Stay Ahead in Fast-Growing Economies.

Browse Reports NowFactoring Services Market Share, Trends & Market Forecast (2024-2032)

Factoring services market concerns itself with the financial service sold by firms of their account’s receivables or invoices to a financier known as the factor for a lesser amount of money to get cash instantly.

IMR Group

Description

Factoring Services Market Synopsis:

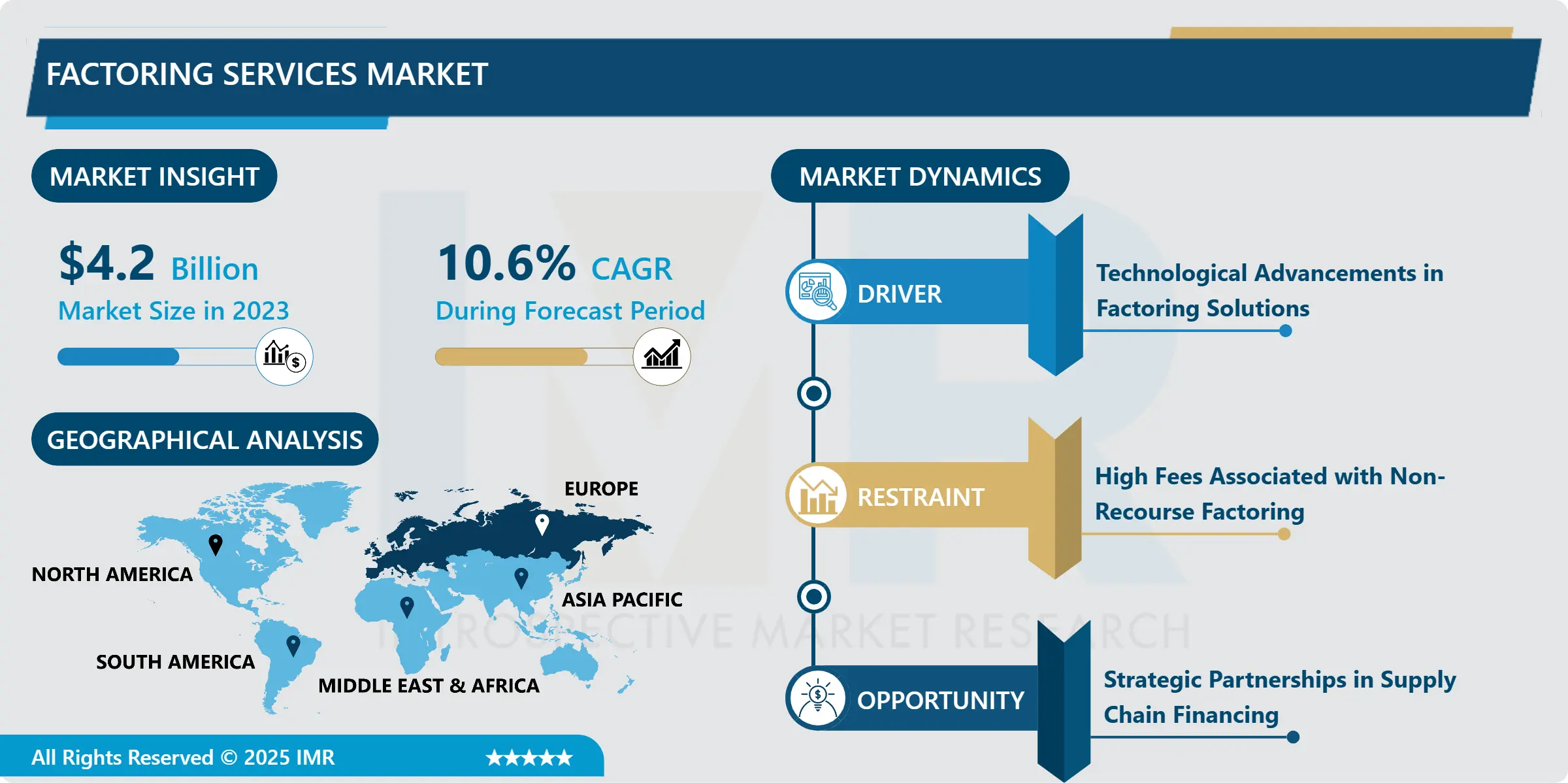

Factoring Services Market Size Was Valued at USD 4.20 Billion in 2023, and is Projected to Reach USD 10.40 Billion by 2032, Growing at a CAGR of 10.60% From 2024-2032.

Factoring services market concerns itself with the financial service sold by firms of their account’s receivables or invoices to a financier known as the factor for a lesser amount of money to get cash instantly. This service aids small and large businesses in the management of the cash flow gap, credit risks, and working capital. Factoring can be recourse or non-recourse in which is the seller takes the liability for the unpaid invoices.

