Stay Ahead in Fast-Growing Economies.

Browse Reports NowAcrylic Foam Tapes Market Size, Share, Growth & Forecast (2024-2032)

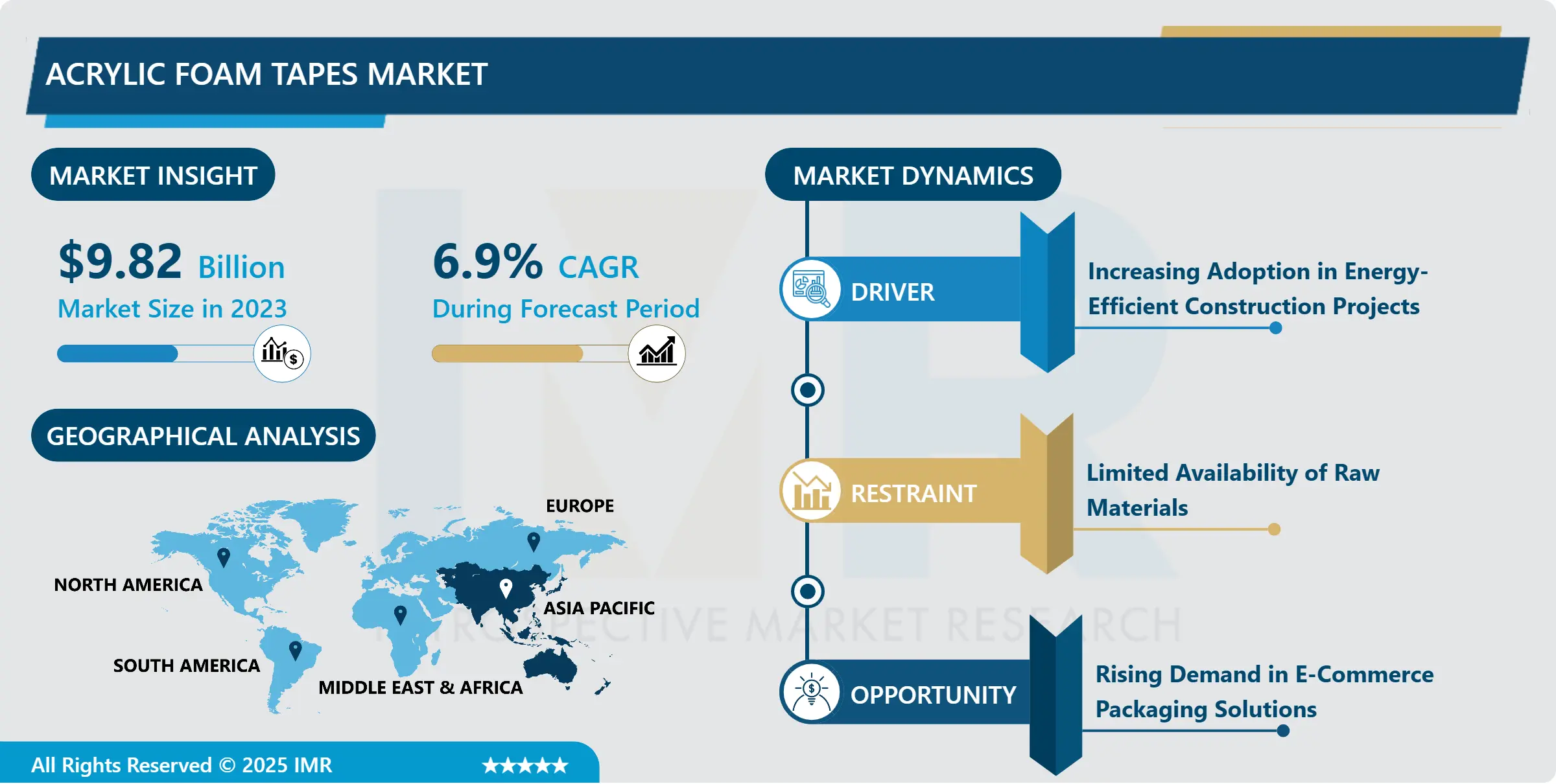

Acrylic Foam Tapes Market Size Was Valued at USD 9.82 Billion in 2023, and is Projected to Reach USD 17.90 Billion by 2032, Growing at a CAGR of 6.90% From 2024-2032.

IMR Group

Description

Acrylic Foam Tapes Market Synopsis:

Acrylic Foam Tapes Market Size Was Valued at USD 9.82 Billion in 2023, and is Projected to Reach USD 17.90 Billion by 2032, Growing at a CAGR of 6.90% From 2024-2032.

