Stay Ahead in Fast-Growing Economies.

Browse Reports NowConfiguration Auditing Tools Market – In-Depth Insights & Analysis

Configuration Auditing Tools encompass software solutions designed to systematically assess, monitor, and manage the configurations of IT systems. These tools actively identify and analyze configuration settings, ensuring adherence to security protocols, regulatory standards, and optimization criteria. Configuration Auditing Tools have diverse applications across industries, proving instrumental in maintaining the integrity and security of IT infrastructures. In cybersecurity, these tools actively assess system configurations, identify vulnerabilities and potential threats, and ensure proactive risk mitigation for organizations.

IMR Group

Description

Configuration Auditing Tools Market Synopsis

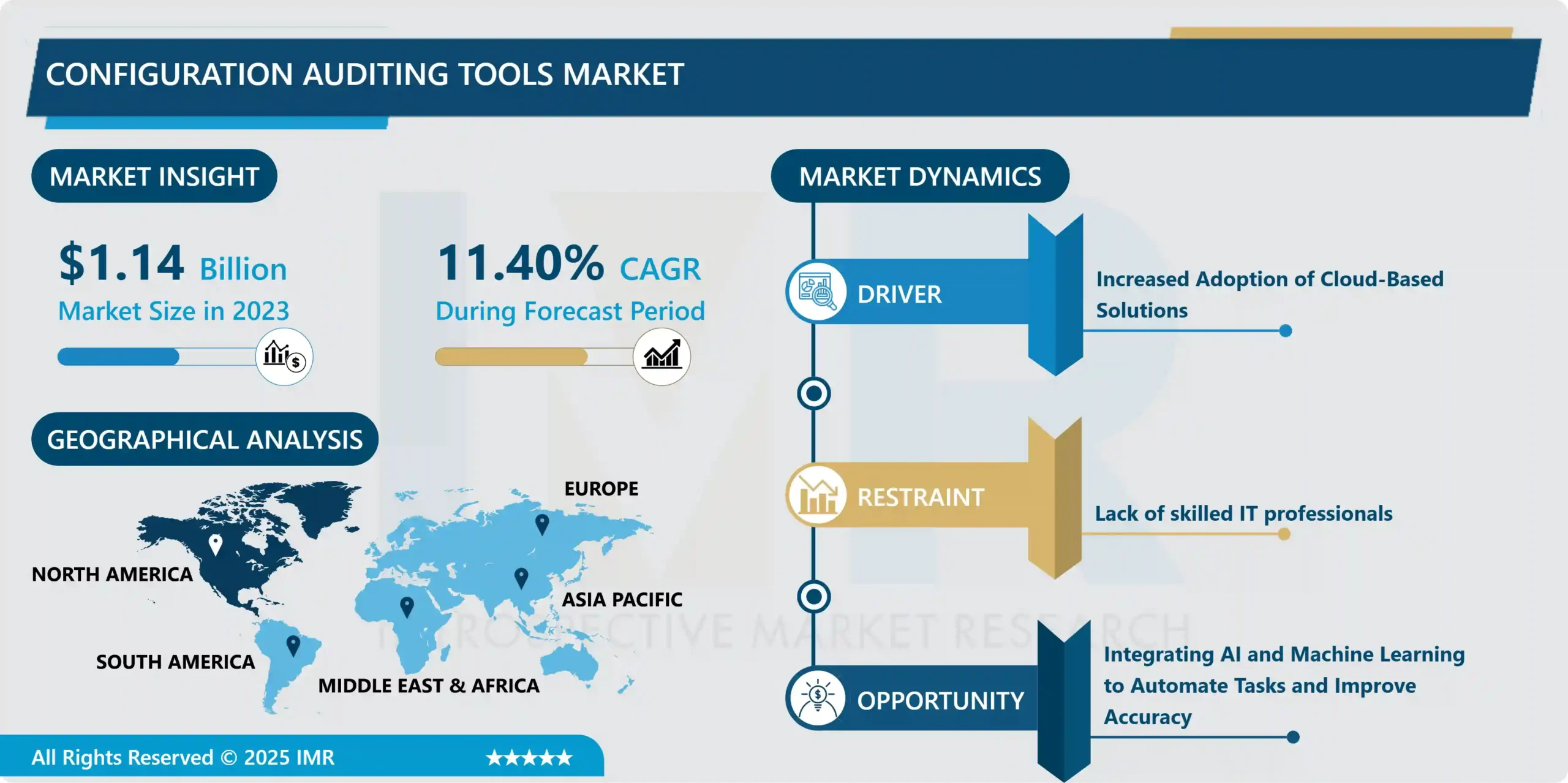

Global Configuration Auditing Tools Market Size Was Valued at USD 1.14 Billion in 2023 and is Projected to Reach USD 3.01 Billion by 2032, Growing at a CAGR of 11.40% From 2024-2032.

