Stay Ahead in Fast-Growing Economies.

Browse Reports NowActive Pharmaceutical Ingredients (API) Market Size, Share, Growth & Forecast (2024-2032)

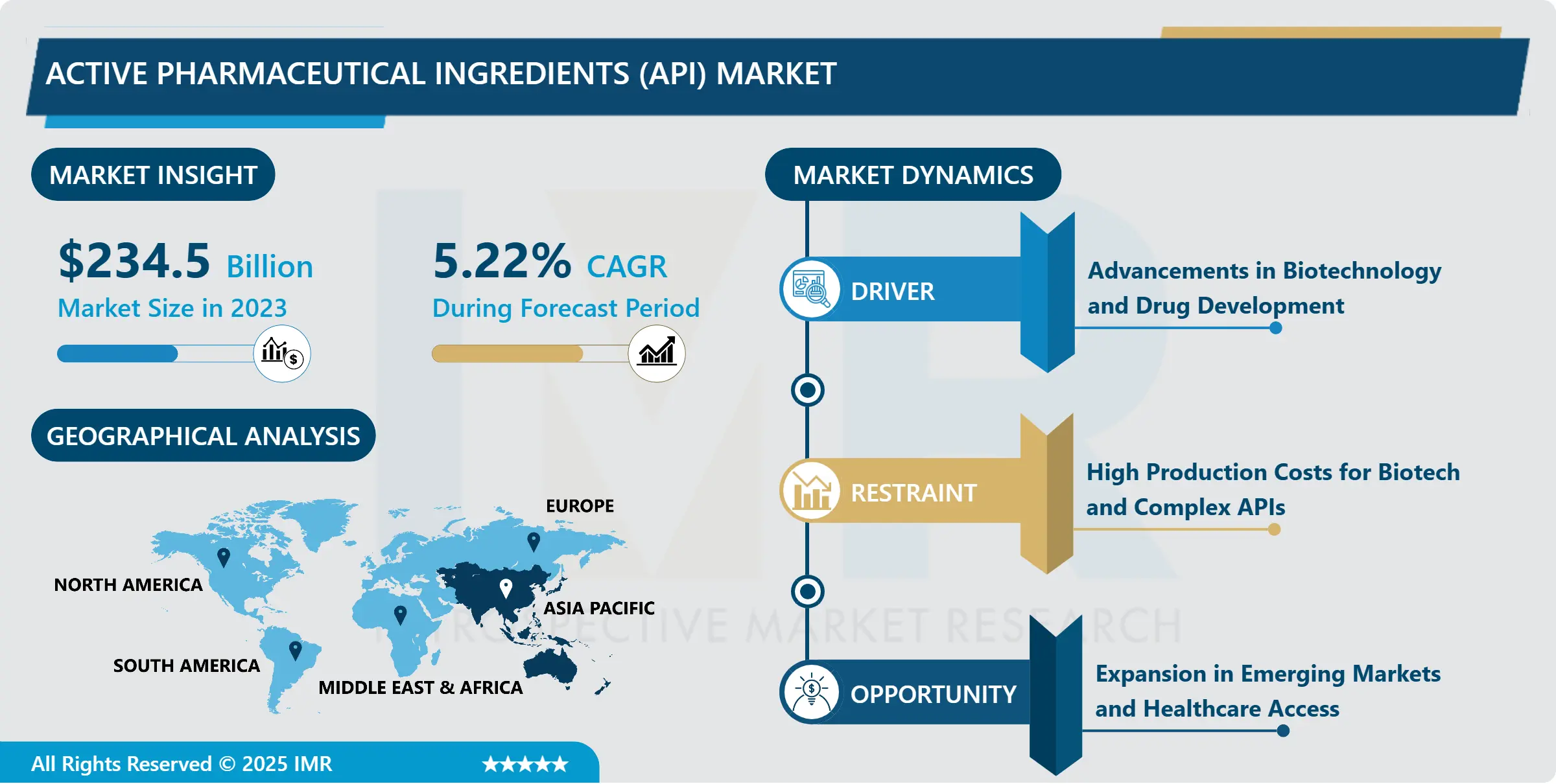

Active Pharmaceutical Ingredients (API) Market Size Was Valued at USD 234.50 Billion in 2023, and is Projected to Reach USD 370.62 Billion by 2032, Growing at a CAGR of 5.22% From 2024-2032.

