Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Fuel Injection Systems Market | Business Research Analysis By 2032

Automotive Fuel Injection Systems are integral components in internal combustion engines, precisely delivering fuel to the engine cylinders. These systems optimize combustion efficiency, enhancing vehicle performance and fuel efficiency. They consist of fuel injectors, a fuel pump, a pressure regulator, and an Electronic Control Unit (ECU) that manages the injection process.

IMR Group

Description

Automotive Fuel Injection Systems Market Synopsis

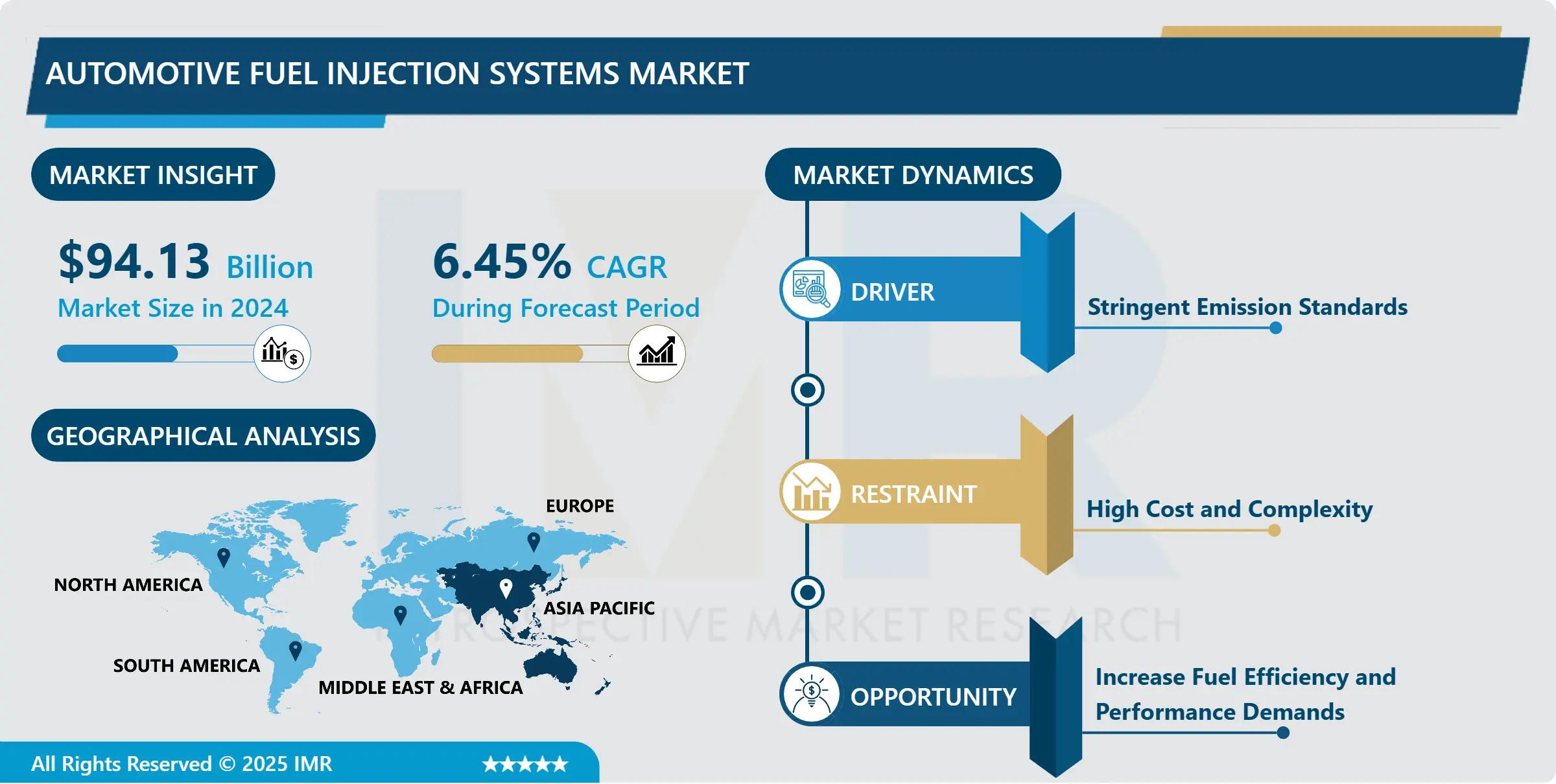

Automotive Fuel Injection Systems Market Size Was Valued at USD 94.13 Billion in 2024, and is Projected to Reach USD 155.20 Billion by 2032, Growing at a CAGR of 6.45% From 2025-2032.

Automotive Fuel Injection Systems are integral components in internal combustion engines, precisely delivering fuel to the engine cylinders. These systems optimize combustion efficiency, enhancing vehicle performance and fuel efficiency. They consist of fuel injectors, a fuel pump, a pressure regulator, and an Electronic Control Unit (ECU) that manages the injection process. Fuel can be injected directly into the combustion chamber (Direct Fuel Injection) or the intake port (Port Fuel Injection). Catering to both gasoline and diesel engines, these systems play a dynamic role in modern vehicles, ensuring precise fuel delivery, reduced emissions, and compliance with stringent environmental standards.

The Automotive Fuel Injection Systems market is experiencing significant growth due to their numerous benefits. These systems improve engine efficiency by controlling fuel-air mixture, optimizing combustion, and improving vehicle performance. This leads to reduced emissions and environmental concerns. Fuel injection systems offer better throttle response, smoother engine operation, and enhanced reliability compared to traditional carburetors. The market is developing advanced fuel injection technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI), which offer improved fuel atomization and combustion, leading to enhanced power and fuel efficiency in gasoline engines. Manufacturers are driven by the demand for fuel-efficient and environmentally friendly vehicles, while the integration of electronic components and sensors is also increasing. The Automotive Fuel Injection Systems market is expected to grow due to the growing automotive industry. The increasing awareness of environmental sustainability and strict emission regulations is driving automakers to invest in advanced fuel injection technologies, resulting in sustained demand and technological advancements.

