Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Lead Acid Battery Market – Insights for Business Growth Report 2024-2032

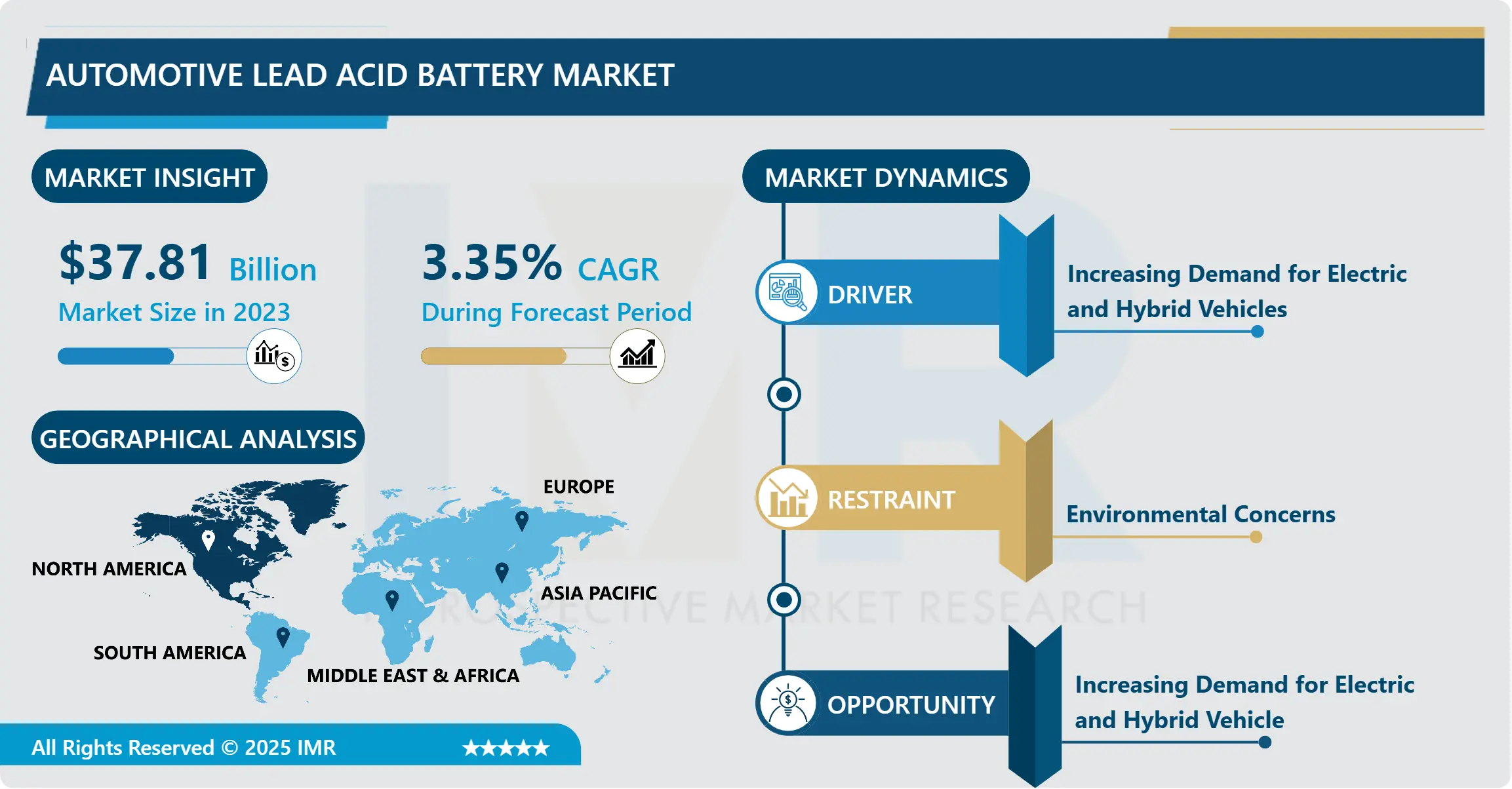

Automotive Lead Acid Battery Market Was Valued at USD 37.81 Billion in 2023 and is Projected to Reach USD 50.86 Billion by 2032, Growing at a CAGR of 3.35 % from 2024 to 2032.

