Stay Ahead in Fast-Growing Economies.

Browse Reports NowFingerprint Sensor Market 2024 – In-Deep Analysis Focusing on Market Share By 2032

A fingerprint sensor is a type of technology that recognizes and authenticates the fingerprints of an individual to grant or deny access to a computer system or a physical facility. The fingerprint sensor is a type of biometric security technology that uses the combination of software and hardware scientific technology to identify the fingerprint scans of a particular person.

IMR Group

Description

Global Fingerprint Sensor Market Overview

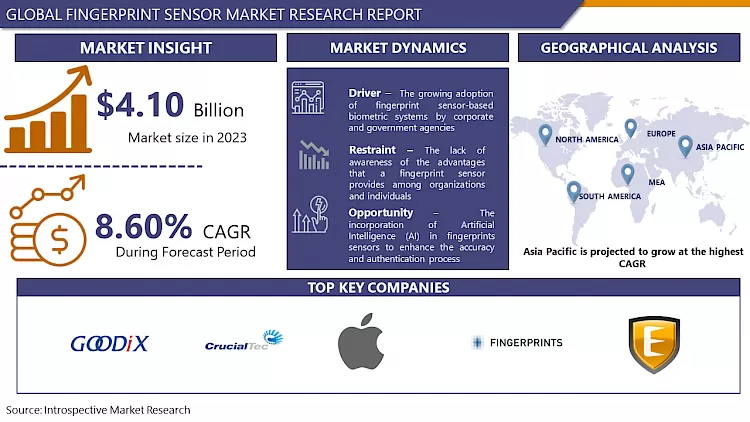

The Fingerprint Sensor Market is projected to grow USD 4.10 billion in 2023, it is expected to reach USD 8.61 Billion by 2032, growing at a CAGR of 8.60% during the forecast period 2024- 2032.

A fingerprint sensor is a type of technology that recognizes and authenticates the fingerprints of an individual to grant or deny access to a computer system or a physical facility. The fingerprint sensor is a type of biometric security technology that uses the combination of software and hardware scientific technology to identify the fingerprint scans of a particular person. A fingerprint is an impression left by the ridges of a human finger. Moreover, they are easily set down on surfaces such as metal, glass, or polished stone by the natural secretions of sweat glands located in human fingers. Furthermore, human fingerprints are precisely detailed, almost unique, difficult to change and remain the same over the lifespan of an individual, making them perfect long-term markers of human identity. This is the main reason for their incorporation in identification purposes. Fingerprint sensors are security systems of biometrics. Additionally, fingerprints are unique and hence, they are used to unlock doors of houses and in other security administration where access is controlled and monitored closely. All these factors are strengthening the expansion of the fingerprint sensor market in the period of forecast.

Moreover, a fingerprint sensor generally works by first recording fingerprint scans of all selected individuals for a specific facility or organization. These scans are then saved within a database. Furthermore, the individual requiring access locates their finger on a hardware scanner, which scans and copies the individual’s fingerprint and checks for any similarity within the already-stored scans. If there is a match, then the distinct individual is granted access. According to Statista, global biometric authentication and identification are anticipated to reach US$100 billion in 2027 from US$33.6 billion in 2019.

Market Dynamics And Key Factors In Fingerprint Sensor Market

Drivers:

The growing adoption of fingerprint sensor-based biometric systems by corporate and government agencies to record the attendance and for measuring service hours of employees is propelling the fingerprint sensor market growth in the span of the forecast. One of the biggest advantages of fingerprint sensors for enterprises is, no other employee can register a proxy of other employees thus preventing the frauds in attendance and thus helping the management to monitor the productivity of employees. Moreover, several schools and colleges are incorporating the use of fingerprint sensors to record and check pupils’ attendance. The growing utilization of fingerprint sensors in mobile appliances for authentication and identification of individual fingerprints due to characteristics such as unique nature, precisely detailed, and hard to change is promoting the expansion of the fingerprint sensor market during the forecast period.

Recently digital appliances such as refrigerators, laptops, wearable devices, and home doors are integrating the use of fingerprint sensors. Fingerprint sensors are widely used in the developed as well as in developing countries in home doors to prevent theft and instances such as loss of house keys. Moreover, the BFSI sector is implementing the use of fingerprint sensors to authenticate the transaction and to eliminate fraud related to card loss. To provide more secure transactions advances security, ease in banking, and enhanced customer experience, the BFSI sector in various countries is incorporating fingerprint sensors in ATM services and mobile banking applications, thus supporting the development of the fingerprint sensor market throughout the forecast period. Furthermore, the increasing use of fingerprint sensor-based biometric systems by government and law enforcement agencies, as it provides quick access to individuals and enhances security is propelling the fingerprint sensor market expansion.

