Stay Ahead in Fast-Growing Economies.

Browse Reports Now3D Secure Pay Authentication Market – In-Depth Analysis by Size

3D Secure is an extra layer of security that you may enable for each online card transaction. Customers and vendors benefit from increased security. When you enable 3D Secure, you’ll be asked to authenticate each transaction by entering your PIN code. Three domains are the definition of 3D. The first is the card issuer; the second is the merchant who receives the payment; and the third is the 3DS infrastructure platform, which acts as a safe mediator between the customer and the shop.

IMR Group

Description

Global 3D Secure Pay Authentication Market Overview

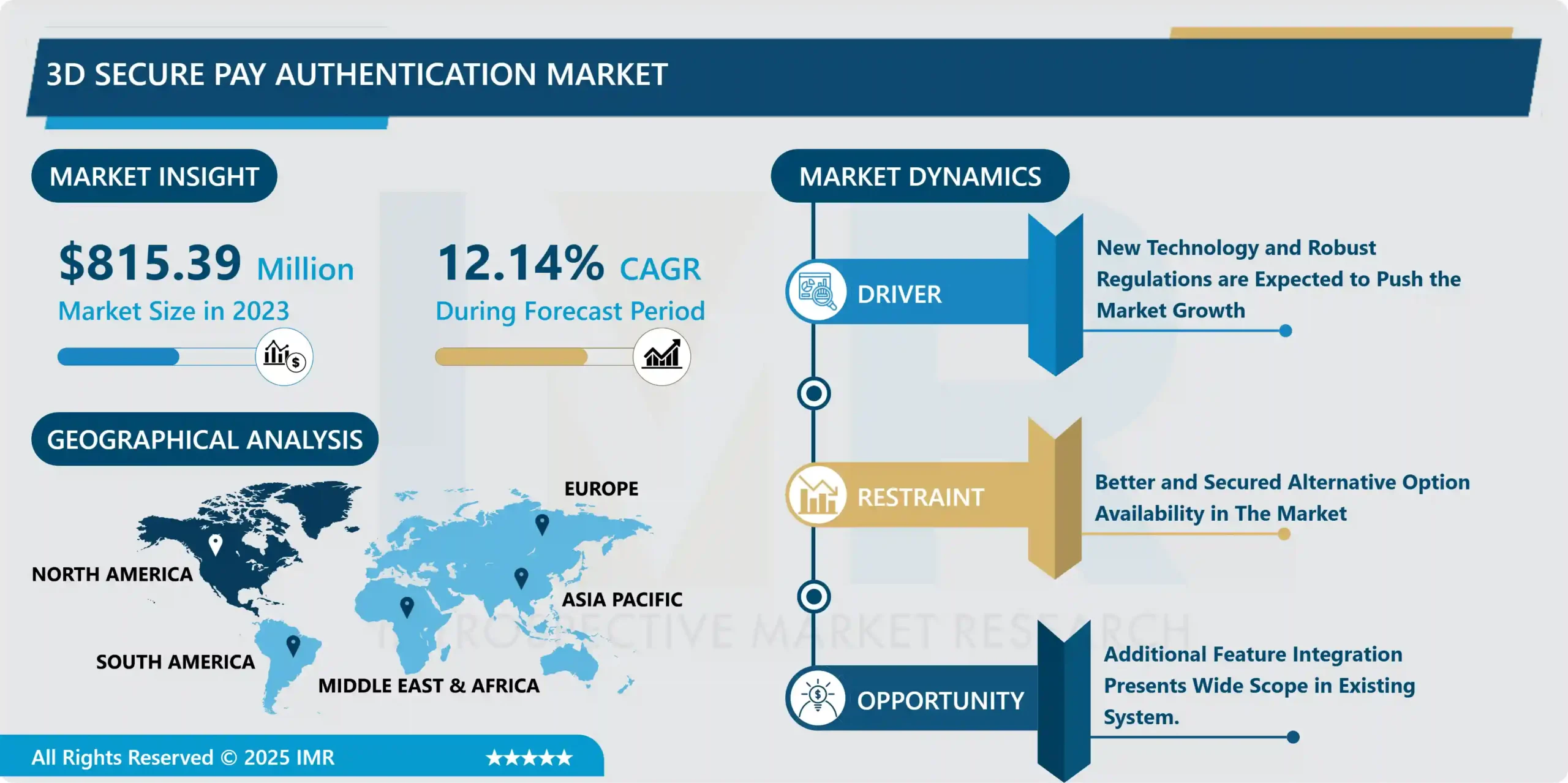

3D Secure Pay Authentication Market Size Was Valued at USD 815.39 Million in 2023 and is Projected to Reach USD 2286.71 Million by 2032, Growing at a CAGR of 12.14% From 2024-2032

3D Secure (3DS) is a verification method that boosts the security of online credit card purchases by asking customers to confirm their identity with the card issuer while making a payment. The added authentication layer greatly decreases the chances of fraudulent behavior.

