Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Pedestrian Protection Systems (PPS) Market – Growth Drivers & Future Scope

Automotive pedestrian protection system is defined as an important safety aspect that relays the presence of a pedestrian. The system aids the driver and brakes the car by using the Advanced Driver Assistance System, also known as ADAS. They consider it in a way that will minimize the intensity of the impact by making the vehicle to absorb maximum amount of energy of an impact.

IMR Group

Description

Automotive Pedestrian Protection Systems (PPS) Market Synopsis:

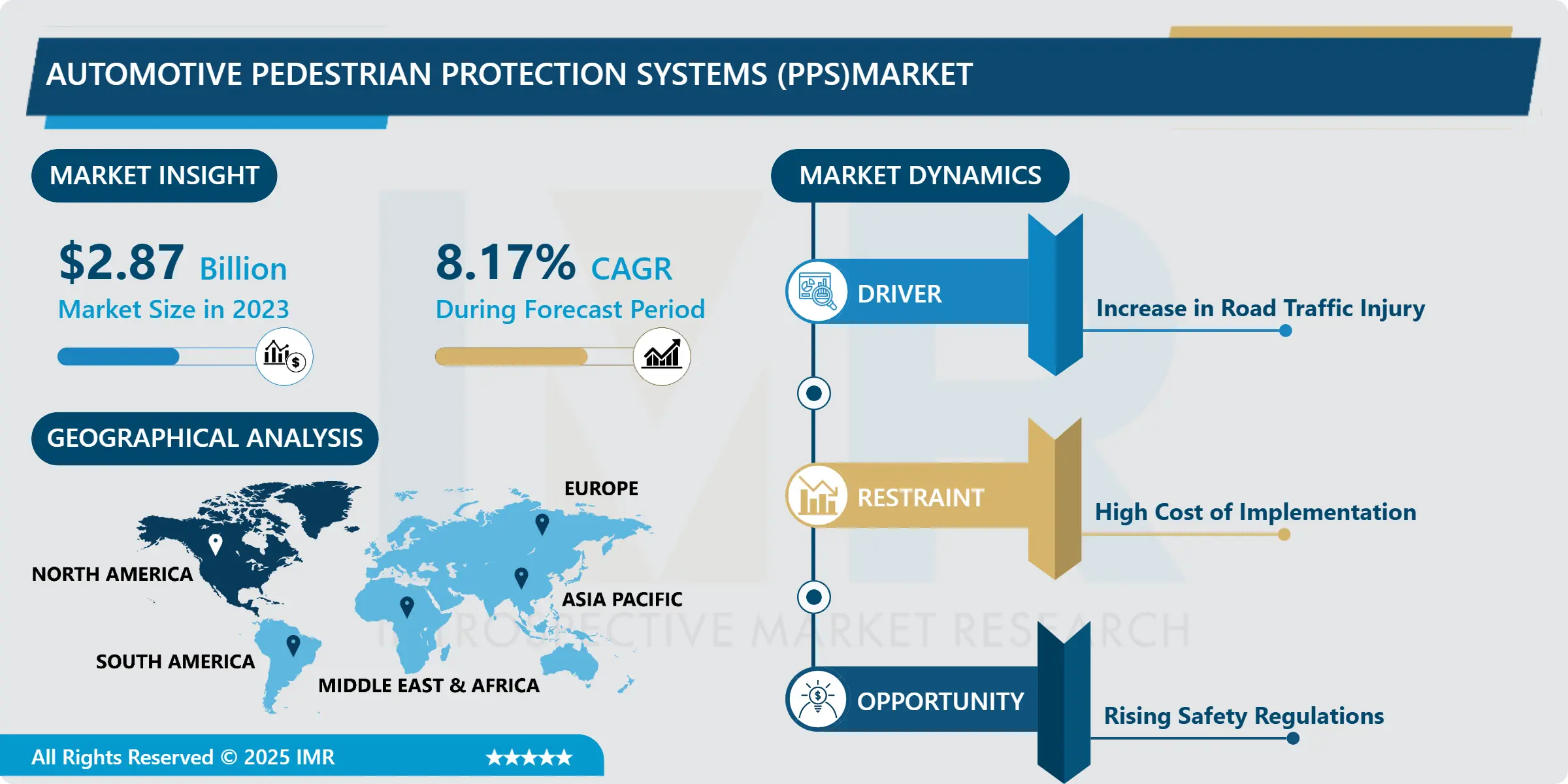

Automotive Pedestrian Protection Systems (PPS) Market Size Was Valued at USD 2.87 Billion in 2023, and is Projected to Reach USD 5.82 Billion by 2032, Growing at a CAGR of 8.17% From 2024-2032.

