Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Motor Market – Insights for Business Growth Report 2024-2032

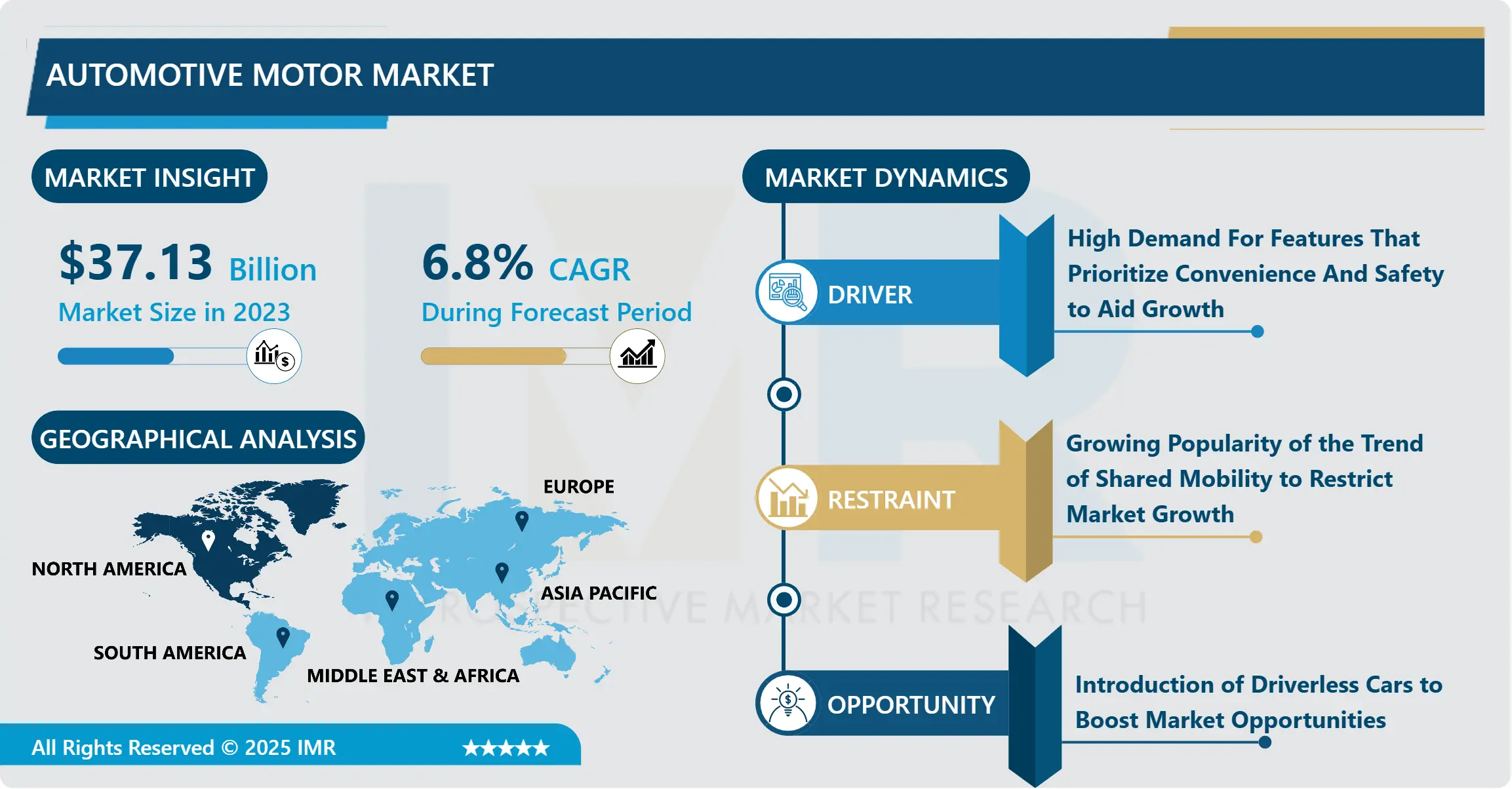

Automotive Motor Market Size Was Valued at USD 37.13 Billion in 2023, and is Projected to Reach USD 67.12 Billion by 2032, Growing at a CAGR of 6.80% From 2024-2032.

