Stay Ahead in Fast-Growing Economies.

Browse Reports Now5G Chipset Market Trends, Growth Opportunities, Analysis By 2032

5G chipsets authorize 5G packet communication on smartphones, portable hotspots, IoT devices, and increasingly, notebook PCs with mobile network capabilities. 5G mobile devices are anticipated to combine familiar sub-6 GHz bands with new MIMO antenna systems, as well as high-frequency millimeter-wave (mm Wave) bands with highly-focused beam-steering. The 5G modem chipsets, in combination with service providers, largely serve and enhance the capabilities of three major applications – enhanced mobile broadband, ultra -reliable and low latency communications, and massive machine type communications.

IMR Group

Description

5G Chipset Market Synopsis

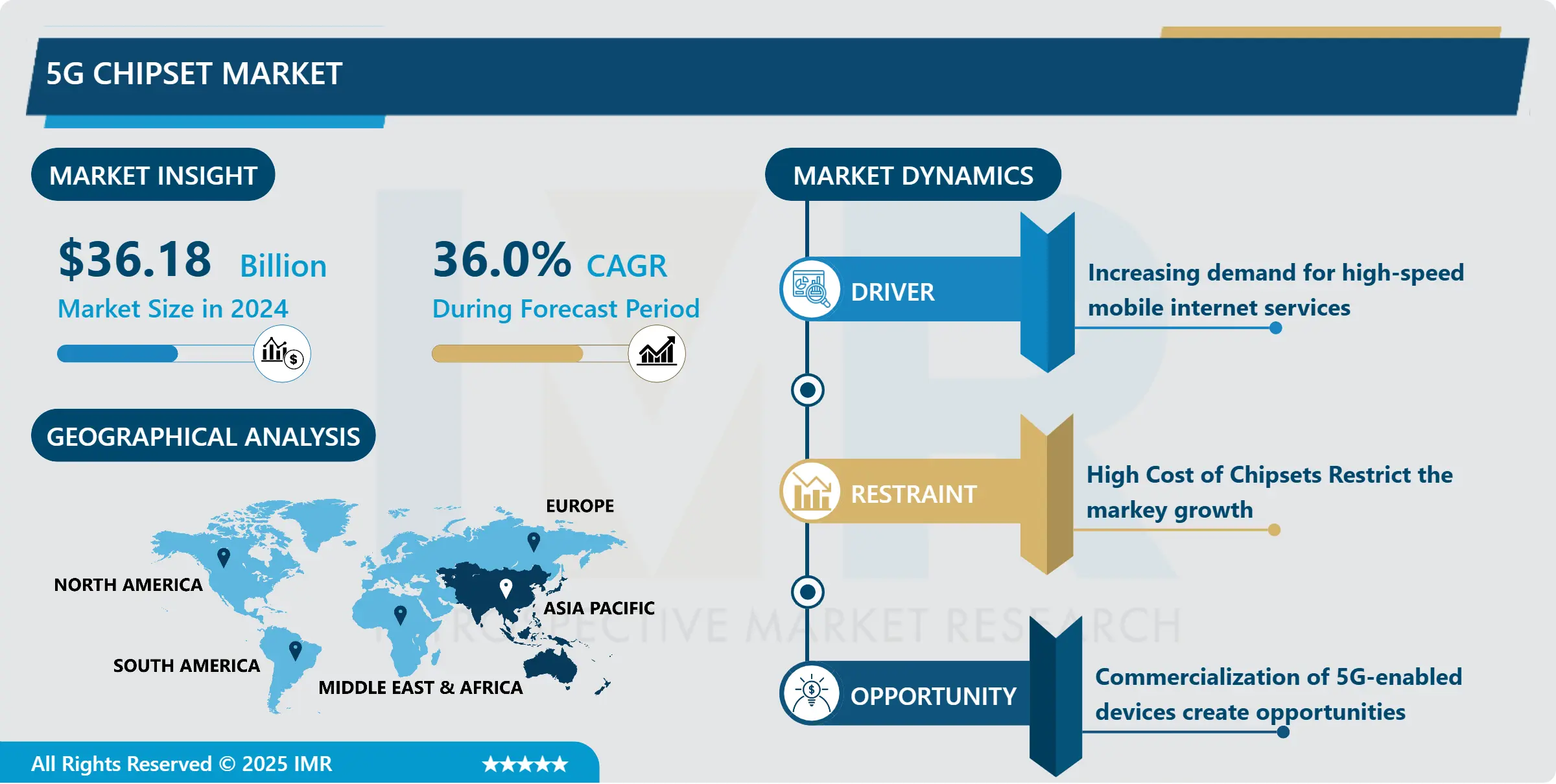

5G Chipset Market Size Was Valued at USD 36.18 Billion in 2024 and is Projected to Reach USD 423.43 Billion by 2032, Growing at a CAGR of 36.0% From 2025-2032.