Restraints:

The lack of awareness of the advantages that a fingerprint sensor provides among organizations and individuals is one of the key factors restraining fingerprint sensor market growth. Moreover, the adoption of face recognition and iris scanners by various institutions as it provides advance level security and eliminates the risk of fraud due to duplicate fingerprint created by silicone. All these factors are hampering the expansion of the fingerprint sensor market in the period of forecast. Furthermore, the system sometimes fails to enroll some individuals and the accuracy rate and working of the system are affected by the skin conditions of some people. Additionally, touching the same fingerprint sensor numerous times can lead to certain health issues that are transmitted by touching an infected surface, thus hindering the development of the fingerprint sensor market during the period of forecast. In some instances, it becomes difficult to capture complete and accurate fingerprint images due to wet, dirty, and rough hands.

The high cost associated with fingerprint sensor devices and the threat related to breach of fingerprint databases is some of the factors obstructing the growth of the market in the period of forecast. Moreover, the prices of raw materials required for manufacturing fingerprint sensors are increasing considerably. Furthermore, the high cost involved in the research and development of fingerprint sensors is restricting consumers from using these innovative technologies.

Opportunities:

The incorporation of Artificial Intelligence (AI) in fingerprints sensors to enhance the accuracy and authentication process, and the growing demand for fingerprint sensors are some of the vital factors providing opportunities for market players. The advancement in technology has given rise to in-display fingerprint sensors in mobile phones. Moreover, several governments are incorporating fingerprints as a data storage to identify and give unique identification numbers to an individual, such as the AADAHAR card implemented by the government of India. Fingerprint sensor provides countless benefits in BFSI sector, further, the use of fingerprint to validate and authenticate transaction is offering market players to develop more efficient and accurate fingerprint sensors.

Challenges:

The high variability majorly found between different impressions of the same finger is one of the biggest challenges of fingerprint recognition. Additionally, this variability is called intraclass variability and is caused by numerous factors such as displacement or rotation between different acquisitions, partial overlap especially in sensors of small areas, and skin conditions. Furthermore, one of the vital challenges in fingerprint verification is the unavailability of robustness against image quality generation. The performance of a fingerprint sensor system is highly affected by the fingerprint image quality. In addition, several factors determine the quality of a fingerprint image such as skin conditions, sensor conditions, and user cooperation. Some of these factors in fingerprint recognition cannot be avoided and some of them vary over time. These are some of the challenges faced by key market players in the fingerprint sensor market.

Market Segmentation Analysis

Segmentation Analysis of Fingerprint Sensor Market:

Depending on Technology, Fingerprint Sensor Market is segmented into optical, capacitive, ultrasonic, thermal, and optical-capacitive. The ultrasonic segment is anticipated to dominate the fingerprint sensor market in the period of forecast. Scanning for some seconds generates data which is more precise and fingerprint data in depth can be captured, which results in a highly specific and more accurate 3D generation of the scanned fingerprint. The 3D capture technique makes it an even more secure alternative among the other technologies available. All these factors are promoting the growth of the ultrasonic segment. The capacitive segment is expected to have the second-highest share of the market owing to their high use of smartphones for fingerprint recognition and authentication.

Depending on Sensing Process, the 2D sensing process is expected to grow at a significant rate owing to its low cost and small size. Moreover, many OEMs are using 2D sensing in mobile phones for faster interpretation and scanning processes. The 3D sensing process is forecasted to grow at a rapid rate owing to the accurate generation and analysis of fingerprints. Furthermore, the research and development in the 3D sensing process are promoting the expansion of this segment.

Depending on Type, the touch segment of the fingerprint sensors market is going to have the highest share of the market in the period of forecast owing to ease in availability, favorable prices, and small convenient shapes and sizes. Touch sensors are widely used in mobile phones and biometrics due to their high accuracy recognition quality.

Depending on Applications, biometrics for digital locks and systems for granting access are expected to dominate the fingerprint sensor market in the period of forecast. The growing use of mobile phones having fingerprint sensors and digital locks used in houses as well as in other sectors to prevent the entry of unrecognized individuals is supporting the growth of this segment.

Depending on End-User Industries, the consumer electronics segment is expected to have the highest share in the fingerprint sensor market. The growing demand for fingerprint sensors in PCs, laptops, mobile phones, tablets, and wearables is propelling the growth of this segment. BFSI segment is forecasted to have the second-highest share of the fingerprint sensor market. With the increasing use of digital banking and to provide smooth and reliable consumer experience banking sectors are incorporating the use of fingerprint sensors. Moreover, preventing fraud due to card loss is supporting the growth of the BFSI segment.

