Stay Ahead in Fast-Growing Economies.

Browse Reports Now5G Fixed Wireless Access Market Size, Share, Growth & Forecast (2024-2032)

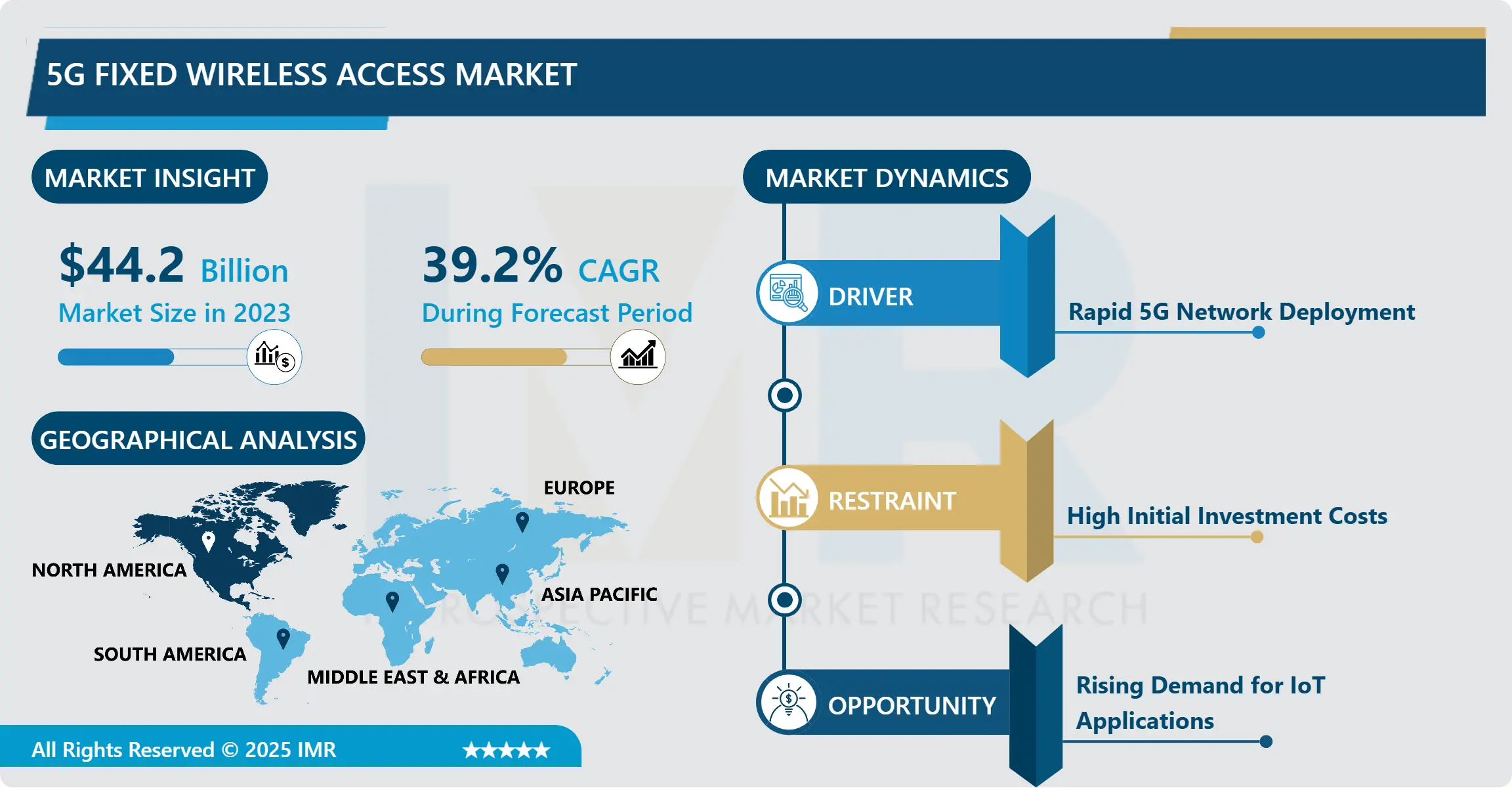

5G Fixed Wireless Access Market Size Was Valued at USD 44.20 Billion in 2023, and is Projected to Reach USD 867.31 Billion by 2032, Growing at a CAGR of 39.2% From 2024-2032.

IMR Group

Description

5G Fixed Wireless Access Market Synopsis

5G Fixed Wireless Access Market Size Was Valued at USD 44.20 Billion in 2023, and is Projected to Reach USD 867.31 Billion by 2032, Growing at a CAGR of 39.2% From 2024-2032.

The 5G FWA also known as Fixed Wireless Broadband market is the use of the 5G technology to provide fast broadband internet connectivity to homes and offices and other hard to reach areas. This technology does not require the fixed telecommunication wired infrastructure used today such as fiber optic or Digital Subscriber Line the which make this technology cheap and efficient for last mile connectivity.

