Stay Ahead in Fast-Growing Economies.

Browse Reports Now3D Sensor Market Global Industry Growth and Trend Analysis 2025

3D sensors are sophisticated technologies designed to capture detailed spatial information from their surroundings, generating realistic three-dimensional (3D) images.

IMR Group

Description

3D Sensor Market Synopsis

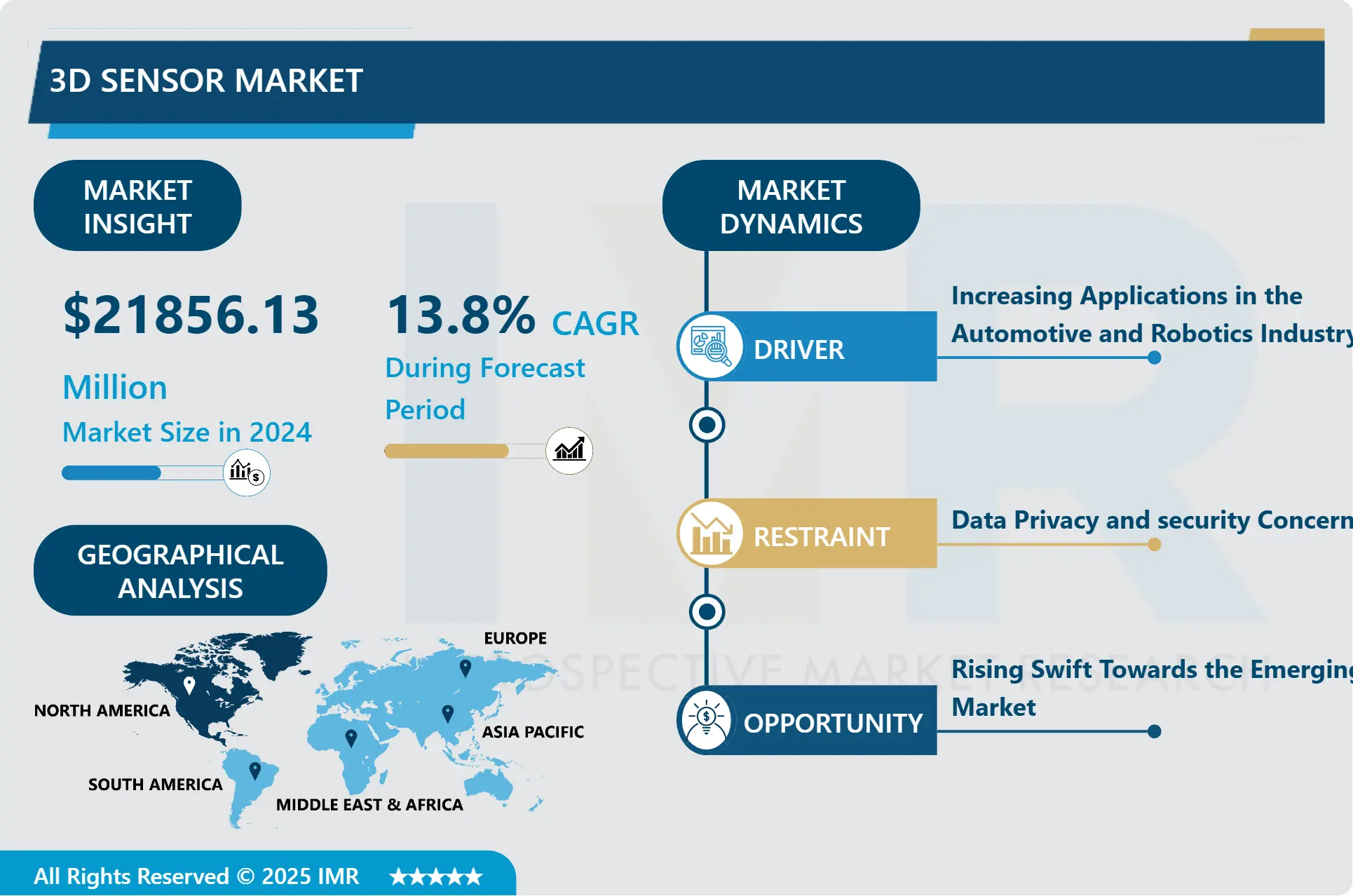

3D Sensor Market Size Was Valued at USD 21856.13 million in 2024, and is Projected to Reach USD 61476.82 million by 2032, Growing at a CAGR of 13.8% From 2025-2032.

