Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Exhaust Systems Market – Insights for Business Growth Report 2024-2032

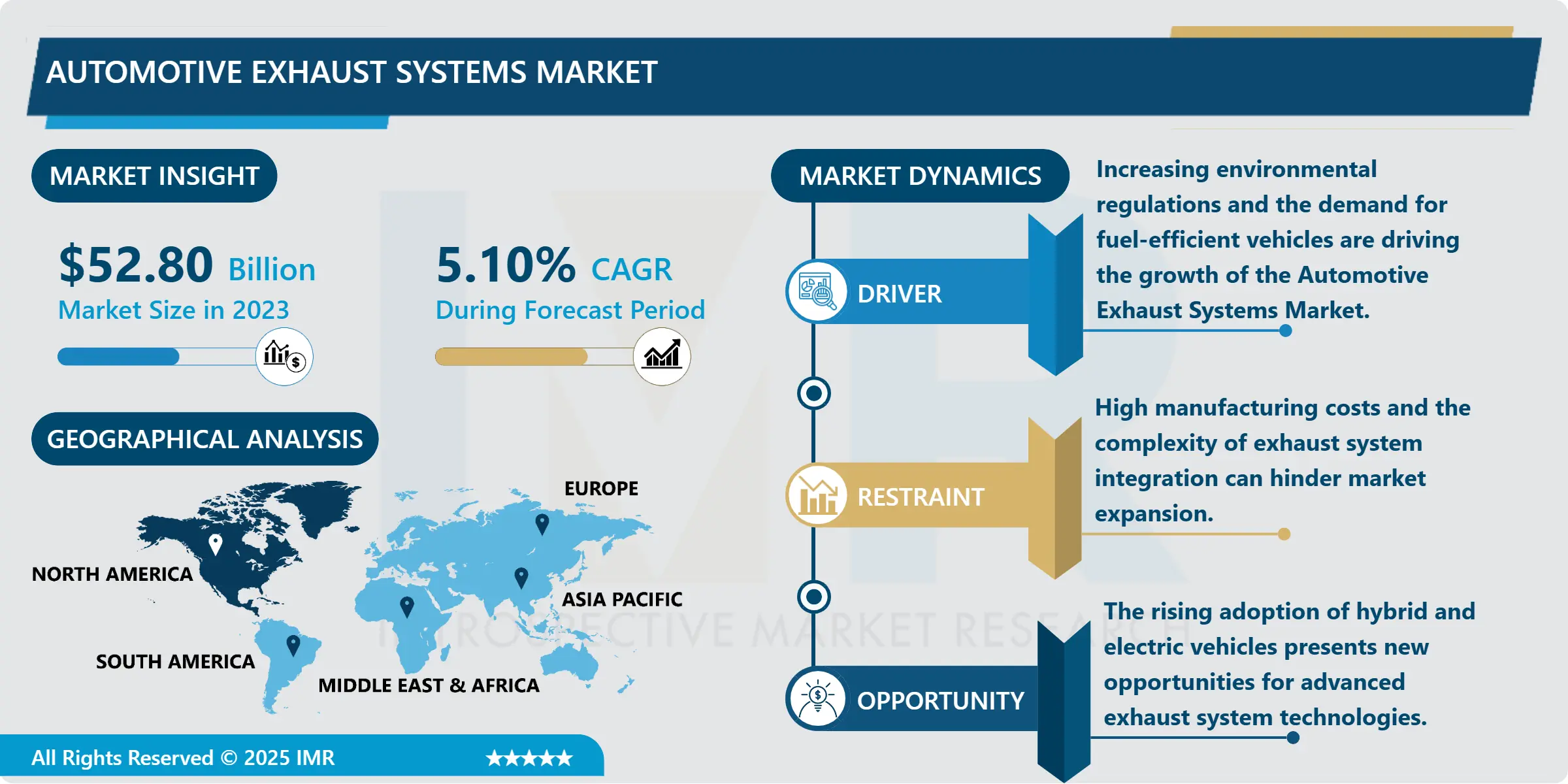

Automotive Exhaust Systems Market Size Was Valued at USD 52.80 Billion in 2023, and is Projected to Reach USD 79.10 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

IMR Group

Description

Automotive Exhaust Systems Market Synopsis:

Automotive Exhaust Systems Market Size Was Valued at USD 52.80 Billion in 2023, and is Projected to Reach USD 79.10 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

The Automotive Exhaust Systems Market research report is brightly anchored with significant growth primarily accelerated by the focus on lowering vehicle emissions and enhancing the quality of the surrounding atmosphere. Such systems as emission control systems, exhaust pipes, catalytic converters and resonance chamber or muffler systems and oxygen sensors for exhaust emissions are valuable in exhaust emissions management. Regulations from different governments like Euro 6 and BS-VI emission standard, compel manufactures to produce highly developed emitters that are in compliance to these regulations and yet able to deliver the optimum vehicle performance.

