Stay Ahead in Fast-Growing Economies.

Browse Reports NowAnti-malarial Drugs Market – Latest Advancement & Future Trends (2024-2032)

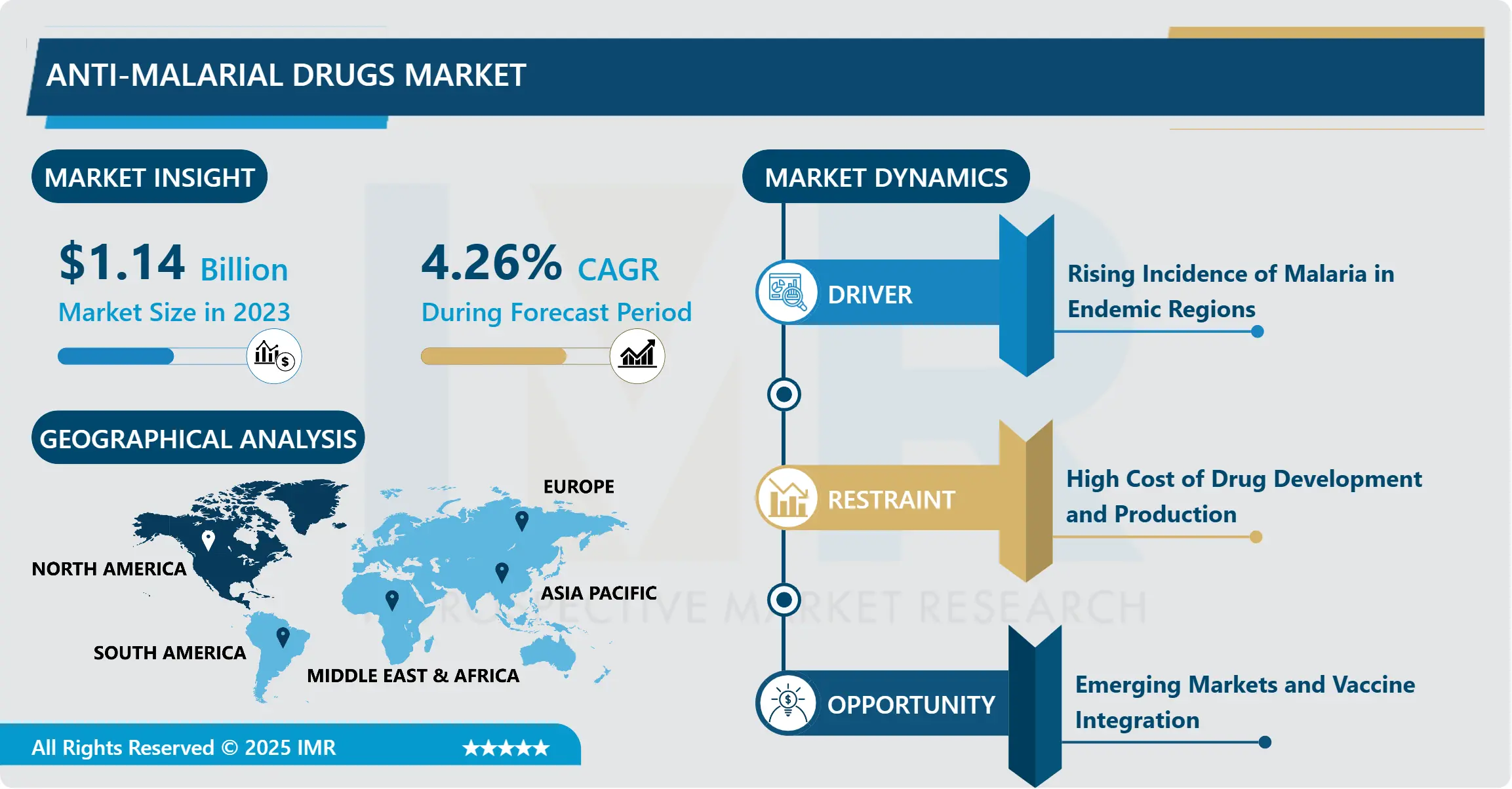

Anti-malarial Drugs Market Size Was Valued at USD 1.14 Billion in 2023, and is Projected to Reach USD 1.66 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.

