Stay Ahead in Fast-Growing Economies.

Browse Reports NowAutomotive Thermal Management Market – Opportunities & Growth Forecast

Automotive thermal management system deals with technologies associated with managing temperature in a car thereby enhancing the performance of the engine, transmission and ac. Such systems include radiators, exhaust gas recirculation systems, and other heating; ventilation; and air conditioning systems for energy efficiency, control of emissions, and overall improvement of the operational life of automobiles.

IMR Group

Description

Automotive Thermal Management Market Synopsis:

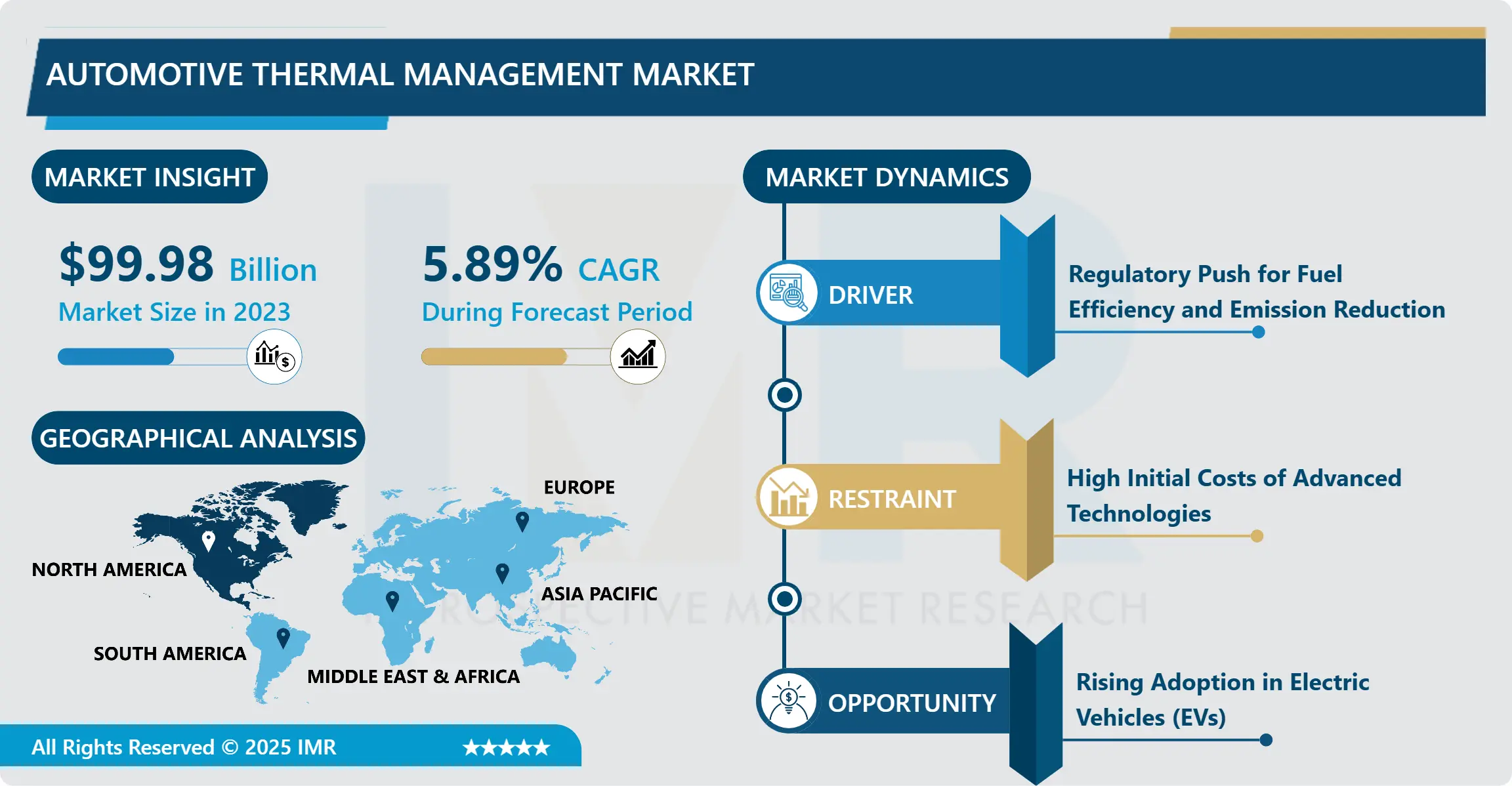

Automotive Thermal Management Market Size Was Valued at USD 99.98 Billion in 2023, and is Projected to Reach USD 167.34 Billion by 2032, Growing at a CAGR of 5.89% From 2024-2032.

Automotive thermal management system deals with technologies associated with managing temperature in a car thereby enhancing the performance of the engine, transmission and ac. Such systems include radiators, exhaust gas recirculation systems, and other heating; ventilation; and air conditioning systems for energy efficiency, control of emissions, and overall improvement of the operational life of automobiles.

The Automotive Thermal Management Market is an important sub sector in current automobile manufacturing as it partakes in the optimization of fuel consumption, lower emissions and enhanced performance. With the availability of electricity, especially with the increasing standard for efficiency in fuel consumption, modern thermal management has undergone a huge transformation. Whereas traditional solutions are based on direct heat transfer techniques, modern complex systems include digital control, sensors, and artificial intelligence.

Since internal combustion engines (ICEs) are subjected to enhance emission standards, thermal management technologies are strategic to meet the regulation requirement. In electric vehicles (EVs) and hybrid electric vehicles (HEVs), thermal management not only improves battery longevity, but also the vehicle’s performance during very cold and very hot conditions. Such integration of waste heat recovery systems can be described as representing new developments in this area.

