Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Interior Leather Market – Insights for Business Growth Report 2024-2032

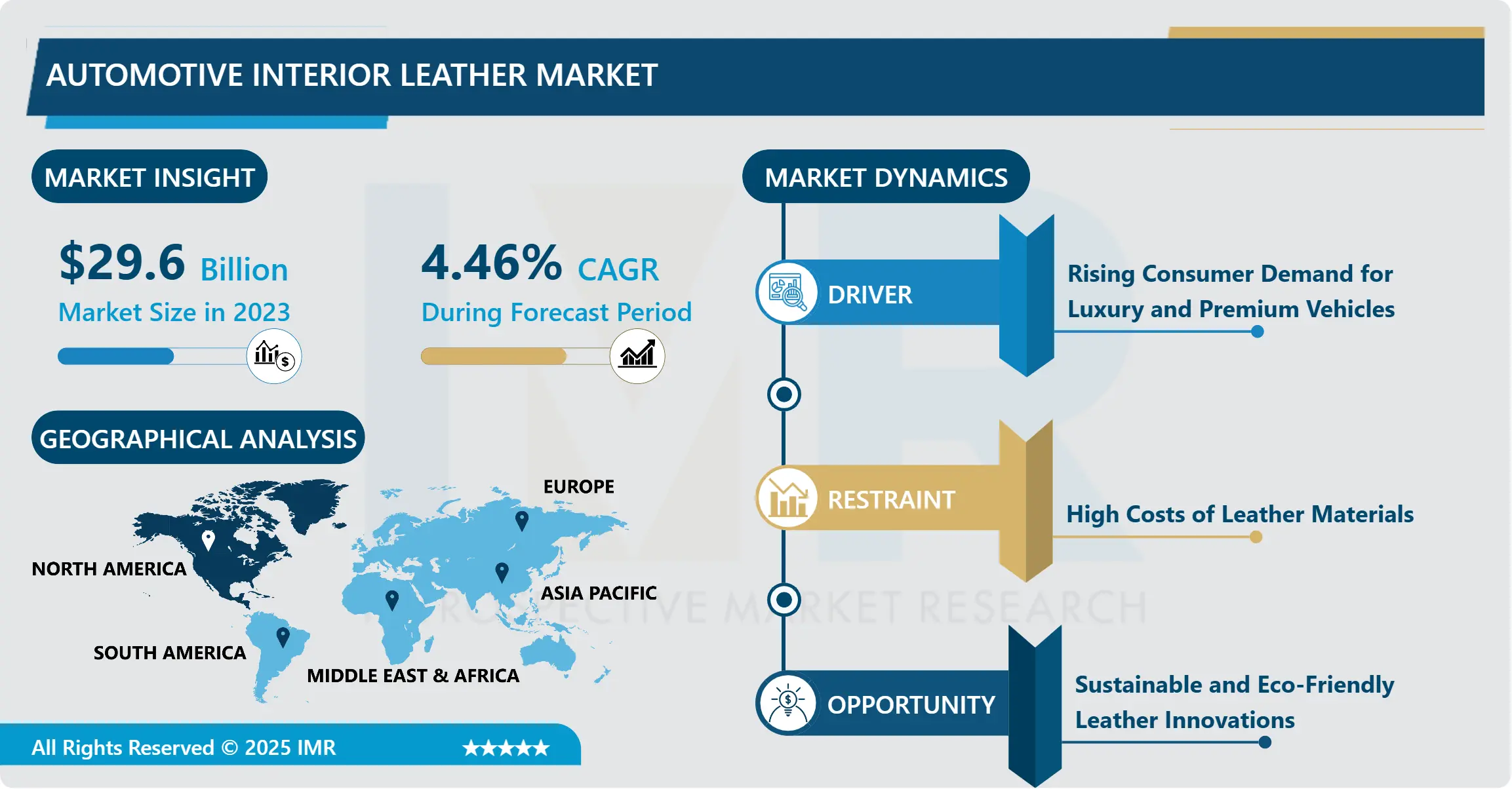

Automotive Interior Leather Market Size Was Valued at USD 29.60 Billion in 2023, and is Projected to Reach USD 43.84 Billion by 2032, Growing at a CAGR of 4.46% From 2024-2032.

