Stay Ahead in Fast-Growing Economies.

Browse Reports NowCough Suppressant Drugs Market Size, Share, Growth & Forecast (2024-2032)

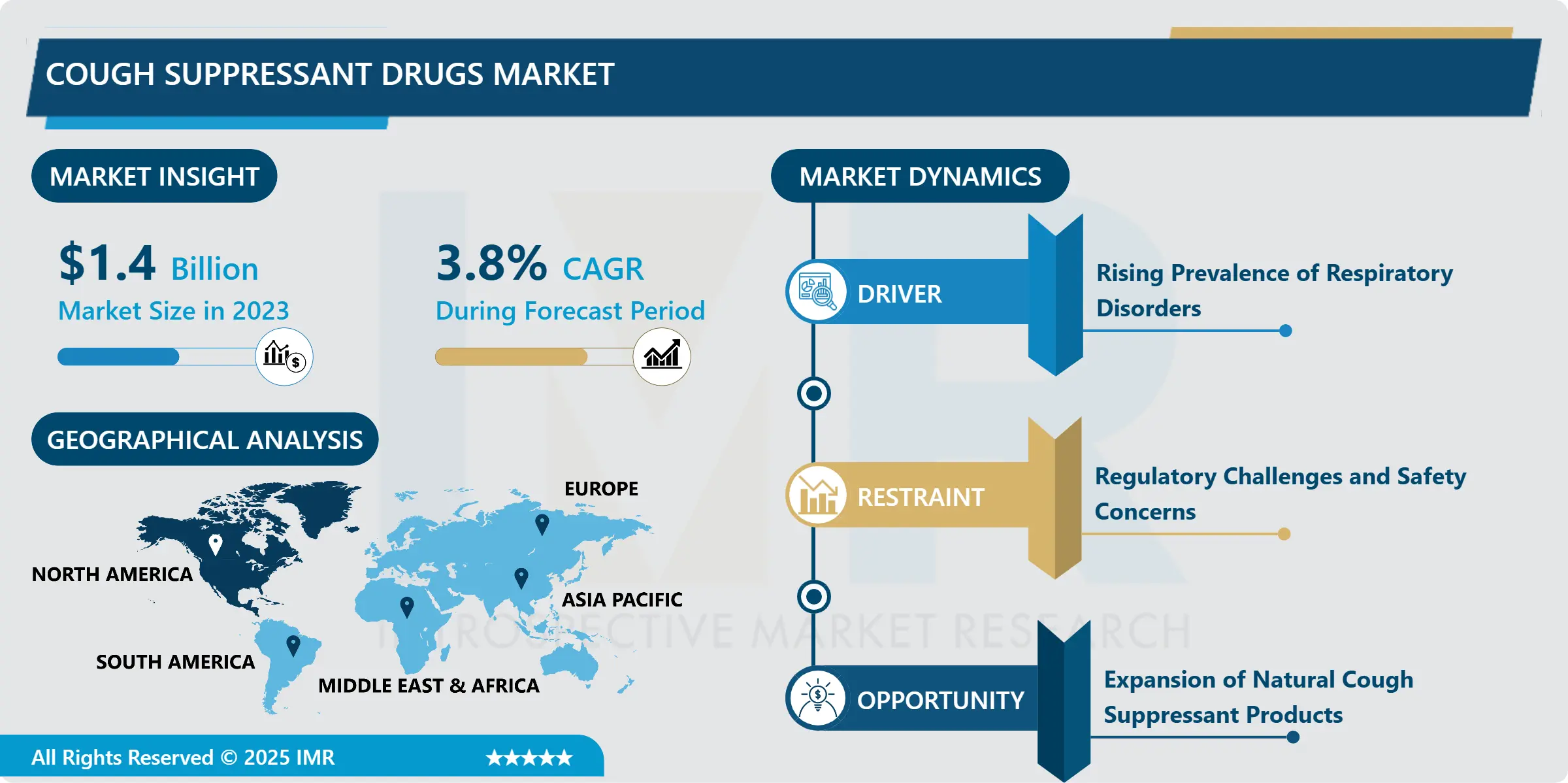

Cough Suppressant Drugs Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.0 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

