Stay Ahead in Fast-Growing Economies.

Browse Reports NowNitinol Medical Devices Market Opportunities, Challenges & Strategic Forecast (2024-2032)

The Nitinol Medical Devices Market refers to a part of the health niche that deals with the application of Nitinol-a NiTi alloy of nickel and titanium-for the creation of medical devices. Because of some attributes including flexibility, enormous strength, and memory — Nitinol can be moulded to a certain shape, and it regains that shape when heat is applied — Nitinol is extensively used in medical applications like stents and guides, orthopedic appliances etc.

IMR Group

Description

Nitinol Medical Devices Market Synopsis:

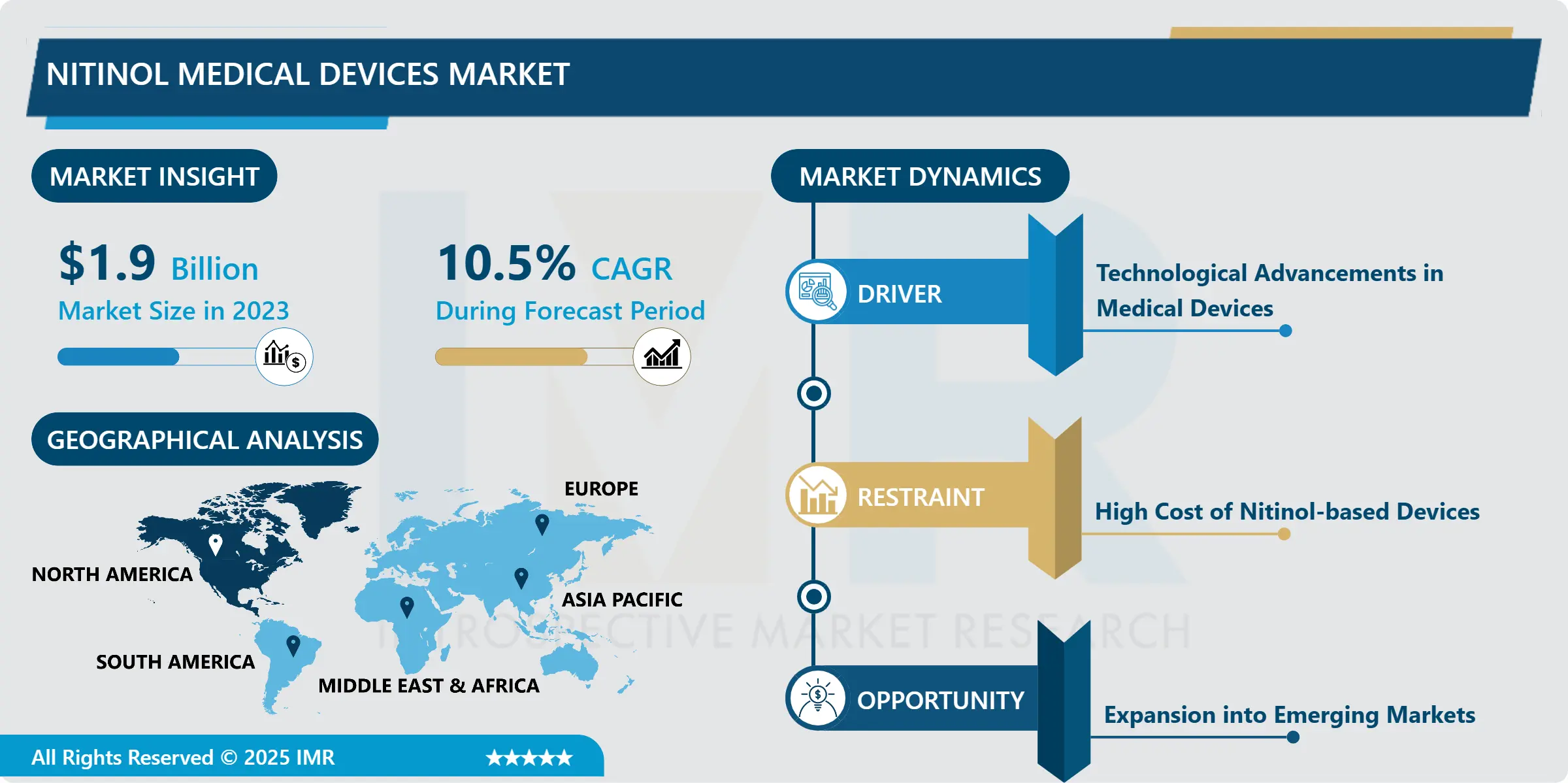

Nitinol Medical Devices Market Size Was Valued at USD 1.9 Billion in 2023, and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 10.5% From 2024-2032.

