Stay Ahead in Fast-Growing Economies.

Browse Reports NowAgricultural Micronutrients Market Key Developments, Demand & Forecast Report (2024-2032)

Agricultural micronutrients market includes production/procurement, distribution and application of some minor essential nutrients like Zinc, Iron, Manganese, Copper, Boron, Molybdenum and Chlorine which are necessary in quantities much lower than macro nutrients but equally as important for good plant-health and high-yield.

IMR Group

Description

Agricultural Micronutrients Market Synopsis:

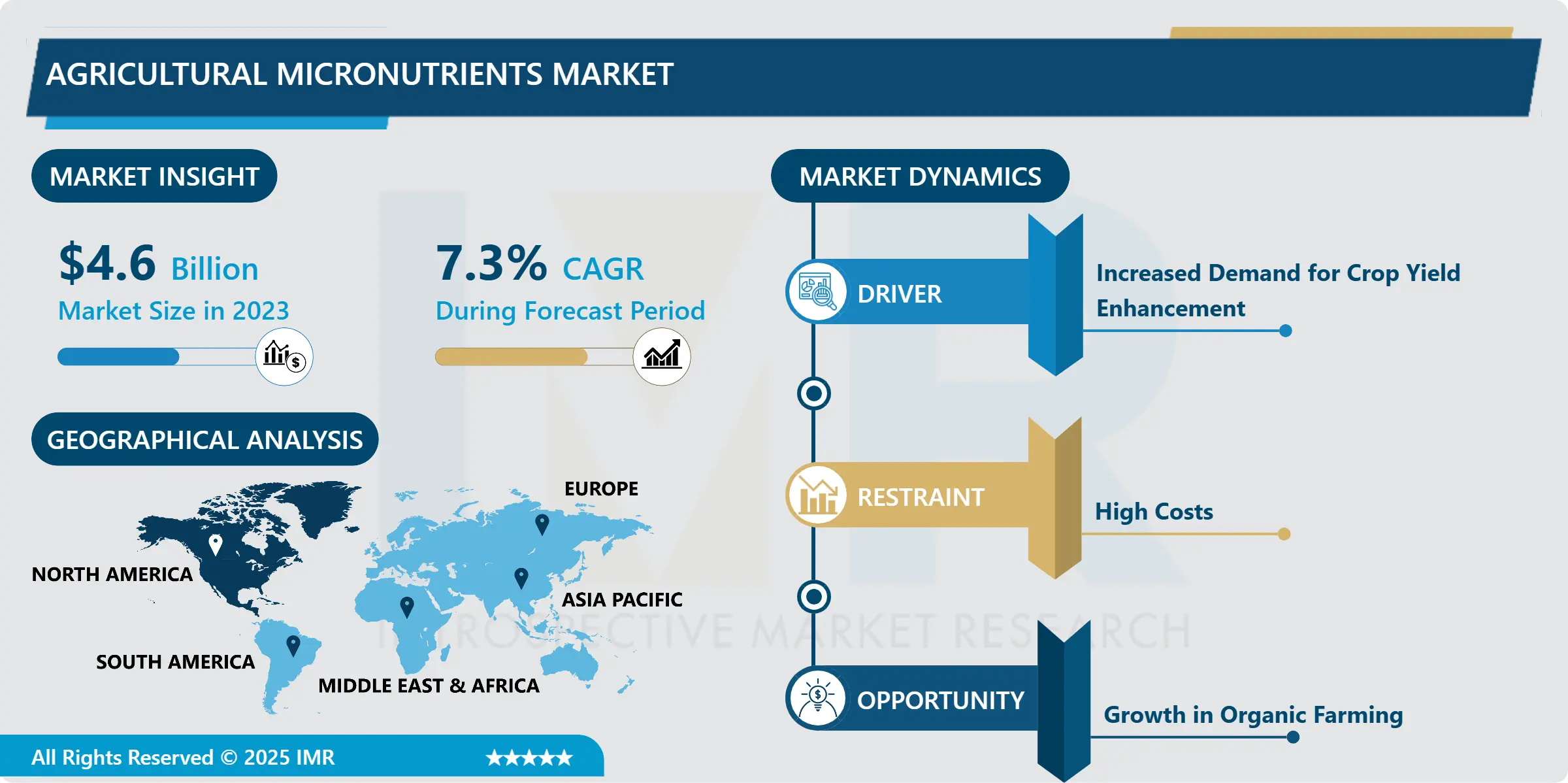

Agricultural Micronutrients Market Size Was Valued at USD 4.60 Billion in 2023, and is Projected to Reach USD 8.67 Billion by 2032, Growing at a CAGR of 7.30% From 2024-2032.

