Stay Ahead in Fast-Growing Economies.

Browse Reports NowAerospace Fasteners Market Size, Share, Growth & Forecast (2024-2032)

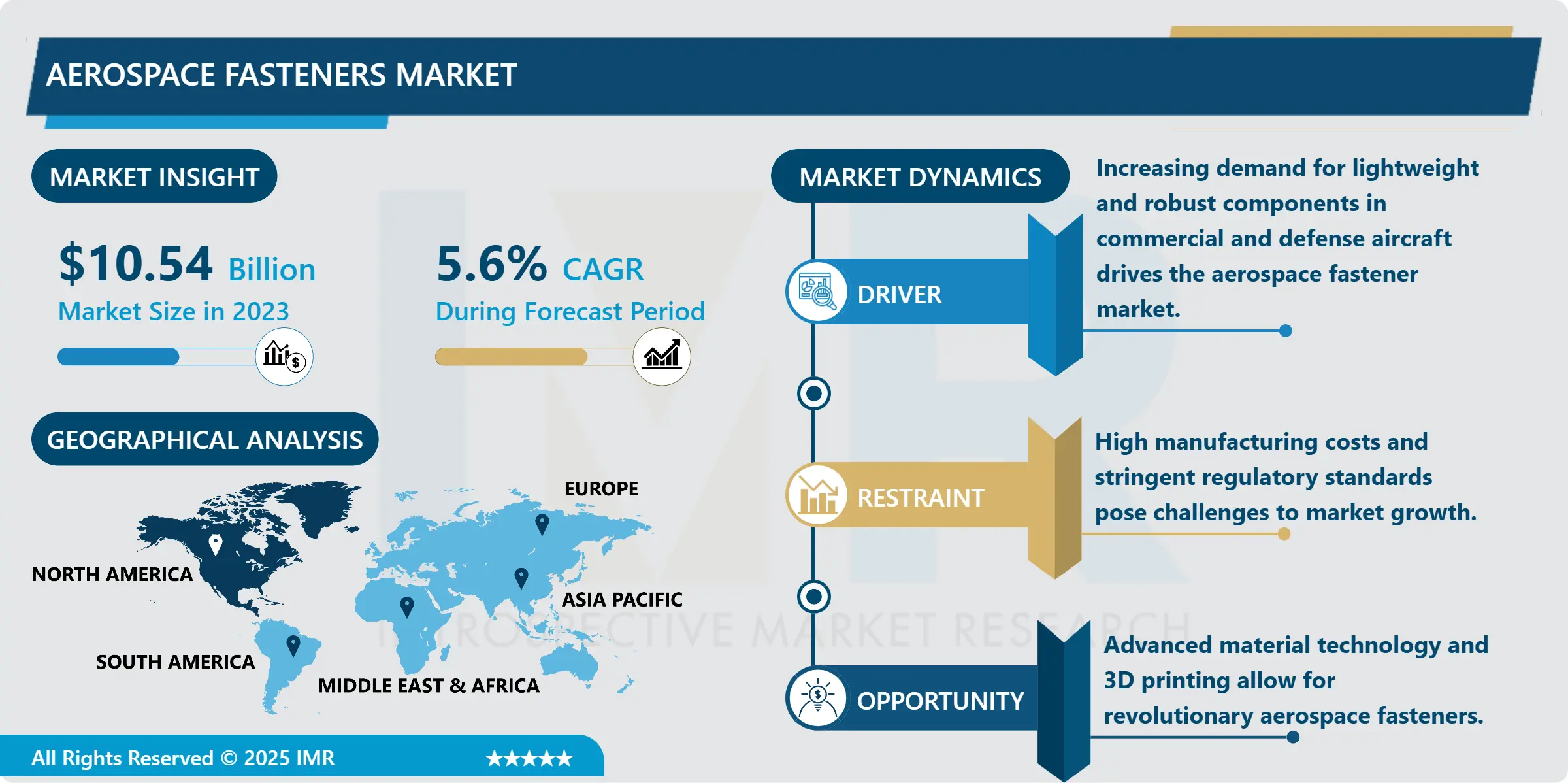

Aerospace Fasteners Market Size Was Valued at USD 8.42 Billion in 2023, and is Projected to Reach USD 13.89 Billion by 2032, Growing at a CAGR of 6.55% From 2024-2032.

IMR Group

Description

Aerospace Fasteners Market Synopsis:

Aerospace Fasteners Market Size Was Valued at USD 8.42 Billion in 2023, and is Projected to Reach USD 13.89 Billion by 2032, Growing at a CAGR of 6.55% From 2024-2032.