IMR Group

Description

Automotive Motor Market Synopsis:

Automotive Motor Market Size Was Valued at USD 37.13 Billion in 2023, and is Projected to Reach USD 67.12 Billion by 2032, Growing at a CAGR of 6.80% From 2024-2032.

Automotive motor market can be defined as the segment of the industry that deals with the manufacturing and sale of motors that are employed in electric vehicles, ICE vehicles and hybrid vehicles. It goes without saying that these motors have critical applications in driving prominent subsystems including the motor vehicle’s drive train, steering, conditioning systems, window controls, seating, and other electrical facilities. The market is giving technological growth in electric motors, increasing energy consumption for green car manufacturing, and progress in structure, material, and methodology for manufacturing. It is further classified by specific technologies now prevalent in vehicles and used to meet market requirements and demands – electric and hybrid vehicles that have disrupted the industry and translated into growing adoption and development opportunities.

The automotive motor market is growing, stimulated by the technological progress in automotive industry and the growing demand on electric vehicles, as well as attempts to increase fuel efficiency and decrease CO2 emissions. Automotive motors are used in vehicles for purposes that include; powering engines, steering systems, braking system and climate control. Given the increased trend of using electric motors in electric and even hybrid vehicles, then their use is rapidly likely to increase. Besides, the trends in applying smart motors for precise control and power saving seem possible, which promote market progression.

Electrics and hybrids are expected to capture the most of the automotive motor market as governments in most countries set high standards in environmental policies and offer generous incentives to car companies and users of environmentally friendly cars. This shift is supported by enhancement of batteries power and in as much as electric motors depend on batteries their performance will shift towards higher efficiency. Moreover, the market is also dynamics by the consumers that demand more efficient vehicles in electric motor technology to support energy demand. The market also enjoys other innovations such as the new brushless DC motors, which are more efficient and dependable.

Due to the ever-rising market for EVs across China, Germany, the United States, and many more, key regions such as North America, Europe and Asia-Pacific are experiencing a rise in automotive motor demand. A large number of automobile giants and the government’s support towards green transportation give a fillip to the market growth. Charging of infrastructure for electric vehicles as well as the production of more electric vehicles are factors that would help the sector in future putting the automotive motor sector as an integral part of the future automobile market.

The most significant level of competition is expressed through market leaders like Bosch, Continental, and Siemens, all of whom are working on the improvement of motor production ranges and optimizing their efficiency. Moreover, the companies in the development stage are leveraging the growing demand for new types of motors, including in-wheel motors and other superior electric drive systems. With the growth in electric vehicles, the automotive motor market was projected to experience continuous growth due to technology advancement, political support and market demands for environmental friendly vehicles.

Automotive Motor Market Trend Analysis:

Growing Demand for Electric and Autonomous Vehicle Motors

Following the recent adoption of electric cars by the automobile giants the utilization of electric motors especially in electric vehicles has boosted. One of them is traction motor that is involved in electric drive line of vehicles and has increasingly become competitive for ICEs. This transformation is as result of the increasing consumer consciousness in the environment and energy efficient vehicles. EVs are winning in terms of the zero carbon-emission policy as well as higher efficiency than ICEs, paving way for electric car and increasing market share all segments of automotive industries. Due to this, there is a rapid demand for these motors within the automotive motor market, with stakeholders directing significant resources towards the improvement of these motors, as more automobile manufacturers engage in the production of EVs.

