Stay Ahead in Fast-Growing Economies.

Browse Reports NowMouthwash Market Size, Share, Growth & Forecast (2024-2032)

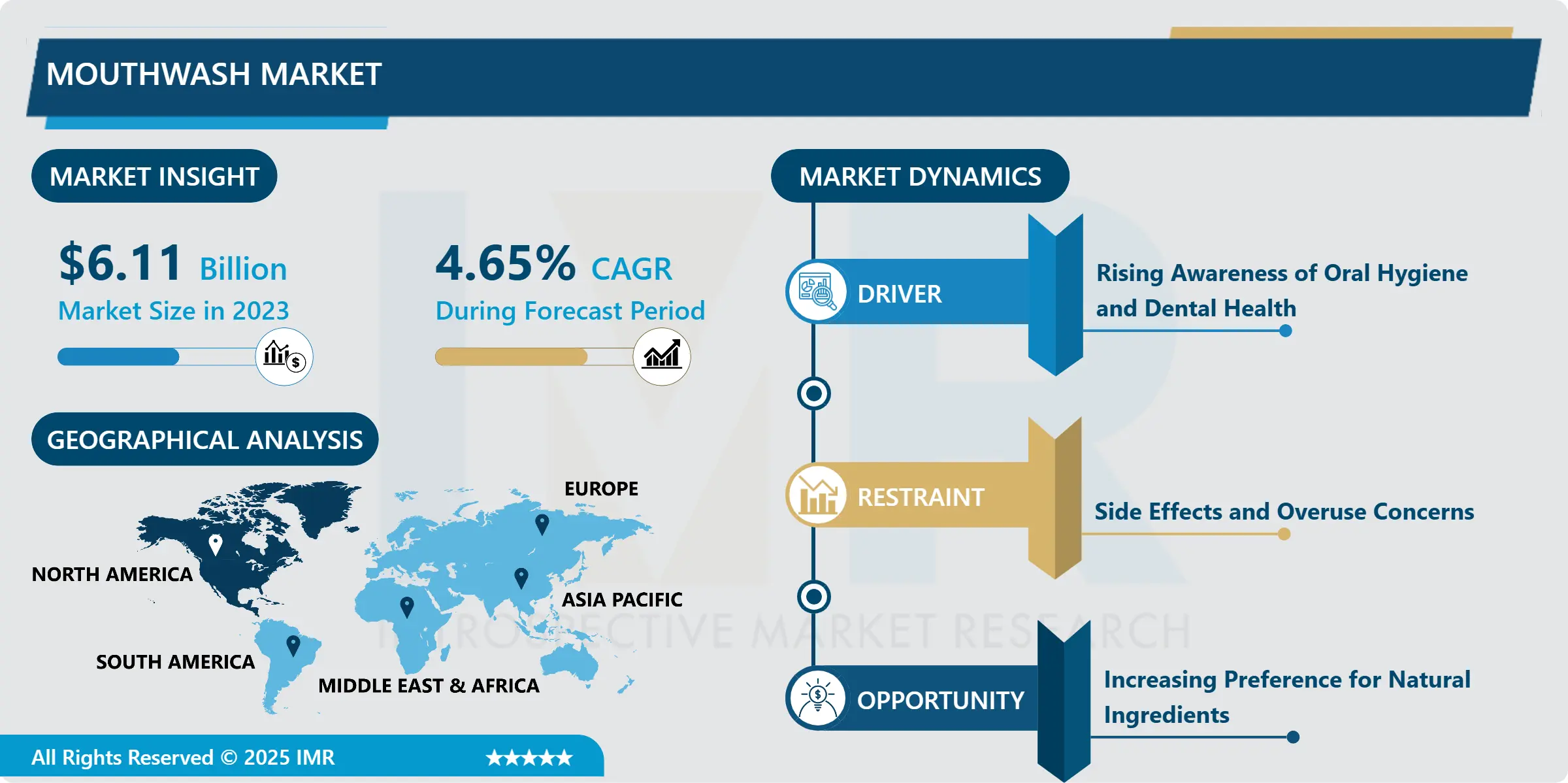

Mouthwash Market Size Was Valued at USD 6.11 Billion in 2023, and is Projected to Reach USD 9.20 Billion by 2032, Growing at a CAGR of 4.65% From 2024-2032.