3D sensors are sophisticated technologies designed to capture detailed spatial information from their surroundings, generating realistic three-dimensional (3D) images. These sensors employ various techniques such as structured light, ultrasound, and time-of-flight (ToF) to create real-time 3D maps. They incorporate cameras with infrared (IR) sources to illuminate the scene and CMOS/CCD sensors to capture the reflected light. The depth information is primarily obtained through ToF, which measures the time taken for the light to travel to an object and back, constructing 3D images from the collected point clouds.

As the demand for gesture recognition and analysis grows, 3D sensors have become integral in enhancing the performance and efficiency of complex systems across various industries, including automotive, electronics, healthcare, industrial robotics, and security and surveillance. In the automotive industry, for instance, 3D sensors enable advanced driver assistance systems (ADAS) and autonomous driving features by providing accurate environment mapping and object detection.

In consumer electronics, they enhance user interfaces through gesture control and facial recognition technologies. The healthcare sector benefits from 3D sensing technology through improved diagnostic tools, minimally invasive surgeries, and patient monitoring systems. Industrial robotics utilize these sensors for precise navigation and manipulation in manufacturing processes.

Security and surveillance systems leverage 3D sensors for enhanced monitoring and threat detection, providing detailed spatial data that improve situational awareness. Consequently, 3D sensing technology is emerging as a pivotal innovation poised to revolutionize the electronics, security and surveillance, and automotive industries. The growing adoption across these sectors underscores its transformative potential, driving advancements and creating new possibilities in both consumer and industrial applications.

3D Sensor Market Trend Analysis

3D Sensor Market Growth Driver- Increasing Applications in the Automotive and Robotics Industry

Automotive applications, of 3D sensor are significantly enhanced by the accurate and reliable depth sensing capabilities provided by 3D time-of-flight (ToF) technology. Inside the car, 3D in-cabin sensing cameras capture and process the data necessary to ensure a high level of passive safety. This enables critical use cases such as driver monitoring, where the system can detect signs of drowsiness or distraction; occupant detection, which helps optimize airbag deployment based on the presence and position of passengers; and smart airbag systems that deploy more effectively to protect occupants. ?

3D depth data gives robust anti-spoofing capabilities, crucial for secure face verification in various applications. This includes in-car payments, access to personal information and cloud services, and keyless auto-entry through biometric authentication. Outside the vehicle, ToF cameras facilitate essential safety features such as safe navigation and collision detection, helping the vehicle to detect and avoid obstacles in real-time. ?In inside of the car, 3D time-of-flight (ToF) technology enables a range of safety and security applications.

Driver monitoring systems use ToF sensors to track eye movements and detect signs of fatigue or distraction, enhancing driver alertness and reducing accident risks. Occupant detection systems utilize 3D depth data to determine the presence and position of passengers, allowing for optimized airbag deployment and improved safety for all occupants. Also, smart airbag systems leverage this data to adjust deployment parameters, minimizing the risk of injury during collisions. So, the rising demand for advanced automotive safety, security, and convenience features is expected to drive significant growth in the adoption of 3D sensors throughout the projection period.

3D Sensor Market Opportunity- Rising Swift Towards the Emerging Market

3D sensors are increasingly uses in emerging markets, by rising disposable incomes and rapid technological advancements. Developing economies are exhibiting swift adoption of 3D sensors across various sectors, including consumer electronics, security and surveillance, and infrastructure. This trend gives the high potential for the rapid uptake of 3D sensor technology in applications such as smart infrastructure, enhanced security systems, and advanced consumer electronics.

In the consumer electronics sector, the demand for devices with innovative features like facial recognition, augmented reality (AR), and gesture control is growing. 3D sensors play an important role in enabling these functionalities, leading to their widespread integration into smartphones, tablets, and wearable devices. As consumers in emerging markets seek the latest technological innovations, the adoption of 3D sensors in these devices is expected to accelerate.

