Stay Ahead in Fast-Growing Economies.

Browse Reports NowDigital Oilfield Market Trends, Analysis & Future Outlook (2024-2032)

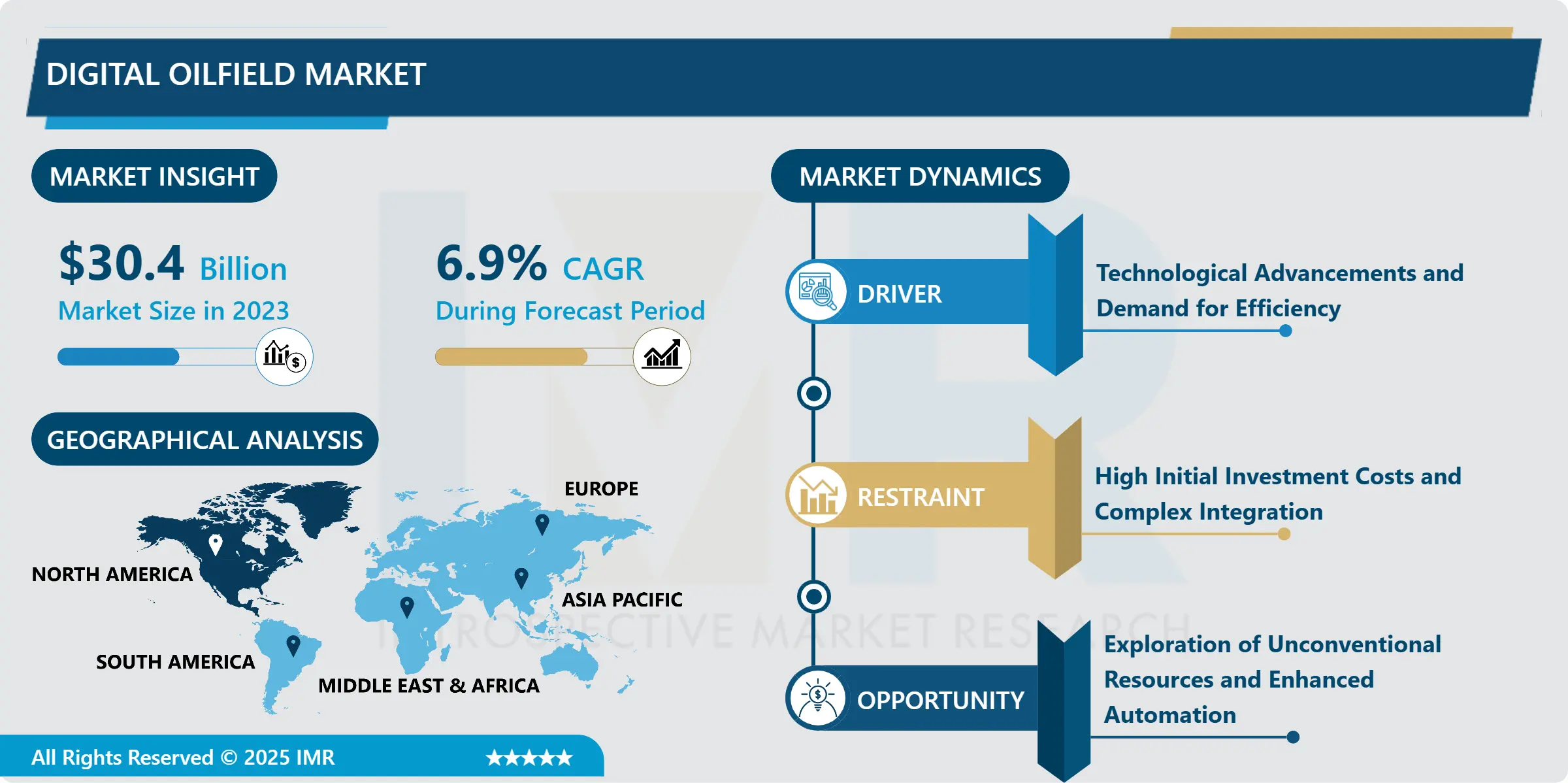

Digital Oilfield Market Size Was Valued at USD 30.4 Billion in 2023, and is Projected to Reach USD 55.42 Billion by 2032, Growing at a CAGR of 6.9% From 2024-2032.