IMR Group

Description

Mouthwash Market Synopsis:

Mouthwash Market Size Was Valued at USD 6.11 Billion in 2023, and is Projected to Reach USD 9.20 Billion by 2032, Growing at a CAGR of 4.65% From 2024-2032.

The mouthwash category refers to the business of manufacturing, selling and marketing of mouthwash products that are products intended to help enhance the cleanliness of the oral cavity by killing germs, enhancing on the breath, and encouraging the growth of stronger gums. These products are in different forms depending on the intended therapeutic and cosmetic purposes and come in as an additional product in a normal regimen of brushing and flossing.

The global market for mouthwash has been growing over the past few years due to enhanced consumer awareness and the growth in cases of dental problems. Mouth wash is used together with brushes and flosses, which makes it convenient and efficiency in the cleaning of mouth. The market can be segmented based on products and the major activities which are healing mouthwash for specific problems such as gums diseases and plagues, tooth sensitivity and cosmetic mouthwash for these purposes as well as for freshening the breath and whitening of the teeth. This is because; there has been a shift towards emphasis on preventive dental care and the continued launch and spread of over the counter mouthwash oral care products.

It is the same for the formulations, new products that can be alcohol-free or containing aloe vera, tea tree oil and so on. Also, there is a shift to value added mouthwash products such as products that provide not only with superior fresh breath but also includes features such as teeth whitening. With consumers getting conscious about their health, people these days are looking for oral hygiene products that help maintain not only their teeth but also have some other uses such as anti bacterial and fluouride which has resulted in the increased sales of disinfecting rinses. Due to the increasing number of consumers looking for better oral hygiene solutions and due to the increasing number of personalized mouthwashes being developed, the market for mouthwash is expected to grow even further.

Mouthwash Market Trend Analysis:

Growing Demand for Alcohol-Free Mouthwashes

One of the key market trends currently distinguishing mouthwash is growing consumer preference for a mouthwash without alcohol. Alcohol-containing mouth rinses are bactericidal, produce a refreshed feeling, and have anticarogenic properties but they cause painful burning sensation in the mouth which has informed the search for non-alcohol containing mouth rinses. The Listerine total care formulation series advertised as alcohol-free mouth washes are accepted as not harming the gums and other oral tissues, and as such this product series enjoys great use among those with sensitive mouth conditions including those with dry mouth or oral ulcers. These products are also consumed by customers who pay attention to genuine oral care products because most alcohol-free mouthwashes are made with additives such as oils, aloe, and herbs.

The cause of this trend is increased consumer awareness about side effects alcohol in oral care products. With new consumers’ focus on healthy living, there is enough demand for mouthwash that provides a natural solution to oral care. Moreover, there is an additional market for alcohol free products, with more choices of product variants and new solution formulations which have therapeutic as well as cosmetic uses For instance, mouthwash containing fluoride which can assist in preventing dental caries but still can be used in an alcohol free mild version. As the customer base expands, manufacturers of mouthwash are targeting on coming up with alcohol-free mouthwash products so as to capture entire customer base with the ever growing preference for healthier products.

Increasing Preference for Natural Ingredients

Analyzing the opportunities in the market of mouthwash it should be noted that there is high potential for the development of products containing natural and organic components. People are conscious of the presence of chemicals and additives used in the products they use on a daily basis, including mouthwash; most of them are opting for products made from natural products such as tea tree oil, aloe Vera and herbal extracts. These ingredients are often advertised as possessing antibacterial, anti-inflammatory and skin-soothing properties which are a selling point to modern consumer who look for eco-friendly and healthy products.

The following trend has therefore added a natural impulse for manufacturers to start developing newer mouthwash products which will be in demand. Emphasis on usage of natural and sustainable elements in the food preparation, packaging and other food related products can help firms tap into the two major healthy and realizing segments in the market. Trends toward plant-based and non-animal tested products are likely to persist to support the growth of mouthwash with additional functional features and a cleaner label. Following increased market demand for natural products, this development offers a wide prospect of growth to companies interested in meeting the altering consumer needs.