This increase in active thermal management technologies such as Active Transmission Warm-Up and Exhaust Gas Recirculation (EGR) is the primary reason. All these innovations help improve time taken to heat engines, fuel efficiency, and low emission. Moreover, the increasing concerns for emissions and fuel economy to develop the lightweight materials for thermal management systems to lessen the vehicle’s weight.

Automotive Thermal Management Market Trend Analysis:

Transition to Smart Thermal Management Systems

The convenient and an efficient solution for thermal systems is also becoming the development of smart thermal management systems due to connection and artificial intelligence techniques. It is these intelligent systems that rely on real time information gathered from sensor to adapt thermal management in line with optimal performance of various elements of the vehicle such as Engines, batteries, HVAC, among others.

For example, in electric vehicles smart systems regulate charge temperature within acceptable levels that prevents heat degradation or freezing of lithium-ion batteries thus increasing battery durability. Furthermore, they indicate that under car environment control and entertainment, AI-controlled HVAC systems condition the cabin to the preference of passengers and weather prevailing outside. This evolution is not only beneficial to energy efficiency, vehicle autonomy, and connected mobility strategies.

Rising Adoption in Electric Vehicles (EVs)

The general transition to electrical mobility is a major chance for thermal management participants. Battery thermal management is a critical aspect for EVs due to its direct relationship between performance, safety, and battery longevity. One factor that is important in fast charging, is thermal management since high temperatures are damaging to battery cells.

Furthermore, it exposes opportunities for advanced application of waste heat recovery in EVs, for instance, by charging auxiliary systems or heating the cabin. With the increasing popularity of EV manufacturers and particularly in territories promoting the use of green energy, the need for high-performance thermal control technologies will foresee significant growth, creating great potential for market development.

Automotive Thermal Management Market Segment Analysis:

Automotive Thermal Management Market is Segmented on the basis of System Type, Technology, Component, Application, Vehicle Type, and Region.

