Stay Ahead in Fast-Growing Economies.

Browse Reports NowTubeless Tire Market Size & Outlook 2025-2032

A tubeless tyre is a type of pneumatic tyre that doesn’t require an inner tube to hold air. Instead, it relies on an airtight seal between the tyre’s inner lining and the wheel rim to maintain pressure. This design eliminates the need for a separate tube, offering various advantages like improved puncture resistance and lighter weight.

IMR Group

Description

Tubeless Tire Market Synopsis:

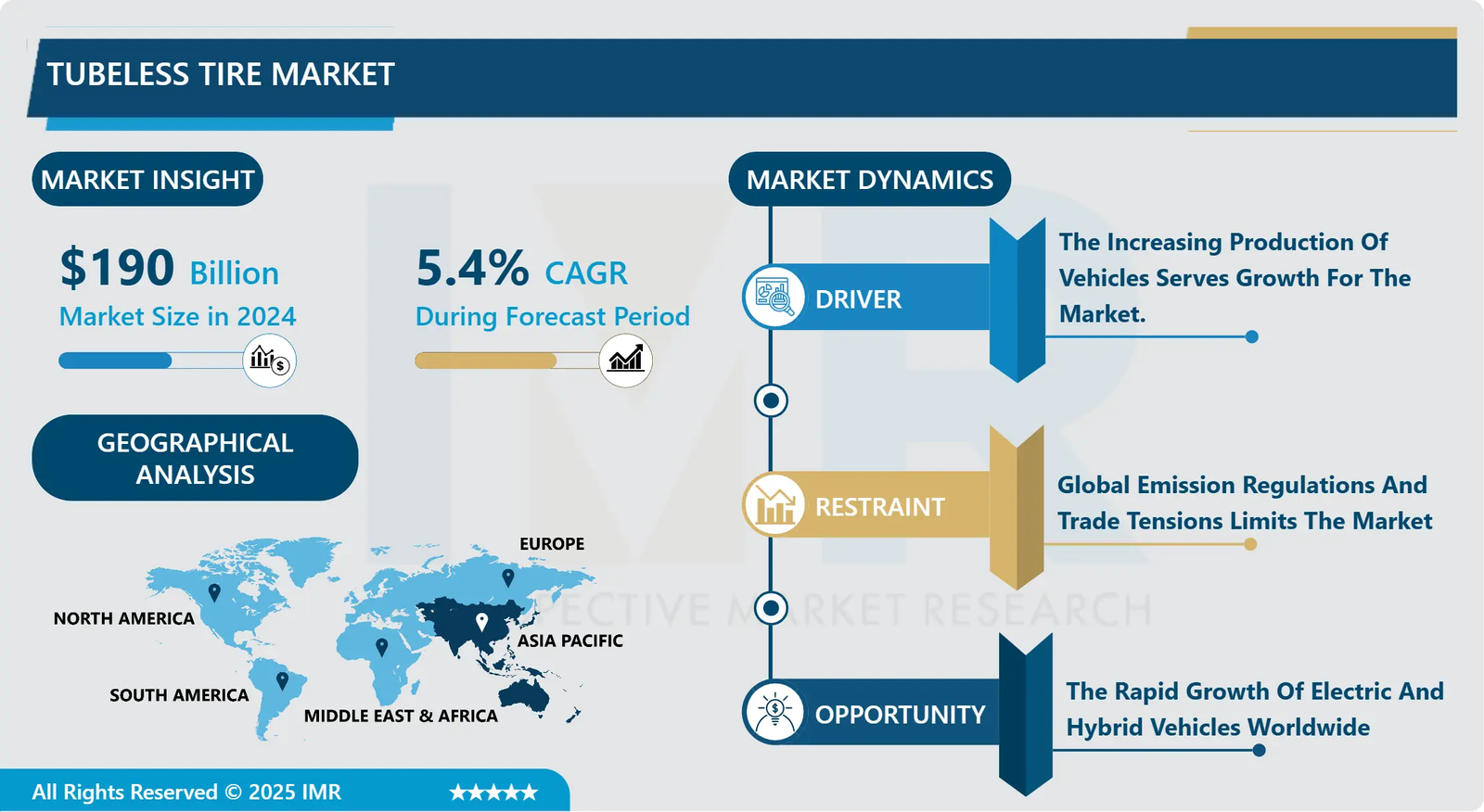

Tubeless Tire Market Size Was Valued at USD 190 Billion in 2024 and is Projected to Reach USD 289.39 Billion by 2032, Growing at a CAGR of 5.4% from 2025-2032.