IMR Group

Description

Anti-malarial Drugs Market Synopsis:

Anti-malarial Drugs Market Size Was Valued at USD 1.14 Billion in 2023, and is Projected to Reach USD 1.66 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.

The anti-malarial drugs market describes the global business of manufacturing and distributing drugs used to treat or prevent malaria, an often-fatal disease diagnosed in millions of individuals each year and transmitted by the bite of infected Anopheles mosquito that carries the Plasmodium parasite. Artemisinin based combination therapy (ACTs), chloroquine, quinine, and handful of new molecules currently under development aiming at the several stage of the Malaria parasite’s development. In this process, the market is determined by the global burden of mal aria, prospective R&D activities for new treatments, and government led malaria elimination programs for medication distribution.

The global anti-malarial drugs market has been a significant focus in the healthcare sector due to the ongoing battle against malaria, especially in tropical and subtropical regions. Malaria continues to be one of the most prominent infectious diseases globally, with the World Health Organization (WHO) estimating around 200 million cases annually and more than 400,000 deaths, predominantly in sub-Saharan Africa. The increasing prevalence of drug-resistant strains of malaria parasites has driven the need for more advanced anti-malarial treatments. Consequently, the demand for effective, affordable, and accessible anti-malarial drugs has surged, especially in countries with high malaria incidence rates, leading to the expansion of market players focusing on developing new drug formulations and delivery mechanisms.

The anti-malarial drug market is also influenced by the dynamics of public health initiatives and global collaborations to combat the disease. International organizations, non-governmental organizations (NGOs), and governments contribute to efforts aimed at controlling malaria through funding, education, and mass drug administration (MDA) programs. Additionally, there has been an increase in research into developing next-generation anti-malarial drugs that are more effective, have fewer side effects, and can combat emerging drug-resistant strains of the parasite. Factors like pricing pressure, the cost-effectiveness of treatments, and affordability in endemic regions also contribute to the market’s dynamics.

Anti-malarial Drugs Market Trend Analysis:

Rising Adoption of Artemisinin-Based Combination Therapies (ACTs)

Another obvious trend that has cropped up in anti- malarial drugs market is the integration of ACTs in the world market. Oral Artesunate’s are popularly accepted as the best treatment for uncomplicated Plasmodium falciparum malaria which is deadly. These are artemisinin-based combination therapy and involve incorporating fast-acting, high parasite killing drugs with other anti-malarial drugs that reduce the chances of developing drug-resistant parasites. The emergence of resistance to art emission in some malaria strains in South eastern Asia has made it clear that such combinatorial therapies are necessary for the durability of the drugs.

A direct result of the escalating threat of resistance and the ever-growing global toll malaria is taking, the WHO and other global health institutions have made ACTs abundantly available across the globe. As a result higher levels of production and distribution have been observed, especially in the regions where malaria remains a major problem in Africa and parts of Asia. Governments and healthcare agencies are also focussing on procurement of ACTs to create adequate stock piles for mass distribution programs that increase the market at large. Such efforts are vital not only in the sustaining the fight against malaria internationally but also in guaranteeing that ACTs are kept available to the populations which need them the most.

Expanding Role of Vaccine Development in Malaria Control

The other major opportunity that exist in the current anti-malarial drugs market includes shift towards malaria vaccines. The malaria vaccine by GlaxoSmithKline known as RTS,S/AS01 was very instrumental in getting a nod from the World Health Organization as the first malaria vaccine. This vaccine afford about 50% protection against the most lethal form of malaria, Plasmodium falciparum malaria. It is the significant development in malaria prevention which provides additional method together with other medications. It is the world’s first available vaccine to be launched in highly affected malaria areas and a significant step towards malaria eradication. This has led to more malaria vaccines which are still under trial and the ones targeting RSA, alternative Plasmodium species and those with greater efficacy rates than RTS,S/AS01.