IMR Group

Description

Automotive Interior Leather Market Synopsis:

Automotive Interior Leather Market Size Was Valued at USD 29.60 Billion in 2023, and is Projected to Reach USD 43.84 Billion by 2032, Growing at a CAGR of 4.46% From 2024-2032.

The automotive interior leather market implies the segment of leather goods industry that deals with the manufacturing and selling of leather products employed in the interiors of vehicles automobiles such as seats, upholstery, steering wheels, dashboards and door panels among others. Automakers love leather for the touch, the look, the sturdiness, and mostly the feel of luxury. It is a popular finish among premium, luxury, and premium class cars as well as in mid-price segment vehicles where companies strive for high-quality internal trim. The market for leather is segmented by type of product including genuine leather, synthetic leather and green leather It also takes in factors such as preference for luxury product, technological improvement for manufacturing the customized vehicles, sustainability issues, and more. As mentioned above, new trends are influencing changes to the use of materials; manufacturers are finding substitutes to conventional materials like leather due to the environmental and ethically-induced challenges.

Automotive interior leather market is steadily growing as customers want to have better quality, more elegant, and environmentally friendly materials and finishes in their cars. High-quality, durable, and fashionable and comfortable leather remains popular in the production of luxurious automobiles, which helps to drive the segment. Market drivers include; there is a growing trend where individuals prefer to purchase expensive automobiles, new techniques used in making leathers, and high disposable income across various markets especially those that are evolving. Moreover, the call to produce and utilize environment-friendly products has compelled the leather’s technological counterparts, plant base and synthetic leathers, into becoming more popular within the automotive industry.

As far as the market segmentation by type is concerned the global market is set according to the type into natural leather, synthetic leather and other type. Natural leather remains the most widely used because of its high quality and soft touch feel particularly in class or sports utility vehicles. Synthetic leather on the other hand seems to grow in popularity as it not only cheaper but also lighter in weight and with growing concerns of sustainability. Automotive interior leather demand is as a result of improvements in various processes including tanning and dyeing of this product that has been prompted by a shift towards environmental friendly solutions. Market growth is also fuelled by the global trend towards increasing specific individualisation and designing of car interiors which use different kinds of leather finish and texture. Though there are many opportunities for the industries, they have some threats like volatile cost of raw material, lengthy manufacturing process within some industries, especially those which involve manual labor, environmental issues associated with the conventional leather processing. As such, there is a strong and growing trend for automotive interior leather in the future to provide high-quality, environmentally friendly, and beautiful materials.

Automotive Interior Leather Market Trend Analysis:

Growing Demand for Premium and Luxury Automotive Interiors with Leather

Automotive interior leather market is experiencing strong market trends where premium and luxury car interiors are based mainly on leather. Leather is believed to be luxurious as it gives an exclusive image that adds elegance and value to the touch feeling of the automobile interior space. This trend is most evident In the passenger automobile sector with the luxury and high-performance cars that require leather interiors as a key factor that they use to provide comfort and quality to their esteemed clients. Thus, as car makers strive to meet this need more and more vehicles are being fitted with leather and are demonstrating a shift in importance towards giving buyers the best possible interiors.

The trend also continues in electric vehicle (EV), of the car manufacturers use leather for the upgrading of the interior. Even though, luxury electric car brands are among the main representatives of innovative and environmentally friendly technologies, they continue using leather. Premium leathers act as a diversification tool that aims at creating a sensation of higher value of electric cars, responding to the demand for wealthier and environmentally concerned customers, who still would like to have as many luxurious elements in their cars as possible. This change is a reaction to a rising trend regarding the demand for high-quality design, whether for electric cars or traditional ICE vehicles and how manufacturers are trying to find the sweet spot between introducing new technologies and delivering exclusivity for new and wider audiences.

Growth Drivers in the Automotive Interior Leather Market

The production of car interiors has been improved in terms of looks and comfort and this has led to increased purchasing of good materials like leather. The element of beauty and the added advantage of durability still plays a significant role in encouraging consumption of leather by those vehicles’ users with a particular interest towards high quality. This trend is especially noticeable in emerging regions as for example Asia-Pacific and Latin America: higher levels of disposable income and shifting consumer focus to the purchase of higher end vehicles indicate significant opportunities. These regions’ consumers are demanding more personalised and more upmarket products, thus forcing car manufacturers to incorporate features such as leather based upholstery to its models.