IMR Group

Description

Cough Suppressant Drugs Market Synopsis:

Cough Suppressant Drugs Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.0 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

The Cough Suppressant Drugs Market refers to the analysis of the effective drugs used in limiting or in the complete stoppage of coughing. These drugs only act on the brain sites of cough, and they suppress the cough reflex of the brain. They find frequent use in the treatment of ailments like the common cold, flu and other respiratory diseases that causing coughing.

The worldwide market for cough suppressant drugs is expected to grow steadily as more people seek good treatment for pathological cough conditions and acute cough. The market is chiefly propelled majorly by increasing instances of respiratory diseases which include common cold, the flu and more severe disorders including asthma and bronchitis. The common flue is known to cause coughe, therefore there is always going to be constant demand for the products that help to ease this ail. Moreover, growing air pollution, smoking tendencies, and life style diseases, like COPD are fostering the market of cough suppressant drugs.

Cough medicines can be categorized into prescription cough medicines and counter (OTC) products. OTC products are normally believed to be used by persons with mild ailments such as dry cough, while prescription drugs are believed to be used by persons with severe conditions. This segmentation due to an expansion of the number of people who prefer to self-treat cough and gain more knowledge of cough treatment. Furthermore, a variety of drug formulations such as syrup, tablet and lozenge has created convenient to customers to select their preferred products. However, some of the issues being experienced in the market include; regulation, misuse of some ingredients such as codeine in prescription drugs, and competition from natural products.

Cough Suppressant Drugs Market Trend Analysis:

Increasing Self-medication with OTC Products

The use of medicines without a doctor’s prescription, particularly OTC cough suppressants has been on the rise in recent years. General healthcare costs are increasing, while consumers increasingly shun doctors’ trips for even mild ailments hence using OTC drugs to treat coughs and colds. These products are widely available and relatively inexpensive and are promoted as having few side effects; therefore, are appreciated by people who need fast and easy remedies. This has also been backed by increase in online pharmacy stores, e-commerce companies, where consumer can by the OTC cough suppressants without consulting with a doctor.

However, self-medication is on the rise and comes with issues like misuse and overuse of some cough suppressants which contain some ingredients that are not restricted in some Countries where laws that ban some drugs are not well implemented. This has in turn put pressure on health authorities to provide awareness of right consumption of these drugs to avoid the pitfalls that could be manifested in dependency on narcotic based suppressants like codeine among others. Despite these challenges, the tendency towards self-medication is expected to persist driving the market most actively in the developed regions with higher levels of disposable income and more active attitude towards health management

Expansion of Natural Cough Suppressant Products

The market for cough suppressant drugs has a good potential for natural or herbal cure. Nowadays, more and more emphasis on using organic products and natural products to cure day to day ailments such as coughs. Such change is due to various reasons such as side effects as well as the negative impacts of taking synthetic substances in the body for an extended period. Home remedy cough products like those with honey, menthol, and herbs like licorice root and eucalyptus are becoming popular as most people in such regions rely on natural products.

Such opportunities reveal modern firms’ enhanced production and commercialization of cough suppressant systems based on natural components and minimal chemical components. These products are especially attractive to people who use products derived from organic or plant origin or who are worried about the negative effects of synthetic chemicals to the environment or to human body. Besides, these natural products may have other uses because they can reduce throat irritation and improve respiratory health. As such, consumer demand for such products offers manufacturers a considerable opportunity to seize new share in this still nascent segment of the cough suppressant market.

Cough Suppressant Drugs Market Segment Analysis:

Cough Suppressant Drugs Market Segmented on the basis of drug type, formulation, active ingredient, distribution channel, application, end user, distribution channel, and region.