IMR Group

Description

Active Pharmaceutical Ingredients (API) Market Synopsis:

Active Pharmaceutical Ingredients (API) Market Size Was Valued at USD 234.50 Billion in 2023, and is Projected to Reach USD 370.62 Billion by 2032, Growing at a CAGR of 5.22% From 2024-2032.

Active Pharmaceutical Ingredients (API) market can be defined as the distillery, manufacturing, developing, and marketing sector that deals with substantial elements or components that are used as medicine’s fundamental components. APIs are the active ingredients in drugs which are hazardous in the pure state, or which are capable of becoming hazardous if ingested or inhaled in adequate amounts. It is comprised of both/components, established and new/ and it is used in numerous therapeutic indications and demanding specific therapeutic application, for example oncology, cardiovascular diseases, diabetes, neurology, etc. Increase in investment in biotechnology, growth in the global population and them improve healthcare demands and advances in drug formulation.

The API market has many opportunities for growth because there is a increasing need for pharmaceuticals, mainly generics as healthcare systems worldwide shift towards cost containment strategies. Nicely, generic APIs act as a key factor in offering cheap products in opposition to costly branded drugs hence extend treatment within the emerging economies. Thank you to home customers and home demand for low cost healthcare rises, the API market seems to grow, especially in regions of high population density like Asia Pacific.

In addition, growth in incidence of chronic diseases coupled with sophisticated diseases like diabetes, cardiovascular diseases, and cancers necessitate new and superior medications. This increased demand for therapeutic drugs fosters the development of new APIs in regions of high therapeutic demands. The further progression of biotechnology and the increasing extent of biologics are also driving the market forward due to new, highly targeted drugs that demand new formulations of API.

Active Pharmaceutical Ingredients (API) Market Trend Analysis:

Biotechnological API Growth

There has been increased demand for biotechnological APIs especially due to growth of the biotherapeutic products and biologics as well as biosimilars useful in treating ailments like cancer and autoimmune diseases. The use of biologics is targeted and individualized treatment procedures, thereby creating a demand for more biotech formed APIs. This is likely to persist as pharmaceuticals move toward personalized medicine, to liberalize exports and to boost globalization.

Another noteworthy trend is linked to API production outsourcing to Contract Manufacturing Organizations (CMOs). As costs on production escalates many pharmaceutical manufacturers have instead opted to outsource API with companies that provide affordable solutions. This tendency is vividly expressed in the regions such as Asia, where the costs of manufacturing are lower, and, therefore, utilization of outsourced API manufacturing for both, generics and innovator products, is higher.

Biotech and Custom APIs

It is observed that there are considerable opportunities for API manufacturers to penetrate deeper into emerging markets especially in Asia Pacific, Latin America, and the Middle East. These are the areas which are showing the growth in healthcare as well as the pharmaceutical products by the middle-class population and the stringer health care policies. For API manufacturers, there benefits are found in these markets through establishing production capacities in these regions and seek to partner with players in these markets to improve supply chains.

Thanks to the continuously increasing need for the approach called personalized medicine, new specially developed APIs for particular individuals can be introduced. Many biosimilar firms are now dedicating resources towards the research and development of exceptional zed APIs, specifically for targeted rare diseases and biological therapy goods. This specialization opens up new opportunities of selling API to other producers who try to supply specialized, niche segments of the market where there are fewer competitors and higher requirements for value added.

Active Pharmaceutical Ingredients (API) Market Segment Analysis:

Active Pharmaceutical Ingredients (API) Market is Segmented on the basis of Type, Function, Application, End User, and Region.

By Type, Generic APIs segment is expected to dominate the market during the forecast period

These APIs are used in a class of drugs commonly referred to as the ‘generic drugs’ which are same in efficacy and chemical composition as professionally endorsed branded drugs, only they are cheaper in the market. The market of the generic APIs is expanding at tremendous rate due to the expiry of patents of the branded drugs and the need for cheaper products.

Those include newer chemical entities designed for new therapeutic products and targeting unmet needs in medicine. Thus, the new API market is stimulated by biotechnology and progressive treatment, such as biologics and other novel therapies.

By Application, Oncology segment expected to held the largest share

Oncology Application programming interfaces implemented in cancer treatments are one of the largest categories due to continuously advancing cancer trends across the world. New API services in this segment include; targeted therapies which are cancer treatments that are more effective than conventional treatments in handling specific types of cancer and immunotherapies which involves treatments that use the body’s immune system in cancer-fighting. Cardiovascular diseases are on the rise and thus the need for APIs that go into manufacturing products for hypertension, cholesterol and heart failure.