Agricultural micronutrients market includes production/procurement, distribution and application of some minor essential nutrients like Zinc, Iron, Manganese, Copper, Boron, Molybdenum and Chlorine which are necessary in quantities much lower than macro nutrients but equally as important for good plant-health and high-yield. They cover micro nutrients in the soil and crops in order to fill the lacking nutrients in plants, better and qualified yield and resistance towards diseases. The market is fueled by a growing population’s need for food and the reduction in the number of tracts of land where farming is possible and useful, as well as the rising trend in precision agriculture that ensures the optimal application of fertilizers and other amendments on tracts of land to harvest the best yield.

The global market for Agricultural Micronutrients can be observed to be in a constant growth path essentially because of the changes in perception regarding the health of soil as well as how effective ruthrengthening micronutrients act in enhancing productivity and quality of the crops. Zinc, iron, boron, manganese, copper just as its name suggests are a micronutrient but are also very essential for plant growth and development. An increasing global population and declining availability and accessibility of arable land for land development have boosted the world’s food requirements, hence the need to increase food production, in particular, through better utilisation of available nutrients. Also, the growing use of the precision farming business approach and the enhancement of focus on sustainable farming have created a demand for micronutrient-fortified fertilizers. Such improvements are made possible by constant research and innovation that seeks to produce specific additional micronutrient formulations.

Regionally, Asia-Pacific holds the largest share in the agricultural micronutrients market due to the high use of agriculture in countries such as India and China and the steady increase in farmers’ knowledge about the advantages of adding micronutrients to the system. North America and Europe are also a large market brought by technological progress in the sphere of agriculture and by strict observance of the quality requirements for crops. In view of this, governments and agricultural organizations in many countries are adopting policies towards the use of micronutrients for correcting the mineral deficiencies of the soil and enhancing the plants ability to withstand environmental stresses. Given the growth trend and forecasted rise in adoption across developing as well as developed nations, the market is anticipated to exhibit strong development in the future fueled by need to address food insecurity and sustainable growing techniques.

Agricultural Micronutrients Market Trend Analysis:

Adoption of Micronutrient-Enriched Fertilizers

As these elements are lacking in the soil and the situation continually degrades farmers are adopting hi-tech agriculture to overcome this vice. Such depletions, occasioned by simple railing, steep cultivation, as well as growing a single crop season after season have badly affected the fertility of the soil and crop yields. To deal with this challenge therefore, micronutrient-enriched fertilizers have taken the simplest and most active forms of improving yields besides plant health. The former aids farmers in increasing yields while the latter measures guard against exhaustion of such nutrients in areas where farmers have engaged in intensive farming. Consequently, micronutrient solutions have become practically essential in modern agriculture and have experienced significant demand in recent years.

The governments are actually credited for precisely fuelling this trend as they are using micronutrients to pursue national food security goals and of course, to better the income of farmers. Farmers adopting these solutions have been reached through subsidies, awareness campaigns, and other agricultural extension programs because of realizing long terms advantages of improving soil and crop quality. Such policy intervention is also playing a major role in the growth of the agricultural micronutrients market since a greater focus is placed on soil replenishment and sustainable farming. These factors are in synergy to provide a firm ground for agricultural micronutrient products uptake across the world.

Advancements in the Agricultural Micronutrients Market

Ongoing concerns of land availability and rapid land intensification due to urbanization and soil land degradation has forced farmers to seek for hi-tech system in culturing and improving on crop yields. Trace elements such as zinc, iron, boron, and manganese are now acknowledged as key nutrients necessary for the replenishment of depleted soils, for stimulating plant vigor, and enhancing production rates. The use of these micronutrients is gradually increasing in developing economies where such nutrient-deficient soils are commonly found to support agricultural production needs in their region. This growing demand is further driven by the farmers’ awareness of the value of micronutrients for enhancing the plants’ disease tolerance and improving overall crop quality, hence presenting good potential for market development.

