Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Collision Repair Market – Growth & Future Trends

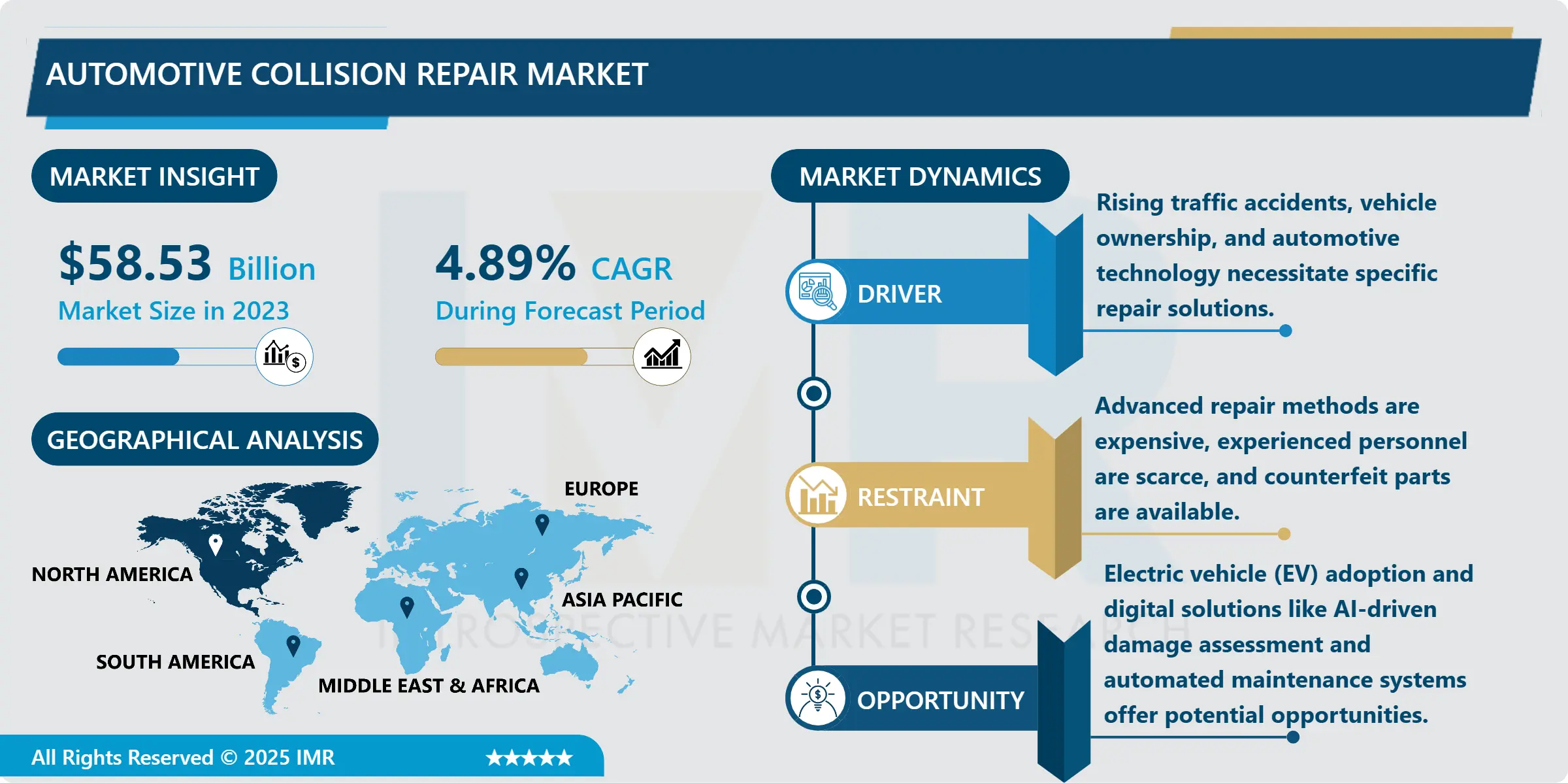

Automotive Collision Repair Market Size Was Valued at USD 58.53 Billion in 2023, and is Projected to Reach USD 82.71 Billion by 2032, Growing at a CAGR of 4.89% From 2024-2032.

