Stay Ahead in Fast-Growing Economies.

Browse Reports NowAirless Tires Market – Latest Advancement & Future Trends (2024-2032)

Airless Tires Market means tires that have no need for inflation to provide support structure and the segment of tire market offering such tires. Such tires cannot be punctured easily while having increased durability and do not require maintenance, so they are suitable for use in various industries, including vehicles with heavy loads, military equipment, off-road vehicles, and new industries such as electric and self-driving automobiles.

IMR Group

Description

Airless Tires Market Synopsis:

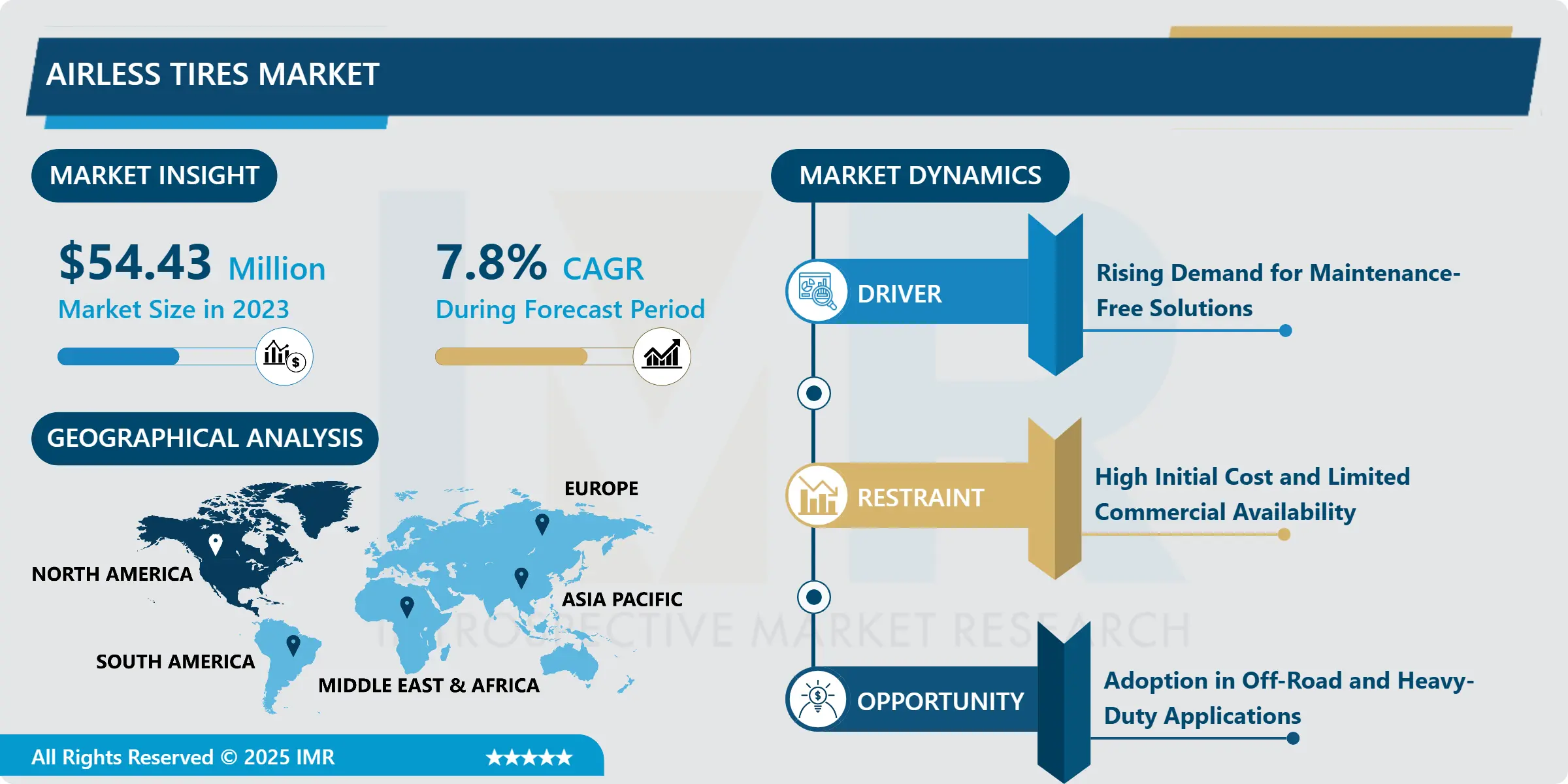

Airless Tires Market Size Was Valued at USD 54.43 Million in 2023, and is Projected to Reach USD 107.01 Million by 2032, Growing at a CAGR of 7.8% From 2024-2032.

