Stay Ahead in Fast-Growing Economies.

Browse Reports NowDelivery Drones Market Size, Share, Growth & Forecast (2024-2032)

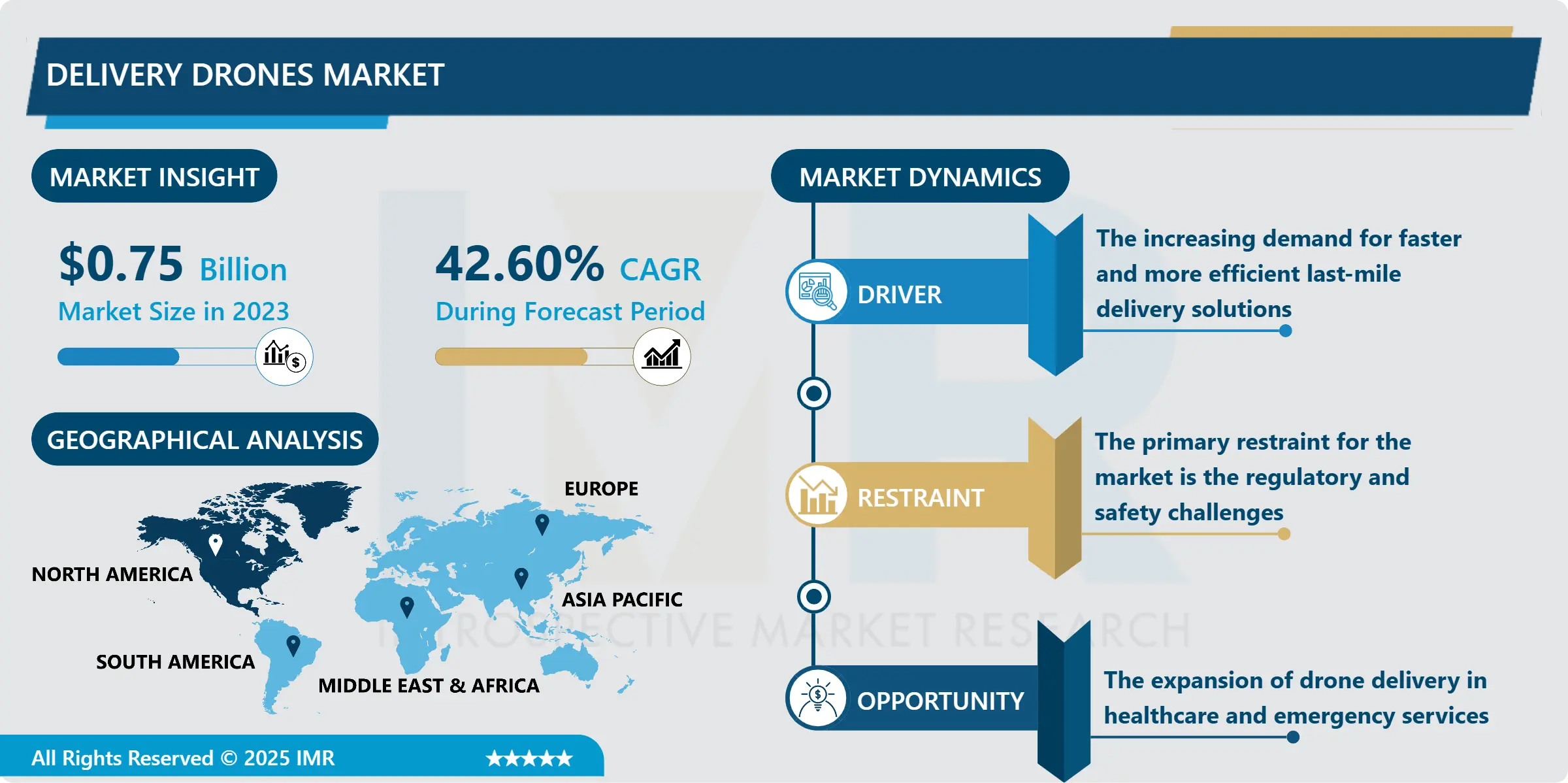

Delivery Drones Market Size Was Valued at USD 0.75 Billion in 2023, and is Projected to Reach USD 18.42 Billion by 2032, Growing at a CAGR of 42.60% From 2024-2032.

