Stay Ahead in Fast-Growing Economies.

Browse Reports NowEmbedded Lending Market Size, Share & Forecast (2024-2032)

Embedded lending is a process where lending services are provided from non-financial service providers like e-commerce companies, software applications or digital systems.

IMR Group

Description

Embedded Lending Market Synopsis:

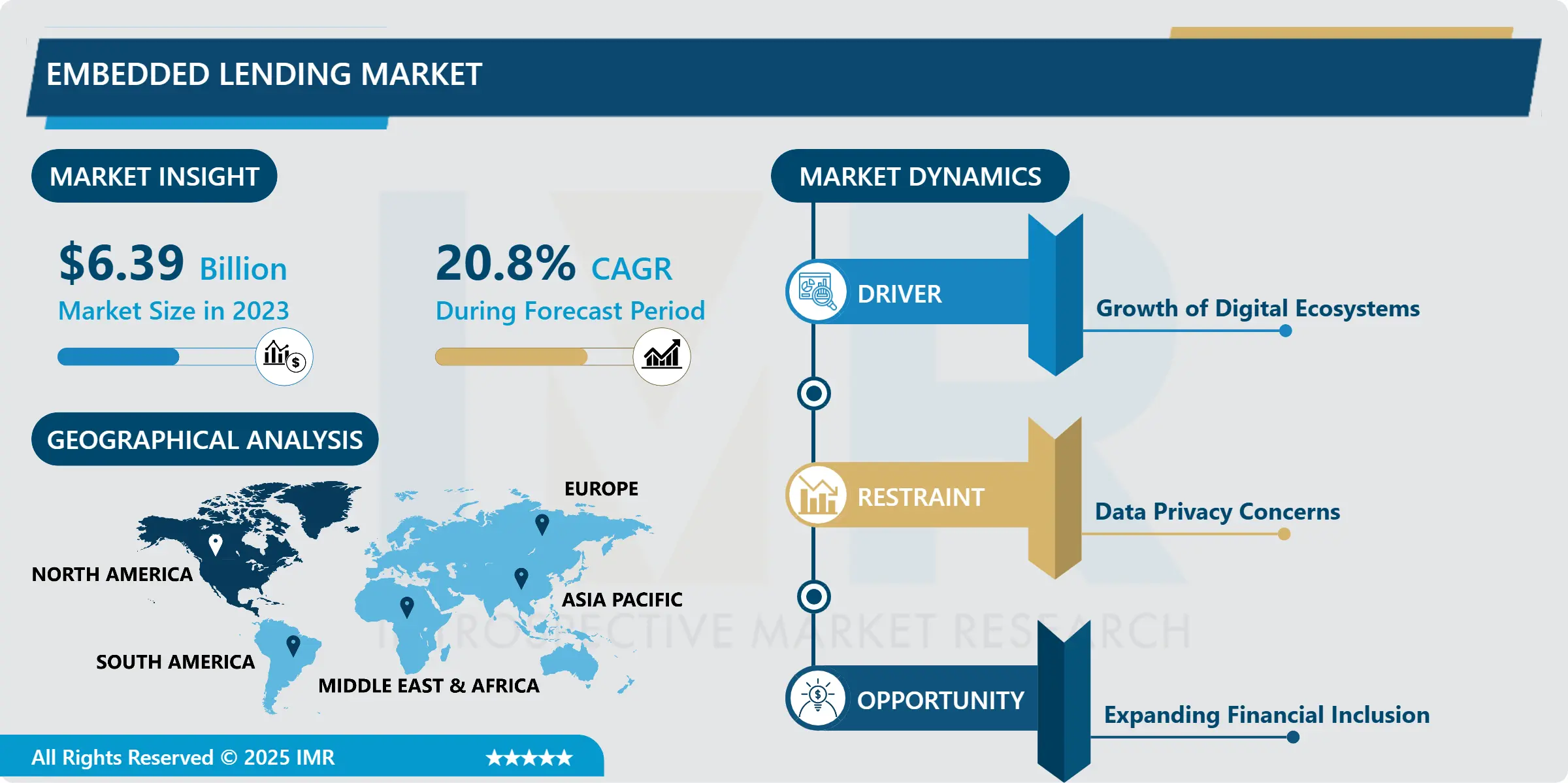

Embedded Lending Market Size Was Valued at USD 6.39 Billion in 2023, and is Projected to Reach USD 35.00 Billion by 2032, Growing at a CAGR of 20.8% From 2024-2032.

Embedded lending is a process where lending services are provided from non-financial service providers like e-commerce companies, software applications or digital systems. Because financing options are integrated as steps in customer journeys, companies allow users to apply for credit without the need to exit the platform. This increases convenience and thus increases customers’ interaction and conversion with the product.

The latest research is that the embedded lending market is expanding greatly because of the following reasons: digitization of financial services and the increasing demand for more convenient and instant forms of credit. Embedded lending is among the latest innovation that has been taken by many businesses while striving to enhance the customer experience as well as offer them value adding services. It thus does away with rigid loan application procedures such as cumbersome procedures needed to access credit by employing technology to grant credit facilities.

These industries are involved in the application of embedded lending: e-commerce, travel services, healthcare, and SMEs. For consumers, the attraction is convenience and gate speed since they can access credit at the point of sales (POS) or even at the time of purchase. To the business entities, it fosters both more sales and patronage and market distinctiveness. AI, ML and API interfaces are some of the premier technologies that have a significant contribution towards embedded financing services.

The regulation is also playing some part on the market where government and the key financial authorities seek for creation of the consumer protection while preserving the innovations. However, data privacy, risk management and market fragmentation still continue to present some of the main challenges. However, the embedded lending market has promising growth prospects as an integration with various industries increases the rates of financial inclusion and development.

Embedded Lending Market Trend Analysis

AI-Driven Underwriting