By Drug Type, Prescription-Based Cough Suppressants segment is expected to dominate the market during the forecast period

Cough suppressants based on prescription are usually recommended for more severe forms or COPD where the cough is continuous and extremely painful. Many of these products include narcotic substances, for example, codeine, they act effectively but have the potential for development of drug dependence. The availability of prescription-based cough suppressants to the public has also been a thorny issue to some regulatory bodies around the world and as such its market potential is a bit constrained.

However, prescription cough medicines are compressed by over the counter cough suppressants regarding market volume as most customers prefer self-diagnosed treatment. These products are mostly taken in coughs that accompany cold or seasonal flu and are known to be safer for use without prescription. They include products like dextromethorphan, menthol or guaifenesin products, if they cause a cough or a sore throat. These products are growing due to the increase in the availability of health-conscious consumers.

By Application, Dry Cough segment expected to held the largest share

The Dry Cough segment is expected to hold the largest share of the Cough Suppressant Drugs Market due to its widespread prevalence and increasing incidence of respiratory infections and environmental pollutants. Dry cough, characterized by the absence of mucus, is commonly associated with viral infections, allergies, and irritants, driving demand for effective symptom relief. The growing awareness among consumers regarding over-the-counter (OTC) medications and the availability of a wide range of dry cough-specific suppressants further supports market growth. Additionally, pharmaceutical companies are focusing on developing innovative, fast-acting formulations tailored for dry cough relief. These factors, coupled with increased healthcare spending and self-medication trends, contribute significantly to the dominance of the dry cough segment within the global cough suppressant drugs market.

Cough Suppressant Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is the largest market for cough suppressant drugs. This is particularly because of the costs of healthcare in the region, enhanced health care systems, and products allowed in the market and accessibility of numerous cough suppressant products. Reasons include; high level of awareness concerning respiratory health across the majority of consumers, a tremendous market for prescription as well as over the counter drugs, and the existence of a vibrant pharmaceutical market in North America. Furthermore, high geriatric population prevalence and high incidences of respiratory diseases such as asthma and chronic obstructive pulmonary disease enhance long-term demand for the therapeutic cough remedies.

Thus, the support of the regulation also contributes significantly to the market in North America. Government health departments including the U.S. FDA also check on that those cough suppressant products are safe for use. Transportation has also gained easier since the increase in online pharmacies and e-commerce stores in North America. They collectively contribute to attributing of North America alone a considerable market shares worldwide; let alone that the leadership in the market share is anticipated to remain intact in the near forecast.

Active Key Players in the Cough Suppressant Drugs Market

AbbVie (USA)

Bayer (Germany)

Eli Lilly (USA)

GlaxoSmithKline (UK)

Johnson & Johnson (USA)

Merck & Co. (USA)

Mylan (USA)

Novartis (Switzerland)

Pfizer (USA)

Reckitt Benckiser (UK)

Sanofi (France)

Teva Pharmaceutical Industries (Israel)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cough Suppressant Drugs Market by Drug Type

4.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

4.2 Cough Suppressant Drugs Market Overview

4.3 Prescription-Based Cough Suppressants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Prescription-Based Cough Suppressants: Geographic Segmentation Analysis

4.4 Over-the-Counter (OTC) Cough Suppressants

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Over-the-Counter (OTC) Cough Suppressants: Geographic Segmentation Analysis

Chapter 5: Cough Suppressant Drugs Market by Formulation

5.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

5.2 Cough Suppressant Drugs Market Overview

5.3 Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Tablets: Geographic Segmentation Analysis

5.4 Syrups

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Syrups: Geographic Segmentation Analysis

5.5 Lozenges

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Lozenges: Geographic Segmentation Analysis

5.6 Sprays

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Sprays: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Cough Suppressant Drugs Market by Active Ingredient

6.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

6.2 Cough Suppressant Drugs Market Overview

6.3 Dextromethorphan

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Dextromethorphan: Geographic Segmentation Analysis