Acrylic foam tapes are available in a range of foam thicknesses and thicknesses coated with an acrylic adhesive on one or both sides of the foam carrier. It’s resistant to weather, has good conformability and offers good bonding strength these tapes are ideal for automotive industries, construction, electronics, and even packaging industries. The versatility is another advantage of the tapes for uses that call for increased bonding and cushioning ability, and the added value of indoors, and outdoors, use.

The usage of acrylic foam tapes in Automobile industry is fostered by the lightweight and fuel-efficient vehicles’ demand. These tapes are widely utilized for joining exterior parts like side markers, body side moldings, mirrors, and emblems and is preferred over most mechanical fasteners because of the kind of bond it develops. This trend is especially evident in the automotive market since most producers strive to decrease the general mass of vehicles in order to increase fuel efficiency and meet increasingly strict environmental standards.

Also, a rising construction & building industry has helped promote the consumption of acrylic foam tapes as these tapes offer application in functions like glazing, insulation, and sealing. Legal requirements for energy efficient and sustainable construction materials are fueling development of adhesive solutions and the acrylic foam tapes are indicating improved sealing, better insulation, noise reduction among others. This is because the growing awareness of environmental conservation orientation towards the utilization of environmentally friendly materials in construction of buildings is also fueling the expansion of the market.

Acrylic Foam Tapes Market Trend Analysis:

Improved adhesion

The market for acrylic foam tapes has also shown a growth in usage of double-sided acrylic foam tapes especially in automotive and electronics sector. These tapes have improved adhesion that is important in mounting applications where both surfaces of the foam tape are used in the joining process. Greater flexibility and practicality resulting from the utilization of this structure make this model the most preferable one for high-precision objectives.

Another significant trend is the appearance of new specialized acrylic foam tapes which fit various industries and their requirements in terms of UV stability, heat and chemical capabilities. Such custom solutions are yet to find demand in areas such as electronics and healthcare, where the tapes are subjected to various unfavourable conditions and have to deliver optimum performance in application-specific fields.

Application in automobiles is of significant potential

There is great potential for increase in market for acrylic foam tapes and its application in automobiles is of significant potential. As the automotive industry migrates toward electric vehicles and as more automotive manufacturers seek to incorporate lightweight material into their manufacturing processes, thus it is set to become an essential element in the production line. These tapes provide the optimal solution for fastening of lightweight materials in EVs at the same time enhancing efficiency and performance.

In this connection, packaging is one of the most significant applications for the expansion of acrylic foam tapes apart from the automotive industry. With the emergence of electronic business and growing importance for safe and efficient methods of packaging, acrylic foam tapes have become popular as a closure and adhesion system in packaging industry. The fact that the tapes are highly adhesive and can be accommodated in a variety of conditions of environment makes it suitable for use in protection of products during transport especially delicate ones.

Acrylic Foam Tapes Market Segment Analysis:

Acrylic Foam Tapes Market is Segmented on the basis of Type, Thickness, Application, End User, and Region.

By Type, Single-Sided segment is expected to dominate the market during the forecast period

Based on the structure and application of the raw material, the acrylic foam tapes market has been categorized into single-sided and double-sided products. Acrylic foam tapes have adhesive coating applied to only one surface of the foam core and it is used in case where only one surface needs to be bonded such as mounting of emblems or trim in automobile industry. Double sided acrylic foam tapes, doing however, have adhesive on each side of the foam core so are more powerful and more versatile. These tapes can be used in any application where two substrates need to be joined, for example in automotive that fixes side moldings or in electronics where components are fixed. Each type offers good bonding and keeps up the performance for a long time, although the exact kind to use will depend with the environment of the application.

By Application, Automotive segment expected to held the largest share

The Global acrylic foam tapes market is classified based on the application area as automotive, construction, electronics, packaging, medical, and other. In automotive sector, these tapes find applications as trim, emblems and side molding that offer better bonding strength than mechanical fasteners but are lightweight in nature. The acrylic foam tapes utilized in construction includes applications such as glazing and sealing, as well as insulation use, some of the advantages offered include; high resistance to weather and energy efficiency. These tapes are used in electronics in component mounting, surface protection and they act as insulators. The packaging industry embraces acrylic foam tapes because of their high bonding performance as well as their ability to withstand great pressure during transport. In the medical industry, the tapes are applied for surgeries, surgeries dressing and in the treatment of wounds, which can take advantage of non-allergic characteristics. A number of other manufacturing applications though more specialized can be classified under the “others” category including aerospace, furniture, and signage among others.