IMR Group

Description

Delivery Drones Market Synopsis:

Delivery Drones Market Size Was Valued at USD 0.75 Billion in 2023, and is Projected to Reach USD 18.42 Billion by 2032, Growing at a CAGR of 42.60% From 2024-2032.

The Delivery Drones Market defines to the emerging segment of the UAVs that are used to deliver parcels, goods or other products across shorter and longer distances. These drones are built with sensor array, GPS system and other facts that allow them to operate on their own or with minimal human control in order to drop the packages. Delivery drones are used for e-commerce, food delivery, medical supplies, and retails, to mention some of the potential to transform the last-mile delivery solutions to enhance the speed, costs, and operations.

The global delivery drone market is a fairly young and highly promising segment that has significant potential for growth due to the constant upgrading of drone technology, the development of e-commerce, increased requirements for the speed and efficiency of transportation. Mentionable business benefits of the use of drones are more pronounced than the conventional approaches to delivery, especially where there is traffic congestion such as in cities. This is due to the increasing demand in retail corporations, logistics providers and even governmental uses of delivery drones for tasks such as; parcel delivery, medical supply or even online food delivery. Also, the regulation of using drones is still in its initial stages but the surrounding regulation is gradually decreasing making it possible to expand more.

The market has seen severally major e-commerce companies partnering with drone technology industries to build the framework for drone delivery. These are in the form of increasing investments in the drone fleets, testing facilities and collaboration with logistics companies. The big giants such as amazon, UPS, DHL, etc. are now actively concentrating and searching for the implementation of drone delivery services for a better organized operation and for fulfilling the customer’s demand for more rapid delivery. Also, some new try and traditional UAV producers aim to develop superior drones to feature flight distance, more and better payload and other security concepts. As technology for drone advances, the prospects for delivery drones to revolutionise the Logistics and supply chain sector becomes more apparent.

Delivery Drones Market Trend Analysis:

Emergence of Autonomous Drone Delivery Solutions

Regarding the self-driving technology, which is one of the most important and fast-developing trends in a delivery drone market. These are autonomous drones that do not require the services of a pilot, they make use of algorithms, sensors and GPS to fly, avoid objects and drop consignments. Self-driven drones organize delivery tasks based on real-time information processing possibilities and are more accurate and faster than standard solutions. Salah this change is expected to transform last-mile delivery; providing faster and cheaper services, especially in areas characterized by enormous traffic hiccups, particularly in metropolitan cities.

The progression of technology is bringing along Artificial Intelligence (AI) and Machine Learning (ML) making autonomous drones to be developed a lot faster. These technologies allow drones to operate under changing conditions, learn from previous performances and improve their performance characteristics continually. The increased reliability and precision help to cut the reliance on human labour while decreasing mistake rates, as well as with solution routes for deliveries. In addition, as the legal requirements for the operation of the drones are changing over time, it is becoming ever more feasible to implement the drones that are autonomous. This trend is the future of delivery services helping logistics disseminating a great potential to intensify the delivery companies and decrease the costs for customers by delivering the products faster and in better conditions.

Expansion of Drone Delivery in Healthcare and Emergency Services

One of the key trends expected in the delivery drone market is the ongoing increase in utilisation of drones in health and safety sectors. Drones offer a special and more effective mean of transport required in the transport of blood, vaccines, important shots and other life essential products which may take considerable time to arrive using other means such as road or air transport in difficult to access areas or regions that may have been affected by disasters. These autonomy ones can be quickly dispatched to deliver life necessities within minutes in emergency moments thus being very vital in local and international disaster response. This becomes important in delivery of urgent healthcare where normal transport may not be able to penetrate inaccessible areas because of bad roads, floods, or mountainous regions etc.

