Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectric Vehicle Transmission Market Size, Share, Growth & Forecast (2024-2032)

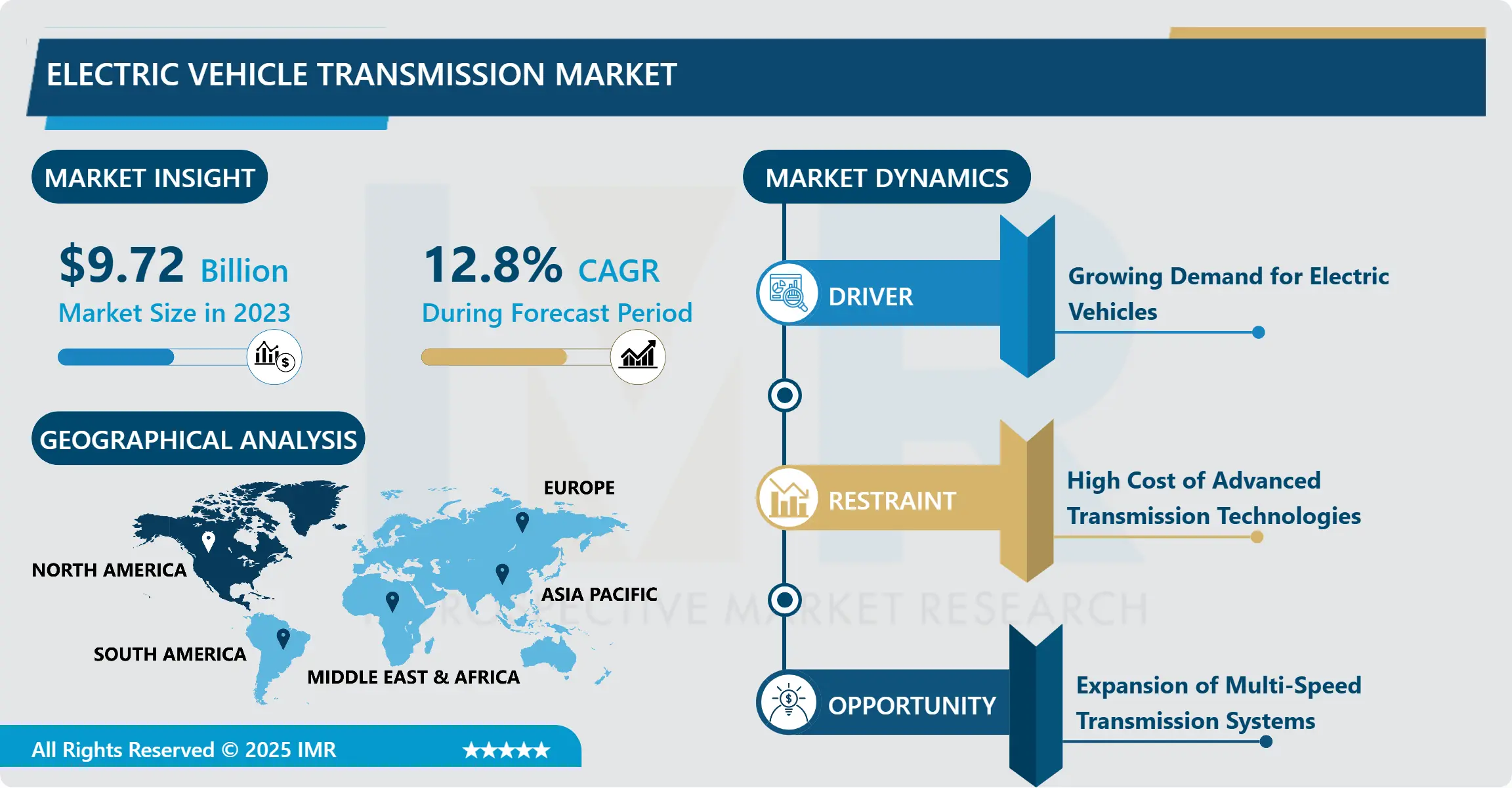

Electric Vehicle Transmission Market Size Was Valued at USD 9.72 Billion in 2023, and is Projected to Reach USD 28.74 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

IMR Group

Description

Electric Vehicle Transmission Market Synopsis:

Electric Vehicle Transmission Market Size Was Valued at USD 9.72 Billion in 2023, and is Projected to Reach USD 28.74 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

The Electric Vehicle (EV) Transmission Market encompasses the systems that transfer power from electric motors to EV wheels, optimizing performance, efficiency, and range. It includes single-speed and multi-speed transmissions tailored for various EV types, driven by increasing EV adoption, technological advancements, and the push for sustainable transportation solutions worldwide.