For retailers, 3D Secure provides various advantages. First and foremost, it offers a liability shift. If a chargeback occurs, usually the responsibility lies with the merchant. Nonetheless, if the 3D Secure protocol is adhered to properly, the issuing bank will take on this responsibility. Merchants must thoroughly examine all documents provided by their issuer to grasp the implementation guidelines and regulations fully.

Additionally, 3DS protects against chargebacks. Transactions authenticated through Verified by Visa provide merchants with protection from chargebacks, safeguarding them against friendly fraud or chargeback fraud. It is essential to mention that MasterCard does not provide a comparable assurance, hence merchants need to recognize the distinctions among card networks.

Another benefit is the possibility of exchanging advantages. Merchants could benefit from reduced interchange fees and extended payment terms from their acquirer by utilizing 3D Secure, leading to savings on costs and better management of cash flow.

Finally, 3D Secure boosts customer trust. Building trust with customers is crucial for Card-Not-Present (CNP) merchants. The extra protection from 3DS gives customers peace of mind that their information is safe, which could make them more likely to finish purchases and drive up total sales. 3D Secure is a useful tool for merchants aiming to prevent fraud, lower liability, and establish customer confidence.

Market Dynamics And Factors For 3D Secure Pay Authentication Market

Drivers:

New Technology And Robust Regulations Are Expected To Push The Market Growth

New technology, such as automated table service and app-based ordering, have been quickly adopted by hotels and restaurants. Customers now have access to a myriad of mobile platforms that make purchasing and paying easier, with several payment options. For things like room reservations and other services, most hotels, resorts, and tourism centers now allow online transactions and payments. Online fraud can happen throughout a reservation transaction. Online payments are commonly performed through online travel agencies (OTAs), online booking engines, and/or directly on the hotel’s website. Hotels are more exposed to online payment frauds and malevolent activities when they allow card-present transactions through their property management system, as well as when they make and receive payments online. With the implementation of the PSD2 standard, hoteliers and restaurants will be required to use forced authentication, also known as Strong Customer Authentication (SCA), which requires two-factor authentication (2FA) to be exact and secure while conducting online transactions. The cashless payment system is expanding at an exponential rate, thanks to evolving payment methods, rising e-commerce use, enhanced internet connectivity, and the introduction of new technology. According to Razorpay, digital payment transactions will grow by 76% in 2020. India’s digital payments business is estimated to reach USD 700 billion by 2022, according to the Reserve Bank of India.

Restraints:

Over the last few decades, several governments and nationalized banks have established high- and low-value payment systems based on security requirements and proprietary communication. As payment systems become more autonomous, there is a higher requirement for standardization and automation across intra-bank and inter-bank networks between countries. This is predicted to limit the use of 3D secure services, and it usually involves the gathering and correction of human data. Intra-bank transactions enable multinational corporations and banks with subsidiaries and branches to transfer funds to countries where they are needed. Beneficiaries are credited to their foreign operation accounts instantly, or payments are sent to their banks via national clearing and settlement processes or bilateral transfers. As a result, the availability of alternatives is likely to stymie the uptake of 3D secure pay authentication systems.

Opportunities:

The improved 3D Secure protocol, 3DS 2.0, will have a big impact on the payments industry, including the ability to cast a wider net in fraud prevention. There are now more channels where the protocol can be implemented for secure transactions, including non-browser-based platforms and mobile integration. Non-payment authentication is one of the aspects that will be introduced with 3DS 2.0 that allows the protocol to be used in more than just traditional browser-based payments. According to a survey conducted by Mastercard, digital wallets were mentioned in some form or another in 75% of all monitored social media conversations. According to a poll done by Points, nearly 100% of users would use a mobile wallet more frequently if it included a loyalty program. This is where the 3DS 2.0’s extra features come into play. It enables the authentication procedure to take place on the merchant’s mobile app, adding an extra degree of security when the customer submits their card information on the platform for later usage.