Airless Tires Market means tires that have no need for inflation to provide support structure and the segment of tire market offering such tires. Such tires cannot be punctured easily while having increased durability and do not require maintenance, so they are suitable for use in various industries, including vehicles with heavy loads, military equipment, off-road vehicles, and new industries such as electric and self-driving automobiles.

Airless tires are completely new in the tire market since they overcome some problems that are connected with traditional pneumatic tires, including punctures, blowouts, and service requirements. These tires are made with composite rubber and resin or a complicated lattice instead of pressure filled with air. Airless tires are in the growth stage at present although this technology has established popularity owing to their operational suitability in harsh conditions besides having a potential appeal in those specifically targeted niches, where product reliability and durability are paramount.

The market’s value is hinging on manufacturing innovation such as three-dimensional (3D) printing and smart materials that make it possible to produce airless tires at an affordable consumption rate. These are the early customers from sectors such as construction industry, agricultural business, and military that can use the tires on the hardest of terrains and in the toughest of climates. Moreover, opportunities in a growth of electric and autonomous vehicles that require lower maintenance solutions and increased safety parameters are driving the interest in airless tires as well. However, the following challenges have been found to limit the use of these tires: high production cost, limited commercial access, and ride comfort in comparison with the conventional tires. However, the market has great potentiality awaiting to be explored more in light of ever advancing technology and increase in production.

Airless Tires Market Trend Analysis:

Integration of Airless Tires in Electric Vehicles (EVs)

The steady advancement of electric vehicles that are popular around the world is also driving innovation in the airless tires market. Airless tires are another innovation, which is sustainable and does not need periodic servicing, making it fit into place with the efficiency push that is characteristic of EVs. These tyres are lighter and consume less energy, rationale that fits the EV industry theme of improving mileage and battery performance.

Airless tires are more relevant to self-driving cars as such cars must have tires with high durability and overall serviceability, as they cannot be repaired during their long-lasting operation, in contrast to traditional cars. Building sensors into airless tire proposals also improve compatibility with electrical vehicles because they report road condition, tire degradation, and performance data instantly. It follows a clear upward trend that has become indicative of strong market coupling between EV manufacturers and airless tire producers, which should ideally bear great advancement for the twinned markets in the future.

Adoption in Off-Road and Heavy-Duty Applications

Off-road and heavy-duty vehicles are expected to offer the best prospects – and these are the markets that airless tires are currently targeting. These vehicles include those used in farming, construction, and mining industries where they work under off-road conditions, which cause frequent punctures or blowouts of conventional pneumatic tyres. Airless tires are more durable, they require minimal maintenance, and they also have a longer cyclic service life; and these are attributes that make airless tires suitable choices where such rugged applications are required.

The defense branch considers airless tire for packaging armored cars and practical transportation means. Some of the benefits of airless tires cannot be underestimated especially for combat use because of issues of puncture resistance and explosion resistance. Due to increased demand for testing of airless tires, more governments around the world are coming up with funds to support the development of these tires specifically for military use, thus promoting the growth of this market niche.

Airless Tires Market Segment Analysis:

Airless Tires Market is Segmented on the basis of Product, Material, Tire Size, Vehicle Type, Sales Channel, and Region.

By Product, Radial segment is expected to dominate the market during the forecast period

Radial airless tires are used more frequently in comparison to other types of tires as they possess improved work performance, heat stability and durability, as well as suitable to work with various types of surfaces. Their design helps prevent energy loss; therefore they occupy small space and can be used for vehicles that need more efficiency and stability. Radial airless tires are used in the automotive and military sectors and due to this reason there is high demand for the radial airless tires.

Bias airless on the other hand has cost advantage and is suitable for particular off road uses. These due to their hard construction and capacity to endure heavy charges they are ordinarily used in horticulture and construction. However, their reduced efficiency or performance on paved roads reduces their popularity in comparison to radial ones out there.

