Stay Ahead in Fast-Growing Economies.

Browse Reports NowAmbulatory Polysomnography System Market – Growth & Trend Analysis

A portable ambulatory polysomnography system can be used to perform a comprehensive overnight PSG study at a patient’s home and in an ordinary hospital room.

IMR Group

Description

Ambulatory Polysomnography System Synopsis:

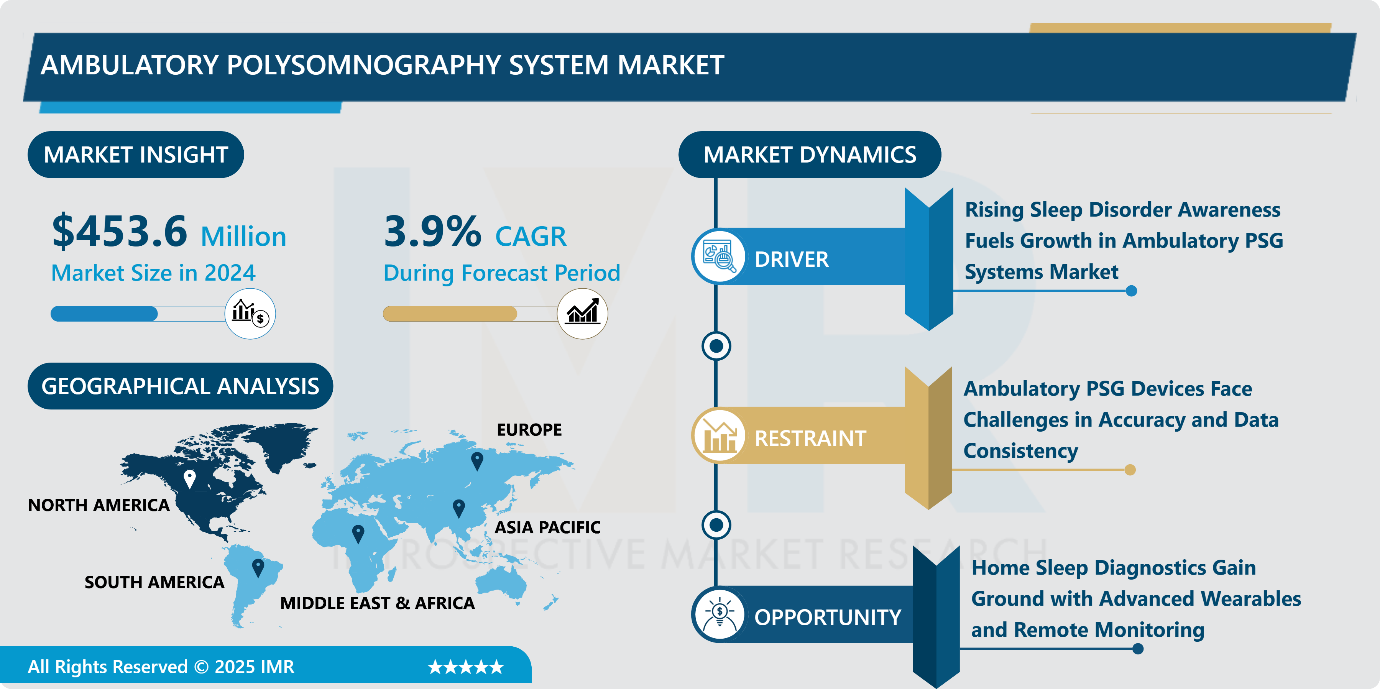

Ambulatory Polysomnography System Size Was Valued at USD 453.6 Million in 2024, and is Projected to Reach USD 616.02 Million by 2032, Growing at a CAGR of 3.9% from 2025-2032.

A portable ambulatory polysomnography system can be used to perform a comprehensive overnight PSG study at a patient’s home and in an ordinary hospital room. There is no need to arrange a sleep lab, and medical personnel continuously monitoring the exam progress are no longer required. Ambulatory PSG is not less effective than clinical PSG, but it is also more comfortable and cost-effective for a medical facility.