IMR Group

Description

Key Market Highlights

Digital Oilfield Market Size Was Valued at USD 30.4 Billion in 2023, and is Projected to Reach USD 55.42 Billion by 2032, Growing at a CAGR of 6.9% From 2024-2032.

Market Size in 2023: USD 30.4 Billion

Projected Market Size by 2032: USD 55.42 Billion

CAGR (2024–2032): 6.9%

Fastest-Growing Market: North America

By Process: The Drilling Optimization segment is anticipated to lead the market by holding 26.87% of market share throughout the forecast period.

By Solution: The Hardware segment is expected to grab 29.81% market share to maintain dominance over the forecast period.

By Region: North America is projected to hold 31.98% market share during the forecast period.

Active Players: ABB Ltd. (Switzerland), Accenture (Ireland), Baker Hughes (USA), Cisco Systems Inc. (USA), Continental Resources (USA), and Other Active Players.

Digital Oilfield Market Synopsis:

Digital oilfield is defined as the application of advanced information technologies and techniques including information management, data analytics, cloud computing, artificial intelligence and machine learning, and internet of things intending to be used in the upstream part of the oil and gas industry. It helps to optimise the general processes of the company, increase effectiveness and availability, provide better decision making and decrease risks and negative impact on the environment. A digital oilfields allows the real time collection of data from sensors, equipment, and other sources and uses it in real time after passing through models for the enhancement of extraction and production processes. The objective in today’s oil technologies is therefore to improve efficiency based on the adoption of smart technologies that deliver upper echelons of decision-making while at the same time reducing cost and enhancing productivity in an advancing, inherently competitive oilfield environment.

Digital Oilfield Market Trend Analysis:

Rise of AI and Automation in Digital Oilfields

One of the most significant trends currently observable on the digital oilfield market is the growing utilization of artificial intelligence and automation tools in business operations. In the industry, AI solutions are already being used to enhance drilling activities, accomplish improved production estimates, and support effective maintenance. With the help of automation and additionally with AI, the real-time decision making capability increases and the dependency on humans in critical and risky areas decreases. In addition, digital twins digital replicas of physical assets that are used to monitor, maintain, and optimize assets in real time and even predict equipment asset failures are becoming possible. These improvements in automation and AI greatly increase the productivity of operations and are contributing to cost cutting throughout the supply chain from discovery to processing.

Exploration of Unconventional Oil Resources

The market potential in the concept of digital oilfield is currently most significant in the development and production of unconventional oil assets. Now with the predictable decline of traditional oil stocks, the oil and gas majors are looking to non traditional resources like the shale oil and deep water exploration. In these areas, digital technologies are used in real time for data, modeling and risk to increase the precision of drilling as well as efficiency of production. Thanks to technological advances like AI, cloud computing and IoT, many firms can overcome issues relating to intricate and expensive extraction operations and boost their stock of potential available resources. The shift from conventional techniques to using technology in the extraction process, offer digital oilfield increasing a chance to expand.

Digital Oilfield Market Segment Analysis:

Digital Oilfield Market Segmented on the basis of Process, Solution and Technology.

By Process, Drilling Optimization segment is expected to dominate the market during the forecast period

Drilling optimization is likely to be the largest contributor to the growth of the digital oilfield market throughout the forecast period. Optimization of drilling processes remains as ongoing process in order to ensure that costs are lowered, safe environments are achieved and high yields as well enhanced. With help of the AI-driven algorithms and machine learning, newest digital technologies enter the oil and gas sector and help to improve parameters of the drilling process, including depth, angle, and pressure in real-time. These technologies facilitate improved decision making, that in turn enables early problem identification and enhanced drillability of wells. With the need to maximize drilling performance and reduce overall drilling cost and time the process of drilling optimization will remain an important catalyst for the growth of the digital oilfield market.

By Solution, Hardware segment expected to held the largest share

The hardware segment alone might alcevate the digital oil field market as more innovations occur in the sensor, automated systems, and digitization tools that nare critical in managing oil fields. Some of the main elements include, sensors, controllers, and electronics equipment required, for factors such as pressure, temperature and rates of flow, which are vital aspects to digital oilfields. These three hardware solutions generate real time information to enable efficiency for the extraction and production of oil. That is why the demand for enhanced hardware, which would guarantee effective performance of digital oilfields, as well as the growing need for monitoring and control systems, will drive the growth of this segment.