The security and surveillance sector in developing regions is also poised for substantial growth, driven by the need for improved safety and security solutions. 3D sensors enhance surveillance systems by providing accurate depth perception and object recognition, enabling more effective monitoring and threat detection. This makes them invaluable for applications in public safety, commercial security, and residential monitoring.

3D Sensor Market Segment Analysis:

3D Sensor Market is segmented on the basis of Product Type, Technology, Connectivity, Application, End-User and Region

By Type, Image Sensor Segment is expected to dominate the market during the forecast period

Image sensor is one of the important applications, including autonomous navigation, virtual reality (VR), robot guidance, robot-computer interfaces, and biological image analysis. These sensors are categorized into Time-of-Flight (ToF), CMOS (Complementary Metal-Oxide-Semiconductor), and electro-optical sensors, each serving specific functions based on their capabilities. CMOS 3D image sensors are particularly prevalent in cameras and smartphones due to their ability to accurately discern size, shape, and distance within a given range.

This versatility makes CMOS sensors an essential component in consumer electronics, enhancing functionalities such as depth sensing, high-resolution imaging, and advanced facial recognition. As the adoption of these technologies grows, especially in emerging markets, the demand for sophisticated image sensors is expected to drive significant expansion in the 3D sensor market.

The Image sensors facilitate interaction between robots and computers, improving control and coordination. Electro-optical sensors are also utilized to capture detailed visual information that enhances robotic interface capabilities. As these sensors become increasingly integral to technologies such as autonomous navigation, VR, robotics, and medical imaging, their market size is anticipated to expand. CMOS 3D image sensors, in particular, are expected to see widespread use due to their versatility and ability to capture detailed spatial information and its use.

By End-User, Consumer Electronics segment held the largest share in 2024

The consumer electronics in 3D sensor market get the highest income, by increasing the integration of biometric scanning and other advanced 3D sensing technologies. 3D sensing is revolutionizing consumer electronics by enabling features such as facial recognition in smartphones, tablets, and laptops, high-performance depth sensing in photography, and augmented reality (AR) and virtual reality (VR) applications in gaming devices.

In Microsoft Kinect has significantly transformed the home gaming industry with innovations like multi-player 3D position sensing, facial expression detection, and touchless heart rate monitoring. These advancements enhance the gaming experience by providing more immersive and interactive gameplay.

Other than gaming, 3D sensing technologies are also enhancing the capabilities of smart home devices, wearable technology, and personal health monitoring systems. Smart home devices, such as smart speakers and home security systems, leverage 3D sensing for improved voice recognition and motion detection. Wearable technology, including smartwatches and fitness trackers, utilizes 3D sensors for accurate tracking of physical activities and health metrics.

The number of IoT connected devices in the consumer goods sector worldwide has shown a consistent and significant increase from 2019 to 2023.

3D Sensor Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America with rapid Industrialization underscores the transformative potential of 3D sensors in industrial settings. The demand for predictive maintenance, automation, robotics, quality control, logistics and warehouse optimization, and remote monitoring is projected to enhance the application of 3D sensor-integrated solutions. These technologies enable industries to achieve higher efficiency, reduce downtime, and improve overall productivity.

Increased penetration of smartphones and smart consumer electronics around the world is driving the growth of the advanced concept of connected things or Internet of things (IoT). IoT growth in the near future will be driven by the rising proliferation of these connected devices in various areas, including smart homes, smart cities, smart buildings, and industrial setups. Rising investments and supportive ecosystem for IoT start-ups is also fuelling the R&D pertaining to the IoT technology. Google, Microsoft, Amazon, Cisco, GE, Intel, Qualcomm, and Samsung have also invested huge amounts in developing IoT across industries.

Smart city initiatives in the US, Canada and Singapore are also boosting the demand for IoT connections. The upcoming and emerging concepts that are considered to be the by-products of IoT are provided with a steady opportunity platform with the usage of these sensors. Therefore, the growing adoption of smart electronics is expected to drive the growth of the 3D sensors market. The 3D sensors market is fragmented with the presence of several market players. The companies operating in the 3D sensors market are focusing on offering flexible and efficient solutions to attract new customers and gain a strong market position.

