Stay Ahead in Fast-Growing Economies.

Browse Reports NowAgricultural Tire Market – Trends, Opportunities & Growth

Agricultural tires are specialized rubber components designed for use on farm vehicles such as tractors and other agricultural machinery. These tires are constructed to withstand the unique demands of farming environments, offering features like enhanced traction, durability, and load-carrying capacity. Agricultural tires play a crucial role in optimizing the performance of farming equipment, facilitating efficient and productive operations in various agricultural activities, from ploughing and planting to harvesting.

IMR Group

Description

Agricultural Tire Market Synopsis

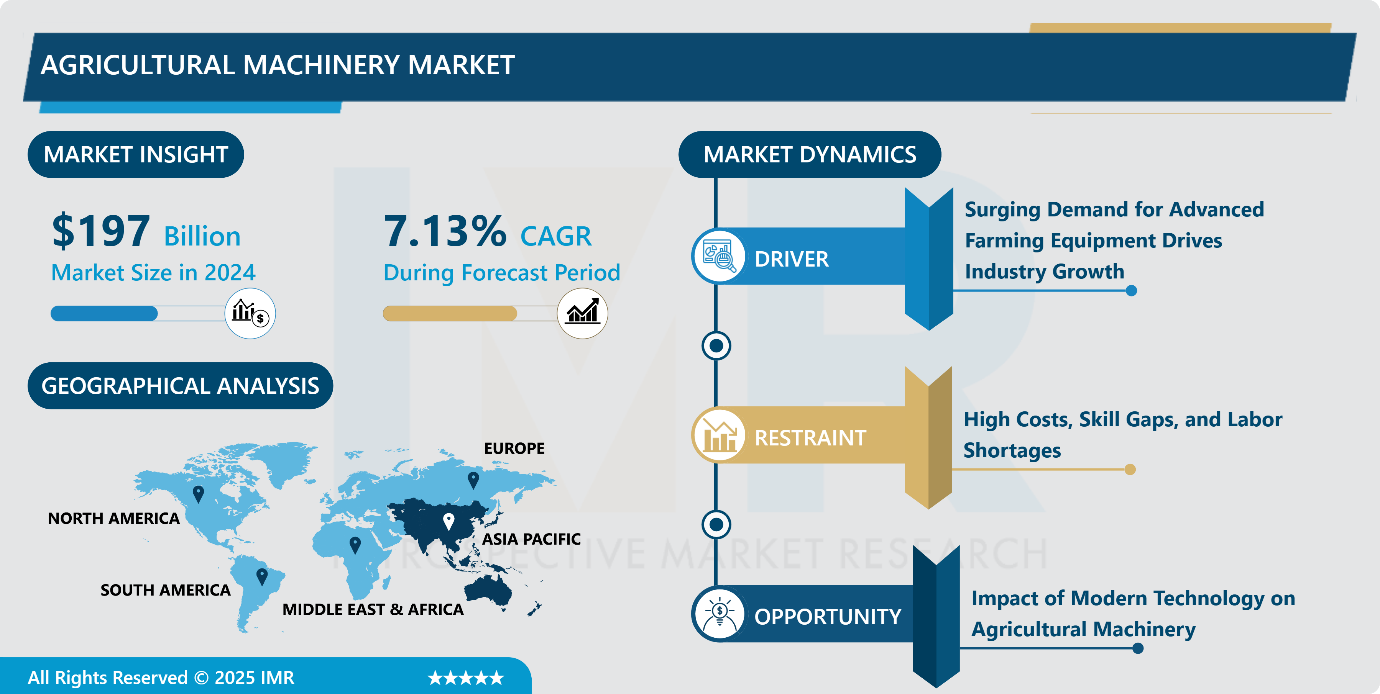

Global Agricultural Tire Market Size Was Valued at USD 7.56 Billion in 2023 and is Projected to Reach USD 12.55 Billion by 2032, Growing at a CAGR of 5.79% From 2024-2032.