Besides, EVs, people today also talk about the growing trend of autonomous vehicles, and to support this technology, automakers want motor systems that are smarter and more effective. Self- operating automobiles involve many operations in which different motor control technologies are required such as control of steering, braking, acceleration systems. Such systems must be highly dependable, quickly reacting, and unconditionally optimally performing to support self-driving car safety and functionality. As AD technology grows more sophisticated, the call for dedicated motors that can perform these functions also produces a new requirement. This trend is also putting pressure on new development of automotive motor market, more emphasis has been placed on the motor accuracy, performance and compatibility with smart car technology.

Automotive Motor Market Driven by Electrification and Sustainability

Since automotive makers are inclining towards production of environmentally friendly cars, high performance motors especially electric motors are expected to experience rise in demand. This is mainly due to the increasing levels of electrification in the two fields of passenger as well as commercial vehicles. EVs are are becoming popular globally due to a number of reasons as they are environmentally friendly as compared to ICEVs. Technological advancement and acceptance of electric powertrains are now being supported by policy and standards by governments to lower emissions. Currently, governments are subsidizing, providing tax credits and other stimuli trying to push the sales of EVs which create a proper environment for manufacturers of electric motor to invest in this technology.

The change to electric powertrains is also a perfect chance for automotive manufacturers to invest in a currently rapidly growing market and has major implications on the development in electric motor technologies. In the field of powertrain electric vehicles they intended to produce powerful and efficient electric motors and these features should be conferred higher torque levels energy efficiency and less weight. Thirdly, consumer’s shift from conventional vehicles to environmentally friendly vehicles has boosted investments in R&D to increase motor performance and reduce cost. While the use of electric vehicles increases in countries of the world, there is a prospect for the development of the market for automotive motors, which offers new opportunities for the development of both experienced market players and new participants in the automotive motor market.

Automotive Motor Market Segment Analysis:

Automotive Motor Market is Segmented on the basis of Type, Vehicle Type, Function, Technology, Application, and Region.

By Type, D.C. Brushed Motors segment is expected to dominate the market during the forecast period

A Brushed motor is one of the oldest type of motor and have high demand in vehicles due to their cheap prices and simple to build nature. These motors have a commutator and brushes that enable it to work, by making electrical connection with the armature windings. Based on the analysis of brushed motors’ concept, their construction is not so complex, and they are easy to produce and incorporate, especially when used for low power applications. In automobiles, they are mostly used in parts like wiper motors, controls for seat movement, and tiny fan motors since besides being cheap, they are extremely reliable. While being more efficient in operation, brushed motors are also easier to wear out because of the contact between brushes and the commutator.

Nevertheless, D.C. brushed motors are cost effective for simple vehicular uses; however, a drawback is that they may not be as efficient as other motors in the high performance or high torque systems. At some point the brushes may get spoilt, thus have low efficiency, and this is always a disadvantage due to the frequent maintenance. However, in automotive applications where, for example, high three phase current or long lifetime is not a requirement, these motors are still able to provide a solution. The combination of sufficient power to drive secondary loads such as power windows, seats, or wiper systems means they remain a standard component in driving vehicles, offering good power, and reasonable cost for ordinary car applications.

By Application, Alternator segment expected to held the largest share

Alternators are the complex assets in the current automobile industry since they play a critical role in the production of electricity for recharging the battery and powering other electrical systems in the car during operations of the engine. An alternator is usually a revolving accessory established on the engine crankshaft, and it employs a belt to make electrical power to the alternator’s rotor. While the rotor is spinning a reverse magnetic field is produced which sets up an AC current in the stator- which is the stationary component of an alternator . This AC power is then rectified into DC by the alternator’s rectifier and can be used to charge the vehicle battery and directly powers electrical workload like lights, infotainment and climate control.

The efficiency of the alternator is most important in order to make sure that the battery is always charged while in use. While the engine is running the alternator charges the battery and feeds electrical current to the car and its electrical system the current output being controlled by the voltage regulator to ensure that the battery does not get overcharged. Alternators are engineered to work effectively with different engine speeds; that is, one can find that the power output at idle is satisfactory for satisfying all the electrical requirements of the particular automobile. Primarily functioning as electrical generator to replenish the power used by onboard systems, it contributes much to the electric system of a car since it supplies amperes to the system so the battery is not relied on heavily, keeping all the electric parts functional.

