Stay Ahead in Fast-Growing Economies.

Browse Reports NowTruck Platooning Market Share, Trends & Market Forecast (2024-2032)

Truck platooning is a motorized convois with a leading truck and several successive trailers through the use of driverless technologies such as the ADAS and V2V systems.

IMR Group

Description

Truck Platooning Market Synopsis:

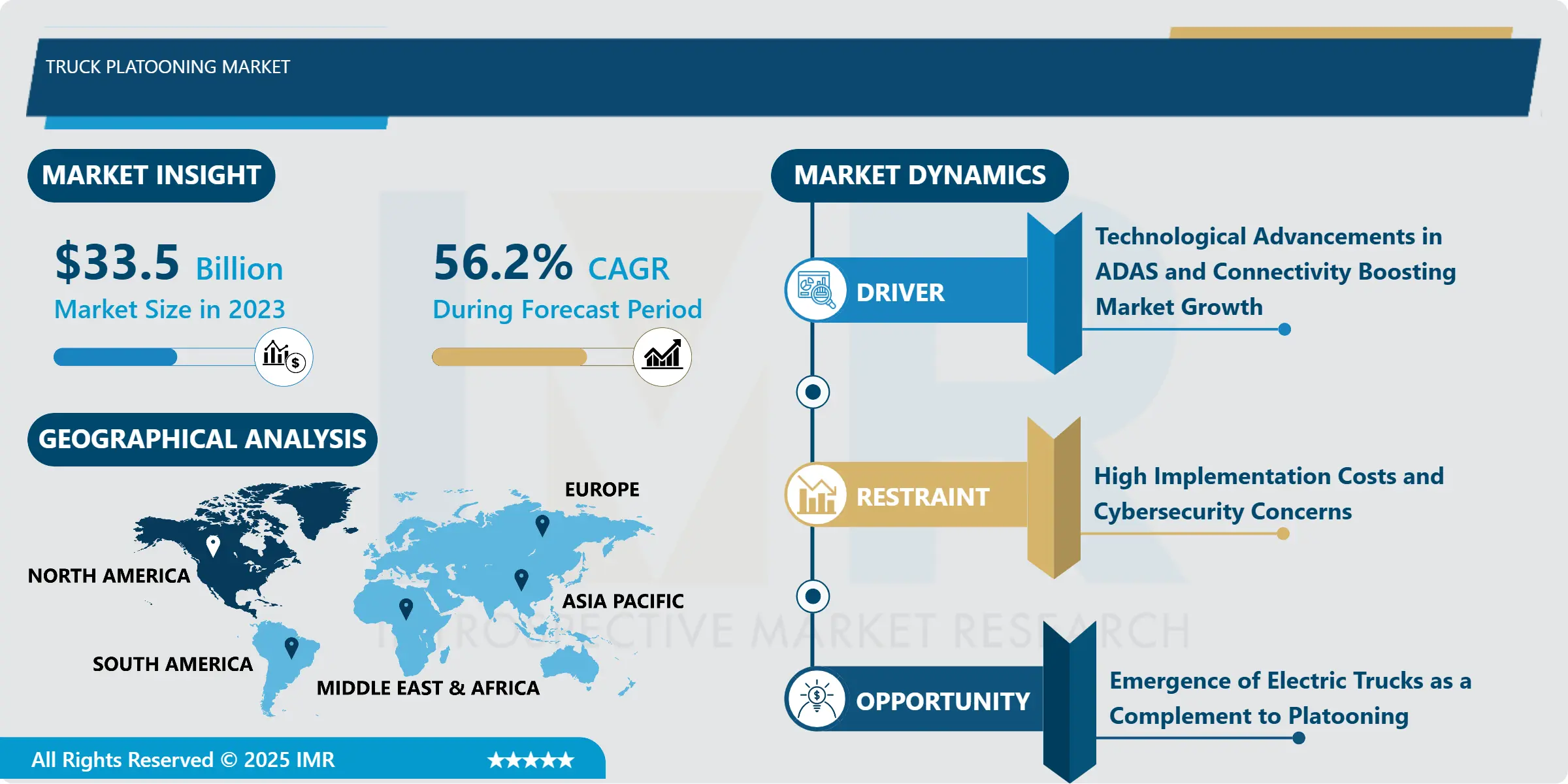

Truck Platooning Market Size Was Valued at USD 33.50 Billion in 2023, and is Projected to Reach USD 1854.27 Billion by 2032, Growing at a CAGR of 56.20% From 2024-2032.

Truck platooning is a motorized convois with a leading truck and several successive trailers through the use of driverless technologies such as the ADAS and V2V systems. Leading truck provides the pace for all other trucks succeeding it which results in better fuel utilization, reduced commuter accidents, as well as generally enhanced traffic patterns.