The aspects of technology for lightness and the availability of higher quality coatings are helping exhausts to evolve for higher performance. While having a positive impact on the need for traditional exhaust systems, the widespread use of hybrid and electric cars has forced companies to develop systems for both types of power trains. Market leaders are experiencing continuous growth as production of vehicles increases and awareness of the effects on the environment rise; especially in the Asian Pacific especially in India and in China.

Manufacturers and suppliers in the market are targeting on investing in new technologies and entering into new partnerships due to changing consumer and regulatory requirements. The inclusion of sensors to monitor emissions and diagnostics on liquids through the IoT is gradually growing, apart from saving costs on maintenance and conforming to the set standards. With upcoming automotive industries across the world and with growing standards of emissions the Automotive Exhaust Systems Market has a huge opportunity for growth with progressing automotive industry for sustainability.

Automotive Exhaust Systems Market Trend Analysis:

Adoption of Lightweight and Advanced Materials

New generation and lightweight materials for production of automotive in stainless steel, titanium & composite material are changing the over view of Automotive Exhaust Systems Market. These materials have the effect of lowering the overall weight of exhaust systems thereby improving vehicle fuel efficiency and lowering emissions output. Further, activities that help in adding advanced coatings and thermal insulation technologies are being innovated for improving the durability coupled with the ability to withstand high temperature meet the emission standards, coupled with the philosophy of high-performance systems.

Integration of IoT and Smart Monitoring

Smart monitoring of emissions and system performance is a trend that is already evident in the market through IoT integration. Some of the exhaust systems through IoT technology incorporate sensors which perform assessments on the composition and temperature of the exhaust gases to determine compliance with the set emission norms. This trend not only helps to maintain compliance with the current regulation but also allows to reduce a vehicle’s unavailability due to maintenance need and improve its efficiency overall, investing into the future and reducing long-term cost.

Automotive Exhaust Systems Market Segment Analysis:

Automotive Exhaust Systems Market Segmented on the basis of Vehicle type, Component type, Fuel type, and Region

By Vehicle type, Passenger cars segment is expected to dominate the market during the forecast period

Passenger cars, commercial vehicles, motorcycles segment the Automotive Exhaust Systems Market by vehicle type, and all the three segments contribute to the growth of the market. The largest market of passenger cars is primarily influenced by the strict requirements to emissions and the increasing demand for efficient, environmentally friendly cars. Trucks and buses also hold an important part because of higher demand for developed exhaust systems for meeting strict emission standards especially in European as well as American markets. The organization’s motorcycle segment may be comparatively smaller, but it is growing alongside environment-savvy customers and legislations against two-wheeler pollutions. In general, introduced into all vehicle categories, construction and application of exhaust systems become progressively effective with the incorporation of new technologies.

By Fuel type, Gasoline segment expected to held the largest share

The Automotive Exhaust Systems Market will be segmented by the type of vehicles such as those powered by gasoline, diesel and other alternative fuels. Passenger cars running on gasoline are predominant in the market, and this has the consumer clamoring for exhaust-efficient tools to control gases like carbon monoxide and nitrogen oxides. Heavier vehicles and those using diesel engines have better fuel economy but demand intricate exhaust systems; more so given the current regulation on exhaust gas emission, especially SCR and DPF. Still, the slow transitioning through the use of alternatively fueled vehicles such as electric, hybrid and bio fueled vehicles is slowly affecting the market. Even though, electric cars will be manufactured with very little or no exhaust systems at all while post-modern hybrid cars will still exist with their conventional exhaust systems though modified due to incorporation of both electric power as well as ICE. A shift towards a sustainable future and decreased emissions impacts are increasing changes in all fuel types to promote more environmentally friendly and efficient exhaust systems.

Automotive Exhaust Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The automotive exhaust systems market is anticipated to grow at the highest rate in North America in the forecast period due to increasing emission standards and automotive industry especially in US and Canada. Efforts to ensure that the region environment is sustainable as well as the greenhouse gas emission standards have prompted the development of the sophisticated exhaust systems that meet the EPA Tier 3 as well as the CARB emissions standards. In the same regard, with peoples’ increasing awareness of fuel efficiency, along with the increasing production of electrical and partially electrical vehicles, manufacturers have opted to advance the technology on its exhaust systems as well. North America also has sufficient investments in R & D as well as main automotive players that help it to remain the market leader till the predicted timeframe.