Moreover, the use of leather in aircraft designs is flexible creating incredible looks and durability that makes it specific choice for any manufacturer who wants to indulge in elegant interiors. It can be further embellished with detailed stiching, colour and certain designs to give a laudable experience. Leather is expected to endure the high use and abuse, hence it retains the luxury of vehicles across their life cycle; therefore, any automaker interested in the aesthetic and use of vehicle interiors should consider leather. As the world shifts more toward premiere and luxury cars, the need for leather as an embodiment of luxury past the comfort point remains nothing but indispensable.

Automotive Interior Leather Market Segment Analysis:

Automotive Interior Leather Market is Segmented on the basis of Material, Vehicle Type, Car Class, Application, and Region.

By Material, Genuine segment is expected to dominate the market during the forecast period

Real things in the use of auto parts are rare because of their originality, endurance, and quality. Such materials are commonly of a organic or conventional origin and provide a luxury feel that synthetic types are unable to provide. Leather makes up the largest part of genuine materials which is widely used in car interiors especially in luxury and higher classes of cars. The original and formal grain enhances the higher class touch that further improves the appearance of the car. Another reason is versatility, durability, resistance to wear and, last but not least, the material’s ability to gracefully wear out over time, which is especially important for cars with a luxurious flair, as leather stands out as a prestigious material for seats, interiors, and trims.

Other real materials that can be used in car interior are real fabrics, wood and metals; their application is dictated by the best quality for certain characteristics of the interior and the car in general, as well as by the exclusiveness of the material. Many of these materials are usually applied in the higher class models where issues to do with quality and class are considered. In auto industry, genuine materials contribute not only to comfort but also to status; people who need refined and durable car interior want to get a corresponding product that would reflect their status and, therefore, their choice. Therefore, replacing with genuine articles is one of the major strategies in a luxury car market which focus on quality, workmanship and appearance.

By Application, Seats & Center Stack segment expected to held the largest share

Car seats are very much important in a car due to both comfort and security of passengers who sit during travel. In luxury and mid-range cars the components of the seating are very importer and are made out of genuine materials such as leather or very high-quality fabric such as leather look alike. They are select materials for their softness, tear resists, and luxurious feel allowing for a better overall cabin feel. For example, leather is a smooth and slightly firm material that can ensure a long-term contact with it, and high-end synthetic fabrics are environmentally friendly counterparts that does not harm the comfort and the style.

Being one of the most conspicuous parts mounted on the face of the car, the centre stack or centre console is a focal point for optimal manipulation of stuff such as the radio, climate system, and any other tool that may require close manipulation as it relates to the car’s navigation. In this component, plastics, metals, and high-end matt and shiny finishes are often used in order to blend with current fashion and to create the product that is easy to manoeuvre and hard to break. They can be molded into various shapes; designs can be simpler because of the material used and still look fashionable while metals or high-quality finishes like brushed aluminum or piano black are elegant. The selection of material of the center stack refers to style aesthetically and the practicality of the vehicle’s interior play a critical role in the formulation such materials contributes greatly to giving a high quality image of that particular model’s interior.

Automotive Interior Leather Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Current market analysis shows that the North American automotive interior leather market is continuously growing primarily due to the growing customer preference for premium vehicles and new developments in automotive technology. Currently, the United States is still a major force in this market because people in this country highly value car comfort with expensive and excellent leather material. Since consumers are interesting in improving comfort as well as appearance of their cars, leather becomes one of the best options for automobile interior. The market is also being backed up by huge investments from automotive makers across high end models and another large area of EV (electric vehicles) sector where leather interiors are linked with high end models and additional luxury features. An important factor for the demand in the current market is the growth of the consumer’s disposable income which allows them to buy more premium, tailored materials for car interior equipment.

Besides the increased need, there is a trend toward increasing the sustainability of the products sold. Strict regulatory requirements connected to vehicle interiors, particularly those standards that affect sustainability and eco-friendliness, are driving manufacturers to seek out solutions other than ‘authentic’ leather, including synthetic leather including eco-leather and vegan leather. This trend is likely to continue having an impact in the region’s markets as consumers embrace sustainable production and demanding manufacturers meet environmental rules. More developments in the automotive form and content will help the present and future North American automotive interior leather market which is a blend of luxury and sustainability.