Malaria vaccines at this stage of development have great potential to bring about a reduction of malaria prevalence in the world besides bringing about a shift in the approach towards the treatment and prevention of the disease. The fact that vaccines are now being incorporated into malaria control initiatives presents market actors with the best chance to engage with affected governments and public health outlets to ramp up the fight against malaria. The launching of more of these vaccines in the endemic zones shall consequently decrease the continued reliance on anti-malarial drugs in the long-term, spur the development of new comprehensive integrated strategies of prevention and managing malaria, and extend the horizons of market growth.

Anti-malarial Drugs Market Segment Analysis:

Anti-malarial Drugs Market is Segmented on the basis of Drug Type, Route of Administration, End User, and Region.

By Drug Type, Chloroquine segment is expected to dominate the market during the forecast period

Anti-malarial drugs mainly by division on the type of drugs which are used to cure malaria. ACT stands for artemisinin-based combination therapies which are the most effective treatment for dealing with uncomplicated P. falciparum malaria. These are co aids, artemisinin derivatives are administered with other anti-malarial drugs to increase effectiveness and curb resistance. Other types of anti-malarial drugs are Chloroquine which, though used earlier as first-line drug has lost potency due to resistance in many areas, and Quinine which continue to be useful in serious cases. The other important member of the safe sex group is mefloquine which is commonly used in chemoprophylaxis in areas having high malaria rates.

Other market available drugs include Atovaquone-Proguanil: It is commonly used for malaria prophylaxis, treatment of acute uncomplicated Plasmodium falciparum malaria and P. vivax malaria during the first trimester of pregnancy Primaquine: It is used for the treatment of subtitles and relapsing malaria due to Plasmodium vivax and Plasmodium oval. Other Drugs include, new formulations and investigational drugs in clinical trial stage in an effort to have better efficacy, safer with few or no side effects and effective against drug resistant bacteria. The availability of a large selection of drugs can be regarded as a plus point; it means that the choice of treatment can be adjusted regarding to the species of malaria and the requirements of the patient or the area.

By Route of Administration, oral segment expected to held the largest share

The choice of route of administration is a particularly crucial factor in defining whether the use of anti-malarial treatments is efficient and convenient. The use of anti-malarial drugs usually by mouth is frequent, especially in the management of uncomplicated malaria. Tablets or liquid doses are much common since they are easy to administer and can be given to a large number of people at a given time in area where malaria is prevalent. Drugs such as Artemisinin Based Combination Therapies (ACTs) and Atovaquone-Proguanil are normally taken orally, so they can be used at outpatient level, minimizing on sample grant health facility visits.

Injectable anti-malarial are administered to severe malaria clients, or when the patient cannot swallow any drug or needs to be treated right away, respectively. These include; Quinine and Artesunate administered in hospital by injections to enhance the speed of drug absorption and action on the parasite causing complicated malaria. Topical drugs may also be associated with malaria prevention or other forms of complementary therapy; for example, in the form of mosquito repellent or insecticide-treated bed nets. Nonetheless, oral and injectable forms of administration dominate the disease control, with injections being used in severe malaria contexts.

Anti-malarial Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the anti-malarial drugs market during the forecast period due to several factors, including the region’s advanced healthcare infrastructure, high investment in research and development, and the increasing focus on global health concerns. The United States, in particular, leads in the development and distribution of new anti-malarial drugs, driven by the presence of major pharmaceutical companies and ongoing government initiatives to combat infectious diseases.

The high level of healthcare access in North America ensures that new treatments reach a broad patient base quickly, contributing to market growth. The region’s emphasis on public health programs aimed at global malaria eradication further supports demand for effective anti-malarial therapies.