5G chipset is a more advanced element of the customer premises equipment and other network infrastructure equipment to enable the end user to set up a wireless network based on the specifications of the 5G network. Advancements in technology result in the proliferation of connected devices spur the need for yet another wireless network that is 5G. The fifth-generation wireless (5G) is the next-level mobile network after the present 4G LTE mobile network. These networks broaden the Operational Frequency of Broadband Wireless past the portable internet, for the internet of things, and crucial correspondence areas so as to constitute a totally linked world.

Furthermore, the future next-generation cheapest chipset solution for 5G is expected to bring out tremendous improvement in the efficiency and performance to create new user experiences and industry connections. Also, consumer demand for networks for 5g infrastructure solutions fuels the 5G chipset market trends because it integrates new industries, enhancing efficiency and reducing cost for the growth of the 5G chipset market.

Several vendors offering solution for 5G chipsets are entering into the 5G chipsets targeted to low and mid-end smartphones due to the increasing demand of end users for high internet speed. For example, in September 2022, Qualcomm Technologies, Inc., a semiconductor firm, introduced the Snapdragon 4 Gen 1 and Snapdragon 6 Gen 1 to attack the mid-range and low-end market. Snapdragon 6 and Snapdragon 4 as series enhancements that unleash new forms of capture, communication, entertainment, and AI. For AI, the device features a new generation of the Qualcomm AI Engine that should deliver up to three times better performance in terms of intelligent assistant and activity recognition.

The demand for 5G chipsets is projected to increase significantly by the forecast period, primarily driven by the M2M / IoT connections. In addition, increase in the demand for faster Internet connection and an extensive telco infrastructure fuels the market growth. In addition, The rising demand for mobile broadband operational frequency in the industry is also expected to contribute towards the growth of the 5G chipset market over the forecast period.

But high investment and 5G network technological & infrastructure implementation issues, and privacy & security concern have been observed as the main factors that hinder the market growth. However, increasing government focus towards developing smart cities in Asia-Pacific is likely to create a better growth prospect for the 5G chipset market during the near future.

5G Chipset Market Trend Analysis

Rising demand for 5G networks that offer high speeds and low latency.

There has been a growing need for faster and more reliable broadband internet connections, particularly in the past decade. This enhances the need for high-speed internet connections, and high-speed data transmission for efficient information delivery is boosting the 5G network technology. They also improve manufacturing and performance of smartphone and other connected devices through 5G technology. For instance in October 2022, one survey report was published through a telecommunication related discussion forum known as TelecomTalk. As stated in the report on the smart device usage, the smart device user spends 312 minutes per day using the 5G smart device in the US which is 37 minutes more than that of 4G smart device user. It also shows that in the U. S, the percentage of 5G smartphone usage increased from 41% to 63% between $2021 to 2022.

Additionally, the popularity of Internet of Things, and connected devices also led to the rise of 5G network technology that acts as the reason for the high penetration of 5G enabled processors and chipsets in the global market. Therefore, 5G chipsets are crucial parts of different 5G related facilities like MODEM, routers, smart phones, laptops and internet base station. There has been innovation in the use of 5G chipsets in many of the consumer electronics. Consequently, increasing penetration of 5G processors and chipsets in consumer electronics devices is a key factor in the global market.

Increased adoption of state-of-the-art devices across multiple industry sectors propels market expansion.

Throughout the last two decades, several industry verticals are moving their operations towards the digital domains. Consequently, the digitization of various sector types is one of the priorities of industry verticals. This digitization involves, for example, the application of advanced and innovative technologies like industrial IoT, industrial robotics, and AI. To make the usage of such technologies conceivable, high speed and low latency internet connection through 5G enabled chipsets can be used. Moreover, these 5G processors and chipset are utilised in hybrid electric and connected vehicles for cars to cars and cars to pedestrens communication. Instant communication in automobiles also seems to enhance chances of avoiding an accident, thus spurring the market. 5G chipset is also applied to the manufacturing sector to facilitate the connectivity between manufacturing equipment and operators. This growth is attributed to the increased use of chipsets in various devices and computers as stated below.