The primary force behind the truck platooning market fundamentally built around the need to increase fuel efficiency in the logistics sector. Trimming aerodynamic drag, the implementation of the platooning can even decrease fuel consumption by up to 10 % and therefore drastically reducing costs for fleet owners. Buy UOP, the implementation of such cost-efficient and green technologies has received a considerate deal of popularity, respectively, with fuel prices on the rise and environmental standards being increasingly stringent. In the same regard, authorities’ support and pilot projects in the region with North America and Europe leading set the pace to create platooning systems.

Another strong influence to the market can be attributed to the development of self-driving mechanism and connectivity options. Some of the advancement in ADAS, GPS, and V2V communication has improved the safety of platooning. These systems minimize the effect of human error so that vehicle movement can be well coordinated. Furthermore, the need for optimum logistics operation and sharply enhanced e-commerce presence has made truck platooning a popular solution for freight management.

Truck Platooning Market Trend Analysis:

Integration of artificial intelligence (AI) for real-time decision-making

Currently, the application of artificial intelligence for decision-making of the trucks present in the truck platooning market is one of the significant trends. As such, conversational artificial intelligence can predict the traffic situation, weather or fuel optimization for the operation of platooning systems. This advancement is expected to increase the chances of using platooning technology in developed states as well as developing states.

Full autonomy constitutes another evolving characteristic of the market in question. Even though Driver-Assisted Truck Platooning (DATP) is prevalent now, businesses arePouring a lot of money into autonomous truck technologies to enable driverless convoy functionality. It also eliminates the labour cost while also having solutions to the scarce driver issue that has remained a bug bear for many logistic firms.

The growing adoption of electric trucks

Truck platooning is an emerging field that will benefit when there is an increasing use of electric trucks. Platooning therefore provides tremendous value to electric vehicles (EVs) because overall energy use is reduced which enhances their range making them suitable for long haul use. With governments from all over the world encouraging people to use electric vehicles, there will be synergy between electrification of vehicles and the formation of platoons to boost the market.

Furthermore, Asia Pacific & Latin America regions remain untapped in terms of truck platooning solution markets. The growth in population, growth in complexities of logistics networks, and rising interest of governments towards adopting smart transport system are the factors which are promoting the growth of the market in these regions. Though, the adoption of smart technologies can be done in partnership between the local government and the global tech companies gaining more ground.

Truck Platooning Market Segment Analysis:

Truck Platooning Market Segmented on the basis of Platooning Type, Technology,, Application, and Region.

By Platooning Type, Autonomous Truck Platooning segment is expected to dominate the market during the forecast period

Driver-Assisted Truck Platooning (DATP) is at the moment most popular because of its cost efficiency and technical simplicity in comparison with completely autonomous systems. Overall, DATP approach is based on the human oversight of ADAS operations combined with safety and operational control. In its nascent stage, Autonomous Truck Platooning is slowly catching on as the breakthroughs in AI and sensing technologies is steadily making the concept more and more practical. It is however expected that there will be more developments in fully autonomous platooning in future due to legislation and technology.

By Application, Heavy Trucks segment expected to held the largest share

Truck platooning is an essential particularly in the long haulage freight transportation hence the application of heavy trucks make up the largest segment in the market. Most of these benefits and cost savings are even more compelling for heavy-duty vehicles, which consume more fuel in platooning. Light Commercial Vehicles (LCVs), although a niche market, is expected to expand in the backdrop of increase in e commerce logistics and micro mobility. In addition, such vehicles can also find ways to cut operational costs and emissions in relation to platooning.

Truck Platooning Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America has the largest market share for truck platooning; it adopted the advanced technologies early and enjoys support from governments. Platooning has also been tested efficiently in the region by some of the giants such as Peloton Technology, Daimler, and Volvo, thus creating the foundation for commercializing the development. Furthermore, developed and actualized railways infrastructure, increased connectivity and good logistic platform have contributed to emergence and development of platooning systems in American and Canadian territories.

North America’s legal structure also plays in favour of platooning. Privacy and provider-awareness polices at the federal and state levels promote the utilisation of autonomous and semi-autonomous technicalities in making the roads safer and also in cutting down pollution. This has set the region more focused on innovation and with the generous commitment of both private and public investors makes it dominate the global truck platooning market.

Active Key Players in the Truck Platooning Market:

Bendix Commercial Vehicle Systems (United States)

Continental AG (Germany)

DAF Trucks N.V. (Netherlands)

Daimler AG (Germany)

MAN Truck & Bus SE (Germany)

Navistar International Corporation (United States)

Peloton Technology (United States)

Scania AB (Sweden)

Volvo Group (Sweden)

ZF Friedrichshafen AG (Germany) Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Truck Platooning Market by Drug Class

4.1 Truck Platooning Market Snapshot and Growth Engine

4.2 Truck Platooning Market Overview

4.3 First-line Anti-Tuberculosis Drugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 First-line Anti-Tuberculosis Drugs: Geographic Segmentation Analysis

4.4 Second-line Anti-Tuberculosis Drugs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Second-line Anti-Tuberculosis Drugs: Geographic Segmentation Analysis