AI is revolutionizing the underwriting process in embedded lending through making it possible to make decisions on the spot. Past techniques of underwriting required time-consuming credit report and data, including income reports, and the like, that would slow the loan approval. Compared to this BI applies complex algorithms on large amount of data including Big data like spending behavior and social media analytics.

This trend means that lenders can determine creditworthiness at the snap of a finger and give out suitable loan offers. However, the application of AI improves risk assessment as potential problem areas may be also detected at this stage. By utilization of artificial intelligence in underwriting, firms can boost their acceptance level and minimize risks of default within the embedded lending marketplace.

Expanding Financial Inclusion

Embedded lending is a perfect chance to further financial inclusiveness, especially in the areas with low coverage. Most of the conventional financial institutions are unable to operate in the rural areas let alone catering for people with no credit reference. Embedded lending plugs this gap due to its ability to work within existing platforms to extend credit services to the targeted clients such as smallholder farmers doing business in an online farmers’ market or hustlers using a digital wallet.

Embedded lending solutions can assess creditworthiness with the help of ADS. This opens the door of credit for millions enabling economic power and entrepreneurship. In the growing network of digital platforms, the opportunity to address the unbanked and underbanked consumers through embedded lending is vast.

Embedded Lending Market Segment Analysis:

Embedded Lending Market is Segmented on the basis of Component, Deployment Model, Application, End User, and Region

By Component, Platform segment is expected to dominate the market during the forecast period

The embedded lending market can be divided into platforms and services. Platforms hence constitute the technological framework for integrated lending since they facilitate easy integration of a lending platform with other applications. These platforms use APIs, artificial intelligence & Machine learning algorithms for credit scoring and approval, loan dispensing, and repayment.

Some of the services are customer relations, underwriting and compliance. They drive the operations of embedded lending solutions so that customer needs are met, risks are managed, and all legal requirements are met. Platforms and services are the main elements that act as a sturdy fabric to sustain the market’s journey.