5G Chipset Market Segment Analysis:

5G Chipset Market is Segmented based on Type, Frequency, Deployment Type, Industry Vertical and Region

By Type, ASIC segment is expected to dominate the market during the forecast period

By type, the market could be segmented Application Specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Integrated Circuit (mm Wave IC), Cellular Integrated Circuit (Cellular IC), and others. Out of all the application segments, the ASIC application held the largest market share in 2022. This is so because of some of the features that it has like, it’s very small in size and very light in weight this make the system small in size. That is why the price of ASIC is considered to be lower than such rivals as Central Processing Unit (CPU). In addition, both segments, such as the Radio Frequency Integrated Circuit (RFIC) and Millimeter Wave Integrated Circuit (mm Wave IC), are expected to exhibit similar trends in the forecast timeframe. Still, the cellular Integrated Circuit segment, also known as cellular IC, is expected to have the highest Compound Annual Growth Rate (CAGR) in the given timeframe. The need for cellular IC in smartphones and tablets to achieve low latency rates and high connectivity speed is a significant factor that has been observed to fuel this segment.

By Deployment Type, Smartphone/Tablets segment held the largest share in 2024

By the type of deployment, the market is segmented into smartphones and tablets, connected vehicles, connected devices, BBAG devices, and other categories. Smartphone/tablet have more revenue in 2022 and it will remain the same in the forecast period as next-generation networking chipsets are integrated frequently in smartphone and tablet. Additionally, the connected vehicle market was noted to have contributed the second highest revenue in the market because of the high integration of advanced hybrid technology in automobiles. However, the corresponding device segment was to have the highest Compound Annual Growth Rate in the overall market during the period under forecast. This is the case due to the rising adoption of emerging technologies in industries through the integration of IoT and industrial automation, among other factors.

5G Chipset Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The 5G chipset market is headed by Asia Pacific with 38% market share. 64% and was valued at USD 7. 61 billion in 2022. Asia Pacific held a significant share and will dominate the global market share in the coming years. This growth is attributed to the sufficient availability of modern manufacturing facilities for advanced processors and chipsets as well as modern research & development facilities in developing countries like China, Japan, South Korea, Taiwan & Singapore. Also, the regional market consists of emerging countries like India, Australia, and countries in the Southeast Asia region. Both India and Singapore are keen on raising the number of manufacturing units of 5G-enabled devices. They are also increasing the size of the manufacturing facility of chipsets and processors in the country. For instance, in October 2022, according to the “Economic Times” publication, 5G smartphone factories in India expanded their production capacity from 2 to 200 units, owing to the launch of 5G service in India. The above factors make the foreign investors to invest in the Indian market to set up manufacturing facilities thereby boosting the market growth

Active Key Players in the 5G Chipset Market

Qualcomm Technologies, Inc. (U.S.)

Broadcom (U.S.)

Unisoc Communications, Inc. (China)

Mediatek Inc. (Taiwan)

Intel Corporation (U.S.)

Samsung Electronics Co., Ltd. (South Korea)

Huawei Technologies Co., Ltd. (China)

Qorvo (U.S.)

Xilinx Inc. (U.S.)

Infineon Technologies AG (Germany)

Other Active Players

Key Industry Developments in the 5G Chipset Market:

In November 2023, Mediatek launched its 5G ready chipset Dimensity 8300 based on TSMC’s second generation 4nm process technology. It has an octa-core processor comprising four Arm cortex A715 and A510.

In November 2023, Qualcomm announced its global expansion with its latest 5G redcap chipset snapdragon X35 5G modem RF system that will enable the smaller and most cost efficient 5G devices to connect and explore the capabilities of 5G.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 5G Chipset Market by Type (2018-2032)

4.1 5G Chipset Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Application Specific Integrated Circuit (ASIC)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Radio Frequency Integrated Circuit (RFIC)

4.5 Millimeter Wave Integrated Circuit (mmWave IC)

4.6 Cellular Integrated Circuit (Cellular IC)

4.7 Others

Chapter 5: 5G Chipset Market by Frequency (2018-2032)

5.1 5G Chipset Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sub-6 GHZ

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 26-39 GHZ

5.5 Above 39 GHz

Chapter 6: 5G Chipset Market by Deployment Type (2018-2032)

6.1 5G Chipset Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Smartphone/Tablets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Connected Vehicles

6.5 Connected Devices

6.6 Broadband Access Gateway Devices

6.7 Others

Chapter 7: 5G Chipset Market by Industry Vertical (2018-2032)

7.1 5G Chipset Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Energy and Utilities