The Electric Vehicle Transmission Market is a critical segment. EV transmissions are instrumental in improving vehicle performance, by transmitting power from the electric motor to the wheels thus ensuring efficient acceleration, low energy consumption. Most electric vehicles use Single speed transmissions because electric motor offers torque range which is relatively broader than the multi-speed transmissions used in the traditional internal combustion engines. However, the need to achieve high speeds, improve efficiency and moving experience in electric vehicles is causing manufacturers to develop multi-speed transmissions for EVs.

As the demand continues to rise and as governments around the world implement new environmental standards, the market is poised for tremendous growth. Currently, governments across the globe are offering ample encouragement to electric vehicles in global market while the consumer is getting conscious regarding the ecological advantages being offered by EVs along with the feasible lessen expenses in the long run. There is forecast demand for the increase in the use of electric vehicle which will require a functional transmission network. Companies are paying particular attention to making the transmission system lighter, more efficient, and more reliable for EVs. Moreover, the proliferation of autonomous driving technologies as well as the developments of battery technology also affect the design and relevance of transmission systems in the evolutions of electric mobility.

Electric Vehicle Transmission Market Trend Analysis:

Adoption of Single-Speed Transmissions

The Electric Vehicle Transmission Market is the market shift toward single-speed transmissions. EVs use electric motors to drive the wheels, these vehicles do not have the ICE related complicated gear shifting gears. This is so because electric motors afford high torque at slow speeds and relatively steady power at an expanded spectrum of revolutions per minute (RPM). Therefore, numerous car producers are switching to single-speed transmissions because this configuration produces a leaner, lighter, and more efficient powertrain. Single-speed systems are simpler and cheaper to produce, and their operation is more comfortable and efficient than the operation of the real multi-speed gearboxes.

Single-speed transmissions are also favoured by consumers, again, due to the focus on improving vehicle efficiency and the trend to simplify the motoring technology of EVs. As for the manufacturers, it means that the fewer components are contained in the transmission system, the more are the cost savings and the fewer potential failures are at stake. This is in line with the overall objective of coming up with more efficiencies in production of electric cars while costing less. This trend will continue as car makers not only look for Longer range and higher performing electric vehicles, but it also wants to make sure the drivetrain is as efficient as possible.

Expansion of Multi-Speed Transmission Systems

The Electric Vehicle Transmission Market is in the use of Multi-Speed Transmission systems. Since electric vehicles are more and more widely used, car makers are turning to multiple-speed transmissions as means to deliver better performance, different driving sensations, and better efficiency in terms of energy usage. Multi speed transmissions provide maximum power at the various driving modes, enhances efficiency and range of the vehicle. The high-performance BEVs employ multi-speed transmissions that can mimic the changing of gears as noted in the conventional vehicles, and hence improve the ride feel though retaining the efficiency required in EV applications.

High-end electric vehicles as well as performance models because consumers seeking enhanced and customizable driving experiences currently exist in limited numbers. For these vehicles, multi-speed transmissions are much better as they allow for variety in control, acceleration and speed to be maintained while on the road. Furthermore, as the EV manufacturers increase the investment in R & D, there remains the chance to develop even better, more efficient multi- speed transmissions that would contribute to further decrease in energy loss and increase in battery durability. The integration of these transmissions could potentially drive the market forward and increase the likelihood of creating a more powerful and competent Electric Vehicle in terms of driving attribute.

Electric Vehicle Transmission Market Segment Analysis:

Electric Vehicle Transmission Market is Segmented on the basis of Transmission Type, Vehicle Type, Powertrain, Component, End User, and Region

By Transmission Type, Single-Speed Transmission segment is expected to dominate the market during the forecast period

Single/multi speed transmissions are the most popular among all the electronic cars due to its simplicity and low cost. These transmissions function based on the connection between the motor and the wheels while having full use of the electric motor’s torque range. Single-speed topology eliminates the need for other gears thus minimizes on chances of mechanical failure and increases general efficiency of the drivetrain.

