Stay Ahead in Fast-Growing Economies.

Browse Reports NowDental Surgical Instruments Market Latest Advancement & Future Trends (2024-2032)

Dental surgical instruments are a broad category which pertains to instruments and devices used in diagnosing treating and preventing diseases affecting the oral cavity using surgery.

IMR Group

Description

Dental Surgical Instruments Market Synopsis:

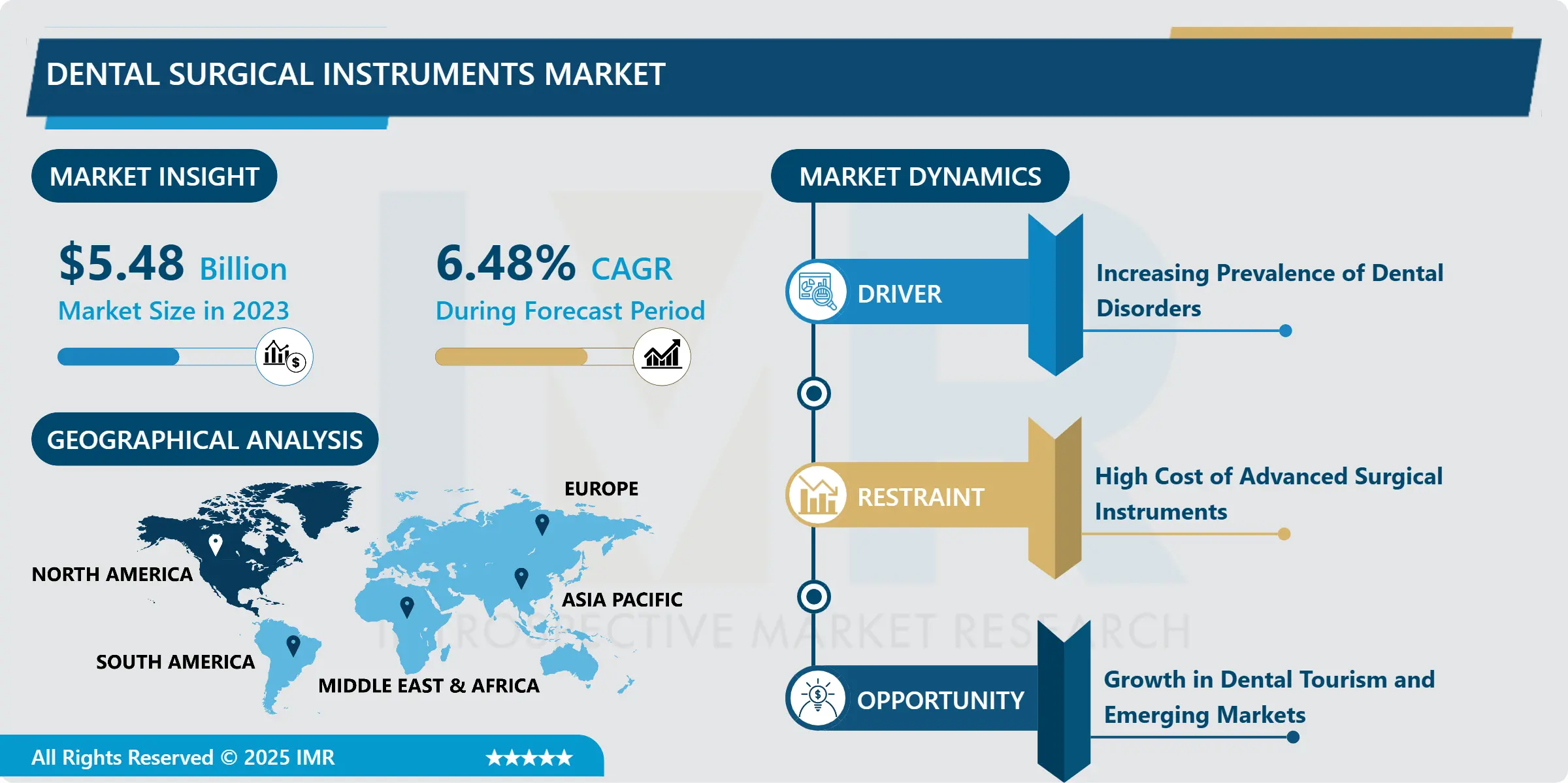

Dental Surgical Instruments Market Size Was Valued at USD 5.48 Billion in 2023, and is Projected to Reach USD 9.65 Billion by 2032, Growing at a CAGR of 6.48% From 2024-2032.