Mouthwash Market Segment Analysis:

Mouthwash Market is Segmented on the basis of Product Type, Form, Flavors, Application, End User, and Region.

By Product Type, Therapeutic segment is expected to dominate the market during the forecast period

Classification of mouthwash products can be done according to their formulation and the general functions it has. They are classified into therapeutic mouthwash and cosmetic mouthwash aimed at addressing consumers’ distinctive requirements. Anti-plaque and anti-gingival therapeutic mouthwashes contain compounds that help deal with oral problems which include gum diseases, plaque and cavity. They include these products are relatively unique and are mostly prescribed by practitioners in the dental field. Cosmetic mouthwash on the other hand is intended to have the effects of revitalizing breath and offering the sense of cleanse, hence can be used normally by the public in their daily oral care regime. Mouthwash products are share widely in many forms and with different therapeutic functions, some of which are cosmetical products as well.

The rise in the number of people shifting to alcohol-free mouthwash is also positively affecting both asept+ and oral-exclusive biz, as consumers mature toward a healthier lifestyle with gentle natural products. Moreover, a new trend has emerged in mouthwashes, which use fluoride or other preventive active agents as therapeutic products. The increasing awareness about the general oral health and hygiene will help the market to grow and increase more demand in mouthwash products with special purpose.

By End User, Individual segment expected to held the largest share

Individual segment is those consumers using mouthwash products personally in their households. This segment mainly includes basic human needs to use products for mouth and teeth cleansing for fresh breath, shiny teeth, and healthy gums. Consumers usually buy mouthwash for use within their homes and many are driven by variables such as ease of use, taste as well as the price.

Special care section comprises of mouthwash products used in dental clinics, hospitals and other medical facilities. Many of these mouth rinses are further specific and are used as per the dental treatments for the patients suffering from special dental conditions like gingivitis, oral infections or after surgery recovery. This segment mainly is often concentrated on the therapeutic mouthwashes that have a scientifically tested value and consumers of this segment are often likely to be influenced by prescriptions from dentists.

Mouthwash Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is the leading region of the mouthwash market due to the higher demographic awareness and the significant usage of dental care products. A key factor is a highly developed health care system in the region since oral care is dependent on the advanced facilities and systems; the consumers have relatively higher purchasing power in North America in terms of oral care products. With major manufacturers and a robust retail system in its region, the North America continues to dictate the market.

North America region which is characterized by high standard of living Boom of preventive oral care solutions This entails a rise in need for mouthwash products that offer enhanced features such as cavity protection from fluoride, a non-alcoholic solution for sensitive mouth, and natur Normally; mouthwash products are also used as a supplement mouthwash, with higher growth rates identified in aspects like the need for fluoride for cavity protection, alcohol-free mouthwash for those with sensitive mouth tissues and natural mouthwash. But at the same time there are signs of premiumisation that is consumers are willing to pay a higher price for a narrow range of mouthwash products that are tailored to their needs being a sign of further increase of the position of the market from North America all over the world.

Active Key Players in the Mouthwash Market:

Colgate-Palmolive (USA)

Procter & Gamble (USA)

Johnson & Johnson (USA)

Unilever (UK)

GlaxoSmithKline (UK)

Henkel AG (Germany)

The Himalaya Drug Company (India)

Dabur India Limited (India)

Sanofi (France)

Liwayway (China)

Marico Limited (India)

Kao Corporation (Japan)

Other Active Players

Key Industry Developments in the Mouthwash Market:

In January 2023, Listerine introduced its cool mint zero alcohol concentrate in refill packs in 100-mL PET bottles. As per the company, the new packs used 60% less plastic than the standard 500-mL bottle packs of Listerine while offering the same benefits.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mouthwash Market by Product Type

4.1 Mouthwash Market Snapshot and Growth Engine

4.2 Mouthwash Market Overview

4.3 Therapeutic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Therapeutic: Geographic Segmentation Analysis

4.4 Cosmetic

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cosmetic: Geographic Segmentation Analysis