A tubeless tyre is a type of pneumatic tyre that doesn’t require an inner tube to hold air. Instead, it relies on an airtight seal between the tyre’s inner lining and the wheel rim to maintain pressure. This design eliminates the need for a separate tube, offering various advantages like improved puncture resistance and lighter weight.

Tubeless tyres are primarily used on vehicles where better performance, safety, and fuel efficiency are desired, such as cars, motorcycles, and some bicycles. They offer advantages over traditional tube-type tyres, including improved handling, reduced rolling resistance, and the ability to run at lower pressures for better traction.

Tubeless tyres are increasingly popular due to several driving factors, including enhanced safety, improved fuel efficiency, and ease of maintenance. They offer a more stable and controlled driving experience, especially at high speeds. Additionally, tubeless tyres can be run at lower pressures for better grip on various surfaces and to reduce the risk.

Tubeless Tire Market Growth and Trend Analysis:

Tubeless Tire Market Growth Driver- The Increasing Production Of Vehicles Serves Growth For The Market

The rise in global vehicle production is a significant growth driver for the tubeless tyre market. Tubeless tyres are increasingly being adopted as standard equipment in both passenger and commercial vehicles due to their superior safety, durability, and performance benefits. This trend is especially pronounced in regions experiencing rapid urbanization and infrastructural development, where the demand for reliable, low-maintenance, and fuel-efficient transportation solutions is high.

Tubeless tyres offer advantages such as reduced risk of sudden deflation, better fuel efficiency, and improved driving comfort, making them a preferred choice for modern vehicles. As vehicle production continues to increase, manufacturers and consumers move toward tubeless technology to meet stricter safety regulations and performance expectations. This shift is further accelerated by the automotive industry’s focus on innovation and efficiency, ensuring that the growth in vehicle output directly translates into expanding opportunities in the tubeless tyre market.

Tubeless Tire Market Limiting Factor- Global Emission Regulations And Trade Tensions Limits The Market

One of the primary limiting factors for the growth of the tubeless tyre market is the uncertainty and complexity surrounding global emission regulations and trade tensions. Evolving and sometimes misaligned emission standards in major markets like the US, EU, and China create compliance challenges for automakers, which can delay or complicate vehicle launches and, by extension, the adoption of new tyre technologies. Trade barriers, such as tariffs on Chinese electric vehicles and components, further disrupt supply chains, increase costs, and reduce the competitiveness of advanced vehicle technologies in Western markets. These geopolitical and regulatory uncertainties can slow overall vehicle production growth, thereby limiting the expansion of the tubeless tyre market.

Additionally, the rapid pace of technological change-especially the move toward software-defined and electrified vehicles-requires substantial investment and adaptation from traditional tyre producers. If tyre manufacturers cannot keep pace with these transformations, or if economic pressures make new vehicles less affordable for consumers, the resultant slowdown in vehicle sales and production will directly impact the demand for tubeless tyres.