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Manufacturing

7.5 IT and Telecommunication

7.6 Media and Entertainment

7.7 Transportation and Logistics

7.8 Consumer Electronics

7.9 Healthcare

7.10 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 5G Chipset Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ORGANOVO HOLDINGS INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ENVISIONTEC (US)

8.4 STRATASYS LTD. (US)

8.5 ALLEVI (US)

8.6 NSCRYPT INC. (US)

8.7 DIGILAB INC. (US)

8.8 BIOBOTS (US)

8.9 TEVIDO BIODEVICES (US)

8.10 AXOLOTL BIOSCIENCES (MEXICO)

8.11 NANO3D BIOSCIENCES INC. (US)

8.12 CELLINK AB (US)

8.13 ADVANCED SOLUTIONS LIFE SCIENCES (US)

8.14 3D SYSTEMS CORPORATION (US)

8.15 ASPECT BIOSYSTEMS LTD. (CANADA)

8.16 MATERIALISE NV (BELGIUM)

8.17 REGENHU LTD. (SWITZERLAND)

8.18 POIETIS (FRANCE)

8.19 GESIM (GERMANY)

8.20 3DYNAMIC SYSTEMS LTD. (UK)

8.21 3D BIOPRINTING SOLUTIONS (RUSSIA)

8.22 BIOPRINTING RESEARCH CENTER (SPAIN)

8.23 CELLINK AB (SWEDEN)

8.24 CYFUSE BIOMEDICAL K.K. (JAPAN)

8.25 REGENOVO BIOTECHNOLOGY COLTD. (CHINA)

8.26 ROKIT HEALTHCARE (SOUTH KOREA)

8.27

Chapter 9: Global 5G Chipset Market By Region

9.1 Overview

9.2. North America 5G Chipset Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Application Specific Integrated Circuit (ASIC)

9.2.4.2 Radio Frequency Integrated Circuit (RFIC)

9.2.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.2.4.4 Cellular Integrated Circuit (Cellular IC)

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Frequency

9.2.5.1 Sub-6 GHZ

9.2.5.2 26-39 GHZ

9.2.5.3 Above 39 GHz

9.2.6 Historic and Forecasted Market Size by Deployment Type

9.2.6.1 Smartphone/Tablets

9.2.6.2 Connected Vehicles

9.2.6.3 Connected Devices

9.2.6.4 Broadband Access Gateway Devices

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 Energy and Utilities

9.2.7.2 Manufacturing

9.2.7.3 IT and Telecommunication

9.2.7.4 Media and Entertainment

9.2.7.5 Transportation and Logistics

9.2.7.6 Consumer Electronics

9.2.7.7 Healthcare

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe 5G Chipset Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Application Specific Integrated Circuit (ASIC)

9.3.4.2 Radio Frequency Integrated Circuit (RFIC)

9.3.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.3.4.4 Cellular Integrated Circuit (Cellular IC)

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Frequency

9.3.5.1 Sub-6 GHZ

9.3.5.2 26-39 GHZ

9.3.5.3 Above 39 GHz

9.3.6 Historic and Forecasted Market Size by Deployment Type

9.3.6.1 Smartphone/Tablets

9.3.6.2 Connected Vehicles

9.3.6.3 Connected Devices

9.3.6.4 Broadband Access Gateway Devices

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 Energy and Utilities

9.3.7.2 Manufacturing

9.3.7.3 IT and Telecommunication

9.3.7.4 Media and Entertainment

9.3.7.5 Transportation and Logistics

9.3.7.6 Consumer Electronics

9.3.7.7 Healthcare

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe 5G Chipset Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Application Specific Integrated Circuit (ASIC)

9.4.4.2 Radio Frequency Integrated Circuit (RFIC)

9.4.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.4.4.4 Cellular Integrated Circuit (Cellular IC)

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Frequency

9.4.5.1 Sub-6 GHZ

9.4.5.2 26-39 GHZ

9.4.5.3 Above 39 GHz

9.4.6 Historic and Forecasted Market Size by Deployment Type

9.4.6.1 Smartphone/Tablets

9.4.6.2 Connected Vehicles

9.4.6.3 Connected Devices

9.4.6.4 Broadband Access Gateway Devices

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 Energy and Utilities

9.4.7.2 Manufacturing

9.4.7.3 IT and Telecommunication

9.4.7.4 Media and Entertainment

9.4.7.5 Transportation and Logistics

9.4.7.6 Consumer Electronics

9.4.7.7 Healthcare

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific 5G Chipset Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Application Specific Integrated Circuit (ASIC)

9.5.4.2 Radio Frequency Integrated Circuit (RFIC)

9.5.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.5.4.4 Cellular Integrated Circuit (Cellular IC)