The Nitinol Medical Devices Market refers to a part of the health niche that deals with the application of Nitinol-a NiTi alloy of nickel and titanium-for the creation of medical devices. Because of some attributes including flexibility, enormous strength, and memory — Nitinol can be moulded to a certain shape, and it regains that shape when heat is applied — Nitinol is extensively used in medical applications like stents and guides, orthopedic appliances etc.

The market of Nitinol Medical Devices has shown considerable growth in the past few years, following the rising trend in minimally invasive surgeries as they have lower recovery rate, involve less invasive procedure, and complications associated with them are less serious. The fact that Nitinol possesses thermally activated shape memory and super elastic properties has made this material suitable for medical applications. The alloy is used in various products such as stents, guidewires, catheters, orthopedic devices etc and has enhanced the outcomes in cardiovascular, urology, orthopedics and other treatments.

This explains why Nitinol is gaining increased acceptance in the market despite the fact that it is relatively new material; this is due to its biocompatibility, its high fatigue resistance enhanced mechanical properties. It has found its application in devices that have laid down requirements of flexibility, toughness, and functionality. It largely builds up with change in temperatures, thus it is useful particularly for products like stents for expansion within blood vessels. Therefore, the devices made from Nitinol have enhanced the chances of curing some ailment such as heart related diseases, urology complications, and orthopedics injuries. In addition, increased technological development associated with the rising popularity of minimally invasive surgeries shall further drive the market in the coming years.

Nitinol Medical Devices Market Trend Analysis:

Rising Adoption of Minimally Invasive Surgeries

One of the major growth opportunities that can be observed for Nitinol medical devices market is MIS or minimally invasive surgeries. Since healthcare practitioners seek to ensure that their clients get better, shorter recovery time, less dangers and negligible discoloration, MIS procedures have become the most preferable in several operations. These characteristics of Nitinol are desirable in the surgical environment particularly for tools required in MIS surgeries such as stents, guidewires and catheters. These devices show enhanced outcomes in contrast to typical materials like stainless steel and the added bonus of being more conformable to a normal range of motion.

The higher growing implementation of Nitinol-based devices in minimally invasions procedures has enhanced patient’s benefits such as short period of recovery, lesser invasion and reduced complications. The continual shift in treatment paradigms in cardiovascular, genitourinary, musculoskeletal, and other diseases and disorders leading to preference for minimally invasive technologies is therefore a factor impacting Nitinol demand. This demand will continue to drive the market demand as technology increases making these procedures better and more easily accessible to the patient and the healthcare worker.

Expansion into Emerging Markets

Nitinol medical devices market is strategically timed to have a great potential for growth in the emerging markets. As the health care system evolves some of the emerging region out there such the Asia Pacific, Latin America and the middle east; there is always demand for sophisticated technology. An increase in the rate of incidents of chronic diseases and diseases relating to the cardiovascular and urological systems also increases the hopes for better treatment through devices. The stability, flexibility and biocompatibility of Nitinol is clearly beneficial to the healthcare providers in these regions.

Incursion into these new markets presents firms with a chance to reach a rising population whose demand for quality healthcare is steadily rising. Thirdly, as the healthcare cost is increasing across the world, the need for the gadgets used in the cost efficient, non-erosive operations will also increase. Furthermore, with growing emphasis on private and public healthcare organizations and an uplift in people’s awareness regarding rather complex treatments the Nitinol medical devices market has the potential to flourish in growing locations.

Nitinol Medical Devices Market Segment Analysis:

Nitinol Medical Devices Market is Segmented on the basis of Product Type, Application, End User, and Region.

By Product Type, Stents segment is expected to dominate the market during the forecast period

The Nitinol medical devices market is classified according to product types to meet specific medical requirements. Among various applications of Nitinol it has been identified that stents, guidewires and catheters are widely used because Nitinol possesses superelasticity. In cardiovascular surgeries, stents have taken advantage of Nitinol’s characteristic that makes it change to the desired size after it is placed in the blood vessels to avoid complex surgeries. Continuously guided and catheters also use this feature including Nitinol’s flexibility and shape memory making it possible to get through intricate and sensitive organ systems such as arterial or urethral systems.

Besides cardiovascular uses, Nitinol orthopedic applications have started to emerge because of the material’s properties such as strength and resilience together with the shape memory effect. These properties are particularly relevant in replacement joint prostheses, fracture fixation plates, and spinal instruments. These filters are also used in embolism preventive operations because of their resistant and flexible properties of Nitinol material. It is anticipated that the increase in the numbers of their medical product uses and rise of new types of Nitinol medical devices in different specialties could further fuel the Nitinol medical devices market.