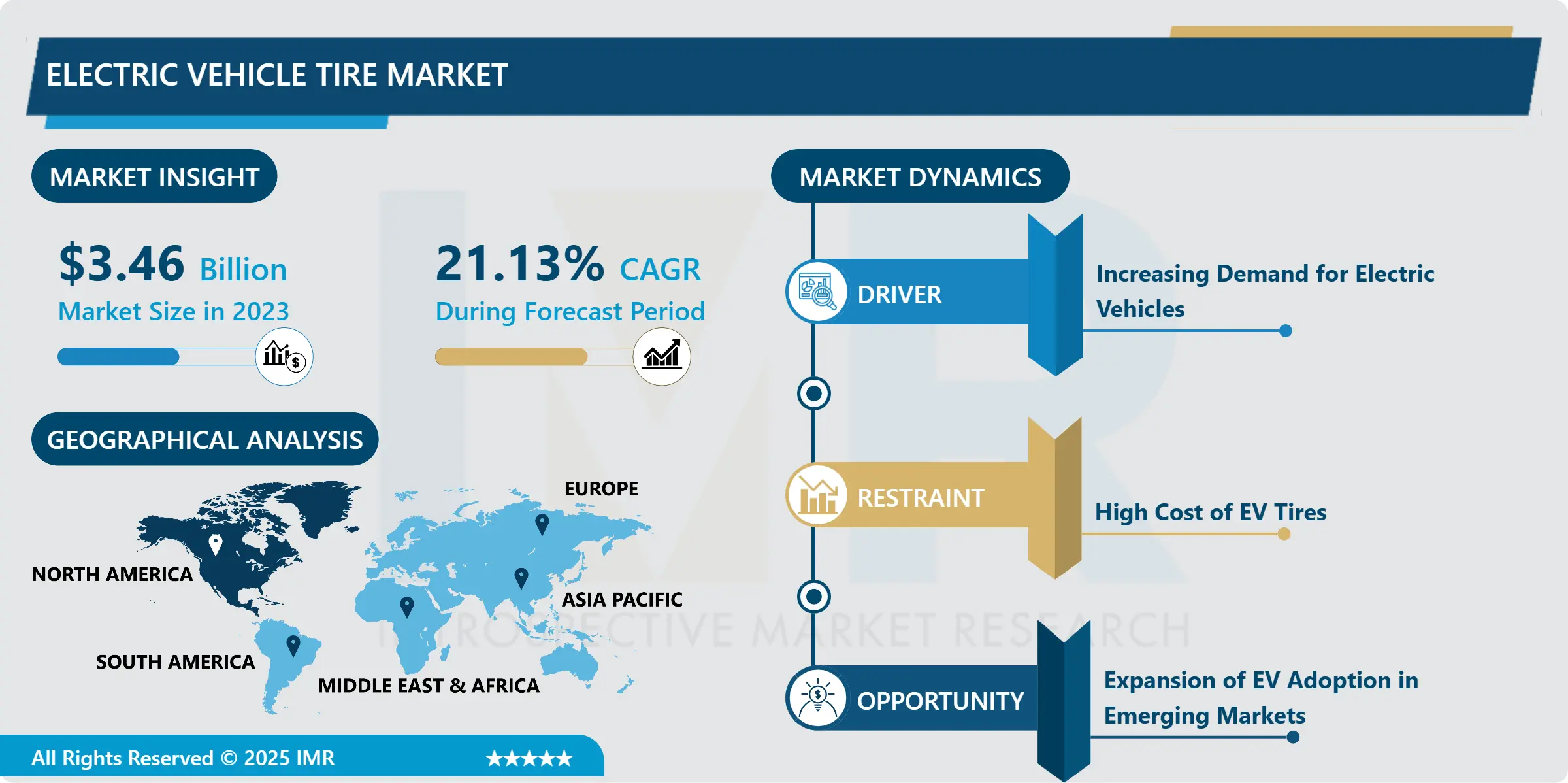

Tubeless Tire Market Expansion Opportunity- The Rapid Growth Of Electric And Hybrid Vehicles Worldwide

As automakers increasingly shift their focus toward electrification, there is a rising demand for advanced tyre technologies that enhance efficiency, safety, and performance. Tubeless tyres, with their lower rolling resistance, improved durability, and compatibility with modern vehicle designs, are well-positioned to become the standard choice for electric vehicles (EVs) and hybrids. This trend is further supported by government incentives, investments in EV infrastructure, and consumer preference for sustainable mobility solutions, all of which create a favourable environment for tubeless tyre adoption.

Additionally, As more consumers seek to upgrade from traditional tube-type tyres to tubeless options for better safety and lower maintenance, tyre manufacturers have the opportunity to expand their product offerings and reach new customer segments. Innovations such as self-sealing and run-flat tubeless tyres, along with increased awareness of their benefits, are expected to drive further market penetration and open up new avenues for growth in both developed and developing regions.

Tubeless Tire Market Challenge Barrier- High Initial Cost And Technical Complexity Limit The Market

One of the main challenge barriers facing the tubeless tyre market is the high initial cost and technical complexity associated with tubeless tyre manufacturing and installation. Compared to traditional tube-type tyres, tubeless tyres require more advanced materials, precise engineering, and specialized equipment for both production and fitting. This can make them less accessible in price-sensitive markets or regions with low service infrastructure, where consumers and retailers may be hesitant to switch due to higher upfront expenses and a lack of skilled technicians.

Another significant challenge is the ongoing volatility in raw material prices, particularly for natural rubber and synthetic compounds used in tyre production. Fluctuating input costs can squeeze profit margins for manufacturers and lead to unpredictable pricing for end consumers.

Additionally, the repair and maintenance of tubeless tyres often require specific tools and expertise, which may not be widely available in rural or less-developed areas. These factors collectively slow the widespread adoption of tubeless tyres, especially in markets where affordability and ease of service are top priorities.

Tubeless Tire Market Segment Analysis:

Tubeless Tire Market is segmented based on Type, Application, and Region

By Type, Radial Tubeless Tyre Segment Expected to Dominate the Market During the Forecast Period

During the forecast period from 2025 to 2032, the radial tubeless tyre segment is expected to dominate the global tubeless tyre market. Radial tubeless tyres are increasingly favoured due to their superior performance characteristics, including better fuel efficiency, improved ride comfort, enhanced traction, and longer tread life compared to bias tubeless tyres. These advantages make radial tubeless tyres the preferred choice for both passenger and commercial vehicles, especially as automakers and consumers seek higher safety standards and lower total cost of ownership.

