Stay Ahead in Fast-Growing Economies.

Browse Reports NowGlobal consumer Identity and Access Management Market & Sale Analysis 2024-2032

Consumer Identity and Access Management (CIAM) refers to the set of technologies and processes that enable organizations to securely manage and authenticate user identities across digital platforms. It focuses on providing seamless and personalized access to consumers while ensuring robust security measures are in place.

IMR Group

Description

Consumer Identity and Access Management Market Synopsis

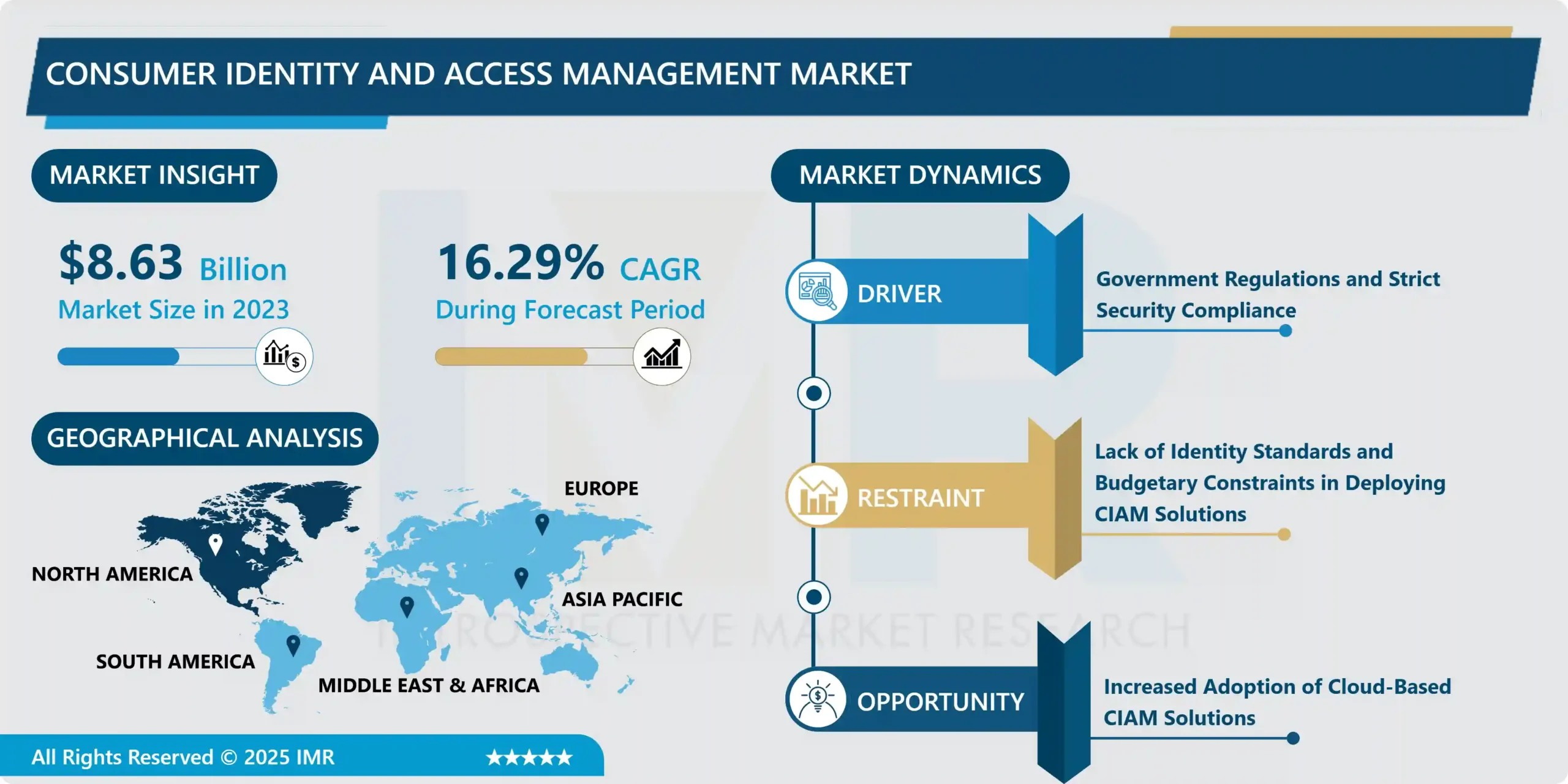

Consumer Identity and Access Management Market Size Was Valued at USD 8.63 Billion in 2023, and is Projected to Reach USD 33.57 Billion by 2032, Growing at a CAGR of 16.29% From 2024-2032

Consumer Identity and Access Management (CIAM) refers to the set of technologies and processes that enable organizations to securely manage and authenticate user identities across digital platforms. It focuses on providing seamless and personalized access to consumers while ensuring robust security measures are in place.