By Application, Cardiovascular segment expected to held the largest share

Nitinol use in medicine ranges across the cardiovascular field, urology and orthopedics although the most exploited is cardiovascular field. In cardiovascular intervention, Nitinol is commonly used for stents, guidewires, and balloons because this shape-memory alloy expands when warmed making it perfect for minimal invasive operations. Some of the growth factors for Nitinol in this segment are the rising cases of heart disease and the rising applications of interventional cardiology.

Favourably, Nitinol forms are pliable, which makes them suitable for urology containing ureteral stents and catheters. Because it can easily move through the different channels of the renal tracts below without causing tissue damage, it is becoming a common material used in urological surgeries. Likewise, Nitinol devices are therefore applied in orthopedic uses such as spinal surgery as well as joint replacement, thanks to their properties that render the device tough while at the same time, it is bendable. Due to the increasing need for devices that cause least forms of interferences, Nitinol is gradually finding application in the expansion of multi-faceted applications in the medical field.

Nitinol Medical Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America occupies the largest share of Nitinol medical devices market because of the region’s well-developed healthcare system and a higher level of healthcare spending with emphasis on medical technologies. Currently, the three leading Nitinol using nation is the United States with high demands in cardiovascular and orthopedic fields. Chronic diseases are on the rise especially heart diseases hence sewing small devices such as stents from Nitinol with minimal invasiveness.

In addition, innovation is a strength in North America, this region is home to many of the industry’s most significant medical device makers, and these factors have kept the region top of the heap. Friendly guidelines from the North American country bureaucracy also explain why Nitinol has widely adopted in medical device crumble. In future as the market grows further, North America remains in forefront due to persistent research and development of Nitinol medical devices.

Active Key Players in the Nitinol Medical Devices Market:

Medtronic (Ireland)

Abbott Laboratories (USA)

Boston Scientific (USA)

Johnson & Johnson (USA)

Stryker Corporation (USA)

Cook Medical (USA)

Terumo Corporation (Japan)

Cardiovascular Systems, Inc. (USA)

Biotronik (Germany)

St. Jude Medical (USA)

Endologix (USA)

Conmed Corporation (USA)

Other Active Players

Key Industry Developments in the Nitinol Medical Devices Market:

On March 20, 2024, Johnson Matthey, a U.K.-based company focused on metals chemistry, is selling its medical device components business as part of a larger restructuring effort started in 2022. The segment produces components for medical devices, including nitinol metal tubing for stents and metallic coatings.

In January 2023, Resonetics, a pioneer in advanced engineering, agreed to acquire Memry Corporation and SAES Smart Materials, Inc., nitinol supply chain companies, both companies are based in the U.S. and specialize in nitinol-based medical devices. The transaction, valued at US$ 900 million, is backed by investment firms Carlyle and GTCR.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nitinol Medical Devices Market by Product Type

4.1 Nitinol Medical Devices Market Snapshot and Growth Engine

4.2 Nitinol Medical Devices Market Overview

4.3 Stents

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Stents: Geographic Segmentation Analysis

4.4 Guidewires

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Guidewires: Geographic Segmentation Analysis

4.5 Catheters

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Catheters: Geographic Segmentation Analysis

4.6 Filters

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Filters: Geographic Segmentation Analysis

4.7 Orthopedic Devices

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Orthopedic Devices: Geographic Segmentation Analysis

4.8 Other

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Other: Geographic Segmentation Analysis

Chapter 5: Nitinol Medical Devices Market by Application

5.1 Nitinol Medical Devices Market Snapshot and Growth Engine

5.2 Nitinol Medical Devices Market Overview

5.3 Cardiovascular

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cardiovascular: Geographic Segmentation Analysis

5.4 Urology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Urology: Geographic Segmentation Analysis

5.5 Orthopedics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Orthopedics: Geographic Segmentation Analysis

5.6 Gastroenterology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Gastroenterology: Geographic Segmentation Analysis

5.7 Neurology

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Neurology: Geographic Segmentation Analysis

5.8 Other

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Other: Geographic Segmentation Analysis

Chapter 6: Nitinol Medical Devices Market by End-User

6.1 Nitinol Medical Devices Market Snapshot and Growth Engine

6.2 Nitinol Medical Devices Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers (ASCs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers (ASCs): Geographic Segmentation Analysis

6.5 Clinics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Clinics: Geographic Segmentation Analysis

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nitinol Medical Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (USA)

