Stay Ahead in Fast-Growing Economies.

Browse Reports NowPatient Positioning Devices Market Insights, Size, Share & Growth Forecast to 2032

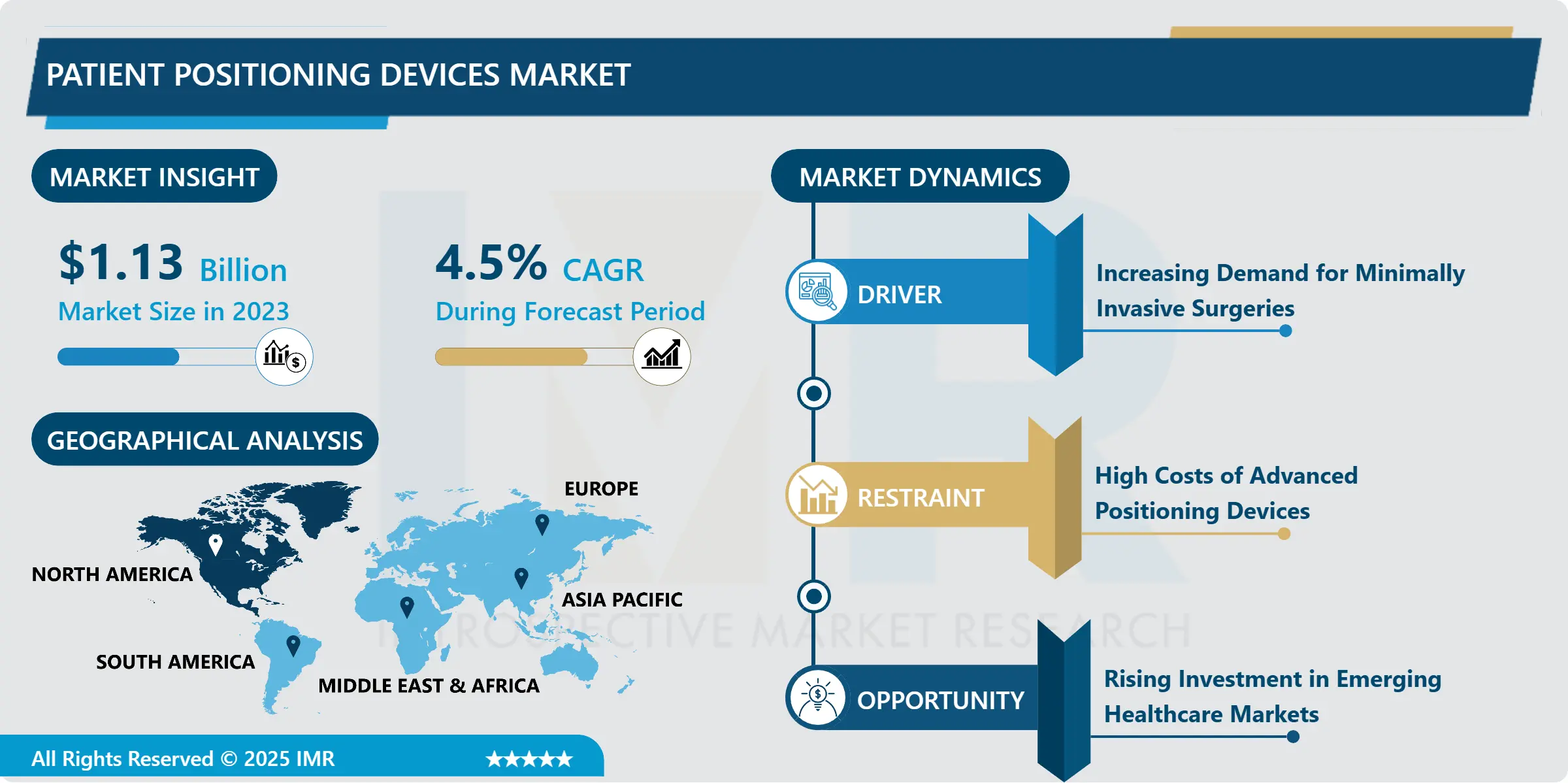

Patient Positioning Devices Market Size Was Valued at USD 1.13 Billion in 2023, and is Projected to Reach USD 1.69 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032. The patient positioning devices market therefore refers to a broad category of patient care support devices that are used in multiple patient positions during surgeries, radiological investigations, and other medical therapies.