Automotive Fuel Injection Systems Market Trend Analysis

Stringent Emission Standards

Stringent emission standards play a crucial role in the Automotive Fuel Injection Systems market. As environmental concerns escalate globally, governments and regulatory bodies are imposing increasingly strict emission standards to mitigate the impact of vehicular pollution. Fuel injection systems prove essential in this context by optimizing the combustion process, ensuring a more efficient and cleaner burn of fuel. Traditional carburetors and fuel injection systems enable specific control over the air-fuel mixture, minimizing unburned hydrocarbons and carbon monoxide emissions.

Automakers are forced to adopt advanced fuel injection technologies to meet these stringent standards, as fuel injection systems contribute significantly to reducing harmful exhaust emissions. This trend is particularly noticeable in regions with robust environmental regulations, promoting a growing market for Automotive Fuel Injection Systems. Manufacturers are investing in research and development to enhance the efficiency of fuel injection systems, aligning with the imperative of achieving lower emission levels and contributing to a more sustainable automotive industry.

Increase Fuel Efficiency and Performance Demands

The increasing importance of fuel efficiency and performance in the automotive industry creates a significant opportunity factor for the Automotive Fuel Injection Systems market. As global concerns regarding environmental sustainability and fuel conservation intensify, consumers are placing a higher premium on vehicles that offer superior fuel efficiency. Advanced fuel injection systems play a crucial role in meeting these demands by precisely controlling the delivery of fuel to the engine, optimizing combustion, and improving overall fuel economy.

The adoption of fuel injection technologies is boosting vehicle performance, with both automotive enthusiasts and consumers seeking improved power, correct response, and smoother engine operation. Advanced fuel injection systems, like GPI and CRDI, contribute to heightened engine performance, meeting consumers’ expectations for fuel efficiency and driving dynamics. This presents a significant opportunity for manufacturers in the Automotive Fuel Injection Systems market to develop and offer innovative solutions.