Active Key Players in the Automotive Exhaust Systems Market:

AP Exhaust Products, Inc. (US)

Benteler Automotive Corporation (US)

Benteler Automotive Rumburk s.r.o. (Czech Republic)

Bosal International N.V. (Belgium)

Boysen Exhaust Systems (Germany)

Chongqing Height Automobile Exhaust System Co., Ltd. (China)

Eberspächer Gruppe GmbH & Co. KG (Germany)

Faurecia SA (France)

Friedrich Boysen GmbH & Co. KG (Germany)

Futaba Industrial Co., Ltd. (Japan)

Katcon Global (Mexico)

MagnaFlow (US)

SANGO Co., Ltd. (Japan)

Sejong Industrial Co., Ltd. (South Korea)

Sona Group (India)

Tenneco Automotive (UK)

Tenneco Inc. (US)

Uniparts Group (India)

Yutaka Giken Co., Ltd. (Japan)

Yutaka Kogyo Co., Ltd. (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Exhaust Systems Market by Vehicle type

4.1 Automotive Exhaust Systems Market Snapshot and Growth Engine

4.2 Automotive Exhaust Systems Market Overview

4.3 Passenger cars

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Passenger cars: Geographic Segmentation Analysis

4.4 commercial vehicles

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 commercial vehicles: Geographic Segmentation Analysis

4.5 and motorcycles

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and motorcycles: Geographic Segmentation Analysis

Chapter 5: Automotive Exhaust Systems Market by Component type

5.1 Automotive Exhaust Systems Market Snapshot and Growth Engine

5.2 Automotive Exhaust Systems Market Overview

5.3 Exhaust manifolds

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Exhaust manifolds: Geographic Segmentation Analysis

5.4 catalytic converters

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 catalytic converters: Geographic Segmentation Analysis

5.5 mufflers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 mufflers: Geographic Segmentation Analysis

5.6 and tailpipes

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 and tailpipes: Geographic Segmentation Analysis

Chapter 6: Automotive Exhaust Systems Market by Fuel type

6.1 Automotive Exhaust Systems Market Snapshot and Growth Engine

6.2 Automotive Exhaust Systems Market Overview

6.3 Gasoline

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Gasoline: Geographic Segmentation Analysis

6.4 diesel

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 diesel: Geographic Segmentation Analysis

6.5 and alternative fuel-powered vehicles

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and alternative fuel-powered vehicles: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Exhaust Systems Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TENNECO INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FAURECIA SA (FRANCE)

7.4 EBERSPÄCHER GRUPPE GMBH & CO. KG (GERMANY)

7.5 MAGNAFLOW (US)

7.6 BOSAL INTERNATIONAL N.V. (BELGIUM)

7.7 FRIEDRICH BOYSEN GMBH & CO. KG (GERMANY)

7.8 YUTAKA GIKEN CO. LTD. (JAPAN)

7.9 BENTELER AUTOMOTIVE RUMBURK S.R.O. (CZECH REPUBLIC)

7.10 SEJONG INDUSTRIAL CO. LTD. (SOUTH KOREA)

7.11 SANGO CO. LTD. (JAPAN)

7.12 KATCON GLOBAL (MEXICO)

7.13 FUTABA INDUSTRIAL CO. LTD. (JAPAN)

7.14 YUTAKA KOGYO CO. LTD. (JAPAN)

7.15 BENTELER AUTOMOTIVE CORPORATION (US)

7.16 SONA GROUP (INDIA)

7.17 CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO. LTD. (CHINA)

7.18 AP EXHAUST PRODUCTS INC. (US)

7.19 UNIPARTS GROUP (INDIA)

7.20 BOYSEN EXHAUST SYSTEMS (GERMANY)

7.21 TENNECO AUTOMOTIVE (UK)

7.22 OTHER ACTIVE PLAYERS

Chapter 8: Global Automotive Exhaust Systems Market By Region

8.1 Overview

8.2. North America Automotive Exhaust Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Vehicle type

8.2.4.1 Passenger cars

8.2.4.2 commercial vehicles

8.2.4.3 and motorcycles

8.2.5 Historic and Forecasted Market Size By Component type

8.2.5.1 Exhaust manifolds

8.2.5.2 catalytic converters

8.2.5.3 mufflers

8.2.5.4 and tailpipes

8.2.6 Historic and Forecasted Market Size By Fuel type

8.2.6.1 Gasoline

8.2.6.2 diesel

8.2.6.3 and alternative fuel-powered vehicles

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Exhaust Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Vehicle type

8.3.4.1 Passenger cars

8.3.4.2 commercial vehicles

8.3.4.3 and motorcycles

8.3.5 Historic and Forecasted Market Size By Component type

8.3.5.1 Exhaust manifolds

8.3.5.2 catalytic converters

8.3.5.3 mufflers

8.3.5.4 and tailpipes

8.3.6 Historic and Forecasted Market Size By Fuel type

8.3.6.1 Gasoline

8.3.6.2 diesel

8.3.6.3 and alternative fuel-powered vehicles

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Exhaust Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Vehicle type