Regional analysis of Fingerprint Sensor Market:

The Asia-Pacific region is set to dominate the fingerprint sensor market during the forecast period, driven by the substantial number of mobile phone operators in countries like China and India. These nations, with their vast consumer bases and rapid technological adoption, are at the forefront of integrating advanced biometric solutions into smartphones and other electronic devices. The increasing demand for secure and convenient authentication methods fuels the widespread use of fingerprint sensors, making the region a key player in the global market.

The robust growth of the consumer electronics industry in Asia-Pacific, coupled with rising disposable incomes and a tech-savvy population, further propels the adoption of fingerprint sensors. Manufacturers in the region are continuously innovating to enhance sensor accuracy and efficiency, catering to the evolving needs of users. As mobile and electronic device usage continues to surge, the Asia-Pacific region’s dominance in the fingerprint sensor market is expected to strengthen, driving significant advancements and growth in this sector.

Players Covered in Fingerprint Sensor market are :

Goodix (China)

Shenzhen Goodix Technology Co. Ltd (China)

CrucialTec (South Korea)

Apple Inc. (US)

FINGERPRINT CARDS AB (Sweden)

EGiS Technologies Inc. (Taiwan)

Qualcomm Technologies Inc. (the US)

ELAN Microelectronics Corp. (Taiwan)

IDEX Biometrics ASA (Norway)

Synaptics Incorporated (US)

PRECISE BIOMETRICS (Sweden)

IDEMIA (France)

Touch Biometrix (UK)

Mantra Softech (India) Pvt. Ltd (India) and other Major Players.

Key Industry Developments in Fingerprint Sensor Market

In August 2021, Fingerprint Cards AB world-leading biometrics company, and Seshaasai, an innovative and top smart card manufacturer in India, have collaborated to launch, market, develop, and sell contactless biometric payment cards in India and the Asia-Pacific region. The card will have hallmark Fingerprints’ Cards AB T-Shape module and software platform, which has ultra-low power utilization and is designed to be incorporated in payment cards using standard automated engineering processes.

In April 2020, Precise revealed that it extended its license agreement with Egis Technology, the global leading fingerprint sensor supplier. This agreement allows Precise Biometrics to successfully integrate Precise identification software into Egis fingerprint sensors, which has been used in different series of mobile devices from large OEM producers during 2019 and at the beginning of 2020.

In May 2024, Goodix Technology introduces its latest ultrasonic fingerprint solution in partnership with vivo, debuting in the vivo X100 Ultra. This innovative technology, boasting a unique architecture and proprietary algorithms, ensures seamless and secure unlocking experiences for mobile devices. Leveraging advanced CMOS sensor architecture and wafer-level acoustic processing, Goodix’s solution offers enhanced signal-to-noise ratio for clearer fingerprint images and rapid recognition, even with wet or oily fingers, marking a significant advancement in ultrasonic fingerprint technology.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fingerprint Sensor Market by Technology (2018-2032)

4.1 Fingerprint Sensor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Optical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Capacitive

4.5 Ultrasonic

4.6 Optical-Capacitive

4.7 Thermal

Chapter 5: Fingerprint Sensor Market by Sensing Process (2018-2032)

5.1 Fingerprint Sensor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 2D

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 3D

Chapter 6: Fingerprint Sensor Market by Type (2018-2032)

6.1 Fingerprint Sensor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Touch

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Swipe

Chapter 7: Fingerprint Sensor Market by Applications (2018-2032)

7.1 Fingerprint Sensor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Access Controls

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Biometric System & Digital Locks

7.5 Biometric Smartcards

7.6 Others

Chapter 8: Fingerprint Sensor Market by End-User Industries (2018-2032)

8.1 Fingerprint Sensor Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Consumer Electronics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Travel and Immigration

8.5 Government and Law Enforcement

8.6 Banking & Finance

8.7 Commercial

8.8 Automotive

8.9 Smart Homes

8.10 Healthcare

8.11 Military

8.12 Defense and Aerospace

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Fingerprint Sensor Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AIVO (ARGENTINA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AWS (US)