Automotive Fuel Injection Systems Market Segment Analysis:

Automotive Fuel Injection Systems Market Segmented based on Fuel Type, Injection System, Components, Vehicle Type, Technology, and Distribution Channel

By Fuel Type, Gasoline segment is expected to dominate the market during the forecast period

Gasoline engines, prevalent in passenger cars and smaller vehicles, are expected to remain the primary choice for consumers due to their perceived efficiency and performance advantages. The increasing stringency of emission regulations encourages automakers to adopt advanced gasoline fuel injection technologies to meet environmental standards. The advancements in Gasoline Direct Injection (GDI) systems, offering improved combustion efficiency and fuel economy, enhance the appeal of gasoline engines. The industry’s focus on developing cleaner and more fuel-efficient gasoline-powered vehicles supports the dominance of the gasoline segment in the Automotive Fuel Injection Systems market. As the automotive landscape evolves towards more eco-friendly solutions, the gasoline segment maintains its market leadership during the forecast period.

By Technology, Gasoline Port Injection (GPI) segment held the largest share in 2022

Gasoline Port Injection (GPI) is known for its reliability, cost-effectiveness, and simplicity, making it a preferred choice for various gasoline-powered vehicles. The established manufacturing infrastructure and familiarity among automakers contribute to its sustained dominance. Advanced technologies like Gasoline Direct Injection (GDI) offer certain advantages, GPI strikes a balance between performance and affordability, making it a pragmatic choice for a diverse range of applications. The forecasted dominance of GPI reflects the industry’s recognition of its track record and the practical considerations of both manufacturers and consumers. As the automotive landscape evolves, GPI is expected to remain a cornerstone technology, meeting the demands for efficiency, reliability, and cost-effectiveness in fuel injection systems.

Automotive Fuel Injection Systems Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The region is home to some of the world’s largest and fastest-growing automotive markets, such as China, Japan, Korea, and India, where rising incomes, urbanization, and increasing demand for personal vehicles fuel the growth of the automotive industry. As these markets continue to expand, there is a parallel increase in the production and consumption of vehicles, driving the demand for advanced fuel injection systems. The stringent emission standards and environmental concerns in the Asia Pacific region are pushing automotive manufacturers to adopt fuel-efficient and cleaner technologies, creating a favorable environment for the adoption of sophisticated fuel injection systems. The region’s emphasis on sustainable and eco-friendly transportation solutions aligns with the capabilities of fuel injection systems in optimizing combustion and reducing emissions.

Furthermore, technological advancements and innovations in fuel injection systems are often concentrated in the Asia Pacific, with key players and research centers contributing to the development of cutting-edge solutions. As the automotive industry undergoes a transformative shift towards electric and hybrid vehicles, the Asia Pacific region is expected to lead in integrating advanced fuel injection technologies into these evolving powertrain systems. Overall, the dominance of the Asia Pacific in the Automotive Fuel Injection Systems market reflects the region’s crucial role in the global automotive Industry.

Automotive Fuel Injection Systems Market Top Key Players:

Carter Fuel Systems, Llc (US)

Edekbrock, Llc (US)

Federal-Mogul Corporation (US)

Kinsler Fuel Injection (US)

Ucal Fuel Systems Ltd. (Canada)

Aptiv Plc (Ireland)

Bosch, Robert (Germany)

Continental Ag (Germany)

Magneti Marelli (Italy)

Magneti Marelli S.P.A. (Italy)

Denso Corporation (Japan)

Hitachi Limited (Japan)

Keihin Corporation (Japan)

Mikuni Corporation (Japan)

Ngk Spark Plug Co., Ltd. (Japan)

Other Active Players.

Key Industry Developments in the Automotive Fuel Injection Systems Market:

In December 2023, Stanadyne, a prominent global provider of fuel and air management systems, introduced an innovative enhancement kit for high-pressure port fuel injection (HPFI). This kit is designed to elevate fuel delivery pressures by up to 100 bar specifically for high-performance and racing gasoline engines. The unveiling of this ground-breaking aftermarket port injection technology took place at the 2023 PRI Show in Indianapolis.