By Technology, Active Transmission Warm-Up segment is expected to dominate the market during the forecast period

Technologies like Active Transmission Warm-Up, and Exhaust Gas Recirculation (EGR), therefore setting the pace in the market. Active Transmission Warm-Up leads to quicker reach of desirable temperatures by the transmission and thereby minimizes heat losses and improves fuel economy. On the other hand, EGR systems recirculate exhaust gases back into the engine reducing the amount of NOx emitted into the atmosphere and promoting the concept of environmental……

Engine Thermal Mass Reduction and Reduced HVAC System Load are also important elements in attaining better overall vehicle performance. They both help lighten the weight of the engine and decrease energy use thanks to utilizing lightweight materials and elevated cooling systems. Taken together these innovations highlights the growing convergence of the market towards systems that are integrated and/or environment friendly.

By Application, Engine Cooling segment expected to held the largest share

Some of the core applications of thermal management systems include; Engine Cooling, and Cabin Comfort. Cooling of engines means the temperatures of these engines are well regulated to avoid rising to very high levels of efficiency. In EVs, this even covers battery pack temperatures hence the need for heating in cold climates. Cabin comfort, as contrasted to exterior conditions, relies on HVAC systems to provide a perfect in-car comfort.

Transmission System and Waste Heat Recovery are in the aspect of developing application. Whereas transmission systems are supported by thermal management solutions for improved fuel efficiency, waste heat recovery recycles unwanted heat into useful power. This is very relevant to hybrid and electric cars, which under sustainability approaches before external energy sources are sought.

Automotive Thermal Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America has the largest share in the Automotive Thermal Management Market because it has a highly developed automotive industry and legal requirements for emissions. In this region efficiency and sustainability in energy usage have promoted innovative Thermal Management technologies.

The leading automotive manufacturers along with the technological advancement improves the market status of North America. Furthermore, such electric and hybrid vehicles promoted by the government have expanded the utilization of the sophisticated thermal managing systems maintaining the dominance in the market.

Active Key Players in the Automotive Thermal Management Market:

BorgWarner Inc. (USA)

Calsonic Kansei Corporation (Japan)

Continental AG (Germany)

Denso Corporation (Japan)

Gentherm Incorporated (USA)

Grayson Thermal Systems (UK)

Hanon Systems (South Korea)

MAHLE GmbH (Germany)

Modine Manufacturing Company (USA)

Robert Bosch GmbH (Germany)

Sanden Holdings Corporation (Japan)

Valeo (France)

Other Active Players

Key Industry Developments in the Automotive Thermal Management Market:

June 2024, Auburn Hills, Michigan’s e-Mobility Innovation Center (eMIC), a new facility designed to handle fluids and maintain temperature, was formally inaugurated by TI Fluid Systems. This 4,460-square-meter facility is intended to promote customer engagement and streamline the development of thermal management systems for North American hybrid, plug-in hybrid, and battery-electric automobiles.

April 2024, Vitesco Technologies, a prominent provider of advanced drivetrain technologies and electrification solutions, formed a partnership with Sanden International (Europe), a major operator in automotive thermal management technology. Vitesco Technologies was previously spun offgrated Thermal Management System specifically designed for Battery Electric Vehicles (BE from the renowned German Tier-1 company Continental. The pair will create an InteVs).

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Thermal Management Market by System Type

4.1 Automotive Thermal Management Market Snapshot and Growth Engine

4.2 Automotive Thermal Management Market Overview

4.3 HVAC (Heating

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 HVAC (Heating: Geographic Segmentation Analysis

4.4 Ventilation

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Ventilation: Geographic Segmentation Analysis

4.5 and Air Conditioning)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Air Conditioning): Geographic Segmentation Analysis

4.6 Powertrain Cooling

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Powertrain Cooling: Geographic Segmentation Analysis

4.7 Battery Thermal Management

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Battery Thermal Management: Geographic Segmentation Analysis

4.8 Waste Heat Recovery

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Waste Heat Recovery: Geographic Segmentation Analysis

Chapter 5: Automotive Thermal Management Market by Technology

5.1 Automotive Thermal Management Market Snapshot and Growth Engine

5.2 Automotive Thermal Management Market Overview

5.3 Active Transmission Warm-Up

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Active Transmission Warm-Up: Geographic Segmentation Analysis