Given the fact that diabetes is becoming more common around the world, the need for APIs, which are useful for insulin synthesis as well as other medications for diabetes mellany has skyrocketed. APIs in these areas encompass both first generation and second generation of products.

Central nervous system diseases such as Alzheimer’s, Parkinson’s, and epilepsy are increasingly common; their treatments require new APIs. Such treatments include therapy to control or reduce the symptoms of chronic neurological disorders. Other uses include treating infection, respiratory disorders, autoimmune diseases and other disorders where API’s will have large roles to play in delivery of medicines.

Active Pharmaceutical Ingredients (API) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The domestic market is most concentrated in the Asia Pacific region owing to the AP dominant API manufacturing nations such as China and India. These nations are equally renowned for their low-cost production solutions that have greatly helped the afford-ability of both cheap, generic and innovative APIs. Consequently, Asia Pacific is now recognized as the most favorable area for outsourcing API manufacturing to meet the rising global pharmaceutical need.

Moreover, API manufacturers have access to strong infrastructure, favourable policies and a qualified, abundant labour force to support the complex and sensitive process of API manufacturing in the region. The growth of healthcare expenditure, boost in healthcare access in nations like India and China adds to the fuel for the respective market in Asia Pacific that asserted its position dominant worldwide API market.

Active Key Players in the Active Pharmaceutical Ingredients (API) Market

Aurobindo Pharma (India)

BASF SE (Germany)

Cipla Limited (India)

Dr. Reddy’s Laboratories (India)

Lonza Group (Switzerland)

Mylan N.V. (United States)

Sandoz International (Switzerland)

Sanofi (France)

Teva Pharmaceutical Industries (Israel)

WuXi AppTec (China)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Active Pharmaceutical Ingredients (API) Market by Type

4.1 Active Pharmaceutical Ingredients (API) Market Snapshot and Growth Engine

4.2 Active Pharmaceutical Ingredients (API) Market Overview

4.3 Generic APIs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Generic APIs: Geographic Segmentation Analysis

4.4 Innovative APIs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Innovative APIs: Geographic Segmentation Analysis

Chapter 5: Active Pharmaceutical Ingredients (API) Market by Function

5.1 Active Pharmaceutical Ingredients (API) Market Snapshot and Growth Engine

5.2 Active Pharmaceutical Ingredients (API) Market Overview

5.3 Primary APIs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Primary APIs: Geographic Segmentation Analysis

5.4 Secondary APIs

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Secondary APIs: Geographic Segmentation Analysis

Chapter 6: Active Pharmaceutical Ingredients (API) Market by Application

6.1 Active Pharmaceutical Ingredients (API) Market Snapshot and Growth Engine

6.2 Active Pharmaceutical Ingredients (API) Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oncology: Geographic Segmentation Analysis

6.4 Cardiovascular

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cardiovascular: Geographic Segmentation Analysis

6.5 Diabetes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Diabetes: Geographic Segmentation Analysis

6.6 Neurology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Neurology: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Active Pharmaceutical Ingredients (API) Market by End User

7.1 Active Pharmaceutical Ingredients (API) Market Snapshot and Growth Engine

7.2 Active Pharmaceutical Ingredients (API) Market Overview

7.3 Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Pharmaceutical Companies: Geographic Segmentation Analysis

7.4 Contract Manufacturing Organizations (CMOs)

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Contract Manufacturing Organizations (CMOs): Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Active Pharmaceutical Ingredients (API) Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LONZA GROUP (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BASF SE (GERMANY)

8.4 TEVA PHARMACEUTICAL INDUSTRIES (ISRAEL)

8.5 SANOFI (FRANCE)

8.6 WUXI APPTEC (CHINA)

8.7 SANDOZ INTERNATIONAL (SWITZERLAND)

8.8 MYLAN N.V. (UNITED STATES)

8.9 CIPLA LIMITED (INDIA)

8.10 DR. REDDY’S LABORATORIES (INDIA)

8.11 AUROBINDO PHARMA (INDIA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Active Pharmaceutical Ingredients (API) Market By Region

9.1 Overview

9.2. North America Active Pharmaceutical Ingredients (API) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Generic APIs

9.2.4.2 Innovative APIs

9.2.5 Historic and Forecasted Market Size By Function

9.2.5.1 Primary APIs

9.2.5.2 Secondary APIs

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Oncology

9.2.6.2 Cardiovascular

9.2.6.3 Diabetes

9.2.6.4 Neurology

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Pharmaceutical Companies

9.2.7.2 Contract Manufacturing Organizations (CMOs)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Active Pharmaceutical Ingredients (API) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Generic APIs