Configuration Auditing Toolsencompass software solutions designed to systematically assess, monitor, and manage the configurations of IT systems. These tools actively identify and analyze configuration settings, ensuring adherence to security protocols, regulatory standards, and optimization criteria.

Configuration Auditing Tools have diverse applications across industries, proving instrumental in maintaining the integrity and security of IT infrastructures. In cybersecurity, these tools actively assess system configurations, identify vulnerabilities and potential threats, and ensure proactive risk mitigation for organizations. Additionally, configuration auditing tools in compliance management, assist businesses in adhering to industry regulations and standards. Continuously monitoring configurations, these tools actively contribute to creating audit trails and documentation, facilitating a seamless process of regulatory compliance.

The Configuration Auditing Tools extend compliance and security. These tools actively optimize system performance by identifying inefficiencies and bottlenecks in configurations. Through ongoing analysis and adjustments, organizations can enhance resource utilization and streamline operations. Moreover, configuration auditing tools contribute to minimizing downtime by identifying issues that could lead to system failures. This proactive approach ensures the continuous availability of critical systems and enhances operational efficiency.

Configuration Auditing Tools Market Trend Analysis:

Increased Adoption of Cloud-Based Solutions

The Configuration Auditing Tools Market witness substantial growth driven by the widespread adoption of cloud-based solutions. Organizations increasingly shift their operations to cloud environments, boosting the demand for tools that efficiently audit and manage configurations in these dynamic settings. Cloud adoption actively propels the market forward, requiring robust solutions to ensure security, compliance, and optimal performance across diverse cloud infrastructures.

The agility and scalability provided by cloud-based solutions heighten the need for configuration auditing tools that can adapt to evolving environments. These tools actively contribute to maintaining the integrity of configurations in the cloud, addressing security concerns, and ensuring that configurations align with regulatory standards. Moreover, as businesses leverage the flexibility of cloud platforms, the demand for auditing tools actively grows, with organizations recognizing their significant role in safeguarding their cloud-based assets.

The surge in cloud adoption stands out as a primary driver. This trend actively shapes the market, emphasizing the importance of solutions that can effectively meet the evolving needs of organizations navigating the complexities of cloud-based infrastructures.

Integrating AI and Machine Learning to Automate Tasks and Improve Accuracy

The Configuration Auditing Tools Market capitalizes on substantial opportunities for growth by integrating AI and Machine Learning (ML) technologies. This integration actively transforms the landscape, automating tasks, and enhancing accuracy in auditing configurations. Organizations benefit from the active automation capabilities that AI and ML bring, streamlining the auditing process and significantly reducing manual intervention.

The adoption of AI and ML in configuration auditing tools actively improves accuracy by enabling these tools to adapt and learn from patterns in configurations. Machine Learning algorithms actively analyze historical data, identify trends, and predict potential issues, contributing to a proactive approach in maintaining system integrity. This enhances the efficiency of auditing processes and positions configuration auditing tools as advanced solutions capable of meeting the evolving demands of dynamic IT environments.

The incorporation of AI and Machine Learning emerges as a major opportunity within the Configuration Auditing Tools Market. This technological integration propels the market forward by providing innovative solutions that actively adapt to the complexities of modern IT infrastructures. In the competitive landscape, the ability of auditing tools to leverage AI and ML technologies becomes a significant differentiator, aligning with the growing demand for advanced, automated solutions in the dynamic field of configuration management.

Configuration Auditing Tools Market Segment Analysis:

Configuration Auditing Tools Market Segmented on the basis of Component, Deployment Organization Size, Application and Industry

By Organization Size, Large Enterprises segment is expected to dominate the market during the forecast period

The Large Enterprises segment is expected to dominate the configuration auditing tools market. This segment stands out due to the extensive requirements and complexities of large-scale organizational infrastructures. Large enterprises actively seek robust configuration auditing tools to ensure the security, compliance, and optimal performance of their intricate systems, given the sheer scale of operations and the critical nature of their data. This makes large enterprises prime candidates for leveraging advanced configuration auditing solutions.