By Application, Consumer Lending segment expected to held the largest share

Embedded lending is driven mostly by consumer lending, more specifically by Buy Now Pay Later solutions and POS financing. These services help clients who search for immediate credit for Internet and other kinds of purchases, thus increasing their consumption capabilities and retailers’ sales.

SME lending is another exciting segment since small businesses rely on embedded lending to obtain working capital, among other things. Promising easier approval conditions and fewer docs necessary, embedded lending solutions respond to SMEs’ issues like short funds and restricted access to traditional credit products.

Embedded Lending Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America reigns as the region with the greatest embedded lending market owing to the steady propagation of digital environments, the integration of advanced fintech solutions, and consumers’ expectations of efficiency. The stability of legal requirements in the area also adds to the ability of non-financial platforms to incorporate the lending services.

Local implementation advances due to the influence of leading technology companies and financial institutions in implementing embedded lending solutions. North America remains at the top of the global market by providing emphasis on customer relationships and insights drawn from customer experience.

Active Key Players in the Embedded Lending Market

PayPal Holdings Inc. (USA)

Square Inc. (USA)

Klarna Bank AB (Sweden)

Affirm Inc. (USA)

Adyen NV (Netherlands)

Stripe Inc. (USA)

Afterpay Limited (Australia)

ZestMoney (India)

WeChat Pay (China)

Razorpay (India)

LendingClub Corporation (USA)

FIS Global (USA)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Embedded Lending Market by Component

4.1 Embedded Lending Market Snapshot and Growth Engine

4.2 Embedded Lending Market Overview

4.3 Platform

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Platform: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

Chapter 5: Embedded Lending Market by Deployment Model

5.1 Embedded Lending Market Snapshot and Growth Engine

5.2 Embedded Lending Market Overview

5.3 Cloud-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cloud-based: Geographic Segmentation Analysis

5.4 On-premises

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 On-premises: Geographic Segmentation Analysis

Chapter 6: Embedded Lending Market by End User

6.1 Embedded Lending Market Snapshot and Growth Engine

6.2 Embedded Lending Market Overview

6.3 Banks

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Banks: Geographic Segmentation Analysis

6.4 Fintech Companies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fintech Companies: Geographic Segmentation Analysis

6.5 Insurance Providers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Insurance Providers: Geographic Segmentation Analysis

6.6 E-commerce Platforms

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 E-commerce Platforms: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Embedded Lending Market by Application

7.1 Embedded Lending Market Snapshot and Growth Engine

7.2 Embedded Lending Market Overview

7.3 Consumer Lending

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Consumer Lending: Geographic Segmentation Analysis

7.4 SME Lending

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 SME Lending: Geographic Segmentation Analysis

7.5 Other

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Other: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Embedded Lending Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PAYPAL HOLDINGS INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SQUARE INC. (USA)

8.4 KLARNA BANK AB (SWEDEN)

8.5 AFFIRM INC. (USA)

8.6 ADYEN NV (NETHERLANDS)

8.7 STRIPE INC. (USA)

8.8 AFTERPAY LIMITED (AUSTRALIA)

8.9 ZESTMONEY (INDIA)

8.10 WECHAT PAY (CHINA)

8.11 RAZORPAY (INDIA)

8.12 LENDINGCLUB CORPORATION (USA)

8.13 FIS GLOBAL (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Embedded Lending Market By Region

9.1 Overview

9.2. North America Embedded Lending Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Component

9.2.4.1 Platform

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size By Deployment Model

9.2.5.1 Cloud-based

9.2.5.2 On-premises

9.2.6 Historic and Forecasted Market Size By End User

9.2.6.1 Banks

9.2.6.2 Fintech Companies

9.2.6.3 Insurance Providers

9.2.6.4 E-commerce Platforms

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Consumer Lending

9.2.7.2 SME Lending

9.2.7.3 Other

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Embedded Lending Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Component