Automotive pedestrian protection system is defined as an important safety aspect that relays the presence of a pedestrian. The system aids the driver and brakes the car by using the Advanced Driver Assistance System, also known as ADAS. They consider it in a way that will minimize the intensity of the impact by making the vehicle to absorb maximum amount of energy of an impact.

Automotive PPS market has gotten much attention for the last few years due to increased awareness levels regarding safety in roads and focus being laid on improving pedestrian security. PPS refers to devices that help mitigate or avoid making pedestrian become a causalities for an accident in the case of collision with a car and includes active safety systems products, airbag and exterior sensorage. As the number of pedestrian deaths is increasing globally, lawful entities and lawmakers are continuing to demand more enhanced safety solutions and integrating ADAS, including PPS. This change has boosted the demand for PPS especially in regions in Europe, North America and Asia Pacific where road safety standards have been upgraded to enhanced levels.

The market for pedestrian protection is being boosted by the innovations in the automotive industry around the world and emerging technologies such as autonomous driving and the use of artificial intelligence on car systems. These manufacturers are thus striving to design new techniques that shall improve the effectiveness of PPS and this in practical applications. Further, to address the need for the protection of pedestrians, more relationships between automotive manufacturers and technology suppliers are being formed. Nonetheless, the market has risen to the challenges and new ones such as high costs, inadequate customers’ awareness, and integration of such systems in current vehicle designs persist. Nevertheless, there are a number of threats, which negatively affect the growth of the Automotive PPS market, yet the latter is expected to develop further as advanced technologies, governmental support, and increasing consumers’ interest in safe vehicles are to stimulate the market’s progress.

Automotive Pedestrian Protection Systems (PPS)Market Trend Analysis:

Growing Demand for Advanced Pedestrian Protection Systems Driven by Regulatory Standards and Safety Innovations

Since pedestrian safety is one of the significant concerns for automotive companies as well as governments, the requirement for innovative protective systems is expected to grow. It has been driven mostly by regulatory initiatives introduced by European and North American countries; these have compelled car makers to improve vehicle designs with pedestrian protection features. For instance, the European Union has drawn a number of safety standards that require new vehicles to come with pedestrian detection systems in place. This has prompted car manufacturers to search for solutions which will help them achieve regulatory compliance and still make their cars safer to use around pedestrians. Consequently, a growing trend has been evidenced toward integrating exotic elements like pedestrians, airbags, bonnets, and more enhanced sensors for perceiving pedestrians and preventing probable collisions.

To satisfy these regulatory standards, Global car makers have started installing radar, camera, and Advanced sensing systems in their vehicles to impose better safety to the pedestrians. These systems are supposed to recognize pedestrians, look for strikes, and engage protective features in order to decrease the likelihood of harm. Members called the move to enhance the safety of the roads for pedestrians as the leading cause of alteration in the design of the car where the implementation of these systems has become standard. As these innovations are making their way, the same customers and regulating authorities are beginning to appreciate the need for them. The advancement of PPS or Powder Metallurgy technologies does not solely stem from the regulations but also from a global trend in looking for ways to make roads safer, and for automotive industries to practice safer production.

Advancements in the Automotive Pedestrian Protection Systems (PPS) Market

The world governments are putting efforts to protect pedestrians; thus, they have set strict safety measures to address causes of pedestrian mishaps and deaths. This regulation is especially present in the European Union, North American, and some Asian countries, where pedestrian protection is advancing from a concept of raising awareness to concepts of postmodern cities as well as postmodern vehicles. Due to these shifting standards, automobile makers are forced into incorporating high- end PPS, which have acceptable regulatory standards. This change will be expected to fuel the consumption of new technologies like AEB system, independent pedestrian recognition sensors, and sophisticated radar systems. By this, manufacturers stand to benefit while opening up opportunities for the companies specializing in automotive safety technologies to provide advanced technologies to meet these requirements and to diversify their portfolios to cater for this emerging market demand.