IMR Group

Description

Automotive Lead Acid Battery Market Synopsis:

Automotive Lead Acid Battery Market Was Valued at USD 37.81 Billion in 2023 and is Projected to Reach USD 50.86 Billion by 2032, Growing at a CAGR of 3.35 % from 2024 to 2032.

The automotive lead-acid battery market can be defined as an area of the battery market specializing in the manufacturing and distribution of lead-acid batteries which serve primarily the automotive sector, particularly in automotive starting, lighting and ignition (SLI) purposes. These batteries are used because of their cheap, durable, and their capacity to give high power over short periods usually required by old conventional internal combustion engine vehicles and HEVs. Even as consumers turn to improved types of energy storage, lead-acid batteries stand as the industry leaders in car manufacturing; they have a solid background, recycling facilities, and are cheaper than modern substitutes.

Automotive Lead-acid Battery is a strategic product in the global automotive market especially in terms of Starting, Lighting, and Ignition (SLI) to power vehicles. This results to the continued use of lead-acid batteries their low initially costs, reliable and being from a relatively mature technology compared to potential solutions such as lithium-ion batteries. Market remains stable because internal combustion engine ICE vehicles are still in use and are dominant in the world’s fleets. However, due to ever increasing automotive aftermarket in which replacement batteries are sold, is a factor that also contributes to market stability. In addition, society’s growing interest in vehicles and lead-acid battery applications and technology improvements, for example, longer cycle life and a greater energy density, is likely to contribute to demand.

One of the major growth forces for the automotive lead-acid battery is the continuously progressing automotive market particularly in the developing nations. Additional, Asia-Pacific and Latin America, collectively, with the Africa regions are expected to record higher vehicles ownership hence boosting battery sales. Further, the light-vehicle market still includes hybrids with lead-acid batteries and lead-acid batteries for auxiliary power in electric vehicles that are coexisting with growing EV battery markets. However, the growth of automotive lead-acid battery has some issues such as environment problems on lead recycling and shift towards other battery technologies in electric vehicles. However lead-acid batteries are expected to continue to retain the automotive application leadership in the short to medium term due to a strong market base and cheap cost of the product.

Automotive Lead Acid Battery Market Trend Analysis

Dominance of Lead-Acid Batteries in Traditional Internal Combustion Engine (ICE) Vehicles

The automotive lead-acid battery market can be defined as an area of the battery market specializing in the manufacturing and distribution of lead-acid batteries which serve primarily the automotive sector, particularly in automotive starting, lighting and ignition (SLI) purposes. These batteries are used because of their cheap, durable, and their capacity to give high power over short periods usually required by old conventional internal combustion engine vehicles and HEVs. Even as consumers turn to improved types of energy storage, lead-acid batteries stand as the industry leaders in car manufacturing; they have a solid background, recycling facilities, and are cheaper than modern substitutes.

Automotive Lead-acid Battery is a strategic product in the global automotive market especially in terms of Starting, Lighting, and Ignition (SLI) to power vehicles. This results to the continued use of lead-acid batteries their low initially costs, reliable and being from a relatively mature technology compared to potential solutions such as lithium-ion batteries. Market remains stable because internal combustion engine ICE vehicles are still in use and are dominant in the world’s fleets. However, due to ever increasing automotive aftermarket in which replacement batteries are sold, is a factor that also contributes to market stability. In addition, society’s growing interest in vehicles and lead-acid battery applications and technology improvements, for example, longer cycle life and a greater energy density, is likely to contribute to demand.