Consumer Identity and Access Management (CIAM) applications offer numerous advantages in the realm of digital security and customer experience. They streamline user authentication and authorization processes, enhancing security while providing a seamless user experience across various digital platforms. Additionally, CIAM applications facilitate personalized interactions with consumers, enabling businesses to deliver targeted services and marketing campaigns based on individual preferences and behavior.

CIAM applications extend beyond immediate security and customer experience benefits. They also contribute to operational efficiency by automating identity verification and access control workflows. This automation reduces the burden on IT teams, allowing them to focus on strategic initiatives rather than routine tasks. Moreover, CIAM applications promote regulatory compliance by enforcing data protection standards and providing audit trails for identity-related activities.

The demand for CIAM solutions is expected to experience substantial growth driven by several factors. These include the continued expansion of digital ecosystems, the rise of remote work and online services, and increasing consumer awareness of data privacy. As businesses seek to build trust with their customers and comply with evolving regulations, CIAM solutions will play a pivotal role in enabling secure and seamless digital experiences while safeguarding sensitive information.

Consumer Identity and Access Management Market Trend Analysis:

Government Regulations and Strict Security Compliance

Stringent security compliances and government laws are major drivers in the Consumer identification and Access Management (CIAM) industry, creating demand for strong identification solutions that fulfill regulatory standards while protecting sensitive consumer data. For instance, regulations such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in California require rigorous data protection, transparency, and user permission when processing personal information. CIAM systems must comply with these rules by incorporating features such as data encryption, secure authentication processes, consent management tools, and audit trails to safeguard customer privacy.

Industry-specific regulations, such as the Payment Card Industry Data Security Standard (PCI DSS) for financial services and the Health Insurance Portability and Accountability Act (HIPAA) for healthcare, place stringent security requirements on organizations that handle payment data or sensitive healthcare information. CIAM vendors and businesses use these regulations as market drivers by creating CIAM platforms that include advanced security controls, access governance, identity lifecycle management, and real-time threat detection capabilities to meet regulatory requirements while also protecting against cyber threats and data breaches. The CIAM market is expanding as enterprises emphasize compliance and data security, driven by the demand for trustworthy, scalable, and regulatory-compliant identity management solutions across a wide range of sectors.

Increased Adoption of Cloud-Based CIAM Solutions

The increased adoption of cloud-based CIAM solutions represents a significant opportunity for the market, driven by the advantages of scalability, flexibility, and cost-effectiveness offered by cloud computing models., indicating a strong trend toward cloud adoption across industries. Cloud-based CIAM solutions align perfectly with this trend, providing businesses with streamlined identity management capabilities without the need for extensive infrastructure investments.

Cloud-based CIAM platforms offer subscription-based models, easy deployment, and seamless updates, making them attractive options for organizations looking to modernize their identity management strategies. flexibility of cloud-based CIAM solutions allows businesses to integrate with other cloud services, applications, and third-party systems seamlessly. on digital transformation, initiatives highlight the importance of integration capabilities in driving business agility and innovation. Cloud-based CIAM platforms that offer robust APIs, pre-built connectors, and interoperability with leading cloud providers empower organizations to create cohesive digital ecosystems and deliver unified customer experiences across channels.

Consumer Identity and Access Management Market Segment Analysis:

Consumer Identity and Access Management Market is Segmented on the basis of Component, Deployment Mode, Solution, Services, and Vertical.

By Vertical, BFSI segment is expected to dominate the market during the forecast period

Banks and financial institutes (BFSI) are facing increased scrutiny for their security measures due to high-profile data breaches and digital transformation efforts. Mortgage lender Radius Financial Group and A Square experienced data breaches, affecting 16,000 customers and 8.2 million employees respectively. These breaches have increased the demand for consumer identity and access management solutions.