Automotive Motor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In North America, the automotive motor market is dominated by the United States because EV production has gained considerable momentum. The increased sales of the EVs are caused by market incentives like tax credit and subsidies that the government offer to the consumers. Also the issue of the environment and the impacts human make towards the environment including the emission of carbon have also fueled the transition towards sustainable transportation. With the rate in which the US continues to set emission targets for carbon and green energy, automakers expect call for electric and hybrid vehicle, and high-performance new motors to rise.

Furthermore, more North American car manufacturers are exploring ways to electrify automobile transport and are spending significantly to upgrade those motors as well as related hardware. Top automobile giants such as General Motors, Ford, and Tesla are already unveiling and ramping up new-generation electric vehicles. This has given rise to a significant market need for new improved, high performing and high durability automotive motors specialized for electric automobiles. Due to the emphasis on sustainability in the region, other aspects of motor improvement, including motor efficiency and compatibility with autonomous systems, will also advance the market’s growth. This trend is set to expand the overall opportunities for automotive motors specifically in the electric and hybrid motor vehicle arrays in a decade.

Active Key Players in the Automotive Motor Market:

Aptiv PLC

BorgWarner Inc.

Buhler Motor

Continental AG

DENSO CORPORATION

Inteva Products LLC

Johnson Electric Holdings Limited

MABUCHI MOTOR CO.LTD.

Magna International Inc

Marelli Europe S.P.A.

Meritor Inc.

Mitsuba Corporation

Nidec Corporation

PST Electronics Ltd

Robert Bosch GmbH

Siemens AG

U-SHIN ltd.

VALEO

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Motor Market by Type

4.1 Automotive Motor Market Snapshot and Growth Engine

4.2 Automotive Motor Market Overview

4.3 D.C. Brushed Motors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 D.C. Brushed Motors: Geographic Segmentation Analysis

4.4 Brushless D.C. Motors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Brushless D.C. Motors: Geographic Segmentation Analysis

4.5 Stepper Motors and Traction Motors

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Stepper Motors and Traction Motors: Geographic Segmentation Analysis

Chapter 5: Automotive Motor Market by Vehicle Type

5.1 Automotive Motor Market Snapshot and Growth Engine

5.2 Automotive Motor Market Overview

5.3 Two-wheelers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Two-wheelers: Geographic Segmentation Analysis

5.4 Electric Two-wheelers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electric Two-wheelers: Geographic Segmentation Analysis

5.5 Passenger Cars

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Passenger Cars: Geographic Segmentation Analysis

5.6 Light Commercial Vehicles (LCVs)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Light Commercial Vehicles (LCVs): Geographic Segmentation Analysis

5.7 Heavy Commercial Vehicles (HCVs)

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Heavy Commercial Vehicles (HCVs): Geographic Segmentation Analysis

5.8 BEV

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 BEV: Geographic Segmentation Analysis

5.9 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV): Geographic Segmentation Analysis

Chapter 6: Automotive Motor Market by Function

6.1 Automotive Motor Market Snapshot and Growth Engine

6.2 Automotive Motor Market Overview

6.3 Performance

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Performance: Geographic Segmentation Analysis

6.4 Comfort & Convenience and Safety & Security

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Comfort & Convenience and Safety & Security: Geographic Segmentation Analysis

Chapter 7: Automotive Motor Market by Technology

7.1 Automotive Motor Market Snapshot and Growth Engine

7.2 Automotive Motor Market Overview

7.3 PWM and DTC54

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 PWM and DTC54: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Motor Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BORGWARNER INC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CONTINENTAL AG