The increasing consciousness towards sustainable farming and the increasing acceptance of advanced technologies is also adding to the demand for the agricultural micronutrients. Oil and fertilizer application tools, for example, allow nutrients to be delivered to the right place at the right time and in the right amount, thereby conserving costs, resources and the environment. Furthermore, there is enough policies in governments that are focusing on sustainable agriculture and polices for the adoption of micronutrient where farmers are likely to drive them as solutions. As knowledge increases regarding its effectiveness and as pressure for enhanced produce yields specifically in the uncertain and marginal nutrient terrains increases, micronutrients remain a must-have tool in the modern farming techniques creating the future growth opportunities.

Agricultural Micronutrients Market Segment Analysis:

Agricultural Micronutrients Market is segmented on the basis of By Type, Crop Type, Form, Application Mode, and Region.

By Type, Zinc segment is expected to dominate the market during the forecast period

Zinc is an important micronutrient in plants influencing a multiplicity of biochemical operations including enzyme activation, protein synthesis and even formation of chlorophylls. These processes are crucial in growth and development of plants. Deficiency symptoms include: stunted growth, chlorosis and reduced vigour in plants as follows: Forage crops utilized for cereal, oil seed and vegetables are most sensitive to zinc deficits as common in soil which contain low levels of zinc. As such, zinc-based fertilizers are applied to correct these shortages in order to enhance the health of plants, their growth and productivity.

Market for zinc in agriculture remains buoyant and firm as more farmers appreciate the use of the micronutrient to improve yield, and disease resistance, among other uses. Zinc containing fertilizers are used in areas with deficiencies of this micronutrient in the soil and are a fundamental component in the management of crop yield. Additionally, zinc fertilizers’ market is predicted to grow at a moderate rate because of the growing popularity of micronutrient fertilizers all over the world, and the need to improve agricultural productivity through the development of more efficient fertilizers due to world population growth.

By Application Mode, Soil segment expected to held the largest share

Soil application commonly known as broadcast application is perhaps the oldest and most extensive method in which fertilizers are spread over the field, and nutrients are taken in by the roots of plants as they seep through the soil. This method if preferred for packaged fertilizers which are in solid form and can either be mixed with the soil or broadcasted on the field, powdery fertilizers included. The controlled release of nutrients in soil applied fertilizers makes sure that the availability of dietary important elements is constant after some time and beneficial for plants. Besides, this method assists in preserving the soil fertility; the staple nutrients are not washed away while the plants all get the needed nutrients for their growth.

Soil application is considered widely in commercial farming activities and with the field crops such as cereals and grains and oil seeds. This is most especially true for plants that need a consistent flow of nutrients all through their development process. Owing to its low-cost implication and simplicity, soil fertilization is still favored by farmers who wish to carryout crop production for an extended period. This to method also minimize over application of fertilizers thus minimize nutrient leaching, environmental pollution and effects on water bodies. With increased and constant call for sustainable agriculture chasing high and sustainable returns, the use of fertilizers from the aerial application viewed from soil application remains paramount in feeding the world and enhancing crop yields globally.

Agricultural Micronutrients Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America and the agricultural micronutrients market is influenced by such factors as North American agriculture and technologies. Precision farming is a modern technique, where the farming is done using instruments such as sensors, data analines and GPS; the two countries in the basin, the U.S. And Canada are referred to be most advanced in this technique of farming. That means, there is increasing tendency of micronutrients application spurred on by technological influence in agriculture as farmers consider ways to enrich the fertility of the soil as well as make crops more resistance to various ailments. Specifically, micronutrient fertilizers are very important components in replenishing the nutrient qualities that are essential in modern efficient farming systems. In particular, micronutrient supplementation has become an essential approach to boost productivity when crop production increased without additional resource utilization in the region.

The growth of the agricultural micronutrients market in North America is also supported by the use of sustainable agriculture practices. Both the US and Canada have gradually placed policies that seek to favor farming with minimal effects on the environment; this includes use of micronutrient fertilizer among others. All these measures have been intended not only for enhancing nutrient content on the soil but also to minimize the usage of even more toxic chemical fertilizers. And most importantly, the subsidies and support programs that the governments all over the world have introduced are favoring the use of micronutrients to farmers by supporting sustainable agriculture. These are factors that will help help grow the agricultural micronutrient market in the region due to increasing demand of quality nutritious food.