The adoption of radial technology is further supported by advancements in tire design, growing demand for high-speed and heavy-load vehicles, and the expansion of road infrastructure in emerging economies. As a result, the radial tubeless tyre segment is set to capture the largest market share and exhibit the fastest growth rate over the forecast period.

By Application, Passenger Vehicles Lead Segment Held the Largest Share in 2024

The passenger vehicles segment is projected to hold the largest share of the tubeless tyre market during 2025–2032. This dominance is attributed to the rising production and sales of passenger cars globally, particularly in Asia-Pacific and other emerging markets. Increasing consumer awareness regarding vehicle safety, comfort, and maintenance, along with regulatory mandates for advanced tyre technologies, is driving the adoption of tubeless tyres in this segment.

While commercial vehicles (including trucks, buses, and light commercial vehicles) are also witnessing the growing adoption of tubeless tyres, their durability and lower maintenance requirements lead the passenger vehicle segment which remains the primary driver of market growth due to its sheer volume and faster replacement cycles.

Tubeless Tire Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

During the forecast period from 2025 to 2032, the Asia-Pacific region is expected to dominate the global tubeless tyre market. This dominance is driven by rapid industrialization, urbanization, and the booming automotive industry in countries such as China, India, Japan, and South Korea. The region benefits from high vehicle production volumes, expanding road infrastructure, and increasing consumer demand for advanced safety and performance features in vehicles. Additionally, favourable government policies supporting automotive manufacturing and the rising adoption of electric and hybrid vehicles further boost the market growth in Asia-Pacific.

The presence of major tyre manufacturers and a large aftermarket for vehicle replacement parts also contribute to the region’s leading position. As a result, Asia-Pacific is projected to capture the largest market share and exhibit the fastest growth rate throughout the forecast period.

Tubeless Tire Market Active Players:

Apollo Tyres Ltd (India)

Bridgestone Corporation (Japan)

Ceat Tyres (India)

Continental AG (Germany)

Cooper Tire & Rubber Company (USA)

Dunlop Tyres (UK)

Giti Tyres (Indonesia)

Goodyear Tire & Rubber Company (USA)

Hankook Tire & Technology Co. Ltd (South Korea)

JK Tyre & Industries Ltd (India)

Kumho Tire (South Korea)

Maxxis (Taiwan)

Michelin (France)

MRF Tyres (India)

Nokian Tyres plc (Finland)

Pirelli & C. S.p.A (Italy)

Sumitomo Rubber Industries Ltd (Japan)

Toyo Tires (Japan)

TVS Eurogrip (India)

Yokohama Rubber Company (Japan)

Other Active Players

Key Industry Developments in the Tubeless Tire Market:

In January 2025, Sumitomo Rubber Industries, Ltd. and Mitsubishi Chemical Corporation launched a joint project for the recycling of carbon black, one of the main raw materials of tyres. Sumitomo Rubber and Mitsubishi Chemical are working together to contribute to realising a circular economy in the automobile and tyre industries.

In August 2024, Bridgestone Announces Japanese Yen 25 Billion Strategic Investment at the Kitakyushu Plant for Mining and Construction Vehicle Tires. This strategic investment Was part of Bridgestone’s Mid Term Business Plan (2024-2026) to focus on delivering value over volume as it strengthens its off-the-road (OTR) tire business, which drives the Company’s premium tyre business.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Tubeless Tire Market Market by Type (2018-2032)

4.1 Tubeless Tire Market Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Radial Tubeless Tyre

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bias Tubeless Tyre

Chapter 5: Tubeless Tire Market Market by Application (2018-2032)

5.1 Tubeless Tire Market Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Tubeless Tire Market Market Share by Manufacturer/Service Provider(2024)