3D Sensor Market Kay Players:

Intel Corporation (USA)

Infineon Technologies AG (Germany)

Sony Corporation (Japan)

Cognex Corporation (USA)

Lumentum Operations LLC (USA)

STMicroelectronics N.V. (Switzerland)

Qualcomm Technologies, Inc. (USA)

Samsung Electronics (South Korea)

Panasonic Corporation (Japan)

Apple Inc. (USA)

Siemens AG(Germany)

Microsoft Corporation (USA)

Texas Instruments Inc. (USA)

Leica Geosystems AG (Switzerland)

Basler AG (Germany)

Autodesk Inc. (USA)

Rockwell Automation, Inc. (USA)

Trimble Inc. (USA)

AMS AG (Austria)

Velodyne Lidar, Inc. (USA)

Ouster, Inc. (USA)

Toposens GmbH (Germany)

Cepton Technologies, Inc. (USA)

Quanergy Systems, Inc. (USA)

Teledyne Technologies Incorporated (USA)

MicroVision, Inc. (USA)

Other Active Player

Key Industry Developments in the 3D Sensor Market:

In March 2024, Siemens and NVIDIA expand collaboration on generative AI for immersive real-time visualization. Siemens announced that it will deepen its collaboration with NVIDIA to help build the industrial metaverse. Siemens is bringing immersive visualization powered by new NVIDIA Omniverse Cloud APIs to the Siemens Xcelerator platform, driving increased use of AI-driven digital twin technology.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 3D Sensor Market by Type (2018-2032)

4.1 3D Sensor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Image Sensor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Position Sensor

4.5 Acoustic Sensors

4.6 Accelerometer

4.7 Temperature Sensor

4.8 Pressure Sensor

4.9 Others

Chapter 5: 3D Sensor Market by Technology (2018-2032)

5.1 3D Sensor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Stereoscopic Vision

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Structured Light

5.5 Time of Flight (Photo Electric)

5.6 Ultrasound

5.7 Capacitive Sensing

5.8 Others (Infrared Sensing

5.9 Electric Field

5.10 Laser)

Chapter 6: 3D Sensor Market by Connectivity (2018-2032)

6.1 3D Sensor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Wired

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wireless

Chapter 7: 3D Sensor Market by Application (2018-2032)

7.1 3D Sensor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Industrial Automation & Robotics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Advanced Driver Assistance System (ADAS)

7.5 Medical Assistance

7.6 Thermal Imaging

7.7 Missile Tracking & Surveillance

7.8 Biometric Scanning

Chapter 8: 3D Sensor Market by End-User (2018-2032)

8.1 3D Sensor Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Automotive

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Aerospace & Defence

8.5 Agriculture

8.6 Consumer Electronics

8.7 Healthcare

8.8 Others (Oil & Gas

8.9 Mining

8.10 Chemical

8.11 Food & Beverages

8.12 Retail

8.13 Warehouse

8.14 Logistics & Power and Utility)

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 3D Sensor Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 INTEL CORPORATION (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 INFINEON TECHNOLOGIES AG (GERMANY)