One of the major growth forces for the automotive lead-acid battery is the continuously progressing automotive market particularly in the developing nations. Additional, Asia-Pacific and Latin America, collectively, with the Africa regions are expected to record higher vehicles ownership hence boosting battery sales. Further, the light-vehicle market still includes hybrids with lead-acid batteries and lead-acid batteries for auxiliary power in electric vehicles that are coexisting with growing EV battery markets. However, the growth of automotive lead-acid battery has some issues such as environment problems on lead recycling and shift towards other battery technologies in electric vehicles. However lead-acid batteries are expected to continue to retain the automotive application leadership in the short to medium term due to a strong market base and cheap cost of the product.

Growth Driven by Start-Stop Systems

One of the emerging trends that can be viewed as the key prospect for the development of the automotive lead-acid battery market is the constantly increasing usage of Start-Stop Systems (SSS) in cars. Those systems aim at cutting fuel use and CO2 emissions by turning off the engine when the car is idle and reviving it as soon as the driver presses the accelerator pedal. Unfortunately, the lead-acid batteries are a key component for starting the engine several times in the course of running a vehicle. The automotive business is aware of their social responsibility to address environmental concerns, including excessive emission of gases and low fuel economy; thus, the introduction of Start-Stop Systems will create a market demand. This will, in turn, create the necessary demand for lead-acid batteries, the most suitable technology for powering such low-energy technologies because of the low cost, high reliability and capacity for handling repeated cycle starting.

With the increased emission standards throughout the world especially in the European, North American, and Asia Pacific markets, car manufacturers have had to seek energy saving measures including Start-Stop Systems. They are regarded as an efficient tool to provide an increase of fuel efficiency without a corresponding escalation of vehicle prices. Since such energy efficient solutions are expected to gain more traction in the future, it is believed that the automotive lead-acid battery market will too find increased opportunities in the future. Lead-acid batteries will remain a standard for SSS because they are inexpensive and reliable, even in segments where hardware prices are low. Start-Stop System, as a result of more stringent emissions regulation, subsequently leading to a sizable market entrance for the automotive lead-acid battery within the forthcoming fiscal year.

Automotive Lead Acid Battery Market Segment Analysis:

Automotive Lead Acid Battery Market is Segmented on the basis of Product Type, Type, Vehicle Type, Application, and Region.

By Product Type, SLI segment is expected to dominate the market during the forecast period

SLI (Starting, Lighting, and Ignition) batteries are solely tasked with feeding the ignition system common in vehicles with internal combustion engines including gasoline, diesel and other types. These batteries supply energy in a short amount of time in a high energy level required to start the engine. Aside from powering the engine, they’re also used to support other electrical fuids in a car, including lighting, air conditioning, and infomercial systems. As a result, SLI batteries offer high reliability and are considered the most used and typical batteries in conventional cars and other vehicles making them a standard element in the automotive industry.

Generally, SLI batteries are lead-acid-based, using a technology whose efficacy has been tried and tested is several decades now. They have specifically gained popularity due to their relatively cheap nature, durability and capacity for high cycles of discharge and recharging characteristic of starting engines and other ancillary jobs. Newer types of batteries such as lithium-ion have now being integrated in electric and hybrid vehicles because they are lighter and have better energy density but lead-acid SLI batteries are still preferred in conventional vehicles because they are cheaper to produce and have long and standard production processes. They are reliable and available for use by millions of vehicles that are on the road today.

By Application, Electric Vehicles segment expected to held the largest share

Electric vehicles (EVs) are fully electrified that receive their motive force from high capacity batteries and electric motors alone. The widely used battery type in EVs are lithium ion because of their high density energy storage resulting in extended driving ranges and greater acceleration than the alternative battery types. This is why development of battery technology is important to increase their efficiency, durability and drive EVs’ performance as the market demand grows. This spans elements such as new technologies that enhance energy density leading to longer travel between recharging, and development of an improved charging network to shorten charging time as experienced by the consumer.