5.4 Exhaust Gas Recirculation (EGR)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Exhaust Gas Recirculation (EGR) : Geographic Segmentation Analysis

5.5 Engine Thermal Mass Reduction

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Engine Thermal Mass Reduction: Geographic Segmentation Analysis

5.6 Reduced HVAC System Load

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Reduced HVAC System Load: Geographic Segmentation Analysis

Chapter 6: Automotive Thermal Management Market by Component

6.1 Automotive Thermal Management Market Snapshot and Growth Engine

6.2 Automotive Thermal Management Market Overview

6.3 Compressor

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Compressor: Geographic Segmentation Analysis

6.4 Heat Exchanger

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Heat Exchanger: Geographic Segmentation Analysis

6.5 Thermoelectric Generator

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Thermoelectric Generator: Geographic Segmentation Analysis

6.6 Control Valves and Actuators

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Control Valves and Actuators: Geographic Segmentation Analysis

Chapter 7: Automotive Thermal Management Market by Vehicle Type

7.1 Automotive Thermal Management Market Snapshot and Growth Engine

7.2 Automotive Thermal Management Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Cars: Geographic Segmentation Analysis

7.4 Light Commercial Vehicles

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Light Commercial Vehicles: Geographic Segmentation Analysis

7.5 Heavy Commercial Vehicles

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Heavy Commercial Vehicles: Geographic Segmentation Analysis

7.6 Electric Vehicles

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Electric Vehicles: Geographic Segmentation Analysis

Chapter 8: Automotive Thermal Management Market by Application

8.1 Automotive Thermal Management Market Snapshot and Growth Engine

8.2 Automotive Thermal Management Market Overview

8.3 Engine Cooling

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Engine Cooling: Geographic Segmentation Analysis

8.4 Cabin Comfort

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Cabin Comfort: Geographic Segmentation Analysis

8.5 Transmission System

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Transmission System: Geographic Segmentation Analysis

8.6 Waste Heat Recovery

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Waste Heat Recovery: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Thermal Management Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BORGWARNER INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DENSO CORPORATION (JAPAN)

9.4 VALEO (FRANCE)

9.5 MAHLE GMBH (GERMANY)

9.6 CONTINENTAL AG (GERMANY)

9.7 GENTHERM INCORPORATED (USA)

9.8 HANON SYSTEMS (SOUTH KOREA)

9.9 ROBERT BOSCH GMBH (GERMANY)

9.10 MODINE MANUFACTURING COMPANY (USA)

9.11 GRAYSON THERMAL SYSTEMS (UK)

9.12 SANDEN HOLDINGS CORPORATION (JAPAN)

9.13 CALSONIC KANSEI CORPORATION (JAPAN)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Thermal Management Market By Region

10.1 Overview

10.2. North America Automotive Thermal Management Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By System Type

10.2.4.1 HVAC (Heating

10.2.4.2 Ventilation

10.2.4.3 and Air Conditioning)

10.2.4.4 Powertrain Cooling

10.2.4.5 Battery Thermal Management

10.2.4.6 Waste Heat Recovery

10.2.5 Historic and Forecasted Market Size By Technology

10.2.5.1 Active Transmission Warm-Up

10.2.5.2 Exhaust Gas Recirculation (EGR)

10.2.5.3 Engine Thermal Mass Reduction

10.2.5.4 Reduced HVAC System Load

10.2.6 Historic and Forecasted Market Size By Component

10.2.6.1 Compressor

10.2.6.2 Heat Exchanger

10.2.6.3 Thermoelectric Generator

10.2.6.4 Control Valves and Actuators

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Cars

10.2.7.2 Light Commercial Vehicles

10.2.7.3 Heavy Commercial Vehicles

10.2.7.4 Electric Vehicles

10.2.8 Historic and Forecasted Market Size By Application

10.2.8.1 Engine Cooling

10.2.8.2 Cabin Comfort

10.2.8.3 Transmission System

10.2.8.4 Waste Heat Recovery

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Thermal Management Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By System Type