Dental surgical instruments are a broad category which pertains to instruments and devices used in diagnosing treating and preventing diseases affecting the oral cavity using surgery. These instruments are imperative for operations like, tooth removal, deep pocket surgeries, implants and other complicated dental operations. The market involves tools like forceps, scalers, retractors and implant equipment for general and surgical dental practices among others.

The global dental surgical instruments are up trending since awareness of oral health has improved and dental diseases such as periodontal diseases, caries, and oral cancer among others are becoming common. The increased concern for aesthetically appealing smile and the increased health and technological awareness have also contributed to increased need of different surgical instruments. Dental practitioners are putting their money into something that would offer accuracy, reduce pains felt by a patient, and ultimately effective surgeries. Also, there is statistic increase in the elderly population worldwide and copious number of them need complicated and creative treatments like dental implantation.

New entrants too have significantly gained center stage due to rise in disposable income and development of dental infrastructure. Currently the government and other players in the private sectors of the countries such as India, China and Brazil are putting more resources in dental healthcare programmes, creating a massive potential in the dental health care services market. But soaring rules and regulations along with the expensive use of optimum instruments hinders market growth in some areas. However, with advancements like Artificial Intelligence incorporated into surgical tools, and minimally invasive tools, and more the growth path of this industry is expected to remain major and consequent in the following years.

Dental Surgical Instruments Market Trend Analysis:

Rising Demand for Minimally Invasive Procedures

Generally, it is greatly established that the dental surgical instruments market is steadily experiencing a change due to the rising use of minimally invasive procedures. They nowadays appreciate less invasive treatments and shorter periods needed for the regeneration: new technologies like, laser-applied instruments and piezo mechanical devices and ultrasound scalers. Such instruments enable dental surgeons to intervene strategically within the mouth area without causing a significant amount of damage to adjacent tissues thereby improving comfort of patient and frequency of post-surgery related complications. Such innovations are also being adopted because they are also accurate and less time consuming when it comes to handling of various dental complications.

Implantology is one of the fields that has embraced this trend to a large extent with the new technologies in implantology like the guided surgery with 3D imaging and CAD CAM systems changing the protocols on treatment. Through these technologies, surgeon ensures that surgeries are made perfect suited to the patient’s need hence enhancing results and satisfaction. Consequently, manufacturers are innovating their tools to be ergonomic, lightweight and to have multiple functions within a surgery in order to optimize practitioners’ performance and therefore cater for the contemporary demand for client-oriented care solutions.

Technological Advancements in Emerging Markets

In the developing world specifically, current ongoing innovations in dental surgical instruments are being expanded significantly as more emerging markets embrace better healthcare technology in dental care. Asia-Pacific and the Latin American countries are acquiring trendy dental surgery centers to respond to the increasing patient demand. Governments in these areas are also contributing by funding campaigns to educate the public on oral health and providing subsidizing for the more complex dental procedures, so that high quality service becomes more available to different groups of patients.

Besides, the increasing focus on domestic growth in countries such as India, Thailand and Mexico due to rapidly emerging medical tourism industry is fuelling the premium dental surgical instruments demand even more. These are the place that are now  drawing more international patients because of their cheaper yet quality dental care services hence creation demand for advanced surgical equipment. To sum up, the growing opportunities favourable for the expansion of manufacturers’ outreach allow proposing affordable industry solutions that meet the requirements of these markets and reinforce the competitors’ dominant position.

Dental Surgical Instruments Market Segment Analysis:

Dental Surgical Instruments Market Segmented on the basis of product type, application, end user, and Region.

By Product Type, the Handheld Instruments segment is expected to dominate the market during the forecast period

The dental surgical instruments differentiate market primarily based on the product type, and within which the handheld instruments are a large part of the market owing to their versatile use in many dental operations. These tools include forceps, scalers, and retractors used in fine surgery operations and appreciated for their simplicity and low procurement costs. Another significant category is laser devices getting popular under the need for using various instruments for the precise minimally invasive treatments. Such surgeries using lasers are most common in such fields as soft tissue surgeries and periodontal treatments as well as in implant surgeries in which the application of lasers provides the following advantages: less painful, heals faster, and results in better patient outcomes.

Professional, high speed dental instruments that can be categorized as powered are drills hand pieces and ultrasonic; these are relatively modern technologies which are useful in special operations which need a high degree of accuracy in finishing and time keeping such as in endodontic and restoration surgery. Proximal accessories such as tips and burrs and irrigation systems add value to these instruments. The increasing need for better ergonomic and high-tech tools in all these segments is a representation of the industry’s ever advancing goal of enhancing the efficiency of the practitioners and comfort of the patients.