Automotive manufacturers are majorly concerned with addressing issues to do with batteries cost and efficacy as a way of making EV affordable for the mass market. With the total cost of lithium-ion batteries and therefore an EV steadily trending downwards due to efficiency gains and mass production, the point at which an EV is cheaper for a consumer to operate than a comparable ICE car is approaching rapidly. Also there is hope in solid-state and other next generation battery technologies in making EVs even more efficient, safer, and better performing. These are enabling the widespread use of electric vehicles hence lower the impacts of transportation on the environment and possibilities of electric mobility for the globally.

Automotive Lead Acid Battery Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In North America, the automotive lead-acid battery market is led by the two nations of the United States and Canada because of the high levels of automobile ownership in both regions and the big car manufacturing industries such as General Motors, Ford, and Chrysler. The current state automotive economics of the region and the customer preference for traditional ICE vehicles as well as their allied requirements for ongoing demand for LA batteries. They have emerged as cheaper and reliable power sources hence widely used in traditional functional automobiles. However, there is a constant increase in the usage of lead-acid batteries, because they remain a primary power source for ICE vehicles, commercial vehicles, and start-lighting-ignition (SLI) applications.

At the same time, North America is experiencing growth in the ownership of electric vehicles (EVs) due to incentives offered at the federal and state levels, along with the push towards sustainability and longer-term protection of the environment. With the continued advancement of EV adoption, some of which exhibit different chemistries for batteries, such as lithium-ion batteries, the move is expected to gradually cut the dependence on technology such as the lead-acid battery in the long run. Moreover, presently existing legislation within the overrepresented Automotive industry, including stringent carbon emissions regulation, encapsulated by fuel efficiency standards, is seen as key in enabling the shift towards green alternatives including energy storage and batteries. All these factors are expected to influence the future characteristics of the automotive lead-acid battery market in the region.

Active Key Players in the Automotive Lead Acid Battery Market:

C&D TECHNOLOGIES

CENTURY BATTERIES INDONESIA

CSB Energy Technology Co., Ltd

East Penn Manufacturing Company

ENERSYS

EXIDE INDUSTRIES LTD

Exide Technologies

GS Yuasa International Ltd.

Johnson Controls

Leoch Battery Corporation

Mebco

NorthStar

Panasonic Corporation,

Reem Batteries & Power Appliances Co. SAOC

Robert Bosch GmbH

Saft

SAMSUNG SDI CO., LTD

Tai Mao Battery Co., Ltd.

Trojan Battery Company,

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Lead Acid Battery Market by Product Type

4.1 Automotive Lead Acid Battery Market Snapshot and Growth Engine

4.2 Automotive Lead Acid Battery Market Overview

4.3 SLI

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 SLI: Geographic Segmentation Analysis

4.4 Stationary

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Stationary: Geographic Segmentation Analysis

4.5 Motive

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Motive: Geographic Segmentation Analysis

Chapter 5: Automotive Lead Acid Battery Market by Type

5.1 Automotive Lead Acid Battery Market Snapshot and Growth Engine

5.2 Automotive Lead Acid Battery Market Overview

5.3 Flooded Batteries

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Flooded Batteries: Geographic Segmentation Analysis

5.4 Enhanced Flooded Batteries

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Enhanced Flooded Batteries: Geographic Segmentation Analysis

5.5 VRLA Batteries

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 VRLA Batteries: Geographic Segmentation Analysis

Chapter 6: Automotive Lead Acid Battery Market by Vehicle Type

6.1 Automotive Lead Acid Battery Market Snapshot and Growth Engine

6.2 Automotive Lead Acid Battery Market Overview

6.3 Passenger Cars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Passenger Cars: Geographic Segmentation Analysis

6.4 Commercial Vehicles

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial Vehicles: Geographic Segmentation Analysis

6.5 Two-Wheelers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Two-Wheelers: Geographic Segmentation Analysis

6.6 HEV Cars

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 HEV Cars: Geographic Segmentation Analysis