Acrylic Foam Tapes Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific occupies the leading position in the consumption of acrylic foam tapes due to the constant development of automotive, construction, and electronics industries. Some of the factors that will cause the demand for adhesive products such as acrylic foam tapes are the steady manufacturing industries especially those regions such as China, Japan, and south Korea. The automotive industry in Asia Pacific, especially in China, is one of the heaviest users of these tapes, due to its emphasis on light weight and fuel-efficient automobiles.

The region’s supremacy is also backed by increasing construction sector demand, where acrylic foam tapes serve the uses like insulation, glazing, and sealing. In addition, the area has a low cost of production for acrylic foam tapes, so both production and consumption occur within the region, which should translate to further market growth in the years ahead.

Active Key Players in the Acrylic Foam Tapes Market

3M (USA)

Avery Dennison Corporation (USA)

DeWAL Industries (USA)

Henkel AG & Co. KGaA (Germany)

Intertape Polymer Group (Canada)

Nitto Denko Corporation (Japan)

Saint-Gobain (France)

Scapa Group Plc (UK)

Tesa SE (Germany)

tesa tape, inc. (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Acrylic Foam Tapes Market by Type

4.1 Acrylic Foam Tapes Market Snapshot and Growth Engine

4.2 Acrylic Foam Tapes Market Overview

4.3 Single-Sided

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Single-Sided: Geographic Segmentation Analysis

4.4 Double-Sided

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Double-Sided: Geographic Segmentation Analysis

Chapter 5: Acrylic Foam Tapes Market by Thickness

5.1 Acrylic Foam Tapes Market Snapshot and Growth Engine

5.2 Acrylic Foam Tapes Market Overview

5.3 Thin (Below 0.5mm)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Thin (Below 0.5mm): Geographic Segmentation Analysis

5.4 Medium (0.5mm – 1mm)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Medium (0.5mm – 1mm): Geographic Segmentation Analysis

5.5 Thick (Above 1mm))

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Thick (Above 1mm)): Geographic Segmentation Analysis

Chapter 6: Acrylic Foam Tapes Market by Application

6.1 Acrylic Foam Tapes Market Snapshot and Growth Engine

6.2 Acrylic Foam Tapes Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive: Geographic Segmentation Analysis

6.4 Construction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Construction: Geographic Segmentation Analysis

6.5 Electronics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Electronics: Geographic Segmentation Analysis

6.6 Packaging

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Packaging: Geographic Segmentation Analysis

6.7 Medical

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Medical: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Acrylic Foam Tapes Market by End User

7.1 Acrylic Foam Tapes Market Snapshot and Growth Engine

7.2 Acrylic Foam Tapes Market Overview

7.3 Automotive & Transportation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Automotive & Transportation: Geographic Segmentation Analysis

7.4 Building & Construction

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Building & Construction: Geographic Segmentation Analysis

7.5 Electrical & Electronics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Electrical & Electronics: Geographic Segmentation Analysis

7.6 Healthcare

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Healthcare: Geographic Segmentation Analysis

7.7 Consumer Goods

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Consumer Goods: Geographic Segmentation Analysis

7.8 Industrial

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Industrial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Acrylic Foam Tapes Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 3M (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TESA SE (GERMANY)

8.4 NITTO DENKO CORPORATION (JAPAN)

8.5 AVERY DENNISON CORPORATION (USA)

8.6 HENKEL AG & CO. KGAA (GERMANY)

8.7 INTERTAPE POLYMER GROUP (CANADA)

8.8 SAINT-GOBAIN (FRANCE)

8.9 SCAPA GROUP PLC (UK)

8.10 TESA TAPE INC. (USA)

8.11 DEWAL INDUSTRIES (USA).

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Acrylic Foam Tapes Market By Region

9.1 Overview

9.2. North America Acrylic Foam Tapes Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Single-Sided

9.2.4.2 Double-Sided

9.2.5 Historic and Forecasted Market Size By Thickness

9.2.5.1 Thin (Below 0.5mm)

9.2.5.2 Medium (0.5mm – 1mm)

9.2.5.3 Thick (Above 1mm))

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Automotive

9.2.6.2 Construction

9.2.6.3 Electronics

9.2.6.4 Packaging

9.2.6.5 Medical

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Automotive & Transportation

9.2.7.2 Building & Construction

9.2.7.3 Electrical & Electronics

9.2.7.4 Healthcare

9.2.7.5 Consumer Goods

9.2.7.6 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Acrylic Foam Tapes Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Single-Sided

9.3.4.2 Double-Sided

9.3.5 Historic and Forecasted Market Size By Thickness

9.3.5.1 Thin (Below 0.5mm)

9.3.5.2 Medium (0.5mm – 1mm)

9.3.5.3 Thick (Above 1mm))

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Automotive

9.3.6.2 Construction

9.3.6.3 Electronics

9.3.6.4 Packaging

9.3.6.5 Medical

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Automotive & Transportation

9.3.7.2 Building & Construction

9.3.7.3 Electrical & Electronics

9.3.7.4 Healthcare

9.3.7.5 Consumer Goods

9.3.7.6 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Acrylic Foam Tapes Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Single-Sided