10.3.4.1 HVAC (Heating

10.3.4.2 Ventilation

10.3.4.3 and Air Conditioning)

10.3.4.4 Powertrain Cooling

10.3.4.5 Battery Thermal Management

10.3.4.6 Waste Heat Recovery

10.3.5 Historic and Forecasted Market Size By Technology

10.3.5.1 Active Transmission Warm-Up

10.3.5.2 Exhaust Gas Recirculation (EGR)

10.3.5.3 Engine Thermal Mass Reduction

10.3.5.4 Reduced HVAC System Load

10.3.6 Historic and Forecasted Market Size By Component

10.3.6.1 Compressor

10.3.6.2 Heat Exchanger

10.3.6.3 Thermoelectric Generator

10.3.6.4 Control Valves and Actuators

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Cars

10.3.7.2 Light Commercial Vehicles

10.3.7.3 Heavy Commercial Vehicles

10.3.7.4 Electric Vehicles

10.3.8 Historic and Forecasted Market Size By Application

10.3.8.1 Engine Cooling

10.3.8.2 Cabin Comfort

10.3.8.3 Transmission System

10.3.8.4 Waste Heat Recovery

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Thermal Management Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By System Type

10.4.4.1 HVAC (Heating

10.4.4.2 Ventilation

10.4.4.3 and Air Conditioning)

10.4.4.4 Powertrain Cooling

10.4.4.5 Battery Thermal Management

10.4.4.6 Waste Heat Recovery

10.4.5 Historic and Forecasted Market Size By Technology

10.4.5.1 Active Transmission Warm-Up

10.4.5.2 Exhaust Gas Recirculation (EGR)

10.4.5.3 Engine Thermal Mass Reduction

10.4.5.4 Reduced HVAC System Load

10.4.6 Historic and Forecasted Market Size By Component

10.4.6.1 Compressor

10.4.6.2 Heat Exchanger

10.4.6.3 Thermoelectric Generator

10.4.6.4 Control Valves and Actuators

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Cars

10.4.7.2 Light Commercial Vehicles

10.4.7.3 Heavy Commercial Vehicles

10.4.7.4 Electric Vehicles

10.4.8 Historic and Forecasted Market Size By Application

10.4.8.1 Engine Cooling

10.4.8.2 Cabin Comfort

10.4.8.3 Transmission System

10.4.8.4 Waste Heat Recovery

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Thermal Management Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By System Type

10.5.4.1 HVAC (Heating

10.5.4.2 Ventilation

10.5.4.3 and Air Conditioning)

10.5.4.4 Powertrain Cooling

10.5.4.5 Battery Thermal Management

10.5.4.6 Waste Heat Recovery

10.5.5 Historic and Forecasted Market Size By Technology

10.5.5.1 Active Transmission Warm-Up

10.5.5.2 Exhaust Gas Recirculation (EGR)

10.5.5.3 Engine Thermal Mass Reduction

10.5.5.4 Reduced HVAC System Load

10.5.6 Historic and Forecasted Market Size By Component

10.5.6.1 Compressor

10.5.6.2 Heat Exchanger

10.5.6.3 Thermoelectric Generator

10.5.6.4 Control Valves and Actuators

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Cars

10.5.7.2 Light Commercial Vehicles

10.5.7.3 Heavy Commercial Vehicles

10.5.7.4 Electric Vehicles

10.5.8 Historic and Forecasted Market Size By Application

10.5.8.1 Engine Cooling

10.5.8.2 Cabin Comfort

10.5.8.3 Transmission System

10.5.8.4 Waste Heat Recovery

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Thermal Management Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By System Type

10.6.4.1 HVAC (Heating

10.6.4.2 Ventilation

10.6.4.3 and Air Conditioning)