Ambulatory polysomnography (PSG) Systems have been driven by the need for more accessible, cost-effective, and patient-convenient diagnostic options for sleep disorders. From a standard viewpoint, PSG conducted by laboratories remains the foremost methodology, yet evaluations through portable home-based monitoring systems have appeared as alternatives due to their expensive nature and inconvenient operation.

Ambulatory Polysomnography System Growth and Trend Analysis:

Growth Driver

Rising Sleep Disorder Awareness Fuels Growth in Ambulatory PSG Systems Market

The global Ambulatory Polysomnography (PSG) System Market is experiencing significant growth, shaped by evolving sleep health trends and rising awareness of conditions like sleep apnea. The market for Ambulatory Polysomnography (PSG) Systems continues to grow worldwide because people are becoming more aware about sleep health issues, including sleep apnea and recent sleep pattern developments. According to the 2024 Sleep Survey, it shows that sleep disorders amount to a significant global health crisis because sleep apnea affects one-third of the population while leaving eighty percent of sufferers unidentified. The extensive underdiagnosis situation drives the need for portable diagnostic tools such as ambulatory PSG systems.

People worldwide have started using devices and apps to monitor their sleep patterns since 36% of respondents now track their nighttime rest. This shows how individuals are increasingly interested in using medical data to enhance their health awareness. Technological innovation in home sleep testing and wearable devices drives hospitals to transition from sleep labs to home testing, which creates growth for the ambulatory PSG market.

The market potential in emerging economies looks strong because high-growth areas including India, Mainland China, and Thailand, show fast-growing awareness about sleep health diagnosis with rising diagnosis rates. The ambulatory PSG market shows promising growth conditions since it combines healthcare deficiencies with technological breakthroughs and evolving perspectives regarding sleep wellness among patients.

Ambulatory PSG Devices Face Challenges in Accuracy and Data Consistency

The main limitation of ambulatory polysomnography systems arises from the lack of EEG monitoring capability, which reduces their ability to stage sleep and identify arousal events. Many devices tend to calculate results at a lower value of the apnea-hypopnea index, which causes the diagnosis to be inaccurate. The proprietary algorithms installed in certain devices prohibit users from both manual scoring and making corrections. Several devices operate using different standards, which causes varied readings in data interpretation. When patients make mistakes during setup operations, it creates substantial negative effects on both the quality and reliability.

Home Sleep Diagnostics Gain Ground with Advanced Wearables and Remote Monitoring

Ambulatory PSG systems demonstrate increasing market potential because healthcare practices shift towards home-based patient diagnostics and person-centered care models. New wireless technologies, together with wearable sensors, lead to superior signal quality for monitoring purposes. Telemedicine platforms enable the integration, which allows distant data transfer with expert evaluation capability. Training employees together with caregivers enhances the accuracy of collected data and expands the number of people who can benefit from this system. The efficiency of such systems increases when they monitor patients who show high vulnerability to sleep apnea.

Lack of Supervision and Skilled Analysis

Achieving diagnostic accuracy in ambulatory PSG presents the biggest challenge because it requires no supervision from a laboratory environment. Patients who perform improper setup of devices create signal loss and incomplete data collection. Healthcare providers face challenges in correctly reading patient data because patients with insomnia or heart problems concurrently show similar signs during polysomnography tests. Insufficient reimbursement and insurance coverage restrict health care access to some users. Home-based data undergoes interpretation challenges when health professionals lacking proper training are unavailable to analyze it.

Ambulatory Polysomnography System Segment Analysis:

Ambulatory Polysomnography System is segmented based on Product, Application, End-Users, and Region

By Product, Up to 24 Channel PSG Systems Segment is Expected to Dominate the Market During the Forecast Period

The 24-channel Polysomnography (PSG) system is currently dominating the global Ambulatory Polysomnography System Market due to its ability to offer comprehensive, multi-parameter sleep diagnostics in both clinical and home-based settings. The 24-channel PSG system offers complete simultaneous bio-signal measurements of EEG, EOG, EMG, ECG, respiratory airflow, and blood oxygen levels together with body movement tracking vital for complex sleep disorder diagnosis, including obstructive sleep apnea and REM behavior disorder, and narcolepsy.