By Application, Endodontics segment expected to held the largest share

The dental surgical instruments market by application involves the segmentation of the market by function in the following fields: restorative dentistry, implantology, endodontics, orthodontics, and periodontics. Restorative dentistry has also a large market share because most of the activities involve fixing teeth that have been broken or decayed using instruments that have finely tuned precision as well as strength. Such treatments as fillings, crowns, and bridges call for efficient tools to provide the best treatment outcomes explaining the need for high-quality instruments in this segment. Likewise, the field of implantology is expanding unexpectedly because of the rising number of toothless individuals and expansion of implant usage. Goods like implant drills and guided surgery tools are common to meet demand for implant placement with high accuracy.

Other exceptional applications are in endodontics where rotary instruments such as files and obturators for are employed for efficient root canal treatment for cleaning and filling the root canal. Orthodontics deals with treating patients with improper alignment of the teeth or bite and makes use of instruments common to braces, aligners, wire bracketing, etc. Lastly, periodontics relates to gum diseases and soft tissue; there are number of tools used for periodontal maintenance such as scalers and curettes etc. The string of applications shows that dental surgical instruments are versatile and can fulfil all manner of dental operations.

Dental Surgical Instruments Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Thus, the global market for dental surgical instruments has become most concentrated, with North America holding about 37% of the market in 2023. It is attributed to developed health care infrastructure, high dental care spending and enhanced rate of subscription to sophisticated dental technologies. The United States is prominently poised in this growth and development on the grounds of its increased significance of oral health literate populace, high rate of dental surgeries and an ample number of dental experts. Sophisticated existing surgical tools could be easily attained in this area and the overall need for accurate and efficient dental treatments is also increasing this demand.

Canada also plays a big role in North America, first, because of the tendencies that indicate constantly growing geriatric population who needs much dental care. Besides, rising trend of cosmetic dentistry and positive efforts to raise awareness for dental care have also boosted market growth in the region. Large scientific developments by significant market entities guarantee that North America sustains its leading position in up to date dental surgical tools development.

Active Key Players in the Dental Surgical Instruments Market:

A-dec Inc. (USA)

BIOLASE, Inc. (USA)

Brasseler USA (USA)

Dentsply Sirona (USA)

Envista Holdings Corporation (USA)

GC Corporation (Japan)

Henry Schein, Inc. (USA)

Ivoclar Vivadent AG (Liechtenstein)

KaVo Dental (Germany)

Midmark Corporation (USA)

Nakanishi Inc. (Japan)

Patterson Companies, Inc. (USA)

Planmeca Group (Finland)

Straumann Group (Switzerland)

Zimmer Biomet (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Surgical Instruments Market by Product Type

4.1 Dental Surgical Instruments Market Snapshot and Growth Engine

4.2 Dental Surgical Instruments Market Overview

4.3 Handheld Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Handheld Instruments: Geographic Segmentation Analysis

4.4 Laser Instruments

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Laser Instruments: Geographic Segmentation Analysis

4.5 Powered Instruments

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Powered Instruments: Geographic Segmentation Analysis

4.6 Accessories

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Accessories: Geographic Segmentation Analysis

Chapter 5: Dental Surgical Instruments Market by Application

5.1 Dental Surgical Instruments Market Snapshot and Growth Engine

5.2 Dental Surgical Instruments Market Overview

5.3 Restorative Dentistry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Restorative Dentistry: Geographic Segmentation Analysis

5.4 Implantology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Implantology: Geographic Segmentation Analysis

5.5 Endodontics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Endodontics: Geographic Segmentation Analysis

5.6 Orthodontics

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Orthodontics: Geographic Segmentation Analysis

5.7 Periodontics

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Periodontics: Geographic Segmentation Analysis

Chapter 6: Dental Surgical Instruments Market by End User

6.1 Dental Surgical Instruments Market Snapshot and Growth Engine

6.2 Dental Surgical Instruments Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Dental Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Dental Clinics: Geographic Segmentation Analysis

6.5 Ambulatory Surgical Centers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Dental Surgical Instruments Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 A-DEC INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOLASE INC. (USA)