IMR Group

Description

Patient Positioning Devices Market Synopsis:

Patient Positioning Devices Market Size Was Valued at USD 1.13 Billion in 2023, and is Projected to Reach USD 1.69 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

The patient positioning devices market therefore refers to a broad category of patient care support devices that are used in multiple patient positions during surgeries, radiological investigations, and other medical therapies. Equipment such as tables, mattresses, straps, and other positioning devices which enable correct positioning before, during and after a procedure in order to enhance favourable process results and decrease adversative consequences for both patients and caregivers.

The patient positioning devices market is forecasted to grow highly at the moment because of the rising popularity of improved healthcare in surgery and diagnostics. Having patient positioning devices in mind, when the healthcare facilities aims at increasing patient safety, the risks like pressure ulcers, nerve injuries and even respiratory distress during long procedures turn crucial. This need is most felt in surgical fields like orthopaedic, cardiovascular and neurological surgeries where positioning of patient is crucial in an attempt to get to a certain area in the body. Further, technological development for imaging systems is putting pressure on positioning accessories that can complement CT, MRI, and X-ray equipment so as to keep patients stable and comfortable for imaging.

The growth of the market is also fuelled by increasing the global population average age and incidence rates of chronic diseases that require surgeries and diagnostics. A rising concern about positioning patients especially in operating theatres and overall comfort has been a success factor in the utilization of the devices. Hospitals and surgical centers are steadily adopting better quality, adjustable, and comfortable positioning healthcare equipment to meet patient safety initiatives, improve clinical workflow and reduce patients’ risks. Thus, it can be seen that manufacturers are now coming up with durable and lightweight models as well as products which are easy to maneuver to fit into these transforming healthcare provisions.

Patient Positioning Devices Market Trend Analysis:

Technological Advancements Driving Market Growth

High development rate in the healthcare industry makes the patient positioning devices relying more on automation and smart solutions. This incorporation includes human-assisted machines fitted with robotics, sensors and artificial intelligence that allow fine tuning, which guarantees consistent positioning during operations and imaging. Such tools and solutions are especially beneficial to apply to certain cases demanding micromovements and accurate angles in particular because automation helps healthcare providers choose the most suitable positions with great accuracy. Such systems also reduce the physical fatigue that is common among health care personnel when having to make hundreds of adjustments by hand – thus achieving correct positioning during long or complex procedures.

Robotic assisted surgeries especially in the developed world has also propelled the need for the product which is an automated positioning mechanism. Robotics in the operating rooms means the procedure needs tremendously stable and accurately positioned patients in order to achieve maximum success. Therefore implementable and automated patient positioning devices are in great demand to address the stringent demands of current surgical and diagnostic procedures. This trend is likely to persists as various healthcare facilities seek better positioning technology to offer better solutions to patient conditions while supporting various health care professionals to provide optimal care solutions.

Expanding Opportunities in Emerging Markets

Asia-Pacific and Latin American markets widely remain promising for the patient positioning devices market because these regions demonstrate a rapidly growing healthcare sector. Primarily driven by government policies, rising private participation, and the enhanced infrastructure of healthcare centers intend to boost the utilization rate of new age surgical and diagnostic tools such as patient positioning devices. These are factors which are ensuring that more patients can now be able to access better procedures which in turn create a broad market for the equipment that makes different procedures safer and more accurate. As healthcare sector is changing in these regions, placing of devices that can satisfy the needs of constantly developing population and various specialties are highly desirable.

As a result, global and regional OEMs are further stepping up attempts to build a deeper base in these growing regions. Lone some of the reasons why such countries such as china and India attracts the manufacturers include the fact that; the countries have favourable policies, cheap and efficient production processes and most importantly availability of skilled labours. Reasons like these not only reduce production cost but also facilitate distribution through Asia-Pacific and Latin America. Since significant emphasis is still placed on developing the advanced healthcare system in these territories, the market for patient positioning devices has enormous potential for growth and attracts growing attention from international manufacturers.