9.4.4.2 Double-Sided

9.4.5 Historic and Forecasted Market Size By Thickness

9.4.5.1 Thin (Below 0.5mm)

9.4.5.2 Medium (0.5mm – 1mm)

9.4.5.3 Thick (Above 1mm))

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Automotive

9.4.6.2 Construction

9.4.6.3 Electronics

9.4.6.4 Packaging

9.4.6.5 Medical

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Automotive & Transportation

9.4.7.2 Building & Construction

9.4.7.3 Electrical & Electronics

9.4.7.4 Healthcare

9.4.7.5 Consumer Goods

9.4.7.6 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Acrylic Foam Tapes Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Single-Sided

9.5.4.2 Double-Sided

9.5.5 Historic and Forecasted Market Size By Thickness

9.5.5.1 Thin (Below 0.5mm)

9.5.5.2 Medium (0.5mm – 1mm)

9.5.5.3 Thick (Above 1mm))

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Automotive

9.5.6.2 Construction

9.5.6.3 Electronics

9.5.6.4 Packaging

9.5.6.5 Medical

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Automotive & Transportation

9.5.7.2 Building & Construction

9.5.7.3 Electrical & Electronics

9.5.7.4 Healthcare

9.5.7.5 Consumer Goods

9.5.7.6 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Acrylic Foam Tapes Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Single-Sided

9.6.4.2 Double-Sided

9.6.5 Historic and Forecasted Market Size By Thickness

9.6.5.1 Thin (Below 0.5mm)

9.6.5.2 Medium (0.5mm – 1mm)

9.6.5.3 Thick (Above 1mm))

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Automotive

9.6.6.2 Construction

9.6.6.3 Electronics

9.6.6.4 Packaging

9.6.6.5 Medical

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Automotive & Transportation

9.6.7.2 Building & Construction

9.6.7.3 Electrical & Electronics

9.6.7.4 Healthcare

9.6.7.5 Consumer Goods

9.6.7.6 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Acrylic Foam Tapes Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Single-Sided

9.7.4.2 Double-Sided

9.7.5 Historic and Forecasted Market Size By Thickness

9.7.5.1 Thin (Below 0.5mm)

9.7.5.2 Medium (0.5mm – 1mm)

9.7.5.3 Thick (Above 1mm))

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Automotive

9.7.6.2 Construction

9.7.6.3 Electronics

9.7.6.4 Packaging

9.7.6.5 Medical

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Automotive & Transportation

9.7.7.2 Building & Construction

9.7.7.3 Electrical & Electronics

9.7.7.4 Healthcare

9.7.7.5 Consumer Goods

9.7.7.6 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Acrylic Foam Tapes Market research report?

A1: The forecast period in the Acrylic Foam Tapes Market research report is 2024-2032.

Q2: Who are the key players in the Acrylic Foam Tapes Market?

A2: 3M (USA), Tesa SE (Germany), Nitto Denko Corporation (Japan), Avery Dennison Corporation (USA), Henkel AG & Co. KGaA (Germany), Intertape Polymer Group (Canada), Saint-Gobain (France), Scapa Group Plc (UK), tesa tape, inc. (USA), DeWAL Industries (USA). and Other Active Players.

Q3: What are the segments of the Acrylic Foam Tapes Market?

A3: The Acrylic Foam Tapes Market is segmented into by Type (Single-Sided, Double-Sided), By Thickness (Thin (Below 0.5mm), Medium (0.5mm – 1mm), Thick (Above 1mm)), Application (Automotive, Construction, Electronics, Packaging, Medical, Others), End User (Automotive & Transportation, Building & Construction, Electrical & Electronics, Healthcare, Consumer Goods, Industrial). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Acrylic Foam Tapes Market?

A4: Acrylic foam tapes are available in a range of foam thicknesses and thicknesses coated with an acrylic adhesive on one or both sides of the foam carrier. It’s resistant to weather, has good conformability and offers good bonding strength these tapes are ideal for automotive industries, construction, electronics, and even packaging industries. The versatility is another advantage of the tapes for uses that call for increased bonding and cushioning ability, and the added value of indoors, and outdoors, use.

Q5: How big is the Acrylic Foam Tapes Market?

A5: Acrylic Foam Tapes Market Size Was Valued at USD 9.82 Billion in 2023, and is Projected to Reach USD 17.90 Billion by 2032, Growing at a CAGR of 6.90% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!