Agricultural tires are specialized rubber components designed for use on farm vehicles such as tractors and other agricultural machinery. These tires are constructed to withstand the unique demands of farming environments, offering features like enhanced traction, durability, and load-carrying capacity. Agricultural tires play a crucial role in optimizing the performance of farming equipment, facilitating efficient and productive operations in various agricultural activities, from ploughing and planting to harvesting.

The market trend is shifting towards technologically advanced tires to address specific agricultural challenges, such as soil compaction and varying field conditions. There’s a noticeable demand for innovative tire solutions that optimize fuel efficiency, minimize environmental impact, and ensure better overall performance. As the agriculture industry undergoes modernization and mechanization, the demand for agricultural tires is on the rise. Farmers and agricultural enterprises recognize the importance of optimizing equipment performance to increase productivity.

The market is witnessing increased demand for radial tires, which offer superior strength, flexibility, and shock absorption compared to bias tires. Increasing focus on sustainable and precision farming methods is raising innovation in agricultural tires, which play a role in maintaining soil health and minimizing the environmental impact. The Agricultural Tire Market is experiencing sustained growth due to the need for efficiency, sustainability, and technology-driven advancements in the rapidly evolving field of agriculture.

Agricultural Tire Market Trend Analysis:

Increase in Demand for Agricultural Machinery

Modern trends in the agricultural tires market include the rising prominence of floatation tires, forestry tires, trailer tires, and compound rubber tires featuring steel flex walls. These emerging tire types address the demands of modern agricultural practices, accommodating the need for durability and adaptability. Farm tires play an important role in sustaining heavy loads and ensuring traction for a range of agricultural machinery, including tractors, combines harvesters, and sprayers.

The mechanization in agriculture increases the demand for these specialized tires. Farmers integrate farm tires into their machinery for crucial operations like ploughing, tilling, sowing, and harrowing. Additionally, tractors equipped with these tires are employed to push or pull agricultural machinery, streamlining farming operations for increased convenience and efficiency. This ongoing transformation in agricultural practices underscores the critical importance of innovative farm tires in meeting the evolving needs of the agricultural sector.

The Technological Development in the Tire Industry

The growing global population has raised the demand for food products, prompting increased productivity in the agricultural industry through the utilization of various agricultural machines. A notable trend in agricultural tires is the widespread adoption of high-flotation tires, characterized by a larger surface area. These tires effectively mitigate soil compaction, minimize crop damage, enhance tractor stability, and consequently, offer superior traction, improved fuel efficiency, and overall enhanced performance.

Radial tires surpass bias-ply tires with advantages such as better traction, reduced soil compaction, heightened ride comfort, and increased fuel efficiency. Dual tires are known for their increased load-carrying capacity, which contributes to extended tire life, improved fuel economy, and enhanced traction. The use of dual tires minimizes ground depressions, reducing soil erosion and enhancing soil quality. Companies are investing heavily in research and development in the agricultural tire sector to introduce advanced tire technologies, ensuring continued growth and innovation.

Agricultural Tire Market Segment Analysis:

The Agricultural Tire Market Segments based on Type, Tire, and Distribution Channel.

By Type, the Tractor segment is expected to dominate the market during the forecast period

Tractors are indispensable for various farm operations, including ploughing, tilling, planting, and harvesting. The demand for specialized tractor tires is escalating with the increasing adoption of advanced agricultural practices and machinery. Tractor tires, designed to handle heavy loads and navigate diverse terrains, are crucial for achieving optimal traction, stability, and efficiency. As the global agricultural industry undergoes modernization and mechanization to meet the rising demand for food, the reliance on tractors and their associated tires is expected to intensify. The Tractor segment’s dominance in modern farming practices underscores the importance of specialized tires in enhancing agricultural productivity and efficiency.

Agricultural Tire Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The Asia Pacific is leading the world in the Agricultural Tire Market due to factors like urbanization, industrialization, and population expansion. The labour-intensive agricultural practices to more mechanized methods underscore the region’s modernization in farming. Asia is home to the world’s largest population, particularly in nations like China and India, which contributes to the vital role of agriculture in its economy. With a significant portion of the population heavily reliant on agricultural activities, the sector holds paramount importance.