Worldwide sleep clinics and hospitals, together with research organizations, consider the 24-channel PSG system their primary diagnostic selection due to its unique combination of flexibility and precise detection abilities. The development of portable PSG devices now allows effective utilization of 24-channel systems during both home-based sleep tests and occupational health evaluations. Leading market position for the 24-channel PSG system occurs because the growing market demand for convenient, high-quality, patient-friendly sleep diagnostics as sleep-related health problems keep increasing worldwide.

By Application, Obstructive Sleep Apnea Segment Held the Largest Share in the Projected Period

Obstructive Sleep Apnea (OSA) is a leading driver in the global Ambulatory Polysomnography System Market, primarily due to its staggering prevalence and associated health consequences. According to the Science Direct 2024 review, approximately 1 billion people worldwide, making it one of the most common chronic respiratory conditions with significant cardiovascular and neurological impacts.

While traditionally linked to obesity, the review underscores that OSA also occurs extensively in non-obese populations, suggesting that a large portion of affected individuals remain undiagnosed due to limitations in conventional screening approaches. This broad and under-recognized patient base reinforces the growing need for accessible, non-invasive diagnostic solutions, such as ambulatory (home-based) polysomnography systems, which can reach underserved and reluctant populations. Given these factors, OSA’s dominance in clinical attention, coupled with an increasing demand for scalable diagnostic tools, directly contributes to the expanding footprint of the ambulatory sleep diagnostics market.

Ambulatory Polysomnography System Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the ambulatory polysomnography system market over the forecast period, driven by the region’s high prevalence of sleep disorders and growing awareness around sleep health. According to the Sleep Statistics 2025 data, approximately 70 million adults in the United States are affected by a sleep disorder, with around 25% of survey respondents reportedly diagnosed with a specific sleep-related condition. Furthermore, an estimated 10% to 30% of U.S.

Adults suffer from obstructive sleep apnea, a condition commonly requiring diagnostic tools like polysomnography. Insomnia also remains a widespread concern, with 30% to 40% of adults reporting symptoms each year. This significant disease burden, coupled with a well-established healthcare infrastructure, widespread access to specialized sleep centers, and growing public awareness about the importance of sleep health, and As the demand for convenient, accurate, and cost-effective sleep disorder diagnostics continues to rise reinforced North America as the leading market for ambulatory polysomnography systems in the coming years.

Ambulatory Polysomnography System Active Players:

Cadwell Industries Inc. (USA)

Compumedics Limited (Australia)

Embleema (USA)

GE Healthcare (USA/UK)

Koninklijke Philips N.V. (Netherlands)

LJV Biomed (Israel)

Löwenstein Medical Technology GmbH + Co. KG. (Germany)

Medtronic (Ireland/USA)

MESA Laboratories (USA)

Natus Medical Incorporated (USA)

NeuroMetrix (USA)

Neurosoft (Russia)

Nihon Kohden Corporation (Japan)

Nox Medical (Iceland)

Onera Technologies B.V. (Netherlands)

ResMed Inc. (USA)

Siemens Healthineers (Germany)

SomnoMed (Australia)

Somnomedics GmbH (Germany)

Sunrise Medical (USA)

Other Active Players

Key Industry Developments in the Ambulatory Polysomnography System:

In April 2025, Nox Medical released a new Clinical Application Paper titled “Inclusive Sleep Testing: Considering Comorbidities in Home Sleep Apnea Testing”, highlighting critical advancements in the field of sleep diagnostics. The paper explored the often-overlooked connection between Obstructive Sleep Apnea (OSA) and chronic diseases, while addressing the limitations of traditional Home Sleep Apnea Testing (HSAT) devices for patients with complex medical profiles.

In August 2024, ReactDx, a division of React Health, launched the NiteWatch home sleep test. NiteWatch, worn on the wrist and finger, measures six health parameters and integrates with a mobile app for quick result access. Validated against polysomnography, it aims to improve diagnostic access and bridge sleep and cardiac health. ReactDx’s platform enables clinicians to prescribe home sleep tests and ambulatory cardiac monitoring, streamlining patient care.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ambulatory Polysomnography System Market Market by Product

4.1 Ambulatory Polysomnography System Market Market Snapshot and Growth Engine

4.2 Ambulatory Polysomnography System Market Market Overview

4.3 Up to 12 Channel PSG Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Up to 12 Channel PSG Systems: Geographic Segmentation Analysis