The factors driving the global PPS market growth are the rising focus on vehicle safety regulation and the increasing customer awareness regarding safety features across the world, which forms a rich target pool for organizations in the PPS market. In this regard, car manufacturers have been incorporating better systems that not only identify pedestrians but also cause the car to act to prevent an accident. This change in demographics offers a great opportunity to improve the automotive safety sector. Further, with the increasing trend of vehicle electrification and advancing developments of autonomous driving, the competition for highly developed PPS solutions increases. It would be to the advantage of the companies the have prominent areas of specialization in the fields of sensor technology, artificial intelligence, and machine learning for they can design and operate next-generation pedestrian protection systems that are aligned with the focus on safety on the roads and the emerging vehicle technologies.

Automotive Pedestrian Protection Systems (PPS)Market Segment Analysis:

Automotive Pedestrian Protection Systems (PPS) Market Segmented on the basis of By Type, Vehicle Type, Component, Technology, Distribution Channel, and Region.

By Type, Automatic Braking and Collision Avoidance segment is expected to dominate the market during the forecast period

Both Automatic Braking and Collision Avoidance systems are considered as subsystems of advanced driver-assistance systems (ADAS) the primary objective of which is to decrease the possibility of an accident due to the system’s capacity to apply the brakes when it detects that an accident may occur. These systems leverage Radar, Lidar, and cameras to keep track of the vehicle environment in real-time continuously. The system checks for potential collisons with other vehicles or pedestrians or obstacles and if it does and the driver doesn’t intervene it will automatically activate the vehicles brakes in order to either avoid a collision at all or to at least mitigate the impact of the collision. This technology is crucial in some accident that often occur through cases such as distracted driving or missed response time.

ABS and CAA systems are becoming used widely as an innovation of the sensor technology as well as the escalating importance of safety measures. Such systems also help in decreasing the insurance risk levels and thus will also help lower on the crash costs. Furthermore, the basic equipment offered by most car makers has been enriched by those options because of the increased interest in safety standards and customer needs. Future developments of these technologies are thought to integrate machine learning and artifical intelligence to identify potential risks and hazards and use these improvements to enhance safe drinking water vehicle design.

By Distribution Channel, OEM segment expected to held the largest share

OEM is defined as auto manufacturers who incorporate PPS into auto production systems at their manufacture plants. Due to the increase in the preference of consumers seeking to buy cars that are safer and the further enchancement of standard set down by regulatory bodies, OEMs are beginning to integrate more safety features including automatic braking, collision avoidance and external airbags. These are systems whose purpose is to minimize the chances of pedestrian involvement in cases of a crash. When these features are included as standard on new models, OEMs help to guarantee that vehicles being produced are capable of conforming or exceeding regional safety standards which are due of late, tending to globally standardize. This trend has been further reinforced by increasing acknowledgment of safety of the pedestrians as an important element of safety of the vehicles.

The OEM segment is one of the largest and most influential market segments in the pedestrian protection system market due to the direct involvement of vehicle producers in this process. As most governments and regulatory authorities the world over continue to enforce safer car designs, manufacturers are putting their research capabilities into working on better pedestrian safety. Furthermore, most car manufacturers are using these technologies to market their products and to capture the market of customers who value safety. With changing safety standards and increasing customer demands OEMs are expected to play a dominant role in the integration of the pedestrian protection technologies into the designs of the future cars thereby making these systems an integral part of todays automobile safety system.

Automotive Pedestrian Protection Systems (PPS)Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The market of Automotive Pedestrian Protection Systems (PPS) in the North American region is still growing due to the growing usage of safety systems in vehicles. This growth can be further attributed to regulations enacted by governments the likes of the National Highway Traffic Safety Administration that has set very high standards for pedestrian protection. Such regulations compel car makers to include pedestrian safety aspects within car design to meet laid down standards. For these reasons, PPS has become a priority in the models of better-known manufacturers and a decisive element in creating and organizing production. In addition, increasing concern towards safety on roads, the raising awareness of consumers about the safety of vehicles augment the demand for PPS in the region.

As the capabilities in the developed autonomous driving technologies develop more in the future, therefore it will be increasing the demand for PPS in North America. That is why the connection of numerous superior pedestrian detection and anti-missile systems will become the key component of the subsequent generation vehicles, including the automobiles with a self-driving system. These technologies are likely to as contribute greatly to the decrease of pedestrian accidents and enhancing overall road safety. Also, the future years will show steeper safety requirements that are to increase the popularity of vehicles installed with PPS. This trend is in line with the general on-going worldwide effort to promote road safety measures, to make it difficult for pedestrians to be knocked down by moving vehicles.