9.4 APPLE(US)

9.5 AVAAMO(US)

9.6 AVAYA (US)

9.7 BAIDU (CHINA)

9.8 CISCO (US)

9.9 CLINC (US)

9.10 CREATIVE VIRTUAL (UK)

9.11 GOOGLE (US)

9.12 INBENTA (US)

9.13 IBM (US)

9.14 HAPTIK (INDIA)

9.15 KATA.AI (INDONESIA)

9.16 MICROSOFT (US)

9.17 MINDSAY (US)

9.18 ORACLE (US)

9.19 RASA (US)

9.20 SAMSUNG (SOUTH KOREA)

9.21 SAP (GERMANY)

9.22 SLANG LABS (INDIA)

9.23 SOUNDHOUND (US)

9.24 VERBIO (SPAIN)

9.25 VERINT SYSTEMS (US)

9.26 ZAION (FRANCE) OTHER MAJOR KEY PLAYERS.

Chapter 10: Global Fingerprint Sensor Market By Region

10.1 Overview

10.2. North America Fingerprint Sensor Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Technology

10.2.4.1 Optical

10.2.4.2 Capacitive

10.2.4.3 Ultrasonic

10.2.4.4 Optical-Capacitive

10.2.4.5 Thermal

10.2.5 Historic and Forecasted Market Size by Sensing Process

10.2.5.1 2D

10.2.5.2 3D

10.2.6 Historic and Forecasted Market Size by Type

10.2.6.1 Touch

10.2.6.2 Swipe

10.2.7 Historic and Forecasted Market Size by Applications

10.2.7.1 Access Controls

10.2.7.2 Biometric System & Digital Locks

10.2.7.3 Biometric Smartcards

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size by End-User Industries

10.2.8.1 Consumer Electronics

10.2.8.2 Travel and Immigration

10.2.8.3 Government and Law Enforcement

10.2.8.4 Banking & Finance

10.2.8.5 Commercial

10.2.8.6 Automotive

10.2.8.7 Smart Homes

10.2.8.8 Healthcare

10.2.8.9 Military

10.2.8.10 Defense and Aerospace

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Fingerprint Sensor Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Technology

10.3.4.1 Optical

10.3.4.2 Capacitive

10.3.4.3 Ultrasonic

10.3.4.4 Optical-Capacitive

10.3.4.5 Thermal

10.3.5 Historic and Forecasted Market Size by Sensing Process

10.3.5.1 2D

10.3.5.2 3D

10.3.6 Historic and Forecasted Market Size by Type

10.3.6.1 Touch

10.3.6.2 Swipe

10.3.7 Historic and Forecasted Market Size by Applications

10.3.7.1 Access Controls

10.3.7.2 Biometric System & Digital Locks

10.3.7.3 Biometric Smartcards

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size by End-User Industries

10.3.8.1 Consumer Electronics

10.3.8.2 Travel and Immigration

10.3.8.3 Government and Law Enforcement

10.3.8.4 Banking & Finance

10.3.8.5 Commercial

10.3.8.6 Automotive

10.3.8.7 Smart Homes

10.3.8.8 Healthcare

10.3.8.9 Military

10.3.8.10 Defense and Aerospace

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Fingerprint Sensor Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Technology

10.4.4.1 Optical

10.4.4.2 Capacitive

10.4.4.3 Ultrasonic

10.4.4.4 Optical-Capacitive

10.4.4.5 Thermal

10.4.5 Historic and Forecasted Market Size by Sensing Process

10.4.5.1 2D

10.4.5.2 3D

10.4.6 Historic and Forecasted Market Size by Type

10.4.6.1 Touch

10.4.6.2 Swipe

10.4.7 Historic and Forecasted Market Size by Applications

10.4.7.1 Access Controls

10.4.7.2 Biometric System & Digital Locks

10.4.7.3 Biometric Smartcards

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size by End-User Industries

10.4.8.1 Consumer Electronics

10.4.8.2 Travel and Immigration

10.4.8.3 Government and Law Enforcement

10.4.8.4 Banking & Finance

10.4.8.5 Commercial

10.4.8.6 Automotive

10.4.8.7 Smart Homes

10.4.8.8 Healthcare

10.4.8.9 Military

10.4.8.10 Defense and Aerospace

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Fingerprint Sensor Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Technology

10.5.4.1 Optical

10.5.4.2 Capacitive

10.5.4.3 Ultrasonic

10.5.4.4 Optical-Capacitive

10.5.4.5 Thermal

10.5.5 Historic and Forecasted Market Size by Sensing Process

10.5.5.1 2D

10.5.5.2 3D

10.5.6 Historic and Forecasted Market Size by Type

10.5.6.1 Touch

10.5.6.2 Swipe

10.5.7 Historic and Forecasted Market Size by Applications

10.5.7.1 Access Controls

10.5.7.2 Biometric System & Digital Locks

10.5.7.3 Biometric Smartcards

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size by End-User Industries

10.5.8.1 Consumer Electronics

10.5.8.2 Travel and Immigration

10.5.8.3 Government and Law Enforcement

10.5.8.4 Banking & Finance

10.5.8.5 Commercial

10.5.8.6 Automotive

10.5.8.7 Smart Homes

10.5.8.8 Healthcare

10.5.8.9 Military

10.5.8.10 Defense and Aerospace

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Fingerprint Sensor Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Technology