Growing awareness about malaria prevention and treatment among healthcare professionals and the general public is expected to drive market expansion. The prevalence of malaria in regions such as Africa, combined with North American support for international health organizations, enhances the region’s role in the global anti-malarial drugs market. The regulatory environment in North America also supports the swift approval of new drugs, positioning the region as a leader in market share and growth prospects.

Active Key Players in the Anti-malarial Drugs Market:

Amgen (USA)

AstraZeneca (UK)

Cipla (India)

GlaxoSmithKline (GSK) (UK)

Ipca Laboratories (India)

Lupin Pharmaceuticals (India)

Novartis International AG (Switzerland)

Pfizer (USA)

Sanofi (France)

Mylan N.V. (USA)

Takeda Pharmaceutical Company (Japan)

Teva Pharmaceutical Industries Ltd. (Israel)

Strides Pharma Science (India)

F. Hoffmann-La Roche Ltd (Switzerland)

Merck & Co. Inc. (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Anti-malarial Drugs Market by Drug Type

4.1 Anti-malarial Drugs Market Snapshot and Growth Engine

4.2 Anti-malarial Drugs Market Overview

4.3 Artemisinin-Based Combination Therapies (ACTs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Artemisinin-Based Combination Therapies (ACTs): Geographic Segmentation Analysis

4.4 Chloroquine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Chloroquine: Geographic Segmentation Analysis

4.5 Quinine

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Quinine: Geographic Segmentation Analysis

4.6 Mefloquine

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Mefloquine: Geographic Segmentation Analysis

4.7 Atovaquone-Proguanil

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Atovaquone-Proguanil: Geographic Segmentation Analysis

4.8 Primaquine

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Primaquine: Geographic Segmentation Analysis

4.9 Other Drugs

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Other Drugs: Geographic Segmentation Analysis

Chapter 5: Anti-malarial Drugs Market by Route of Administration

5.1 Anti-malarial Drugs Market Snapshot and Growth Engine

5.2 Anti-malarial Drugs Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Injectable

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Injectable: Geographic Segmentation Analysis

5.5 Topical

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Topical: Geographic Segmentation Analysis

Chapter 6: Anti-malarial Drugs Market by End User

6.1 Anti-malarial Drugs Market Snapshot and Growth Engine

6.2 Anti-malarial Drugs Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

6.6 Government and Non-Governmental Organizations (NGOs)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Government and Non-Governmental Organizations (NGOs): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Anti-malarial Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTRAZENECA (UK)

7.4 CIPLA (INDIA)

7.5 GLAXOSMITHKLINE (GSK) (UK)

7.6 IPCA LABORATORIES (INDIA)

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Anti-malarial Drugs Market By Region

8.1 Overview

8.2. North America Anti-malarial Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Type

8.2.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.2.4.2 Chloroquine

8.2.4.3 Quinine

8.2.4.4 Mefloquine

8.2.4.5 Atovaquone-Proguanil

8.2.4.6 Primaquine

8.2.4.7 Other Drugs

8.2.5 Historic and Forecasted Market Size By Route of Administration

8.2.5.1 Oral

8.2.5.2 Injectable

8.2.5.3 Topical

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.6.4 Government and Non-Governmental Organizations (NGOs)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Anti-malarial Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Type

8.3.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.3.4.2 Chloroquine

8.3.4.3 Quinine

8.3.4.4 Mefloquine

8.3.4.5 Atovaquone-Proguanil

8.3.4.6 Primaquine

8.3.4.7 Other Drugs

8.3.5 Historic and Forecasted Market Size By Route of Administration

8.3.5.1 Oral

8.3.5.2 Injectable

8.3.5.3 Topical

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.6.4 Government and Non-Governmental Organizations (NGOs)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Anti-malarial Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Type

8.4.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.4.4.2 Chloroquine

8.4.4.3 Quinine

8.4.4.4 Mefloquine

8.4.4.5 Atovaquone-Proguanil

8.4.4.6 Primaquine

8.4.4.7 Other Drugs

8.4.5 Historic and Forecasted Market Size By Route of Administration

8.4.5.1 Oral

8.4.5.2 Injectable

8.4.5.3 Topical

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.6.4 Government and Non-Governmental Organizations (NGOs)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Anti-malarial Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Type