7.4 BOSTON SCIENTIFIC (USA)

7.5 JOHNSON & JOHNSON (USA)

7.6 STRYKER CORPORATION (USA)

7.7 COOK MEDICAL (USA)

7.8 TERUMO CORPORATION (JAPAN)

7.9 CARDIOVASCULAR SYSTEMS INC. (USA)

7.10 BIOTRONIK (GERMANY)

7.11 ST. JUDE MEDICAL (USA)

7.12 ENDOLOGIX (USA)

7.13 CONMED CORPORATION (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Nitinol Medical Devices Market By Region

8.1 Overview

8.2. North America Nitinol Medical Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Stents

8.2.4.2 Guidewires

8.2.4.3 Catheters

8.2.4.4 Filters

8.2.4.5 Orthopedic Devices

8.2.4.6 Other

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Cardiovascular

8.2.5.2 Urology

8.2.5.3 Orthopedics

8.2.5.4 Gastroenterology

8.2.5.5 Neurology

8.2.5.6 Other

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers (ASCs)

8.2.6.3 Clinics

8.2.6.4 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nitinol Medical Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Stents

8.3.4.2 Guidewires

8.3.4.3 Catheters

8.3.4.4 Filters

8.3.4.5 Orthopedic Devices

8.3.4.6 Other

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Cardiovascular

8.3.5.2 Urology

8.3.5.3 Orthopedics

8.3.5.4 Gastroenterology

8.3.5.5 Neurology

8.3.5.6 Other

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers (ASCs)

8.3.6.3 Clinics

8.3.6.4 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nitinol Medical Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Stents

8.4.4.2 Guidewires

8.4.4.3 Catheters

8.4.4.4 Filters

8.4.4.5 Orthopedic Devices

8.4.4.6 Other

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Cardiovascular

8.4.5.2 Urology

8.4.5.3 Orthopedics

8.4.5.4 Gastroenterology

8.4.5.5 Neurology

8.4.5.6 Other

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers (ASCs)

8.4.6.3 Clinics

8.4.6.4 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nitinol Medical Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Stents

8.5.4.2 Guidewires

8.5.4.3 Catheters

8.5.4.4 Filters

8.5.4.5 Orthopedic Devices

8.5.4.6 Other

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Cardiovascular

8.5.5.2 Urology

8.5.5.3 Orthopedics

8.5.5.4 Gastroenterology

8.5.5.5 Neurology

8.5.5.6 Other

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers (ASCs)

8.5.6.3 Clinics

8.5.6.4 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nitinol Medical Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Stents

8.6.4.2 Guidewires

8.6.4.3 Catheters

8.6.4.4 Filters

8.6.4.5 Orthopedic Devices

8.6.4.6 Other

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Cardiovascular

8.6.5.2 Urology

8.6.5.3 Orthopedics

8.6.5.4 Gastroenterology

8.6.5.5 Neurology

8.6.5.6 Other

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers (ASCs)

8.6.6.3 Clinics

8.6.6.4 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nitinol Medical Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Stents

8.7.4.2 Guidewires

8.7.4.3 Catheters

8.7.4.4 Filters

8.7.4.5 Orthopedic Devices

8.7.4.6 Other

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Cardiovascular

8.7.5.2 Urology

8.7.5.3 Orthopedics

8.7.5.4 Gastroenterology

8.7.5.5 Neurology

8.7.5.6 Other

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers (ASCs)

8.7.6.3 Clinics

8.7.6.4 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Nitinol Medical Devices Market research report?

A1: The forecast period in the Nitinol Medical Devices Market research report is 2024-2032.

Q2: Who are the key players in the Nitinol Medical Devices Market?

A2: Medtronic (Ireland), Abbott Laboratories (USA), Boston Scientific (USA), Johnson & Johnson (USA), Stryker Corporation (USA), Cook Medical (USA), Terumo Corporation (Japan), Cardiovascular Systems, Inc. (USA), Biotronik (Germany), St. Jude Medical (USA), Endologix (USA), Conmed Corporation (USA), and Other Active Players.

Q3: What are the segments of the Nitinol Medical Devices Market?

A3: The Nitinol Medical Devices Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Stents, Guidewires, Catheters, Filters, Orthopedic Devices, Other. By Application, the market is categorized into Cardiovascular, Urology, Orthopedics, Gastroenterology, Neurology, Other. By End-User, the market is categorized into Hospitals, Ambulatory Surgical Centers (ASCs), Clinics, Other. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Nitinol Medical Devices Market?

A4: The Nitinol Medical Devices Market refers to a part of the health niche that deals with the application of Nitinol-a NiTi alloy of nickel and titanium-for the creation of medical devices. Because of some attributes including flexibility, enormous strength, and memory — Nitinol can be molded to a certain shape, and it regains that shape when heat is applied — Nitinol is extensively used in medical applications like stents and guides, orthopedic appliances etc.

Q5: How big is the Nitinol Medical Devices Market?

A5: Nitinol Medical Devices Market Size Was Valued at USD 1.9 Billion in 2023, and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 10.5% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!