8.4 DENSO CORPORATION

8.5 JOHNSON ELECTRIC HOLDINGS LIMITED

8.6 MITSUBA CORPORATION

8.7 MABUCHI MOTOR CO.LTD.

8.8 NIDEC CORPORATION

8.9 ROBERT BOSCH GMBH

8.10 SIEMENS AG

8.11 VALEO

8.12 INTEVA PRODUCTS LLC

8.13 MAGNA INTERNATIONAL INC

8.14 MARELLI EUROPE S.P.A.

8.15 APTIV PLC

8.16 BUHLER MOTOR

8.17 MERITOR INC.

8.18 PST ELECTRONICS LTD

8.19 U-SHIN LTD

8.20 OTHER ACTIVE PLAYERS

Chapter 9: Global Automotive Motor Market By Region

9.1 Overview

9.2. North America Automotive Motor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 D.C. Brushed Motors

9.2.4.2 Brushless D.C. Motors

9.2.4.3 Stepper Motors and Traction Motors

9.2.5 Historic and Forecasted Market Size By Vehicle Type

9.2.5.1 Two-wheelers

9.2.5.2 Electric Two-wheelers

9.2.5.3 Passenger Cars

9.2.5.4 Light Commercial Vehicles (LCVs)

9.2.5.5 Heavy Commercial Vehicles (HCVs)

9.2.5.6 BEV

9.2.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.2.6 Historic and Forecasted Market Size By Function

9.2.6.1 Performance

9.2.6.2 Comfort & Convenience and Safety & Security

9.2.7 Historic and Forecasted Market Size By Technology

9.2.7.1 PWM and DTC54

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Motor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 D.C. Brushed Motors

9.3.4.2 Brushless D.C. Motors

9.3.4.3 Stepper Motors and Traction Motors

9.3.5 Historic and Forecasted Market Size By Vehicle Type

9.3.5.1 Two-wheelers

9.3.5.2 Electric Two-wheelers

9.3.5.3 Passenger Cars

9.3.5.4 Light Commercial Vehicles (LCVs)

9.3.5.5 Heavy Commercial Vehicles (HCVs)

9.3.5.6 BEV

9.3.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.3.6 Historic and Forecasted Market Size By Function

9.3.6.1 Performance

9.3.6.2 Comfort & Convenience and Safety & Security

9.3.7 Historic and Forecasted Market Size By Technology

9.3.7.1 PWM and DTC54

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Motor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 D.C. Brushed Motors

9.4.4.2 Brushless D.C. Motors

9.4.4.3 Stepper Motors and Traction Motors

9.4.5 Historic and Forecasted Market Size By Vehicle Type

9.4.5.1 Two-wheelers

9.4.5.2 Electric Two-wheelers

9.4.5.3 Passenger Cars

9.4.5.4 Light Commercial Vehicles (LCVs)

9.4.5.5 Heavy Commercial Vehicles (HCVs)

9.4.5.6 BEV

9.4.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.4.6 Historic and Forecasted Market Size By Function

9.4.6.1 Performance

9.4.6.2 Comfort & Convenience and Safety & Security

9.4.7 Historic and Forecasted Market Size By Technology

9.4.7.1 PWM and DTC54

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Motor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 D.C. Brushed Motors

9.5.4.2 Brushless D.C. Motors

9.5.4.3 Stepper Motors and Traction Motors

9.5.5 Historic and Forecasted Market Size By Vehicle Type

9.5.5.1 Two-wheelers

9.5.5.2 Electric Two-wheelers

9.5.5.3 Passenger Cars

9.5.5.4 Light Commercial Vehicles (LCVs)

9.5.5.5 Heavy Commercial Vehicles (HCVs)

9.5.5.6 BEV

9.5.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.5.6 Historic and Forecasted Market Size By Function

9.5.6.1 Performance

9.5.6.2 Comfort & Convenience and Safety & Security

9.5.7 Historic and Forecasted Market Size By Technology

9.5.7.1 PWM and DTC54

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Motor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 D.C. Brushed Motors