Patient Positioning Devices Market Segment Analysis:

Patient Positioning Devices Market is Segmented on the basis of type, application, end user, and Region.

By Product Type, surgical tables segment is expected to dominate the market during the forecast period

patient positioning devices industry categorizes many types of products, and all of them have different purposes in healthcare facilities. Surgical tables are incorporated in this market as they offer a secure and mobile base for patients to under through a series of surgical operations. These tables are intended for various positions needed in intricate surgeries, of orthopedic and cardiovascular nature, improving surgical delicacy and patients’ comfort. Likewise, examination table is paramount for routine examinations, greatly facilitating positioning of the patient during general and special tests. Each type of tables is critical to healthcare as they provide patients with stability and serve in ensuring that proper assessment is made.

The other important segment is patient positioning accessories, which are used to support the patient, to prevent movement that might interfere with the procedure, through use of pads, straps, and cushions. These accessories are used to prevent complications related to massive operation and long anaesthesia, for example pressure ulcers or nerve injuries. Special imaging tables for X-ray examination, which enable the transmission of X-ray beams, are also necessary in diagnostic imagery handling, to provide clear pictures of patients who must remain in fixed positions. Other include devices focused on specific medical purposes like prone positioner that are used in ophthalmologic applications, positioning chairs for dental applications etc.

By Application, surgery segment expected to held the largest share

Patient positioning devices market is used in several important aspects of healthcare sector out of which surgery is one of the most important. Surgical procedures need proper positioning of the patient so that access and visibility to the operational area is made possible, increase chances of accuracy and decrease on dangers that are usually posed to the patient. Equipment like the vertically mobile surgical table has been developed to accommodate numerous surgical procedures ranging from small operation procedures to large operations, and fields such as orthopaedic, neurosurgery, cardiovascular among others. The need for these devices is rising because the number of operations is increasing and attention is being paid to enhancing the results and minimizing adverse effects.

Besides surgery, diagnostics and imaging is another area of the use of patient positioning devices. They assist in imaging which includes; X-ray, CT and MRI scans through keeping patients well aligned for right interpretations of the images. For instance, image receptor tables which are radiolucent enable clear imaging since the patient does not move or is positioned correctly. In addition, patient positioning devices is also found widely in cancer treatment in which positioning is crucial to radiation-based cancer treatment to irradiate the cancerous tissues due to tight localization while avoiding healthy tissues. Other application segments also continue to fuel the growth of the overall market as they still have specific positioning devices that suit their dental and ophthalmology practices along with chair and positioners to provide comfort during lengthy processes.

Patient Positioning Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America continues to dominate the global patient positioning devices market and in 2023. This domination is due to a highly developed healthcare system, a high rate of innovative medical technology and a constant number of operations. Health care organizations in North America, especially those in United States and Canada enjoy rich resource base that enable constant modernization including the use of high-quality positioning devices that are useful and comfortable for patients. Due to a focus on adopting the latest technologies in the region, the application of automation and adjustable positioning schemes in surgical procedures and diagnostic imaging has shown a growth trend.

Other factors that drive the market growth in the North America are demographic and health factors such as; increasing proportion of a ageing population and high prevalence of chronic diseases that need surgeries. Moreover, the region’s strict healthcare hygiene standards remain crucial to patient safety which increases the need for quality positioning devices that meet ergonomic patient support equipment guidelines. This consideration for safety and innovation is backed by traditional healthcare companies that provide high-quality and compliance with North America as the main driver of innovation for the patient positioning devices market around the world.

Active Key Players in the Patient Positioning Devices Market:

Allen Medical Systems (USA)

C-RAD AB (Sweden)

Elekta AB (Sweden)

Eschmann Equipment (UK)

GE Healthcare (USA)

Getinge AB (Sweden)

Hill-Rom Holdings, Inc. (USA)

Leoni AG (Germany)

Medifa GmbH (Germany)

Medtronic plc (Ireland)

Mizuho OSI (USA)

SchureMed (USA)

Skytron, LLC (USA)

STERIS plc (USA)

Stryker Corporation (USA), and Other Active Player.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Patient Positioning Devices Market by Product Type