10.6.4.4 Powertrain Cooling

10.6.4.5 Battery Thermal Management

10.6.4.6 Waste Heat Recovery

10.6.5 Historic and Forecasted Market Size By Technology

10.6.5.1 Active Transmission Warm-Up

10.6.5.2 Exhaust Gas Recirculation (EGR)

10.6.5.3 Engine Thermal Mass Reduction

10.6.5.4 Reduced HVAC System Load

10.6.6 Historic and Forecasted Market Size By Component

10.6.6.1 Compressor

10.6.6.2 Heat Exchanger

10.6.6.3 Thermoelectric Generator

10.6.6.4 Control Valves and Actuators

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Cars

10.6.7.2 Light Commercial Vehicles

10.6.7.3 Heavy Commercial Vehicles

10.6.7.4 Electric Vehicles

10.6.8 Historic and Forecasted Market Size By Application

10.6.8.1 Engine Cooling

10.6.8.2 Cabin Comfort

10.6.8.3 Transmission System

10.6.8.4 Waste Heat Recovery

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Thermal Management Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By System Type

10.7.4.1 HVAC (Heating

10.7.4.2 Ventilation

10.7.4.3 and Air Conditioning)

10.7.4.4 Powertrain Cooling

10.7.4.5 Battery Thermal Management

10.7.4.6 Waste Heat Recovery

10.7.5 Historic and Forecasted Market Size By Technology

10.7.5.1 Active Transmission Warm-Up

10.7.5.2 Exhaust Gas Recirculation (EGR)

10.7.5.3 Engine Thermal Mass Reduction

10.7.5.4 Reduced HVAC System Load

10.7.6 Historic and Forecasted Market Size By Component

10.7.6.1 Compressor

10.7.6.2 Heat Exchanger

10.7.6.3 Thermoelectric Generator

10.7.6.4 Control Valves and Actuators

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Cars

10.7.7.2 Light Commercial Vehicles

10.7.7.3 Heavy Commercial Vehicles

10.7.7.4 Electric Vehicles

10.7.8 Historic and Forecasted Market Size By Application

10.7.8.1 Engine Cooling

10.7.8.2 Cabin Comfort

10.7.8.3 Transmission System

10.7.8.4 Waste Heat Recovery

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Automotive Thermal Management Market research report?

A1: The forecast period in the Automotive Thermal Management Market research report is 2024-2032.

Q2: Who are the key players in the Automotive Thermal Management Market?

A2: BorgWarner Inc. (USA), Denso Corporation (Japan), Valeo (France), MAHLE GmbH (Germany), Continental AG (Germany), Gentherm Incorporated (USA), Hanon Systems (South Korea), Robert Bosch GmbH (Germany), Modine Manufacturing Company (USA), Grayson Thermal Systems (UK), Sanden Holdings Corporation (Japan), Calsonic Kansei Corporation (Japan), and Other Active Players.

Q3: What are the segments of the Automotive Thermal Management Market?

A3: The Automotive Thermal Management Market is segmented into System Type, Technology Application, Component, Vehicle Type and region. By System Type, the market is categorized into HVAC (Heating, Ventilation, and Air Conditioning), Powertrain Cooling, Battery Thermal Management, Waste Heat Recovery. By Technology, the market is categorized into Active Transmission Warm-Up, Exhaust Gas Recirculation (EGR), Engine Thermal Mass Reduction, Reduced HVAC System Load. By Component, the market is categorized into Compressor, Heat Exchanger, Thermoelectric Generator, Control Valves and Actuators. By Vehicle Type, the market is categorized into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles. By Application, the market is categorized into Engine Cooling, Cabin Comfort, Transmission System, Waste Heat Recovery. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Automotive Thermal Management Market?

A4: Automotive thermal management system deals with technologies associated with managing temperature in a car thereby enhancing the performance of the engine, transmission and ac. Such systems include radiators, exhaust gas recirculation systems, and other heating; ventilation; and air conditioning systems for energy efficiency, control of emissions, and overall improvement of the operational life of automobiles.

Q5: How big is the Automotive Thermal Management Market?

A5: Automotive Thermal Management Market Size Was Valued at USD 99.98 Billion in 2023, and is Projected to Reach USD 167.34 Billion by 2032, Growing at a CAGR of 5.89% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!