIES LTD. (AFRICA)

9.19 ALPS COATING SDN. BHD. (MALAYSIA)

9.20 NOROO PAINT & COATINGS CO. LTD. (SOUTH KOREA)

9.21 KONINKLIJKE DSM N.V. (NETHERLANDS)

9.22 WEG SA (BRAZIL)

9.23 THE LUBRIZOL CORPORATION (US)

9.24 HMG PAINTS LTD (UK)

9.25 JAMES BRIGGS LIMITED (UK)

9.26 REICHHOLD LLC (US)

9.27 TOA PERFORMANCE COATING CORPORATION CO. LTD. (THAILAND)

9.28 YASHM PAINT & RESIN INDUSTRIES (IRAN)

9.29 ALLNEX GROUP (GERMANY)

9.30 SAMHWA PAINTS INDUSTRIAL CO. LTD (SOUTH KOREA)

9.31 U.S. PAINT (US)

9.32 BASF SE (GERMANY)

9.33 AMONG OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Refinish Market By Region

10.1 Overview

10.2. North America Automotive Refinish Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Material Type

10.2.4.1 Polyurethanes

10.2.4.2 Acrylics and Alkyd

10.2.5 Historic and Forecasted Market Size By Product Type

10.2.5.1 Primer

10.2.5.2 Base Coat

10.2.5.3 Top Coat and Clear Coat

10.2.6 Historic and Forecasted Market Size By Technology

10.2.6.1 Solvent Borne

10.2.6.2 Water Borne and UV Cure

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Cars and Commercial Vehicles

10.2.8 Historic and Forecasted Market Size By End Use

10.2.8.1 OEM and After

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Refinish Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Material Type

10.3.4.1 Polyurethanes

10.3.4.2 Acrylics and Alkyd

10.3.5 Historic and Forecasted Market Size By Product Type

10.3.5.1 Primer

10.3.5.2 Base Coat

10.3.5.3 Top Coat and Clear Coat

10.3.6 Historic and Forecasted Market Size By Technology

10.3.6.1 Solvent Borne

10.3.6.2 Water Borne and UV Cure

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Cars and Commercial Vehicles

10.3.8 Historic and Forecasted Market Size By End Use

10.3.8.1 OEM and After

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Refinish Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Material Type

10.4.4.1 Polyurethanes

10.4.4.2 Acrylics and Alkyd

10.4.5 Historic and Forecasted Market Size By Product Type

10.4.5.1 Primer

10.4.5.2 Base Coat

10.4.5.3 Top Coat and Clear Coat

10.4.6 Historic and Forecasted Market Size By Technology

10.4.6.1 Solvent Borne

10.4.6.2 Water Borne and UV Cure

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Cars and Commercial Vehicles

10.4.8 Historic and Forecasted Market Size By End Use

10.4.8.1 OEM and After

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Refinish Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Material Type

10.5.4.1 Polyurethanes

10.5.4.2 Acrylics and Alkyd

10.5.5 Historic and Forecasted Market Size By Product Type

10.5.5.1 Primer

10.5.5.2 Base Coat

10.5.5.3 Top Coat and Clear Coat

10.5.6 Historic and Forecasted Market Size By Technology

10.5.6.1 Solvent Borne

10.5.6.2 Water Borne and UV Cure

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Cars and Commercial Vehicles

10.5.8 Historic and Forecasted Market Size By End Use

10.5.8.1 OEM and After

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Refinish Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Material Type

10.6.4.1 Polyurethanes

10.6.4.2 Acrylics and Alkyd

10.6.5 Historic and Forecasted Market Size By Product Type

10.6.5.1 Primer

10.6.5.2 Base Coat

10.6.5.3 Top Coat and Clear Coat

10.6.6 Historic and Forecasted Market Size By Technology

10.6.6.1 Solvent Borne

10.6.6.2 Water Borne and UV Cure

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Cars and Commercial Vehicles

10.6.8 Historic and Forecasted Market Size By End Use

10.6.8.1 OEM and After

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Refinish Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Material Type

10.7.4.1 Polyurethanes

10.7.4.2 Acrylics and Alkyd

10.7.5 Historic and Forecasted Market Size By Product Type

10.7.5.1 Primer

10.7.5.2 Base Coat

10.7.5.3 Top Coat and Clear Coat

10.7.6 Historic and Forecasted Market Size By Technology

10.7.6.1 Solvent Borne

10.7.6.2 Water Borne and UV Cure

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Cars and Commercial Vehicles

10.7.8 Historic and Forecasted Market Size By End Use

10.7.8.1 OEM and After

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Automotive Refinish Market research report?

A1: The forecast period in the Automotive Refinish Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Refinish Market?

A2: 3M (US), AkzoNobel N.V. (Netherlands), Allnex Group (Germany), Alps Coating Sdn. Bhd. (Malaysia), Axalta Coating Systems, Ltd. (US), BASF SE (Germany), Bernardo Ecenarro S.A. (Spain), Covestro AG (Germany), Cresta Paint Industries Ltd. (Africa), Dow (US), HMG Paints Ltd (UK), James Briggs Limited (UK), Kansai Paint Co., Ltd. (Japan), KAPCI Coatings (India), KCC Corporation (South Korea), Koninklijke DSM N.V. (Netherlands), Nippon Paint Holdings Co., Ltd. (Japan), NOROO Paint & Coatings Co., Ltd. (South Korea), NOVOL Sp. Z o.o. (Poland), PPG Industries, Inc. (US), Reichhold LLC (US), Samhwa Paints Industrial Co. Ltd (South Korea), SEM Products, Inc. (US), Sheboygan Paint Co (US), The Lubrizol Corporation (US), The Sherwin-Williams Company (US), TOA Performance Coating Corporation CO., Ltd. (Thailand), U.S. Paint (US), WEG SA (Brazil), Yashm Paint & Resin Industries (Iran), and Other Active Players.

Q3: What are the segments of the Automotive Refinish Market?

A3: The Automotive Refinish Market is segmented into By Material Type, By Product Type, By Technology, By Vehicle Type, By End Use and region. By Material Type, the market is categorized into Polyurethanes, Acrylics and Alkyd. By Product Type, the market is categorized into Primer, Base Coat, Top Coat and Clear Coat. By Technology, the market is categorized into Solvent Borne, Water Borne and UV Cure. By Vehicle Type, the market is categorized into Passenger Cars and Commercial Vehicles. By End Use, the market is categorized into OEM and Aftermarket. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Refinish Market?

A4: Vehicle body shops and repair facilities employ polyurethane, acrylic, or alkyd-based coatings for automotive refinish. These coatings are applied to new and used passenger and commercial cars to protect the body against damage caused by severe temperatures, accidents, and stone impact. Primer, filler, topcoat, basecoat, and activator or hardener coatings are some of the most often used refinish coatings.

Q5: How big is the Automotive Refinish Market?

A5: Automotive Refinish Market Was Valued at USD 13.43 Billion in 2023 and is Projected to Reach USD 24.65 Billion by 2032, Growing at a CAGR of 6.98 % from 2024 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!