In September 2023, Continental and Google Cloud have joined forces in a strategic partnership aimed at revolutionizing the automotive industry. The collaboration merges Continental’s automotive prowess with Google’s data and AI technologies to pioneer innovative in-vehicle experiences and advance automotive-grade software. The partnership signifies a commitment to enhancing safety, efficiency, and user-centricity in automotive solutions. Future collaboration avenues are anticipated, promising expanded connectivity and enriched customer experiences.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Fuel Injection Systems Market by Type (2018-2032)

4.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gasoline

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Diesel

Chapter 5: Automotive Fuel Injection Systems Market by Injection System (2018-2032)

5.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Single-point Injection (SPI)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multi-point Injection (MPI)

Chapter 6: Automotive Fuel Injection Systems Market by Components (2018-2032)

6.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Fuel injectors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fuel Pressure Regulator (FPR)

6.5 Fuel Pump

6.6 Electronic Control Unit (ECU)

Chapter 7: Automotive Fuel Injection Systems Market by Vehicle Type (2018-2032)

7.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Light Commercial Vehicles (LCVs)

7.5 Heavy Commercial Vehicles (HCVs)

Chapter 8: Automotive Fuel Injection Systems Market by Technology (2018-2032)

8.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Diesel Direct Injection

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Gasoline Port Injection

8.5 Gasoline Direct Injection

Chapter 9: Automotive Fuel Injection Systems Market by Distribution Channel (2018-2032)

9.1 Automotive Fuel Injection Systems Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Original Equipment Manufacturer (OEM)

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Aftermarket

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Automotive Fuel Injection Systems Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 CARL ZEISS MEDITEC AG (GERMANY)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 LEICA MICROSYSTEMS (GERMANY)

10.4 OLYMPUS CORPORATION (JAPAN)

10.5 HAAG-STREIT GROUP (SWITZERLAND)

10.6 SYNAPTIVE MEDICAL (CANADA)

10.7 ALCON INC. (SWITZERLAND)

10.8 TOPCON CORPORATION (JAPAN)

10.9 TAKAGI SEIKO COLTD. (JAPAN)

10.10 ARI MEDICAL TECHNOLOGY COLTD. (CHINA)

10.11 CHAMMED COLTD. (SOUTH KOREA)

10.12 SEILER INSTRUMENT INC. (UNITED STATES)

10.13 AND OTHER KEY PLAYERS

Chapter 11: Global Automotive Fuel Injection Systems Market By Region

11.1 Overview

11.2. North America Automotive Fuel Injection Systems Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Type

11.2.4.1 Gasoline

11.2.4.2 Diesel

11.2.5 Historic and Forecasted Market Size by Injection System

11.2.5.1 Single-point Injection (SPI)

11.2.5.2 Multi-point Injection (MPI)

11.2.6 Historic and Forecasted Market Size by Components

11.2.6.1 Fuel injectors

11.2.6.2 Fuel Pressure Regulator (FPR)

11.2.6.3 Fuel Pump

11.2.6.4 Electronic Control Unit (ECU)

11.2.7 Historic and Forecasted Market Size by Vehicle Type

11.2.7.1 Passenger Cars

11.2.7.2 Light Commercial Vehicles (LCVs)

11.2.7.3 Heavy Commercial Vehicles (HCVs)

11.2.8 Historic and Forecasted Market Size by Technology

11.2.8.1 Diesel Direct Injection

11.2.8.2 Gasoline Port Injection

11.2.8.3 Gasoline Direct Injection

11.2.9 Historic and Forecasted Market Size by Distribution Channel

11.2.9.1 Original Equipment Manufacturer (OEM)

11.2.9.2 Aftermarket

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Automotive Fuel Injection Systems Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Type