4.4 Up to 24 Channel PSG Systems

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Up to 24 Channel PSG Systems: Geographic Segmentation Analysis

4.5 up to 32 Channel PSG Systems

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 up to 32 Channel PSG Systems: Geographic Segmentation Analysis

4.6 and Above 32 Channel PSG Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Above 32 Channel PSG Systems: Geographic Segmentation Analysis

Chapter 5: Ambulatory Polysomnography System Market Market by Application

5.1 Ambulatory Polysomnography System Market Market Snapshot and Growth Engine

5.2 Ambulatory Polysomnography System Market Market Overview

5.3 Obstructive Sleep Apnea

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Obstructive Sleep Apnea: Geographic Segmentation Analysis

5.4 Narcolepsy

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Narcolepsy: Geographic Segmentation Analysis

5.5 Chronic Insomnia

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Chronic Insomnia: Geographic Segmentation Analysis

5.6 and Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 and Others: Geographic Segmentation Analysis

Chapter 6: Ambulatory Polysomnography System Market Market by End-user

6.1 Ambulatory Polysomnography System Market Market Snapshot and Growth Engine

6.2 Ambulatory Polysomnography System Market Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Sleep Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Sleep Laboratories: Geographic Segmentation Analysis

6.5 and Home Care Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Home Care Settings: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ambulatory Polysomnography System Market Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NATUS MEDICAL INCORPORATED (USA)

7.4 NIHON KOHDEN CORPORATION (JAPAN)

7.5 RESMED INC. (USA)

7.6 LÖWENSTEIN MEDICAL TECHNOLOGY GMBH + CO. KG. (GERMANY)

7.7 NEUROSOFT (RUSSIA)

7.8 CADWELL INDUSTRIES INC. (USA)

7.9 SOMNOMEDICS GMBH (GERMANY)

7.10 COMPUMEDICS LIMITED (AUSTRALIA)

7.11 ONERA TECHNOLOGIES B.V. (NETHERLANDS)

7.12 NOX MEDICAL (ICELAND)

7.13 MESA LABORATORIES (USA)

7.14 MEDTRONIC (IRELAND/USA)

7.15 SIEMENS HEALTHINEERS (GERMANY)

7.16 SOMNOMED (AUSTRALIA)

7.17 NEUROMETRIX (USA)

7.18 EMBLEEMA (USA)

7.19 SUNRISE MEDICAL (USA)

7.20 LJV BIOMED (ISRAEL)

7.21 GE HEALTHCARE (USA/UK)

7.22 OTHER ACTIVE PLAYERS.

Chapter 8: Global Ambulatory Polysomnography System Market Market By Region

8.1 Overview

8.2. North America Ambulatory Polysomnography System Market Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Up to 12 Channel PSG Systems

8.2.4.2 Up to 24 Channel PSG Systems

8.2.4.3 up to 32 Channel PSG Systems

8.2.4.4 and Above 32 Channel PSG Systems

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Obstructive Sleep Apnea

8.2.5.2 Narcolepsy

8.2.5.3 Chronic Insomnia

8.2.5.4 and Others

8.2.6 Historic and Forecasted Market Size By End-user

8.2.6.1 Hospitals

8.2.6.2 Sleep Laboratories

8.2.6.3 and Home Care Settings

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ambulatory Polysomnography System Market Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Up to 12 Channel PSG Systems

8.3.4.2 Up to 24 Channel PSG Systems

8.3.4.3 up to 32 Channel PSG Systems

8.3.4.4 and Above 32 Channel PSG Systems

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Obstructive Sleep Apnea

8.3.5.2 Narcolepsy

8.3.5.3 Chronic Insomnia

8.3.5.4 and Others

8.3.6 Historic and Forecasted Market Size By End-user

8.3.6.1 Hospitals

8.3.6.2 Sleep Laboratories

8.3.6.3 and Home Care Settings

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ambulatory Polysomnography System Market Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Up to 12 Channel PSG Systems

8.4.4.2 Up to 24 Channel PSG Systems

8.4.4.3 up to 32 Channel PSG Systems

8.4.4.4 and Above 32 Channel PSG Systems

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Obstructive Sleep Apnea

8.4.5.2 Narcolepsy

8.4.5.3 Chronic Insomnia

8.4.5.4 and Others

8.4.6 Historic and Forecasted Market Size By End-user

8.4.6.1 Hospitals

8.4.6.2 Sleep Laboratories

8.4.6.3 and Home Care Settings

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ambulatory Polysomnography System Market Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Up to 12 Channel PSG Systems