IMR Group

Description

Automotive Collision Repair Market Synopsis:

Automotive Collision Repair Market Size Was Valued at USD 58.53 Billion in 2023, and is Projected to Reach USD 82.71 Billion by 2032, Growing at a CAGR of 4.89% From 2024-2032.

The Automotive Collision Repair Market comprises all the goods and services required to restore vehicles that has been impacted through an accident, collision or any other kind of impact. This market encompasses those undertaking repair work, replacement of a faulty component(s), painting, denting removal, and structures repair among others while using both OEM and aftermarket parts to facilitate the repair. There are many players in this ecosystem such as independents shops, car dealers, insurance companies and suppliers of car parts. A growing number of vehicles in the world and more and more frequent road accidents drive the need for collision repairs.

ADAS, lightweight vehicle materials, car connectivity and innovations in powertrains are altering the dynamics of this market by demanding corresponding approaches to maintenance and repair. Thus, the growing usage of EVs complicates collision repair procedures, and as a result, there is a requirement for higher training and service introducing. Consumers really value quality services and they also do not want their devices to be out of service for very long hence advanced repair solutions like AI for assessment of the damage and auto painting solutions.

The position of insurance in the collision repair market is importance since a majority of collision repairs are paid through insurance claims. Higher customer awareness on insured repair and improvement and extension of insurance services are the factors impacting growth. Nevertheless, factors such as fake components, skilled workforce unavailability and high cost of various forms of repairing technologies are likely to act as restriction to the markets’ growth. However, the automotive collision repair market remains with the possibility of steady growth due to factors such as increased urbanization and consumer disposable incomes coupled with technological advancement in repair industry.

Automotive Collision Repair Market Trend Analysis:

Integration of Advanced Driver-Assistance Systems (ADAS) in Repairs

As the number of installed Advanced Driver Assistance Systems (ADAS) features increases, including lane departure warnings, adaptive cruise control, and automatic emergency braking, the automotive collision repair market is undergoing significant transformation. Vehicles equipped with these sophisticated technologies require meticulous fine-tuning and recalibration after sustaining any damage, creating a growing demand for specialized diagnostic equipment and advanced repair tools.

Small and medium-sized businesses (SMBs) in the repair sector are increasingly investing in high-end diagnostic tools, calibration systems, and continuous education programs to meet these evolving technological needs. This shift is not only enhancing the skill sets of technicians but also revolutionizing traditional repair processes within collision repair services. The reliance on advanced technology is elevating the industry’s standards, making technology integration a critical factor for success. Ultimately, ADAS technologies are reshaping the future of collision repair, promoting innovation and precision.

Rising Influence of Digital Solutions and Automation

The collision repair market is undergoing a dramatic transformation due to rapid technological advancements. Concepts such as computerized damage estimation, driven by artificial intelligence, and the emergence of autonomously controlled repair systems are reshaping traditional repair practices. New indirect technologies are playing a crucial role, including mobile applications that allow users to quickly assess estimated repair costs, automatic digital claims processing systems, and innovative automated painting solutions. These advancements improve efficiency and enhance accuracy in the repair process.

The introduction of cloud-based solutions has led to significant improvements in communication and collaboration between repair centers, insurance companies, and parts suppliers. This interconnected ecosystem facilitates faster decision-making, greater transparency, and a substantial increase in the overall speed of the repair cycle. As a result, the entire collision repair industry is becoming more streamlined, customer-friendly, and technologically advanced.

Automotive Collision Repair Market Segment Analysis:

Automotive Collision Repair Market is Segmented on the basis of Product Type, Repair Type, Service Channel, Sales Channel, Shop Type, Vehicle Type, and Region.