Active Key Players in the Automotive Interior Leather Market:

Alfatex Italia

Alphaline auto

Bader GmbH & Co. KG

BOXMARK Leather GmbH & Co KG

Classic soft trim

CTL leather

DK leather corporation

Eagle Ottawa

GST Autoleather Inc

Katzkin Leather inc

Kuraray plastics

Lear Corporation

Scottish leather group

Seiren Co Ltd

Wollsdorf leder schmidt & Co Ges

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Interior Leather Market by Material

4.1 Automotive Interior Leather Market Snapshot and Growth Engine

4.2 Automotive Interior Leather Market Overview

4.3 Genuine and Synthetic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Genuine and Synthetic: Geographic Segmentation Analysis

Chapter 5: Automotive Interior Leather Market by Vehicle Type

5.1 Automotive Interior Leather Market Snapshot and Growth Engine

5.2 Automotive Interior Leather Market Overview

5.3 Passenger Car

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Car: Geographic Segmentation Analysis

5.4 Light Commercial Vehicle and Heavy Commercial Vehicle

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Light Commercial Vehicle and Heavy Commercial Vehicle: Geographic Segmentation Analysis

Chapter 6: Automotive Interior Leather Market by Car Class

6.1 Automotive Interior Leather Market Snapshot and Growth Engine

6.2 Automotive Interior Leather Market Overview

6.3 Economy Car

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Economy Car: Geographic Segmentation Analysis

6.4 Mid-Segment Car and Luxury Car

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Mid-Segment Car and Luxury Car: Geographic Segmentation Analysis

Chapter 7: Automotive Interior Leather Market by Application

7.1 Automotive Interior Leather Market Snapshot and Growth Engine

7.2 Automotive Interior Leather Market Overview

7.3 Seats & Center Stack

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Seats & Center Stack: Geographic Segmentation Analysis

7.4 Carpets

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Carpets: Geographic Segmentation Analysis

7.5 Headliners

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Headliners: Geographic Segmentation Analysis

7.6 Upholstery

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Upholstery: Geographic Segmentation Analysis

7.7 Seat Belt

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Seat Belt: Geographic Segmentation Analysis

7.8 Door Panels and Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Door Panels and Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Interior Leather Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GST AUTOLEATHER INC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EAGLE OTTAWA

8.4 CTL LEATHER

8.5 ALPHALINE AUTO

8.6 DK LEATHER CORPORATION

8.7 SCOTTISH LEATHER GROUP

8.8 WOLLSDORF LEDER SCHMIDT & CO GES

8.9 CLASSIC SOFT TRIM

8.10 KATZKIN LEATHER INC

8.11 KURARAY PLASTICS

8.12 ALFATEX ITALIA

8.13 SEIREN CO LTD

8.14 LEAR CORPORATION

8.15 BADER GMBH & CO. KG

8.16 BOXMARK LEATHER GMBH & CO KG

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Automotive Interior Leather Market By Region

9.1 Overview

9.2. North America Automotive Interior Leather Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Material

9.2.4.1 Genuine and Synthetic

9.2.5 Historic and Forecasted Market Size By Vehicle Type

9.2.5.1 Passenger Car

9.2.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.2.6 Historic and Forecasted Market Size By Car Class

9.2.6.1 Economy Car

9.2.6.2 Mid-Segment Car and Luxury Car

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Seats & Center Stack

9.2.7.2 Carpets

9.2.7.3 Headliners

9.2.7.4 Upholstery

9.2.7.5 Seat Belt

9.2.7.6 Door Panels and Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Interior Leather Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Material

9.3.4.1 Genuine and Synthetic

9.3.5 Historic and Forecasted Market Size By Vehicle Type

9.3.5.1 Passenger Car

9.3.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.3.6 Historic and Forecasted Market Size By Car Class

9.3.6.1 Economy Car

9.3.6.2 Mid-Segment Car and Luxury Car

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Seats & Center Stack

9.3.7.2 Carpets

9.3.7.3 Headliners

9.3.7.4 Upholstery

9.3.7.5 Seat Belt

9.3.7.6 Door Panels and Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Interior Leather Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Material

9.4.4.1 Genuine and Synthetic

9.4.5 Historic and Forecasted Market Size By Vehicle Type

9.4.5.1 Passenger Car

9.4.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.4.6 Historic and Forecasted Market Size By Car Class