11.3.4.1 Gasoline

11.3.4.2 Diesel

11.3.5 Historic and Forecasted Market Size by Injection System

11.3.5.1 Single-point Injection (SPI)

11.3.5.2 Multi-point Injection (MPI)

11.3.6 Historic and Forecasted Market Size by Components

11.3.6.1 Fuel injectors

11.3.6.2 Fuel Pressure Regulator (FPR)

11.3.6.3 Fuel Pump

11.3.6.4 Electronic Control Unit (ECU)

11.3.7 Historic and Forecasted Market Size by Vehicle Type

11.3.7.1 Passenger Cars

11.3.7.2 Light Commercial Vehicles (LCVs)

11.3.7.3 Heavy Commercial Vehicles (HCVs)

11.3.8 Historic and Forecasted Market Size by Technology

11.3.8.1 Diesel Direct Injection

11.3.8.2 Gasoline Port Injection

11.3.8.3 Gasoline Direct Injection

11.3.9 Historic and Forecasted Market Size by Distribution Channel

11.3.9.1 Original Equipment Manufacturer (OEM)

11.3.9.2 Aftermarket

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Automotive Fuel Injection Systems Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Type

11.4.4.1 Gasoline

11.4.4.2 Diesel

11.4.5 Historic and Forecasted Market Size by Injection System

11.4.5.1 Single-point Injection (SPI)

11.4.5.2 Multi-point Injection (MPI)

11.4.6 Historic and Forecasted Market Size by Components

11.4.6.1 Fuel injectors

11.4.6.2 Fuel Pressure Regulator (FPR)

11.4.6.3 Fuel Pump

11.4.6.4 Electronic Control Unit (ECU)

11.4.7 Historic and Forecasted Market Size by Vehicle Type

11.4.7.1 Passenger Cars

11.4.7.2 Light Commercial Vehicles (LCVs)

11.4.7.3 Heavy Commercial Vehicles (HCVs)

11.4.8 Historic and Forecasted Market Size by Technology

11.4.8.1 Diesel Direct Injection

11.4.8.2 Gasoline Port Injection

11.4.8.3 Gasoline Direct Injection

11.4.9 Historic and Forecasted Market Size by Distribution Channel

11.4.9.1 Original Equipment Manufacturer (OEM)

11.4.9.2 Aftermarket

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Automotive Fuel Injection Systems Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Type

11.5.4.1 Gasoline

11.5.4.2 Diesel

11.5.5 Historic and Forecasted Market Size by Injection System

11.5.5.1 Single-point Injection (SPI)

11.5.5.2 Multi-point Injection (MPI)

11.5.6 Historic and Forecasted Market Size by Components

11.5.6.1 Fuel injectors

11.5.6.2 Fuel Pressure Regulator (FPR)

11.5.6.3 Fuel Pump

11.5.6.4 Electronic Control Unit (ECU)

11.5.7 Historic and Forecasted Market Size by Vehicle Type

11.5.7.1 Passenger Cars

11.5.7.2 Light Commercial Vehicles (LCVs)

11.5.7.3 Heavy Commercial Vehicles (HCVs)

11.5.8 Historic and Forecasted Market Size by Technology

11.5.8.1 Diesel Direct Injection

11.5.8.2 Gasoline Port Injection

11.5.8.3 Gasoline Direct Injection

11.5.9 Historic and Forecasted Market Size by Distribution Channel

11.5.9.1 Original Equipment Manufacturer (OEM)

11.5.9.2 Aftermarket

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Automotive Fuel Injection Systems Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Type

11.6.4.1 Gasoline

11.6.4.2 Diesel

11.6.5 Historic and Forecasted Market Size by Injection System

11.6.5.1 Single-point Injection (SPI)

11.6.5.2 Multi-point Injection (MPI)

11.6.6 Historic and Forecasted Market Size by Components

11.6.6.1 Fuel injectors

11.6.6.2 Fuel Pressure Regulator (FPR)

11.6.6.3 Fuel Pump

11.6.6.4 Electronic Control Unit (ECU)

11.6.7 Historic and Forecasted Market Size by Vehicle Type

11.6.7.1 Passenger Cars

11.6.7.2 Light Commercial Vehicles (LCVs)

11.6.7.3 Heavy Commercial Vehicles (HCVs)

11.6.8 Historic and Forecasted Market Size by Technology

11.6.8.1 Diesel Direct Injection

11.6.8.2 Gasoline Port Injection

11.6.8.3 Gasoline Direct Injection

11.6.9 Historic and Forecasted Market Size by Distribution Channel

11.6.9.1 Original Equipment Manufacturer (OEM)

11.6.9.2 Aftermarket

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Automotive Fuel Injection Systems Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Type