4.1 Patient Positioning Devices Market Snapshot and Growth Engine

4.2 Patient Positioning Devices Market Overview

4.3 Surgical Tables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Surgical Tables: Geographic Segmentation Analysis

4.4 Examination Table

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Examination Table: Geographic Segmentation Analysis

4.5 Patient Positioning Accessories (pads

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Patient Positioning Accessories (pads: Geographic Segmentation Analysis

4.6 straps

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 straps: Geographic Segmentation Analysis

4.7 cushions

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 cushions: Geographic Segmentation Analysis

4.8 etc.)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 etc.): Geographic Segmentation Analysis

4.9 Radiolucent Imaging Tables

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Radiolucent Imaging Tables: Geographic Segmentation Analysis

4.10 Others (including chairs

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others (including chairs: Geographic Segmentation Analysis

4.11 prone positioners)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 prone positioners): Geographic Segmentation Analysis

Chapter 5: Patient Positioning Devices Market by Application

5.1 Patient Positioning Devices Market Snapshot and Growth Engine

5.2 Patient Positioning Devices Market Overview

5.3 Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Surgery: Geographic Segmentation Analysis

5.4 Diagnostics and Imaging

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Diagnostics and Imaging: Geographic Segmentation Analysis

5.5 Cancer Therapy

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Cancer Therapy: Geographic Segmentation Analysis

5.6 Others (dentistry

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others (dentistry: Geographic Segmentation Analysis

5.7 ophthalmology)

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 ophthalmology): Geographic Segmentation Analysis

Chapter 6: Patient Positioning Devices Market by End User

6.1 Patient Positioning Devices Market Snapshot and Growth Engine

6.2 Patient Positioning Devices Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers (ASCs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers (ASCs): Geographic Segmentation Analysis

6.5 Diagnostic Centers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Diagnostic Centers: Geographic Segmentation Analysis

6.6 Specialty Clinics

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Specialty Clinics: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Patient Positioning Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALLEN MEDICAL SYSTEMS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 C-RAD AB (SWEDEN)

7.4 ELEKTA AB (SWEDEN)

7.5 ESCHMANN EQUIPMENT (UK)

7.6 GE HEALTHCARE (USA)

7.7 GETINGE AB (SWEDEN)

7.8 HILL-ROM HOLDINGS INC. (USA)

7.9 LEONI AG (GERMANY)

7.10 MEDIFA GMBH (GERMANY)

7.11 MEDTRONIC PLC (IRELAND)

7.12 MIZUHO OSI (USA)

7.13 SCHUREMED (USA)

7.14 SKYTRON LLC (USA)

7.15 STERIS PLC (USA)

7.16 STRYKER CORPORATION (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Patient Positioning Devices Market By Region

8.1 Overview

8.2. North America Patient Positioning Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Surgical Tables

8.2.4.2 Examination Table

8.2.4.3 Patient Positioning Accessories (pads

8.2.4.4 straps

8.2.4.5 cushions

8.2.4.6 etc.)

8.2.4.7 Radiolucent Imaging Tables

8.2.4.8 Others (including chairs

8.2.4.9 prone positioners)

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Surgery

8.2.5.2 Diagnostics and Imaging

8.2.5.3 Cancer Therapy

8.2.5.4 Others (dentistry

8.2.5.5 ophthalmology)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers (ASCs)

8.2.6.3 Diagnostic Centers

8.2.6.4 Specialty Clinics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Patient Positioning Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Surgical Tables

8.3.4.2 Examination Table

8.3.4.3 Patient Positioning Accessories (pads

8.3.4.4 straps

8.3.4.5 cushions

8.3.4.6 etc.)

8.3.4.7 Radiolucent Imaging Tables

8.3.4.8 Others (including chairs

8.3.4.9 prone positioners)

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Surgery

8.3.5.2 Diagnostics and Imaging

8.3.5.3 Cancer Therapy

8.3.5.4 Others (dentistry

8.3.5.5 ophthalmology)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers (ASCs)

8.3.6.3 Diagnostic Centers

8.3.6.4 Specialty Clinics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Patient Positioning Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Surgical Tables

8.4.4.2 Examination Table

8.4.4.3 Patient Positioning Accessories (pads

8.4.4.4 straps

8.4.4.5 cushions

8.4.4.6 etc.)