For this reason, hardware enablers such as high-performance computing systems, edge devices and sound network infrastructure remain critical in the functioning of large scale digital oilfield systems. Evolving technology incorporated with automation and real-time monitoring, makes it mandatory for super hardware sub-systems. Thus, as more oilfield operators try to adopt integrated end-to-end digital solutions the hardware segment is expected to remain the growth engine in the digital oilfield market.

Digital Oilfield Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

According to the analysis by the research experts, in 2023, North America would have the largest market share of accounting for about 35- 40 % in the global use of digital oilfield. This dominance is due to their technical readiness level in oil and gas industry, high level of digitalisation and basing of many big IOCs who integrate digital tools to improve operational output. The USA, in extenso, has been the world’s leader in implementing technologically advanced solutions like cloud computing, AI, IoT, etc., in O&G industry operations. Increased spending in digital oilfield technologies and an increasing concentration in getting better recovery from the unconventional sources such as shale are strengthening the regions’ position in the market. As the demand for efficient drilling and exploration or production of more wells increases in the oil rich planet called North America, the manufacturers and producers of drilling and exploration equipment will always have a large slice of the market.

Active Key Players in the Digital Oilfield Market:

ABB Ltd. (Switzerland)

Accenture (Ireland)

Baker Hughes (USA)

Cisco Systems Inc. (USA)

Continental Resources (USA)

Cyberhawk Innovations (UK)

Emerson Electric Co. (USA)

Halliburton (USA)

Honeywell International Inc. (USA)

IBM Corporation (USA)

Intel Corporation (USA)

National Oilwell Varco (USA)

Rockwell Automation Inc. (USA)

Schlumberger Limited (USA)

Weatherford International PLC (Switzerland)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Oilfield Market by Process

4.1 Digital Oilfield Market Snapshot and Growth Engine

4.2 Digital Oilfield Market Overview

4.3 Drilling Optimization

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Drilling Optimization: Geographic Segmentation Analysis

4.4 Reservoir Production

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Reservoir Production: Geographic Segmentation Analysis

4.5 Production Optimization

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Production Optimization: Geographic Segmentation Analysis

4.6 Safety Management

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Safety Management: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Digital Oilfield Market by Solution

5.1 Digital Oilfield Market Snapshot and Growth Engine

5.2 Digital Oilfield Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Geographic Segmentation Analysis

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Geographic Segmentation Analysis

5.5 Data Storage

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Data Storage: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Digital Oilfield Market by Technology

6.1 Digital Oilfield Market Snapshot and Growth Engine

6.2 Digital Oilfield Market Overview

6.3 IoT

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 IoT: Geographic Segmentation Analysis

6.4 Advance Analytics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Advance Analytics: Geographic Segmentation Analysis

6.5 Robotics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Robotics: Geographic Segmentation Analysis

6.6 Cloud Computing

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cloud Computing: Geographic Segmentation Analysis

6.7 Mobility

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Mobility: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Digital Oilfield Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ACCENTURE (IRELAND)

7.4 BAKER HUGHES (USA)

7.5 CISCO SYSTEMS INC. (USA)

7.6 CONTINENTAL RESOURCES (USA)

7.7 CYBERHAWK INNOVATIONS (UK)

7.8 EMERSON ELECTRIC CO. (USA)

7.9 HALLIBURTON (USA)

7.10 HONEYWELL INTERNATIONAL INC. (USA)

7.11 IBM CORPORATION (USA)

7.12 INTEL CORPORATION (USA)

7.13 NATIONAL OILWELL VARCO (USA)

7.14 ROCKWELL AUTOMATION INC. (USA)

7.15 SCHLUMBERGER LIMITED (USA)

7.16 WEATHERFORD INTERNATIONAL PLC (SWITZERLAND)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Digital Oilfield Market By Region

8.1 Overview

8.2. North America Digital Oilfield Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Process

8.2.4.1 Drilling Optimization

8.2.4.2 Reservoir Production

8.2.4.3 Production Optimization

8.2.4.4 Safety Management

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Solution

8.2.5.1 Hardware

8.2.5.2 Software

8.2.5.3 Data Storage

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By Technology

8.2.6.1 IoT

8.2.6.2 Advance Analytics

8.2.6.3 Robotics

8.2.6.4 Cloud Computing

8.2.6.5 Mobility

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Digital Oilfield Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Process