8.5.4.2 Up to 24 Channel PSG Systems

8.5.4.3 up to 32 Channel PSG Systems

8.5.4.4 and Above 32 Channel PSG Systems

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Obstructive Sleep Apnea

8.5.5.2 Narcolepsy

8.5.5.3 Chronic Insomnia

8.5.5.4 and Others

8.5.6 Historic and Forecasted Market Size By End-user

8.5.6.1 Hospitals

8.5.6.2 Sleep Laboratories

8.5.6.3 and Home Care Settings

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ambulatory Polysomnography System Market Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Up to 12 Channel PSG Systems

8.6.4.2 Up to 24 Channel PSG Systems

8.6.4.3 up to 32 Channel PSG Systems

8.6.4.4 and Above 32 Channel PSG Systems

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Obstructive Sleep Apnea

8.6.5.2 Narcolepsy

8.6.5.3 Chronic Insomnia

8.6.5.4 and Others

8.6.6 Historic and Forecasted Market Size By End-user

8.6.6.1 Hospitals

8.6.6.2 Sleep Laboratories

8.6.6.3 and Home Care Settings

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ambulatory Polysomnography System Market Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Up to 12 Channel PSG Systems

8.7.4.2 Up to 24 Channel PSG Systems

8.7.4.3 up to 32 Channel PSG Systems

8.7.4.4 and Above 32 Channel PSG Systems

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Obstructive Sleep Apnea

8.7.5.2 Narcolepsy

8.7.5.3 Chronic Insomnia

8.7.5.4 and Others

8.7.6 Historic and Forecasted Market Size By End-user

8.7.6.1 Hospitals

8.7.6.2 Sleep Laboratories

8.7.6.3 and Home Care Settings

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What is the Forecast Period Covered in the Ambulatory Polysomnography System Research Report?

A1: The projected forecast period for the Ambulatory Polysomnography System Research Report is 2025-2032.

Q2: Who are the Key Players in the Ambulatory Polysomnography System?

A2: Koninklijke Philips N.V. (Netherlands), Natus Medical Incorporated (USA), Nihon Kohden Corporation (Japan), ResMed Inc. (USA), Löwenstein Medical Technology GmbH + Co. KG. (Germany), Neurosoft (Russia), Cadwell Industries Inc. (USA), Somnomedics GmbH (Germany), Compumedics Limited (Australia), Onera Technologies B.V. (Netherlands), Nox Medical (Iceland), MESA Laboratories (USA), Medtronic (Ireland/USA), Siemens Healthineers (Germany), SomnoMed (Australia), NeuroMetrix (USA), Embleema (USA), Sunrise Medical (USA), LJV Biomed (Israel), GE Healthcare (USA/UK), and Other Active Players.

Q3: How is the Ambulatory Polysomnography System segmented?

A3: The Ambulatory Polysomnography System is segmented into Product, Application, End-Users, and Region. By Product, it is categorized into Up to 12 Channel PSG Systems, Up to 24 Channel PSG Systems, up to 32 Channel PSG Systems, and Above 32 Channel PSG Systems. By Application, it is categorized into Obstructive Sleep Apnea, Narcolepsy, Chronic Insomnia, and Others. By End-user, it is categorized into Hospitals, Sleep Laboratories, and Home Care Settings. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What defines the Ambulatory Polysomnography System?

A4: A portable ambulatory polysomnography system can be used to perform a comprehensive overnight PSG study at a patient’s home and in an ordinary hospital room. There is no need to arrange a sleep lab, and medical personnel continuously monitoring the exam progress are no longer required. Ambulatory PSG is not less effective than clinical PSG, but it is also more comfortable and cost-effective for a medical facility.

Q5: What is the market size of the Ambulatory Polysomnography System?

A5: Ambulatory Polysomnography System Size Was Valued at USD 453.6 Million in 2024, and is Projected to Reach USD 616.02 Million by 2032, Growing at a CAGR of 3.9% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!