Liquidity and working capital needs especially from small and medium enterprises (SMEs) is a key factors driving the factoring services market. Due to increased demand for more efficient and swift credit products, factoring services also fills the space of bank credits by giving the clients a possibility to get the required sum of money quickly without providing assets as security. In addition, the increase of international trade has further boosted the need to factor since it reduces risk factors that are inherent when entering into cross border transactions and where payment terms are normally stretched.

The second influence relates to the expansion of the volume of international trade and the corresponding higher level of supply chain contracts. Factors afford protection from payments’ failure, which is essential to consider by companies that enter new markets. The opportunity to obtain capital rapidly helps companies appeal to new opportunities, thus driving the market even more. Also, significant advancements in technology like AI and blockchain are changing factoring, making it more effective, therefore attracting many customers.

Factoring Services Market Trend Analysis:

Digital Transformation in Factoring Services:

The last trend is the use of the digital platforms for factoring services. Most of the financial institutions are adopting online factoring services to minimize instances of intervention by human beings. Such platforms have integrated superior data analysis and Artificial Intelligence to ascertain the credit worth of customers and thus enabling organizations to easily obtain the necessary funds. As the factoring services becomes more automated more business are likely to access the market especially the small business and markets that are in the developing stage.

As we have mentioned above, it is also appropriate to identify increasing inclinations towards offering factoring services as a part of supply chain financing. Factoring today is used by the companies not only as the independent source of financing but as the integrated system of supplying chain management. This approach serves better than a typical financing approach because it eliminates the delays involved in going through the usual channels of financing and offers a better control of cash flows.

Rising Demand from SMEs

SMEs also stands as the biggest unexplored growth opportunity within the factoring services industry. Most of these business struggle to obtain financing from conventional sources such as credit history, collateral, or high-interest rates. This is especially the case with factoring, which is able to provide SMEs with the funding they require without having to fulfill the standard set by classic banks. As SMEs expand internationally, particularly in developing countries, factoring services would also experience increasing purchase.

Asia and Latin America offer massive prospects to factoring services providers through emerging economies. They have experienced increased industrialization as well as an upsurge in the number of firms particularly small businesses who require sound working capital management techniques. As the trade between countries in these regions increases more, the demand for factoring services in easing credit risks and improving liquidity escalates. In these areas of opportunities, service providers should localize services to suit the regional markets as well as conform to the local trade-Related requirements.

Factoring Services Market Segment Analysis:

Factoring Services Market Segmented on the basis of Type, Application, and Region

By Type, Recourse Factoring segment is expected to dominate the market during the forecast period

Recourse factoring, the business that is selling the accounts receivable retains responsibility if the buyer failed to pay the invoice. This is also called traditional factoring since it is more frequent than non-recourse factoring because it is cheaper.

The risk of non-payment is transferred to the seller, but they are able to receive working capital as soon as possible without obviously taking a long-term loan. Non-recourse factoring involves the factor bearing the burden of risk and therefore, should the customer fail to pay, then the selling business is off the hook. This type of factoring is relatively safer for the business but attracts high price charges since the factor assumes more risk.

By Application, Large Enterprises segment expected to held the largest share

Many SMEs use factoring services since they rarely get traditional loans because they lack enough credit history, have smaller balance sheets, and minimal access to collateral. It helps the SMEs to sell the invoices to get quick cash inflows and use it for the daily running, expansion and ensuring that their working capital is not fluctuating erratically. The factoring services are also utilized in the trading companies particularly when handling big portfolios of receivables or when it enters in the foreign market. These companies need factoring as a way of managing their cash flow in a better way, spending least time on credit management, and effectively using its working capital in the business.

Factoring Services Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

The factoring of services have shown the dominance of European area in the market. This region has quite a developed factoring market and increased legislative protection, combined with a sufficient number of SMEs. The factoring industry is also developed in Europe, providing large number of factoring companies providing both recourse and non-recourse factoring. This is because factoring provides solutions to the needs of SMEs for financing, and because factoring interacts with trade and financing environments in larger contexts.

The excellent infrastructure, sound legislation for factoring, and qualified access to international markets is also adding to the factoring services. At this stage, factoring represents a basic tool for managing credit risks and ensuring adequate funding as European companies continue to grow, especially via internationalisation of activity. However, it should be noted that more and more European financial institutions use technology to make factoring transactions faster and more efficient, provision of leadership.