7.4 BRASSELER USA (USA)

7.5 DENTSPLY SIRONA (USA)

7.6 ENVISTA HOLDINGS CORPORATION (USA)

7.7 GC CORPORATION (JAPAN)

7.8 HENRY SCHEIN INC. (USA)

7.9 IVOCLAR VIVADENT AG (LIECHTENSTEIN)

7.10 KAVO DENTAL (GERMANY)

7.11 MIDMARK CORPORATION (USA)

7.12 NAKANISHI INC. (JAPAN)

7.13 PATTERSON COMPANIES INC. (USA)

7.14 PLANMECA GROUP (FINLAND)

7.15 STRAUMANN GROUP (SWITZERLAND)

7.16 ZIMMER BIOMET (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Dental Surgical Instruments Market By Region

8.1 Overview

8.2. North America Dental Surgical Instruments Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Handheld Instruments

8.2.4.2 Laser Instruments

8.2.4.3 Powered Instruments

8.2.4.4 Accessories

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Restorative Dentistry

8.2.5.2 Implantology

8.2.5.3 Endodontics

8.2.5.4 Orthodontics

8.2.5.5 Periodontics

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Dental Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Dental Surgical Instruments Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Handheld Instruments

8.3.4.2 Laser Instruments

8.3.4.3 Powered Instruments

8.3.4.4 Accessories

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Restorative Dentistry

8.3.5.2 Implantology

8.3.5.3 Endodontics

8.3.5.4 Orthodontics

8.3.5.5 Periodontics

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Dental Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Dental Surgical Instruments Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Handheld Instruments

8.4.4.2 Laser Instruments

8.4.4.3 Powered Instruments

8.4.4.4 Accessories

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Restorative Dentistry

8.4.5.2 Implantology

8.4.5.3 Endodontics

8.4.5.4 Orthodontics

8.4.5.5 Periodontics

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Dental Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Dental Surgical Instruments Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Handheld Instruments

8.5.4.2 Laser Instruments

8.5.4.3 Powered Instruments

8.5.4.4 Accessories

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Restorative Dentistry

8.5.5.2 Implantology

8.5.5.3 Endodontics

8.5.5.4 Orthodontics

8.5.5.5 Periodontics

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Dental Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Dental Surgical Instruments Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Handheld Instruments

8.6.4.2 Laser Instruments

8.6.4.3 Powered Instruments

8.6.4.4 Accessories

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Restorative Dentistry

8.6.5.2 Implantology

8.6.5.3 Endodontics

8.6.5.4 Orthodontics

8.6.5.5 Periodontics

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Dental Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Dental Surgical Instruments Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Handheld Instruments

8.7.4.2 Laser Instruments

8.7.4.3 Powered Instruments

8.7.4.4 Accessories

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Restorative Dentistry

8.7.5.2 Implantology

8.7.5.3 Endodontics

8.7.5.4 Orthodontics

8.7.5.5 Periodontics

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Dental Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Dental Surgical Instruments Market research report?

A1: The forecast period in the Dental Surgical Instruments Market research report is 2024-2032.

Q2: Who are the key players in the Dental Surgical Instruments Market?

A2: A-dec Inc. (USA), BIOLASE, Inc. (USA), Brasseler USA (USA), Dentsply Sirona (USA), Envista Holdings Corporation (USA), GC Corporation (Japan), Henry Schein, Inc. (USA), Ivoclar Vivadent AG (Liechtenstein), KaVo Dental (Germany), Midmark Corporation (USA), Nakanishi Inc. (Japan), Patterson Companies, Inc. (USA), Planmeca Group (Finland), Straumann Group (Switzerland), Zimmer Biomet (USA). and Other Major Players.

Q3: What are the segments of the Dental Surgical Instruments Market?

A3: The Dental Surgical Instruments Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Handheld Instruments, Laser Instruments, Powered Instruments, Accessories. By Application, the market is categorized into Restorative Dentistry, Implantology, Endodontics, Orthodontics, Periodontics. By End User, the market is categorized into Hospitals, Dental Clinics, Ambulatory Surgical Centers. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Dental Surgical Instruments Market?

A4: Dental surgical instruments are a broad category which pertains to instruments and devices used in diagnosing treating and preventing diseases affecting the oral cavity using surgery. These instruments are imperative for operations like, tooth removal, deep pocket surgeries, implants and other complicated dental operations. The market involves tools like forceps, scalers, retractors and implant equipment for general and surgical dental practices among others.

Q5: How big is the Dental Surgical Instruments Market?

A5: Dental Surgical Instruments Market Size Was Valued at USD 5.48 Billion in 2023, and is Projected to Reach USD 9.65 Billion by 2032, Growing at a CAGR of 6.48% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!