Electric vehicles increases the use of single speed transmissions is likely to remain as the technology of choice for most passenger cars. This transmission type is especially effective for the urban and suburban driving that electric vehicles with significant battery capacity are designed for. Innovations in battery systems and powertrain architectures therefore continue to support single speed transmissions as a feasible, optimized low cost solution to power the increasing EV demand.

By End User, OEMs (Original Equipment Manufacturers) segment expected to held the largest share

The major customers of electric vehicle transmissions are Original Equipment Manufacturers (OEMs). OEMs are involved in development of electric vehicles and offer their vehicle models with transmission systems. Emerging economies as well as the rapid growth of electric vehicles globally make Original Equipment Manufacturers primary consumers of EVT technology, need for single speed as well as multi-speed transmission. Transmission makers engage with auto manufactures to create systems that meet ideal performance, efficiency, and Expense for the electric cars in the production line.

There is also the growing trend with OEMs providing a great deal of focus to developing own transmission technologies to avoid being overdependent and at the mercy of third-party suppliers as well as to effectively manage quality and performance rates within the vehicle’s different parts. With the projected increase in the demand for electric vehicles, OEMs will be the primary end user segment that sets the tempo and direction of evolution of transmission systems. Moreover, they are required to pursue the construction of cost-effective, but highly reliable and competitive transmission systems for both the mainstream and the premium EV markets.

Electric Vehicle Transmission Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The region for the Electric Vehicle Transmission Market is anticipated to be North America due to established automobile industries and increasing EV adoption. Governments all over the world are encouraging automobile producers to invest in electric vehicle manufacturing due to the strict emission controls as well as increasing customer awareness regarding green cars. Also, the region has many key players in electric car manufacturing including Tesla, General Motors, and Ford, which are considering the improvements to the transmission system in their electric cars.

The United States and Canada have set themselves on a pedestal in the electric vehicle market, thus providing a strong market for electric vehicle components, such as transmissions. Besides, government policies and regulations that seek to control emission of carbon are also boosting adoption of electric vehicles in the area. As the support for the EV infrastructure expansion, North America remains as the leading region to dominate the electric vehicle transmission market in the future years.

Active Key Players in the Electric Vehicle Transmission Market

Tesla, Inc. (United States)

General Motors Company (United States)

Ford Motor Company (United States)

ZF Friedrichshafen AG (Germany)

Aisin Seiki Co., Ltd. (Japan)

Magna International Inc. (Canada)

BorgWarner Inc. (United States)

Valeo S.A. (France)

Continental AG (Germany)

Hyundai Motor Group (South Korea)

Toyota Motor Corporation (Japan)

Nidec Corporation (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Transmission Market by Transmission Type

4.1 Electric Vehicle Transmission Market Snapshot and Growth Engine

4.2 Electric Vehicle Transmission Market Overview

4.3 Single-Speed Transmission

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Single-Speed Transmission: Geographic Segmentation Analysis

4.4 Multi-Speed Transmission

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Multi-Speed Transmission: Geographic Segmentation Analysis

Chapter 5: Electric Vehicle Transmission Market by Vehicle Type

5.1 Electric Vehicle Transmission Market Snapshot and Growth Engine

5.2 Electric Vehicle Transmission Market Overview

5.3 Battery Electric Vehicles (BEVs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Battery Electric Vehicles (BEVs): Geographic Segmentation Analysis

5.4 Plug-in Hybrid Electric Vehicles (PHEVs)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Plug-in Hybrid Electric Vehicles (PHEVs): Geographic Segmentation Analysis

5.5 Hybrid Electric Vehicles (HEVs)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hybrid Electric Vehicles (HEVs): Geographic Segmentation Analysis

Chapter 6: Electric Vehicle Transmission Market by Powertrain

6.1 Electric Vehicle Transmission Market Snapshot and Growth Engine

6.2 Electric Vehicle Transmission Market Overview

6.3 Front-Wheel Drive (FWD)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Front-Wheel Drive (FWD): Geographic Segmentation Analysis

6.4 Rear-Wheel Drive (RWD)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Rear-Wheel Drive (RWD): Geographic Segmentation Analysis

6.5 All-Wheel Drive (AWD)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 All-Wheel Drive (AWD): Geographic Segmentation Analysis

Chapter 7: Electric Vehicle Transmission Market by Component

7.1 Electric Vehicle Transmission Market Snapshot and Growth Engine

7.2 Electric Vehicle Transmission Market Overview

7.3 Gearbox

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Gearbox: Geographic Segmentation Analysis

