Stay Ahead in Fast-Growing Economies.

Browse Reports NowActive Protection Systems Market Size, Share, Growth & Forecast (2024-2032)

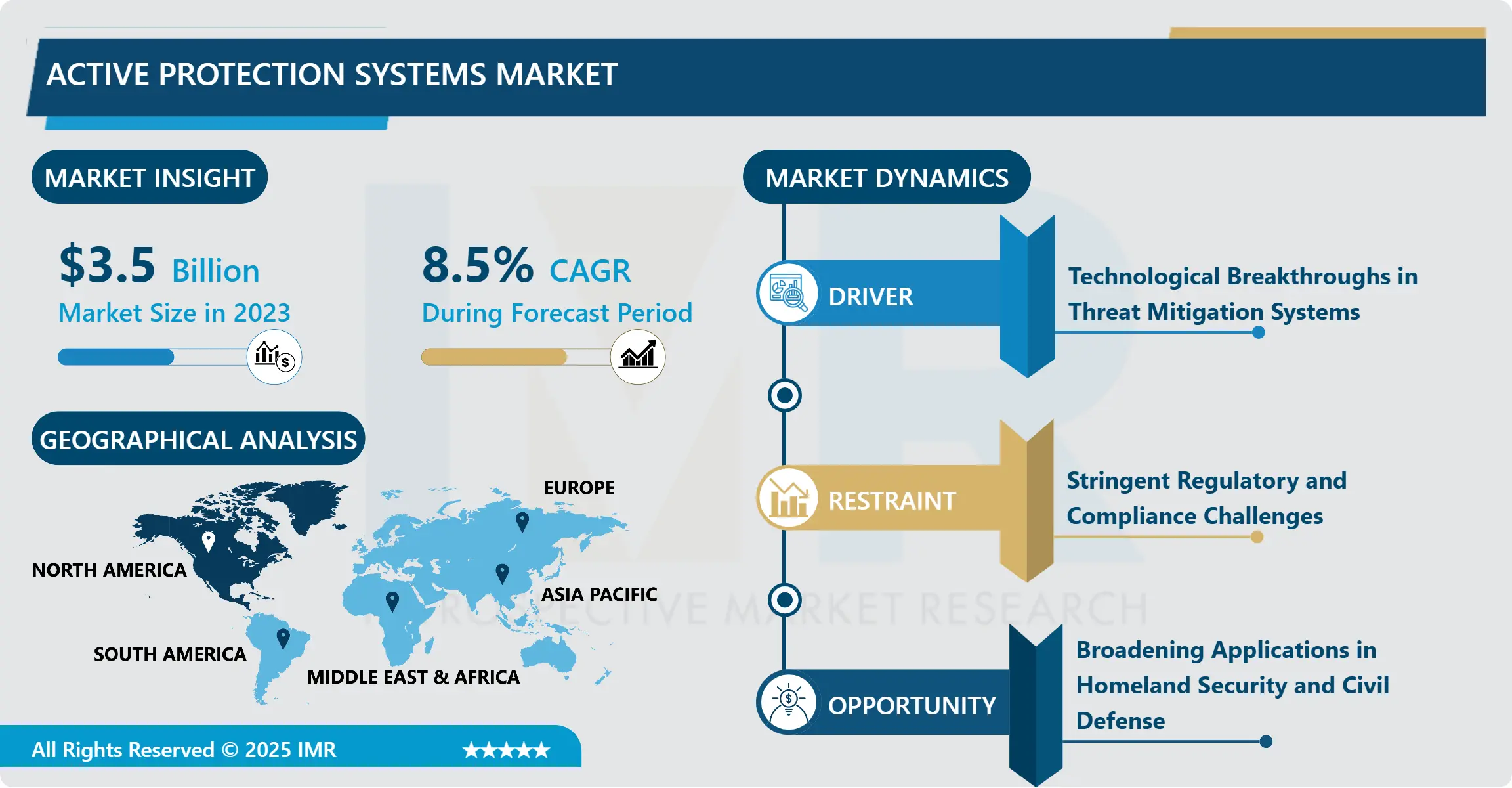

Active Protection Systems Market Size Was Valued at USD 3.50 Billion in 2023, and is Projected to Reach USD 7.30 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

IMR Group

Description

Active Protection Systems Market Synopsis:

Active Protection Systems Market Size Was Valued at USD 3.50 Billion in 2023, and is Projected to Reach USD 7.30 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

The Active Protection Systems (APS) Market represents the set of technologies and solutions, which can detect, track, and defeat impending threats to military platforms, including projectiles, missiles, or explosive devices. These systems improve the ability of the vehicle, aircraft & Naval Ships to survive by proactive as well as their reactive mechanisms.