The market is witnessing expansion fueled by the substantial demand for agricultural tires, driven by the extensive agricultural land and the significant dependence of farmers on machinery such as tractors and combines. Recognizing the region’s potential, many leading tire manufacturers have established production facilities in the Asia Pacific. Localized manufacturing has not only reduced tire costs but has also enhanced the tire supply chain, providing a strategic advantage in the competitive market landscape. The robust agricultural sector in Asia continues to be a driving force in shaping the demand and supply dynamics of agricultural tires in the global market.

Key Players Covered in the Agricultural Tire Market:

Titan International Inc (U.S.)

Cooper Tires (U.S.)

The Goodyear Tire & Rubber Company (U.S.)

Carlisle (U.S.)

Eurotire, Inc (U.S.)

Michelin (France)

Continental Ag (Germany)

Zenises (UK)

Starco (Denmark)

Tomket Tires (Czech Republic)

Trelleborg Ab (Sweden)

Belshina (Belarus)

Apollo Tyres Limited (India)

MRF (India)

BKT (India)

CEAT Limited (India)

TVS Group (India)

Birla Tyres (India)

YHI Group (South Korea)

Bridgestone (Japan), and other major players.

Key Industry Development in The Agricultural Tire Market:

In May 2023, Bridgestone introduces its new premium VX-R TRACTOR tire range with wide-tread traction, long wear life, and excellent driver comfort. All Bridgestone VX-R TRACTOR tires feature an optimized tire-combination front axle LEAD for improved fuel efficiency, tire life, and traction. With ENLITEN Technology, the new Bridgestone VX-R TRACTOR supports sustainable farming without compromising tire performance.

In June 2022, MICHELIN launched new tires for 2022.MICHELIN Pilot Sport 5, MICHELIN Road 6, and MICHELIN for the 2022. These Tyres are for mobility and are even more sustainable. The specific feature of the MICHELIN Road 6 range is its excellent performance in the wet thanks to the 3D swipe technology.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Agricultural Tire Market by Type (2018-2032)

4.1 Agricultural Tire Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tractors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Harvesters

4.5 Loaders

4.6 Sprayers

4.7 Trailers

Chapter 5: Agricultural Tire Market by Tire (2018-2032)

5.1 Agricultural Tire Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Radial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bais

Chapter 6: Agricultural Tire Market by Distribution Channel (2018-2032)

6.1 Agricultural Tire Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Convenience Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets/Hypermarkets

6.5 Online Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Agricultural Tire Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TESLA (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FORD (U.S.)

7.4 GENERAL MOTORS (U.S.)

7.5 MERCEDES-BENZ (GERMANY)

7.6 VOLKSWAGEN (GERMANY)

7.7 BMW (GERMANY)

7.8 AUDI (GERMANY)

7.9 FERRARI (ITALY)

7.10 PORSCHE (GERMANY)

7.11 STELLANTIS (NETHERLANDS)

7.12 RENAULT (FRANCE)

7.13 TOYOTA (JAPAN)

7.14 HONDA (JAPAN)

7.15 NISSAN(JAPAN)

7.16 SUZUKI MOTOR (JAPAN)

7.17 AIRWAYS (CHINA)

7.18 MITSUBISHI MOTORS CORPORATION (JAPAN)

7.19 HYUNDAI (SOUTH KOREA)

7.20 KIA (SOUTH KOREA)

7.21 DENSO CORPORATION (JAPAN)

7.22

Chapter 8: Global Agricultural Tire Market By Region

8.1 Overview

8.2. North America Agricultural Tire Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Tractors

8.2.4.2 Harvesters

8.2.4.3 Loaders

8.2.4.4 Sprayers

8.2.4.5 Trailers

8.2.5 Historic and Forecasted Market Size by Tire

8.2.5.1 Radial

8.2.5.2 Bais

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Convenience Stores

8.2.6.2 Supermarkets/Hypermarkets

8.2.6.3 Online Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Agricultural Tire Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Tractors