These solutions enable financial institutions to scale their identity management infrastructure, support omnichannel banking experiences, and reduce operational costs. cloud-based services for innovation, customer engagement, and digital competitiveness. The dominance of the BFSI segment in the CIAM market is attributed to factors like digitalization, regulatory compliance, security concerns, and strategic cloud technology adoption.

By Deployment Mode, Cloud segment held the largest share of 66.12% in 2023

The Cloud segment dominated the Consumer Identity and Access Management (CIAM) market, capturing the largest share due to its scalability, flexibility, and cost-effectiveness. With businesses increasingly adopting cloud-based solutions, CIAM solutions delivered via the cloud offer seamless integration, simplified management, and enhanced security features. This segment’s growth is further fueled by the rising demand for digital transformation, mobile applications, and remote work environments, driving organizations to prioritize secure and convenient customer access. The scalability of cloud infrastructure enables CIAM solutions to accommodate fluctuating user volumes and evolving business requirements efficiently.

The industry’s shift towards subscription-based models, reducing upfront costs and enabling businesses to access advanced CIAM capabilities without significant capital investments. This trend aligns with the growing emphasis on operational efficiency, rapid deployment, and continuous innovation in the CIAM market, driving organizations to leverage cloud-based solutions for comprehensive identity and access management strategies.

Consumer Identity and Access Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the global consumer identity and access management market due to the increasing adoption of these solutions across various sectors and the presence of major players like Microsoft, Salesforce, and Broadcom. The increasing number of data breaches in the US is further driving the need for these solutions, as cybercriminals are constantly exploring new methods. Major data breaches have shown that supposedly secure systems are often surprisingly vulnerable, highlighting the need for robust solutions in this market.

The Gramm-Leach-Bliley Act is a key regulatory framework in the US that mandates the protection of consumer data privacy in securities firms and financial institutions. This act requires them to assess data risks and protect against threats. As the demand for these solutions grows, major companies like GBG are acquiring competitors, such as Acuant, to expand into the US market. This merger aims to strengthen GBG’s presence in the largest and most strategically important market for location, identity, and fraud service

Consumer Identity and Access Management Market Top Key Players:

IBM (US)

Microsoft (US)

Salesforce (US)

Broadcom (US)

Okta (US)

Akamai Technologies (US)

Ping Identity (US)

ForgeRock (US)

HID Global (US)

ManageEngine (US)

Acuant (US)

SecureAuth (US)

WSO2 (US)

AWS (US)

Simeio Solutions (US)

Auth0 (US)

Cyberark (US)

OneLogin (US)

Trusona (US)

FusionAuth (US)

Strata Identity (US)

Evident (US)

WidasConcepts (Germany)

IDnow (Germany)

OneWelcome (Netherland), and Other Major Players

Key Industry Developments in the Consumer Identity and Access Management Market:

In February 2023, Ping Identity partnered with security consulting services provider Deloitte to offer organizations advanced identity and access solutions. This strategic partnership is expected to help firms’ joint clientele benefit from improved IAM solution selection and onboarding.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: consumer Identity and Access Management Market by Component (2018-2032)

4.1 consumer Identity and Access Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: consumer Identity and Access Management Market by Deployment Mode (2018-2032)

5.1 consumer Identity and Access Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-Premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud

Chapter 6: consumer Identity and Access Management Market by Solution (2018-2032)

6.1 consumer Identity and Access Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Identity Governance

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Identity Verification & Authentication

6.5 Behavioural Analytics

6.6 Access Management

Chapter 7: consumer Identity and Access Management Market by Services (2018-2032)

7.1 consumer Identity and Access Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Support & Maintenance

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Consulting

7.5 Integration & deployment Vertical

Chapter 8: consumer Identity and Access Management Market by Vertical (2018-2032)

8.1 consumer Identity and Access Management Market Snapshot and Growth Engine

8.2 Market Overview

8.3 BFSI

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retail & E-Commerce

8.5 Education

8.6 Government

8.7 Travel

8.8 Tourism & Hospitality

8.9 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 consumer Identity and Access Management Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SYMANTEC (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CA TECHNOLOGIES (UNITED STATES)