Active Key Players in the Automotive Pedestrian Protection Systems (PPS) Market:

AB Volvo (Sweden)

Aptiv PLC (Ireland)

Audi AG (Germany)

Autoliv Inc (Sweden)

Continental AG (Germany)

Daimler AG (Germany)

DENSO CORPORATION (Japan)

General Motors (US)

Magna International Inc (Canada)

Magneti Marelli SpA. (Italy)

Mobileye (Jerusalem)

Nissan Motor Company Ltd (Japan)

Robert Bosch GmbH (Germany)

Subaru Corporation (Japan)

Toyota Motor Corporation (Japan)

Valeo (France)

WABCO Holdings, Inc (France)

ZF Friedrichshafen AG (Germany)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Pedestrian Protection Systems (PPS) Market by Typ

4.1 Automotive Pedestrian Protection Systems (PPS) Market Snapshot and Growth Engine

4.2 Automotive Pedestrian Protection Systems (PPS) Market Overview

4.3 Automatic Braking and Collision Avoidance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Automatic Braking and Collision Avoidance: Geographic Segmentation Analysis

4.4 Brake Assist

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Brake Assist: Geographic Segmentation Analysis

4.5 External Airbags

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 External Airbags: Geographic Segmentation Analysis

4.6 Pop-up Bonnets

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Pop-up Bonnets: Geographic Segmentation Analysis

Chapter 5: Automotive Pedestrian Protection Systems (PPS) Market by Vehicle Type

5.1 Automotive Pedestrian Protection Systems (PPS) Market Snapshot and Growth Engine

5.2 Automotive Pedestrian Protection Systems (PPS) Market Overview

5.3 Internal Combustion Engine (ICE) Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Internal Combustion Engine (ICE) Vehicles: Geographic Segmentation Analysis

5.4 Electric Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electric Vehicles: Geographic Segmentation Analysis

5.5 Hybrid Vehicles

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hybrid Vehicles: Geographic Segmentation Analysis

Chapter 6: Automotive Pedestrian Protection Systems (PPS) Market by Component

6.1 Automotive Pedestrian Protection Systems (PPS) Market Snapshot and Growth Engine

6.2 Automotive Pedestrian Protection Systems (PPS) Market Overview

6.3 Sensor

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Sensor: Geographic Segmentation Analysis

6.4 Actuator

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Actuator: Geographic Segmentation Analysis

6.5 Control Unit

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Control Unit: Geographic Segmentation Analysis

6.6 Cameras

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cameras: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Automotive Pedestrian Protection Systems (PPS) Market by Technology

7.1 Automotive Pedestrian Protection Systems (PPS) Market Snapshot and Growth Engine

7.2 Automotive Pedestrian Protection Systems (PPS) Market Overview

7.3 Active Pedestrian Protection System

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Active Pedestrian Protection System: Geographic Segmentation Analysis

7.4 Passive Pedestrian Protection System.

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Passive Pedestrian Protection System. : Geographic Segmentation Analysis

Chapter 8: Automotive Pedestrian Protection Systems (PPS) Market by Distribution Channel

8.1 Automotive Pedestrian Protection Systems (PPS) Market Snapshot and Growth Engine

8.2 Automotive Pedestrian Protection Systems (PPS) Market Overview

8.3 OEM

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEM: Geographic Segmentation Analysis

8.4 After.

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 After. : Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Pedestrian Protection Systems (PPS) Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ROBERT BOSCH GMBH (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 SUBARU CORPORATION (JAPAN)

9.4 APTIV PLC (IRELAND)

9.5 DAIMLER AG (GERMANY)

9.6 AUDI AG (GERMANY)

9.7 GENERAL MOTORS (US)

9.8 CONTINENTAL AG (GERMANY)

9.9 AUTOLIV INC (SWEDEN)

9.10 TOYOTA MOTOR CORPORATION (JAPAN)

9.11 DENSO CORPORATION (JAPAN)

9.12 MAGNA INTERNATIONAL INC (CANADA)

9.13 MAGNETI MARELLI SPA. (ITALY)

9.14 ZF FRIEDRICHSHAFEN AG (GERMANY)

9.15 MOBILEYE (JERUSALEM)

9.16 WABCO HOLDINGS INC (FRANCE)

9.17 VALEO (FRANCE)

9.18 NISSAN MOTOR COMPANY LTD (JAPAN)

9.19 AND AB VOLVO (SWEDEN)

9.20 AMONG OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Pedestrian Protection Systems (PPS) Market By Region

10.1 Overview

10.2. North America Automotive Pedestrian Protection Systems (PPS) Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Typ