6.4 Codeine

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Codeine: Geographic Segmentation Analysis

6.5 Benzonatate

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Benzonatate: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Cough Suppressant Drugs Market by Application

7.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

7.2 Cough Suppressant Drugs Market Overview

7.3 Dry Cough

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Dry Cough: Geographic Segmentation Analysis

7.4 Productive Cough

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Productive Cough: Geographic Segmentation Analysis

Chapter 8: Cough Suppressant Drugs Market by End User

8.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

8.2 Cough Suppressant Drugs Market Overview

8.3 Hospitals & Clinics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

8.4 Retail Pharmacies

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Retail Pharmacies: Geographic Segmentation Analysis

8.5 Online Pharmacies

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Online Pharmacies: Geographic Segmentation Analysis

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Geographic Segmentation Analysis

Chapter 9: Cough Suppressant Drugs Market by Distribution Channel

9.1 Cough Suppressant Drugs Market Snapshot and Growth Engine

9.2 Cough Suppressant Drugs Market Overview

9.3 Direct Sales

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Direct Sales: Geographic Segmentation Analysis

9.4 Third-Party Distribution

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Third-Party Distribution: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Cough Suppressant Drugs Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 JOHNSON & JOHNSON (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 GLAXOSMITHKLINE (UK)

10.4 PFIZER (USA)

10.5 NOVARTIS (SWITZERLAND)

10.6 BAYER (GERMANY)

10.7 MYLAN (USA)

10.8 SANOFI (FRANCE)

10.9 RECKITT BENCKISER (UK)

10.10 ELI LILLY (USA)

10.11 ABBVIE (USA)

MERCK & CO. (USA)

10.12 TEVA PHARMACEUTICAL INDUSTRIES (ISRAEL)

10.13 OTHER ACTIVE PLAYERS

Chapter 11: Global Cough Suppressant Drugs Market By Region

11.1 Overview

11.2. North America Cough Suppressant Drugs Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Drug Type

11.2.4.1 Prescription-Based Cough Suppressants

11.2.4.2 Over-the-Counter (OTC) Cough Suppressants

11.2.5 Historic and Forecasted Market Size By Formulation

11.2.5.1 Tablets

11.2.5.2 Syrups

11.2.5.3 Lozenges

11.2.5.4 Sprays

11.2.5.5 Others

11.2.6 Historic and Forecasted Market Size By Active Ingredient

11.2.6.1 Dextromethorphan

11.2.6.2 Codeine

11.2.6.3 Benzonatate

11.2.6.4 Others

11.2.7 Historic and Forecasted Market Size By Application

11.2.7.1 Dry Cough

11.2.7.2 Productive Cough

11.2.8 Historic and Forecasted Market Size By End User

11.2.8.1 Hospitals & Clinics

11.2.8.2 Retail Pharmacies

11.2.8.3 Online Pharmacies

11.2.8.4 Others

11.2.9 Historic and Forecasted Market Size By Distribution Channel

11.2.9.1 Direct Sales

11.2.9.2 Third-Party Distribution

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Cough Suppressant Drugs Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Drug Type

11.3.4.1 Prescription-Based Cough Suppressants

11.3.4.2 Over-the-Counter (OTC) Cough Suppressants

11.3.5 Historic and Forecasted Market Size By Formulation

11.3.5.1 Tablets

11.3.5.2 Syrups

11.3.5.3 Lozenges

11.3.5.4 Sprays

11.3.5.5 Others

11.3.6 Historic and Forecasted Market Size By Active Ingredient

11.3.6.1 Dextromethorphan

11.3.6.2 Codeine

11.3.6.3 Benzonatate

11.3.6.4 Others

11.3.7 Historic and Forecasted Market Size By Application

11.3.7.1 Dry Cough

11.3.7.2 Productive Cough

11.3.8 Historic and Forecasted Market Size By End User

11.3.8.1 Hospitals & Clinics

11.3.8.2 Retail Pharmacies

11.3.8.3 Online Pharmacies

11.3.8.4 Others

11.3.9 Historic and Forecasted Market Size By Distribution Channel

11.3.9.1 Direct Sales

11.3.9.2 Third-Party Distribution

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Cough Suppressant Drugs Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Drug Type