The dominance of the Large Enterprises segment is driven by the unique challenges these organizations face in managing diverse and interconnected IT environments. Configuration auditing tools cater to the specific needs of large enterprises by providing scalable solutions that can effectively handle the complexity and volume of configurations within their networks. The market dynamics are shaped by the heightened demand from large enterprises for sophisticated tools that contribute actively to maintaining the integrity and efficiency of their expansive IT landscapes. As a result, the market landscape is expected to be significantly influenced by the preferences and requirements of large enterprises, making them a driving force in the growth and evolution of configuration auditing tools.

By Deployment, Cloud-Based egment held the largest share of 62.10% in 2022

The configuration auditing tools market is dominated by the Cloud-Based segment, holding the largest share. This segment’s ascendancy is propelled by the global shift towards cloud computing solutions, with organizations increasingly migrating their operations to the cloud to benefit from scalability, flexibility, and cost-efficiency. there is a surge in demand for configuration auditing tools tailored for cloud environments, establishing the Cloud-Based segment as a formidable player in the market.

The robust growth of the Cloud-Based segment is further fueled by the inherent advantages of cloud computing, such as remote accessibility and centralized data storage. Configuration auditing tools designed for cloud infrastructures actively address the unique challenges posed by these dynamic environments, ensuring the security, compliance, and optimization of configurations across diverse cloud platforms. The dominance of the Cloud-Based segment reflects the market’s responsiveness to the evolving IT landscape, where organizations increasingly rely on cloud solutions, making configuration auditing tools for the cloud a critical component in modernizing and securing IT infrastructures globally.

Configuration Auditing Tools Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is poised to dominate the configuration auditing tools market, driven by key factors that underscore the region’s prominence in the technology landscape. The strong market presence is characterized by the advanced and mature IT infrastructure prevalent in the region. With a concentration of large enterprises and a thriving technology sector, North America actively fosters robust demand for configuration auditing tools as organizations prioritize the security and optimization of their complex IT environments.

Furthermore, the region’s commitment to stringent regulatory frameworks and data protection policies amplifies the necessity for effective configuration auditing tools. As businesses in North America navigate the intricate landscape of compliance requirements, the demand for solutions ensuring adherence to regulations and standards intensifies. The dominance of North America is further accentuated by the presence of key market players and technological innovators, contributing to the continuous evolution and adoption of advanced configuration auditing tools. the region’s tech-savvy ecosystem, coupled with the imperative need for robust IT security and compliance solutions, positions North America as a frontrunner in shaping the trajectory of the configuration auditing tools market.

Configuration Auditing Tools Market Top Key Players:

SolarWinds (US)

Tenable (US)

Tripwire (US)

Qualys (US)

Microsoft Baseline Security Analyzer (MBSA) (US)

Netwrix (US)

Onspring Technologies (US)

Puppet (US)

Quest Software (US)

Workiva (US)

AuditBoard (US)

CIS-CAT (US)

Galvanize (Canada)

Refinitiv (UK)

SAP (Germany)

Wolters Kluwer (Netherlands)

Alibaba Cloud (China), and Other Major Players.

Key Industry Developments in the Configuration Auditing Tools Market:

In January 2024, The EDPB launched a website auditing tool that can be used to help analyze whether websites are compliant with the law. The tool was developed in the setting of the EDPB Support Pool of Experts (SPE) and can be used by both legal and technical auditors at data protection authorities (DPAs), as well as by controllers and processors who wish to test their websites.

In December 2023, Tenable unveiled version 7.2 of Tenable.sc, emphasizing enhancements in risk assessments, prioritization of vulnerabilities, and reporting functionalities tailored for configuration compliance. This update underscores Tenable’s commitment to providing users with improved tools for assessing and managing cybersecurity risks associated with system configurations.

