Stay Ahead in Fast-Growing Economies.

Browse Reports NowAccounts Receivable Automation Market Insights, Dynamics, and Growth Forecast (2024-2032)

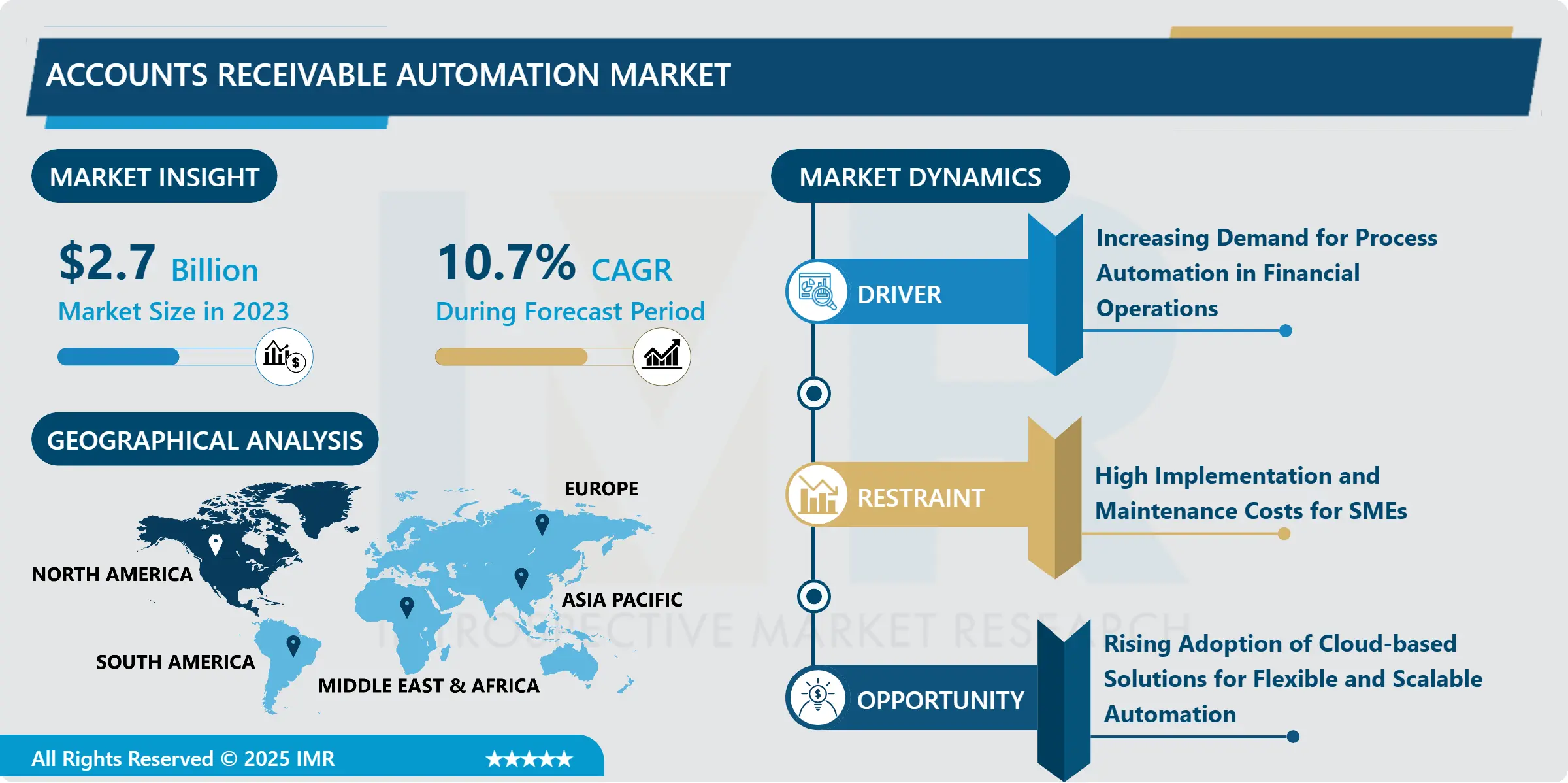

Accounts Receivable Automation Market Size Was Valued at USD 2.70 Billion in 2023, and is Projected to Reach USD 6.74 Billion by 2032, Growing at a CAGR of 10.7% From 2024-2032.