By Product Type, the Spare Parts segment is expected to dominate the market during the forecast period

The Automotive Collision Repair Market by product type consists of spare parts, replacement parts, paintings & coatings and consumables wherein all these products are an essential element of the repair value chain. The largest groups of components sold include spare and replacement parts including bumpers, fenders and windscreen as these are some of the most critical auto parts which need to be replaced in case of an accident or mechanical failure.

The body works employs paintings and coatings that play a crucial role in the aesthetic aspect of restoration, which gives the car its new look after a repair; the new growths in the painting industry pertain to the environmentally friendly products and the fast-drying assortments. Expenses such as adhesive, abrasive, and cleaning materials are used during repair to show the importance of using high quality materials for repairing services with long life cycle duration and precision.

By Vehicle Type, Passenger Cars egment expected to held the largest share

The Automotive Collision Repair Market also offer services to a wide variety of vehicles such as cars, Multi-purpose Vehicles and Light Commercial Vehicles, Heavy Commercial vehicles, and two-wheeler, each segment holding a different position in the market. This includes passenger car, which accounts for the majority of the insured type of automobile because majority of the people own them, use them often and are more likely to have an accident in the urban center than owners of other type of automobile.

The demand of commercial vehicle such as truck, buses etc are high in the market since they cover lots of kilometer and they are frequently used for heavy duty jobs. low achievers to the market especially in the densely populated and developing regions and are easily involved in accidents in traffic congested areas. Every segment requires specific repair services ranging from premium car spare parts for affects sales and passenger cars to affordable parts for commercial and two-wheeled vehicles and thus establishing interdependence.

Automotive Collision Repair Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is estimated to hold the highest market share in the automotive collision repair industry, driven by several key factors. The region has a large number of vehicles on the road, and a majority of the population owns at least one vehicle, creating a strong base for repair services. Additionally, the market benefits from a highly developed and concentrated network of repair shops and service centers that offer specialized and efficient services.

Another significant factor contributing to market growth is the presence of a well-established insurance sector, which provides broad and comprehensive coverage for collision repairs, thereby encouraging customers to seek professional repair solutions. Moreover, the rising popularity of electric vehicles and self-driving cars, particularly in the United States and Canada, is fueling the demand for specialized services like ADAS (Advanced Driver-Assistance Systems) repair. Technological advancements and increased consumer focus on high-quality repairs further solidify North America’s leading position in this market.

Active Key Players in the Automotive Collision Repair Market:

DENSO CORPORATION (Japan)

Robert Bosch GmbH (Germany)

Continental AG (Germany)

3M (USA)

AISIN CORPORATION (Japan)

VALEO S.A. (France)

Hyundai Motor Company (South Korea)

DuPont (USA)

Nippon Paint Holdings Co., Ltd (Japan)

Tenneco Inc. (USA)

Honeywell International Inc. (USA)

Henkel AG & Co. KGaA (Germany)

Magna International Inc (Canada)

OPmobility SE (Germany)

FORVIA Faurecia (France)

Martinrea International Inc (Canada)

MANN+HUMMEL (Germany)

Mitsuba Corp. (Japan)

ABRA Auto Body Repair of America (USA)

Caliber Holdings LLC (USA)

Gerber Collision & Glass (USA)

ATP Automotive (USA)

AMERICA’S AUTO BODY (USA)

Jeff Schmitt (USA)

Mitsubishi (Japan)

Automotive Technology (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Collision Repair Market by Product Type

4.1 Automotive Collision Repair Market Snapshot and Growth Engine

4.2 Automotive Collision Repair Market Overview

4.3 Spare Parts

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Spare Parts: Geographic Segmentation Analysis

4.4 Replacement Parts

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Replacement Parts: Geographic Segmentation Analysis

4.5 Paintings & Coatings

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Paintings & Coatings: Geographic Segmentation Analysis

4.6 and Consumables

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Consumables: Geographic Segmentation Analysis