In November 2023, Qualys and Rapid7 revealed a collaborative effort through a strategic partnership. This initiative involves the integration of their respective solutions in vulnerability management and security configuration management. The primary objective is to deliver enhanced visibility and control over security posture, offering organizations a more comprehensive approach to safeguarding their systems and data.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Configuration Auditing Tools Market by Component (2018-2032)

4.1 Configuration Auditing Tools Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Configuration Auditing Tools Market by Deployment (2018-2032)

5.1 Configuration Auditing Tools Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud-Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-Premise

Chapter 6: Configuration Auditing Tools Market by Organization Size (2018-2032)

6.1 Configuration Auditing Tools Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Large Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small

6.5 Medium-Sized Enterprises (SMEs)

Chapter 7: Configuration Auditing Tools Market by Application (2018-2032)

7.1 Configuration Auditing Tools Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Servers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 PCs

7.5 Databases

7.6 Network devices

7.7 Security devices

7.8 Cloud infrastructure

Chapter 8: Configuration Auditing Tools Market by Industry (2018-2032)

8.1 Configuration Auditing Tools Market Snapshot and Growth Engine

8.2 Market Overview

8.3 IT & Telecom

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 BFSI

8.5 Healthcare

8.6 Government

8.7 Retail

8.8 Manufacturing

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Configuration Auditing Tools Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 TASKRABBIT (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 THUMBTACK (USA)

9.4 ERRAND SOLUTIONS (USA)

9.5 FANCY HANDS (USA)

9.6 RUN MY ERRAND (USA)

9.7 ERRANDS.COM (USA)

9.8 CAVIAR (USA)

9.9 POSTMATES (USA)

9.10 DELIV (USA)

9.11 INSTACART (USA)

9.12 SHIPT (USA)

9.13 GOFER (USA)

9.14 DONE.COM (USA)

9.15 ERRANDRUNNERPRO (USA)

9.16 GETDONE (USA)

9.17 ZAARLY (USA)

9.18 DOORMAN (USA)

9.19 HELLO ALFRED (USA)

9.20 FETCH (USA)

9.21 TASKPAPA (USA)

9.22 TASKR (USA)

9.23 URBANCLAP (INDIA)

9.24 AIRTASKER (AUSTRALIA)

9.25

Chapter 10: Global Configuration Auditing Tools Market By Region

10.1 Overview

10.2. North America Configuration Auditing Tools Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Software

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Deployment

10.2.5.1 Cloud-Based

10.2.5.2 On-Premise

10.2.6 Historic and Forecasted Market Size by Organization Size

10.2.6.1 Large Enterprises

10.2.6.2 Small

10.2.6.3 Medium-Sized Enterprises (SMEs)

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Servers

10.2.7.2 PCs

10.2.7.3 Databases

10.2.7.4 Network devices

10.2.7.5 Security devices

10.2.7.6 Cloud infrastructure

10.2.8 Historic and Forecasted Market Size by Industry

10.2.8.1 IT & Telecom

10.2.8.2 BFSI

10.2.8.3 Healthcare

10.2.8.4 Government

10.2.8.5 Retail

10.2.8.6 Manufacturing

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Configuration Auditing Tools Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Software

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Deployment

10.3.5.1 Cloud-Based

10.3.5.2 On-Premise

10.3.6 Historic and Forecasted Market Size by Organization Size

10.3.6.1 Large Enterprises

10.3.6.2 Small

10.3.6.3 Medium-Sized Enterprises (SMEs)

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Servers

10.3.7.2 PCs

10.3.7.3 Databases

10.3.7.4 Network devices

10.3.7.5 Security devices

10.3.7.6 Cloud infrastructure

10.3.8 Historic and Forecasted Market Size by Industry

10.3.8.1 IT & Telecom

10.3.8.2 BFSI

10.3.8.3 Healthcare

10.3.8.4 Government

10.3.8.5 Retail

10.3.8.6 Manufacturing

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Configuration Auditing Tools Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Software

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Deployment

10.4.5.1 Cloud-Based

10.4.5.2 On-Premise

10.4.6 Historic and Forecasted Market Size by Organization Size

10.4.6.1 Large Enterprises

10.4.6.2 Small

10.4.6.3 Medium-Sized Enterprises (SMEs)

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Servers

10.4.7.2 PCs

10.4.7.3 Databases

10.4.7.4 Network devices

10.4.7.5 Security devices

10.4.7.6 Cloud infrastructure

10.4.8 Historic and Forecasted Market Size by Industry

10.4.8.1 IT & Telecom

10.4.8.2 BFSI

10.4.8.3 Healthcare

10.4.8.4 Government

10.4.8.5 Retail

10.4.8.6 Manufacturing

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Configuration Auditing Tools Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Software