IMR Group

Description

Accounts Receivable Automation Market Synopsis:

Accounts Receivable Automation Market Size Was Valued at USD 2.70 Billion in 2023, and is Projected to Reach USD 6.74 Billion by 2032, Growing at a CAGR of 10.7% From 2024-2032.

The Accounts Receivable Automation (ARA) Market is the application of tools, products, and techniques in software that enable the automation of account receivables including issuing invoices, collecting receivables and processing payments, and reporting. Thus, ARA’s goal is to minimize the user input and optimize organisations’ financial processes and cash flow management. This market involves the implementation of solutions both in-house and through the internet, and use is steadily moving more to organizations seeking ways to revolutionize their operations, reduce mistakes, and speed up receipt of revenues.

The Accounts Receivable Automation Market is growing at a fast pace for the reason that the various organizations in different industries are in search of for improvement in the accounting function and reduction of heavy manual work loads. The increase in the necessity for organizations to optimize cash flow, cut expenses, and lessen human errors is the main reason behind such evolution. Due to the demand for digital systems that would optimize companies’ accounts receivable, ARA technologies are becoming more and more critical to all types of organizations. In particular, the necessity for automation of the financial functions like invoicing and collection is forcing innovations into the market, which make the market segment highly competitive.

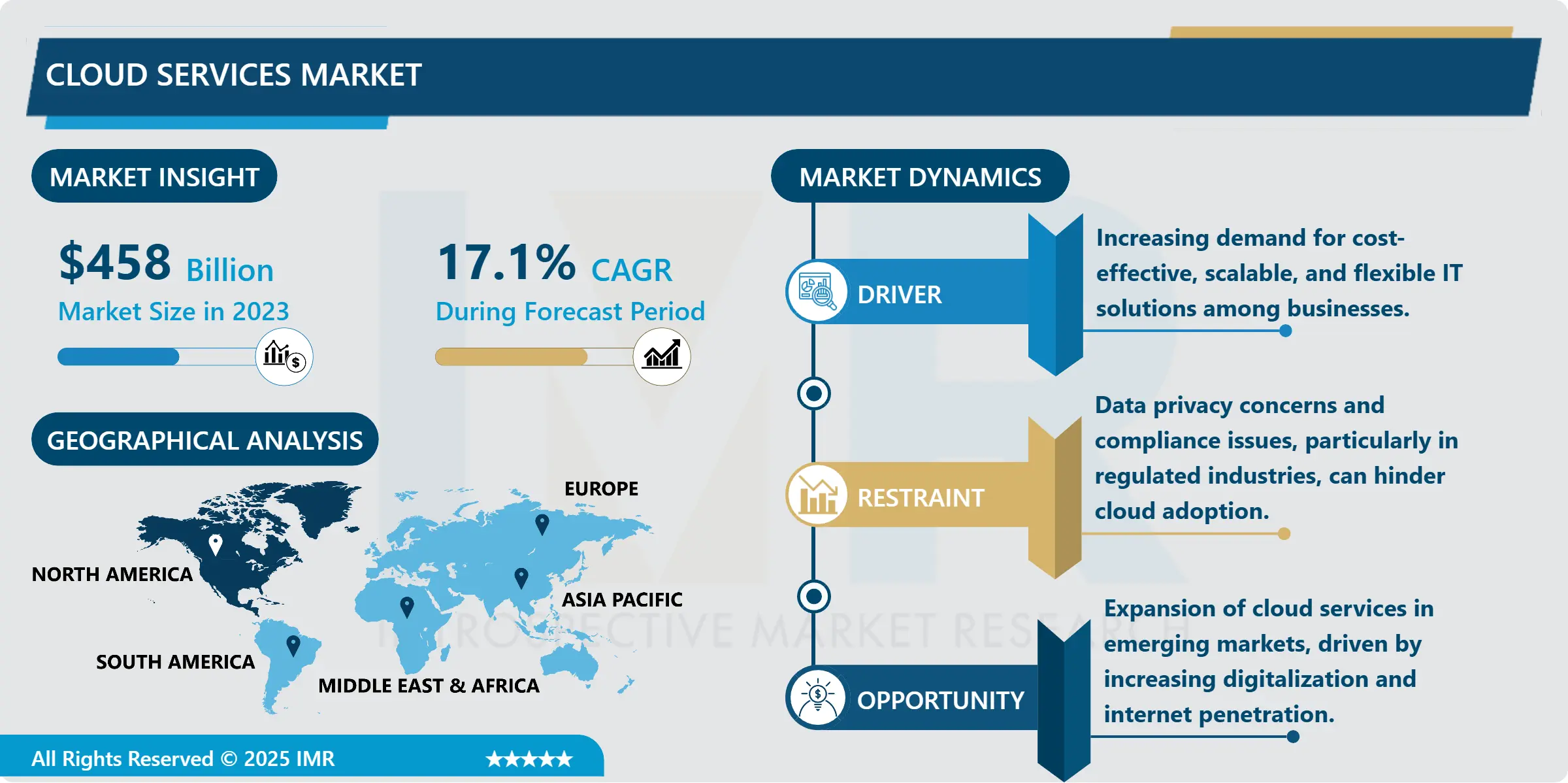

In the ARA market across the globe, growth has been witnessed in cloud-based solutions due to factors such as scalability and flexibility of the solutions to the business organizations, thus enabling them work remotely to access their finances. The market is expected to be led by off-premise solutions because of their affordability and compatibility with the other financial applications. Besides, there is an increasing popularity of the cloud services required for the credit management and there is AI/ML in the credit management, forecasting, and forecasting analysis. These high end technologies provide accurate and timely intelligence besides facilitating informed decision making hence contributing to the growth of the ARA market. Since business organisations are increasingly implementing various measures towards digitalization, the improvement of the accounts receivable automation is poised for a high growth rate.

Accounts Receivable Automation Market Trend Analysis

Increasing Integration with Artificial Intelligence and Machine Learning