10.2.4.1 Automatic Braking and Collision Avoidance

10.2.4.2 Brake Assist

10.2.4.3 External Airbags

10.2.4.4 Pop-up Bonnets

10.2.5 Historic and Forecasted Market Size By Vehicle Type

10.2.5.1 Internal Combustion Engine (ICE) Vehicles

10.2.5.2 Electric Vehicles

10.2.5.3 Hybrid Vehicles

10.2.6 Historic and Forecasted Market Size By Component

10.2.6.1 Sensor

10.2.6.2 Actuator

10.2.6.3 Control Unit

10.2.6.4 Cameras

10.2.6.5 Others

10.2.7 Historic and Forecasted Market Size By Technology

10.2.7.1 Active Pedestrian Protection System

10.2.7.2 Passive Pedestrian Protection System.

10.2.8 Historic and Forecasted Market Size By Distribution Channel

10.2.8.1 OEM

10.2.8.2 After.

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Pedestrian Protection Systems (PPS) Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Typ

10.3.4.1 Automatic Braking and Collision Avoidance

10.3.4.2 Brake Assist

10.3.4.3 External Airbags

10.3.4.4 Pop-up Bonnets

10.3.5 Historic and Forecasted Market Size By Vehicle Type

10.3.5.1 Internal Combustion Engine (ICE) Vehicles

10.3.5.2 Electric Vehicles

10.3.5.3 Hybrid Vehicles

10.3.6 Historic and Forecasted Market Size By Component

10.3.6.1 Sensor

10.3.6.2 Actuator

10.3.6.3 Control Unit

10.3.6.4 Cameras

10.3.6.5 Others

10.3.7 Historic and Forecasted Market Size By Technology

10.3.7.1 Active Pedestrian Protection System

10.3.7.2 Passive Pedestrian Protection System.

10.3.8 Historic and Forecasted Market Size By Distribution Channel

10.3.8.1 OEM

10.3.8.2 After.

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Bulgaria

10.3.9.2 The Czech Republic

10.3.9.3 Hungary

10.3.9.4 Poland

10.3.9.5 Romania

10.3.9.6 Rest of Eastern Europe

10.4. Western Europe Automotive Pedestrian Protection Systems (PPS) Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Typ

10.4.4.1 Automatic Braking and Collision Avoidance

10.4.4.2 Brake Assist

10.4.4.3 External Airbags

10.4.4.4 Pop-up Bonnets

10.4.5 Historic and Forecasted Market Size By Vehicle Type

10.4.5.1 Internal Combustion Engine (ICE) Vehicles

10.4.5.2 Electric Vehicles

10.4.5.3 Hybrid Vehicles

10.4.6 Historic and Forecasted Market Size By Component

10.4.6.1 Sensor

10.4.6.2 Actuator

10.4.6.3 Control Unit

10.4.6.4 Cameras

10.4.6.5 Others

10.4.7 Historic and Forecasted Market Size By Technology

10.4.7.1 Active Pedestrian Protection System

10.4.7.2 Passive Pedestrian Protection System.

10.4.8 Historic and Forecasted Market Size By Distribution Channel

10.4.8.1 OEM

10.4.8.2 After.

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 Netherlands

10.4.9.5 Italy

10.4.9.6 Russia

10.4.9.7 Spain

10.4.9.8 Rest of Western Europe

10.5. Asia Pacific Automotive Pedestrian Protection Systems (PPS) Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Typ

10.5.4.1 Automatic Braking and Collision Avoidance

10.5.4.2 Brake Assist

10.5.4.3 External Airbags

10.5.4.4 Pop-up Bonnets

10.5.5 Historic and Forecasted Market Size By Vehicle Type

10.5.5.1 Internal Combustion Engine (ICE) Vehicles

10.5.5.2 Electric Vehicles

10.5.5.3 Hybrid Vehicles

10.5.6 Historic and Forecasted Market Size By Component

10.5.6.1 Sensor

10.5.6.2 Actuator

10.5.6.3 Control Unit

10.5.6.4 Cameras

10.5.6.5 Others

10.5.7 Historic and Forecasted Market Size By Technology

10.5.7.1 Active Pedestrian Protection System

10.5.7.2 Passive Pedestrian Protection System.

10.5.8 Historic and Forecasted Market Size By Distribution Channel

10.5.8.1 OEM

10.5.8.2 After.

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Pedestrian Protection Systems (PPS) Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Typ