This mode of health and emergency services delivery is still in its infancy in many ways; however, it has an almost limitless potential especially in parts of the world with a constrained or poorly developed transport network. The future innovations in drone technologies for medical deliveries draws on improvements in the lifting capacity, stabilization of drones, and increased battery capabilities to include delivery of a variety of medical shipments. Consequently, technology enablers of the above capabilities should advance rapidly to support the delivery of healthcare and emergency services by drones, creating good growth prospects for both incumbent and new entrant firms within the current market. By extension, this could also result in quicker distribution of medical products, redesigning the shape of healthcare supply chain and augmenting disaster response systems worldwide.

Delivery Drones Market Segment Analysis:

Delivery Drones Market is Segmented on the basis of type, application, end user and region.

By Type, rotary wing segment is expected to dominate the market during the forecast period

The delivery drone market can be categorized based on type to include rotary wing delivery drones, fixed wing delivery drones, as well as the hybrid system delivery drones. Delivery applications mostly use rotary wing drones because of their ability to hover, take off, and make a landing at a similar point. Because of this, they are recommended for use in the urban areas and areas with limited space for landing. Short range delivery drones are predominantly used and are preferred for their operational flexibility. They include the ability to manoeuvre within the defined space or get past barriers to access local consumers through last mile delivery which is effective when used in busy areas.

The fixed wing drones are meant for distances, and in terms of energy consumption, they are more ideal for the big deliveries over large distance. They are usually applied to large volume or large distance routes for instance moving medicines to remote areas or in regions where there is a low demand for delivery services most of the time. A quite logical development is the usage of hybrid drones, which are fitted with both rotary and fixed wing mechanisms, as they provide VTOL, yet also contain increased range in comparison with drones that are completely based on the fixed wing design. Such drones are emerging because they are much more effective than rotary wing and fixed wing drones that have various applications in different delivery sectors.

By Application, E-commerce and retail segment expected to held the largest share

The use of delivery drones is heavily divided between various sectors with industries adapting to the drone delivery system. Shipping and parcel delivery are at the forefront in the use of drones for last mile delivery through e-commerce and retail stores. Is it not interesting that market leaders of e-commerce businesses including Amazon are putting their money in drones as they seek to minimize delivery time for products by providing same day or one-hour delivery. Drones ensure that retailers get to reach many customers especially in the urban and the remote areas for purpose of delivery of small to medium sized products within the shortest time and at reduced cost as compared to other methods of delivering the goods.

Apart from e- commerce another expanding area for drone usage is healthcare and medical deliveries. Due to their unique design, these vehicles can be used to transport some of the most important blood, vaccines and medications to remote facilities or regions. The use of drones has been known to ease delivery helping in the case of the emergency. The food delivery industry is also embracing drones as the companies seek to know how it can shuttle the meals with efficiency, especially in the busy towns where traffic might slow down the services. There are also other activities that are business related, for example, industrial and warehouse deliveries that are another type of deliveries that concentrate on the supply chains or transportation of goods within industrial buildings or between warehouses. Besides, the technology has found application in delivery of seeds, fertilizers and pesticides and relief supplies in case of natural disasters, calamities and other humanitarian crises. These applications demonstrate a vast possibility of delivery drones in different industries.

Delivery Drones Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is dominating the delivery drone market followed by United States, thereby occupying a large share of the entire global market share. This domination is rather explained by the governmental support and regulation, especially from major institutions such as FAA that opens a specific regulatory framework for drones’ operation in the United States. This has in turn created a conducive environment for the use of drone technology through regulation of risks accompanying the technology and more so the development of the technology. The fact that the US government is actively supports the development of the drone industry is also an evidence; the investments into the drone infrastructure and testing facilities which ideally proved the development of delivery drones across sectors.