Chapter 7: Automotive Lead Acid Battery Market by Application

7.1 Automotive Lead Acid Battery Market Snapshot and Growth Engine

7.2 Automotive Lead Acid Battery Market Overview

7.3 Electric Vehicles

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Electric Vehicles: Geographic Segmentation Analysis

7.4 Hybrid Vehicles

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Hybrid Vehicles: Geographic Segmentation Analysis

7.5 Light Motor Vehicles

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Light Motor Vehicles: Geographic Segmentation Analysis

7.6 Heavy Motor Vehicles

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Heavy Motor Vehicles: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Lead Acid Battery Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 JOHNSON CONTROLS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EXIDE TECHNOLOGIES

8.4 GS YUASA INTERNATIONAL LTD.

8.5 MEBCO

8.6 REEM BATTERIES & POWER APPLIANCES CO. SAOC

8.7 ENERSYS

8.8 SAFT

8.9 NORTHSTAR

8.10 C&D TECHNOLOGIES

8.11 ROBERT BOSCH GMBH

8.12 EAST PENN MANUFACTURING COMPANY

8.13 PANASONIC CORPORATION

8.14 TROJAN BATTERY COMPANY

8.15 SAMSUNG SDI CO.

8.16 LTD

8.17 LEOCH BATTERY CORPORATION

8.18 EXIDE INDUSTRIES LTD

8.19 CENTURY BATTERIES INDONESIA

8.20 TAI MAO BATTERY CO. LTD.

8.21 AND CSB ENERGY TECHNOLOGY CO. LTD

8.22 OTHER ACTIVE PLAYERS

Chapter 9: Global Automotive Lead Acid Battery Market By Region

9.1 Overview

9.2. North America Automotive Lead Acid Battery Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 SLI

9.2.4.2 Stationary

9.2.4.3 Motive

9.2.5 Historic and Forecasted Market Size By Type

9.2.5.1 Flooded Batteries

9.2.5.2 Enhanced Flooded Batteries

9.2.5.3 VRLA Batteries

9.2.6 Historic and Forecasted Market Size By Vehicle Type

9.2.6.1 Passenger Cars

9.2.6.2 Commercial Vehicles

9.2.6.3 Two-Wheelers

9.2.6.4 HEV Cars

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Electric Vehicles

9.2.7.2 Hybrid Vehicles

9.2.7.3 Light Motor Vehicles

9.2.7.4 Heavy Motor Vehicles

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Lead Acid Battery Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 SLI

9.3.4.2 Stationary

9.3.4.3 Motive

9.3.5 Historic and Forecasted Market Size By Type

9.3.5.1 Flooded Batteries

9.3.5.2 Enhanced Flooded Batteries

9.3.5.3 VRLA Batteries

9.3.6 Historic and Forecasted Market Size By Vehicle Type

9.3.6.1 Passenger Cars

9.3.6.2 Commercial Vehicles

9.3.6.3 Two-Wheelers

9.3.6.4 HEV Cars

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Electric Vehicles

9.3.7.2 Hybrid Vehicles

9.3.7.3 Light Motor Vehicles

9.3.7.4 Heavy Motor Vehicles

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Lead Acid Battery Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 SLI

9.4.4.2 Stationary

9.4.4.3 Motive

9.4.5 Historic and Forecasted Market Size By Type

9.4.5.1 Flooded Batteries

9.4.5.2 Enhanced Flooded Batteries

9.4.5.3 VRLA Batteries

9.4.6 Historic and Forecasted Market Size By Vehicle Type

9.4.6.1 Passenger Cars

9.4.6.2 Commercial Vehicles

9.4.6.3 Two-Wheelers

9.4.6.4 HEV Cars

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Electric Vehicles

9.4.7.2 Hybrid Vehicles

9.4.7.3 Light Motor Vehicles

9.4.7.4 Heavy Motor Vehicles

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Lead Acid Battery Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 SLI