9.4 SONY CORPORATION (JAPAN)

9.5 COGNEX CORPORATION (USA)

9.6 LUMENTUM OPERATIONS LLC (USA)

9.7 STMICROELECTRONICS N.V. (SWITZERLAND)

9.8 QUALCOMM TECHNOLOGIES INC. (USA)

9.9 SAMSUNG ELECTRONICS (SOUTH KOREA)

9.10 PANASONIC CORPORATION (JAPAN)

9.11 APPLE INC. (USA)

9.12 SIEMENS AG(GERMANY)

9.13 MICROSOFT CORPORATION (USA)

9.14 TEXAS INSTRUMENTS INC. (USA)

9.15 LEICA GEOSYSTEMS AG (SWITZERLAND)

9.16 BASLER AG (GERMANY)

9.17 AUTODESK INC. (USA)

9.18 ROCKWELL AUTOMATION INC. (USA)

9.19 TRIMBLE INC. (USA)

9.20 AMS AG (AUSTRIA)

9.21 VELODYNE LIDAR INC. (USA)

9.22 OUSTER INC. (USA)

9.23 TOPOSENS GMBH (GERMANY)

9.24 CEPTON TECHNOLOGIES INC. (USA)

9.25 QUANERGY SYSTEMS INC. (USA)

9.26 TELEDYNE TECHNOLOGIES INCORPORATED (USA)

9.27 MICROVISION INC. (USA)

Chapter 10: Global 3D Sensor Market By Region

10.1 Overview

10.2. North America 3D Sensor Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Image Sensor

10.2.4.2 Position Sensor

10.2.4.3 Acoustic Sensors

10.2.4.4 Accelerometer

10.2.4.5 Temperature Sensor

10.2.4.6 Pressure Sensor

10.2.4.7 Others

10.2.5 Historic and Forecasted Market Size by Technology

10.2.5.1 Stereoscopic Vision

10.2.5.2 Structured Light

10.2.5.3 Time of Flight (Photo Electric)

10.2.5.4 Ultrasound

10.2.5.5 Capacitive Sensing

10.2.5.6 Others (Infrared Sensing

10.2.5.7 Electric Field

10.2.5.8 Laser)

10.2.6 Historic and Forecasted Market Size by Connectivity

10.2.6.1 Wired

10.2.6.2 Wireless

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Industrial Automation & Robotics

10.2.7.2 Advanced Driver Assistance System (ADAS)

10.2.7.3 Medical Assistance

10.2.7.4 Thermal Imaging

10.2.7.5 Missile Tracking & Surveillance

10.2.7.6 Biometric Scanning

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Automotive

10.2.8.2 Aerospace & Defence

10.2.8.3 Agriculture

10.2.8.4 Consumer Electronics

10.2.8.5 Healthcare

10.2.8.6 Others (Oil & Gas

10.2.8.7 Mining

10.2.8.8 Chemical

10.2.8.9 Food & Beverages

10.2.8.10 Retail

10.2.8.11 Warehouse

10.2.8.12 Logistics & Power and Utility)

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe 3D Sensor Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Image Sensor

10.3.4.2 Position Sensor

10.3.4.3 Acoustic Sensors

10.3.4.4 Accelerometer

10.3.4.5 Temperature Sensor

10.3.4.6 Pressure Sensor

10.3.4.7 Others

10.3.5 Historic and Forecasted Market Size by Technology

10.3.5.1 Stereoscopic Vision

10.3.5.2 Structured Light

10.3.5.3 Time of Flight (Photo Electric)

10.3.5.4 Ultrasound

10.3.5.5 Capacitive Sensing

10.3.5.6 Others (Infrared Sensing

10.3.5.7 Electric Field

10.3.5.8 Laser)

10.3.6 Historic and Forecasted Market Size by Connectivity

10.3.6.1 Wired

10.3.6.2 Wireless

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Industrial Automation & Robotics

10.3.7.2 Advanced Driver Assistance System (ADAS)

10.3.7.3 Medical Assistance

10.3.7.4 Thermal Imaging

10.3.7.5 Missile Tracking & Surveillance

10.3.7.6 Biometric Scanning

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Automotive

10.3.8.2 Aerospace & Defence

10.3.8.3 Agriculture

10.3.8.4 Consumer Electronics

10.3.8.5 Healthcare

10.3.8.6 Others (Oil & Gas

10.3.8.7 Mining

10.3.8.8 Chemical

10.3.8.9 Food & Beverages

10.3.8.10 Retail

10.3.8.11 Warehouse

10.3.8.12 Logistics & Power and Utility)

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe 3D Sensor Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Image Sensor

10.4.4.2 Position Sensor

10.4.4.3 Acoustic Sensors

10.4.4.4 Accelerometer

10.4.4.5 Temperature Sensor

10.4.4.6 Pressure Sensor

10.4.4.7 Others

10.4.5 Historic and Forecasted Market Size by Technology

10.4.5.1 Stereoscopic Vision

10.4.5.2 Structured Light

10.4.5.3 Time of Flight (Photo Electric)

10.4.5.4 Ultrasound

10.4.5.5 Capacitive Sensing

10.4.5.6 Others (Infrared Sensing

10.4.5.7 Electric Field

10.4.5.8 Laser)

10.4.6 Historic and Forecasted Market Size by Connectivity

10.4.6.1 Wired

10.4.6.2 Wireless

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Industrial Automation & Robotics