8.3.4.2 Harvesters

8.3.4.3 Loaders

8.3.4.4 Sprayers

8.3.4.5 Trailers

8.3.5 Historic and Forecasted Market Size by Tire

8.3.5.1 Radial

8.3.5.2 Bais

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Convenience Stores

8.3.6.2 Supermarkets/Hypermarkets

8.3.6.3 Online Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Agricultural Tire Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Tractors

8.4.4.2 Harvesters

8.4.4.3 Loaders

8.4.4.4 Sprayers

8.4.4.5 Trailers

8.4.5 Historic and Forecasted Market Size by Tire

8.4.5.1 Radial

8.4.5.2 Bais

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Convenience Stores

8.4.6.2 Supermarkets/Hypermarkets

8.4.6.3 Online Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Agricultural Tire Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Tractors

8.5.4.2 Harvesters

8.5.4.3 Loaders

8.5.4.4 Sprayers

8.5.4.5 Trailers

8.5.5 Historic and Forecasted Market Size by Tire

8.5.5.1 Radial

8.5.5.2 Bais

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Convenience Stores

8.5.6.2 Supermarkets/Hypermarkets

8.5.6.3 Online Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Agricultural Tire Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Tractors

8.6.4.2 Harvesters

8.6.4.3 Loaders

8.6.4.4 Sprayers

8.6.4.5 Trailers

8.6.5 Historic and Forecasted Market Size by Tire

8.6.5.1 Radial

8.6.5.2 Bais

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Convenience Stores

8.6.6.2 Supermarkets/Hypermarkets

8.6.6.3 Online Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Agricultural Tire Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Tractors

8.7.4.2 Harvesters

8.7.4.3 Loaders

8.7.4.4 Sprayers

8.7.4.5 Trailers

8.7.5 Historic and Forecasted Market Size by Tire

8.7.5.1 Radial

8.7.5.2 Bais

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Convenience Stores

8.7.6.2 Supermarkets/Hypermarkets

8.7.6.3 Online Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Agricultural Tire Market research report?

A1: The forecast period in the Agricultural Tire Market research report is 2024-2032.

Q2: Who are the key players in The Agricultural Tire Market?

A2: Titan International Inc (U.S.), Cooper Tires (U.S.), The Goodyear Tire & Rubber Company (U.S.), Carlisle (U.S.), Eurotire, Inc (U.S.), Michelin (France), Continental Ag (Germany), Zenises (UK), Starco (Denmark), Tomket Tires (Czech Republic), Trelleborg Ab (Sweden), Belshina (Belarus), Apollo Tyres Limited (India), MRF (India), BKT (India), CEAT Limited (India), TVS Group (India), Birla Tyres (India), YHI Group (South Korea), Bridgestone (Japan), and other major players

Q3: What are the segments of the Agricultural Tire Market?

A3: The Agricultural Tire Market is segmented into Type, Tire, Distribution Channel, and Region. By Type, the market is categorized into Tractors Harvesters, Loaders, Sprayers, and Trailers, By Tire, the market is categorized into Radial and Bais. By Distribution Channel, the market is categorized into Convenience Stores, Supermarkets/Hypermarkets, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Agricultural Tire Market?

A4: Agricultural tires are specialized rubber components designed for use on farm vehicles such as tractors and other agricultural machinery. These tires are constructed to withstand the unique demands of farming environments, offering features like enhanced traction, durability, and load-carrying capacity. Agricultural tires play a crucial role in optimizing the performance of farming equipment, facilitating efficient and productive operations in various agricultural activities, from ploughing and planting to harvesting.

Q5: How big is the Agricultural Tire Market?

A5: Global Agricultural Tire Market Size Was Valued at USD 7.56 Billion in 2023 and is Projected to Reach USD 12.55 Billion by 2032, Growing at a CAGR of 5.79% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!