By Tire Size,

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Airless Tires Market by Material

4.1 Airless Tires Market Snapshot and Growth Engine

4.2 Airless Tires Market Overview

4.3 Rubber

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rubber: Geographic Segmentation Analysis

4.4 Plastic

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Plastic: Geographic Segmentation Analysis

Chapter 5: Airless Tires Market by Product

5.1 Airless Tires Market Snapshot and Growth Engine

5.2 Airless Tires Market Overview

5.3 Radial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Radial: Geographic Segmentation Analysis

5.4 Bias

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Bias: Geographic Segmentation Analysis

Chapter 6: Airless Tires Market by Tire Size

6.1 Airless Tires Market Snapshot and Growth Engine

6.2 Airless Tires Market Overview

6.3 35 inches: Geographic Segmentation Analysis

Chapter 7: Airless Tires Market by Vehicle Type

7.1 Airless Tires Market Snapshot and Growth Engine

7.2 Airless Tires Market Overview

7.3 Military Vehicles

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Military Vehicles: Geographic Segmentation Analysis

7.4 PS/LT (Passenger& Light truck

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 PS/LT (Passenger& Light truck: Geographic Segmentation Analysis

7.5 All-Terrain Vehicles

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 All-Terrain Vehicles: Geographic Segmentation Analysis

7.6 Utility Vehicles

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Utility Vehicles: Geographic Segmentation Analysis

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation Analysis

Chapter 8: Airless Tires Market by Sales Channel

8.1 Airless Tires Market Snapshot and Growth Engine

8.2 Airless Tires Market Overview

8.3 OEM

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEM: Geographic Segmentation Analysis

8.4 Afters

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Afters: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Airless Tires Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 MICHELIN (FRANCE)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BRIDGESTONE CORPORATION (JAPAN)

9.4 GOODYEAR TIRE & RUBBER COMPANY (UNITED STATES)

9.5 HANKOOK TIRE (SOUTH KOREA)

9.6 CONTINENTAL AG (GERMANY)

9.7 SUMITOMO RUBBER INDUSTRIES (JAPAN)

9.8 TOYO TIRE CORPORATION (JAPAN)

9.9 PIRELLI & C. S.P.A. (ITALY)

9.10 NOKIAN TYRES PLC (FINLAND)

9.11 YOKOHAMA RUBBER COMPANY (JAPAN)

9.12 COOPER TIRE & RUBBER COMPANY (UNITED STATES)

9.13 MAXXIS INTERNATIONAL (TAIWAN)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Airless Tires Market By Region

10.1 Overview

10.2. North America Airless Tires Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Material

10.2.4.1 Rubber

10.2.4.2 Plastic

10.2.5 Historic and Forecasted Market Size By Product

10.2.5.1 Radial

10.2.5.2 Bias

10.2.6 Historic and Forecasted Market Size By Tire Size

10.2.6.1 35 inches

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Military Vehicles

10.2.7.2 PS/LT (Passenger& Light truck

10.2.7.3 All-Terrain Vehicles

10.2.7.4 Utility Vehicles

10.2.7.5 Others

10.2.8 Historic and Forecasted Market Size By Sales Channel

10.2.8.1 OEM

10.2.8.2 Afters

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Airless Tires Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Material