Chapter 5: Automotive Collision Repair Market by Repair Type

5.1 Automotive Collision Repair Market Snapshot and Growth Engine

5.2 Automotive Collision Repair Market Overview

5.3 Dent Removal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Dent Removal: Geographic Segmentation Analysis

5.4 Auto Glass Replacement

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Auto Glass Replacement: Geographic Segmentation Analysis

5.5 Straightening Out Bent Metal

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Straightening Out Bent Metal: Geographic Segmentation Analysis

5.6 Replacing Doors or Panels

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Replacing Doors or Panels: Geographic Segmentation Analysis

5.7 Paint Matching

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Paint Matching: Geographic Segmentation Analysis

5.8 Scratch Removal

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Scratch Removal: Geographic Segmentation Analysis

5.9 Auto Detailing

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Auto Detailing: Geographic Segmentation Analysis

5.10 and Others

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 and Others: Geographic Segmentation Analysis

Chapter 6: Automotive Collision Repair Market by Service Channel

6.1 Automotive Collision Repair Market Snapshot and Growth Engine

6.2 Automotive Collision Repair Market Overview

6.3 OE

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 OE: Geographic Segmentation Analysis

6.4 DIFM (Do it for Me)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 DIFM (Do it for Me): Geographic Segmentation Analysis

6.5 and DIY (Do it Yourself)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and DIY (Do it Yourself): Geographic Segmentation Analysis

Chapter 7: Automotive Collision Repair Market by Sales Channel

7.1 Automotive Collision Repair Market Snapshot and Growth Engine

7.2 Automotive Collision Repair Market Overview

7.3 New OEM

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 New OEM: Geographic Segmentation Analysis

7.4 After

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 After: Geographic Segmentation Analysis

7.5 Recycled

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Recycled: Geographic Segmentation Analysis

7.6 Remanufactured

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Remanufactured: Geographic Segmentation Analysis

7.7 and Salvage

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 and Salvage: Geographic Segmentation Analysis

Chapter 8: Automotive Collision Repair Market by Shops Type

8.1 Automotive Collision Repair Market Snapshot and Growth Engine

8.2 Automotive Collision Repair Market Overview

8.3 Auto Body Shops

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Auto Body Shops: Geographic Segmentation Analysis

8.4 Dealer Owned Shops

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Dealer Owned Shops: Geographic Segmentation Analysis

8.5 Independent Repair Shops

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Independent Repair Shops: Geographic Segmentation Analysis

Chapter 9: Automotive Collision Repair Market by Vehicle Type

9.1 Automotive Collision Repair Market Snapshot and Growth Engine

9.2 Automotive Collision Repair Market Overview

9.3 Passenger Cars

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Passenger Cars: Geographic Segmentation Analysis

9.4 Commercial Vehicle

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Commercial Vehicle: Geographic Segmentation Analysis

9.5 and Two Wheelers

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 and Two Wheelers: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Automotive Collision Repair Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 DENSO CORPORATION (JAPAN)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 ROBERT BOSCH GMBH (GERMANY)

10.4 CONTINENTAL AG (GERMANY)

10.5 3M (USA)