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Deployment

10.5.5.1 Cloud-Based

10.5.5.2 On-Premise

10.5.6 Historic and Forecasted Market Size by Organization Size

10.5.6.1 Large Enterprises

10.5.6.2 Small

10.5.6.3 Medium-Sized Enterprises (SMEs)

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Servers

10.5.7.2 PCs

10.5.7.3 Databases

10.5.7.4 Network devices

10.5.7.5 Security devices

10.5.7.6 Cloud infrastructure

10.5.8 Historic and Forecasted Market Size by Industry

10.5.8.1 IT & Telecom

10.5.8.2 BFSI

10.5.8.3 Healthcare

10.5.8.4 Government

10.5.8.5 Retail

10.5.8.6 Manufacturing

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Configuration Auditing Tools Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Software

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Deployment

10.6.5.1 Cloud-Based

10.6.5.2 On-Premise

10.6.6 Historic and Forecasted Market Size by Organization Size

10.6.6.1 Large Enterprises

10.6.6.2 Small

10.6.6.3 Medium-Sized Enterprises (SMEs)

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Servers

10.6.7.2 PCs

10.6.7.3 Databases

10.6.7.4 Network devices

10.6.7.5 Security devices

10.6.7.6 Cloud infrastructure

10.6.8 Historic and Forecasted Market Size by Industry

10.6.8.1 IT & Telecom

10.6.8.2 BFSI

10.6.8.3 Healthcare

10.6.8.4 Government

10.6.8.5 Retail

10.6.8.6 Manufacturing

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Configuration Auditing Tools Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Software

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Deployment

10.7.5.1 Cloud-Based

10.7.5.2 On-Premise

10.7.6 Historic and Forecasted Market Size by Organization Size

10.7.6.1 Large Enterprises

10.7.6.2 Small

10.7.6.3 Medium-Sized Enterprises (SMEs)

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Servers

10.7.7.2 PCs

10.7.7.3 Databases

10.7.7.4 Network devices

10.7.7.5 Security devices

10.7.7.6 Cloud infrastructure

10.7.8 Historic and Forecasted Market Size by Industry

10.7.8.1 IT & Telecom

10.7.8.2 BFSI

10.7.8.3 Healthcare

10.7.8.4 Government

10.7.8.5 Retail

10.7.8.6 Manufacturing

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Configuration Auditing Tools Market research report?

A1: The forecast period in the Configuration Auditing Tools Market research report is 2024-2032.

Q2: Who are the key players in the Configuration Auditing Tools Market?

A2: SolarWinds (US), Tenable (US), Tripwire (US), Qualys (US), Microsoft Baseline Security Analyzer (MBSA) (US), Netwrix (US), Onspring Technologies (US), Puppet (US), Quest Software (US), Workiva (US), AuditBoard (US), CIS-CAT (US), Galvanize (Canada), Refinitiv (UK), SAP (Germany), Wolters Kluwer (Netherlands), Alibaba Cloud (China), and Other Major Players.

Q3: What are the segments of the Configuration Auditing Tools Market?

A3: The Configuration Auditing Tools Market is segmented into Component, Deployment, Organization Size, Application, Industry, and region. By Component, the market is categorized into Software and Services. By Deployment, the market is categorized into Cloud-Based and On-Premise. By Organization Size, the market is categorized into Large Enterprises, Small and Medium-Sized Enterprises (SMEs). By Application, the market is categorized into Servers, PCs, Databases, Network devices, Security devices and Cloud infrastructure. By Industry, the market is categorized into IT & Telecom, BFSI, Healthcare, Government, Retail and Manufacturing. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Configuration Auditing Tools Market?

A4: Configuration Auditing Tools encompass software solutions designed to systematically assess, monitor, and manage the configurations of IT systems. These tools actively identify and analyze configuration settings, ensuring adherence to security protocols, regulatory standards, and optimization criteria.

Q5: How big is the Configuration Auditing Tools Market?

A5: Global Configuration Auditing Tools Market Size Was Valued at USD 1.14 Billion in 2023 and is Projected to Reach USD 3.01 Billion by 2032, Growing at a CAGR of 11.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!