11.7.4.1 Gasoline

11.7.4.2 Diesel

11.7.5 Historic and Forecasted Market Size by Injection System

11.7.5.1 Single-point Injection (SPI)

11.7.5.2 Multi-point Injection (MPI)

11.7.6 Historic and Forecasted Market Size by Components

11.7.6.1 Fuel injectors

11.7.6.2 Fuel Pressure Regulator (FPR)

11.7.6.3 Fuel Pump

11.7.6.4 Electronic Control Unit (ECU)

11.7.7 Historic and Forecasted Market Size by Vehicle Type

11.7.7.1 Passenger Cars

11.7.7.2 Light Commercial Vehicles (LCVs)

11.7.7.3 Heavy Commercial Vehicles (HCVs)

11.7.8 Historic and Forecasted Market Size by Technology

11.7.8.1 Diesel Direct Injection

11.7.8.2 Gasoline Port Injection

11.7.8.3 Gasoline Direct Injection

11.7.9 Historic and Forecasted Market Size by Distribution Channel

11.7.9.1 Original Equipment Manufacturer (OEM)

11.7.9.2 Aftermarket

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Automotive Fuel Injection Systems Market research report?

A1: The forecast period in the Automotive Fuel Injection Systems Market research report is 2025-2032.

Q2: Who are the key players in the Automotive Fuel Injection Systems Market?

A2: Carter Fuel Systems, Llc (US), Edekbrock, Llc (US), Federal-Mogul Corporation (US), Kinsler Fuel Injection (US), Ucal Fuel Systems Ltd. (Canada), Aptiv Plc (Ireland), Bosch, Robert (Germany), Continental Ag (Germany), Magneti Marelli (Italy), Denso Corporation (Japan), Hitachi Limited (Japan), Keihin Corporation (Japan), Mikuni Corporation (Japan), Ngk Spark Plug Co., Ltd. (Japan), and Other Active Players.

Q3: What are the segments of the Automotive Fuel Injection Systems Market?

A3: The Automotive Fuel Injection Systems Market is segmented into Fuel Type, Injection System, Components, Vehicle Type, Technology, Distribution Channel, and region. By Fuel Type, the market is categorized into Gasoline and Diesel. By Injection System, the market is categorized into Single-point Injection (SPI) and multi-point Injection (MPI). By Components, the market is categorized into Fuel injectors, Fuel Pressure Regulator (FPR), Fuel pumps, and Electronic Control Units (ECU). By Vehicle Type, the market is categorized into Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). By Technology, the market is categorized into Diesel Direct Injection, Gasoline Port Injection, and Gasoline Direct Injection. By Distribution Channel, the market is categorized into Original Equipment Manufacturer (OEM), and Aftermarket. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the Automotive Fuel Injection Systems Market?

A4: Automotive Fuel Injection Systems are integral components in internal combustion engines, precisely delivering fuel to the engine cylinders. These systems optimize combustion efficiency, enhancing vehicle performance and fuel efficiency. They consist of fuel injectors, a fuel pump, a pressure regulator, and an Electronic Control Unit (ECU) that manages the injection process. Fuel can be injected directly into the combustion chamber (Direct Fuel Injection) or the intake port (Port Fuel Injection). Catering to both gasoline and diesel engines, these systems play a dynamic role in modern vehicles, ensuring precise fuel delivery, reduced emissions, and compliance with stringent environmental standards.

Q5: How big is the Automotive Fuel Injection Systems Market?

A5: Automotive Fuel Injection Systems Market Size Was Valued at USD 94.13 Billion in 2024, and is Projected to Reach USD 155.20 Billion by 2032, Growing at a CAGR of 6.45% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!