9.3.4.1 Platform

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size By Deployment Model

9.3.5.1 Cloud-based

9.3.5.2 On-premises

9.3.6 Historic and Forecasted Market Size By End User

9.3.6.1 Banks

9.3.6.2 Fintech Companies

9.3.6.3 Insurance Providers

9.3.6.4 E-commerce Platforms

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Consumer Lending

9.3.7.2 SME Lending

9.3.7.3 Other

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Embedded Lending Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Component

9.4.4.1 Platform

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size By Deployment Model

9.4.5.1 Cloud-based

9.4.5.2 On-premises

9.4.6 Historic and Forecasted Market Size By End User

9.4.6.1 Banks

9.4.6.2 Fintech Companies

9.4.6.3 Insurance Providers

9.4.6.4 E-commerce Platforms

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Consumer Lending

9.4.7.2 SME Lending

9.4.7.3 Other

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Embedded Lending Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Component

9.5.4.1 Platform

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size By Deployment Model

9.5.5.1 Cloud-based

9.5.5.2 On-premises

9.5.6 Historic and Forecasted Market Size By End User

9.5.6.1 Banks

9.5.6.2 Fintech Companies

9.5.6.3 Insurance Providers

9.5.6.4 E-commerce Platforms

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Consumer Lending

9.5.7.2 SME Lending

9.5.7.3 Other

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Embedded Lending Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Component

9.6.4.1 Platform

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size By Deployment Model

9.6.5.1 Cloud-based

9.6.5.2 On-premises

9.6.6 Historic and Forecasted Market Size By End User

9.6.6.1 Banks

9.6.6.2 Fintech Companies

9.6.6.3 Insurance Providers

9.6.6.4 E-commerce Platforms

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Consumer Lending

9.6.7.2 SME Lending

9.6.7.3 Other

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Embedded Lending Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Component

9.7.4.1 Platform

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size By Deployment Model

9.7.5.1 Cloud-based

9.7.5.2 On-premises

9.7.6 Historic and Forecasted Market Size By End User

9.7.6.1 Banks

9.7.6.2 Fintech Companies

9.7.6.3 Insurance Providers

9.7.6.4 E-commerce Platforms

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Consumer Lending

9.7.7.2 SME Lending

9.7.7.3 Other

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Embedded Lending Market research report?

A1: The forecast period in the Embedded Lending Market research report is 2024-2032.

Q2: Who are the key players in the Embedded Lending Market?

A2: PayPal Holdings Inc. (USA), Square Inc. (USA), Klarna Bank AB (Sweden), Affirm Inc. (USA), Adyen NV (Netherlands), Stripe Inc. (USA), Afterpay Limited (Australia), ZestMoney (India), WeChat Pay (China), Razorpay (India), LendingClub Corporation (USA), FIS Global (USA), and Other Active Players.

Q3: What are the segments of the Embedded Lending Market?

A3: The Embedded Lending Market is segmented into Component, Deployment Model, Application, End User and region. By Component, the market is categorized into Platform, Services. By Deployment Model, the market is categorized into Cloud-based, On-premises. By End User, the market is categorized into Banks, Fintech Companies, Insurance Providers, E-commerce Platforms, and Others. By Application, the market is categorized into Consumer Lending, SME Lending, and Other. By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Embedded Lending Market?

A4: Embedded lending is a process where lending services are provided from non-financial service providers like e-commerce companies, software applications or digital systems. Because financing options are integrated as steps in customer journeys, companies allow users to apply for credit without the need to exit the platform. This increases convenience and thus increases customers’ interaction and conversion with the product.

Q5: How big is the Embedded Lending Market?

A5: Embedded Lending Market Size Was Valued at USD 6.39 Billion in 2023, and is Projected to Reach USD 35.00 Billion by 2032, Growing at a CAGR of 20.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!