10.3.4.1 Rubber

10.3.4.2 Plastic

10.3.5 Historic and Forecasted Market Size By Product

10.3.5.1 Radial

10.3.5.2 Bias

10.3.6 Historic and Forecasted Market Size By Tire Size

10.3.6.1 35 inches

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Military Vehicles

10.3.7.2 PS/LT (Passenger& Light truck

10.3.7.3 All-Terrain Vehicles

10.3.7.4 Utility Vehicles

10.3.7.5 Others

10.3.8 Historic and Forecasted Market Size By Sales Channel

10.3.8.1 OEM

10.3.8.2 Afters

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Bulgaria

10.3.9.2 The Czech Republic

10.3.9.3 Hungary

10.3.9.4 Poland

10.3.9.5 Romania

10.3.9.6 Rest of Eastern Europe

10.4. Western Europe Airless Tires Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Material

10.4.4.1 Rubber

10.4.4.2 Plastic

10.4.5 Historic and Forecasted Market Size By Product

10.4.5.1 Radial

10.4.5.2 Bias

10.4.6 Historic and Forecasted Market Size By Tire Size

10.4.6.1 35 inches

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Military Vehicles

10.4.7.2 PS/LT (Passenger& Light truck

10.4.7.3 All-Terrain Vehicles

10.4.7.4 Utility Vehicles

10.4.7.5 Others

10.4.8 Historic and Forecasted Market Size By Sales Channel

10.4.8.1 OEM

10.4.8.2 Afters

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 Netherlands

10.4.9.5 Italy

10.4.9.6 Russia

10.4.9.7 Spain

10.4.9.8 Rest of Western Europe

10.5. Asia Pacific Airless Tires Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Material

10.5.4.1 Rubber

10.5.4.2 Plastic

10.5.5 Historic and Forecasted Market Size By Product

10.5.5.1 Radial

10.5.5.2 Bias

10.5.6 Historic and Forecasted Market Size By Tire Size

10.5.6.1 35 inches

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Military Vehicles

10.5.7.2 PS/LT (Passenger& Light truck

10.5.7.3 All-Terrain Vehicles

10.5.7.4 Utility Vehicles

10.5.7.5 Others

10.5.8 Historic and Forecasted Market Size By Sales Channel

10.5.8.1 OEM

10.5.8.2 Afters

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Airless Tires Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Material

10.6.4.1 Rubber

10.6.4.2 Plastic

10.6.5 Historic and Forecasted Market Size By Product

10.6.5.1 Radial

10.6.5.2 Bias

10.6.6 Historic and Forecasted Market Size By Tire Size

10.6.6.1 35 inches

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Military Vehicles

10.6.7.2 PS/LT (Passenger& Light truck

10.6.7.3 All-Terrain Vehicles

10.6.7.4 Utility Vehicles

10.6.7.5 Others

10.6.8 Historic and Forecasted Market Size By Sales Channel

10.6.8.1 OEM

10.6.8.2 Afters

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkey

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Airless Tires Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Material

10.7.4.1 Rubber

10.7.4.2 Plastic

10.7.5 Historic and Forecasted Market Size By Product

10.7.5.1 Radial

10.7.5.2 Bias

10.7.6 Historic and Forecasted Market Size By Tire Size

10.7.6.1 35 inches

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Military Vehicles

10.7.7.2 PS/LT (Passenger& Light truck

10.7.7.3 All-Terrain Vehicles

10.7.7.4 Utility Vehicles

10.7.7.5 Others

10.7.8 Historic and Forecasted Market Size By Sales Channel

10.7.8.1 OEM

10.7.8.2 Afters

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Airless Tires Market research report?

A1: The forecast period in the Airless Tires Market research report is 2024-2032.

Q2: Who are the key players in the Airless Tires Market?

A2: Michelin (France), Bridgestone Corporation (Japan), Goodyear Tire & Rubber Company (United States), Hankook Tire (South Korea), Continental AG (Germany), Sumitomo Rubber Industries (Japan), Toyo Tire Corporation (Japan), Pirelli & C. S.p.A. (Italy), Nokian Tyres plc (Finland), Yokohama Rubber Company (Japan), Cooper Tire & Rubber Company (United States), Maxxis International (Taiwan), and Other Active Players

Q3: What are the segments of the Airless Tires Market?

A3: The Airless Tires Market is segmented into Material, Product, Tire Size, Vehicle Type, Sales Channel, and Region. By Material, the market is categorized into Rubber, Plastic. By Product, the market is categorized into Radial and bias. By Tire Size, the market is categorized into 35 inches. By Vehicle Type, the market is categorized into Military Vehicles, PS/LT (Passenger& Light truck), All-Terrain Vehicles, Utility Vehicles, Others. By Sales Channel, the market is categorized into OEM, Aftermarkets. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Airless Tires Market?

A4: Airless Tires Market means tires that have no need for inflation to provide support structure and the segment of tire market offering such tires. Such tires cannot be punctured easily while having increased durability and do not require maintenance, so they are suitable for use in various industries, including vehicles with heavy loads, military equipment, off-road vehicles, and new industries such as electric and self-driving automobiles.

Q5: How big is the Airless Tires Market?

A5: Airless Tires Market Size Was Valued at USD 54.43 Million in 2023, and is Projected to Reach USD 107.01 Million by 2032, Growing at a CAGR of 7.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!