One trend visible in the Accounts Receivable Automation Market is that the AI and Machine Learning are rapidly being integrated into the market. These are revolutionizing conventional accounts receivable through assessment of account predictive models, credit scoring, and decision-making. It utilises AI to forecast payment conduct, identify which customers to focus on collecting money from, and change credit terms on their own, using the data collected in the past and about the customers in question. This does not only fast forward the receivables process, but it also minimizes chances of delayed payments and bad debts. Therefore, AI-based systems are becoming popular in organization as solutions to automate the accounts receivable or collection process to effectively execute organizational tasks and improve cash flow operation.

Rising Adoption of Cloud-based Solutions

Another apparent benefit that has been identified to be a strong driver behind Accounts Receivable Automation Market is the more use of cloud-based tools. Chief financial officer are turning to the cloud for the management of their financial processes as cloud platforms are flexible, scalable and economic. ASP ARA solutions do not require significant its infrastructure on the part of the business and offer the flexibility of remote access to and updating of financial information. This is especially useful in establishments which have staff working from different provinces or states or even internationally.

It is also enabled by the increasing emphasis on digital change in enterprises, which makes cloud computing its natural ground. With industries emphasising on automation to increase speed and reliability, Cloud-Based ARA solutions make for great propositions to any business regardless of its size.

Accounts Receivable Automation Market Segment Analysis:

Accounts Receivable Automation Market is Segmented on the basis of Component, Organisation Size, End User, and Region.

By Component, Solution segment is expected to dominate the market during the forecast period

The Accounts Receivable Automation Market application segment is divided into Solution segment that is anticipated to lead throughout the forecast period. This segment comprises of any software solution or application used in the accounts receivable cycle like Billing, Collections, Payment Collection and Reporting. As more companies set out to optimise their cash flow and cut operational expenses, the applications incorporating the range of automation solutions are required. Besides increasing performance levels these solutions also decrease the probabilities of mistakes and minimize interventions in the accounts receivable processes of organizations.