8.4.4.7 Radiolucent Imaging Tables

8.4.4.8 Others (including chairs

8.4.4.9 prone positioners)

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Surgery

8.4.5.2 Diagnostics and Imaging

8.4.5.3 Cancer Therapy

8.4.5.4 Others (dentistry

8.4.5.5 ophthalmology)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers (ASCs)

8.4.6.3 Diagnostic Centers

8.4.6.4 Specialty Clinics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Patient Positioning Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Surgical Tables

8.5.4.2 Examination Table

8.5.4.3 Patient Positioning Accessories (pads

8.5.4.4 straps

8.5.4.5 cushions

8.5.4.6 etc.)

8.5.4.7 Radiolucent Imaging Tables

8.5.4.8 Others (including chairs

8.5.4.9 prone positioners)

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Surgery

8.5.5.2 Diagnostics and Imaging

8.5.5.3 Cancer Therapy

8.5.5.4 Others (dentistry

8.5.5.5 ophthalmology)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers (ASCs)

8.5.6.3 Diagnostic Centers

8.5.6.4 Specialty Clinics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Patient Positioning Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Surgical Tables

8.6.4.2 Examination Table

8.6.4.3 Patient Positioning Accessories (pads

8.6.4.4 straps

8.6.4.5 cushions

8.6.4.6 etc.)

8.6.4.7 Radiolucent Imaging Tables

8.6.4.8 Others (including chairs

8.6.4.9 prone positioners)

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Surgery

8.6.5.2 Diagnostics and Imaging

8.6.5.3 Cancer Therapy

8.6.5.4 Others (dentistry

8.6.5.5 ophthalmology)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers (ASCs)

8.6.6.3 Diagnostic Centers

8.6.6.4 Specialty Clinics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Patient Positioning Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Surgical Tables

8.7.4.2 Examination Table

8.7.4.3 Patient Positioning Accessories (pads

8.7.4.4 straps

8.7.4.5 cushions

8.7.4.6 etc.)

8.7.4.7 Radiolucent Imaging Tables

8.7.4.8 Others (including chairs

8.7.4.9 prone positioners)

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Surgery

8.7.5.2 Diagnostics and Imaging

8.7.5.3 Cancer Therapy

8.7.5.4 Others (dentistry

8.7.5.5 ophthalmology)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers (ASCs)

8.7.6.3 Diagnostic Centers

8.7.6.4 Specialty Clinics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Patient Positioning Devices Market research report?

A1: The forecast period in the Patient Positioning Devices Market research report is 2024-2032.

Q2: Who are the key players in the Patient Positioning Devices Market?

A2: Allen Medical Systems (USA), C-RAD AB (Sweden), Elekta AB (Sweden), Eschmann Equipment (UK), GE Healthcare (USA), Getinge AB (Sweden), Hill-Rom Holdings, Inc. (USA), Leoni AG (Germany), Medifa GmbH (Germany), Medtronic plc (Ireland), Mizuho OSI (USA), SchureMed (USA), Skytron, LLC (USA), STERIS plc (USA), Stryker Corporation (USA), Other Active Players

Q3: What are the segments of the Patient Positioning Devices Market?

A3: The Patient Positioning Devices Market is segmented into Type, Application, End User and region. By Product Type, the market is categorized into Surgical Tables, Examination Tables, Patient Positioning Accessories, Radiolucent Imaging Tables, and Others. By Application, the market is categorized into Surgery, Diagnostics and Imaging, Cancer Therapy, and Others. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, and Specialty Clinics. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Patient Positioning Devices Market?

A4: The patient positioning devices market therefore refers to a broad category of patient care support devices that are used in multiple patient positions during surgeries, radiological investigations, and other medical therapies. Equipment such as tables, mattresses, straps, and other positioning devices which enable correct positioning before, during and after a procedure in order to enhance favorable process results and decrease adversative consequences for both patients and caregivers.

Q5: How big is the Patient Positioning Devices Market?

A5: Patient Positioning Devices Market Size Was Valued at USD 1.13 Billion in 2023, and is Projected to Reach USD 1.69 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!