The Aerospace Fasteners Market plays a significant role in the aerospace industry and is a set of fasteners and speedy applied in aviation and spacewalk aircraft and spacecraft equipment system. These fasteners are used mainly for joining and repairing airframes, engines and other structure parts required for the planes and other enormous components. The market faces growth due to the following reasons: expansion of the aviation industry, rising demand for air travel, and new aero technologies. The aerospace fasteners come in various forms such as bolts, rivets, nuts, screws and clamps and are manufactured in a way that the can handle environmental pressures such as pressure, temperature and vibration.

The need for lightweight and high-strength fasteners for manufacturing aircraft is significantly promoting aerospace fasteners market. Titanium, aluminum alloys and advanced composites fasteners are popular because they must meet high strength to weight ratio according to the modern requirement for increasing efficiency and performance levels in aircraft. Furthermore, as the aviation manufacturing community transitions to lighter and greener designs for aircraft, faster and more environmentally friendly fasteners are being developed to support sustainable aviation technologies. This trend is also evident from the increasing usage of sophisticated manufacturing techniques like additive manufacturing to produced tailored fasteners that have been designed for the unique functionalities and performance characteristics.

Regionally, North America is expected to a be the largest consumer for aerospace fasteners due to the presence of key players like Boeing and Lockheed Martin and favourable conditions for supply chain. The demand for commercial aircraft is also increasing across Europe helping overall market leaders like Airbus and others in the aerospace range. The Asia-Pacific region is fast growing due the expansion of commercial and military aircraft manufactures mainly China and India. The market is set to increase further as technology in fastener application improves, globalization in air travel demands increase, many new as well as replacement aircraft parts are required in the industry.

Aerospace Fasteners Market Trend Analysis:

Increasing Demand for Lightweight Fasteners

This Aerospace Fasteners Market has one of the most observed trends this year where a tendency to use light weight aerospace fasteners made from advanced material such as titanium alloys, aluminum with composite material. As the aerospace industry pays more attention to fuel consumption and environmental impacts, lighter but strong, fasteners are now required. The function of these materials is to impart the requisite strength where it is required whereas at the same time ensuring that the weight of the aircraft is optimised so that it puts less stress on the fuel consumption. Lightweight fasteners are especially relevant to commercial aviation, since each kilogram above is expensive in terms of operating costs and represents a compromise in terms of aircraft design and the construction of environmentally friendly aircraft of the next generation.

Adoption of Advanced Manufacturing Technologies

The second major trend in the Aerospace Fasteners Market is the increased use of specialized production technologies, including additive manufacturing and processes based on information and communication technologies. These technologies can result in creating detailed and rather complex fasteners with considerably less material, improving overall efficiency of the process as well as enhancing fastener properties in aerospace applications due to 3D printing abilities of the technology. While manufacturers aim to develop better designs and upgrades for aerospace components, these advancements are contributing to the advancement of fasteners capable of meeting the demands of such conditions and expanding on their potential for custom uses while providing better performance for the aerospace industry as a whole.

Aerospace Fasteners Market Segment Analysis:

Aerospace Fasteners Market is Segmented on the basis of Type, Material, Application, Aircraft Type, and Region.

By Type, Rivets segment is expected to dominate the market during the forecast period

The Aerospace Fasteners Market is classified based on type, where the main classification includes rivets, screws as well as bolts, and nuts. Rivets are used extensively in aerospace applications for joining the airplane structures though they are useful in all applications where robust and permanent fastening is required especially in airframes. Rivets are good for high clamping loads and it is used in aluminum and composite material joints. Rivets are still in demand today because: It is trusted and easier to use because of resistance to stresses and vibrations in an airplane.

Screws and bolts are another big portion in aerospace fasteners market due to its extensive use in engine components, landing gear and many internal installations. These fasteners are flexible and can also be easily maintained since they can be easily fixed and removed. Expansion of the commercial and military aerospace industries lead to the demand of screws and bolts for high temperature, pressure and vibration applications. Bolts are used together with the nuts and also the screws in order to guarantee safe fixing within different application areas of aerospace. Both types of fasteners play a significant part of constructing, running, and maintaining aircraft safely and effectively, so they will sell more as the aerospace segment expands.

By Aircraft Type, Commercial Aircraft segment expected to held the largest share

The commercial aircraft accounts for the largest share in the Aerospace Fasteners Market because of the increasing air travel and numbers of airlines fleets. Genuine aerospace applications need to include many millions of fasteners for assembling and overhauling commercial aircraft structures and materials, engines, landing gear, and interior trims. A further market expectation is the increase in the production of long-distance efficient aircraft and the pressure on airliner manufactures to provide more efficient fasteners. These fasteners are paramount in maintaining the structural aspects of intended commercial aircrafts as this would significantly determine on safety and practical aspect.