Active Key Players in the Agricultural Micronutrients Market

BASF SE

Coromandel International Limited

Haifa Negev Technologies Ltd.

Helena AgriEnterprises, LLC

Koch Agronomic Services, LLC

Land O’lakes, Inc.

Nouryon

Nufarm

Nutrien Ltd.

The Mosaic Company

Yara International ASA

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Agricultural Micronutrients Market by Type

4.1 Agricultural Micronutrients Market Snapshot and Growth Engine

4.2 Agricultural Micronutrients Market Overview

4.3 Zinc

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Zinc: Geographic Segmentation Analysis

4.4 Boron

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Boron: Geographic Segmentation Analysis

4.5 Manganese

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Manganese: Geographic Segmentation Analysis

4.6 Iron

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Iron: Geographic Segmentation Analysis

4.7 Molybdenum

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Molybdenum: Geographic Segmentation Analysis

4.8 Copper and Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Copper and Others: Geographic Segmentation Analysis

Chapter 5: Agricultural Micronutrients Market by Crop Type

5.1 Agricultural Micronutrients Market Snapshot and Growth Engine

5.2 Agricultural Micronutrients Market Overview

5.3 Cereals and grains

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cereals and grains: Geographic Segmentation Analysis

5.4 Oilseeds and pulses

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Oilseeds and pulses: Geographic Segmentation Analysis

5.5 Fruits and vegetables and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Fruits and vegetables and Others: Geographic Segmentation Analysis

Chapter 6: Agricultural Micronutrients Market by Form

6.1 Agricultural Micronutrients Market Snapshot and Growth Engine

6.2 Agricultural Micronutrients Market Overview

6.3 Solid and Liquid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Solid and Liquid: Geographic Segmentation Analysis

Chapter 7: Agricultural Micronutrients Market by Application Mode

7.1 Agricultural Micronutrients Market Snapshot and Growth Engine

7.2 Agricultural Micronutrients Market Overview

7.3 Soil

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Soil: Geographic Segmentation Analysis

7.4 Foliar and Fertigation.

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Foliar and Fertigation. : Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Agricultural Micronutrients Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BASF SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NOURYON

8.4 NUFARM

8.5 YARA INTERNATIONAL ASA

8.6 COROMANDEL INTERNATIONAL LIMITED

8.7 LAND O’LAKES INC.

8.8 HELENA AGRIENTERPRISES LLC

8.9 THE MOSAIC COMPANY

8.10 HAIFA NEGEV TECHNOLOGIES LTD.

8.11 NUTRIEN LTD.

8.12 KOCH AGRONOMIC SERVICES LLC

8.13 OTHER ACTIVE PLAYERS

Chapter 9: Global Agricultural Micronutrients Market By Region

9.1 Overview

9.2. North America Agricultural Micronutrients Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Zinc

9.2.4.2 Boron

9.2.4.3 Manganese

9.2.4.4 Iron

9.2.4.5 Molybdenum

9.2.4.6 Copper and Others

9.2.5 Historic and Forecasted Market Size By Crop Type

9.2.5.1 Cereals and grains

9.2.5.2 Oilseeds and pulses

9.2.5.3 Fruits and vegetables and Others

9.2.6 Historic and Forecasted Market Size By Form

9.2.6.1 Solid and Liquid

9.2.7 Historic and Forecasted Market Size By Application Mode

9.2.7.1 Soil

9.2.7.2 Foliar and Fertigation.

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Agricultural Micronutrients Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Zinc

9.3.4.2 Boron

9.3.4.3 Manganese

9.3.4.4 Iron

9.3.4.5 Molybdenum

9.3.4.6 Copper and Others

9.3.5 Historic and Forecasted Market Size By Crop Type

9.3.5.1 Cereals and grains

9.3.5.2 Oilseeds and pulses

9.3.5.3 Fruits and vegetables and Others

9.3.6 Historic and Forecasted Market Size By Form

9.3.6.1 Solid and Liquid

9.3.7 Historic and Forecasted Market Size By Application Mode

9.3.7.1 Soil

9.3.7.2 Foliar and Fertigation.

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Agricultural Micronutrients Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Zinc