9.4.6.1 Economy Car

9.4.6.2 Mid-Segment Car and Luxury Car

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Seats & Center Stack

9.4.7.2 Carpets

9.4.7.3 Headliners

9.4.7.4 Upholstery

9.4.7.5 Seat Belt

9.4.7.6 Door Panels and Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Interior Leather Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Material

9.5.4.1 Genuine and Synthetic

9.5.5 Historic and Forecasted Market Size By Vehicle Type

9.5.5.1 Passenger Car

9.5.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.5.6 Historic and Forecasted Market Size By Car Class

9.5.6.1 Economy Car

9.5.6.2 Mid-Segment Car and Luxury Car

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Seats & Center Stack

9.5.7.2 Carpets

9.5.7.3 Headliners

9.5.7.4 Upholstery

9.5.7.5 Seat Belt

9.5.7.6 Door Panels and Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Interior Leather Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Material

9.6.4.1 Genuine and Synthetic

9.6.5 Historic and Forecasted Market Size By Vehicle Type

9.6.5.1 Passenger Car

9.6.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.6.6 Historic and Forecasted Market Size By Car Class

9.6.6.1 Economy Car

9.6.6.2 Mid-Segment Car and Luxury Car

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Seats & Center Stack

9.6.7.2 Carpets

9.6.7.3 Headliners

9.6.7.4 Upholstery

9.6.7.5 Seat Belt

9.6.7.6 Door Panels and Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Interior Leather Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Material

9.7.4.1 Genuine and Synthetic

9.7.5 Historic and Forecasted Market Size By Vehicle Type

9.7.5.1 Passenger Car

9.7.5.2 Light Commercial Vehicle and Heavy Commercial Vehicle

9.7.6 Historic and Forecasted Market Size By Car Class

9.7.6.1 Economy Car

9.7.6.2 Mid-Segment Car and Luxury Car

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Seats & Center Stack

9.7.7.2 Carpets

9.7.7.3 Headliners

9.7.7.4 Upholstery

9.7.7.5 Seat Belt

9.7.7.6 Door Panels and Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Automotive Interior Leather Market research report?

A1: The forecast period in the Automotive Interior Leather Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Interior Leather Market?

A2: GST Autoleather Inc.; Eagle Ottawa; CTL Leather; Alphaline Auto; DK leather Corporation; Scottish Leather Group; Wollsdorf Leder Schmidt & Co Ges; Classic Soft Trim; Katzkin Leather Inc; Kuraray Plastics; Alfatex Italia; Seiren Co Ltd; Lear Corporation; Bader GmbH & Co. KG; BOXMARK Leather GmbH & Co KG and Other Major Players.

Q3: What are the segments of the Automotive Interior Leather Market?

A3: The Automotive Interior Leather Market is segmented into By Material, By Vehicle Type, By Car Class, By Application and region. By Material, the market is categorized into Genuine and Synthetic. By Vehicle Type, the market is categorized into Passenger Car, Light Commercial Vehicle and Heavy Commercial Vehicle. By Car Class, the market is categorized into Economy Car, Mid-Segment Car and Luxury Car. By Application, the market is categorized into Seats & Center Stack, Carpets, Headliners, Upholstery, Seat Belt, Door Panels and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Interior Leather Market?

A4: The automotive interior leather market refers to the industry focused on the production and supply of leather materials used in the interior of vehicles, including seats, upholstery, steering wheels, dashboards, and door panels. Leather is favored in automotive interiors for its aesthetic appeal, comfort, durability, and premium feel. It is commonly used in high-end, luxury, and premium vehicles, as well as in mid-range vehicles where manufacturers aim to offer superior quality interiors. The market encompasses various types of leather, such as genuine leather, synthetic leather, and eco-friendly options, and is influenced by factors such as consumer preference for luxury, advancements in manufacturing technology, sustainability concerns, and increasing demand for automotive customization. With evolving trends, manufacturers are also exploring alternatives to traditional leather, such as vegan leather, in response to environmental and ethical considerations.

Q5: How big is the Automotive Interior Leather Market?

A5: Automotive Interior Leather Market Size Was Valued at USD 29.60 Billion in 2023, and is Projected to Reach USD 43.84 Billion by 2032, Growing at a CAGR of 4.46% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!