Stay Ahead in Fast-Growing Economies.

Browse Reports NowForex Cards Market – Trend, Growth, Forecast 2025-2032

A Forex card, also known as a travel card, is a prepaid card designed for travellers to make transactions in foreign currencies. It’s a convenient way to carry and spend foreign currency while abroad, eliminating the need to carry large amounts of cash. Forex cards are issued by banks and financial institutions and can be used for various expenses like shopping, dining, and cash withdrawals at ATMs.

IMR Group

Description

Forex Cards Market Synopsis:

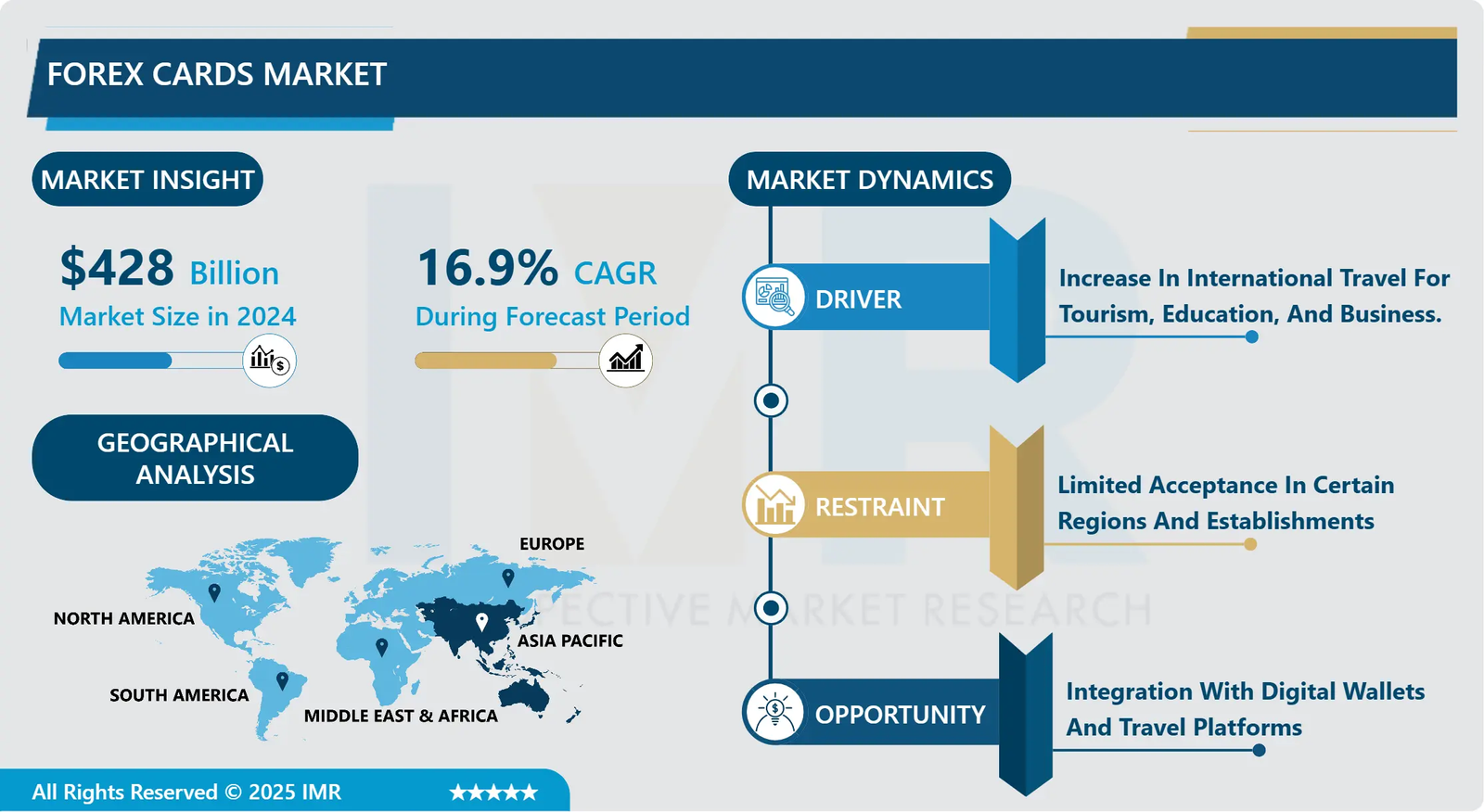

Forex Cards Market Size Was Valued at USD 428 Billion in 2024 and is Projected to Reach USD 1492.66 Billion by 2032, Growing at a CAGR of 16.9% from 2025-2032.

In 2024, global international tourist arrivals reached 1.4 billion, a 9 % annual increase over the past five years, directly contributing to the growing demand for forex cards.