By Organisation Size, Small and Medium Enterprises (SMEs) segment expected to held the largest share

Of all the industry segments, Small and Medium Enterprises (SMEs) are expected to occupy the largest market share for Accounts Receivable Automation over the projection period. During the recent years, due to the desire of SMEs to enhance the financial processes and the management of their cash flows, the implementation of accounts receivable automation solutions is viewed as highly desirable. Many of these businesses work with limited resources to collect receivables and automation becomes a way of minimizing efforts, reducing errors and ensure timely payments. The simplicity of implementation and low costs of automation solutions mean that they could be tailor-made for SMEs, who otherwise may not be able to fund large scale financial departments.

Accounts Receivable Automation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America will see a in Accounts Receivable Automation Market during 2023. The region’s supremacy, therefore, owes to the early and fast incorporation of technologies aimed at automating industrial processes, technology solution providers, as well as the increasing uptake of technological solutions across the finance industry. The United States has specifically been one of the early industries to implement accounts receivable automation solutions as various companies in finance, healthcare and manufacturing industries look to improve their accounts receivable management.. This growth is also backed by the fact that cloud solutions, with which these financial operations were carried out, are still actively introduced into business processes, and the use of artificial intelligence and machine learning in operations with financial data is only growing. This has been mainly due to the well-established technology in the region and the increasing need for organization to enhance their cash flow forecasting.

Active Key Players in the Accounts Receivable Automation Market

Accenture (Ireland)

Aptean (USA)

Bill.com (USA)

BlackLine (USA)

Bottomline Technologies (USA)

DataServ (USA)

FIS Global (USA)

HighRadius (USA)

Infor (USA)

Kofax (USA)

Oracle Corporation (USA)

SAP SE (Germany)

Serrala (Germany)

Versapay (Canada)

Zuora (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Accounts Receivable Automation Market by Component

4.1 Accounts Receivable Automation Market Snapshot and Growth Engine

4.2 Accounts Receivable Automation Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Solution: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

4.5 Consulting and Implementation Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Consulting and Implementation Services: Geographic Segmentation Analysis

4.6 Support and Maintenance Services

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Support and Maintenance Services: Geographic Segmentation Analysis

4.7 Other Components

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Other Components: Geographic Segmentation Analysis

Chapter 5: Accounts Receivable Automation Market by Organisation Size

5.1 Accounts Receivable Automation Market Snapshot and Growth Engine

5.2 Accounts Receivable Automation Market Overview

5.3 Small and Medium Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small and Medium Enterprises (SMEs): Geographic Segmentation Analysis

5.4 Large Enterprises

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Large Enterprises: Geographic Segmentation Analysis

Chapter 6: Accounts Receivable Automation Market by End User

6.1 Accounts Receivable Automation Market Snapshot and Growth Engine

6.2 Accounts Receivable Automation Market Overview

6.3 Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Banking: Geographic Segmentation Analysis

6.4 Financial Services

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Financial Services: Geographic Segmentation Analysis

6.5 an Insurance (BFSI) Sector

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 an Insurance (BFSI) Sector: Geographic Segmentation Analysis

6.6 Information Technology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Information Technology: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Accounts Receivable Automation Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCENTURE (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 APTEAN (USA)

7.4 BILL.COM (USA)

7.5 BLACKLINE (USA)

7.6 BOTTOMLINE TECHNOLOGIES (USA)

7.7 DATASERV (USA)

7.8 FIS GLOBAL (USA)

7.9 HIGHRADIUS (USA)

7.10 INFOR (USA)

7.11 KOFAX (USA)

7.12 ORACLE CORPORATION (USA)

7.13 SAP SE (GERMANY)

7.14 SERRALA (GERMANY)

7.15 VERSAPAY (CANADA)

7.16 ZUORA (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Accounts Receivable Automation Market By Region

8.1 Overview

8.2. North America Accounts Receivable Automation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Solution

8.2.4.2 Services

8.2.4.3 Consulting and Implementation Services

8.2.4.4 Support and Maintenance Services

8.2.4.5 Other Components

8.2.5 Historic and Forecasted Market Size By Organisation Size

8.2.5.1 Small and Medium Enterprises (SMEs)

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Banking

8.2.6.2 Financial Services

8.2.6.3 an Insurance (BFSI) Sector

8.2.6.4 Information Technology

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Accounts Receivable Automation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Solution