10.4.7.2 Advanced Driver Assistance System (ADAS)

10.4.7.3 Medical Assistance

10.4.7.4 Thermal Imaging

10.4.7.5 Missile Tracking & Surveillance

10.4.7.6 Biometric Scanning

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Automotive

10.4.8.2 Aerospace & Defence

10.4.8.3 Agriculture

10.4.8.4 Consumer Electronics

10.4.8.5 Healthcare

10.4.8.6 Others (Oil & Gas

10.4.8.7 Mining

10.4.8.8 Chemical

10.4.8.9 Food & Beverages

10.4.8.10 Retail

10.4.8.11 Warehouse

10.4.8.12 Logistics & Power and Utility)

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific 3D Sensor Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Image Sensor

10.5.4.2 Position Sensor

10.5.4.3 Acoustic Sensors

10.5.4.4 Accelerometer

10.5.4.5 Temperature Sensor

10.5.4.6 Pressure Sensor

10.5.4.7 Others

10.5.5 Historic and Forecasted Market Size by Technology

10.5.5.1 Stereoscopic Vision

10.5.5.2 Structured Light

10.5.5.3 Time of Flight (Photo Electric)

10.5.5.4 Ultrasound

10.5.5.5 Capacitive Sensing

10.5.5.6 Others (Infrared Sensing

10.5.5.7 Electric Field

10.5.5.8 Laser)

10.5.6 Historic and Forecasted Market Size by Connectivity

10.5.6.1 Wired

10.5.6.2 Wireless

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Industrial Automation & Robotics

10.5.7.2 Advanced Driver Assistance System (ADAS)

10.5.7.3 Medical Assistance

10.5.7.4 Thermal Imaging

10.5.7.5 Missile Tracking & Surveillance

10.5.7.6 Biometric Scanning

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Automotive

10.5.8.2 Aerospace & Defence

10.5.8.3 Agriculture

10.5.8.4 Consumer Electronics

10.5.8.5 Healthcare

10.5.8.6 Others (Oil & Gas

10.5.8.7 Mining

10.5.8.8 Chemical

10.5.8.9 Food & Beverages

10.5.8.10 Retail

10.5.8.11 Warehouse

10.5.8.12 Logistics & Power and Utility)

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa 3D Sensor Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Image Sensor

10.6.4.2 Position Sensor

10.6.4.3 Acoustic Sensors

10.6.4.4 Accelerometer

10.6.4.5 Temperature Sensor

10.6.4.6 Pressure Sensor

10.6.4.7 Others

10.6.5 Historic and Forecasted Market Size by Technology

10.6.5.1 Stereoscopic Vision

10.6.5.2 Structured Light

10.6.5.3 Time of Flight (Photo Electric)

10.6.5.4 Ultrasound

10.6.5.5 Capacitive Sensing

10.6.5.6 Others (Infrared Sensing

10.6.5.7 Electric Field

10.6.5.8 Laser)

10.6.6 Historic and Forecasted Market Size by Connectivity

10.6.6.1 Wired

10.6.6.2 Wireless

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Industrial Automation & Robotics

10.6.7.2 Advanced Driver Assistance System (ADAS)

10.6.7.3 Medical Assistance

10.6.7.4 Thermal Imaging

10.6.7.5 Missile Tracking & Surveillance

10.6.7.6 Biometric Scanning

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Automotive

10.6.8.2 Aerospace & Defence

10.6.8.3 Agriculture

10.6.8.4 Consumer Electronics

10.6.8.5 Healthcare

10.6.8.6 Others (Oil & Gas

10.6.8.7 Mining

10.6.8.8 Chemical

10.6.8.9 Food & Beverages

10.6.8.10 Retail

10.6.8.11 Warehouse

10.6.8.12 Logistics & Power and Utility)

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America 3D Sensor Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Image Sensor