10.6 AISIN CORPORATION (JAPAN)

10.7 VALEO S.A. (FRANCE)

10.8 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

10.9 DUPONT (USA)

10.10 NIPPON PAINT HOLDINGS CO. LTD (JAPAN)

10.11 TENNECO INC. (USA)

10.12 HONEYWELL INTERNATIONAL INC. (USA)

10.13 HENKEL AG & CO. KGAA (GERMANY)

10.14 MAGNA INTERNATIONAL INC (CANADA)

10.15 OPMOBILITY SE (GERMANY)

10.16 FORVIA FAURECIA (FRANCE)

10.17 MARTINREA INTERNATIONAL INC (CANADA)

10.18 MANN+HUMMEL (GERMANY)

10.19 MITSUBA CORP. (JAPAN)

10.20 ABRA AUTO BODY REPAIR OF AMERICA (USA)

10.21 CALIBER HOLDINGS LLC (USA)

10.22 GERBER COLLISION & GLASS (USA)

10.23 ATP AUTOMOTIVE (USA)

10.24 AMERICA’S AUTO BODY (USA)

10.25 JEFF SCHMITT (USA)

10.26 MITSUBISHI (JAPAN)

10.27 AUTOMOTIVE TECHNOLOGY (USA)

10.28 AMONG OTHER ACTIVE PLAYERS

Chapter 11: Global Automotive Collision Repair Market By Region

11.1 Overview

11.2. North America Automotive Collision Repair Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Product Type

11.2.4.1 Spare Parts

11.2.4.2 Replacement Parts

11.2.4.3 Paintings & Coatings

11.2.4.4 and Consumables

11.2.5 Historic and Forecasted Market Size By Repair Type

11.2.5.1 Dent Removal

11.2.5.2 Auto Glass Replacement

11.2.5.3 Straightening Out Bent Metal

11.2.5.4 Replacing Doors or Panels

11.2.5.5 Paint Matching

11.2.5.6 Scratch Removal

11.2.5.7 Auto Detailing

11.2.5.8 and Others

11.2.6 Historic and Forecasted Market Size By Service Channel

11.2.6.1 OE

11.2.6.2 DIFM (Do it for Me)

11.2.6.3 and DIY (Do it Yourself)

11.2.7 Historic and Forecasted Market Size By Sales Channel

11.2.7.1 New OEM

11.2.7.2 After

11.2.7.3 Recycled

11.2.7.4 Remanufactured

11.2.7.5 and Salvage

11.2.8 Historic and Forecasted Market Size By Shops Type

11.2.8.1 Auto Body Shops

11.2.8.2 Dealer Owned Shops

11.2.8.3 Independent Repair Shops

11.2.9 Historic and Forecasted Market Size By Vehicle Type

11.2.9.1 Passenger Cars

11.2.9.2 Commercial Vehicle

11.2.9.3 and Two Wheelers

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Automotive Collision Repair Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Product Type

11.3.4.1 Spare Parts

11.3.4.2 Replacement Parts

11.3.4.3 Paintings & Coatings

11.3.4.4 and Consumables

11.3.5 Historic and Forecasted Market Size By Repair Type

11.3.5.1 Dent Removal

11.3.5.2 Auto Glass Replacement

11.3.5.3 Straightening Out Bent Metal

11.3.5.4 Replacing Doors or Panels

11.3.5.5 Paint Matching

11.3.5.6 Scratch Removal

11.3.5.7 Auto Detailing

11.3.5.8 and Others

11.3.6 Historic and Forecasted Market Size By Service Channel

11.3.6.1 OE

11.3.6.2 DIFM (Do it for Me)

11.3.6.3 and DIY (Do it Yourself)

11.3.7 Historic and Forecasted Market Size By Sales Channel

11.3.7.1 New OEM

11.3.7.2 After

11.3.7.3 Recycled

11.3.7.4 Remanufactured

11.3.7.5 and Salvage

11.3.8 Historic and Forecasted Market Size By Shops Type

11.3.8.1 Auto Body Shops

11.3.8.2 Dealer Owned Shops

11.3.8.3 Independent Repair Shops

11.3.9 Historic and Forecasted Market Size By Vehicle Type

11.3.9.1 Passenger Cars

11.3.9.2 Commercial Vehicle

11.3.9.3 and Two Wheelers

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Automotive Collision Repair Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Product Type

11.4.4.1 Spare Parts

11.4.4.2 Replacement Parts

11.4.4.3 Paintings & Coatings

11.4.4.4 and Consumables

11.4.5 Historic and Forecasted Market Size By Repair Type

11.4.5.1 Dent Removal

11.4.5.2 Auto Glass Replacement

11.4.5.3 Straightening Out Bent Metal

11.4.5.4 Replacing Doors or Panels

11.4.5.5 Paint Matching

11.4.5.6 Scratch Removal

11.4.5.7 Auto Detailing

11.4.5.8 and Others

11.4.6 Historic and Forecasted Market Size By Service Channel

11.4.6.1 OE

11.4.6.2 DIFM (Do it for Me)

11.4.6.3 and DIY (Do it Yourself)