A Forex card, also known as a travel card, is a prepaid card designed for travellers to make transactions in foreign currencies. It’s a convenient way to carry and spend foreign currency while abroad, eliminating the need to carry large amounts of cash. Forex cards are issued by banks and financial institutions and can be used for various expenses like shopping, dining, and cash withdrawals at ATMs.

A forex card comes with two main variants–multicurrency forex cards and single currency cards. A single-currency card has limited use and will incur higher cross-currency charges if used in another currency. A multicurrency card can load it with up to 23 currencies and use it across the world. Users can also shuffle funds from one currency to another whenever needed via prepaid Net Banking — for example, if the traveller is visiting two countries that have different currencies then a multicurrency card can help the traveller to use different currencies from a single multicurrency card

Forex Cards Market Growth and Trend Analysis:

Forex Cards Market Growth Driver- Increase In International Travel For Tourism, Education, And Business.

As global mobility increases post-pandemic, millions of people are resuming overseas trips. Whether its students going abroad for higher education or families vacationing in foreign countries, the demand for convenient, secure, and cost-effective payment methods is on the rise. Forex cards offer travellers a reliable way to carry multiple currencies without the risk associated with carrying large amounts of cash or incurring high charges on international credit card transactions.

Moreover, many travellers prefer forex cards due to their fixed exchange rates, which protect them from currency fluctuations that can occur during long trips. The cards also offer added benefits such as ATM access, spending controls, and fraud protection features, making them a more attractive option than traditional traveller’s checks or currency exchanges. This travel-related demand is fueling sustained growth in the global forex card market.

Forex Cards Market Limiting Factor- Limited Acceptance In Certain Regions And Establishments

While forex cards are accepted at most major retailers, hotels, and online merchants, especially in developed countries, their usage may be restricted in rural areas, small towns, or countries with low digital infrastructure. Local vendors in places like small shops, street markets, or transport services often prefer cash or may only accept local bank cards. This forces travellers to carry additional cash or seek alternative payment options, reducing the perceived utility of forex cards.

Additionally, some travellers experience difficulty using Forex cards at fuel stations, toll booths, or offline transactions where card authorization systems are unavailable. This partial acceptance can make users hesitant to rely solely on a Forex card during international travel.

As a result, despite their convenience and cost-effectiveness, this limited usability in certain regions continues to constrain market growth and user confidence.

Forex Cards Market Expansion Opportunity- Integration With Digital Wallets And Travel Platforms

A major opportunity for forex card providers lies in the integration with digital wallets and travel platforms. By linking forex cards with mobile wallets like Google Pay, Apple Pay, and local fintech apps, providers can enhance user convenience, security, and usage frequency. Integration with travel booking apps, loyalty programs, and international insurance can create bundled offerings that appeal to frequent travellers and digital-first consumers.

This ecosystem-based approach allows card issuers to move beyond simple currency exchange and become part of a traveller’s full journey. Fintech players are especially well-positioned to lead this shift, offering real-time exchange updates, in-app card control, and budgeting features that traditional banks often lack.

Forex Cards Market Challenge Barrier- Regulatory Environments In Some Countries

Forex card expansion is significantly influenced by regulatory policies, especially in countries with stringent foreign exchange and capital control laws. Many governments, particularly in emerging or developing markets, place limits on how much foreign currency individuals can purchase or transfer abroad within a financial year.

For instance, India’s Liberalized Remittance Scheme (LRS) caps outbound foreign exchange transactions at $250,000 per person annually, which directly affects the forex card loading capacity. Additionally, such regulations often come with bureaucratic hurdles, including mandatory documentation, approvals, and tax disclosures, which can delay or discourage users from adopting forex cards for overseas travel, education, or shopping.

Forex Cards Market Segment Analysis:

Forex Cards Market is segmented based on Type, Application, End-Users, and Region

By Type, Multi-Currency Segment is Expected to Dominate the Market During the Forecast Period

Multi-currency forex cards dominate the market because they offer unmatched convenience and flexibility for international travellers. With the ability to load and use multiple currencies on a single card, users can seamlessly pay or withdraw cash in local currency across different countries without the hassle of carrying or exchanging multiple currencies. This not only simplifies travel but also ensures that travellers are protected from currency fluctuations, as exchange rates are locked in at the time of loading the card. Additionally, these cards allow easy online management, quick fund transfers between currency wallets, and instant reloading, making them highly user-friendly

Cost efficiency and security are other key drivers of their dominance. Multi-currency cards typically offer better exchange rates and lower transaction fees than cash or international credit/debit cards, with some cards waiving ATM and cross-currency charges altogether.