9.5.4.2 Stationary

9.5.4.3 Motive

9.5.5 Historic and Forecasted Market Size By Type

9.5.5.1 Flooded Batteries

9.5.5.2 Enhanced Flooded Batteries

9.5.5.3 VRLA Batteries

9.5.6 Historic and Forecasted Market Size By Vehicle Type

9.5.6.1 Passenger Cars

9.5.6.2 Commercial Vehicles

9.5.6.3 Two-Wheelers

9.5.6.4 HEV Cars

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Electric Vehicles

9.5.7.2 Hybrid Vehicles

9.5.7.3 Light Motor Vehicles

9.5.7.4 Heavy Motor Vehicles

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Lead Acid Battery Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 SLI

9.6.4.2 Stationary

9.6.4.3 Motive

9.6.5 Historic and Forecasted Market Size By Type

9.6.5.1 Flooded Batteries

9.6.5.2 Enhanced Flooded Batteries

9.6.5.3 VRLA Batteries

9.6.6 Historic and Forecasted Market Size By Vehicle Type

9.6.6.1 Passenger Cars

9.6.6.2 Commercial Vehicles

9.6.6.3 Two-Wheelers

9.6.6.4 HEV Cars

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Electric Vehicles

9.6.7.2 Hybrid Vehicles

9.6.7.3 Light Motor Vehicles

9.6.7.4 Heavy Motor Vehicles

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Lead Acid Battery Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 SLI

9.7.4.2 Stationary

9.7.4.3 Motive

9.7.5 Historic and Forecasted Market Size By Type

9.7.5.1 Flooded Batteries

9.7.5.2 Enhanced Flooded Batteries

9.7.5.3 VRLA Batteries

9.7.6 Historic and Forecasted Market Size By Vehicle Type

9.7.6.1 Passenger Cars

9.7.6.2 Commercial Vehicles

9.7.6.3 Two-Wheelers

9.7.6.4 HEV Cars

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Electric Vehicles

9.7.7.2 Hybrid Vehicles

9.7.7.3 Light Motor Vehicles

9.7.7.4 Heavy Motor Vehicles

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Automotive Lead Acid Battery Market research report?

A1: The forecast period in the Automotive Lead Acid Battery Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Lead Acid Battery Market?

A2: Johnson Controls, Exide Technologies, GS Yuasa International Ltd., Mebco, Reem Batteries & Power Appliances Co. SAOC, ENERSYS, Saft, NorthStar, C&D Technologies, Robert Bosch GmbH, East Penn Manufacturing Company, Panasonic Corporation, Trojan Battery Company, Samsung SDI Co., Ltd., Leoch Battery Corporation, Exide Industries Ltd., Century Batteries Indonesia, Tai Mao Battery Co., Ltd., CSB Energy Technology Co., Ltd., and Other Active Players.

Q3: What are the segments of the Automotive Lead Acid Battery Market?

A3: The Automotive Lead Acid Battery Market is segmented into By Product Type, By Type, By Vehicle Type, By Application and region. By Product Type, the market is categorized into SLI, Stationary, Motive. By Type, the market is categorized into Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, Two-Wheelers, HEV Cars. By Application, the market is categorized into Electric Vehicles, Hybrid Vehicles, Light Motor Vehicles, Heavy Motor Vehicles. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Lead Acid Battery Market?

A4: The automotive lead-acid battery market refers to the segment of the battery industry focused on the production and sale of lead-acid batteries primarily used in automotive applications, such as starting, lighting, and ignition (SLI) systems in vehicles. These batteries are widely adopted due to their cost-effectiveness, reliability, and ability to deliver high power in short bursts, making them essential for traditional internal combustion engine vehicles and hybrid electric vehicles. Despite the growing adoption of alternative energy storage solutions, lead-acid batteries continue to dominate the automotive sector due to their established infrastructure, recycling capabilities, and lower upfront costs.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!