Challenges:

The most difficult aspect of 3DS2 has been knowledge transfer. The merchants and consumers, in particular, were not sufficiently informed about the necessary modifications. Merchants and banks have until the end of 2020 to comply with 3DS2 or face fines. It’s worth noting that, aside from information exchange, the banks were also unprepared for the introduction of 3DS2. Many big banks initially failed transactions because they did not support the 3DS version 2 flow, which Visa and Mastercard required. The larger banks were eventually able to deliver a satisfactory implementation of 3DS2 via their app or website, but the lesser banks were unable to keep up. This scenario even stretched to whole countries, as some mandated 3DS2 while others did not. As a result, it became increasingly difficult for merchants, particularly worldwide merchants, to keep up with local compliance and implementation of 3DS2.

Segmentation Analysis of 3D Secure Pay Authentication Market

By Type, the Merchant plug-in is dominating in the 3D Secure Pay Authentication Market. The merchant plug-in (MPI) is one of the most significant aspects of the online card payment system, as it conducts 3D secure pay authentication and verification of debit and credit cards. It’s a server-side software module that allows the merchant to identify the issuer card’s account number and see if it’s registered in the 3D-secure procedure. For example, GPayments Pty Ltd offers ActiveMerchant, Worldline offers Plugins, and Worldpay offers MOLPay, Redsys, and Iyzico. MPI assists in cardholder verification with the issuing bank, resulting in a higher success rate for online transactions. The market for 3D secure pay authentication is dominated by access control servers (ACS). Each card issuer is obligated to maintain ACS, which is an inherent element of the issuer domain/banks.

By Application, Merchants and Payment processors are the dominating in the 3D Secure Pay Authentication Market. In the event of a fraudulent transaction, 3D secure pay authentication protects merchants from chargebacks. Accepting credit cards in Europe requires 3D security, which is presently optional in other locations. It assists merchants and payment processors in reducing fraud and chargebacks, as well as increasing online commerce and cardholder trust. Similarly, 3D secure pay authentication allows banks to take into account elements such as a customer’s transaction history, behavioral history, transaction cost, and device information.

Regional Analysis of 3D Secure Pay Authentication Market

North America is dominating the 3D Secure Pay Authentication Market. North America is the potent region for fintech companies due to favored government policies, tax relaxations, and market competitiveness making it an ideal location for fintech companies to invest and introduced new products before the global launch. Also, In North America is the hub for fintech and payment companies such as Visa, Mastercard, America Express, Fiserv. These companies have the upper hand in the regional market. Two-factor authentication also improves security and complies with the new Payment Service Directives (PSD2) standard, which takes effect on September 14, 2019. As international organizations in the United States conduct business with European clients, 3DS2 adoption is projected to expand as they see success in Europe.

Europe region is the fastest-growing region in the 3D Secure Pay Authentication Market. The growth in the region is attributed to the legislation and robust regulatory framework applied in all European Union countries which gives protection for merchants as well as a customer from any misconduct from both ends. Strong Customer Authentication (SCA) imposed in Europe is a part of the revised Payment service directive (PSD2) regulation with the additional mandate of extra authentication measures. The United Kingdom is now the only European country that offers Address Verification Service (AVS) and 3D secure pay authentication. It is one of the only places in the world where providing three-dimensional secure payment authentication has improved total transactions. The United Kingdom has a developed internet shopping business, with most users opting for bank-linked card payments when purchasing goods. The acceptance rate of 3D security is high in nations like Finland, Sweden, Denmark, and Norway (between 83-86 percent acceptance). In terms of payment options, Germany is regarded as one of the most fragmented markets. The bulk of online transactions is made using non-credit card payment options including SOFORT, SEPA direct debit, and Giropay.

Although the Asia Pacific is recognized as a leader in several trends, such as mobile payment and ecommerce adoption, it is also one of the most fragmented areas in terms of digital payments. China is Asia Pacific’s largest retail ecommerce market and a major factor behind mobile commerce. UnionPay, Alipay, and WeChat Pay are the most popular payment methods in the nation. Credit and debit cards are the most popular payment methods in nations like Australia, Singapore, and South Korea.