8.4.4.1 Passenger cars

8.4.4.2 commercial vehicles

8.4.4.3 and motorcycles

8.4.5 Historic and Forecasted Market Size By Component type

8.4.5.1 Exhaust manifolds

8.4.5.2 catalytic converters

8.4.5.3 mufflers

8.4.5.4 and tailpipes

8.4.6 Historic and Forecasted Market Size By Fuel type

8.4.6.1 Gasoline

8.4.6.2 diesel

8.4.6.3 and alternative fuel-powered vehicles

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Exhaust Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Vehicle type

8.5.4.1 Passenger cars

8.5.4.2 commercial vehicles

8.5.4.3 and motorcycles

8.5.5 Historic and Forecasted Market Size By Component type

8.5.5.1 Exhaust manifolds

8.5.5.2 catalytic converters

8.5.5.3 mufflers

8.5.5.4 and tailpipes

8.5.6 Historic and Forecasted Market Size By Fuel type

8.5.6.1 Gasoline

8.5.6.2 diesel

8.5.6.3 and alternative fuel-powered vehicles

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Exhaust Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Vehicle type

8.6.4.1 Passenger cars

8.6.4.2 commercial vehicles

8.6.4.3 and motorcycles

8.6.5 Historic and Forecasted Market Size By Component type

8.6.5.1 Exhaust manifolds

8.6.5.2 catalytic converters

8.6.5.3 mufflers

8.6.5.4 and tailpipes

8.6.6 Historic and Forecasted Market Size By Fuel type

8.6.6.1 Gasoline

8.6.6.2 diesel

8.6.6.3 and alternative fuel-powered vehicles

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Exhaust Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Vehicle type

8.7.4.1 Passenger cars

8.7.4.2 commercial vehicles

8.7.4.3 and motorcycles

8.7.5 Historic and Forecasted Market Size By Component type

8.7.5.1 Exhaust manifolds

8.7.5.2 catalytic converters

8.7.5.3 mufflers

8.7.5.4 and tailpipes

8.7.6 Historic and Forecasted Market Size By Fuel type

8.7.6.1 Gasoline

8.7.6.2 diesel

8.7.6.3 and alternative fuel-powered vehicles

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Automotive Exhaust Systems Market research report?

A1: The forecast period in the Automotive Exhaust Systems Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Exhaust Systems Market?

A2: Tenneco Inc. (US), Faurecia SA (France), Eberspächer Gruppe GmbH & Co. KG (Germany), MagnaFlow (US), Bosal International N.V. (Belgium), Friedrich Boysen GmbH & Co. KG (Germany), Yutaka Giken Co., Ltd. (Japan), Benteler Automotive Rumburk s.r.o. (Czech Republic), Sejong Industrial Co., Ltd. (South Korea), SANGO Co., Ltd. (Japan), Katcon Global (Mexico), Futaba Industrial Co., Ltd. (Japan), Yutaka Kogyo Co., Ltd. (Japan), Benteler Automotive Corporation (US), Sona Group (India), Chongqing Height Automobile Exhaust System Co., Ltd. (China), AP Exhaust Products, Inc. (US), Uniparts Group (India), Boysen Exhaust Systems (Germany), Tenneco Automotive (UK), Other Active Players.

Q3: What are the segments of the Automotive Exhaust Systems Market?

A3: The Automotive Exhaust Systems Market is segmented into By Vehicle type, By Component type, By Fuel type, and region. By Vehicle type(Passenger cars, commercial vehicles, and motorcycles), By Component type(Exhaust manifolds, catalytic converters, mufflers, and tailpipes), By Fuel type(Gasoline, diesel, and alternative fuel-powered vehicles). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Exhaust Systems Market?

A4: Automotive Exhaust Systems are essential components of a vehicle's powertrain that manage and control the flow of exhaust gases produced during engine combustion. These systems typically consist of various parts, including the exhaust manifold, catalytic converter, muffler, oxygen sensors, and exhaust pipes, all working together to reduce harmful emissions, minimize noise, and improve engine performance. The primary function of the exhaust system is to redirect exhaust gases away from the engine and the cabin, while also converting toxic substances like carbon monoxide and nitrogen oxides into less harmful emissions. Additionally, modern exhaust systems are designed to meet stringent environmental regulations, contributing to the reduction of vehicle pollution and enhancing fuel efficiency.

Q5: How big is the Automotive Exhaust Systems Market?

A5: Automotive Exhaust Systems Market Size Was Valued at USD 52.80 Billion in 2023, and is Projected to Reach USD 79.10 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!