The report also discusses the rising trend in the 5G Fixed Wireless Access market due to the rising necessity of broadband internet connection in urban and rural settings. As more people use smart devices and IoT apps and as video streaming becomes more popular, affordable broadband Internet becomes increasingly important New 5G fixed wireless access or FWA brings ultra-low latency, enhanced bandwidth, and high speed to the tabletop, making it an excellent substitute for wired broadband. As the solution is gaining momentum, markets for it are benefitting from the investments made by governments and telecom operators around the world to bring internet access to areas within the world that currently lack such services – an effort that will contribute to market growth going forward.

The trend is that the market is expanding due to the companies’ utilization of reliable internet services. Hence due to its flexibility and scalability, 5G FWA becomes popular in environments where continuity and secure connection is highly demanded. Furthermore, continuous introduction in 5G networks services and increase in coverage geography act as drivers for FWA services Market which is showing good prognosis for the following coming years.

5G Fixed Wireless Access Market Trend Analysis:

Growing Deployment in Rural and Underserved Areas

Another factor making a significant impact on the 5G FWA market dynamic is the incessant expansion of the technology in rural and uncharted businesses. Broadband technology infrastructure in the traditional scenario is expensive and deployment planning is complex when considering remote access-points. 5G FWA can be a viable solution where existing cellular infrastructure can be utilized to deliver broadband internet service without physical cables. Both Governments and telecom operators are striving to make 5G FWA to connect everyone to the internet, including the unserved and underserved regions. This trend goes further in solving connectivity woes around the globe but also helps in the creation of socio-economic changes by tackling digital divides.

Accelerated Adoption in Emerging Markets

At the same time, the fifth generation of wireless technology fixed wireless access market is a promising segment in the context of emerging economies. Customers in the Asia-Pacific region, Africa or Latin America are keen on experiencing a brand new model of fast Internet connection within close proximity at a sensible price. Because these areas are not connected to the internet, 5G FWA provides an innovative solution, based mainly on service delivery with limited development of basic infrastructure. Due to this realization, telecom providers are looking forward to acquiring these dormant markets with FWA as a key enabler of digital change in developing nations.

5G Fixed Wireless Access Market Segment Analysis:

5G Fixed Wireless Access Market is Segmented on the basis of Offering, Operating Frequency End User, and Region.

By Offering, Hardware segment is expected to dominate the market during the forecast period

In more detail, the hardware segment is expected to hold the largest proportion of the 5G FWA market in the period 2020-2025. This dominance is attributed to the centrality of the customer premise equipment (CPE), Antennas and routers in creating high speed connectivity. Equipment vendors are also adopting superior hardware platforms for the purpose of guaranteeing optimality when supporting the deployment of 5G FWA services.

However, frequent developments in cripple hardware technologies are improving the performance and potential of 5G FWA systems. In order to fill the demand for easy to use products, compact and inexpensive hardware is being launched to the market by companies. The increased popularity of these devices in the residential, commercial and industrial applications area point to the hardware segment key role in the growth of this market.

By Operating Frequency, Sub-6 GHz segment expected to held the largest share

However, within the 5G FWA market, it is estimated that a Sub-6 GHz will dominate the largest market share. The sub 6 GHz frequencies offer great coverage and penetration, hence usable in both urban and rural areas. These frequencies allow 5G FWA networks to provide consistent and satisfying connections in various locations and fulfilling the demand of all categories of users.

Closely related to this, the share of the Sub-6 GHz segment is additionally maximized due to its relatively low cost and accessibility. This frequency band is being used by telecom providers to ensure fast market growth in the deployment of the 5G FWA networks. But its compatibility with the currently existing system makes it to be easily adopted in different areas and regions.

5G Fixed Wireless Access Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Currently, North America remained the largest consumer of 5G Fixed Wireless Access. This leadership can be attributed by regional telecom advancement, high 5G penetration and strong investment by the key industry players. Especially, the United States has become one of the leading countries in 5G FWA utilization since Verizon and AT&T have started large networks of FWA to meet the high need for internet speed. Add to that the region’s emphasis on digitalization and the emergence of smart cities and the company’s stranglehold on the market is assured.

Active Key Players in the 5G Fixed Wireless Access Market

ADTRAN (USA)

Airspan Networks (USA)

AT&T (USA)

Aviat Networks (USA)

Cambium Networks (USA)

Ericsson (Sweden)

Huawei Technologies (China)

Inseego (USA)

Mimosa Networks (USA)

Nokia (Finland)

Qualcomm Technologies (USA)

Samsung Electronics (South Korea)

Siklu Communication (Israel)

Telefonica (Spain)

Verizon Communications (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 5G Fixed Wireless Access Market by Offering

4.1 5G Fixed Wireless Access Market Snapshot and Growth Engine

4.2 5G Fixed Wireless Access Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Service

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Service: Geographic Segmentation Analysis