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Frequency

9.5.5.1 Sub-6 GHZ

9.5.5.2 26-39 GHZ

9.5.5.3 Above 39 GHz

9.5.6 Historic and Forecasted Market Size by Deployment Type

9.5.6.1 Smartphone/Tablets

9.5.6.2 Connected Vehicles

9.5.6.3 Connected Devices

9.5.6.4 Broadband Access Gateway Devices

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 Energy and Utilities

9.5.7.2 Manufacturing

9.5.7.3 IT and Telecommunication

9.5.7.4 Media and Entertainment

9.5.7.5 Transportation and Logistics

9.5.7.6 Consumer Electronics

9.5.7.7 Healthcare

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa 5G Chipset Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Application Specific Integrated Circuit (ASIC)

9.6.4.2 Radio Frequency Integrated Circuit (RFIC)

9.6.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.6.4.4 Cellular Integrated Circuit (Cellular IC)

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Frequency

9.6.5.1 Sub-6 GHZ

9.6.5.2 26-39 GHZ

9.6.5.3 Above 39 GHz

9.6.6 Historic and Forecasted Market Size by Deployment Type

9.6.6.1 Smartphone/Tablets

9.6.6.2 Connected Vehicles

9.6.6.3 Connected Devices

9.6.6.4 Broadband Access Gateway Devices

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 Energy and Utilities

9.6.7.2 Manufacturing

9.6.7.3 IT and Telecommunication

9.6.7.4 Media and Entertainment

9.6.7.5 Transportation and Logistics

9.6.7.6 Consumer Electronics

9.6.7.7 Healthcare

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America 5G Chipset Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Application Specific Integrated Circuit (ASIC)

9.7.4.2 Radio Frequency Integrated Circuit (RFIC)

9.7.4.3 Millimeter Wave Integrated Circuit (mmWave IC)

9.7.4.4 Cellular Integrated Circuit (Cellular IC)

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Frequency

9.7.5.1 Sub-6 GHZ

9.7.5.2 26-39 GHZ

9.7.5.3 Above 39 GHz

9.7.6 Historic and Forecasted Market Size by Deployment Type

9.7.6.1 Smartphone/Tablets

9.7.6.2 Connected Vehicles

9.7.6.3 Connected Devices

9.7.6.4 Broadband Access Gateway Devices

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 Energy and Utilities

9.7.7.2 Manufacturing

9.7.7.3 IT and Telecommunication

9.7.7.4 Media and Entertainment

9.7.7.5 Transportation and Logistics

9.7.7.6 Consumer Electronics

9.7.7.7 Healthcare

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the 5G Chipset Market research report?

A1: The forecast period in the 5G Chipset Market research report is 2025-2032.

Q2: Who are the key players in the 5G Chipset Market?

A2: Qualcomm Technologies, Inc. (U.S.) Broadcom (U.S.) Unisoc Communications, Inc. (China) Mediatek Inc. (Taiwan) Intel Corporation (U.S.) Samsung Electronics Co., Ltd. (South Korea) Huawei Technologies Co., Ltd. (China) Qorvo (U.S.) Xilinx Inc. (U.S.) Infineon Technologies AG (Germany), and Other Active Players.

Q3: What are the segments of the 5G Chipset Market?

A3: The 5G Chipset Market is segmented into type, frequency, deployment type, industry vertica, and region. By type, the market is categorized into Application Specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Integrated Circuit (mm Wave IC), Cellular Integrated Circuit (Cellular IC), and others. By frequency, the market is categorized into Sub-6 GHZ, 26-39 GHZ, and above 39 GHz. By deployment type, the market is categorized into smartphones/tablets, connected vehicles, connected devices, broadband access gateway devices, and others. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the 5G Chipset Market?

A4: A 5G chipset is an integrated circuit that is designed to provide allowance for the interconnectivity of the devices with what is referred to as 5G networks today, which promises to support higher data rates per user and use bandwidths for data transmission while ensuring lower latency than the earlier 4G networks. These chipsets are used in smartphones, tablets, IoT and other connected world including AR technologies, autopilot cars and smart cities, and all applications which involve high speed communication. They perform a number of tasks such as data processing, signal modulation, and power regulation with a view of achieving required performance and minimal energy consumption in ultra 5G networks.

Q5: How big is the 5G Chipset Market?

A5: 5G Chipset Market Size Was Valued at USD 36.18 Billion in 2024 and is Projected to Reach USD 423.43 Billion by 2032, Growing at a CAGR of 36.0% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!