Chapter 5: Truck Platooning Market by Disease Type

5.1 Truck Platooning Market Snapshot and Growth Engine

5.2 Truck Platooning Market Overview

5.3 Active Tuberculosis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Active Tuberculosis: Geographic Segmentation Analysis

5.4 Latent Tuberculosis

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Latent Tuberculosis: Geographic Segmentation Analysis

Chapter 6: Truck Platooning Market by End User

6.1 Truck Platooning Market Snapshot and Growth Engine

6.2 Truck Platooning Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Specialty Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Specialty Clinics: Geographic Segmentation Analysis

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Truck Platooning Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PELOTON TECHNOLOGY (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VOLVO GROUP (SWEDEN)

7.4 DAIMLER AG (GERMANY)

7.5 SCANIA AB (SWEDEN)

7.6 MAN TRUCK & BUS SE (GERMANY)

7.7 CONTINENTAL AG (GERMANY)

7.8 ZF FRIEDRICHSHAFEN AG (GERMANY)

7.9 BENDIX COMMERCIAL VEHICLE SYSTEMS (UNITED STATES)

7.10 DAF TRUCKS N.V. (NETHERLANDS)

7.11 NAVISTAR INTERNATIONAL CORPORATION (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Truck Platooning Market By Region

8.1 Overview

8.2. North America Truck Platooning Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Class

8.2.4.1 First-line Anti-Tuberculosis Drugs

8.2.4.2 Second-line Anti-Tuberculosis Drugs

8.2.5 Historic and Forecasted Market Size By Disease Type

8.2.5.1 Active Tuberculosis

8.2.5.2 Latent Tuberculosis

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Specialty Clinics

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Truck Platooning Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Class

8.3.4.1 First-line Anti-Tuberculosis Drugs

8.3.4.2 Second-line Anti-Tuberculosis Drugs

8.3.5 Historic and Forecasted Market Size By Disease Type

8.3.5.1 Active Tuberculosis

8.3.5.2 Latent Tuberculosis

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Specialty Clinics

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Truck Platooning Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Class

8.4.4.1 First-line Anti-Tuberculosis Drugs

8.4.4.2 Second-line Anti-Tuberculosis Drugs

8.4.5 Historic and Forecasted Market Size By Disease Type

8.4.5.1 Active Tuberculosis

8.4.5.2 Latent Tuberculosis

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Specialty Clinics

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Truck Platooning Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Class

8.5.4.1 First-line Anti-Tuberculosis Drugs

8.5.4.2 Second-line Anti-Tuberculosis Drugs

8.5.5 Historic and Forecasted Market Size By Disease Type

8.5.5.1 Active Tuberculosis

8.5.5.2 Latent Tuberculosis

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Specialty Clinics

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Truck Platooning Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Class

8.6.4.1 First-line Anti-Tuberculosis Drugs

8.6.4.2 Second-line Anti-Tuberculosis Drugs

8.6.5 Historic and Forecasted Market Size By Disease Type

8.6.5.1 Active Tuberculosis

8.6.5.2 Latent Tuberculosis

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Specialty Clinics

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Truck Platooning Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Class

8.7.4.1 First-line Anti-Tuberculosis Drugs

8.7.4.2 Second-line Anti-Tuberculosis Drugs

8.7.5 Historic and Forecasted Market Size By Disease Type

8.7.5.1 Active Tuberculosis

8.7.5.2 Latent Tuberculosis

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Specialty Clinics

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Truck Platooning Market research report?

A1: The forecast period in the Truck Platooning Market research report is 2024-2032.

Q2: Who are the key players in the Truck Platooning Market?

A2: Peloton Technology (United States), Volvo Group (Sweden), Daimler AG (Germany), Scania AB (Sweden), MAN Truck & Bus SE (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Bendix Commercial Vehicle Systems (United States), DAF Trucks N.V. (Netherlands), Navistar International Corporation (United States). and Other Active Players.

Q3: What are the segments of the Truck Platooning Market?

A3: The Truck Platooning Market is segmented into Platooning Type, Technology, Application and region. by Platooning Type (Driver-Assisted Truck Platooning (DATP), Autonomous Truck Platooning), By Technology (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Keep Assist (LKA), Blind Spot Warning (BSW), Global Positioning System (GPS), Others), Application (Heavy Trucks, Light Commercial Vehicles (LCVs)). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Truck Platooning Market?

A4: Truck platooning is a motorized convois with a leading truck and several successive trailers through the use of driverless technologies such as the ADAS and V2V systems. Leading truck provides the pace for all other trucks succeeding it which results in better fuel utilization, reduced commuter accidents, as well as generally enhanced traffic patterns.

Q5: How big is the Truck Platooning Market?

A5: Truck Platooning Market Size Was Valued at USD 33.50 Billion in 2023, and is Projected to Reach USD 1854.27 Billion by 2032, Growing at a CAGR of 56.20% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!