Active Key Players in the Factoring Services Market

Barclays (UK)

BNP Paribas (France)

Citi (USA)

Deutsche Bank (Germany)

Factor Capital (USA)

FIMBank (Malta)

HSBC (UK)

JPMorgan Chase (USA)

Siemens Financial Services (Germany)

Standard Chartered (UK)

Other active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Factoring Services Market by Type

4.1 Factoring Services Market Snapshot and Growth Engine

4.2 Factoring Services Market Overview

4.3 Recourse Factoring

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Recourse Factoring: Geographic Segmentation Analysis

4.4 Non-Recourse Factoring

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Non-Recourse Factoring: Geographic Segmentation Analysis

Chapter 5: Factoring Services Market by Application

5.1 Factoring Services Market Snapshot and Growth Engine

5.2 Factoring Services Market Overview

5.3 Small & Medium Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small & Medium Enterprises (SMEs): Geographic Segmentation Analysis

5.4 Large Enterprises

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Large Enterprises: Geographic Segmentation Analysis

Chapter 6: Factoring Services Market by End User

6.1 Factoring Services Market Snapshot and Growth Engine

6.2 Factoring Services Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Manufacturing: Geographic Segmentation Analysis

6.4 Healthcare

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare: Geographic Segmentation Analysis

6.5 Retail

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Retail: Geographic Segmentation Analysis

6.6 Transportation & Logistics

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Transportation & Logistics: Geographic Segmentation Analysis

6.7 Construction

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Construction: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Factoring Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HSBC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DEUTSCHE BANK (GERMANY)

7.4 BNP PARIBAS (FRANCE)

7.5 STANDARD CHARTERED (UK)

7.6 CITI (USA)

7.7 BARCLAYS (UK)

7.8 SIEMENS FINANCIAL SERVICES (GERMANY)

7.9 JPMORGAN CHASE (USA)

7.10 FACTOR CAPITAL (USA)

7.11 FIMBANK (MALTA) AND OTHER ACTIVE PLAYERS

Chapter 8: Global Factoring Services Market By Region

8.1 Overview

8.2. North America Factoring Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Recourse Factoring

8.2.4.2 Non-Recourse Factoring

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Small & Medium Enterprises (SMEs)

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Manufacturing

8.2.6.2 Healthcare

8.2.6.3 Retail

8.2.6.4 Transportation & Logistics

8.2.6.5 Construction

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Factoring Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Recourse Factoring

8.3.4.2 Non-Recourse Factoring

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Small & Medium Enterprises (SMEs)

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Manufacturing

8.3.6.2 Healthcare

8.3.6.3 Retail

8.3.6.4 Transportation & Logistics

8.3.6.5 Construction

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Factoring Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Recourse Factoring

8.4.4.2 Non-Recourse Factoring

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Small & Medium Enterprises (SMEs)

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Manufacturing

8.4.6.2 Healthcare

8.4.6.3 Retail

8.4.6.4 Transportation & Logistics

8.4.6.5 Construction

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Factoring Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Recourse Factoring

8.5.4.2 Non-Recourse Factoring

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Small & Medium Enterprises (SMEs)

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Manufacturing

8.5.6.2 Healthcare

8.5.6.3 Retail

8.5.6.4 Transportation & Logistics

8.5.6.5 Construction

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Factoring Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Recourse Factoring

8.6.4.2 Non-Recourse Factoring

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Small & Medium Enterprises (SMEs)

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Manufacturing

8.6.6.2 Healthcare

8.6.6.3 Retail

8.6.6.4 Transportation & Logistics

8.6.6.5 Construction

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Factoring Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Recourse Factoring

8.7.4.2 Non-Recourse Factoring

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Small & Medium Enterprises (SMEs)

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Manufacturing

8.7.6.2 Healthcare

8.7.6.3 Retail

8.7.6.4 Transportation & Logistics

8.7.6.5 Construction

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Factoring Services Market research report?

A1: The forecast period in the Factoring Services Market research report is 2024-2032.

Q2: Who are the key players in the Factoring Services Market?

A2: Barclays (UK), BNP Paribas (France), Citi (USA), Deutsche Bank (Germany), Factor Capital (USA), FIMBank (Malta), HSBC (UK), JPMorgan Chase (USA), Siemens Financial Services (Germany), Standard Chartered (UK), and Others Active Players.

Q3: What are the segments of the Factoring Services Market?

A3: The Factoring Services Market is segmented into by Type (Recourse Factoring, Non-Recourse Factoring), Application (Small & Medium Enterprises (SMEs), Large Enterprises), End User (Manufacturing, Healthcare, Retail, Transportation & Logistics, Construction, Others). By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

Q4: What is the Factoring Services Market?

A4: Factoring services market concerns itself with the financial service sold by firms of their account’s receivables or invoices to a financier known as the factor for a lesser amount of money to get cash instantly. This service aids small and large businesses in the management of the cash flow gap, credit risks, and working capital. Factoring can be recourse or non-recourse in which is the seller takes the liability for the unpaid invoices.

Q5: How big is the Factoring Services Market?

A5: Factoring Services Market Size Was Valued at USD 4.20 Billion in 2023, and is Projected to Reach USD 10.40 Billion by 2032, Growing at a CAGR of 10.60% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!