9.6.4.2 Brushless D.C. Motors

9.6.4.3 Stepper Motors and Traction Motors

9.6.5 Historic and Forecasted Market Size By Vehicle Type

9.6.5.1 Two-wheelers

9.6.5.2 Electric Two-wheelers

9.6.5.3 Passenger Cars

9.6.5.4 Light Commercial Vehicles (LCVs)

9.6.5.5 Heavy Commercial Vehicles (HCVs)

9.6.5.6 BEV

9.6.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.6.6 Historic and Forecasted Market Size By Function

9.6.6.1 Performance

9.6.6.2 Comfort & Convenience and Safety & Security

9.6.7 Historic and Forecasted Market Size By Technology

9.6.7.1 PWM and DTC54

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Motor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 D.C. Brushed Motors

9.7.4.2 Brushless D.C. Motors

9.7.4.3 Stepper Motors and Traction Motors

9.7.5 Historic and Forecasted Market Size By Vehicle Type

9.7.5.1 Two-wheelers

9.7.5.2 Electric Two-wheelers

9.7.5.3 Passenger Cars

9.7.5.4 Light Commercial Vehicles (LCVs)

9.7.5.5 Heavy Commercial Vehicles (HCVs)

9.7.5.6 BEV

9.7.5.7 Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV)

9.7.6 Historic and Forecasted Market Size By Function

9.7.6.1 Performance

9.7.6.2 Comfort & Convenience and Safety & Security

9.7.7 Historic and Forecasted Market Size By Technology

9.7.7.1 PWM and DTC54

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Automotive Motor Market research report?

A1: The forecast period in the Automotive Motor Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Motor Market?

A2: BorgWarner Inc., Continental AG, DENSO CORPORATION, Johnson Electric Holdings Limited, Mitsuba Corporation, MABUCHI MOTOR CO. LTD., Nidec Corporation, Robert Bosch GmbH, Siemens AG, VALEO, Inteva Products LLC, Magna International Inc., Marelli Europe S.P.A., Aptiv PLC, Buhler Motor, Meritor Inc., PST Electronics Ltd, U-SHIN Ltd., and Other Active Players.

Q3: What are the segments of the Automotive Motor Market?

A3: The Automotive Motor Market is segmented into By Type, By Vehicle Type, By Function, By Technology, By Application and region. By Type, the market is categorized into D.C. Brushed Motors, Brushless D.C. Motors, Stepper Motors and Traction Motors. By Vehicle Type, the market is categorized into Two-wheelers, Electric Two-wheelers, Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), BEV, Plug-in hybrid electric vehicle (PHEV) and Hybrid electric vehicle (HEV). By Function, the market is categorized into Performance, Comfort & Convenience and Safety & Security. By Technology, the market is categorized into PWM and DTC54.By Application, the market is categorized into Alternator, ETC, Electric Parking Brake, Sun Roof Motor, Fuel Pump Motor, Wiper Motor, Engine Cooling Fan, HVAC, Starter Motor, Anti-lock Brake System, EPS, Electronically commutated motor (ECM), Variable valve timing (VVT), Exhaust gas recirculation (EGR), Power liftgate (PLG) and Others.By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Motor Market?

A4: The automotive motor market refers to the industry segment that involves the production and distribution of motors used in various automotive applications, including electric vehicles (EVs), internal combustion engine (ICE) vehicles, and hybrid vehicles. These motors are essential for driving key components like the vehicle's propulsion system, power steering, HVAC systems, windows, seats, and other electrical components. The market is driven by technological advancements in electric motors, the growing demand for energy-efficient and eco-friendly vehicles, and innovations in motor design, materials, and manufacturing techniques. The rise of electric and hybrid vehicles has significantly impacted the market, leading to increased adoption and growth opportunities.

Q5: How big is the Automotive Motor Market?

A5: Automotive Motor Market Size Was Valued at USD 37.13 Billion in 2023, and is Projected to Reach USD 67.12 Billion by 2032, Growing at a CAGR of 6.80% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!