New generations of threats, including growing international conflict and modern warfare with different scale have made defense forces adapt to the modern protection systems. Governments are dedicating larger proportions for upgrading their defense equipment and thus creating more market for APS to address emerging threats.

The AI technology including sensors, and the operation of APS has helped increase reliability and effectiveness of the current methods. This technological evolution has invited the attention of defense agencies to protect vital installations and also minimize the damage on surrounding areas.

Active Protection Systems Market Trend Analysis:

Integration with AI and Autonomous Systems

Due to implementation of artificial intelligence and conveyer-based learning in active protection systems, the old model of threat identification and containment is changing. They enable systems to forecast threats better and also enable counter actions and other procedures to be done by the system and not a person to improve the efficiency of the works being done.

To compete with traditional armoured battle vehicles in the new era requirements of mobility in the warfare, manufactures of APS are developing new generation that is lightweight and modular. Compared to other systems they are very compatible with various platforms, and thus can be used differently within systems in military applications.

Growth in Homeland Security Applications:

Countries of the third world, especially in Asia-Pacific and Middle East, are expanding their defense budgets. As the new and trendy warfare components in these areas increase their procurement, so does the potential for APS provider’s growth.

In addition to military applications, the APS technologies are starting to be employed homeland security for safeguarding infrastructures and other public property. This diversification should help new avenues of revenue generation for the participant in the market.

Active Protection Systems Market Segment Analysis:

Active Protection Systems Market is Segmented on the basis of Type, Platform, End User, and Region.

By Type, Soft-kill System segment is expected to dominate the market during the forecast period

Soft-kill systems deny the incoming threat its intended target through using Counter Measures such as radar or missile guidance systems. Hard-kill systems engage a threat as well as disable it physically using methods such as shooting a projectile. In its turn, the responsibility for the stopping of the projectiles piercing into the vehicle falls on the elements placed in the reactive armor which might be explosive or non-explosive.

By Platform, Land-based segment expected to held the largest share

Industry-psychological systems are more extensively used within the APS market to protect ground-based tanks, armored personnel carriers, and other vehicles. Powder APS is used in airborne platforms to against the threats posed by such missiles, and naval systems safeguard ships and submarines against torpedoes and other possible sea-based threats.

Active Protection Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America holds the highest market share in terms of active protection system due to a strong defense expenditure and investments in military development. The United States has been proactive in improving and integrating high-performance APS technologies because of its government support and an established defense industry.

Besides, there are constant collaborations between contractors in defense and government organizations in North America to continually develop APS. This has ensured the region takes the leadership status in the market by employing advanced solutions such as AI systems and autonomous technologies.

Active Key Players in the Active Protection Systems Market

Aselsan (Turkey)

BAE Systems (UK)

Elbit Systems (Israel)

General Dynamics (USA)

Leonardo S.p.A. (Italy)

Northrop Grumman (USA)

Rafael Advanced Defense Systems (Israel)

Raytheon Technologies (USA)

Rheinmetall AG (Germany)

Saab AB (Sweden)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Active Protection Systems Market by Platform

4.1 Active Protection Systems Market Snapshot and Growth Engine

4.2 Active Protection Systems Market Overview

4.3 Land-based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Land-based: Geographic Segmentation Analysis

4.4 Airborne

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Airborne: Geographic Segmentation Analysis

4.5 Naval

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Naval: Geographic Segmentation Analysis

Chapter 5: Active Protection Systems Market by Type

5.1 Active Protection Systems Market Snapshot and Growth Engine

5.2 Active Protection Systems Market Overview

5.3 Soft-kill System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Soft-kill System: Geographic Segmentation Analysis

5.4 Hard-kill System

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Hard-kill System: Geographic Segmentation Analysis

5.5 Reactive Armor

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Reactive Armor: Geographic Segmentation Analysis