9.4.4.2 Boron

9.4.4.3 Manganese

9.4.4.4 Iron

9.4.4.5 Molybdenum

9.4.4.6 Copper and Others

9.4.5 Historic and Forecasted Market Size By Crop Type

9.4.5.1 Cereals and grains

9.4.5.2 Oilseeds and pulses

9.4.5.3 Fruits and vegetables and Others

9.4.6 Historic and Forecasted Market Size By Form

9.4.6.1 Solid and Liquid

9.4.7 Historic and Forecasted Market Size By Application Mode

9.4.7.1 Soil

9.4.7.2 Foliar and Fertigation.

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Agricultural Micronutrients Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Zinc

9.5.4.2 Boron

9.5.4.3 Manganese

9.5.4.4 Iron

9.5.4.5 Molybdenum

9.5.4.6 Copper and Others

9.5.5 Historic and Forecasted Market Size By Crop Type

9.5.5.1 Cereals and grains

9.5.5.2 Oilseeds and pulses

9.5.5.3 Fruits and vegetables and Others

9.5.6 Historic and Forecasted Market Size By Form

9.5.6.1 Solid and Liquid

9.5.7 Historic and Forecasted Market Size By Application Mode

9.5.7.1 Soil

9.5.7.2 Foliar and Fertigation.

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Agricultural Micronutrients Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Zinc

9.6.4.2 Boron

9.6.4.3 Manganese

9.6.4.4 Iron

9.6.4.5 Molybdenum

9.6.4.6 Copper and Others

9.6.5 Historic and Forecasted Market Size By Crop Type

9.6.5.1 Cereals and grains

9.6.5.2 Oilseeds and pulses

9.6.5.3 Fruits and vegetables and Others

9.6.6 Historic and Forecasted Market Size By Form

9.6.6.1 Solid and Liquid

9.6.7 Historic and Forecasted Market Size By Application Mode

9.6.7.1 Soil

9.6.7.2 Foliar and Fertigation.

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Agricultural Micronutrients Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Zinc

9.7.4.2 Boron

9.7.4.3 Manganese

9.7.4.4 Iron

9.7.4.5 Molybdenum

9.7.4.6 Copper and Others

9.7.5 Historic and Forecasted Market Size By Crop Type

9.7.5.1 Cereals and grains

9.7.5.2 Oilseeds and pulses

9.7.5.3 Fruits and vegetables and Others

9.7.6 Historic and Forecasted Market Size By Form

9.7.6.1 Solid and Liquid

9.7.7 Historic and Forecasted Market Size By Application Mode

9.7.7.1 Soil

9.7.7.2 Foliar and Fertigation.

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Agricultural Micronutrients Market research report?

A1: The forecast period in the Agricultural Micronutrients Market research report is 2024-2032.

Q2: Who are the key players in the Agricultural Micronutrients Market?

A2: BASF SE, Nouryon, Nufarm, Yara International ASA, Coromandel International Limited, Land O’lakes, Inc., Helena AgriEnterprises, LLC, The Mosaic Company, Haifa Negev Technologies Ltd., Nutrien Ltd., Koch Agronomic Services, LLC and Other Active Players.

Q3: What are the segments of the Agricultural Micronutrients Market?

A3: The Agricultural Micronutrients Market is segmented into By Type, By Crop Type, By Form, By Application Mode and region. By Type, the market is categorized into Zinc, Boron, Manganese, Iron, Molybdenum, Copper and Others. By Crop Type, the market is categorized into Cereals and grains, Oilseeds and pulses, Fruits and vegetables and Others. By Form, the market is categorized into Solid and Liquid. By Application Mode, the market is categorized into Soil, Foliar and Fertigation. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Agricultural Micronutrients Market?

A4: The agricultural micronutrients market encompasses the production, distribution, and utilization of essential trace elements such as zinc, iron, manganese, copper, boron, molybdenum, and chlorine, which are required in small quantities for optimal plant growth and productivity. These micronutrients address deficiencies in soil and crops, ensuring better nutrient absorption, improved yield quality, and enhanced resistance to diseases. The market is driven by increasing global food demand, shrinking arable land, and the adoption of modern farming techniques, including precision agriculture, which prioritizes the efficient use of fertilizers and soil amendments to maximize crop output.

Q5: How big is the Agricultural Micronutrients Market?

A5: Agricultural Micronutrients Market Size Was Valued at USD 4.60 Billion in 2023, and is Projected to Reach USD 8.67 Billion by 2032, Growing at a CAGR of 7.30% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!