9.4 ZEROFOX (UNITED STATES)

9.5 RISKIQ (UNITED STATES)

9.6 SOLARWINDS (UNITED STATES)

9.7 PROOFPOINT (UNITED STATES)

9.8 LOOKINGGLASS CYBER SOLUTIONS (UNITED STATES)

9.9 KNOWBE4 (UNITED STATES)

9.10 CENTRIFY (UNITED STATES)

9.11 SOCIAL HUB (UNITED STATES)

9.12 BRANDLE (UNITED STATES)

9.13 DIGITALSTAKEOUT (UNITED STATES)

9.14 BOWLINE SECURITY (UNITED STATES)

9.15 SOCIAL SENTINEL (UNITED STATES)

9.16 SECUREMYSOCIAL (UNITED STATES)

9.17 HUEYA (UNITED STATES)

9.18 CSC (UNITED STATES)

9.19 CONETRIX (UNITED STATES)

9.20 SOPHOS (UNITED KINGDOM)

9.21 MICRO FOCUS (UNITED KINGDOM)

9.22 DIGITAL SHADOWS (UNITED KINGDOM)

9.23 CRISP THINKING (UNITED KINGDOM)

9.24 CROWDCONTROLHQ (UNITED KINGDOM)

9.25 TREND MICRO (JAPAN) OTHERS MAJOR PLAYERS

9.26

Chapter 10: Global consumer Identity and Access Management Market By Region

10.1 Overview

10.2. North America consumer Identity and Access Management Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Solutions

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Deployment Mode

10.2.5.1 On-Premises

10.2.5.2 Cloud

10.2.6 Historic and Forecasted Market Size by Solution

10.2.6.1 Identity Governance

10.2.6.2 Identity Verification & Authentication

10.2.6.3 Behavioural Analytics

10.2.6.4 Access Management

10.2.7 Historic and Forecasted Market Size by Services

10.2.7.1 Support & Maintenance

10.2.7.2 Consulting

10.2.7.3 Integration & deployment Vertical

10.2.8 Historic and Forecasted Market Size by Vertical

10.2.8.1 BFSI

10.2.8.2 Retail & E-Commerce

10.2.8.3 Education

10.2.8.4 Government

10.2.8.5 Travel

10.2.8.6 Tourism & Hospitality

10.2.8.7 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe consumer Identity and Access Management Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Solutions

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Deployment Mode

10.3.5.1 On-Premises

10.3.5.2 Cloud

10.3.6 Historic and Forecasted Market Size by Solution

10.3.6.1 Identity Governance

10.3.6.2 Identity Verification & Authentication

10.3.6.3 Behavioural Analytics

10.3.6.4 Access Management

10.3.7 Historic and Forecasted Market Size by Services

10.3.7.1 Support & Maintenance

10.3.7.2 Consulting

10.3.7.3 Integration & deployment Vertical

10.3.8 Historic and Forecasted Market Size by Vertical

10.3.8.1 BFSI

10.3.8.2 Retail & E-Commerce

10.3.8.3 Education

10.3.8.4 Government

10.3.8.5 Travel

10.3.8.6 Tourism & Hospitality

10.3.8.7 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe consumer Identity and Access Management Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Solutions

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Deployment Mode

10.4.5.1 On-Premises

10.4.5.2 Cloud

10.4.6 Historic and Forecasted Market Size by Solution

10.4.6.1 Identity Governance

10.4.6.2 Identity Verification & Authentication

10.4.6.3 Behavioural Analytics

10.4.6.4 Access Management

10.4.7 Historic and Forecasted Market Size by Services

10.4.7.1 Support & Maintenance

10.4.7.2 Consulting

10.4.7.3 Integration & deployment Vertical

10.4.8 Historic and Forecasted Market Size by Vertical

10.4.8.1 BFSI

10.4.8.2 Retail & E-Commerce

10.4.8.3 Education

10.4.8.4 Government

10.4.8.5 Travel

10.4.8.6 Tourism & Hospitality

10.4.8.7 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific consumer Identity and Access Management Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Solutions