Chapter 6: Active Protection Systems Market by End-User

6.1 Active Protection Systems Market Snapshot and Growth Engine

6.2 Active Protection Systems Market Overview

6.3 Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Defense: Geographic Segmentation Analysis

6.4 Homeland Security

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Homeland Security: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Active Protection Systems Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 RAFAEL ADVANCED DEFENSE SYSTEMS (ISRAEL)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 RAYTHEON TECHNOLOGIES (USA)

7.4 RHEINMETALL AG (GERMANY)

7.5 SAAB AB (SWEDEN)

7.6 LEONARDO S.P.A. (ITALY)

7.7 BAE SYSTEMS (UK)

7.8 ASELSAN (TURKEY)

7.9 ELBIT SYSTEMS (ISRAEL)

7.10 NORTHROP GRUMMAN (USA)

7.11 GENERAL DYNAMICS (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Active Protection Systems Market By Region

8.1 Overview

8.2. North America Active Protection Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Platform

8.2.4.1 Land-based

8.2.4.2 Airborne

8.2.4.3 Naval

8.2.5 Historic and Forecasted Market Size By Type

8.2.5.1 Soft-kill System

8.2.5.2 Hard-kill System

8.2.5.3 Reactive Armor

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Defense

8.2.6.2 Homeland Security

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Active Protection Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Platform

8.3.4.1 Land-based

8.3.4.2 Airborne

8.3.4.3 Naval

8.3.5 Historic and Forecasted Market Size By Type

8.3.5.1 Soft-kill System

8.3.5.2 Hard-kill System

8.3.5.3 Reactive Armor

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Defense

8.3.6.2 Homeland Security

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Active Protection Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Platform

8.4.4.1 Land-based

8.4.4.2 Airborne

8.4.4.3 Naval

8.4.5 Historic and Forecasted Market Size By Type

8.4.5.1 Soft-kill System

8.4.5.2 Hard-kill System

8.4.5.3 Reactive Armor

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Defense

8.4.6.2 Homeland Security

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Active Protection Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Platform

8.5.4.1 Land-based

8.5.4.2 Airborne

8.5.4.3 Naval

8.5.5 Historic and Forecasted Market Size By Type

8.5.5.1 Soft-kill System

8.5.5.2 Hard-kill System

8.5.5.3 Reactive Armor

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Defense

8.5.6.2 Homeland Security

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Active Protection Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Platform

8.6.4.1 Land-based

8.6.4.2 Airborne

8.6.4.3 Naval

8.6.5 Historic and Forecasted Market Size By Type

8.6.5.1 Soft-kill System

8.6.5.2 Hard-kill System

8.6.5.3 Reactive Armor

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Defense

8.6.6.2 Homeland Security

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Active Protection Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Platform

8.7.4.1 Land-based

8.7.4.2 Airborne

8.7.4.3 Naval

8.7.5 Historic and Forecasted Market Size By Type

8.7.5.1 Soft-kill System

8.7.5.2 Hard-kill System

8.7.5.3 Reactive Armor

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Defense

8.7.6.2 Homeland Security

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Active Protection Systems Market research report?

A1: The forecast period in the Active Protection Systems Market research report is 2024-2032.

Q2: Who are the key players in the Active Protection Systems Market?

A2: •Rafael Advanced Defense Systems (Israel), Raytheon Technologies (USA), Rheinmetall AG (Germany), Saab AB (Sweden), Leonardo S.p.A. (Italy), BAE Systems (UK), Aselsan (Turkey), Elbit Systems (Israel), Northrop Grumman (USA), General Dynamics (USA). and Other Active Players.

Q3: What are the segments of the Active Protection Systems Market?

A3: The Active Protection Systems Market is segmented into By Platform (Land-based, Airborne, Naval), By Type (Soft-kill System, Hard-kill System, Reactive Armor), By End-User (Defense, Homeland Security). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Active Protection Systems Market?

A4: The Active Protection Systems (APS) Market represents the set of technologies and solutions, which can detect, track, and defeat impending threats to military platforms, including projectiles, missiles, or explosive devices. These systems improve the ability of the vehicle, aircraft & Naval Ships to survive by proactive as well as their reactive mechanisms.

Q5: How big is the Active Protection Systems Market?

A5: Active Protection Systems Market Size Was Valued at USD 3.50 Billion in 2023, and is Projected to Reach USD 7.30 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!