Chapter 5: Mouthwash Market by Form

5.1 Mouthwash Market Snapshot and Growth Engine

5.2 Mouthwash Market Overview

5.3 Liquid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Liquid: Geographic Segmentation Analysis

5.4 Gel

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Gel: Geographic Segmentation Analysis

5.5 Spray

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Spray: Geographic Segmentation Analysis

Chapter 6: Mouthwash Market by Flavors

6.1 Mouthwash Market Snapshot and Growth Engine

6.2 Mouthwash Market Overview

6.3 Mint

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Mint: Geographic Segmentation Analysis

6.4 Fruit

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fruit: Geographic Segmentation Analysis

6.5 Herbal

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Herbal: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Mouthwash Market by End User

7.1 Mouthwash Market Snapshot and Growth Engine

7.2 Mouthwash Market Overview

7.3 Individual

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Individual: Geographic Segmentation Analysis

7.4 Professional (Dental Clinics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Professional (Dental Clinics: Geographic Segmentation Analysis

7.5 Hospitals)

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Hospitals): Geographic Segmentation Analysis

Chapter 8: Mouthwash Market by Sales Channel

8.1 Mouthwash Market Snapshot and Growth Engine

8.2 Mouthwash Market Overview

8.3 Online

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Online: Geographic Segmentation Analysis

8.4 Offline

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Offline: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Mouthwash Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 COLGATE-PALMOLIVE (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 PROCTER & GAMBLE (USA)

9.4 JOHNSON & JOHNSON (USA)

9.5 UNILEVER (UK)

9.6 GLAXOSMITHKLINE (UK)

9.7 HENKEL AG (GERMANY)

9.8 THE HIMALAYA DRUG COMPANY (INDIA)

9.9 DABUR INDIA LIMITED (INDIA)

9.10 SANOFI (FRANCE)

9.11 LIWAYWAY (CHINA)

9.12 MARICO LIMITED (INDIA)

9.13 KAO CORPORATION (JAPAN)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Mouthwash Market By Region

10.1 Overview

10.2. North America Mouthwash Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Product Type

10.2.4.1 Therapeutic

10.2.4.2 Cosmetic

10.2.5 Historic and Forecasted Market Size By Form

10.2.5.1 Liquid

10.2.5.2 Gel

10.2.5.3 Spray

10.2.6 Historic and Forecasted Market Size By Flavors

10.2.6.1 Mint

10.2.6.2 Fruit

10.2.6.3 Herbal

10.2.6.4 Others

10.2.7 Historic and Forecasted Market Size By End User

10.2.7.1 Individual

10.2.7.2 Professional (Dental Clinics

10.2.7.3 Hospitals)

10.2.8 Historic and Forecasted Market Size By Sales Channel

10.2.8.1 Online

10.2.8.2 Offline

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Mouthwash Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Product Type

10.3.4.1 Therapeutic

10.3.4.2 Cosmetic

10.3.5 Historic and Forecasted Market Size By Form

10.3.5.1 Liquid

10.3.5.2 Gel

10.3.5.3 Spray

10.3.6 Historic and Forecasted Market Size By Flavors

10.3.6.1 Mint

10.3.6.2 Fruit

10.3.6.3 Herbal

10.3.6.4 Others

10.3.7 Historic and Forecasted Market Size By End User

10.3.7.1 Individual

10.3.7.2 Professional (Dental Clinics

10.3.7.3 Hospitals)

10.3.8 Historic and Forecasted Market Size By Sales Channel

10.3.8.1 Online

10.3.8.2 Offline

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Mouthwash Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Product Type

10.4.4.1 Therapeutic

10.4.4.2 Cosmetic

10.4.5 Historic and Forecasted Market Size By Form

10.4.5.1 Liquid

10.4.5.2 Gel

10.4.5.3 Spray

10.4.6 Historic and Forecasted Market Size By Flavors

10.4.6.1 Mint

10.4.6.2 Fruit

10.4.6.3 Herbal

10.4.6.4 Others

10.4.7 Historic and Forecasted Market Size By End User

10.4.7.1 Individual

10.4.7.2 Professional (Dental Clinics

10.4.7.3 Hospitals)

10.4.8 Historic and Forecasted Market Size By Sales Channel

10.4.8.1 Online

10.4.8.2 Offline

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Mouthwash Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Product Type