8.5.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.5.4.2 Chloroquine

8.5.4.3 Quinine

8.5.4.4 Mefloquine

8.5.4.5 Atovaquone-Proguanil

8.5.4.6 Primaquine

8.5.4.7 Other Drugs

8.5.5 Historic and Forecasted Market Size By Route of Administration

8.5.5.1 Oral

8.5.5.2 Injectable

8.5.5.3 Topical

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.6.4 Government and Non-Governmental Organizations (NGOs)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Anti-malarial Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Type

8.6.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.6.4.2 Chloroquine

8.6.4.3 Quinine

8.6.4.4 Mefloquine

8.6.4.5 Atovaquone-Proguanil

8.6.4.6 Primaquine

8.6.4.7 Other Drugs

8.6.5 Historic and Forecasted Market Size By Route of Administration

8.6.5.1 Oral

8.6.5.2 Injectable

8.6.5.3 Topical

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.6.4 Government and Non-Governmental Organizations (NGOs)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Anti-malarial Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Type

8.7.4.1 Artemisinin-Based Combination Therapies (ACTs)

8.7.4.2 Chloroquine

8.7.4.3 Quinine

8.7.4.4 Mefloquine

8.7.4.5 Atovaquone-Proguanil

8.7.4.6 Primaquine

8.7.4.7 Other Drugs

8.7.5 Historic and Forecasted Market Size By Route of Administration

8.7.5.1 Oral

8.7.5.2 Injectable

8.7.5.3 Topical

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.6.4 Government and Non-Governmental Organizations (NGOs)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Anti-malarial Drugs Market research report?

A1: The forecast period in the Anti-malarial Drugs Market research report is 2024-2032.

Q2: Who are the key players in the Anti-malarial Drugs Market?

A2: Amgen (USA), AstraZeneca (UK), Cipla (India), GlaxoSmithKline (GSK) (UK), Ipca Laboratories (India), Lupin Pharmaceuticals (India), Novartis International AG (Switzerland), Pfizer (USA), Sanofi (France), Mylan N.V. (USA), Takeda Pharmaceutical Company (Japan), Teva Pharmaceutical Industries Ltd. (Israel), Strides Pharma Science (India), F. Hoffmann-La Roche Ltd (Switzerland), Merck & Co. Inc. (USA), and Other Active Players.

Q3: What are the segments of the Anti-malarial Drugs Market?

A3: The Anti-malarial Drugs Market is segmented into Drug Type, Route of Administration, End User, and Region. By Drug Type, the market is categorized into Artemisinin-Based Combination Therapies (ACTs), Chloroquine, Quinine, Mefloquine, Atovaquone-Proguanil, Primaquine, and Other Drugs. By Route of Administration, the market is categorized into Oral, Injectable, and Topical. By End User, the market is categorized into Hospitals & Clinics, Retail Pharmacies, Online Pharmacies, Government, and Non-Governmental Organizations (NGOs). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Anti-malarial Drugs Market?

A4: The anti-malarial drugs market describes the global business of manufacturing and distributing drugs used to treat or prevent malaria, an often-fatal disease diagnosed in millions of individuals each year and transmitted by the bite of infected Anopheles mosquito that carries the Plasmodium parasite. Artemisinin based combination therapy (ACTs), chloroquine, quinine, and handful of new molecules currently under development aiming at the several stage of the Malaria parasite’s development. In this process, the market is determined by the global burden of mal aria, prospective R&D activities for new treatments, and government led malaria elimination programs for medication distribution.

Q5: How big is the Anti-malarial Drugs Market?

A5: Anti-malarial Drugs Market Size Was Valued at USD 1.14 Billion in 2023, and is Projected to Reach USD 1.66 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!