6.1.3 Industry BCG Matrix

6.1.4 PArtnerships, Mergers & Acquisitions

6.2 APOLLO TYRES LTD (INDIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Recent News & Developments

6.2.10 SWOT Analysis

6.3 BRIDGESTONE CORPORATION (JAPAN)

6.4 CEAT TYRES (INDIA)

6.5 CONTINENTAL AG (GERMANY)

6.6 COOPER TIRE & RUBBER COMPANY (USA)

6.7 DUNLOP TYRES (UK)

6.8 GITI TYRES (INDONESIA)

6.9 GOODYEAR TIRE & RUBBER COMPANY (USA)

6.10 HANKOOK TIRE & TECHNOLOGY CO. LTD (SOUTH KOREA)

6.11 JK TYRE & INDUSTRIES LTD (INDIA)

6.12 KUMHO TIRE (SOUTH KOREA)

6.13 MAXXIS (TAIWAN)

6.14 MICHELIN (FRANCE)

6.15 MRF TYRES (INDIA)

6.16 NOKIAN TYRES PLC (FINLAND)

6.17 PIRELLI & C. S.P.A (ITALY)

6.18 SUMITOMO RUBBER INDUSTRIES LTD (JAPAN)

6.19 TOYO TIRES (JAPAN)

6.20 TVS EUROGRIP (INDIA)

6.21 YOKOHAMA RUBBER COMPANY (JAPAN)

6.22 OTHER ACTIVE PLAYERS

Chapter 7: Global Tubeless Tire Market Market By Region

7.1 Overview

7.2. North America Tubeless Tire Market Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecast Market Size by Country

7.2.4.1 US

7.2.4.2 Canada

7.2.4.3 Mexico

7.3. Eastern Europe Tubeless Tire Market Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecast Market Size by Country

7.3.4.1 Russia

7.3.4.2 Bulgaria

7.3.4.3 The Czech Republic

7.3.4.4 Hungary

7.3.4.5 Poland

7.3.4.6 Romania

7.3.4.7 Rest of Eastern Europe

7.4. Western Europe Tubeless Tire Market Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecast Market Size by Country

7.4.4.1 Germany

7.4.4.2 UK

7.4.4.3 France

7.4.4.4 The Netherlands

7.4.4.5 Italy

7.4.4.6 Spain

7.4.4.7 Rest of Western Europe

7.5. Asia Pacific Tubeless Tire Market Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecast Market Size by Country

7.5.4.1 China

7.5.4.2 India

7.5.4.3 Japan

7.5.4.4 South Korea

7.5.4.5 Malaysia

7.5.4.6 Thailand

7.5.4.7 Vietnam

7.5.4.8 The Philippines

7.5.4.9 Australia

7.5.4.10 New Zealand

7.5.4.11 Rest of APAC

7.6. Middle East & Africa Tubeless Tire Market Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecast Market Size by Country

7.6.4.1 Turkiye

7.6.4.2 Bahrain

7.6.4.3 Kuwait

7.6.4.4 Saudi Arabia

7.6.4.5 Qatar

7.6.4.6 UAE

7.6.4.7 Israel

7.6.4.8 South Africa

7.7. South America Tubeless Tire Market Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecast Market Size by Country

7.7.4.1 Brazil

7.7.4.2 Argentina

7.7.4.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

Chapter 9 Our Thematic Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

9.1 Sources

9.2 List of Tables and figures

9.3 Short Forms and Citations

9.4 Assumption and Conversion

9.5 Disclaimer

Q1: What is the Forecast Period Covered in the Tubeless Tire Market Research Report?

A1: The projected forecast period for the Tubeless Tire Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Tubeless Tire Market?

A2: Apollo Tyres Ltd (India), Bridgestone Corporation (Japan), Ceat Tyres (India), Continental AG (Germany), Cooper Tire & Rubber Company (USA), Dunlop Tyres (UK), Giti Tyres (Indonesia), Goodyear Tire & Rubber Company (USA), Hankook Tire & Technology Co. Ltd (South Korea), JK Tyre & Industries Ltd (India), Kumho Tire (South Korea), Maxxis (Taiwan), Michelin (France), MRF Tyres (India), Nokian Tyres plc (Finland), Pirelli & C. S.p.A (Italy), Sumitomo Rubber Industries Ltd (Japan), Toyo Tires (Japan), TVS Eurogrip (India), Yokohama Rubber Company (Japan), and Other Active Players.

Q3: How is the Tubeless Tire Market segmented?

A3: The Tubeless Tire Market is segmented into Type, Application, and Region. By Type, the market is categorized into Radial Tubeless Tyre, and Bias Tubeless Tyre. By Application, the market is categorized into Passenger Vehicles and Commercial Vehicles. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy;; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What defines the Tubeless Tire Market?

A4: A tubeless tyre is a type of pneumatic tyre that doesn't require an inner tube to hold air. Instead, it relies on an airtight seal between the tyres inner lining and the wheel rim to maintain pressure. This design eliminates the need for a separate tube, offering various advantages like improved puncture resistance and lighter weight.

Q5: What is the market size of the Tubeless Tire Market?

A5: Tubeless Tire Market Size Was Valued at USD 190 Billion in 2024 and is Projected to Reach USD 289.39 Billion by 2032, Growing at a CAGR of 5.4% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!