8.3.4.1 Drilling Optimization

8.3.4.2 Reservoir Production

8.3.4.3 Production Optimization

8.3.4.4 Safety Management

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Solution

8.3.5.1 Hardware

8.3.5.2 Software

8.3.5.3 Data Storage

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By Technology

8.3.6.1 IoT

8.3.6.2 Advance Analytics

8.3.6.3 Robotics

8.3.6.4 Cloud Computing

8.3.6.5 Mobility

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Digital Oilfield Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Process

8.4.4.1 Drilling Optimization

8.4.4.2 Reservoir Production

8.4.4.3 Production Optimization

8.4.4.4 Safety Management

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Solution

8.4.5.1 Hardware

8.4.5.2 Software

8.4.5.3 Data Storage

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By Technology

8.4.6.1 IoT

8.4.6.2 Advance Analytics

8.4.6.3 Robotics

8.4.6.4 Cloud Computing

8.4.6.5 Mobility

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Digital Oilfield Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Process

8.5.4.1 Drilling Optimization

8.5.4.2 Reservoir Production

8.5.4.3 Production Optimization

8.5.4.4 Safety Management

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Solution

8.5.5.1 Hardware

8.5.5.2 Software

8.5.5.3 Data Storage

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By Technology

8.5.6.1 IoT

8.5.6.2 Advance Analytics

8.5.6.3 Robotics

8.5.6.4 Cloud Computing

8.5.6.5 Mobility

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Digital Oilfield Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Process

8.6.4.1 Drilling Optimization

8.6.4.2 Reservoir Production

8.6.4.3 Production Optimization

8.6.4.4 Safety Management

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Solution

8.6.5.1 Hardware

8.6.5.2 Software

8.6.5.3 Data Storage

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By Technology

8.6.6.1 IoT

8.6.6.2 Advance Analytics

8.6.6.3 Robotics

8.6.6.4 Cloud Computing

8.6.6.5 Mobility

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Digital Oilfield Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Process

8.7.4.1 Drilling Optimization

8.7.4.2 Reservoir Production

8.7.4.3 Production Optimization

8.7.4.4 Safety Management

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Solution

8.7.5.1 Hardware

8.7.5.2 Software

8.7.5.3 Data Storage

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By Technology

8.7.6.1 IoT

8.7.6.2 Advance Analytics

8.7.6.3 Robotics

8.7.6.4 Cloud Computing

8.7.6.5 Mobility

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Digital Oilfield Market research report?

A1: The forecast period in the Digital Oilfield Market research report is 2024-2032.

Q2: Who are the key players in the Digital Oilfield Market?

A2: ABB Ltd. (Switzerland), Accenture (Ireland), Baker Hughes (USA), Cisco Systems Inc. (USA), Continental Resources (USA) and Other Active Players.

Q3: What are the segments of the Digital Oilfield Market?

A3: The Digital Oilfield Market is segmented into Process, Solution, Technology and region. By Process, the market is categorized into Drilling Optimization, Reservoir Production, Production Optimization, Safety Management, Others. By Solution, the market is categorized into Hardware, Software, Data Storage, Others. By Technology, the market is categorized into IoT, Advance Analytics, Robotics, Cloud Computing, Mobility, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Digital Oilfield Market?

A4: Digital oilfield is defined as the application of advanced information technologies and techniques including information management, data analytics, cloud computing, artificial intelligence and machine learning, and internet of things intending to be used in the upstream part of the oil and gas industry. It helps to optimise the general processes of the company, increase effectiveness and availability, provide better decision making and decrease risks and negative impact on the environment. A digital oilfield allows the real time collection of data from sensors, equipment, and other sources and uses it in real time after passing through models for the enhancement of extraction and production processes. The objective in today’s oil technologies is therefore to improve efficiency based on the adoption of smart technologies that deliver upper echelons of decision-making while at the same time reducing cost and enhancing productivity in an advancing, inherently competitive oilfield environment.

Q5: How big is the Digital Oilfield Market?

A5: Digital Oilfield Market Size Was Valued at USD 30.4 Billion in 2023, and is Projected to Reach USD 55.42 Billion by 2032, Growing at a CAGR of 6.9% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!