11.4.7 Historic and Forecasted Market Size By Sales Channel

11.4.7.1 New OEM

11.4.7.2 After

11.4.7.3 Recycled

11.4.7.4 Remanufactured

11.4.7.5 and Salvage

11.4.8 Historic and Forecasted Market Size By Shops Type

11.4.8.1 Auto Body Shops

11.4.8.2 Dealer Owned Shops

11.4.8.3 Independent Repair Shops

11.4.9 Historic and Forecasted Market Size By Vehicle Type

11.4.9.1 Passenger Cars

11.4.9.2 Commercial Vehicle

11.4.9.3 and Two Wheelers

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Automotive Collision Repair Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Product Type

11.5.4.1 Spare Parts

11.5.4.2 Replacement Parts

11.5.4.3 Paintings & Coatings

11.5.4.4 and Consumables

11.5.5 Historic and Forecasted Market Size By Repair Type

11.5.5.1 Dent Removal

11.5.5.2 Auto Glass Replacement

11.5.5.3 Straightening Out Bent Metal

11.5.5.4 Replacing Doors or Panels

11.5.5.5 Paint Matching

11.5.5.6 Scratch Removal

11.5.5.7 Auto Detailing

11.5.5.8 and Others

11.5.6 Historic and Forecasted Market Size By Service Channel

11.5.6.1 OE

11.5.6.2 DIFM (Do it for Me)

11.5.6.3 and DIY (Do it Yourself)

11.5.7 Historic and Forecasted Market Size By Sales Channel

11.5.7.1 New OEM

11.5.7.2 After

11.5.7.3 Recycled

11.5.7.4 Remanufactured

11.5.7.5 and Salvage

11.5.8 Historic and Forecasted Market Size By Shops Type

11.5.8.1 Auto Body Shops

11.5.8.2 Dealer Owned Shops

11.5.8.3 Independent Repair Shops

11.5.9 Historic and Forecasted Market Size By Vehicle Type

11.5.9.1 Passenger Cars

11.5.9.2 Commercial Vehicle

11.5.9.3 and Two Wheelers

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Automotive Collision Repair Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Product Type

11.6.4.1 Spare Parts

11.6.4.2 Replacement Parts

11.6.4.3 Paintings & Coatings

11.6.4.4 and Consumables

11.6.5 Historic and Forecasted Market Size By Repair Type

11.6.5.1 Dent Removal

11.6.5.2 Auto Glass Replacement

11.6.5.3 Straightening Out Bent Metal

11.6.5.4 Replacing Doors or Panels

11.6.5.5 Paint Matching

11.6.5.6 Scratch Removal

11.6.5.7 Auto Detailing

11.6.5.8 and Others

11.6.6 Historic and Forecasted Market Size By Service Channel

11.6.6.1 OE

11.6.6.2 DIFM (Do it for Me)

11.6.6.3 and DIY (Do it Yourself)

11.6.7 Historic and Forecasted Market Size By Sales Channel

11.6.7.1 New OEM

11.6.7.2 After

11.6.7.3 Recycled

11.6.7.4 Remanufactured

11.6.7.5 and Salvage

11.6.8 Historic and Forecasted Market Size By Shops Type

11.6.8.1 Auto Body Shops

11.6.8.2 Dealer Owned Shops

11.6.8.3 Independent Repair Shops

11.6.9 Historic and Forecasted Market Size By Vehicle Type

11.6.9.1 Passenger Cars

11.6.9.2 Commercial Vehicle

11.6.9.3 and Two Wheelers

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Automotive Collision Repair Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Product Type