Also, North America is benefited from large e-commerce and logistics companies, for instance, Amazon, UPS, and FedEx, which is investing in new delivery equipment including drone. These companies are already experimenting and implementing drone delivery solutions to solve the last mile delivery challenges, strike the best price, and satisfy their clients. Consequently, North America would occupy the global delivery drone market size. Technological proficiency, well-developed physical infrastructure, and the first movers utilizing drones also make this region the leader with high future growth potential.

Active Key Players in the Delivery Drones Market:

Airbus (France)

Amazon Prime Air (United States)

ASI (Aero Systems Engineering) (United States)

Asteria Aerospace (India)

DHL (Germany)

Drone Delivery Canada (Canada)

DroneScan (United States)

Flirtey (United States)

Matternet (United States)

Microdrones (Germany)

PrecisionHawk (United States)

Skyports (United Kingdom)

Swiss Post (Switzerland)

Wing Aviation (Alphabet Inc.) (United States)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Delivery Drones Market by Type

4.1 Delivery Drones Market Snapshot and Growth Engine

4.2 Delivery Drones Market Overview

4.3 Rotary Wing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rotary Wing: Geographic Segmentation Analysis

4.4 Fixed Wing

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Fixed Wing: Geographic Segmentation Analysis

4.5 Hybrid

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid: Geographic Segmentation Analysis

Chapter 5: Delivery Drones Market by Application

5.1 Delivery Drones Market Snapshot and Growth Engine

5.2 Delivery Drones Market Overview

5.3 E-commerce & Retail

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 E-commerce & Retail: Geographic Segmentation Analysis

5.4 Healthcare & Medical Deliveries

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Healthcare & Medical Deliveries: Geographic Segmentation Analysis

5.5 Food Delivery

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Food Delivery: Geographic Segmentation Analysis

5.6 Industrial & Warehouse Deliveries

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Industrial & Warehouse Deliveries: Geographic Segmentation Analysis

5.7 Others (Agriculture

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others (Agriculture: Geographic Segmentation Analysis

5.8 Emergency Services

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Emergency Services: Geographic Segmentation Analysis

5.9 etc.)

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 etc.): Geographic Segmentation Analysis

Chapter 6: Delivery Drones Market by End User

6.1 Delivery Drones Market Snapshot and Growth Engine

6.2 Delivery Drones Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial: Geographic Segmentation Analysis

6.4 Government

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Government: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Delivery Drones Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIRBUS (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMAZON PRIME AIR (UNITED STATES)

7.4 ASI (AERO SYSTEMS ENGINEERING) (UNITED STATES)

7.5 ASTERIA AEROSPACE (INDIA)

7.6 DHL (GERMANY)

7.7 DRONE DELIVERY CANADA (CANADA)

7.8 DRONESCAN (UNITED STATES)

7.9 FLIRTEY (UNITED STATES)

7.10 MATTERNET (UNITED STATES)

7.11 MICRODRONES (GERMANY)

7.12 PRECISIONHAWK (UNITED STATES)

7.13 SKYPORTS (UNITED KINGDOM)

7.14 SWISS POST (SWITZERLAND)

7.15 WING AVIATION (ALPHABET INC.) (UNITED STATES)

7.16 ZIPLINE (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Delivery Drones Market By Region

8.1 Overview

8.2. North America Delivery Drones Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Rotary Wing

8.2.4.2 Fixed Wing

8.2.4.3 Hybrid

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 E-commerce & Retail

8.2.5.2 Healthcare & Medical Deliveries

8.2.5.3 Food Delivery

8.2.5.4 Industrial & Warehouse Deliveries

8.2.5.5 Others (Agriculture

8.2.5.6 Emergency Services

8.2.5.7 etc.)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Commercial

8.2.6.2 Government

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Delivery Drones Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Rotary Wing