Chapter 5: 5G Fixed Wireless Access Market by Operating Frequency

5.1 5G Fixed Wireless Access Market Snapshot and Growth Engine

5.2 5G Fixed Wireless Access Market Overview

5.3 Sub-6 GHz

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Sub-6 GHz: Geographic Segmentation Analysis

5.4 24-39 GHz

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 24-39 GHz: Geographic Segmentation Analysis

5.5 Above 39 GHz

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Above 39 GHz: Geographic Segmentation Analysis

Chapter 6: 5G Fixed Wireless Access Market by Application

6.1 5G Fixed Wireless Access Market Snapshot and Growth Engine

6.2 5G Fixed Wireless Access Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

6.6 Government

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Government: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 5G Fixed Wireless Access Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADTRAN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AIRSPAN NETWORKS (USA)

7.4 AT&T (USA)

7.5 AVIAT NETWORKS (USA)

7.6 CAMBIUM NETWORKS (USA)

7.7 ERICSSON (SWEDEN)

7.8 HUAWEI TECHNOLOGIES (CHINA)

7.9 INSEEGO (USA)

7.10 MIMOSA NETWORKS (USA)

7.11 NOKIA (FINLAND)

7.12 QUALCOMM TECHNOLOGIES (USA)

7.13 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.14 SIKLU COMMUNICATION (ISRAEL)

7.15 TELEFONICA (SPAIN)

7.16 VERIZON COMMUNICATIONS (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global 5G Fixed Wireless Access Market By Region

8.1 Overview

8.2. North America 5G Fixed Wireless Access Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Offering

8.2.4.1 Hardware

8.2.4.2 Service

8.2.5 Historic and Forecasted Market Size By Operating Frequency

8.2.5.1 Sub-6 GHz

8.2.5.2 24-39 GHz

8.2.5.3 Above 39 GHz

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Industrial

8.2.6.4 Government

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe 5G Fixed Wireless Access Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Offering

8.3.4.1 Hardware

8.3.4.2 Service

8.3.5 Historic and Forecasted Market Size By Operating Frequency

8.3.5.1 Sub-6 GHz

8.3.5.2 24-39 GHz

8.3.5.3 Above 39 GHz

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Industrial

8.3.6.4 Government

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe 5G Fixed Wireless Access Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Offering

8.4.4.1 Hardware

8.4.4.2 Service

8.4.5 Historic and Forecasted Market Size By Operating Frequency

8.4.5.1 Sub-6 GHz

8.4.5.2 24-39 GHz

8.4.5.3 Above 39 GHz

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Industrial

8.4.6.4 Government

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific 5G Fixed Wireless Access Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Offering

8.5.4.1 Hardware

8.5.4.2 Service

8.5.5 Historic and Forecasted Market Size By Operating Frequency

8.5.5.1 Sub-6 GHz

8.5.5.2 24-39 GHz

8.5.5.3 Above 39 GHz

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Industrial

8.5.6.4 Government

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa 5G Fixed Wireless Access Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Offering

8.6.4.1 Hardware

8.6.4.2 Service

8.6.5 Historic and Forecasted Market Size By Operating Frequency

8.6.5.1 Sub-6 GHz

8.6.5.2 24-39 GHz

8.6.5.3 Above 39 GHz

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Industrial

8.6.6.4 Government

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America 5G Fixed Wireless Access Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Offering

8.7.4.1 Hardware

8.7.4.2 Service

8.7.5 Historic and Forecasted Market Size By Operating Frequency

8.7.5.1 Sub-6 GHz

8.7.5.2 24-39 GHz

8.7.5.3 Above 39 GHz

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Industrial

8.7.6.4 Government

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the 5G Fixed Wireless Access Market research report?

A1: The forecast period in the 5G Fixed Wireless Access Market research report is 2024-2032.

Q2: Who are the key players in the 5G Fixed Wireless Access Market?

A2: Ericsson, Huawei Technologies, Nokia, Qualcomm Technologies, Samsung Electronics and Other Active Players.

Q3: What are the segments of the 5G Fixed Wireless Access Market?

A3: The 5G Fixed Wireless Access Market is segmented into Offering, Operating Frequency, Application and region. By Offering, the market is categorized into Hardware, Service. By Operating Frequency, the market is categorized into Sub-6 GHz, 24-39 GHz, Above 39 GHz. By End User, the market is categorized into Residential, Commercial, Industrial, Government. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the 5G Fixed Wireless Access Market?

A4: The 5G FWA also known as Fixed Wireless Broadband market is the use of the 5G technology to provide fast broadband internet connectivity to homes and offices and other hard to reach areas. This technology does not require the fixed telecommunication wired infrastructure used today such as fiber optic or Digital Subscriber Line the which make this technology cheap and efficient for last mile connectivity.

Q5: How big is the 5G Fixed Wireless Access Market?

A5: 5G Fixed Wireless Access Market Size Was Valued at USD 44.20 Billion in 2023, and is Projected to Reach USD 867.31 Billion by 2032, Growing at a CAGR of 39.2% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!