10.7.4.2 Position Sensor

10.7.4.3 Acoustic Sensors

10.7.4.4 Accelerometer

10.7.4.5 Temperature Sensor

10.7.4.6 Pressure Sensor

10.7.4.7 Others

10.7.5 Historic and Forecasted Market Size by Technology

10.7.5.1 Stereoscopic Vision

10.7.5.2 Structured Light

10.7.5.3 Time of Flight (Photo Electric)

10.7.5.4 Ultrasound

10.7.5.5 Capacitive Sensing

10.7.5.6 Others (Infrared Sensing

10.7.5.7 Electric Field

10.7.5.8 Laser)

10.7.6 Historic and Forecasted Market Size by Connectivity

10.7.6.1 Wired

10.7.6.2 Wireless

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Industrial Automation & Robotics

10.7.7.2 Advanced Driver Assistance System (ADAS)

10.7.7.3 Medical Assistance

10.7.7.4 Thermal Imaging

10.7.7.5 Missile Tracking & Surveillance

10.7.7.6 Biometric Scanning

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Automotive

10.7.8.2 Aerospace & Defence

10.7.8.3 Agriculture

10.7.8.4 Consumer Electronics

10.7.8.5 Healthcare

10.7.8.6 Others (Oil & Gas

10.7.8.7 Mining

10.7.8.8 Chemical

10.7.8.9 Food & Beverages

10.7.8.10 Retail

10.7.8.11 Warehouse

10.7.8.12 Logistics & Power and Utility)

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the 3D Sensor Market research report?

A1: The forecast period in the 3D Sensor Market research report is 2025-2032.

Q2: Who are the key players in the 3D Sensor Market?

A2: Intel Corporation (USA), Infineon Technologies AG (Germany), OmniVision Technologies, Inc. (USA), Sony Corporation (Japan), Cognex Corporation (USA), Lumentum Operations LLC (USA), STMicroelectronics N.V. (Switzerland), Qualcomm Technologies, Inc. (USA), Samsung Electronics (South Korea), Panasonic Corporation (Japan), Apple Inc. (USA), Siemens AG(Germany), Microsoft Corporation (USA), Texas Instruments Inc. (USA), Leica Geosystems AG (Switzerland), Basler AG (Germany), Autodesk Inc. (USA), Rockwell Automation, Inc. (USA), Trimble Inc. (USA), AMS AG (Austria), Velodyne Lidar, Inc. (USA), Ouster, Inc. (USA), Toposens GmbH (Germany), Cepton Technologies, Inc. (USA), Quanergy Systems, Inc. (USA), Teledyne Technologies Incorporated (USA), MicroVision, Inc. (USA) and other Active players

Q3: What are the segments of the 3D Sensor Market?

A3: The 3D Sensor Market is segmented into Type, technology, connectivity, Application, End-User, and Region. By Type, the market is categorized into Image Sensor, Position Sensor, Acoustic Sensors, Accelerometer, Temperature Sensor, Pressure Sensor, Others. By technology, the market is categorized into Stereoscopic Vision, Structured Light, Time of Flight (Photo Electric), Ultrasound, MEMS, Capacitive Sensing, others( Infrared Sensing, Electric Field, Laser) By Connectivity market is categorized into wired and wireless. By Application, the market is categorized into Industrial Automation & Robotics, Advanced Driver Assistance System (ADAS), Medical Assistance, Thermal Imaging, Missile Tracking & Surveillance, Biometric Scanning. By end-user market is categorized into Automotive, Aerospace & Defense, Agriculture, Consumer Electronics, Healthcare and Others (Oil & Gas, Mining, Chemical, Food & Beverages, Retail, Warehouse & Logistics, Power and Utility. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the 3D Sensor Market?

A4: 3D sensors are sophisticated technologies designed to capture detailed spatial information from their surroundings, generating realistic three-dimensional (3D) images. These sensors employ various techniques such as structured light, ultrasound, and time-of-flight (ToF) to create real-time 3D maps. They incorporate cameras with infrared (IR) sources to illuminate the scene and CMOS/CCD sensors to capture the reflected light.

Q5: How big is the 3D Sensor Market?

A5: 3D Sensor Market Size Was Valued at USD 21856.13 million in 2024, and is Projected to Reach USD 61476.82 Billion by 2032, Growing at a CAGR of 13.8% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!