10.6.4.1 Optical

10.6.4.2 Capacitive

10.6.4.3 Ultrasonic

10.6.4.4 Optical-Capacitive

10.6.4.5 Thermal

10.6.5 Historic and Forecasted Market Size by Sensing Process

10.6.5.1 2D

10.6.5.2 3D

10.6.6 Historic and Forecasted Market Size by Type

10.6.6.1 Touch

10.6.6.2 Swipe

10.6.7 Historic and Forecasted Market Size by Applications

10.6.7.1 Access Controls

10.6.7.2 Biometric System & Digital Locks

10.6.7.3 Biometric Smartcards

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size by End-User Industries

10.6.8.1 Consumer Electronics

10.6.8.2 Travel and Immigration

10.6.8.3 Government and Law Enforcement

10.6.8.4 Banking & Finance

10.6.8.5 Commercial

10.6.8.6 Automotive

10.6.8.7 Smart Homes

10.6.8.8 Healthcare

10.6.8.9 Military

10.6.8.10 Defense and Aerospace

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Fingerprint Sensor Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Technology

10.7.4.1 Optical

10.7.4.2 Capacitive

10.7.4.3 Ultrasonic

10.7.4.4 Optical-Capacitive

10.7.4.5 Thermal

10.7.5 Historic and Forecasted Market Size by Sensing Process

10.7.5.1 2D

10.7.5.2 3D

10.7.6 Historic and Forecasted Market Size by Type

10.7.6.1 Touch

10.7.6.2 Swipe

10.7.7 Historic and Forecasted Market Size by Applications

10.7.7.1 Access Controls

10.7.7.2 Biometric System & Digital Locks

10.7.7.3 Biometric Smartcards

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size by End-User Industries

10.7.8.1 Consumer Electronics

10.7.8.2 Travel and Immigration

10.7.8.3 Government and Law Enforcement

10.7.8.4 Banking & Finance

10.7.8.5 Commercial

10.7.8.6 Automotive

10.7.8.7 Smart Homes

10.7.8.8 Healthcare

10.7.8.9 Military

10.7.8.10 Defense and Aerospace

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be forecast period in the Fingerprint Sensor market research report?

A1: The forecast period in the Fingerprint Sensor market research report is 2024-2032.

Q2: Who are the key players in Fingerprint Sensor market?

A2: The key players mentioned are Goodix (China), Fingerprint Cards AB (Sweden), Synaptics (US), Apple Inc. (US), and Egis Technology (Taiwan), Crucialtec (South Korea), Next Biometrics (Norway), Novatek Microelectronics (Taiwan), Qualcomm (US), Q Technology (China). The other company profiles included in the scope are CMOS Sensor Inc. (US), ELAN Microelectonics (Taiwan), Focaltech (China), ID3 Technologies (France), IDEX Biometrics (Norway), Japan Display Inc. (Japan), OXI Technology (China), Sonavation Inc. (US), Touch Biometrix (UK) and Vkansee (US) and other major players.

Q3: What are the segments of Fingerprint Sensor market?

A3: The Fingerprint Sensor market is segmented into application type, product type , Sensing Process , Technology , and region. By Technology, the market is categorized into Optical, Capacitive, Ultrasonic, Optical-Capacitive, Thermal. By Sensing Process market is categorized into 2D And 3D. By Type, the market is categorized into Touch and Swipe. By Application type, the market is categorized into Consumer Electronics, Travel and Immigration, Government and Law Enforcement, Banking & Finance, Commercial, Automotive, Smart Homes, Healthcare, Military, Defense and Aerospace. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Q4: What is the Fingerprint Sensor market?

A4: A fingerprint sensor is a type of technology that recognizes and authenticates the fingerprints of an individual to grant or deny access to a computer system or a physical facility. The fingerprint sensor is a type of biometric security technology that uses the combination of software and hardware scientific technology to identify the fingerprint scans of a particular person.

Q5: How big is the Fingerprint Sensor market?

A5: The Fingerprint Sensor Market is projected to grow USD 4.10 billion in 2023, it is expected to reach USD 8.61 Billion by 2032, growing at a CAGR of 8.60% during the forecast period 2024- 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!