7.4 Electric Motor

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Electric Motor: Geographic Segmentation Analysis

7.5 Power Electronics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Power Electronics: Geographic Segmentation Analysis

7.6 Bearings

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Bearings: Geographic Segmentation Analysis

Chapter 8: Electric Vehicle Transmission Market by End-User

8.1 Electric Vehicle Transmission Market Snapshot and Growth Engine

8.2 Electric Vehicle Transmission Market Overview

8.3 OEMs (Original Equipment Manufacturers)

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEMs (Original Equipment Manufacturers): Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Vehicle Transmission Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 TESLA INC. – (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 GENERAL MOTORS COMPANY – (UNITED STATES)

9.4 FORD MOTOR COMPANY – (UNITED STATES)

9.5 ZF FRIEDRICHSHAFEN AG – (GERMANY)

9.6 AISIN SEIKI CO. LTD. – (JAPAN)

9.7 MAGNA INTERNATIONAL INC. – (CANADA)

9.8 BORGWARNER INC. – (UNITED STATES)

9.9 VALEO S.A. – (FRANCE)

9.10 CONTINENTAL AG – (GERMANY)

9.11 HYUNDAI MOTOR GROUP – (SOUTH KOREA)

9.12 TOYOTA MOTOR CORPORATION – (JAPAN)

9.13 NIDEC CORPORATION – (JAPAN)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Electric Vehicle Transmission Market By Region

10.1 Overview

10.2. North America Electric Vehicle Transmission Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Transmission Type

10.2.4.1 Single-Speed Transmission

10.2.4.2 Multi-Speed Transmission

10.2.5 Historic and Forecasted Market Size By Vehicle Type

10.2.5.1 Battery Electric Vehicles (BEVs)

10.2.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.2.5.3 Hybrid Electric Vehicles (HEVs)

10.2.6 Historic and Forecasted Market Size By Powertrain

10.2.6.1 Front-Wheel Drive (FWD)

10.2.6.2 Rear-Wheel Drive (RWD)

10.2.6.3 All-Wheel Drive (AWD)

10.2.7 Historic and Forecasted Market Size By Component

10.2.7.1 Gearbox

10.2.7.2 Electric Motor

10.2.7.3 Power Electronics

10.2.7.4 Bearings

10.2.8 Historic and Forecasted Market Size By End-User

10.2.8.1 OEMs (Original Equipment Manufacturers)

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Vehicle Transmission Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Transmission Type

10.3.4.1 Single-Speed Transmission

10.3.4.2 Multi-Speed Transmission

10.3.5 Historic and Forecasted Market Size By Vehicle Type

10.3.5.1 Battery Electric Vehicles (BEVs)

10.3.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.3.5.3 Hybrid Electric Vehicles (HEVs)

10.3.6 Historic and Forecasted Market Size By Powertrain

10.3.6.1 Front-Wheel Drive (FWD)

10.3.6.2 Rear-Wheel Drive (RWD)

10.3.6.3 All-Wheel Drive (AWD)

10.3.7 Historic and Forecasted Market Size By Component

10.3.7.1 Gearbox

10.3.7.2 Electric Motor

10.3.7.3 Power Electronics

10.3.7.4 Bearings

10.3.8 Historic and Forecasted Market Size By End-User

10.3.8.1 OEMs (Original Equipment Manufacturers)

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Vehicle Transmission Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Transmission Type

10.4.4.1 Single-Speed Transmission

10.4.4.2 Multi-Speed Transmission

10.4.5 Historic and Forecasted Market Size By Vehicle Type

10.4.5.1 Battery Electric Vehicles (BEVs)

10.4.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.4.5.3 Hybrid Electric Vehicles (HEVs)

10.4.6 Historic and Forecasted Market Size By Powertrain

10.4.6.1 Front-Wheel Drive (FWD)

10.4.6.2 Rear-Wheel Drive (RWD)

10.4.6.3 All-Wheel Drive (AWD)

10.4.7 Historic and Forecasted Market Size By Component

10.4.7.1 Gearbox

10.4.7.2 Electric Motor

10.4.7.3 Power Electronics

10.4.7.4 Bearings

10.4.8 Historic and Forecasted Market Size By End-User

10.4.8.1 OEMs (Original Equipment Manufacturers)

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Vehicle Transmission Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Transmission Type