The military aircraft segment also plays a large role in the aerospace fasteners market because of the continuing military aircraft fleet upgrades and the continued creation of new military systems. Fighter jets, transport aircraft, and naval helicopters are among the aircraft applications where fasteners must be produced with superior performance for environments, including fluctuating high temperatures, pressure, and possible combat. These fasteners are usually manufactured in special alloys and high strength material so that the equipment can be safe when in operation. Also, the rising concern about defense expenditure and progress in military aviation in increasing the requirement for Aerospace Fasteners in this segment. The business and general aviation segment is also gradually growing, and as the demand for private airplanes and unique specialized aviation equipment where high-quality fasteners are needed for performance and reliability are in demand.

Aerospace Fasteners Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America due to the growth in the aerospace industry in North America particularly in United States over the forecast period. Significant prime aerospace players, including Boeing, Lockheed Martin, and Northrop Grumman, are located in the Americas, and a robust aerospace fastener production environment because of the commercial and defense aerospace industry contributes to the high demand. These companies demand strong and dependable fasteners for their aircraft as well as to enhance their performance and safety, as the rate of flying and improvements in aerospace technology continues to expand. A stable aerospace fasteners market in the United States could also be attributed to the government’s ongoing funding commitment towards defence and space technology sectors; including NASA’s Artemis mission programs and advancement of military aircraft engineering technology.

Apart from a sound aerospace manufacturing and production, North American market is also benefited by the region’s well developed supply chain and market of fastener manufacturers. Leading manufacturing companies involved in the aerospace fasteners market are located in this region and are investing in development of products to accommodate the different quality and specifications that defines or is applicable to aerospace applications. Continued growth in demand for light weight, high strength, and more reliable aerospace fasteners most notable in commercial aviation places North America at the forefront of the aerospace fasteners market. As a direct result of rising commercial and defense development expenditures, the region should be able to sustain its position over the duration of the forecast cycle.

Active Key Players in the Aerospace Fasteners Market

3V Aerospace (United Kingdom)

Acument Global Technologies (USA)

Arconic, Inc. (USA)

Boeing (through KLX Aerospace) (USA)

Howmet Aerospace, Inc. (USA)

LISI Aerospace (France)

National Aerospace Fasteners Corporation (Taiwan)

Precision Castparts Corp. (USA)

Stanley Black & Decker, Inc. (USA)

TriMas Corporation (USA)

Wurth Group (Germany)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aerospace Fasteners Market by Type

4.1 Aerospace Fasteners Market Snapshot and Growth Engine

4.2 Aerospace Fasteners Market Overview

4.3 Rivets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rivets: Geographic Segmentation Analysis

4.4 Screws & Bolts

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Screws & Bolts: Geographic Segmentation Analysis

4.5 Nuts

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Nuts: Geographic Segmentation Analysis

Chapter 5: Aerospace Fasteners Market by Material

5.1 Aerospace Fasteners Market Snapshot and Growth Engine

5.2 Aerospace Fasteners Market Overview

5.3 Titanium

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Titanium: Geographic Segmentation Analysis

5.4 Aluminum

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Aluminum: Geographic Segmentation Analysis

5.5 Stainless Steel

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Stainless Steel: Geographic Segmentation Analysis

Chapter 6: Aerospace Fasteners Market by Aircraft Type

6.1 Aerospace Fasteners Market Snapshot and Growth Engine

6.2 Aerospace Fasteners Market Overview

6.3 Commercial Aircraft

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial Aircraft: Geographic Segmentation Analysis

6.4 Military Aircraft

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Military Aircraft: Geographic Segmentation Analysis

6.5 Business & General Aviation

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Business & General Aviation: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Aerospace Fasteners Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 STANLEY BLACK & DECKER INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARCONIC INC. (USA)

7.4 3V AEROSPACE (UNITED KINGDOM)

7.5 LISI AEROSPACE (FRANCE)

7.6 PRECISION CASTPARTS CORP. (USA)

7.7 BOEING (THROUGH KLX AEROSPACE) (USA)

7.8 TRIMAS CORPORATION (USA)

7.9 NATIONAL AEROSPACE FASTENERS CORPORATION (TAIWAN)

7.10 HOWMET AEROSPACE INC. (USA)

7.11 ACUMENT GLOBAL TECHNOLOGIES (USA)

7.12 WURTH GROUP (GERMANY)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Aerospace Fasteners Market By Region

8.1 Overview

8.2. North America Aerospace Fasteners Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Rivets

8.2.4.2 Screws & Bolts

8.2.4.3 Nuts

8.2.5 Historic and Forecasted Market Size By Material

8.2.5.1 Titanium

8.2.5.2 Aluminum

8.2.5.3 Stainless Steel

8.2.6 Historic and Forecasted Market Size By Aircraft Type

8.2.6.1 Commercial Aircraft

8.2.6.2 Military Aircraft

8.2.6.3 Business & General Aviation

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Aerospace Fasteners Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Rivets