11.4.4.1 Prescription-Based Cough Suppressants

11.4.4.2 Over-the-Counter (OTC) Cough Suppressants

11.4.5 Historic and Forecasted Market Size By Formulation

11.4.5.1 Tablets

11.4.5.2 Syrups

11.4.5.3 Lozenges

11.4.5.4 Sprays

11.4.5.5 Others

11.4.6 Historic and Forecasted Market Size By Active Ingredient

11.4.6.1 Dextromethorphan

11.4.6.2 Codeine

11.4.6.3 Benzonatate

11.4.6.4 Others

11.4.7 Historic and Forecasted Market Size By Application

11.4.7.1 Dry Cough

11.4.7.2 Productive Cough

11.4.8 Historic and Forecasted Market Size By End User

11.4.8.1 Hospitals & Clinics

11.4.8.2 Retail Pharmacies

11.4.8.3 Online Pharmacies

11.4.8.4 Others

11.4.9 Historic and Forecasted Market Size By Distribution Channel

11.4.9.1 Direct Sales

11.4.9.2 Third-Party Distribution

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Cough Suppressant Drugs Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Drug Type

11.5.4.1 Prescription-Based Cough Suppressants

11.5.4.2 Over-the-Counter (OTC) Cough Suppressants

11.5.5 Historic and Forecasted Market Size By Formulation

11.5.5.1 Tablets

11.5.5.2 Syrups

11.5.5.3 Lozenges

11.5.5.4 Sprays

11.5.5.5 Others

11.5.6 Historic and Forecasted Market Size By Active Ingredient

11.5.6.1 Dextromethorphan

11.5.6.2 Codeine

11.5.6.3 Benzonatate

11.5.6.4 Others

11.5.7 Historic and Forecasted Market Size By Application

11.5.7.1 Dry Cough

11.5.7.2 Productive Cough

11.5.8 Historic and Forecasted Market Size By End User

11.5.8.1 Hospitals & Clinics

11.5.8.2 Retail Pharmacies

11.5.8.3 Online Pharmacies

11.5.8.4 Others

11.5.9 Historic and Forecasted Market Size By Distribution Channel

11.5.9.1 Direct Sales

11.5.9.2 Third-Party Distribution

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Cough Suppressant Drugs Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Drug Type

11.6.4.1 Prescription-Based Cough Suppressants

11.6.4.2 Over-the-Counter (OTC) Cough Suppressants

11.6.5 Historic and Forecasted Market Size By Formulation

11.6.5.1 Tablets

11.6.5.2 Syrups

11.6.5.3 Lozenges

11.6.5.4 Sprays

11.6.5.5 Others

11.6.6 Historic and Forecasted Market Size By Active Ingredient

11.6.6.1 Dextromethorphan

11.6.6.2 Codeine

11.6.6.3 Benzonatate

11.6.6.4 Others

11.6.7 Historic and Forecasted Market Size By Application

11.6.7.1 Dry Cough

11.6.7.2 Productive Cough

11.6.8 Historic and Forecasted Market Size By End User

11.6.8.1 Hospitals & Clinics

11.6.8.2 Retail Pharmacies

11.6.8.3 Online Pharmacies

11.6.8.4 Others

11.6.9 Historic and Forecasted Market Size By Distribution Channel

11.6.9.1 Direct Sales

11.6.9.2 Third-Party Distribution

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Cough Suppressant Drugs Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Drug Type