Players Covered in 3D Secure Pay Authentication Market are:

Visa Inc. (USA)

Mastercard Incorporated (USA)

The American Express Company (USA)

ENTERSEKT (South Africa)

Broadcom Inc. (USA)

Medium (Estonia)

SIA SpA (Italy)

Fiserv Inc. (USA)

Cardknox Development Inc. (the USA)

Marqeta Inc. (the USA)

Gemalto (Netherlands)

Adyen (Netherlands)

Nets Group (Denmark)

Worldline (France)

Cybersource (USA)

Discover Financial Services (USA) and other major players.

Key Industry Developments In 3D Secure Pay Authentication Market:

In April 2023, Visa announced it is partnering with PayPal and Venmo to pilot Visa+, an innovative service that aims to help individuals move money quickly and securely between different person-to-person (P2P) digital payment apps. Later this year, Venmo and PayPal users in the US will be able to start moving money seamlessly between the two platforms.

In February 2023, PayU, India’s leading online payments solution provider, announced the launch of 3D Secure 2.0 SDK, offering a full native checkout and superior customer experience for all card transactions. PayU merchants can provide optimized customer experience while complying with major card network upgrades – including Visa and Mastercard while gaining better security and fraud protection. PayU’s lightweight 3DS 2.0 SDK provides lowered latency and a 40% reduction in checkout time.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 3D Secure Pay Authentication Market by Type (2018-2032)

4.1 3D Secure Pay Authentication Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Access Control Server

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Merchant Plug-in

4.5 Others

Chapter 5: 3D Secure Pay Authentication Market by Application (2018-2032)

5.1 3D Secure Pay Authentication Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Merchant & Payment Processors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Banks

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 3D Secure Pay Authentication Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 KUKA AG

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ENSAI INGENIERIA S.LSIEMENS AG

6.4 ROCKWELL AUTOMATION INCSCHNEIDER ELECTRIC

6.5 ABB LTDIBM CORPORATION

6.6 MICROSOFT CORPORATION

6.7 CISCO SYSTEMS INCGENERAL ELECTRIC COMPANY

Chapter 7: Global 3D Secure Pay Authentication Market By Region

7.1 Overview

7.2. North America 3D Secure Pay Authentication Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Access Control Server

7.2.4.2 Merchant Plug-in

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Merchant & Payment Processors

7.2.5.2 Banks

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe 3D Secure Pay Authentication Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Access Control Server

7.3.4.2 Merchant Plug-in

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Merchant & Payment Processors

7.3.5.2 Banks

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe 3D Secure Pay Authentication Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Access Control Server

7.4.4.2 Merchant Plug-in

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Merchant & Payment Processors

7.4.5.2 Banks

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific 3D Secure Pay Authentication Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Access Control Server

7.5.4.2 Merchant Plug-in

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Merchant & Payment Processors

7.5.5.2 Banks

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa 3D Secure Pay Authentication Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Access Control Server

7.6.4.2 Merchant Plug-in

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Merchant & Payment Processors

7.6.5.2 Banks

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America 3D Secure Pay Authentication Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Access Control Server

7.7.4.2 Merchant Plug-in

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Merchant & Payment Processors

7.7.5.2 Banks

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the 3D Secure Pay Authentication Market research report?

A1: The forecast period in the 3D Secure Pay Authentication Market research report is 2024-2032.

Q2: Who are the key players in 3D Secure Pay Authentication Market?

A2: Visa Inc. (USA), Mastercard Incorporated (USA), The American Express Company (USA), ENTERSEKT (South Africa), Broadcom Inc. (USA), Medium (Estonia), SIA SpA (Italy), Fiserv Inc. (USA), Cardknox Development Inc. (the USA), Marqeta Inc. (the USA), Discover Financial Services (USA), and other major players.

Q3: What are the segments of the 3D Secure Pay Authentication Market?

A3: The 3D Secure Pay Authentication Market is segmented into Type, Application, and region. By Type, the market is categorized into Access Control Server, Merchant Plug-in, Others. By Application, the market is categorized into Merchant & Payment Processors, Banks. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the 3D Secure Pay Authentication Market?

A4: 3D Secure is an extra layer of security that you may enable for each online card transaction. Customers and vendors benefit from increased security.

Q5: How big is the 3D Secure Pay Authentication Market?

A5: 3D Secure Pay Authentication Market Size Was Valued at USD 815.39 Million in 2023 and is Projected to Reach USD 2286.71 Million by 2032, Growing at a CAGR of 12.14% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!