8.3.4.2 Fixed Wing

8.3.4.3 Hybrid

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 E-commerce & Retail

8.3.5.2 Healthcare & Medical Deliveries

8.3.5.3 Food Delivery

8.3.5.4 Industrial & Warehouse Deliveries

8.3.5.5 Others (Agriculture

8.3.5.6 Emergency Services

8.3.5.7 etc.)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Commercial

8.3.6.2 Government

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Delivery Drones Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Rotary Wing

8.4.4.2 Fixed Wing

8.4.4.3 Hybrid

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 E-commerce & Retail

8.4.5.2 Healthcare & Medical Deliveries

8.4.5.3 Food Delivery

8.4.5.4 Industrial & Warehouse Deliveries

8.4.5.5 Others (Agriculture

8.4.5.6 Emergency Services

8.4.5.7 etc.)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Commercial

8.4.6.2 Government

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Delivery Drones Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Rotary Wing

8.5.4.2 Fixed Wing

8.5.4.3 Hybrid

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 E-commerce & Retail

8.5.5.2 Healthcare & Medical Deliveries

8.5.5.3 Food Delivery

8.5.5.4 Industrial & Warehouse Deliveries

8.5.5.5 Others (Agriculture

8.5.5.6 Emergency Services

8.5.5.7 etc.)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Commercial

8.5.6.2 Government

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Delivery Drones Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Rotary Wing

8.6.4.2 Fixed Wing

8.6.4.3 Hybrid

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 E-commerce & Retail

8.6.5.2 Healthcare & Medical Deliveries

8.6.5.3 Food Delivery

8.6.5.4 Industrial & Warehouse Deliveries

8.6.5.5 Others (Agriculture

8.6.5.6 Emergency Services

8.6.5.7 etc.)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Commercial

8.6.6.2 Government

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Delivery Drones Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Rotary Wing

8.7.4.2 Fixed Wing

8.7.4.3 Hybrid

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 E-commerce & Retail

8.7.5.2 Healthcare & Medical Deliveries

8.7.5.3 Food Delivery

8.7.5.4 Industrial & Warehouse Deliveries

8.7.5.5 Others (Agriculture

8.7.5.6 Emergency Services

8.7.5.7 etc.)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Commercial

8.7.6.2 Government

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Delivery Drones Market research report?

A1: The forecast period in the Delivery Drones Market research report is 2024-2032.

Q2: Who are the key players in the Delivery Drones Market?

A2: Airbus (France), Amazon Prime Air (United States), ASI (Aero Systems Engineering) (United States), Asteria Aerospace (India), DHL (Germany), Drone Delivery Canada (Canada), DroneScan (United States), Flirtey (United States), Matternet (United States), Microdrones (Germany), PrecisionHawk (United States), Skyports (United Kingdom), Swiss Post (Switzerland), Wing Aviation (Alphabet Inc.) (United States), Zipline (United States) and Other Active Players.

Q3: What are the segments of the Delivery Drones Market?

A3: The Delivery Drones Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Rotary Wing, Fixed Wing, Hybrid. By Application, the market is categorized into E-commerce & Retail, Healthcare & Medical Deliveries, Food Delivery, Industrial & Warehouse Deliveries, Others (Agriculture, Emergency Services, etc.). By End User, the market is categorized into Commercial, Government, Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Delivery Drones Market?

A4: The Delivery Drones Market defines to the emerging segment of the UAVs that are used to deliver parcels, goods or other products across shorter and longer distances. These drones are built with sensor array, GPS system and other facts that allow them to operate on their own or with minimal human control in order to drop the packages. Delivery drones are used for e-commerce, food delivery, medical supplies, and retails, to mention some of the potential to transform the last-mile delivery solutions to enhance the speed, costs, and operations.

Q5: How big is the Delivery Drones Market?

A5: Delivery Drones Market Size Was Valued at USD 0.75 Billion in 2023, and is Projected to Reach USD 18.42 Billion by 2032, Growing at a CAGR of 42.60% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!