11.7.4.1 Spare Parts

11.7.4.2 Replacement Parts

11.7.4.3 Paintings & Coatings

11.7.4.4 and Consumables

11.7.5 Historic and Forecasted Market Size By Repair Type

11.7.5.1 Dent Removal

11.7.5.2 Auto Glass Replacement

11.7.5.3 Straightening Out Bent Metal

11.7.5.4 Replacing Doors or Panels

11.7.5.5 Paint Matching

11.7.5.6 Scratch Removal

11.7.5.7 Auto Detailing

11.7.5.8 and Others

11.7.6 Historic and Forecasted Market Size By Service Channel

11.7.6.1 OE

11.7.6.2 DIFM (Do it for Me)

11.7.6.3 and DIY (Do it Yourself)

11.7.7 Historic and Forecasted Market Size By Sales Channel

11.7.7.1 New OEM

11.7.7.2 After

11.7.7.3 Recycled

11.7.7.4 Remanufactured

11.7.7.5 and Salvage

11.7.8 Historic and Forecasted Market Size By Shops Type

11.7.8.1 Auto Body Shops

11.7.8.2 Dealer Owned Shops

11.7.8.3 Independent Repair Shops

11.7.9 Historic and Forecasted Market Size By Vehicle Type

11.7.9.1 Passenger Cars

11.7.9.2 Commercial Vehicle

11.7.9.3 and Two Wheelers

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Automotive Collision Repair Market research report?

A1: The forecast period in the Automotive Collision Repair Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Collision Repair Market?

A2: DENSO CORPORATION (Japan), Robert Bosch GmbH (Germany), Continental AG (Germany), 3M (USA), AISIN CORPORATION (Japan), VALEO S.A. (France), Hyundai Motor Company (South Korea), DuPont (USA), Nippon Paint Holdings Co., Ltd (Japan), Tenneco Inc. (USA), Honeywell International Inc. (USA), Henkel AG & Co. KGaA (Germany), Magna International Inc (Canada), OPmobility SE (Germany), FORVIA Faurecia (France), Martinrea International Inc (Canada), MANN+HUMMEL (Germany), Mitsuba Corp. (Japan), ABRA Auto Body Repair of America (USA), Caliber Holdings LLC (USA), Gerber Collision & Glass (USA), ATP Automotive (USA), AMERICA'S AUTO BODY (USA), Jeff Schmitt (USA), Mitsubishi (Japan), Automotive Technology (USA), and Other Active Players.

Q3: What are the segments of the Automotive Collision Repair Market?

A3: The Automotive Collision Repair Market is segmented into Product Type, Repair Type, Service Channel, Sales Channel, Shop Type, Vehicle Type, and region. By Product Type, the market is categorized into Spare Parts, Replacement Parts, Paintings & Coatings, and Consumables. By Repair Type, the market is categorized into Dent Removal, Auto Glass Replacement, Straightening Out Bent Metal, Replacing Doors or Panels, Paint Matching, Scratch Removal, Auto Detailing, and Others. By Service Channel, the market is categorized into OE, DIFM, and DIY. By Sales Channel, the market is categorized into New OEM, Aftermarket, Recycled, Remanufactured, and Salvage. By Shop Type, the market is categorized into Auto Body Shops, Dealer-Owned Shops, and Independent Repair Shops. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, and Two Wheelers. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Collision Repair Market?

A4: Automotive collision repair refers to the process of restoring vehicles to their pre-accident condition after damage caused by collisions, accidents, or other external impacts. This includes a range of services such as dent removal, frame straightening, body panel replacement, painting, and repair or replacement of damaged components. Utilizing both original equipment manufacturer (OEM) and aftermarket parts, collision repair ensures structural integrity, aesthetic restoration, and functional safety of the vehicle. The process often involves collaboration with insurance companies, repair shops, and parts suppliers to provide timely and cost-effective solutions.

Q5: How big is the Automotive Collision Repair Market?

A5: Automotive Collision Repair Market Size Was Valued at USD 58.53 Billion in 2023, and is Projected to Reach USD 82.71 Billion by 2032, Growing at a CAGR of 4.89% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!