10.6.4.1 Automatic Braking and Collision Avoidance

10.6.4.2 Brake Assist

10.6.4.3 External Airbags

10.6.4.4 Pop-up Bonnets

10.6.5 Historic and Forecasted Market Size By Vehicle Type

10.6.5.1 Internal Combustion Engine (ICE) Vehicles

10.6.5.2 Electric Vehicles

10.6.5.3 Hybrid Vehicles

10.6.6 Historic and Forecasted Market Size By Component

10.6.6.1 Sensor

10.6.6.2 Actuator

10.6.6.3 Control Unit

10.6.6.4 Cameras

10.6.6.5 Others

10.6.7 Historic and Forecasted Market Size By Technology

10.6.7.1 Active Pedestrian Protection System

10.6.7.2 Passive Pedestrian Protection System.

10.6.8 Historic and Forecasted Market Size By Distribution Channel

10.6.8.1 OEM

10.6.8.2 After.

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkey

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Pedestrian Protection Systems (PPS) Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Typ

10.7.4.1 Automatic Braking and Collision Avoidance

10.7.4.2 Brake Assist

10.7.4.3 External Airbags

10.7.4.4 Pop-up Bonnets

10.7.5 Historic and Forecasted Market Size By Vehicle Type

10.7.5.1 Internal Combustion Engine (ICE) Vehicles

10.7.5.2 Electric Vehicles

10.7.5.3 Hybrid Vehicles

10.7.6 Historic and Forecasted Market Size By Component

10.7.6.1 Sensor

10.7.6.2 Actuator

10.7.6.3 Control Unit

10.7.6.4 Cameras

10.7.6.5 Others

10.7.7 Historic and Forecasted Market Size By Technology

10.7.7.1 Active Pedestrian Protection System

10.7.7.2 Passive Pedestrian Protection System.

10.7.8 Historic and Forecasted Market Size By Distribution Channel

10.7.8.1 OEM

10.7.8.2 After.

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Automotive Pedestrian Protection Systems (PPS) Market research report?

A1: The forecast period in the Automotive Pedestrian Protection Systems (PPS) Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Pedestrian Protection Systems (PPS) Market?

A2: AB Volvo (Sweden), Aptiv PLC (Ireland), Audi AG (Germany), Autoliv Inc (Sweden), Continental AG (Germany), Daimler AG (Germany), DENSO CORPORATION (Japan), General Motors (US), Magna International Inc (Canada), Magneti Marelli SpA. (Italy), Mobileye (Jerusalem), Nissan Motor Company Ltd (Japan), Robert Bosch GmbH (Germany), Subaru Corporation (Japan), Toyota Motor Corporation (Japan), Valeo (France), WABCO Holdings, Inc (France), ZF Friedrichshafen AG (Germany), and Other Active Players.

Q3: What are the segments of the Automotive Pedestrian Protection Systems (PPS) Market?

A3: The Automotive Pedestrian Protection Systems (PPS) Market is segmented into By Type, By Vehicle Type, By Component, By Technology, By Distribution Channel and region. By Type, the market is categorized into Automatic Braking and Collision Avoidance, Brake Assist, External Airbags, Pop-up Bonnets. By Vehicle Type, the market is categorized into Internal Combustion Engine (ICE) Vehicles, Electric Vehicles, Hybrid Vehicles. By Component, the market is categorized into Sensor, Actuator, Control Unit, Cameras, Others. By Technology, the market is categorized into Active Pedestrian Protection System, Passive Pedestrian Protection System. By Distribution Channel, the market is categorized into OEM, Aftermarket. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Pedestrian Protection Systems (PPS)Market?

A4: Automotive pedestrian protection system is defined as an essential safety feature that assists in alerting the driver. The system helps the driver and activates the brake of the vehicle through the Advanced Driver Assistance System (ADAS). Manufacturers design the vehicle to absorb maximum energy of an impact to lessen impact of the collision.

Q5: How big is the Automotive Pedestrian Protection Systems (PPS) Market?

A5: Automotive Pedestrian Protection Systems (PPS) Market Size Was Valued at USD 2.87 Billion in 2023, and is Projected to Reach USD 5.82 Billion by 2032, Growing at a CAGR of 8.17% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!