10.5.4.1 Single-Speed Transmission

10.5.4.2 Multi-Speed Transmission

10.5.5 Historic and Forecasted Market Size By Vehicle Type

10.5.5.1 Battery Electric Vehicles (BEVs)

10.5.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.5.5.3 Hybrid Electric Vehicles (HEVs)

10.5.6 Historic and Forecasted Market Size By Powertrain

10.5.6.1 Front-Wheel Drive (FWD)

10.5.6.2 Rear-Wheel Drive (RWD)

10.5.6.3 All-Wheel Drive (AWD)

10.5.7 Historic and Forecasted Market Size By Component

10.5.7.1 Gearbox

10.5.7.2 Electric Motor

10.5.7.3 Power Electronics

10.5.7.4 Bearings

10.5.8 Historic and Forecasted Market Size By End-User

10.5.8.1 OEMs (Original Equipment Manufacturers)

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Vehicle Transmission Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Transmission Type

10.6.4.1 Single-Speed Transmission

10.6.4.2 Multi-Speed Transmission

10.6.5 Historic and Forecasted Market Size By Vehicle Type

10.6.5.1 Battery Electric Vehicles (BEVs)

10.6.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.6.5.3 Hybrid Electric Vehicles (HEVs)

10.6.6 Historic and Forecasted Market Size By Powertrain

10.6.6.1 Front-Wheel Drive (FWD)

10.6.6.2 Rear-Wheel Drive (RWD)

10.6.6.3 All-Wheel Drive (AWD)

10.6.7 Historic and Forecasted Market Size By Component

10.6.7.1 Gearbox

10.6.7.2 Electric Motor

10.6.7.3 Power Electronics

10.6.7.4 Bearings

10.6.8 Historic and Forecasted Market Size By End-User

10.6.8.1 OEMs (Original Equipment Manufacturers)

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Vehicle Transmission Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Transmission Type

10.7.4.1 Single-Speed Transmission

10.7.4.2 Multi-Speed Transmission

10.7.5 Historic and Forecasted Market Size By Vehicle Type

10.7.5.1 Battery Electric Vehicles (BEVs)

10.7.5.2 Plug-in Hybrid Electric Vehicles (PHEVs)

10.7.5.3 Hybrid Electric Vehicles (HEVs)

10.7.6 Historic and Forecasted Market Size By Powertrain

10.7.6.1 Front-Wheel Drive (FWD)

10.7.6.2 Rear-Wheel Drive (RWD)

10.7.6.3 All-Wheel Drive (AWD)

10.7.7 Historic and Forecasted Market Size By Component

10.7.7.1 Gearbox

10.7.7.2 Electric Motor

10.7.7.3 Power Electronics

10.7.7.4 Bearings

10.7.8 Historic and Forecasted Market Size By End-User

10.7.8.1 OEMs (Original Equipment Manufacturers)

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Electric Vehicle Transmission Market research report?

A1: The forecast period in the Electric Vehicle Transmission Market research report is 2024-2032.

Q2: Who are the key players in the Electric Vehicle Transmission Market?

A2: Tesla, Inc. (United States), General Motors Company (United States), Ford Motor Company (United States), ZF Friedrichshafen AG (Germany), Aisin Seiki Co., Ltd. (Japan), Magna International Inc. (Canada), BorgWarner Inc. (United States), Valeo S.A. (France), and Other Active Players.

Q3: What are the segments of the Electric Vehicle Transmission Market?

A3: The Electric Vehicle Transmission Market is segmented into Transmission Type, Vehicle Type, Powertrain, Component, End User and Region. By Transmission Type, the market is categorized into Single-Speed Transmission, Multi-Speed Transmission. By Vehicle Type, the market is categorized into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs). By Powertrain, the market is categorized into Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), All-Wheel Drive (AWD). By Component, the market is categorized into Gearbox, Electric Motor, Power Electronics, Bearings. By End-User, the market is categorized into OEMs (Original Equipment Manufacturers) and, Aftermarket. By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Electric Vehicle Transmission Market?

A4: The Electric Vehicle (EV) Transmission Market encompasses the systems that transfer power from electric motors to EV wheels, optimizing performance, efficiency, and range. It includes single-speed and multi-speed transmissions tailored for various EV types, driven by increasing EV adoption, technological advancements, and the push for sustainable transportation solutions worldwide.

Q5: How big is the Electric Vehicle Transmission Market?

A5: Electric Vehicle Transmission Market Size Was Valued at USD 9.72 Billion in 2023, and is Projected to Reach USD 28.74 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!