8.3.4.2 Screws & Bolts

8.3.4.3 Nuts

8.3.5 Historic and Forecasted Market Size By Material

8.3.5.1 Titanium

8.3.5.2 Aluminum

8.3.5.3 Stainless Steel

8.3.6 Historic and Forecasted Market Size By Aircraft Type

8.3.6.1 Commercial Aircraft

8.3.6.2 Military Aircraft

8.3.6.3 Business & General Aviation

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Aerospace Fasteners Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Rivets

8.4.4.2 Screws & Bolts

8.4.4.3 Nuts

8.4.5 Historic and Forecasted Market Size By Material

8.4.5.1 Titanium

8.4.5.2 Aluminum

8.4.5.3 Stainless Steel

8.4.6 Historic and Forecasted Market Size By Aircraft Type

8.4.6.1 Commercial Aircraft

8.4.6.2 Military Aircraft

8.4.6.3 Business & General Aviation

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Aerospace Fasteners Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Rivets

8.5.4.2 Screws & Bolts

8.5.4.3 Nuts

8.5.5 Historic and Forecasted Market Size By Material

8.5.5.1 Titanium

8.5.5.2 Aluminum

8.5.5.3 Stainless Steel

8.5.6 Historic and Forecasted Market Size By Aircraft Type

8.5.6.1 Commercial Aircraft

8.5.6.2 Military Aircraft

8.5.6.3 Business & General Aviation

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Aerospace Fasteners Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Rivets

8.6.4.2 Screws & Bolts

8.6.4.3 Nuts

8.6.5 Historic and Forecasted Market Size By Material

8.6.5.1 Titanium

8.6.5.2 Aluminum

8.6.5.3 Stainless Steel

8.6.6 Historic and Forecasted Market Size By Aircraft Type

8.6.6.1 Commercial Aircraft

8.6.6.2 Military Aircraft

8.6.6.3 Business & General Aviation

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Aerospace Fasteners Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Rivets

8.7.4.2 Screws & Bolts

8.7.4.3 Nuts

8.7.5 Historic and Forecasted Market Size By Material

8.7.5.1 Titanium

8.7.5.2 Aluminum

8.7.5.3 Stainless Steel

8.7.6 Historic and Forecasted Market Size By Aircraft Type

8.7.6.1 Commercial Aircraft

8.7.6.2 Military Aircraft

8.7.6.3 Business & General Aviation

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Aerospace Fasteners Market research report?

A1: The forecast period in the Aerospace Fasteners Market research report is 2024-2032.

Q2: Who are the key players in the Aerospace Fasteners Market?

A2: Stanley Black & Decker, Inc. (USA), Arconic, Inc. (USA), 3V Aerospace (United Kingdom), LISI Aerospace (France), Precision Castparts Corp. (USA), Boeing (through KLX Aerospace) (USA), TriMas Corporation (USA), National Aerospace Fasteners Corporation (Taiwan), Howmet Aerospace, Inc. (USA), Acument Global Technologies (USA), Wurth Group (Germany), and Other Active Players.

Q3: What are the segments of the Aerospace Fasteners Market?

A3: The Aerospace Fasteners Market is segmented into By Type, By Material, By Aircraft Type, and region. By Type (Rivets, Screws & Bolts, Nuts), By Material (Titanium, Aluminum, Stainless Steel), By Aircraft Type (Commercial Aircraft, Military Aircraft, Business & General Aviation). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Aerospace Fasteners Market?

A4: Aerospace fasteners are specialized hardware components used to join and secure parts in aircraft, spacecraft, and other aerospace systems. These fasteners are designed to meet the stringent requirements of the aerospace industry, including high strength, lightweight properties, and resistance to extreme conditions such as temperature fluctuations, pressure variations, and vibrations. Common types include bolts, screws, nuts, rivets, and pins, often made from advanced materials like titanium, aluminum alloys, and high-strength composites. Aerospace fasteners are critical for ensuring the structural integrity, safety, and reliability of aerospace vehicles, playing an essential role in both manufacturing and maintenance operations.

Q5: How big is the Aerospace Fasteners Market?

A5: Aerospace Fasteners Market Size Was Valued at USD 8.42 Billion in 2023, and is Projected to Reach USD 13.89 Billion by 2032, Growing at a CAGR of 6.55% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!