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Deployment Mode

10.5.5.1 On-Premises

10.5.5.2 Cloud

10.5.6 Historic and Forecasted Market Size by Solution

10.5.6.1 Identity Governance

10.5.6.2 Identity Verification & Authentication

10.5.6.3 Behavioural Analytics

10.5.6.4 Access Management

10.5.7 Historic and Forecasted Market Size by Services

10.5.7.1 Support & Maintenance

10.5.7.2 Consulting

10.5.7.3 Integration & deployment Vertical

10.5.8 Historic and Forecasted Market Size by Vertical

10.5.8.1 BFSI

10.5.8.2 Retail & E-Commerce

10.5.8.3 Education

10.5.8.4 Government

10.5.8.5 Travel

10.5.8.6 Tourism & Hospitality

10.5.8.7 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa consumer Identity and Access Management Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Solutions

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Deployment Mode

10.6.5.1 On-Premises

10.6.5.2 Cloud

10.6.6 Historic and Forecasted Market Size by Solution

10.6.6.1 Identity Governance

10.6.6.2 Identity Verification & Authentication

10.6.6.3 Behavioural Analytics

10.6.6.4 Access Management

10.6.7 Historic and Forecasted Market Size by Services

10.6.7.1 Support & Maintenance

10.6.7.2 Consulting

10.6.7.3 Integration & deployment Vertical

10.6.8 Historic and Forecasted Market Size by Vertical

10.6.8.1 BFSI

10.6.8.2 Retail & E-Commerce

10.6.8.3 Education

10.6.8.4 Government

10.6.8.5 Travel

10.6.8.6 Tourism & Hospitality

10.6.8.7 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America consumer Identity and Access Management Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Solutions

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Deployment Mode

10.7.5.1 On-Premises

10.7.5.2 Cloud

10.7.6 Historic and Forecasted Market Size by Solution

10.7.6.1 Identity Governance

10.7.6.2 Identity Verification & Authentication

10.7.6.3 Behavioural Analytics

10.7.6.4 Access Management

10.7.7 Historic and Forecasted Market Size by Services

10.7.7.1 Support & Maintenance

10.7.7.2 Consulting

10.7.7.3 Integration & deployment Vertical

10.7.8 Historic and Forecasted Market Size by Vertical

10.7.8.1 BFSI

10.7.8.2 Retail & E-Commerce

10.7.8.3 Education

10.7.8.4 Government

10.7.8.5 Travel

10.7.8.6 Tourism & Hospitality

10.7.8.7 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Consumer Identity and Access Management Market research report?

A1: The forecast period in the Consumer Identity and Access Management Market research report is 2024-2032.

Q2: Who are the key players in the Consumer Identity and Access Management Market?

A2: IBM (US), Microsoft (US), Salesforce (US), Broadcom (US), Okta (US), Akamai Technologies (US), Ping Identity (US), ForgeRock (US), HID Global (US), ManageEngine (US), Acuant (US), SecureAuth (US), WSO2 (US), AWS (US), Simeio Solutions (US), Auth US), Cyberark (US), OneLogin (US), Trusona (US), FusionAuth (US), Strata Identity (US), Evident (US), WidasConcepts (Germany), IDnow (Germany), OneWelcome (Netherland) and Other Major Players.

Q3: What are the segments of the Consumer Identity and Access Management Market?

A3: The Consumer Identity and Access Management Market is segmented into Components, Deployment Mode, Solution, Services, Vertical, and Region. By Component, the market is categorized into Solutions and services. By Deployment Mode, the market is categorized into On-Premises and Cloud. By Solution, the market is categorized into Identity Governance, Identity Verification & Authentication, Behavioural Analytics, and Access Management. By Services, the market is categorized into Support & Maintenance, Consulting, Integration & deployment. By Vertical, the market is categorized into BFSI, Retail & E-Commerce, Education, Government, Travel, Tourism & Hospitality, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Consumer Identity and Access Management Market?

A4: Consumer Identity and Access Management (CIAM) refers to the set of technologies and processes that enable organizations to securely manage and authenticate user identities across digital platforms. It focuses on providing seamless and personalized access to consumers while ensuring robust security measures are in place.

Q5: How big is the Consumer Identity and Access Management Market?

A5: Consumer Identity and Access Management Market Size Was Valued at USD 8.63 Billion in 2023, and is Projected to Reach USD 33.57 Billion by 2032, Growing at a CAGR of 16.29% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!