By Application, Travel and Tourism Segment Held the Largest Share

This dominance is primarily driven by the surge in international tourism and business travel, which has significantly increased the demand for secure and convenient payment solutions abroad. Forex cards, especially multi-currency variants, provide travellers with the flexibility to carry and spend in multiple currencies, making them a preferred choice over traditional payment methods like cash or traveller’s cheques. The ability to look at favourable exchange rates and avoid currency fluctuation risks further enhances their appeal to tourists and business travellers

Additionally, Enhanced security features, widespread acceptance, and partnerships between banks and travel service providers have also played a crucial role in cementing travel and tourism as the leading application area for forex cards in 2024

Forex Cards Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast Period

The Asia-Pacific region is expected to dominate the forex cards market throughout the forecast period, driven by a rapidly expanding tourism industry, increasing disposable incomes, and a surge in outbound travel from countries such as India and China

The region’s market growth is further supported by rising awareness of the benefits of forex cards, technological advancements in banking services, and partnerships between banks and travel service providers, making forex cards more accessible and attractive to travellers

Moreover, the region benefits from robust government initiatives promoting digital payments and financial inclusion, alongside partnerships between banks, fintech companies, and travel service providers. These collaborations integrate forex cards into broader payment platforms and super-apps (such as Alipay, Paytm, and GrabPay), creating seamless user experiences and expanding market reach.

Forex Cards Market Active Players

American Express Company (USA)

Axis Bank (India)

Circle (USA)

HDFC Bank Ltd. (India)

HSBC Group (UK)

ICICI Bank (India)

Mastercard (New York)

Remitly (USA)

Revolut Ltd (UK)

Standard Chartered Bank (Hong Kong)

Thomascook (UK)

Travelex International Limited (UK)

Visa (California)

Wise Payments Limited (UK)

Worldpay (UK)

Other Active Players

Key Industry Developments in the Forex Cards Market:

In May 2024, Blockchain and cryptocurrency integration is emerging, with some forex cards leveraging blockchain for enhanced security, transparency, and efficiency in cross-border transactions. This trend is also paving the way for cards that support cryptocurrency balances

In September 2023, Thomas Cook (India) Ltd, in partnership with NPCI, launched a RuPay prepaid forex card for Indian travellers to the UAE, loaded in dirhams for both transactions and ATM withdrawals. Similarly, Mint Middle East introduced a multi-currency prepaid card solution supporting up to 25 currencies through a dedicated mobile app

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Forex Cards Market Market by Type (2018-2032)

4.1 Forex Cards Market Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Single Currency Forex Card

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Multi-Currency Forex Card

Chapter 5: Forex Cards Market Market by Application (2018-2032)

5.1 Forex Cards Market Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Travel and Tourism

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 International Shopping

5.5 Education

5.6 Other

Chapter 6: Forex Cards Market Market by End-User (2018-2032)

6.1 Forex Cards Market Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Individuals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Corporates

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Forex Cards Market Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 AMERICAN EXPRESS COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 AXIS BANK (INDIA)

7.4 CIRCLE (USA)

7.5 HDFC BANK LTD. (INDIA)

7.6 HSBC GROUP (UK)

7.7 ICICI BANK (INDIA)

7.8 MASTERCARD (USA)

7.9 REMITLY (USA)

7.10 REVOLUT LTD (UK)

7.11 STANDARD CHARTERED BANK (UK)

7.12 THOMASCOOK (UK)

7.13 TRAVELEX INTERNATIONAL LIMITED (UK)

7.14 VISA (CALIFORNIA)

7.15 WISE PAYMENTS LIMITED (UK)

7.16 WORLDPAY (UK)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Forex Cards Market Market By Region

8.1 Overview

8.2. North America Forex Cards Market Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Forex Cards Market Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Forex Cards Market Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Forex Cards Market Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Forex Cards Market Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Forex Cards Market Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

Q1: What is the Forecast Period Covered in the Forex Cards Market Research Report?

A1: The projected forecast period for the Forex Cards Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Forex Cards Market?

A2: American Express Company (USA), Axis Bank (India), Circle (USA), HDFC Bank Ltd. (India), HSBC Group (UK), ICICI Bank (India), Mastercard (USA), Remitly (USA), Revolut Ltd (UK), Standard Chartered Bank (UK), Thomascook (UK), Travelex International Limited (UK), Visa (California), Wise Payments Limited (UK), Worldpay (UK), Other Active Players.

Q3: How is the Forex Cards Market segmented?

A3: The Forex Cards Market is segmented into Type, Application, End User and Region. By Type, the market is categorized into Single Currency Forex Card, and Multi-Currency Forex Card. By Application, the market is categorized into Travel and Tourism, International Shopping, Education, and Other. By End User, the market is categorized into Individuals and Corporates. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What defines the Forex Cards Market?

A4: A Forex card, also known as a travel card, is a prepaid card designed for travellers to make transactions in foreign currencies. It's a convenient way to carry and spend foreign currency while abroad, eliminating the need to carry large amounts of cash. Forex cards are issued by banks and financial institutions and can be used for various expenses like shopping, dining, and cash withdrawals at ATMs.

Q5: What is the market size of the Forex Cards Market?

A5: Forex Cards Market Size Was Valued at USD 428 Billion in 2024 and is Projected to Reach USD 1492.66 Billion by 2032, Growing at a CAGR of 16.9% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!