9.3.4.2 Innovative APIs

9.3.5 Historic and Forecasted Market Size By Function

9.3.5.1 Primary APIs

9.3.5.2 Secondary APIs

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Oncology

9.3.6.2 Cardiovascular

9.3.6.3 Diabetes

9.3.6.4 Neurology

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Pharmaceutical Companies

9.3.7.2 Contract Manufacturing Organizations (CMOs)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Active Pharmaceutical Ingredients (API) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Generic APIs

9.4.4.2 Innovative APIs

9.4.5 Historic and Forecasted Market Size By Function

9.4.5.1 Primary APIs

9.4.5.2 Secondary APIs

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Oncology

9.4.6.2 Cardiovascular

9.4.6.3 Diabetes

9.4.6.4 Neurology

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Pharmaceutical Companies

9.4.7.2 Contract Manufacturing Organizations (CMOs)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Active Pharmaceutical Ingredients (API) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Generic APIs

9.5.4.2 Innovative APIs

9.5.5 Historic and Forecasted Market Size By Function

9.5.5.1 Primary APIs

9.5.5.2 Secondary APIs

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Oncology

9.5.6.2 Cardiovascular

9.5.6.3 Diabetes

9.5.6.4 Neurology

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Pharmaceutical Companies

9.5.7.2 Contract Manufacturing Organizations (CMOs)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Active Pharmaceutical Ingredients (API) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Generic APIs

9.6.4.2 Innovative APIs

9.6.5 Historic and Forecasted Market Size By Function

9.6.5.1 Primary APIs

9.6.5.2 Secondary APIs

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Oncology

9.6.6.2 Cardiovascular

9.6.6.3 Diabetes

9.6.6.4 Neurology

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Pharmaceutical Companies

9.6.7.2 Contract Manufacturing Organizations (CMOs)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Active Pharmaceutical Ingredients (API) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Generic APIs

9.7.4.2 Innovative APIs

9.7.5 Historic and Forecasted Market Size By Function

9.7.5.1 Primary APIs

9.7.5.2 Secondary APIs

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Oncology

9.7.6.2 Cardiovascular

9.7.6.3 Diabetes

9.7.6.4 Neurology

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Pharmaceutical Companies

9.7.7.2 Contract Manufacturing Organizations (CMOs)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Active Pharmaceutical Ingredients (API) Market research report?

A1: The forecast period in the Active Pharmaceutical Ingredients (API) Market research report is 2024-2032.

Q2: Who are the key players in the Active Pharmaceutical Ingredients (API) Market?

A2: Aurobindo Pharma (India), BASF SE (Germany), Cipla Limited (India), Dr. Reddy’s Laboratories (India), Lonza Group (Switzerland), Mylan N.V. (United States), Sandoz International (Switzerland), Sanofi (France), Teva Pharmaceutical Industries (Israel), WuXi AppTec (China), Other Active Players.

Q3: What are the segments of the Active Pharmaceutical Ingredients (API) Market?

A3: The Active Pharmaceutical Ingredients (API) Market is segmented into by Type (Generic APIs, Innovative APIs), By Function (Primary APIs, Secondary APIs), Application (Oncology, Cardiovascular, Diabetes, Neurology, Others), End User (Pharmaceutical Companies, Contract Manufacturing Organizations (CMOs)). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Active Pharmaceutical Ingredients (API) Market?

A4: Active Pharmaceutical Ingredients (API) market can be defined as the distillery, manufacturing, developing, and marketing sector that deals with substantial elements or components that are used as medicine’s fundamental components. APIs are the active ingredients in drugs which are hazardous in the pure state, or which are capable of becoming hazardous if ingested or inhaled in adequate amounts. It is comprised of both/components, established and new/ and it is used in numerous therapeutic indications and demanding specific therapeutic application, for example oncology, cardiovascular diseases, diabetes, neurology, etc. Increase in investment in biotechnology, growth in the global population and them improve healthcare demands and advances in drug formulation.

Q5: How big is the Active Pharmaceutical Ingredients (API) Market?

A5: Active Pharmaceutical Ingredients (API) Market Size Was Valued at USD 234.50 Billion in 2023, and is Projected to Reach USD 370.62 Billion by 2032, Growing at a CAGR of 5.22% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!