8.3.4.2 Services

8.3.4.3 Consulting and Implementation Services

8.3.4.4 Support and Maintenance Services

8.3.4.5 Other Components

8.3.5 Historic and Forecasted Market Size By Organisation Size

8.3.5.1 Small and Medium Enterprises (SMEs)

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Banking

8.3.6.2 Financial Services

8.3.6.3 an Insurance (BFSI) Sector

8.3.6.4 Information Technology

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Accounts Receivable Automation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Solution

8.4.4.2 Services

8.4.4.3 Consulting and Implementation Services

8.4.4.4 Support and Maintenance Services

8.4.4.5 Other Components

8.4.5 Historic and Forecasted Market Size By Organisation Size

8.4.5.1 Small and Medium Enterprises (SMEs)

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Banking

8.4.6.2 Financial Services

8.4.6.3 an Insurance (BFSI) Sector

8.4.6.4 Information Technology

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Accounts Receivable Automation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Solution

8.5.4.2 Services

8.5.4.3 Consulting and Implementation Services

8.5.4.4 Support and Maintenance Services

8.5.4.5 Other Components

8.5.5 Historic and Forecasted Market Size By Organisation Size

8.5.5.1 Small and Medium Enterprises (SMEs)

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Banking

8.5.6.2 Financial Services

8.5.6.3 an Insurance (BFSI) Sector

8.5.6.4 Information Technology

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Accounts Receivable Automation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Solution

8.6.4.2 Services

8.6.4.3 Consulting and Implementation Services

8.6.4.4 Support and Maintenance Services

8.6.4.5 Other Components

8.6.5 Historic and Forecasted Market Size By Organisation Size

8.6.5.1 Small and Medium Enterprises (SMEs)

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Banking

8.6.6.2 Financial Services

8.6.6.3 an Insurance (BFSI) Sector

8.6.6.4 Information Technology

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Accounts Receivable Automation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Solution

8.7.4.2 Services

8.7.4.3 Consulting and Implementation Services

8.7.4.4 Support and Maintenance Services

8.7.4.5 Other Components

8.7.5 Historic and Forecasted Market Size By Organisation Size

8.7.5.1 Small and Medium Enterprises (SMEs)

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Banking

8.7.6.2 Financial Services

8.7.6.3 an Insurance (BFSI) Sector

8.7.6.4 Information Technology

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Accounts Receivable Automation Market research report?

A1: The forecast period in the Accounts Receivable Automation Market research report is 2024-2032.

Q2: Who are the key players in the Accounts Receivable Automation Market?

A2: Accenture (Ireland), Aptean (USA), Bill.com (USA), BlackLine (USA), Bottomline Technologies (USA) and Other Active Players.

Q3: What are the segments of the Accounts Receivable Automation Market?

A3: The Accounts Receivable Automation Market is segmented into Component, Organisation Size, End User and region. By Component, the market is categorized into Solution, Services, Consulting and Implementation Services, Support and Maintenance Services, Other Components. By Organisation Size, the market is categorized into Small and Medium Enterprises (SMEs), Large Enterprises. By End User, the market is categorized into Banking, Financial Services, an Insurance (BFSI) Sector, Information Technology (IT) and Telecom Sector, Manufacturing Sector, Consumer Goods and Retail Sector, Healthcare Sector, Energy and Utilities Sector, Other Sectors. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Accounts Receivable Automation Market?

A4: The Accounts Receivable Automation (ARA) Market is the application of tools, products, and techniques in software that enable the automation of account receivables including issuing invoices, collecting receivables and processing payments, and reporting. Thus, ARA’s goal is to minimize the user input and optimize organisations’ financial processes and cash flow management. This market involves the implementation of solutions both in-house and through the internet, and use is steadily moving more to organizations seeking ways to revolutionize their operations, reduce mistakes, and speed up receipt of revenues.

Q5: How big is the Accounts Receivable Automation Market?

A5: Accounts Receivable Automation Market Size Was Valued at USD 2.70 Billion in 2023, and is Projected to Reach USD 6.74 Billion by 2032, Growing at a CAGR of 10.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!