10.5.4.1 Therapeutic

10.5.4.2 Cosmetic

10.5.5 Historic and Forecasted Market Size By Form

10.5.5.1 Liquid

10.5.5.2 Gel

10.5.5.3 Spray

10.5.6 Historic and Forecasted Market Size By Flavors

10.5.6.1 Mint

10.5.6.2 Fruit

10.5.6.3 Herbal

10.5.6.4 Others

10.5.7 Historic and Forecasted Market Size By End User

10.5.7.1 Individual

10.5.7.2 Professional (Dental Clinics

10.5.7.3 Hospitals)

10.5.8 Historic and Forecasted Market Size By Sales Channel

10.5.8.1 Online

10.5.8.2 Offline

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Mouthwash Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Product Type

10.6.4.1 Therapeutic

10.6.4.2 Cosmetic

10.6.5 Historic and Forecasted Market Size By Form

10.6.5.1 Liquid

10.6.5.2 Gel

10.6.5.3 Spray

10.6.6 Historic and Forecasted Market Size By Flavors

10.6.6.1 Mint

10.6.6.2 Fruit

10.6.6.3 Herbal

10.6.6.4 Others

10.6.7 Historic and Forecasted Market Size By End User

10.6.7.1 Individual

10.6.7.2 Professional (Dental Clinics

10.6.7.3 Hospitals)

10.6.8 Historic and Forecasted Market Size By Sales Channel

10.6.8.1 Online

10.6.8.2 Offline

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Mouthwash Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Product Type

10.7.4.1 Therapeutic

10.7.4.2 Cosmetic

10.7.5 Historic and Forecasted Market Size By Form

10.7.5.1 Liquid

10.7.5.2 Gel

10.7.5.3 Spray

10.7.6 Historic and Forecasted Market Size By Flavors

10.7.6.1 Mint

10.7.6.2 Fruit

10.7.6.3 Herbal

10.7.6.4 Others

10.7.7 Historic and Forecasted Market Size By End User

10.7.7.1 Individual

10.7.7.2 Professional (Dental Clinics

10.7.7.3 Hospitals)

10.7.8 Historic and Forecasted Market Size By Sales Channel

10.7.8.1 Online

10.7.8.2 Offline

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Mouthwash Market research report?

A1: The forecast period in the Mouthwash Market research report is 2024-2032.

Q2: Who are the key players in the Mouthwash Market?

A2: Colgate-Palmolive (USA), Procter & Gamble (USA), Johnson & Johnson (USA), Unilever (UK), GlaxoSmithKline (UK), Henkel AG (Germany), The Himalaya Drug Company (India), Dabur India Limited (India), Sanofi (France), Liwayway (China), Marico Limited (India), Kao Corporation (Japan), and Other Active Players.

Q3: What are the segments of the Mouthwash Market?

A3: The Mouthwash Market is segmented into Product Type, Form, Flavors, Sales Channel, End User and region. By Product Type, the market is categorized into Therapeutic, Cosmetic. By Form, the market is categorized into Liquid, Gel, Spray. By Flavors, the market is categorized into Mint, Fruit, Herbal, Others. By End User, the market is categorized into Individual, Professional. By Sales Channel, the market is categorized into Online, Offline. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Mouthwash Market?

A4: The mouthwash category refers to the business of manufacturing, selling and marketing of mouthwash products that are products intended to help enhance the cleanliness of the oral cavity by killing germs, enhancing on the breath, and encouraging the growth of stronger gums. These products are in different forms depending on the intended therapeutic and cosmetic purposes and come in as an additional product in a normal regimen of brushing and flossing.

Q5: How big is the Mouthwash Market?

A5: Mouthwash Market Size Was Valued at USD 6.11 Billion in 2023, and is Projected to Reach USD 9.20 Billion by 2032, Growing at a CAGR of 4.65% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!