11.7.4.1 Prescription-Based Cough Suppressants

11.7.4.2 Over-the-Counter (OTC) Cough Suppressants

11.7.5 Historic and Forecasted Market Size By Formulation

11.7.5.1 Tablets

11.7.5.2 Syrups

11.7.5.3 Lozenges

11.7.5.4 Sprays

11.7.5.5 Others

11.7.6 Historic and Forecasted Market Size By Active Ingredient

11.7.6.1 Dextromethorphan

11.7.6.2 Codeine

11.7.6.3 Benzonatate

11.7.6.4 Others

11.7.7 Historic and Forecasted Market Size By Application

11.7.7.1 Dry Cough

11.7.7.2 Productive Cough

11.7.8 Historic and Forecasted Market Size By End User

11.7.8.1 Hospitals & Clinics

11.7.8.2 Retail Pharmacies

11.7.8.3 Online Pharmacies

11.7.8.4 Others

11.7.9 Historic and Forecasted Market Size By Distribution Channel

11.7.9.1 Direct Sales

11.7.9.2 Third-Party Distribution

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Global Cough Suppressant Drugs Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 1.4 Billion

Forecast Period 2024-32 CAGR:

3.8%

Market Size in 2032:

USD 2.0 Billion

Segments Covered:

By Drug Type

Prescription-Based Cough Suppressants

Over-the-Counter (OTC) Cough Suppressants

By Formulation

Tablets

Syrups

Lozenges

Sprays

Others

By Active Ingredient

Dextromethorphan

Codeine

Benzonatate

Others

By Application

Dry Cough

Productive Cough

By End User

Hospitals & Clinics

Retail Pharmacies

Online Pharmacies

Others

By Distribution Channel

Direct Sales

Third-Party Distribution

By Region

North America (U.S., Canada, Mexico)

Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

Rising Prevalence of Respiratory Disorders

Key Market Restraints:

Regulatory Challenges and Safety Concerns

Key Opportunities:

Expansion of Natural Cough Suppressant Products

Companies Covered in the report:

Johnson & Johnson (USA), GlaxoSmithKline (UK), Pfizer (USA), Novartis (Switzerland), Bayer (Germany), Mylan (USA), Sanofi (France), and Other Active Players.

Q1: What would be the forecast period in the Cough Suppressant Drugs Market research report?

A1: The forecast period in the Cough Suppressant Drugs Market research report is 2024-2032.

Q2: Who are the key players in the Cough Suppressant Drugs Market?

A2: AbbVie (USA), Bayer (Germany), Eli Lilly (USA), GlaxoSmithKline (UK), Johnson & Johnson (USA), Merck & Co. (USA), Mylan (USA), Novartis (Switzerland), Pfizer (USA), Reckitt Benckiser (UK), Sanofi (France), Teva Pharmaceutical Industries (Israel), Other Active Players

Q3: What are the segments of the Cough Suppressant Drugs Market?

A3: The Cough Suppressant Drugs Market is segmented into Drug Type, Formulation, Active Ingredients, Distribution Channel, Application, End User and region. By Drug Type, the market is categorized into Prescription-Based Cough Suppressants, Over-the-Counter (OTC) Cough Suppressants. By Formulation, the market is categorized into Tablets, Syrups, Lozenges, Sprays, Others. By Active Ingredient, the market is categorized into Dextromethorphan, Codeine, Benzonatate, Others. By Application, the market is categorized into Dry Cough, Productive Cough. By End User, the market is categorized into Hospitals & Clinics, Retail Pharmacies, Online Pharmacies, Others. By Distribution Channel, the market is categorized into Direct Sales, Third-Party Distribution. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Cough Suppressant Drugs Market?

A4: The Cough Suppressant Drugs Market refers to the analysis of the effective drugs used in limiting or in the complete stoppage of coughing. These drugs only act on the brain sites of cough, and they suppress the cough reflex of the brain. They find frequent use in the treatment of ailments like the common cold, flu and other respiratory diseases that causing coughing.

Q5: How big is the Cough Suppressant Drugs Market?

A5: Cough Suppressant Drugs Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.0 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!